Mobile User Authentication Market Outlook:

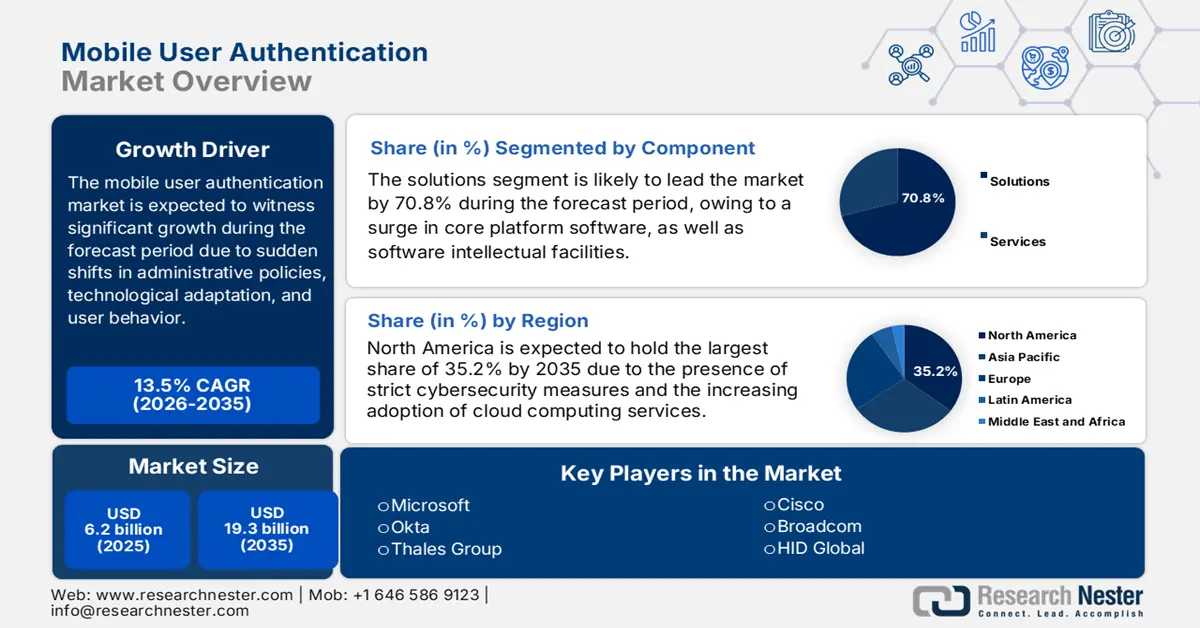

Mobile User Authentication Market size was USD 6.2 billion in 2025 and is anticipated to reach USD 19.3 billion by the end of 2035, increasing at a CAGR of 13.5% during the forecast period, i.e., 2026-2035. In 2026, the industry size of mobile user authentication is assessed at USD 7 billion.

The international market is effectively witnessing non-cyclical and accelerated growth, which is readily boosted by fundamental transitions in regulation, user behavior, and technology. These include regulatory mandates, such as the U.S. FFIEC and Europe’s PSD2 Strong Customer Authentication (SCA). Besides, according to an article published by PURPLESEC in May 2025, the approximate expense of a data breach usually varies, and small-scale businesses are expected to initiate a payment of USD 120,000 to USD 1.2 million as of 2025 to resolve and respond to any security incidents. In addition, ransomware accounts for 33% of overall data breaches, and it was one of the top threats in 92% sectors, thereby uplifting the market globally.

Furthermore, the economic expenses of insecurity, followed by the concept of mobile-first everything, pervasive digitalization, and the shift towards password-less authentication, are also readily bolstering the market globally. As per an article published by Harvard Business Review in May 2023, it has been revealed that an estimated 83% of organizations have experienced over one data breach as of 2022. In addition, there has been a surge in ransomware attacks by almost 13%. Besides, the severity of the situation is continuing to be evident with the disclosure of nearly 310 cyber incidents, which is boosting the market’s exposure across different nations.

Key Mobile User Authentication Market Insights Summary:

Regional Insights:

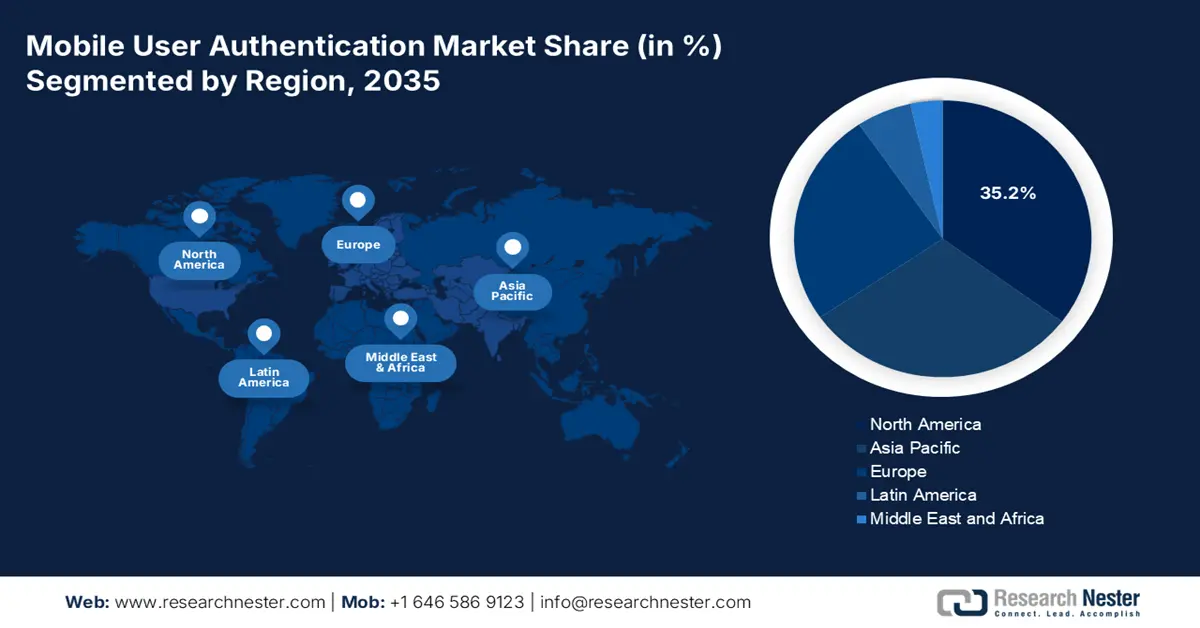

- North America is anticipated to command a 35.2% share of the Mobile User Authentication Market by 2035, supported by stringent cybersecurity mandates, extensive cloud adoption, and accelerating digital transformation.

- Europe is projected to emerge as the fastest-growing region during 2026–2035, stimulated by the enforcement of the regional Cybersecurity Act and the growing emphasis on digital skill enhancement.

Segment Insights:

- The solutions segment is projected to capture a dominant 70.8% share of the Mobile User Authentication Market by 2035, propelled by the rising intrinsic value of core platforms and software intellectual property.

- The cloud-based segment is anticipated to hold a substantial share during 2026–2035, impelled by the growing preference for secure, scalable, and user-friendly authentication environments.

Key Growth Trends:

- Increase in behavioral biometrics

- Convergence with zero-trust architecture

Major Challenges:

- Interoperability with legacy health systems

- Backlogs in cybersecurity certification

Key Players: Microsoft, Okta, Thales Group, Cisco, Broadcom, HID Global, IBM, Google, OneLogin, Ping Identity, ForgeRock, RSA Security, Entrust, NEC Corporation, Yubico, Samsung SDS, Auth0, IDEMIA, Evolve Technologies, eMudhra.

Global Mobile User Authentication Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 6.2 billion

- 2026 Market Size: USD 7 billion

- Projected Market Size: USD 19.3 billion by 2035

- Growth Forecasts: 13.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35.2% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, Germany, United Kingdom, China, Japan

- Emerging Countries: India, South Korea, Singapore, Australia, Brazil

Last updated on : 10 October, 2025

Mobile User Authentication Market - Growth Drivers and Challenges

Growth Drivers

- Increase in behavioral biometrics: The utilization of machine learning-based solutions is currently analyzing innovative user behavior patterns, including mouse movements, walking gait, swipe gestures, and typing rhythm, which is positively impacting the market. According to an article published by the National Science Foundation in 2022, an artificial intelligence framework has been successfully developed, which was effectively able to crack fingerprint-specific authentication with a 20% success rate. This was possible by efficiently matching partial prints to complete biometric data, thereby suitable for the market’s growth.

- Convergence with zero-trust architecture: The aspect of authentication is not considered a gateway, but has evolved as an essential part of the continuous zero-trust security model, which is evident in the market. As stated in the November 2023 NLM article, the proportion of internal and external threats changed from 6% and 94% to 53% and 47%, resulting in increased risks. Therefore, the zero-trust model has been successfully proposed to cater to this rising dilemma in conventional network security, which is positively impacting the overall market internationally.

- Surge in AI-based authentication: The majority of advanced multi-factor authentication platforms currently implement risk-based authentication (RBA) engines, which is also uplifting the market internationally. As per an article published by the MDPI in April 2023, there has been an increase in employees operating from home, accounting for nearly 9 million to almost 27 million. This has resulted in a surge in cloud-based digitalization, which presents the newest security issues, which in turn are successfully overcome by cloud computing, thereby making it suitable for the market development.

Confidence Levels in Different Regions for Cyber Resilience Driving the Mobile User Authentication Market (2025)

|

Regions/Components |

Not Confident |

Neutral |

Confident |

Very Confident |

|

Latin America |

42% |

40% |

14% |

4% |

|

Africa |

36% |

27% |

27% |

9% |

|

Asia |

20% |

40% |

31% |

9% |

|

Middle East |

21% |

7% |

36% |

36% |

|

Europe |

15% |

35% |

375 |

13% |

|

North America |

15% |

35% |

37% |

13% |

|

Oceania |

- |

50% |

25% |

25% |

Source: World Economic Forum

Organizational Cyber Risk Ranking (2025) Uplifting the Mobile User Authentication Market

|

Cyber Risk Types |

Ranking % |

|

Ransomware attack |

45 |

|

Cyber-based fraud |

20% |

|

Supply chain disruption |

17% |

|

Malicious insider |

7% |

|

Disinformation |

6% |

|

Denial of service and distributed denial of service attacks |

6% |

Source: World Economic Forum

Challenges

- Interoperability with legacy health systems: The majority of the international healthcare industry operates on legacy IT systems that tentatively lack modernized API-based security integration points. These historical systems only support primitive methods for authentication, which makes it technically challenging for the market globally. Besides, the expenses and risk of replacing or upgrading these crore systems are extremely prohibitive for major public health providers. However, manufacturers need to invest readily in creating customized adapters and bridge technologies to boost developmental expenses and personalized bespoke.

- Backlogs in cybersecurity certification: The presence of compulsory cybersecurity certifications, including those under Europe’s Cybersecurity Act, is effectively curated to provide product quality, but are frequently develop significant bottlenecks in the market. Certification bodies are often under-resourced, resulting in long-lasting periods for a product to be approved and evaluated. Besides, during this time, manufacturers are unable to sell their solution in the market, thereby causing a delay in revenue generation and providing a window of opportunity to existing competitors. This has particularly caused damage in fast-paced technology industries, wherein a product is bound to be at risk.

Mobile User Authentication Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

13.5% |

|

Base Year Market Size (2025) |

USD 6.2 billion |

|

Forecast Year Market Size (2035) |

USD 19.3 billion |

|

Regional Scope |

|

Mobile User Authentication Market Segmentation:

Component Segment Analysis

Based on the component, the solutions segment is anticipated to garner the largest share of 70.8% by the end of 2035. The segment’s upliftment is highly attributed to an increase in the intrinsic value of the core platform and software intellectual property. In addition, the segment has readily encompassed the actual authentication engines, such as risk-based authentication platforms, behavioral analytics, biometric algorithms, and multi-factor authentication. Besides, the revenue share has reflected severe and non-negotiable demand for sophisticated software components to develop a standard digital identity framework.

Deployment Mode Segment Analysis

Based on the deployment mode, the cloud-based segment is expected to account for the second-largest share during the forecast period. The segment’s growth is highly driven by the provision of strong security, streamlined user experience, and flexible scalability that on-premise solutions are unable to match effectively. According to an article published by NLM in December 2024, severe issues in video frame recognition result in an accuracy of less than 90%. Therefore, to combat this, a hybrid face detection system has been readily integrated with cloud-based IoT, with a 90% accuracy rate, and successfully exhibits suitable face recognition.

Enterprise Size Segment Analysis

Based on the enterprise size, the large enterprises segment is predicted to cater to the third-largest share by the end of the projected timeline. The segment’s development is highly fueled by its impact on technology through scale, influence, and the need for sophisticated security-based solutions. For instance, in November 2024, Accenture declared that new capabilities and services have been readily designed to reinvent cyber and business resilience through the power of generative AI, quantum-based data security solutions, and deepfake protection. The purpose is to assist potential clients from different sectors to emerge as cyber-resilient organizations, thus suitable for the segment’s exposure.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegments |

|

Component |

|

|

Deployment Mode |

|

|

Enterprise Size |

|

|

Authentication Method |

|

|

End user |

|

|

Technology |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Mobile User Authentication Market - Regional Analysis

North America Market Insights

North America in the mobile user authentication market is projected to account for the largest share of 35.2% by the end of 2035. The market’s exposure in the region is highly attributed to the presence of strict cybersecurity mandates, massive cloud adoption, and increased digitalization. Besides, the Cybersecurity and Infrastructure Security Agency (CISA) has actively promoted MFA through the More Than A Password campaign, which is also uplifting the market. According to an article published by the 2022 AWS U.S. report, an average of 50% of IT expenses has been successfully saved in the U.S. by users by deliberately migrating services to the cloud, thus suitable for the market’s growth.

The mobile user authentication market in the U.S. is growing significantly, owing to the existence of mandates from the Cybersecurity and Infrastructure Security Agency (CISA), along with the National Institute of Standards and Technology (NIST) continuously refining the digital identity guidelines. According to the May 2024 White House report, the Federal Bureau of Investigation (FBI) Internet Crime Complaint Center (IC3) achieved a 22% increase in ransomware cases from victims in the country, owing to which cybersecurity is a huge concern. In addition, there has also been a 74% increase in expenses associated with ransomware as of 2023, thereby driving the market’s demand in the country.

The mobile user authentication market in Canada is also growing due to the aspect of national-provincial efforts to gain digitalized infrastructure with emerging privacy laws. Besides, the Canadian Centre for Cyber Security has ensured multi-factor authentication through a foundational security control, which is readily utilized across overall federal departments. As per an article published by the Office of the Privacy Commissioner of Canada in 2025, 83% of people in the country are extremely concerned about privacy while utilizing artificial intelligence (AI) tools, whereas 88% are less concerned about their personal information. Therefore, this denotes a huge growth opportunity for the market in the overall country.

Business Cloud Adoption Driving the Mobile User Authentication Market in North America (2022)

|

Countries/Components |

Rates |

|

Cloud services utilized |

51% of businesses |

|

IaaS or PaaS |

21% businesses |

|

Women-owned businesses |

46% |

|

Minority-owned businesses |

58% |

|

Increase among small and medium enterprises |

10% |

|

Business scale-up valuation |

More than USD 26 billion |

Source: AWS U.S.

Europe Market Insights

Europe in the mobile user authentication market is expected to be the fastest-growing region during the forecast timeline. The market’s development in the overall region is highly driven by the presence of the regional Cybersecurity Act, along with its connected certification framework, which has mandated strong security standards for severe infrastructure and digitalized services. As stated in the 2024 Eurostat article, 56% of citizens in the overall region have basic and more than basic digital skills as of 2023. In addition, it has been estimated that almost 80% of adults should be well versed with digital skills by the end of 2030, which is positively impacting the market.

The mobile user authentication market in the UK is gaining increased traction, owing to the dominating international financial services and fintech industry, legally bound to integrate strong consumer authentication (SCA). Additionally, the country’s National Cyber Security Center (NCSC) offers influential and explicit guidance for companies to successfully adopt phishing-based MFA and password-less authentication to create a compliant-specific market. As stated in the July 2025 Government UK article, 94% of services in the overall country utilize some form of biometric technology. The majority of these incorporate facial recognition by utilizing 11% of fingerprint and 2% of voice recognition, thus suitable for the market’s growth.

The mobile user authentication market in Germany is also developing due to the Industry 4.0 initiative and strict regulatory oversight. The country’s Federal Office for Information Security (BSI) has readily mandated strong security for severe industrial and infrastructure control systems, which has directly fueled the need for suitable mobile access solutions. Besides, as per the August 2025 ITA data report, the ICT market’s overall export has been valued at USD 69.5 billion as of May 2025, along with USD 78.6 billion in total imports. Additionally, imports from the U.S. to the country account for USD 2.3 billion within the same year.

Overall Cloud Computation and IaaS/PaaS in Europe (2022)

|

Countries |

Overall Cloud |

IaaS/PaaS |

|

UK |

28% |

8% |

|

Germany |

27% |

15% |

|

France |

32% |

9% |

|

Spain |

44% |

19% |

|

Italy |

39% |

13% |

|

Netherlands |

26% |

9% |

|

Poland |

27% |

10% |

|

Finland |

50% |

10% |

|

Sweden |

37% |

13% |

Source: AWS U.S.

APAC Market Insights

Asia Pacific in the mobile user authentication market is effectively boosting, with a steady growth by the end of the projected year. The market’s exposure in the region is uplifting, owing to the aspect of massive digitalization, a boom in the mobile-first population, and strict new data protection legal policies. According to an article published by the Journal of Open Innovation: Technology, Market, and Complexity in March 2024, the region accounted for more than 50% of overall patents globally, with nearly 60% catering to computer and digitalized technologies. Besides, a 1% increase in digital technology has resulted in economic growth by 0.8%, which is bolstering the overall market.

The mobile user authentication market in China is developing, owing to the presence of cybersecurity laws and personal information protection laws, as well as the aspect of government expenditure on cybersecurity, which includes mobile authentication for protecting citizen data. Besides, according to an article published by The People’s Republic of China in December 2024, there has been a significant surge in 5G mobile phone subscriptions by 1.002 billion, thereby denoting a 56% increase in overall mobile phone subscriptions in the country, based on which there is a huge growth opportunity for the market.

The mobile user authentication market in India is also growing due to the government’s focus on a digitalized economy, which is readily anchored by authentic identification. In addition, the aspect of spending on digital infrastructure and cybersecurity, including authentication for e-governance, is also driving the market in the country. As stated in the September 2025 Carnegie Endowment Organization article, the country’s digitalized landscape is growing rapidly, with 971 million internet subscribers. Additionally, between 2022 and 2023, the economy was valued at 11.7% of its overall national income, further contributing USD 402 billion to the gross domestic product (GDP), thereby making it suitable for the market’s development.

Key Mobile User Authentication Market Players:

- Microsoft (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Okta (U.S.)

- Thales Group (France)

- Cisco (U.S.)

- Broadcom (U.S.)

- HID Global (U.S.)

- IBM (U.S.)

- Google (U.S.)

- OneLogin (U.S.)

- Ping Identity (U.S.)

- ForgeRock (U.S.)

- RSA Security (U.S.)

- Entrust (U.S.)

- NEC Corporation (Japan)

- Yubico (Sweden/ U.S.)

- Samsung SDS (South Korea)

- Auth0 (U.S.)

- IDEMIA (France)

- Evolve Technologies (Australia)

- eMudhra (India)

The global market is a consolidating and dynamic arena, presently dominated by the U.S.-specific cloud identity giants, such as Okta and Microsoft, by leveraging extended ecosystem integrations as well as SaaS models. The market’s competitive landscape is effectively defined by three main tactical initiatives, including the sudden push towards password-less authentication, successfully adopted by Microsoft, Yubico, and Google. Secondly is the incorporation of machine learning and AI, suitable for risk-specific adaptive authentication, which is considered a core differentiator for players, such as Ping Identity and IBM. Third is the tactical partnerships and acquisitions, which are prevalent as observed with Okta’s purchase of Auth0, thereby bolstering the market internationally.

Here is a list of key players operating in the global market:

Recent Developments

· In April 2025, Infopercept declared the unveiling of Invinsense 6.0, which is the newest version of its signature cybersecurity platform. With the launch, the company integrated Agentic AI across its compliance, defensive, and offensive modules and developed intelligent and autonomous systems to undertake cybersecurity decisions.

· In December 2024, Tata Consultancy Services (TCS) notified its 2025 Cybersecurity Outlook, which indicates a list of technological trends, along with an effective focus on areas created by TCS experts.

· In November 2024, VVDN Technologies announced that it has effectively signed a Memorandum of Understanding (MoU) by collaborating with SecureThings.ai Pvt Ltd to ensure standard cybersecurity services.

- Report ID: 8189

- Published Date: Oct 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Mobile User Authentication Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.