Oculopharyngeal Muscular Dystrophy (OPMD) Market Outlook:

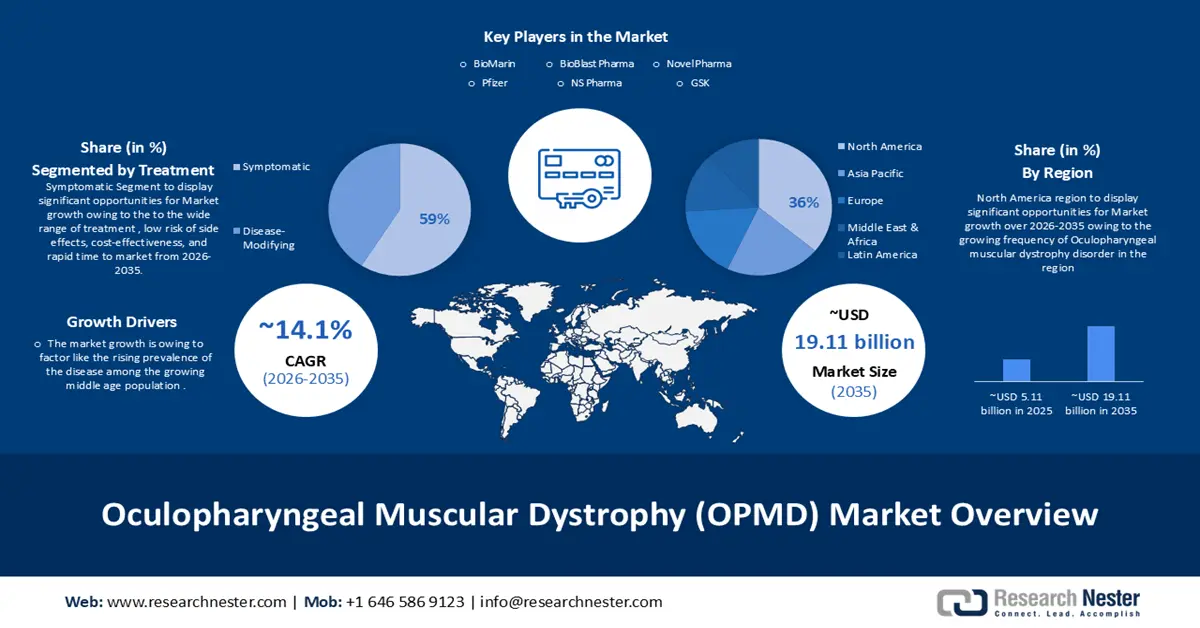

Oculopharyngeal Muscular Dystrophy (OPMD) Market size was valued at USD 5.11 billion in 2025 and is expected to reach USD 19.11 billion by 2035, registering around 14.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of oculopharyngeal muscular dystrophy is evaluated at USD 5.76 billion.

The market growth is on account of the rising prevalence of OPMD among the growing middle-aged population. According to MedlinePlus, muscular disease affects 1-100,000 people, especially occurring in the middle-aged population mostly after the age of 45. Affected patients can usually first experience weakness of the muscles in both eyelids that causes droopy eyelids and develop weakness in throat muscles making it hard for the patient to see or swallow.

Furthermore, other factors that are believed to fuel the growth of the market are advancements in symptomatic treatments like CP myotomy, and gastrostomy feeding tube insertion which are mostly aimed at reducing the symptoms and gaining signs for the comfort and well-being of the patients. This factor provides an additional opportunity for key players present in the market to expand their research and development activities.

Key Oculopharyngeal Muscular Dystrophy (OPMD) Market Insights Summary:

Regional Insights:

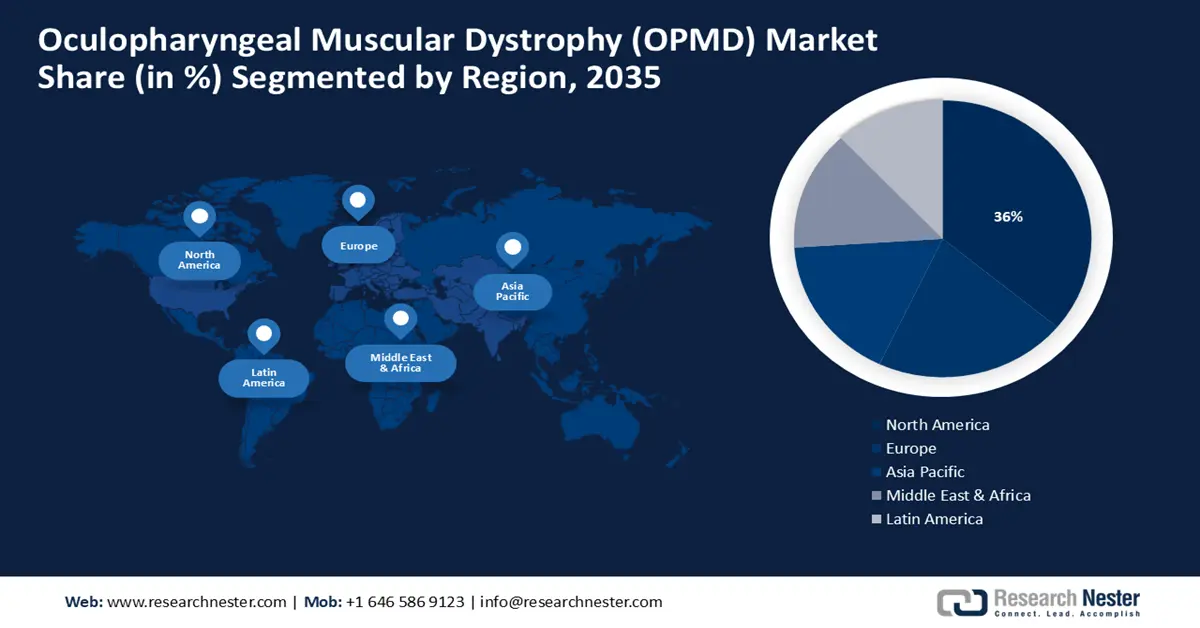

- By 2035, North America is projected to secure a 36% share in the oculopharyngeal muscular dystrophy (OPMD) market, supported by the rising incidence of OPMD cases across the region owing to the increasing frequency of the disorder.

- The Asia Pacific region is anticipated to command about 29% share by 2035, underpinned by the escalating burden of chronic diseases across the population leading to sustained market traction.

Segment Insights:

- The symptomatic segment is forecast to account for nearly 59% share by 2035 in the oculopharyngeal muscular dystrophy (OPMD) market, propelled by the expanding geriatric population that heightens susceptibility to OPMD.

- By 2035, the hospital segment is expected to capture around 42% share, reinforced by broad hospital availability and advanced therapeutic offerings catering to OPMD treatment.

Key Growth Trends:

- Expanding Geriatric Population

- Introduction of New Therapies

Major Challenges:

- High Costs of Treatment

- Unavailability of effective treatment of oculopharyngeal muscular dystrophy.

Key Players: Bioblast Pharma, PTC Therapeutics, NS Pharma, Nobelpharma Co., Ltd, Santhera Pharmaceuticals, Pfizer Inc., Marathon Pharmaceuticals, Fibrinogen, GSK.

Global Oculopharyngeal Muscular Dystrophy (OPMD) Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 5.11 billion

- 2026 Market Size: USD 5.76 billion

- Projected Market Size: USD 19.11 billion by 2035

- Growth Forecasts: 14.1%

Key Regional Dynamics:

- Largest Region: North America (36% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Canada, Germany, United Kingdom, Japan

- Emerging Countries: China, India, South Korea, Brazil, Australia

Last updated on : 28 November, 2025

Oculopharyngeal Muscular Dystrophy (OPMD) Market - Growth Drivers and Challenges

Growth Drivers

- Expanding Geriatric Population: Elderly people are more susceptible to Oculopharyngeal muscular dystrophy as they have stagnant body organs and are associated to higher muscle weakness especially after the age of 60 years making them more prone to the disorder. Thus the growing percentage of elderly people is anticipated to drive the market growth further. According to the World Health Organization, the rate of the ageing population is rising rapidly. In 2020 the population of people above the age of 60 years and older outnumbered children younger than 5 years. And the proportion of people above 60 years will nearly double from 12% to 22% in 2050.

- Introduction of New Therapies: For the treatment of Oculopharyngeal muscular dystrophy, much research are being done on new therapies. Several therapeutic strategies are being developed and tested namely mammalian cells, nematode, drosophila, mouse are currently under research. The majority of them are pharmacologic approaches to reduce cell toxicity and reduce PABPN1 (gene which produces protein and is one of the main causes of OPMD). In addition to that reduction of PABPN1 by using drugs such as doxycycline or trehalose has shown improved cell survival and muscle weakness in patients. Hence, the introduction of new therapies in the treatment of Oculopharyngeal muscular dystrophy is expected to boost the oculopharyngeal muscular dystrophy market growth.

- Increase in Healthcare Expenditure: The recent growth in healthcare expenditure due to the rising economy is also one of the factors expected to spur the growth of the market. Hence, due to the rise in healthcare expenditure and reimbursement policies most people are able to afford premium healthcare treatments. For instance, The World Bank revealed that healthcare expenditure increased from 9.68% in 2020 to 10.89% of total global GDP in 2020 and is expected to grow.

Challenges

- High Costs of Treatment - Oculopharyngeal muscular dystrophy is a rare genetic disorder making the drugs and different procedures used in its treatment and diagonisis very expensive as it requires technologically advanced medical products and devics. Thus, this factor is antcipated to lower the adoption rate of Oculopharyngeal muscular dystrophy among the middle & lower income households as a result restricting the market growth.

- Unavailability of effective treatment of oculopharyngeal muscular dystrophy.

- Lack of healthcare budget in lower and middle-income households.

Oculopharyngeal Muscular Dystrophy (OPMD) Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

14.1% |

|

Base Year Market Size (2025) |

USD 5.11 billion |

|

Forecast Year Market Size (2035) |

USD 19.11 billion |

|

Regional Scope |

|

Oculopharyngeal Muscular Dystrophy (OPMD) Market Segmentation:

Treatment Segment Analysis

The symptomatic segment in the oculopharyngeal muscular dystrophy market is estimated to gain the largest revenue share of about 59% in the year 2035. The segment growth can be attributed to the burgeoning geriatric population which makes the populace more susceptible to oculopharyngeal muscular dystrophy.According to surveys by various firms and organizations this disorder has been reported approximately in 29 countries. Additionally, the high cost and risk of side effects of surgery and disease-modifying treatments has led to the rise of the segment as symptomatic treatment which mostly consists of therapies like the wide range of motion stretching exercises, braces which add mobility and function by providing support for weakened muscles, sleep apnea device that helps improve oxygen delivery during the night.

End-User Segment Analysis

The hospital segment in the oculopharyngeal muscular dystrophy market is estimated to gain the largest revenue share of about 42% in the year 2035. The availability of hospitals in every region of the world alongside the presence of advanced therapeutic medicinal products for the treatment of oculopharyngeal muscular dystrophy is expected to drive the segment growth. To make reference, as of 2021, there are reportedly around 167,000 hospitals in the world. Asia has over 100,000 hospitals alone. Additionally, the rising inclination towards hospitals for receiving treatment by the population owning to the easy accessibility of trained medical staff and professionals among other factors attributed to the segment’s market growth.

Our in-depth analysis of the global market includes the following segments:

|

Type |

|

|

Distribution Channels |

|

|

End-Users |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Oculopharyngeal Muscular Dystrophy (OPMD) Market - Regional Analysis

North American Market Insights

The North America industry is poised to hold largest revenue share of 36% by 2035. The growth of the market can be attributed to the growing frequency of Oculopharyngeal muscular dystrophy disorder in the region. For instance, the highest prevalence rate of Oculopharyngeal muscular dystrophy 1/1000 people can be found in French Canadian population of Quebec Canada. In USA around 1/100,000 people are diagnosed with Oculopharyngeal muscular dystrophy. Furthermore, high health awareness among the population along with easy access to quality healthcare in developed region is attributed to rapid market expansion in the region during the forecast period. In addition to that, the region’s rising technological healthcare industry and expanding expenditure are also anticipated to boost the market growth in the upcoming years.

APAC Market Insights

The Asia Pacific oculopharyngeal muscular dystrophy market is estimated to the second largest, revenue share of about 29% by the end of 2035. The market’s expansion can be attributed majorly to the soaring prevalence of different chronic diseases and prolonged pain, ache and infection among the people living in the region. According to studies across Asia, the prevalence of chronic pain in adults has been reported to vary greatly, ranging from 7% in Malaysia to 60% in Cambodia and Northern Iraq. Older adults are more likely to experience chronic pain, with prevalence rates as high as 40% to 90%. Additionally, the rising focus on health and fitness coupled with government initiatives which promote a healthy lifestyle is anticipated to increase the adoption rate of Oculopharyngeal muscular dystrophy. These factors are estimated to expand the market size in the forecast period.

Oculopharyngeal Muscular Dystrophy (OPMD) Market Players:

- Bristol-Myers Squibb

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- BioMarin

- Sarepta Therapeutics

- Benitec Biopharma Inc

- Bioblast Pharma

- PTC Therapeutics

- NS Pharma

- Nobel pharma Co. Ltd

- Santhera Pharmaceuticals

- Pfizer Inc.

- Fibrinogen

- GSK

Recent Developments

- 16 February 2024 - Sarepta Therapeutics Inc., the leader in precision genetic medicine for rare diseases, today announced the U.S. Food and Drug Administration (FDA) has accepted and filed the Company's efficacy supplement to the Biologics License Application. The FDA has granted the Efficacy Supplement a Priority Review with a review goal date of June 21, 2024. The Agency has also confirmed they are not planning to hold an advisory committee meeting to discuss the supplement.

- Monday, February 05, 2024 - The American Cancer Society (ACS) and Pfizer Inc. announced the launch of “Change the Odds: Uniting to Improve Cancer Outcomes™,” a three-year initiative to bridge the gap in cancer care disparities. Through $15 million in funding from Pfizer, the initiative aims to improve health outcomes in medically underrepresented communities across the United States by enhancing awareness of and access to cancer screenings, clinical trial opportunities, and patient support and comprehensive navigation. “Change the Odds” will initially focus on breast and prostate cancer in medically underserved communities, with the potential to expand to additional cancer types.

- Report ID: 5825

- Published Date: Nov 28, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Oculopharyngeal Muscular Dystrophy (OPMD) Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.