Hybrid Solar Wind Energy Storage Market Outlook:

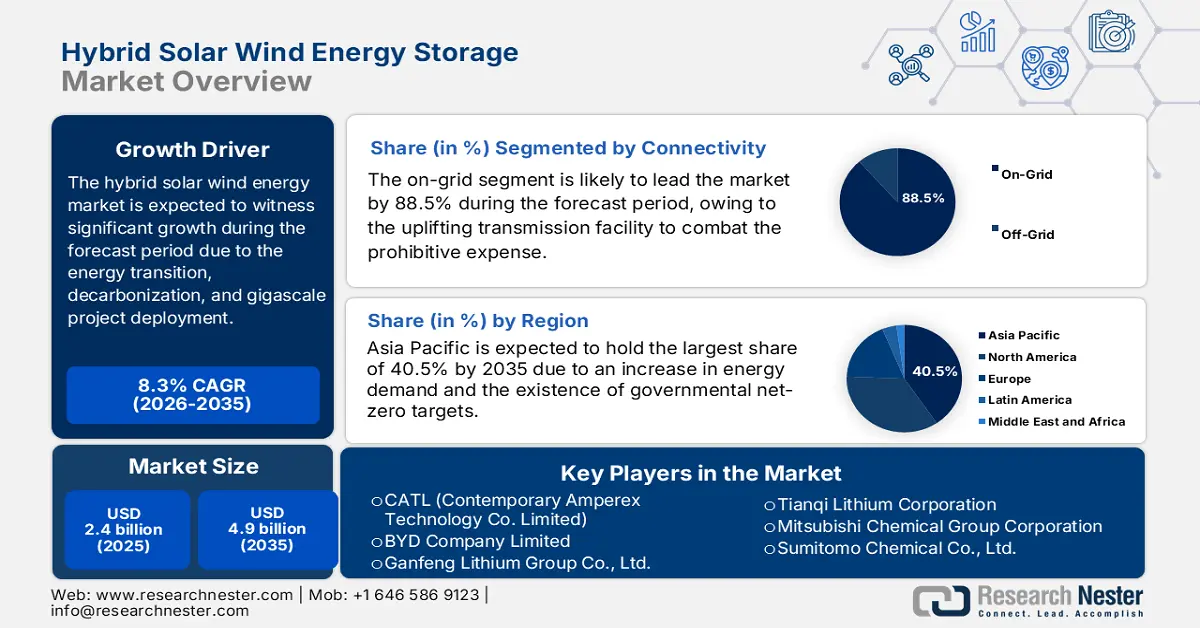

Hybrid Solar Wind Energy Storage Market size was over USD 2.4 billion in 2025 and is estimated to reach USD 4.9 billion by the end of 2035, expanding at a CAGR of 8.3% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of hybrid solar wind energy storage is evaluated at USD 2.6 billion.

The international hybrid solar wind energy storage market has represented the cutting-edge energy transition, emerging from a niche concept to the center pillar of decarbonization and grid modernization. The gigascale project deployment and vertical supply chain integration are readily driving the market’s development. According to an article published by the ANL Government in April 2024, through artificial intelligence, commercial powerplant licensing and design cater to a multi-year effort that can account for nearly 50% of the time to commercialize for the latest energy deployments. Additionally, the 1.6 TW of new solar capacity and 200 GW of new nuclear capacity onboarding is also possible through AI, thus suitable for bolstering the market’s growth.

Furthermore, the aspect of the merchant hybrid project model and a rise in long-lasting energy storage also cater to the hybrid solar wind energy storage market’s development across different nations. As per an article published by the U.S. Department of Energy in September 2023, the organization, along with the Office of Energy Efficiency and Renewable Energy (EERE), has declared selecting five projects, amounting to USD 16 million. The purpose is to initiate domestic capabilities in flow battery manufacturing. Besides, there is a growing trend in deregulated economies that involves developers creating hybrid projects without the need for fixed Power Purchase Agreements (PPAs), which is boosting the market’s exposure.

Funding Opportunities Uplifting the Hybrid Solar Wind Energy Storage Market (2024-2025)

|

Project Name |

Funding Amount |

Components |

Approval by the Office |

Closing Date |

|

Energy Storage Innovations |

USD 300,000 |

Innovations in storing energy |

Office of Electricity |

April 2025 |

|

Blue Sky Training Program |

USD 41.2 million |

Three funding opportunities to ensure electricity grid reliability, security, and resilience |

Office of Electricity |

February 2025 |

|

Critical Facility Energy Resilience |

USD 15 million |

Energy Department Pioneers latest energy storage approaches |

Office of Electricity |

October 2024 |

|

Programa de Comunidades Resilientes |

USD 365 million |

Building energy infrastructure |

Grid Deployment Office |

October 2024 |

|

Technical Assistance Voucher Program: Long Duration Energy Storage Technology Acceleration (Recipient) |

USD 1 million |

Office of Electricity |

USD 1 million announcement by the Energy Department for storage vouchers |

August 2024 |

|

Platform Technologies for Transformative Battery Manufacturing |

USD 15.7 million |

Office of Energy Efficiency and Renewable Energy |

Fund released by AMMTO to ensure advancement in domestic manufacturing of cutting-edge batteries |

May 2024 |

Source: U.S. Department of Energy

Key Hybrid Solar Wind Energy Storage Market Insights Summary:

Regional Insights:

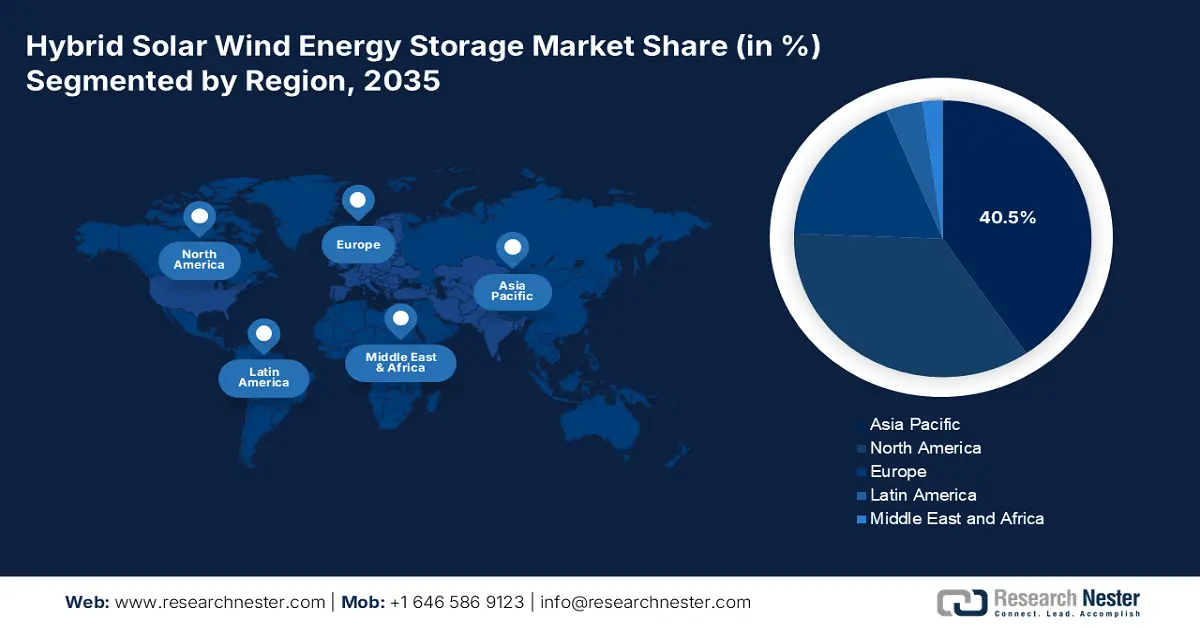

- Asia Pacific is expected to command a 40.5% share by 2035 in the hybrid solar wind energy storage market, propelled by rising energy demand, aggressive net-zero commitments, and large-scale regional manufacturing of core components.

- Europe is projected to expand at the fastest pace by 2035, underpinned by strong decarbonization mandates and energy-sovereignty objectives embedded in the EU Green Deal and REPowerEU Plan.

Segment Insights:

- The on-grid segment is projected to secure an 88.5% share by 2035 in the hybrid solar wind energy storage market, supported by its ability to utilize existing transmission infrastructure which reduces the need for costly new power line development.

- The utility-scale power generation segment is anticipated to hold the second-largest share by 2035, bolstered by its strategic role in enhancing grid reliability and accelerating decarbonization.

Key Growth Trends:

- Fiscal and policy incentives

- Reliability and grid stability demands

Major Challenges:

- Increased capital spending and financial obstacles

- Permitting and regulatory inefficiencies

Key Players: Albemarle Corporation (U.S.), SQM S.A. (Chile), Livent Corporation (U.S.), BASF SE (Germany), Umicore (Belgium), Johnson Matthey (UK), POSCO Holdings (South Korea), LG Chem Ltd. (South Korea), Samsung SDI Co., Ltd. (South Korea), CATL (Contemporary Amperex Technology Co. Limited) (China), BYD Company Limited (China), Ganfeng Lithium Group Co., Ltd. (China), Tianqi Lithium Corporation (China), Mitsubishi Chemical Group Corporation (Japan), Sumitomo Chemical Co., Ltd. (Japan), Toray Industries, Inc. (Japan), Reliance Industries Limited (India), Gujarat Fluorochemicals Limited (India), Lynas Rare Earths Ltd. (Australia), Petronas Chemicals Group Berhad (Malaysia)

Global Hybrid Solar Wind Energy Storage Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.4 billion

- 2026 Market Size: USD 2.6 billion

- Projected Market Size: USD 4.9 billion by 2035

- Growth Forecasts: 8.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (40.5% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, China, Germany, Japan, India

- Emerging Countries: Vietnam, Brazil, United Arab Emirates, South Korea, Australia

Last updated on : 17 November, 2025

Hybrid Solar Wind Energy Storage Market - Growth Drivers and Challenges

Growth Drivers

- Fiscal and policy incentives: The aspect of landmark legislation, such as Europe’s REPowerEU Plan and the U.S.’s Inflation Reduction Act, are offering long-lasting tax credits, loan guarantees, grants, de-risking investments, and optimized project economics. According to an article published by the Ministry of Power in November 2025, there has been an increase in the primary energy demand in India, which is expected to surge to almost 1,250 to 1,500 by the end of 2030. This is readily driven by a boost in economic and income growth, resulting in a massive demand for energy services.

- Reliability and grid stability demands: An increase in the penetration of intermittent renewables is causing strain on the grid infrastructure, which is creating an urgent demand for storage to offer crucial dependability services. These include black-start capability, voltage support, and frequency regulation, positively impacting the hybrid solar wind energy storage market. For instance, as per an article published by the Observer Research Foundation in May 2023, internationally, almost 190 GW of pumped hydro storage operates as the world’s largest water battery, catering to more than 85% of installed worldwide energy storage capacity, uplifting the market’s exposure.

- Increased electrical energy supply: The hybrid solar wind energy storage market usually revolves around supplying, storing, and generating electrical energy from wind and solar sources. Therefore, there is a surge in the focus on hybrid systems that effectively combine both wind and solar power with battery storage to develop a stable and more reliable electricity supply. According to the 2025 IEA Organization article, there has been an increase in the demand for electricity by 4.3% as of 2024, denoting a 2.5% growth since 2023. The average electricity demand pace has increased from 2010 to 2023 by 2.7%, thus making it suitable for the market’s upliftment.

Electrical Energy 2023 Export and Import

|

Countries/Components |

Export |

Import |

|

France |

USD 9.9 billion |

- |

|

Germany |

USD 6.0 billion |

USD 7.5 billion |

|

Switzerland |

USD 4.6 billion |

USD 4.2 billion |

|

Italy |

- |

USD 7.2 billion |

|

Global Trade Valuation |

USD 75.6 billion |

|

|

Global Trade Share |

0.3% |

|

Source: OEC

Challenges

- Increased capital spending and financial obstacles: The effective upfront expenses for incorporating wind, solar, and other storage technologies continue to remain a primary barrier, negatively affecting the hybrid solar wind energy storage market globally. Besides, a hybrid system needs investment in two assets, along with a complicated storage component, resulting in a surge in capital outlay in comparison to single-technology projects. This has resulted in financial risks, since lenders might perceive the higher integrated technology risk, creating strict due diligence as well as potential higher capital costs.

- Permitting and regulatory inefficiencies: The regulatory framework present in different jurisdictions has not evolved in a way to readily accommodate hybrid resources, causing a hindrance in the hybrid solar wind energy storage market. Permitting frequently demands lengthy and separate processes for wind, solar, and storage, efficiently tripling the overall duration. Moreover, tariff designs, market structures, and grid interconnection rules have been created for conventional power plants. Meanwhile, hybrid systems witness challenges in being identified as the most standard single dispatchable entity that can be subjected to double-charging for grid fees, and are frequently not eligible for ancillary services.

Hybrid Solar Wind Energy Storage Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

8.3% |

|

Base Year Market Size (2025) |

USD 2.4 billion |

|

Forecast Year Market Size (2035) |

USD 4.9 billion |

|

Regional Scope |

|

Hybrid Solar Wind Energy Storage Market Segmentation:

Connectivity Segment Analysis

The on-grid segment in the hybrid solar wind energy storage market is anticipated to garner the largest share of 88.5% by the end of 2035. The segment’s upliftment is highly attributed to leveraging the existing transmission facility, thereby mitigating the prohibitive cost of developing new power lines to remote locations. According to an article published by the IEA Organization in 2025, the investment provision for electricity grids surged nearly 8.0% as of 2022. For instance, the Europe Union’s action plan is expected to initiate a EUR 584 billion (USD 633 billion) investment by the end of 2030, denoting a positive outlook for the segment’s growth.

Application Segment Analysis

The utility-scale power generation segment in the hybrid solar wind energy storage market is predicted to constitute the second-largest share during the projected period. The segment’s growth is driven by its unusual position within the grid reliability and decarbonization intersection. Independent power producers (IPPs) and utilities are readily adopting these large-scale hybrid systems as the most suitable, affordable, and dependable methodology to replace retiring fossil-fuel power plants, while catering to strict government-based renewable portfolio standards. Therefore, this has created a positive influence on the overall segment’s development in the market.

Capacity Segment Analysis

The large-scale (>100 MW) segment in the hybrid solar wind energy storage market is projected to account for the third-largest share by the end of the forecast timeline. The segment’s development is highly fueled by its grid stability provision, along with significant economies of scale by catering to the large-area or baseload demand. This is considered essential for the mass and efficient deployment of both renewable and traditional energy technologies to meet domestic energy objectives. As per the February 2025 PIB Government article, India has been successful in gaining a historic milestone by crossing 100 GW of installed solar power capacity. This achievement is a testament to the country’s commitment to a green and clean future of achieving the 500 GW target.

Our in-depth analysis of the hybrid solar wind energy storage market includes the following segments:

|

Segment |

Subsegments |

|

Connectivity |

|

|

Application |

|

|

Capacity |

|

|

Technology |

|

|

End user |

|

|

Storage Duration |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Hybrid Solar Wind Energy Storage Market - Regional Analysis

APAC Market Insights

Asia Pacific in the hybrid solar wind energy storage market is anticipated to garner the highest share of 40.5% by the end of 2035. The market in the region is effectively propelled by a huge demand for energy, ambitious government-based net-zero targets, and the overall region’s status as the international manufacturing center for severe components, such as batteries and solar panels. Besides, Japan’s Green Growth Strategy, India’s Production Linked Incentive (PLI) scheme for advanced chemistry cell battery storage, and China’s 14th Five-Year Plan for renewable energy are also uplifting the market’s growth in the region.

The hybrid solar wind energy storage market in China is growing significantly, owing to its wide-ranging industrial policy, which deliberately controls the overall renewable energy supply chain, including raw material processing, panel, and final battery manufacturing. According to an article published by the CNESA Organization in August 2025, the country has reached 73.7 GW of cumulative new energy storage capacity as of 2024, denoting over 130% increase year-over-year (YoY). This, in turn, accounts for more than 40% of the international total, significantly consolidating the country’s notable position in the global new energy storage sector. Besides, new capacities have been installed in China in terms of nuclear, thermal, solar, wind, and hydropower, which is also fueling the market’s growth in the country.

New Capacity Installed in China Between January and December 2024

|

Power Type |

January-December 2024 (GW) |

Share % |

Growth % |

December 2024 (GW) |

Share % |

|

Thermal Power |

54.1 |

13% |

-7% |

10.2 |

9% |

|

Hydropower |

14.4 |

3% |

79% |

3.9 |

3% |

|

Nuclear Power |

3.9 |

1% |

184% |

2.8 |

2% |

|

Wind Power |

79.3 |

18% |

5% |

28.5 |

25% |

|

Solar Power |

277.2 |

65% |

28% |

68.3 |

61% |

|

Total capacity added |

429.0 |

100% |

21% |

113.6 |

100% |

|

Renewable Energy adds |

370.9 |

86% |

25% |

100.7 |

89% |

|

Zero Emissions Capacity Adds |

374.8 |

87% |

26% |

103.4 |

91% |

|

Overall new spent on power grid investment |

USD 84.7 billion (15%) |

||||

Source: Climate Energy Finance

The hybrid solar wind energy storage market in India is also growing due to the severe convergence of increased unmet energy demand, robust governmental targets, and critical grid constraints that make hybrid storage systems a necessity rather than an option. As per an article published by the PIB Government in August 2025, the International Renewable Energy Agency (IRENA) stated that the country has generated an outstanding 1,08,494 GWh of solar energy, leaving behind Japan at 96,459 GWh. In addition, the domestic solar power capacity stands at 119.0 GW as of July 2025, which includes 90.9 GW from ground-mounted solar plants, 3.0 GW from hybrid projects, and 19.8 GW from grid-connected rooftop systems, along with 5.0 GW from off-grid solar installations.

Europe Market Insights

Europe in the hybrid solar wind energy storage market is predicted to emerge as the fastest-growing region during the projected period. The market’s development in the region is highly fueled by strategic imperatives for decarbonization and energy sovereignty, which are readily codified in the Europe Green Deal and REPowerEU Plan. For instance, in May 2025, Solar Power Europe revealed the latest analysis, wherein there has been a growth in battery storage by 15% as of 2024. This has been possible with the installation of 21.9 GWh of battery energy storage systems (BESS), and providing the region with 61.1 GWh overall battery fleet. Meanwhile, business innovations, such as synthetic PPAs and merchant storage, are also gaining more exposure, which in turn is driving the market.

Rapid Growth in Europe’s Battery Deployment

|

Years |

Storage Growth (GWh) |

|

2020 |

2.3 |

|

2021 |

4.2 (+86%) |

|

2022 |

10.4 (+145%) |

|

2023 |

19.1 (+84%) |

|

2024 |

21.9 (+15%) |

Source: Solar Power Europe

The hybrid solar wind energy storage market in Germany is gaining increased traction, owing to the existence of the Energiewende policy, which has readily mandated a phase-out of nuclear and coal power, developing a huge gap filled by renewable energy and storage. Besides, as per the August 2025 ITA data report, the country has an 80% target for its electricity supply, which is projected to derive from renewables by the end of 2030, and to date 59% has been achieved in 2024. The country has also planned to diminish greenhouse gas emissions by 65% within the same year, along with gaining carbon neutrality by 2045, thus boosting the market’s demand.

The hybrid solar wind energy storage market in Spain is also developing due to an explosive growth in wind and solar resources, rapidly decreasing technological expenses, and a government-led slow permitting process. In this regard, the April 2025 Ammonia Energy Association article indicated that the Spanish government has declared €1.2 billion in funding, particularly for 2.3 GW of renewable hydrogen projects. For instance, €81 million has been allocated for Compostilla Green, with RIC Energy as the leading partner for targeting aviation fuel. Likewise, €180 million has been provided for Valle Leonés Verde Hydrogen, with Reolum as the notable partner, with a focus on power generation, mobility fuel, and chemical feedstock.

North America Market Insights

North America in the hybrid solar wind energy storage market is projected to grow steadily by the end of the forecast timeline. The market’s upliftment in the region is highly attributed to unprecedented federal legislation, offering long-lasting tax incentives for regional deployment and clean energy manufacturing. Besides, as per an article published by the EPA Government in April 2024, the Biden-Harris administration has announced USD 7.0 billion to effectively deliver residential solar to more than 900,000 households, which is poised to save USD 350 million for the population. This funding is managed by the EPA’s USD 27 billion Greenhouse Gas Reduction Fund, which caters to territories, states, governments, and municipalities to develop solar programs.

The hybrid solar wind energy storage market in the U.S. is gaining increased exposure, owing to federal budget allocation, along with the presence of governmental programs to ensure environmental sustainability and advanced manufacturing technologies. As per the January 2025 U.S. Department of Energy, the Internal Revenue Service (IRS) declared USD 6.0 billion in tax credits for the second time under the Inflation Reduction Act’s (IRA) § 48C Qualifying Advanced Energy Project Tax Credit (§ 48C Program). The purpose is to expand clean energy manufacturing, materials processing, and reduce greenhouse gas emissions, thus suitable for the market’s demand.

The hybrid solar wind energy storage market in Canada is also developing due to the core climate policy for a nationwide carbon pricing system, tactical federal funding and investment tax credits, the presence of indigenous and remote communities, and corporate procurement, along with provincial ambition. As stated in the Canada Renewable Energy Association, in March 2023, the Budget comprised a 30% refundable tax credit on the capital cost of investments, which are made by taxable entities in solar PV, energy-storage technologies, and wind. In addition, a refundable 15% tax credit is also available on clean electricity investment, thus bolstering the market’s exposure and increasing demand in the country.

Key Hybrid Solar Wind Energy Storage Market Players:

- Albemarle Corporation (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- SQM S.A. (Chile)

- Livent Corporation (U.S.)

- BASF SE (Germany)

- Umicore (Belgium)

- Johnson Matthey (UK)

- POSCO Holdings (South Korea)

- LG Chem Ltd. (South Korea)

- Samsung SDI Co., Ltd. (South Korea)

- CATL (Contemporary Amperex Technology Co. Limited) (China)

- BYD Company Limited (China)

- Ganfeng Lithium Group Co., Ltd. (China)

- Tianqi Lithium Corporation (China)

- Mitsubishi Chemical Group Corporation (Japan)

- Sumitomo Chemical Co., Ltd. (Japan)

- Toray Industries, Inc. (Japan)

- Reliance Industries Limited (India)

- Gujarat Fluorochemicals Limited (India)

- Lynas Rare Earths Ltd. (Australia)

- Petronas Chemicals Group Berhad (Malaysia)

- Albemarle Corporation is one of the world’s largest lithium producers as well as a severe supplier of high-purity lithium compounds crucial for the cathode materials and electrolytes, effectively utilized in hybrid energy storage systems. The organization is extending its production capacity internationally to uplift supply chain bottlenecks and is proactively creating direct lithium-based extraction technologies. As per its 2024 annual report, the aspect of revenue is based on the bromine price, ranging from USD 1,661 to USD 3,020 per metric ton, while the operating expense is estimated to be USD 364 per metric ton.

- SQM S.A. is considered the leading lithium producer, significantly leveraging its massive brine resources in the Salar de Atacama, with the intention of supplying the battery-grade lithium carbonate, along with hydroxide, needed for the international energy storage market. The organization is readily investing in extending its lithium output and also downstreaming into the battery chemical-based value chain to gain its position as a notable clean energy transition enabler.

- Livent Corporation is regarded as the most vertically integrated and prominent lithium technology, well-known for its quality lithium hydroxide, which is immensely essential for nickel-rich cathode chemistry, enabling high energy density in long-lasting storage batteries. The firm has focused on long-standing consumer deals, and is effectively pursuing mergers, including its planned partnership with Alkem, to develop a resilient and diversified lithium supplier for the hybrid solar wind energy storage market.

- BASF SE is one of the leading international cathode active materials suppliers, and its precursors play a critical role in successfully determining the carbon footprint, cost, and performance of batteries for hybrid systems. Based on this, the company’s 2024 annual report indicates €65.3 billion in sales, €7.9 billion in EBITDA, €6.9 billion in cash flow, €0.7 billion in free cash flow, and €6.0 billion in capital spending, denoting growth opportunities in the overall hybrid solar wind energy storage market.

- Umicore is one of the international frontrunners in offering circular cathode materials, along with advanced recycling technologies, successfully turning end-of-life batteries into valuable resources for the newest energy storage systems. Additionally, its closed-loop strategy and expanded high-performance CAM portfolio are essential for diminishing the environmental impact and gaining the sustainable material supply chain demanded for the market’s development.

Here is a list of key players operating in the global hybrid solar wind energy storage market:

The hybrid solar wind energy storage market competitive landscape is significantly fragmented and readily defined by a tactical race to achieve supply chain sovereignty for advanced materials and severe battery chemicals. China-based players, such as Ganfeng and CATL, have leveraged control over mineral refining to dominate the majority share in the hybrid solar wind energy storage market. Besides, West and Korea-specific companies are currently adopting strong vertical integration and long-lasting deals to de-risk the supply chain system for high-purity electrolytes, cobalt, and lithium. Besides, in September 2025, CVC DIF declared to acquire the Gabriela project, which is considered a utility-scale hybrid PV-BESS energy project, thereby suitable for boosting the market globally.

Corporate Landscape of the Hybrid Solar Wind Energy Storage Market:

Recent Developments

- In July 2025, ITOCHU Corporation notified a power purchase agreement with EDF Power Solutions, with Electricidade de Timor-Leste, to collectively operate on a renewable energy IPP project in the Democratic Republic of Timor-Leste.

- In April 2025, Wärtsilä supplied a 64 MW / 128 MWh energy storage system for Octopus, which is the Fulham Solar Battery Hybrid project in Australia. The project paired with the 128 MWh DC-coupled battery and an 80 MW AC solar farm to modify hybrid renewable storage and energy solutions.

- In October 2024, Adani Group, along with Google, declared their collaboration to ensure advancement in organizations’ sustainability objectives and provide clean energy to the overall grid infrastructure in India.

- Report ID: 8245

- Published Date: Nov 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.