Duchenne Muscular Dystrophy Treatment Market Outlook:

Duchenne Muscular Dystrophy Treatment Market size was over USD 1.9 million in 2025 and is estimated to reach USD 6.2 million by the end of 2035, expanding at a CAGR of 12.8% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of duchenne muscular dystrophy treatment is evaluated at USD 2.1 million.

The enlarging patient population of Duchenne muscular dystrophy (DMD) is becoming a global concern, which is pushing healthcare authorities to procure and cultivate effective treatments. As evidence, the National Institute of Health (NIH) in June 2022, the global prevalence of Duchenne muscular dystrophy is 1 in 3500 to 1 in 5000 live male births. Besides, the Centers for Disease Control and Prevention (CDC) reported that DMD occurrence intensifies among newborns, which is driving for lifelong therapeutic intervention to combat progressive muscle degeneration. Hence, it signifies the presence of a sustainable consumer base for the market.

The indication of payers' price pressure on the duchenne muscular dystrophy treatment market can be illustrated by the high inflation of major economic indicators. Federal grants and funding have raised their spending on gene therapy trials and research, to improve patient lifespan and enhance quality of life. The gene therapy alone itself indicates an investment horizon of hundreds of millions in America alone, with each dose costing anywhere from USD 2.1 million, according to the NLM report in November 2023, indicating both cost and technological intensity. Strategic mitigation in B2B operations generally revolves around multi-sourcing of key reagents, backward integration for manufacturing of plasmids, and long-term agreements with CDMOs to stabilize throughput and minimize time-to-market risk.

Key Duchenne Muscular Dystrophy Treatment Market Insights Summary:

Regional Highlights:

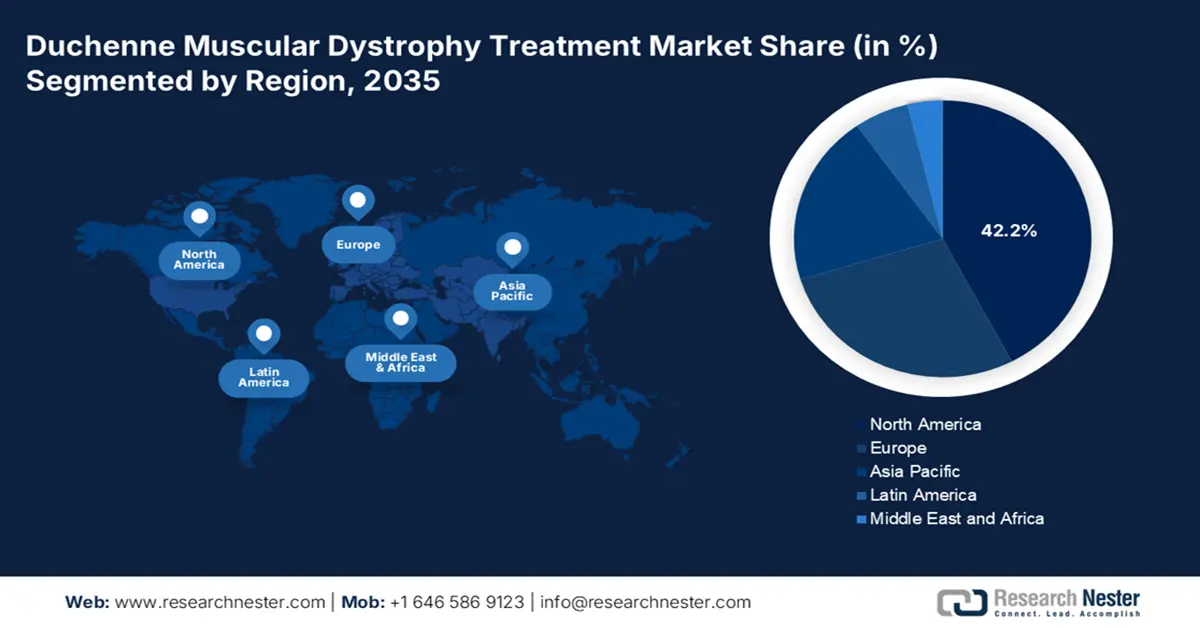

- North America is projected to command a 42.2% share in the Duchenne Muscular Dystrophy Treatment Market by 2035, owing to its robust therapy pipeline and expanded insurance coverage.

- Asia Pacific is anticipated to record the fastest growth by 2035 with its rising DMD incidence and strengthened rare-disease initiatives, attributed to newborn screening expansion and increased multinational collaborations.

Segment Insights:

- The hospital pharmacies segment is expected to hold a 65.5% share during 2026–2035, propelled by their essential role in administering complex DMD treatments under specialized clinical supervision.

- The gene therapy segment is projected to dominate by 2035, impelled by its global acceptance as a first-line DMD therapy and escalating R&D investments.

Key Growth Trends:

- Amplification of financial backing

- Increased investments and participation in R&D

Major Challenges:

- Regulatory compliance-related hurdles

Key Players: Sarepta Therapeutics, Inc., Pfizer Inc., NS Pharma, Inc., PTC Therapeutics, Inc., Santhera Pharmaceuticals, Solid Biosciences Inc., Edgewise Therapeutics, Inc., Catabasis Pharmaceuticals, FibroGen, Inc., Italfarmaco S.p.A., BioMarin Pharmaceutical Inc., Dyne Therapeutics, Inc., Roche Holding AG, Genethon, Wave Life Sciences, Daiichi Sankyo Company, Limited, Taisho Pharmaceutical Holdings, Takeda Pharmaceutical Company Limited, JCR Pharmaceuticals Co., Ltd.

Global Duchenne Muscular Dystrophy Treatment Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.9 million

- 2026 Market Size: USD 2.1 million

- Projected Market Size: USD 6.2 billion by 2035

- Growth Forecasts: 12.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (42.2% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Australia, Canada

Last updated on : 12 September, 2025

Duchenne Muscular Dystrophy Treatment Market - Growth Drivers and Challenges

Growth Drivers

- Amplification of financial backing: Medicare spending on duchenne muscular dystrophy (DMD) therapies was estimated at USD 104 million from 2017 to 2022 based on CMS Medicaid State Drug Utilization data, with Medicaid spending significantly higher at USD 1.1 billion during the same period. The total combined spending on key DMD medications (eteplirsen, golodirsen, casimersen) increased from USD 25 million in 2017 to approximately USD 327 million in 2022, based on NLM report in March 2024. This highlights the growing recognition of DMD in creating new business opportunities via a reduction in patient financial burdens.

- Increased investments and participation in R&D: Continuous effort towards extensive research, development, and deployment is propelling expansion in the Duchenne muscular dystrophy treatment market. As evidence, the Parent Project Muscular Therapy report in November 2023 states that it has funded over USD 7 million in a variety of gene therapies. Further, CDC’s Muscular Dystrophy Program funding is set to rise from USD 7.5 million to USD 10 million. Moreover, these investments are accelerating therapeutic innovation in this sector.

- Rising patient pool and disease prevalence: The Parent Project Muscular Therapy report in 2025 estimates that 20,000 babies worldwide are born with the disease and nearly 15,000 men are living with Duchenne today in the U.S. These figures indicate a rising patient base due to improved diagnostics and longer survival rates, directly increasing therapeutic demand. Growing prevalence especially in developed regions drives procurement and clinical trial activity.

Percentage of Male Population with Duchenne Muscular Dystrophy Varied by Age

|

Age |

Percentage |

|

5-9 |

29% |

|

10-14 |

82% |

|

15-24 |

90% |

Source: CDC, January 2025

Challenges

- Regulatory compliance-related hurdles: Strict requirements from indifferent regulations in various landscapes pose a significant hurdle for the Duchenne muscular dystrophy treatment market. The elongated process of therapy approvals often delays product launch and restricts optimum profitability. For instance, in 2022, the Pharmaceuticals and Medical Devices Agency (PMDA) postponed clearance for exon-skipping therapies. To resolve this issue, Sarepta expedited review pathways, where the fast-tracked FDA allowances reduced review times in 2023.

Duchenne Muscular Dystrophy Treatment Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

12.8% |

|

Base Year Market Size (2025) |

USD 1.9 million |

|

Forecast Year Market Size (2035) |

USD 6.2 million |

|

Regional Scope |

|

Duchenne Muscular Dystrophy Treatment Market Segmentation:

Distribution Channel Segment Analysis

In terms of distribution channel, hospital pharmacies dominate the segment and are expected to have the revenue share of 65.5% in the Duchenne muscular dystrophy treatment market over the assessed period. The segment is driven by the critical role in healthcare facilities in administering complex DMD curatives, which require specialized medical supervision. Moreover, the importance of these settings in managing progressive neuromuscular disorders due to the availability of multidisciplinary financial support and ongoing therapeutic monitoring helps this segment outperform home-based treatment options.

Treatment Type Segment Analysis

Based on treatment type, the gene therapy segment is expected to dominate the Duchenne muscular dystrophy treatment market by 2035. The dominance of the segment can be characterized by its worldwide acceptance as the gold standard first-line DBD therapy. Based on the evidence in June 2023, Indiana University received USD 3.8 million for research in gene therapies and also tested alternative forms of treatment for degenerative diseases such as duchenne muscular dystrophy. The increased R&D investment highlights the innovation in the treatment of DMD.

Route of Administration Segment Analysis

The intravenous (IV) is the largest sub-segment in the route of administration segment. The dominance is due to the need for biologics such as antisense oligonucleotides (e.g., eteplirsen, golodirsen) and gene therapies to be administered systemically. According to the Clinical Trial Register in 2025, almost 44358 clinical trials are conducted in duchenne muscular dystrophy. In addition, advanced DMD clinical trials overwhelmingly utilized IV infusion, reflecting its critical role in ensuring precise dosing and bioavailability for these complex and high-cost therapeutics.

Our in-depth analysis of the duchenne muscular dystrophy treatment market includes the following segments:

| Segment | Subsegment |

|

Treatment Type |

|

|

Distribution Channel |

|

|

Drug Class |

|

|

Route of Administration |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Duchenne Muscular Dystrophy Treatment Market - Regional Analysis

North America Market Insights

North America is anticipated to attain the largest share of 42.2% in the duchenne muscular dystrophy treatment market throughout the analyzed timeframe. The dominance is based on the robust pipeline of innovative therapies and broadened insurance coverage, which enhances patient access to advanced care. As per the CDC report in January 2025, nearly 14 in 100,000 males are affected by duchenne muscular dystrophy. Rising patient pool and healthcare advancements make North America a leader in therapeutic development and commercialization.

The U.S. dominates the regional Duchenne muscular dystrophy treatment market due to the substantial public and personal spending. As per the Rare Disease report in August 2025, fewer than 50,000 people in the U.S. have this disease. This is a genetic disease and mostly occurs at a young age. Market demand is fueled by strong patient advocacy groups like Parent Project Muscular Dystrophy (PPMD), which push for accelerated access and favorable insurance policies, ensuring that approved therapies reach the patient population despite annual costs.

Birth Prevalence and Diagnosis Rates of Duchenne Muscular Dystrophy

|

Year Range |

Region |

Birth Prevalence (per 100,000 male live births) |

Diagnosis Notes |

|

2020–2024 (approx) |

Global |

15.1–19.5 |

Consistent with historic rates; ranges approximately 1 in 3500 to 1 in 5000 male live births |

|

2023 |

United States |

2 per 10,000 males |

Diagnosis tends to occur before age 5 with improved genetic screening and newborn screening programs |

|

2022 |

Canada |

4.8 per 100,000 |

Prevalence consistent with rare disease profile; diagnostic advances underway |

Sources: NLM June 2022, NLM July 2023, NLM February 2022

APAC Market Insights

Asia Pacific is expected to achieve the highest growth rate in the duchenne muscular dystrophy treatment market by the year 2035. The increasing incidence of DMD, is the key driver for the region's outstanding spread in this segment. Furthermore, initiatives by governments in terms of rare diseases are also driving adoption in this segment. Key trends are the growth of newborn screening programs across countries such as South Korea and Taiwan, and strategic entry by multinational players through tie-ups with domestic manufacturers to enhance affordability and reach.

The China Duchenne muscular dystrophy treatment market is experiencing rapid growth on account of significant progress in cell-based research and development. Testifying to the same, the National Medical Products Administration (NMPA) approved DMD therapies in 2023. As per the NLM report in June 2022, the mean age at diagnosis is approximately 4.3 years, comparable to that in the U.S., and 71.3% of patients aged 5 and above use corticosteroids, a higher rate than in several Western countries. Telemedicine has emerged as an effective care model during the pandemic, highlighting the need for collaborative governmental and non-governmental efforts to improve drug accessibility for patients in China with DMD.

Europe Market Insights

The Europe duchenne muscular dystrophy treatment market is exhibiting robust growth to gain the 2nd largest revenue share by 2035. This is a result of favorable government initiatives and improved national healthcare policies. In this regard, based on the European Commission report in February 2025, European member states received €18.75 million to improve the national plan for rare diseases, which includes DMD. Further, the region is also benefiting from cross-border data sharing and national awareness programs.

Germany is leading the Europe duchenne muscular dystrophy treatment market with a huge public and private capital investment. According to the NLM report of August 2025, duchenne muscular dystrophy has a prevalence of 14.85 to 18.91 per 100,000 males aged under 40 years in 2021. The disease management programs (DMPs) of the country have enhanced the results of the patients through standardized care guidelines, and the healthcare costs extended to an average of €41,888.70 per patient each year in advanced stages, with more medical aids and interventions. The leadership of the nation is complemented by the early implementation of the cutting-edge therapies for rare disease fund in 2023.

Key Duchenne Muscular Dystrophy Treatment Market Players:

- Sarepta Therapeutics, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Pfizer Inc.

- NS Pharma, Inc.

- PTC Therapeutics, Inc.

- Santhera Pharmaceuticals

- Solid Biosciences Inc.

- Edgewise Therapeutics, Inc.

- Catabasis Pharmaceuticals

- FibroGen, Inc.

- Italfarmaco S.p.A.

- BioMarin Pharmaceutical Inc.

- Dyne Therapeutics, Inc.

- Roche Holding AG

- Genethon

- Wave Life Sciences

- NS Pharma, Inc.

- Daiichi Sankyo Company, Limited

- Taisho Pharmaceutical Holdings

- Takeda Pharmaceutical Company Limited

- JCR Pharmaceuticals Co., Ltd.

The duchenne muscular dystrophy treatment market is led by the heavy competition among key players, including Sarepta, Pfizer, and Roche, who collectively control the global revenue. Their focus on gene therapies and exon-skipping drugs, coupled with strategic collaborations and manufacturing capacity expansion, is highlighting the major opportunity present in this sector. On the other hand, emerging innovators, such as Wave Life Sciences and CRISPR Therapeutics. The current dynamics of this merchandise are shaped by accelerating participation of APAC, advancements in clinical trials, and expedited regulatory approvals.

Below is the list of some prominent players operating in the global market:

Recent Developments

- In August 2025, Dyne Therapeutics announced FDA Breakthrough Therapy Designation for DYNE-251 in duchenne muscular dystrophy. It targets exon 51 skipping and has shown sustained functional improvements in clinical trials, with accelerated approval expected in early 2026.

- In May 2025, Chugai Pharmaceutical receives regulatory approval for ELEVIDYS, which is a gene therapy product for duchenne muscular dystrophy in japan.

- Report ID: 3814

- Published Date: Sep 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Duchenne Muscular Dystrophy Treatment Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.