Stationary Energy Storage Market Outlook:

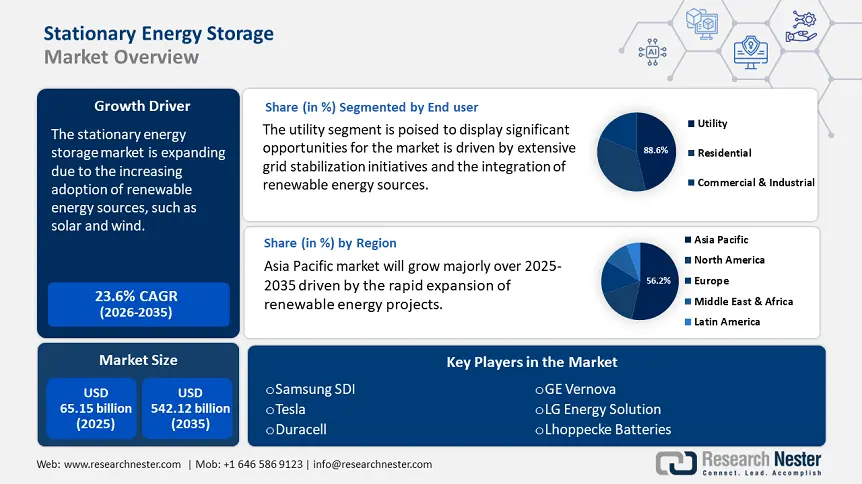

Stationary Energy Storage Market size was valued at USD 65.15 billion in 2025 and is set to exceed USD 542.12 billion by 2035, registering over 23.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of stationary energy storage is estimated at USD 78.99 billion.

The increasing adoption of renewable energy sources, such as solar and wind, has accelerated the need for stationary energy storage systems to address intermittency issues and ensure grid stability and supply-demand imbalances. Rising carbon emissions and stringent global decarbonization targets have accelerated the shift towards clean energy, necessitating efficient storage solutions to maximize renewable energy utilization. Additionally, the growing electrification of industries and transportation demands a more resilient power infrastructure to prevent outages and ensure energy security. Aging grid infrastructure in many regions further underscores the requirement for enhanced energy storage to improve reliability and minimize transmission losses.

Market volatility in energy prices and peak demand fluctuation also highlights the significance of storage systems for cost optimization and grid efficiency. Together, these factors are driving the rapid deployment of stationary energy storage solutions worldwide. According to the International Renewable Energy Agency (IRENA), global renewable power generation capacity reached 3,870 GW in 2023, accounting for 86% of new capacity additions. Governments worldwide are implementing policies to improve renewable energy integration. For instance, the EU Renewable Energy Directive (EU/2023/2413) has raised the 2030 renewable energy target to at least 42.5% with a goal of 45%.

Stationary energy storage solutions, such as lithium-ion batteries, flow batteries, and pumped hydro storage, play a crucial role in balancing supply and demand by storing surplus energy during peak production and releasing it when needed. A notable example is Japan’s Fukushima Battery Storage Project, which features a 100 MW/200 MWh lithium-ion battery system to support renewable energy integration. With increasing renewable energy deployment and supportive policies, the need for stationary energy storage is expected to rise, ensuring a reliable and sustainable power supply.

Key Stationary Energy Storage Market Insights Summary:

Regional Highlights:

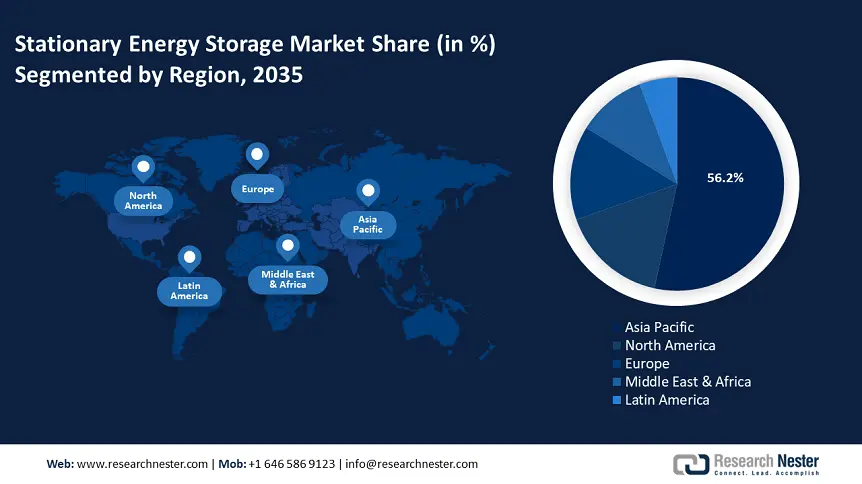

- Asia Pacific dominates with a 56.2% share in the Stationary Energy Storage Market, fueled by rapid expansion of renewable energy projects and policy incentives, ensuring robust growth from 2026–2035.

- North America's Stationary Energy Storage Market is projected for the fastest growth by 2035, driven by investments in energy storage and grid modernization efforts.

Segment Insights:

- The Residential segment is anticipated to grow at the fastest rate during 2026-2035, driven by the rising need for emergency power backup and growing adoption of residential solar systems.

- The Utility segment is projected to achieve an 88.6% share by 2035, driven by grid stabilization and renewable energy integration initiatives.

Key Growth Trends:

- Renewable energy integration

- Government policies and incentive schemes to expand market size

Major Challenges:

- Technological limitations

- Negative decomposition impacts of batteries to restrain market growth

- Key Players: Samsung SDI, Tesla, Samsung SDI, Johnson Controls, Philips.

Global Stationary Energy Storage Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 65.15 billion

- 2026 Market Size: USD 78.99 billion

- Projected Market Size: USD 542.12 billion by 2035

- Growth Forecasts: 23.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (56.2% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, Germany, South Korea

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 12 August, 2025

Stationary Energy Storage Market Growth Drivers and Challenges:

Growth Drivers

- Renewable energy integration: The rapid deployment of renewable energy, coupled with favorable government initiatives to reduce carbon emissions, is significantly driving the stationary energy storage market. Furthermore, the rise of renewable energy integration is driven by challenges such as grid stability due to intermittent power generation, limited energy storage capacity, and regulatory complexities. Additionally, fluctuating energy demand and transmission constraints necessitate enhanced solutions to ensure a stable, efficient, and sustainable power supply.

Stationary energy storage systems play a crucial role by storing excess power generation during periods of high production and releasing it during shortages, thus balancing consumption patterns. According to the International Energy Agency (IEA), global renewable electric generation is projected to exceed 17,000 terawatt-hours (TWh) by 2030, making an increase of almost 90% from the 2023 level. This substantial growth underscores the necessity for enhanced storage solutions to manage the variability inherent in renewable power generation. For instance, Poland’s utility company PGE plans to invest approximately USD 4.7 billion in battery storage projects, aiming to develop 85 energy storage facilities with a combined capacity exceeding 17,000 megawatt-hours, sufficient to supply energy to about 2.5 million households.

- Government policies and incentive schemes to expand market size: Favorable government policies and regulations are significantly propelling the expansion of the stationary energy storage market to address critical issues such as renewable energy intermittency and rising electricity demand. Additionally, regulatory targets for carbon reduction, peak load management, and economic competitiveness drive policy support to accelerate storage deployment and ensure a resilient energy transition.

In February 2021, the Spanish government approved its Energy Storage Strategy, targeting 20 GW of storage capacity by 2030 and 30 GW by 2050, encompassing both large-scale and distributed storage solutions. Additionally, the Spanish government has allocated approximately USD 310 million for various energy storage projects, including standalone, thermal, and pumped hydro storage, intending to enhance grid stability and integrate renewable energy sources. Similarly, in July 2021, China’s National Development and Reform Commission announced plans to install over 30 GW of new energy storage capacity by 2025, aiming to improve renewable energy consumption and ensure grid stability. These strategic initiatives underscore a global commitment to advancing energy storage infrastructure, facilitating the integration of renewable energy sources, and achieving decarbonization objectives.

Challenges

- Technological limitations: The growth of the stationary energy storage market is hindered by technological limitations in energy storage, such as low energy density, efficiency challenges, and rapid degradation. Stationary storage systems lose effectiveness over time, requiring frequent replacements, which increases costs. Additionally, current storage technologies are not fully optimized to satisfy global energy demands, creating barriers to large-scale adoption.

Integrating these systems with existing energy infrastructure is complex, requiring significant investment and technical expertise. Advancements in battery technology, materials science, and grid integration strategies are crucial to overcoming these challenges and ensuring energy storage solutions are reliable, efficient, and sustainable for long-term use in renewable energy systems.

- Negative decomposition impacts of batteries to restrain market growth: The growth of the stationary energy storage market faces numerous challenges due to the environmental impact of battery manufacturing and disposal. The extraction of key raw materials such as lithium, cobalt, and nickel contributes to habitat destruction, water depletion, and carbon emissions.

Cobalt mining, especially in regions with weak regulations, leads to toxic waste and pollution. Additionally, improper disposal of used batteries results in soil and water contamination, as hazardous components leach into the environment. Recycling processes remain complex and underdeveloped, causing significant battery waste accumulation. These negative decomposition impacts pose a major restraint on stationary energy storage market expansion and sustainability.

Stationary Energy Storage Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

23.6% |

|

Base Year Market Size (2025) |

USD 65.15 billion |

|

Forecast Year Market Size (2035) |

USD 542.12 billion |

|

Regional Scope |

|

Stationary Energy Storage Market Segmentation:

End user (Utility, Residential, Commercial, and Industrial)

Utility segment is expected to hold over 88.6% stationary energy storage market share by the end of 2035. The growth of the market is driven by extensive grid stabilization initiatives and the integration of renewable energy sources. Solar and wind energy projects often require backup systems to supply electricity during periods of intermittency, leading to the growth of lithium-ion battery installations.

The utility-scale energy storage applications are projected to reach 86 GWh by 2030, reflecting the need for large-scale systems to support grid stability and renewable energy integration. For instance, Poland’s utility company PGE plans to invest USD 4.7 billion in battery storage projects, targeting 17,000 megawatt-hours of capacity to support renewable energy expansion. Similarly, in the U.S., Texas’s Revolutionary battery storage project provides 150 MW/300 MWh of grid stabilization capacity, reducing reliance on fossil fuels. These initiatives highlight the significance of utility-scale storage in modernizing energy infrastructure and supporting sustainability goals.

On the other hand, the residential segment is also expected to expand at the fastest rate due to the rising need for emergency power backup during outages and the growing adoption of residential solar energy systems. These factors underscore the pivotal role of stationary energy storage systems across various industries, with utility-scale projects ensuring grid stability and residential systems enhancing individual energy security.

Type (Pumped Hydro Storage, and Lithium-ion batteries)

Pumped hydrogen storage segment has long dominated the stationary energy storage market due to its high efficiency, large-scale capacity, and extended operational lifespan. This technology enables storage of energy by pumping water to a higher elevation during periods of low demand and releasing it through turbines to generate electricity during peak times. For instance, the proposed Glen Earache Energy project near Loch Ness in Scotland aims to develop a 2 GW pumped hydro storage facility, which could significantly contribute to the UK's net-zero targets by providing substantial grid-scale energy storage.

The pumped hydro storage continues to play a pivotal role in global energy strategies, with ongoing projects and technological innovation enhancing its viability. Balancing development with environmental stewardship remains essential to maximize the benefits of this technology.

On the other hand, lithium-ion batteries are gaining traction, particularly in residential and commercial sectors, due to decreasing costs and flexible deployment options. Innovations in lithium-ion technology have led to enhanced safety and energy density, making them increasingly viable for large-scale applications. The global deployment of lithium-ion battery energy storage systems reached 92.3 GWh in 2023, reflecting their growing role in stationary storage.

Our in-depth analysis of the global stationary energy storage market includes the following segments:

|

End user |

|

|

Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Stationary Energy Storage Market Regional Analysis:

Asia Pacific Market Statistics

Asia Pacific stationary energy storage market is set to hold revenue share of over 56.2% by the end of 2035, driven by the rapid expansion of renewable energy projects in countries such as China, Australia, and the Philippines. This surge is primarily due to the increasing deployment of renewable power sources, which necessitate efficient energy storage solutions to manage intermittency and meet peak demand periods. China, for instance, is projected to become the largest stationary energy storage market in the Asia Pacific region, with a cumulative capacity expected to reach 12.5 GW. This growth is fueled by policy incentives and a strong push towards integrating renewable energy into the grid.

Similarly, in Australia, substantial investments are being made to support the clean energy transition. The government has pledged USD 5 billion to develop renewable energy and green metal industries, including USD 2 billion for the Clean Energy Finance Corporation and USD 3 billion to aid the green made sector. This initiative aligns with Australia’s vision of boosting its manufacturing sector and achieving net-zero emissions during the forecast period. These developments underscore the Asia Pacific region’s commitment to enhancing energy storage capabilities to support the growing share of renewables in the energy mix.

North America Market Analysis

North America has rapidly emerged as the fast-growing stationary energy storage market, driven by a swift transition toward cleaner energy sources. This shift is bolstered by significant investment in energy storage solutions and grid modernization efforts aimed at improving the reliability and efficiency of the power infrastructure.

The U.S. in particular leads this growth, driven by a strong pipeline of large-scale projects in states like California, the Southwest, and Texas. For instance, Schneider Electric’s recent commitment to invest over USD 700 million in the U.S. energy sector. This investment, the largest in the company’s 135-year history, focuses on manufacturing electrical equipment and expanding facilities in Missouri, Ohio, and Tennessee. The initiative aims to address the increasing power demand driven by advancements in artificial intelligence and increasing domestic manufacturing. These development underscores North America’s dedication to enhancing its energy infrastructure, accommodating the growing adoption of renewable energy sources, and ensuring a resilient and sustainable power grid for the future.

Similarly, Canada’s stationary energy storage market is expanding due to increased renewable energy adoption and government support. Investments in battery and pumped hydrogen storage projects enhance grid reliability and energy efficiency. For example, Ontario’s Oneida Energy Storage Project, a 250 MW facility, is set to become Canada’s largest battery storage system.

Key Stationary Energy Storage Market Players:

- Doosan Fuel Cell Co., Ltd.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Durapower

- Samsung SDI

- Tesla

- Johnson Controls

- Philips

- Hoppecke Batteries

- Duracell

- LG Energy Solution

- GE Vernova

The companies lead the stationary energy storage market through innovation, large-scale deployments, and strategic partnerships. The companies drive the energy system by focusing on efficiency and longevity for various applications. These companies shape the stationary energy storage market by advancing technology, optimizing performance, and expanding global adoption.

Recent Developments

- In July 2024, Exide Technologies, a prominent global provider of battery storage solutions, upheld its tradition of innovation and sustainability by introducing Customized Energy Systems (CES). These systems utilize cutting-edge lithium-ion battery technology to deliver both stationary and mobile energy storage solutions, assisting businesses and communities in stabilizing the grid, optimizing energy consumption, and reducing environmental impact. With more than 100 MWh of installed lithium-ion storage projects, Exide Technologies is advancing its dedication to achieving a net-zero future. Their energy management solutions enable industries to improve operational efficiency while tackling the challenges associated with renewable energy integration.

- In June 2024, BASF Stationary Energy Storage GmbH, in collaboration with NGK INSULATORS, LTD., introduced an innovative container-type NAS (sodium-sulfur) battery known as the NAS MODEL L24. This newly engineered product boasts a notably lower degradation rate of under 1% annually, attributed to enhanced corrosion resistance within the battery cells. Furthermore, the battery features an upgraded thermal management system, which improves continuous discharge performance and prolongs the system's lifespan. This advancement marks significant progress in stationary energy storage, meeting the increasing demand for efficient and durable battery solutions in the clean energy industry.

- Report ID: 7494

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Stationary Energy Storage Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.