Duchenne Muscular Dystrophy Drugs Market Outlook:

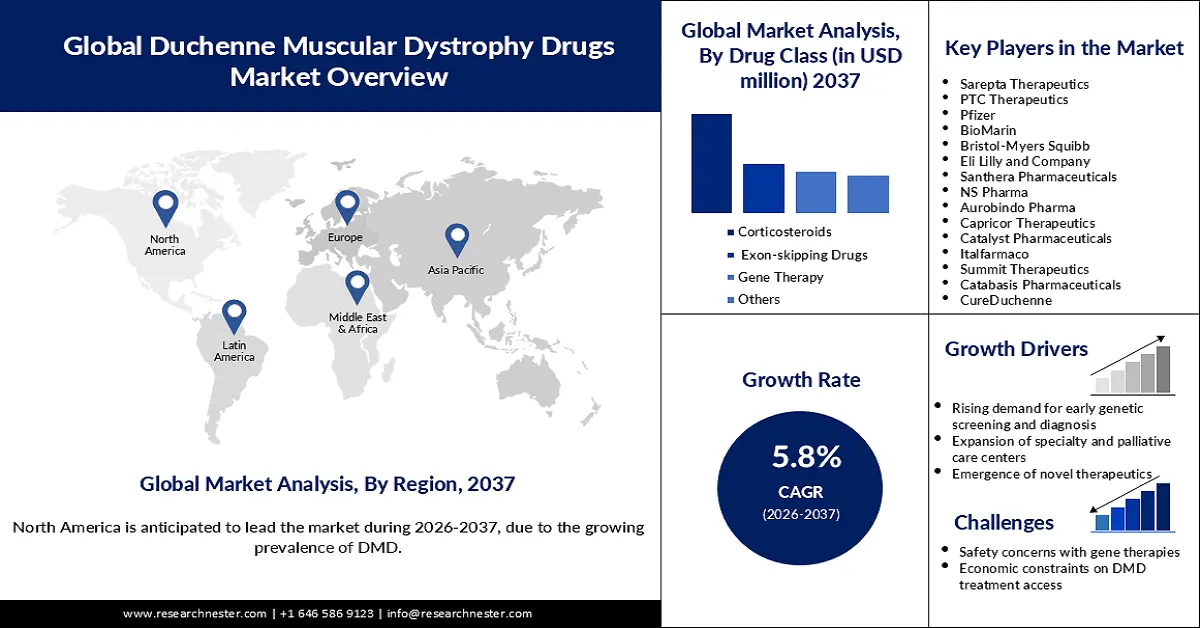

Duchenne Muscular Dystrophy Drugs Market was valued at USD 32.91 billion in 2025 and is forecasted to reach a valuation of USD 66.56 billion by the end of 2037, rising at a CAGR of 5.8% during the forecast period, i.e., 2026-2037. In 2026, the industry size of duchenne muscular dystrophy (DMD) drugs is estimated at USD 35.59 billion.

The growing prevalence of Duchenne Muscular Dystrophy (DMD), a disease caused by a mutation of the gene on the X chromosome, is fueling the market growth globally. In July 2024, the National Organization for Rare Disorders reported that DMD affects around 1 in every 3,500 male births globally and is typically diagnosed between 3 and 6 years of age. A report by the CDRR Editors revealed in 2024 that around 1.0 individuals per 100,000 population were suffering from DMD. The demand for DMD drugs, such as corticosteroids, exon-skipping drugs, and others, is likely to increase with the growing prevalence of the disease to manage symptoms, slow its progression, and enhance gene function.

Additionally, rising investments by governments across different regions to enhance healthcare infrastructure are also fostering the Duchenne Muscular Dystrophy (DMD) drugs industry expansion significantly. The growth of the market is further supported by the rising healthcare spending by regulators and the general population. As revealed by the International Finance Corporation in March 2025, it provided private healthcare services to around 61.5 million people across different regions globally through investments from 2021 to 2023. High healthcare expenditure indicates the likelihood of accelerated adoption of DMD drugs in different healthcare settings. Manufacturers also have access to adequate funding required to invest in research and development, focused on the advancement of the drugs. Patients with poor financial backgrounds can also gain access to unaffordable DMD drugs using government financial assistance programs under national policies for rare diseases.

Key Duchenne Muscular Dystrophy Drugs Market Insights Summary:

Regional Insights:

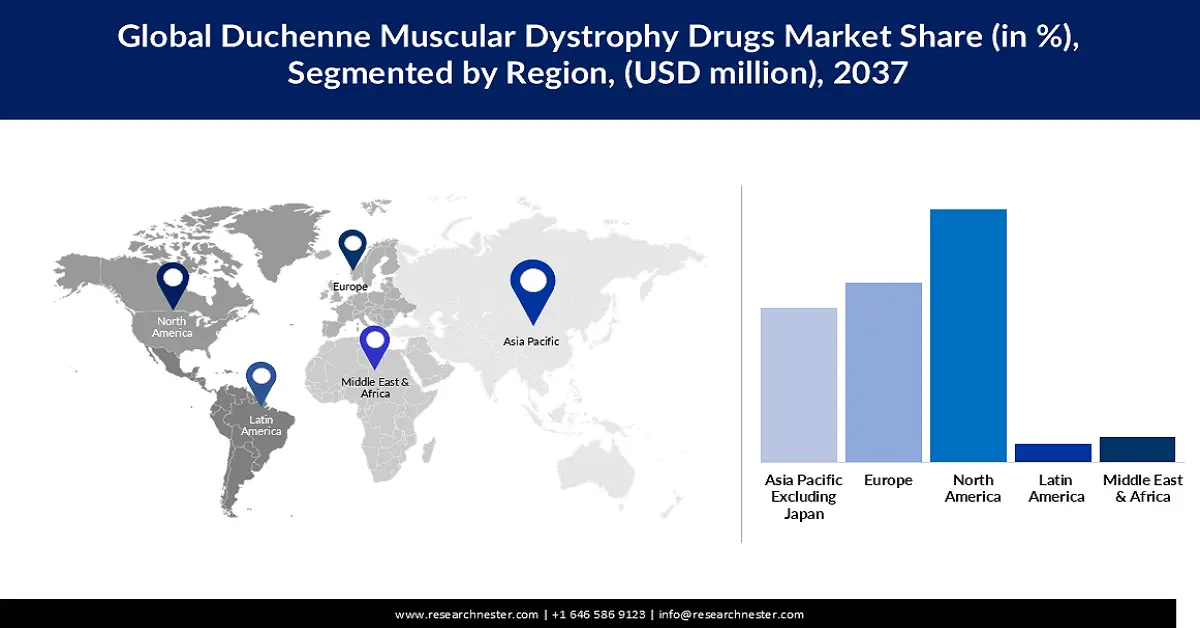

- The North America duchenne muscular dystrophy drugs market is anticipated to acquire a 43.2% share by 2037, driven by the growing prevalence of DMD and a robust development ecosystem for gene therapies.

- The Europe duchenne muscular dystrophy drugs market is poised to hold a 28.8% share by 2037, owing to the increasing prevalence of DMD across the region.

Segment Insights:

- The corticosteroids segment is projected to hold a 50.1% share by 2037, impelled by the growing demand in the healthcare sector to enhance muscle strength and function, and to prevent disease progression.

- The hospital pharmacy segment is poised to capture a 58.1% share by 2037, fueled by the central role of hospitals in treatment administration.

Key Growth Trends:

- Rising demand for early genetic screening and diagnosis

- Expansion of specialty and palliative care centers

Major Challenges:

- Safety concerns with gene therapies

- Economic constraints on DMD treatment access

Key Players: PTC Therapeutics (U.S.), Pfier (U.S.), BioMarin (U.S.), Bristol-Myers Squibb (U.S.), Eli Lilly and Company (U.S.), Santhera Pharmaceuticals (Switzerland), NS Pharma (Japan), Aurobindo Pharma (India), Capricor Therapeutics (U.S.), Catalyst Pharmaceuticals (U.S.), Italfarmaco (Italy), Summit Therapeutics (U.K.), Catabasis Pharmaceuticals (U.S.), CureDuchenne (U.S.).

Global Duchenne Muscular Dystrophy Drugs Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 32.91 billion

- 2026 Market Size: USD 35.59 billion

- Projected Market Size: USD 66.56 billion by 2037

- Growth Forecasts: 5.8% CAGR (2026-2037)

Key Regional Dynamics:

- Largest Region: North America (43.2% Share by 2037)

- Fastest Growing Region: Asia Pacific Excluding Japan

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Australia, Canada

Last updated on : 5 November, 2025

Duchenne Muscular Dystrophy Drugs Market - Growth Drivers and Challenges

Growth Drivers

- Rising demand for early genetic screening and diagnosis: Growing health awareness and surging prevalence of genetic and lifestyle-caused disorders are driving the demand for early genetic screening and diagnosis. In addition, the demand is expected to continue accelerating over time as people are increasingly realizing that genomic tests can be helpful to prevent the onset of genetic and lifestyle-caused diseases. Healthcare practitioners can also recommend precise and personalized drugs to patients with the advancement of genetic screening, driven by rapid therapeutic developments for DMD.

- Expansion of specialty and palliative care centers: Strong movements are being observed across different countries to expand public access to palliative care through exclusive channels, such as nursing homes, hospitals, and other healthcare facilities. The governments of different countries are also supporting the population in gaining access to specialty care when in need. For instance, the Press Information Bureau reported in June 2025 that the government of India introduced the Ayushman Vay Vandana initiative in October 2024, which served senior citizens aged 70 and older regardless of their socio-economic and earning status with a total financial aid of approximately USD 56.4 million. This type of government support is making specialty care increasingly affordable for the older-aged population. As a result, the consumption of DMD therapeutic drugs for the provision of specialty and palliative care is expected to increase, helping prevent disease progression, manage symptoms and complications, and enhance the quality of life for patients.

- Emergence of novel therapeutics: Companies associated with the market are increasingly investing in research and development, leading to the emergence of novel gene, cell, and antisense oligonucleotide-based therapies as well as small molecule-derived drugs. As reported by the National Library of Medicine in November 2023, the number of antisense oligonucleotides (ASOs) approved by the U.S. Food and Drug Administration (FDA) has surpassed 13, while 8 have been approved by the European Medicines Agency (EMA). The development of novel therapeutics has provided healthcare practitioners with the opportunity to not only use DMD therapeutic drugs for the provision of palliative care but also for addressing the root causes of different illnesses.

Challenges

- Safety concerns with gene therapies: In February 2022, the National Library of Medicine disclosed that traditional gene therapies may increase the risk of acute health disorders, including cancer, inflammation, and toxicity in the human body that can be caused by unwanted reactions of the immune system, use of infectious delivery vectors, and the disruption of the new gene in normal functions. The likelihood of these risks can hinder the adoption of DMD therapeutic drugs. It also creates the need for relevant organizations to invest heavily in research and development to design safer vectors and optimize dosing techniques.

- Economic constraints on DMD treatment access: The cost of accessing DMD therapeutic drugs is relatively high compared to a range of other treatments. The price of DMD drugs used for disease management varies among healthcare organizations depending on the extent to which mobility support and respiratory care are needed during a treatment procedure. This often leads to a lack of affordability for patients in regions where disposable income is comparatively low, thereby limiting the overall consumption of these drugs.

Duchenne Muscular Dystrophy Drugs Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.8% |

|

Base Year Market Size (2025) |

USD 32.91 billion |

|

Forecast Year Market Size (2035) |

USD 66.56 billion |

|

Regional Scope |

|

Duchenne Muscular Dystrophy Drugs Market Segmentation:

Drug Class Segment Analysis

The corticosteroids segment is projected to hold a market share of 50.1% by the end of 2037, owing to the growing demand in the healthcare sector to enhance muscle strength and function, and to prevent disease progression. The corticosteroid class of DMD drugs can strengthen muscle and its function over a period of 12 months. The growing prevalence of respiratory diseases is also expected to fuel the consumption of corticosteroids in the upcoming years, as these drugs help reduce inflammation associated with asthma, croup, COPD, and different interstitial lung disorders. According to estimates by the World Health Organization in June 2025, over 80 million people worldwide suffer from reported respiratory diseases, with many more yet to be diagnosed.

Distribution Channel Segment Analysis

The hospital pharmacy segment is poised to continue its dominance, capturing a market share of 58.1% by 2037, due to the central role of hospitals in treatment administration. In other words, hospitals are best-suited to ensure the delivery of DMD therapeutic drug doses to patients because of their centralized access to a diverse range of healthcare professionals. The majority of public spending on health takes place in hospitals, which increases their investment capability and facilitates the sourcing of DMD therapeutic drugs for treatment provision. In June 2025, the Centers for Medicare & Medicaid Services disclosed that hospital expenditures globally increased by 10.4% in 2023 to reach USD 1,519.7 million.

Treatment Approach Segment Analysis

The steroid therapy segment is set to hold 48% of the market share between 2026 and 2037, on account of the capacity of the treatment approach to prevent the progression of muscle weakness and damage effectively. The delivery of the DMD therapeutic drugs through the use of steroid therapy also enhances muscle mobility and function for at least 3 years. Therefore, healthcare organizations are likely to be increasingly attracted to the use of steroid therapy in treating patients using DMD therapeutic drugs, given the rising prevalence of the disease. Companies are actively involved in the development of drugs that can be classified into both DMD therapeutic drugs and steroid categories. A report by the National Library of Medicine, published in January 2024, revealed that ReveraGen BioPharma’s Vamorolone, a DMD therapeutic drug that was approved in October 2023 in the U.S. for use with a steroid-based approach in treating patients aged 2 years and older.

Our in-depth analysis of the global Duchenne Muscular Dystrophy (DMD) drugs market includes the following segments:

|

Segments |

Subsegments |

|

Drug Class |

|

|

Distribution Channel |

|

|

Treatment Approach |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Duchenne Muscular Dystrophy Drugs Market - Regional Analysis

North America Market Insights

The North America duchenne muscular dystrophy drugs market is anticipated to acquire a revenue share of 43.2% by the end of 2037, owing to the growing prevalence of DMD. As updated by CDRR Editors in October 2024, North America recorded the highest prevalence of DMD (1.2 per 100,000 population) among all the regions globally. Therefore, the region demonstrates a strong demand for DMD therapeutic drugs. A robust development ecosystem for gene therapies also contributes to the evolution of DMD therapeutic drugs with the emergence of novel curative possibilities. In February 2022, the North Carolina General Assembly reported that the state had emerged as a hub for gene and cell therapy activities.

The U.S. DMD drugs industry is estimated to witness a CAGR of 5.6% from 2026 to 2037, on account of the rising number of patients diagnosed with DMD, which can drive the demand for DMD therapeutic drugs. Growing awareness of DMD and its treatment, driven by public and private organizations, is also likely to accelerate the consumption of DMD therapeutic drugs in the years to come. In August 2025, the Centers for Disease Control and Prevention announced that September is observed as Muscular Dystrophy (MD) Awareness Month. The organization also collaborates actively in developing guidelines for the treatment of DMD, including through funding initiatives. Advanced DMD therapeutic drugs are also expected to be recommended by the CDC for use in treatment processes.

Canada is set to emerge as an expanding duchenne muscular dystrophy drugs market, due to strong investment in relevant research and development. As revealed by the University of Toronto Mississauga in February 2024, the Canadian Institutes of Health Research awarded the University of Toronto Mississauga and the U of T Donnelly Centre funding worth USD 900,000 for their project, focused on combating muscular dystrophy. Access to this type of funding supports adequate investment in R&D aimed at advancing DMD therapeutic drugs. The demand for the drugs is also expected to rise with the growing prevalence of DMD across the country.

Europe Market Insights

The Duchenne muscular dystrophy (DMD) drugs market in Europe is poised to acquire a revenue share of 28.8% by 2037, owing to the growing demand for the drugs, driven by the increasing prevalence of DMD across the region. According to the latest update by the European Parliament in March 2024, DMD affects approximately 3,500 newborn male babies. As per the European Medicines Agency, around 26,000 people were reported to be suffering from DMD.

Supporting regulatory and government policies is also expected to accelerate market growth significantly. For instance, a leading multinational healthcare business, Roche, received a negative opinion from the Committee for Medicinal Products for Human Use (CHMP) of the European Medicines Agency (EMA) regarding Elevidys. The organization was obliged to obtain conditional marketing authorization for the DMD therapeutic drug for ambulatory people aged between 3 and 7 years. As a result, the organization started working with EMA to find a potential path forward, which is likely to foster innovation.

The duchenne muscular dystrophy drugs market in Germany is expected to experience a 7.1% CAGR throughout the forecast period, due to the robust healthcare system of the country, which is aimed at enhancing the management of rare diseases. In December 2023, the Robert Koch Institute (RKI) revealed the outcomes of its survey, indicating that the development of orphan drugs has offered novel treatment options for individuals suffering from rare diseases. This indicates the likelihood of a significant increase in the consumption of the DMD therapeutic drugs. The development of novel exon-skipping and gene-based therapies has taken place in Germany, which can enhance the delivery of the DMD therapeutic drugs to patients. As reported by the Max Delbrück Center for Molecular Medicine in March 2021, its research, along with the professionals from Charité, developed a new gene therapy utilizing a special T-cell receptor capable of enabling the immune system to effectively recognize and combat cancer cells.

The DMD industry in the UK is set to grow steadily throughout the projection period, due to the surge in the prevalence of DMD, driving the demand for DMD therapeutic drugs for diagnostic purposes. In October 2024, Action Medical Research disclosed that around 100 male babies are born with DMD every year in the UK. The market is also expanding within the country with the development of exon-skipping drugs domestically. For instance, in March 2025, Entrada Therapeutics received approval to carry out ELEVATE-45-201, a Phase 1/2 clinical trial of multiple ascending dose (MAD). The study intended to evaluate the potential of ENTR-601-45, an exon-skipping drug, to treat patients with DMD.

Asia Pacific Excluding Japan Market Insights

The Asia Pacific Excluding Japan can emerge as an expanding duchenne muscular dystrophy drugs market, acquiring a revenue share of 14.2% between 2026 and 2037, due to booming investment by biotechnology businesses and academic institutions in relevant research and development. This can lead to the detection of the stronger pipelines for DMD therapeutic drugs. As reported by the Singapore Economic Development Board (EDB) in October 2025, despite a decline by 11% in early-stage funding for biotechnology in the Asia Pacific between 2019 and 2024, the late-stage deal volume surged 1.5 times over the same financial period. People within the region are highly aware of the DMD, influencing the probability of an accelerated consumption of the therapeutic drugs in the upcoming business years.

The duchenne muscular dystrophy drugs market in China is set for a robust expansion at a CAGR of 7.6% during the projection timeline, as a consequence of the suitable reimbursement policies of the government. For instance, the Professional Society for Health Economics and Outcomes Research revealed in June 2022 that the National Healthcare Security Administration applied a novel annual negotiation process for all the new and innovative drugs drafted in the National Reimbursement Drug List (NRDL). This creates pressure on the suppliers to take measures for a reduction in the prices of DMD therapeutic drugs, which can lead to increased market affordability. Rapid advancements in gene therapy are also influencing the enhancement in the delivery of the DMD therapeutic drugs while treating patients.

The India DMD drugs industry can experience a compound annual growth rate of 7.2% during the stipulated timeframe. The growth is driven by the booming incidence of DMD, which is influencing a consistent demand for the drugs for diagnostic reasons. The development of mutation-specific therapies can also boost the market expansion significantly. In May 2025, the Indian Organization for Rare Diseases disclosed that breakthroughs in the Clustered Regularly Interspaced Short Palindromic Repeats (CRISPR) therapies led to significant advancement in rare diseases research. This can shift the focus of the DMD drugs industry from symptom management to the detection and implementation of permanent genetic cures.

Key Duchenne Muscular Dystrophy Drugs Market Players:

- Sarepta Therapeutics (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- PTC Therapeutics (U.S.)

- Pfier (U.S.)

- BioMarin (U.S.)

- Bristol-Myers Squibb (U.S.)

- Eli Lilly and Company (U.S.)

- Santhera Pharmaceuticals (Switzerland)

- NS Pharma (Japan)

- Aurobindo Pharma (India)

- Capricor Therapeutics (U.S.)

- Catalyst Pharmaceuticals (U.S.)

- Italfarmaco (Italy)

- Summit Therapeutics (U.K.)

- Catabasis Pharmaceuticals (U.S.)

- CureDuchenne (U.S.)

- A global biopharmaceutical leader, Bristol-Myers Squibb focuses on innovative therapies for rare and genetic disorders, including DMD. The company leverages its expertise in biologics and gene-modifying technologies to develop treatments aimed at slowing disease progression and improving patients' quality of life.

- Eli Lilly is a major pharmaceutical company engaged in research and development of therapies for neuromuscular and genetic disorders. Its focus in DMD includes novel approaches in antisense oligonucleotides and supportive care therapies to enhance muscle function and delay disease progression.

- Santhera is a Swiss specialty pharmaceutical company focused on rare neuromuscular and mitochondrial disorders. In the DMD market, Santhera develops targeted therapies designed to improve respiratory and skeletal muscle function and address disease-related complications.

- A Japanese biopharmaceutical company, NS Pharma, emphasizes the development of treatments for rare and pediatric diseases. Its DMD-related initiatives involve the commercialization of approved therapies and collaboration with global partners to enhance access and treatment outcomes in Japan and Asia.

- Aurobindo Pharma is a leading Indian pharmaceutical company with a strong focus on generic and specialty medicines. In the DMD therapeutic space, it works on manufacturing and supplying approved drugs, aiming to improve the affordability and accessibility of treatments for patients in emerging markets.

Below is the list of the key players associated with the global Duchenne Muscular Dystrophy (DMD) drugs market:

The competition in the global duchenne muscular dystrophy drugs market is estimated to intensify over the next few years, owing to the increasing involvement of the key players in research and development, which can drive the development of novel and creative therapies. The market is moderately concentrated as the large established competitors are ahead of the smaller players in terms of innovation and price competitiveness. Strategic collaborations are optimally prioritized by all the key players in the market. They are even focused on the adoption of suitable measures that can lead to a reduction in the prices of the DMD drugs.

Corporate Landscape of the Global Duchenne Muscular Dystrophy (DMD) Drugs Market:

Recent Developments

- In April 2025, Dyne Therapeutics, Inc., a clinical-stage company dedicated to developing transformative therapies for genetically driven neuromuscular diseases, announced that the European Commission (EC) granted orphan drug designation for DYNE-251 for the treatment of Duchenne Muscular Dystrophy (DMD). DYNE-251 is currently being evaluated in the Phase 1/2 DELIVER global clinical trial in patients amenable to exon 51 skipping. Long-term data from the ongoing trial, presented in March 2025 at the Muscular Dystrophy Association (MDA) Clinical & Scientific Conference, demonstrated unprecedented and sustained functional improvements at the selected registrational dose. Key functional assessments include Stride Velocity 95th Centile (SV95C), an objective digital measure recognized as a primary endpoint for DMD trials in Europe.

- In December 2024, Santhera Pharmaceuticals announced that China’s National Medical Products Administration (NMPA) approved AGAMREE® (vamorolone) for use in patients aged 4 years and older, marking the first approved therapy for Duchenne Muscular Dystrophy (DMD) in China.

- Report ID: 8222

- Published Date: Nov 05, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.