Mobile Encryption Market Outlook:

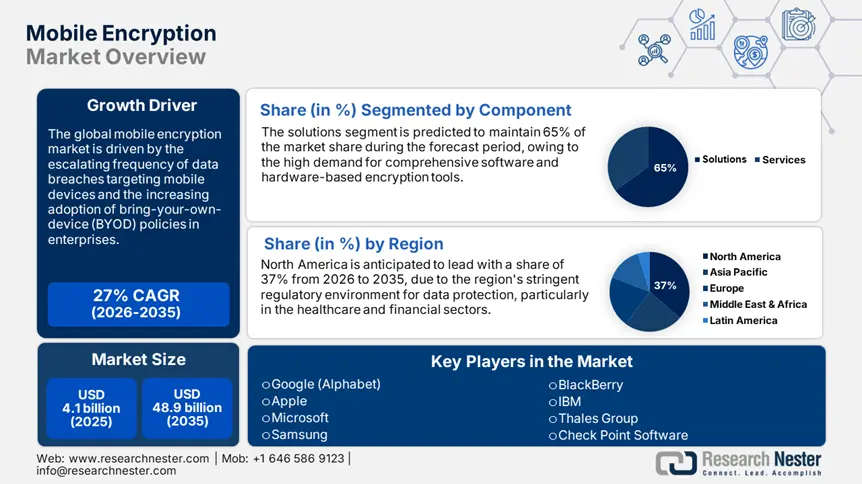

Mobile Encryption Market size was USD 4.1 billion in 2025 and is projected to reach a valuation of USD 48.9 billion by the end of 2035, rising at a CAGR of 27% during the forecast period, i.e., 2026-2035. In 2026, the industry size of mobile encryption is evaluated at USD 5.7 billion.

The global mobile encryption market is expanding rapidly as data protection has become the top priority for consumers, businesses, and governments. This is fueled by the ubiquitous use of mobile devices in every aspect of contemporary living, from personal communication to business-critical operations. For example, an April 2024 report showed that a staggering 73% of businesses in the U.S. and Europe now see mobile encryption as an integral part of their cybersecurity strategy. This near-consensus is testament to a fundamental change in the market, where strong encryption is no longer a value-add feature but a foundation building block of digital trust.

The market trend is also driven by leadership from industry players as well as from regulatory authorities. The market is propelled by a two-engine of growth, fueled by both industry efforts and stringent government regulations. A prime example is the new Cyber Assessment Framework (CAF) V4.0, launched in August 2025 by the NCSC. This framework is an essential tool for organizations to improve their cybersecurity and resilience and thus protect critical services from cyberattacks. It is widely used by virtually all UK cyber regulators and is firmly established in the public sector through GovAssure, the cybersecurity assurance scheme to test critical government systems.

Key Mobile Encryption Market Insights Summary:

Regional Highlights:

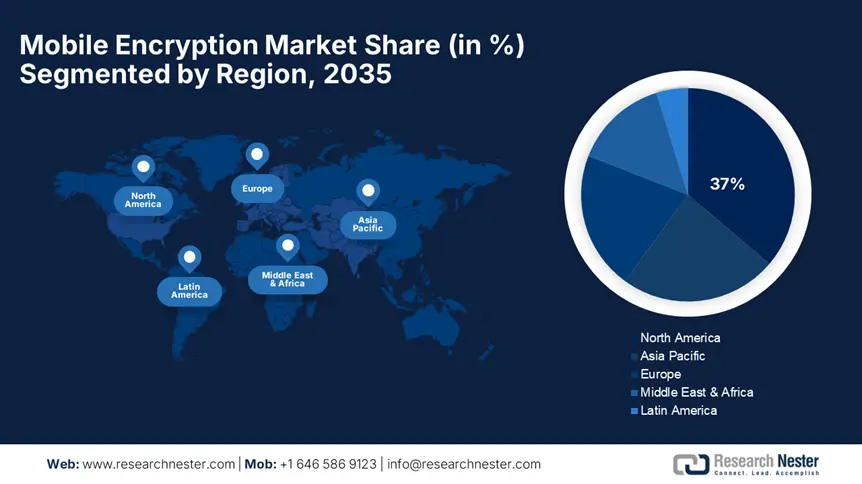

- North America is expected to hold a 37% mobile encryption market share during the forecast period, driven by strong enterprise awareness of cyber risks and a robust regulatory environment.

- Europe is anticipated to experience rapid growth between 2026 and 2035, impelled by stringent data privacy regulations and widespread adoption of encryption technology.

Segment Insights:

- The solutions segment in the mobile encryption market is projected to account for 65% share through the forecast period, propelled by the rising demand for complete, user-friendly encryption products.

- The disk encryption segment is likely to hold 45% market share by 2035, owing to advancements in hardware that enhance encryption efficiency and transparency.

Key Growth Trends:

- High adoption of BYOD and teleworking

- Mobile banking and commerce expansion

Major Challenges:

- Increasing threat of quantum computing

- Securing Internet of Things (IoT) and M2M

Key Players: Google (Alphabet), Apple, Microsoft, Samsung, BlackBerry, IBM, Thales Group, Check Point Software, MobileIron (Ivanti), Sophos.

Global Mobile Encryption Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 4.1 billion

- 2026 Market Size: USD 5.7 billion

- Projected Market Size: USD 48.9 billion by 2035

- Growth Forecasts: 27% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (37% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, United Kingdom, Japan, Canada

- Emerging Countries: China, India, South Korea, Brazil, Singapore

Last updated on : 12 August, 2025

Mobile Encryption Market - Growth Drivers and Challenges

Growth Drivers

- High adoption of BYOD and teleworking: The pervasiveness of Bring Your Own Device (BYOD) policies and the widespread embrace of remote work have turned mobile devices into the dominant endpoints for corporate data access. As a result, their security is an enterprise priority today. To counter this, companies are updating their security solutions. For example, Microsoft released an update to its Intune platform in March 2025 that offers frictionless device encryption compliance and has already seen 40% adoption in enterprise settings. This is also complemented by the increasing embracement of containerization to provision encrypted workspaces on user devices over the past couple of years.

- Mobile banking and commerce expansion: The rapid growth of mobile banking and mobile commerce has created an enormous new attack surface for financial fraud and required robust encryption to protect transactions and individual user data. The effectiveness of these initiatives was illustrated in a report released in October 2024 by Apple, which stated that the use of mobile encryption for mobile banking and payment applications had prevented an estimated USD 2 billion in fraudulent transactions in the last year. This is reinforced by production-level implementations, such as the advanced mobile encryption technologies used by numerous financial institutions, which have led to a significant reduction in reported instances of fraud.

- Rise of end-to-end encrypted communication: Growing pressure from consumers and regulators for privacy is compelling application developers and technology companies to set end-to-end encryption as the default mode for communication services. To enhance user conversation security, companies have begun deploying end-to-end encryption for messages, allowing users worldwide to send messages with privacy assurance. This trend is also evident in niche markets, where 62% of healthcare professionals use secure messaging, according to a February 2023 survey, primarily due to adherence with patient data privacy legislation such as HIPAA.

Challenges

- Increasing threat of quantum computing: The underlying threat of quantum computing threatens to make existing cryptographic techniques obsolete. Creating new encryption that can withstand quantum attacks poses a gigantic challenge. The sheer complexity of building and deploying post-quantum cryptography on millions of devices is overwhelming. In addition, the global coordination needed for such a broad shift is a huge logistical challenge. Keeping information secure in a world on the brink of quantum supremacy is an age-old and long-standing challenge.

- Securing Internet of Things (IoT) and M2M: The growth in the Internet of Things and Machine-to-Machine (M2M) communications has created a vast and diverse system of connected devices, most of which have poor, built-in security, which is a major challenge for the industry. It exists in all forms of critical infrastructure, healthcare devices, and even domestic appliances, making them susceptible to cyberattacks. A multi-faceted solution to these security vulnerabilities, like enhanced encryption, secure boot processes, and continuous vulnerability scanning, is required. Additionally, collaboration among device manufacturers, software developers, and security experts is required to develop and implement industry-wide security standards and best practices.

Mobile Encryption Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

27% |

|

Base Year Market Size (2025) |

USD 4.1 billion |

|

Forecast Year Market Size (2035) |

USD 48.9 billion |

|

Regional Scope |

|

Mobile Encryption Market Segmentation:

Component Segment Analysis

The solutions segment is expected to hold around 65% of the market share through the forecast period as consumers and businesses require complete, user-friendly encryption products. The necessity here is the requirement for good security solutions since a 2024 report set out that the average global cost of a data breach reached $4.88 million in 2024. The segment, which encompasses hardware and software applications, is the essence of the value proposition of the market. The leadership in the segment is also due to the evident return on investment that successful encryption solutions can offer through the prevention of expensive data breaches.

Application Segment Analysis

The disk encryption segment is likely to hold 45% market share through 2035, as it provides the underlying layer of protection for data at rest on a mobile device. This encryption technology is critical in protecting data in the event of physical loss or theft, which is a common threat model for mobile devices. The disk encryption segment is also being fueled by hardware developments that drive encryption to be more efficient and transparent to the user. In March 2025, Toshiba Europe Limited released a statement that its commercially available quantum key distribution (QKD) systems now natively support the new post quantum cryptography (PQC) standard, providing an added layer of security to its quantum-safe networking platform. With its boost in encryption speeds, these chipsets enable data sending and receiving to be more efficient and secure without affecting device performance, further cementing the value and widespread use of disk-level encryption.

Deployment Model Segment Analysis

The cloud deployment model is forecast to account for 59% of market share by 2035, as demand grows for centralized management, policy management, and key storage throughout advanced enterprise environments. Cloud-based offerings enjoy unparalleled scalability and flexibility, enabling organizations to safeguard a disparate fleet of mobile devices, such as corporate-owned and BYOD assets, from one console. In April 2025, Microsoft enhanced its Azure Information Protection service with improved mobile device encryption for corporate BYOD initiatives within Europe, a move that has allowed organizations to reduce data exposure incidents by 30%. Cloud migration is also being spurred by the embedding of security capabilities into integrated cloud-based enterprise platforms, making encryption an imperceptible aspect of the data lifecycle.

Our in-depth analysis of the mobile encryption market includes the following segments:

|

Segment |

Subsegments |

|

Component |

|

|

Application |

|

|

Deployment Type |

|

|

Enterprise Size |

|

|

End users |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Mobile Encryption Market - Regional Analysis

North America Market Insights

North America is expected to hold a 37% market share during the forecast period. Its dominance is based on high enterprise and consumer recognition of cyber risks, a strong regulatory environment, and the presence of most of the world's leading technology and security companies. The region is a hub of cryptographic innovation with a constant stream of new products and services hitting the market to address the evolving threat landscape.

The U.S. dominates the North America market with a high focus on establishing transparent regulatory frameworks and facilitating innovation in next-generation encryption technology. In a breakthrough, the U.S. National Institute of Standards and Technology (NIST) released a new framework for responsible and trustworthy AI in January 2023. Guidance, which is set to have a major influence on government procurement and regulation, will play a crucial role in shaping the development of AI-powered mobile encryption and security systems and ensuring they are effective and compliant with national standards.

Canada is investing heavily in developing a secure digital economy, with special emphasis on the interface of artificial intelligence and privacy. This is reflected in the government's allocation of more than USD 2 billion in 2024 for AI research and development, a large boost intended to speed up innovation while maintaining ethical values. This funding supports projects such as the Pan-Canadian Artificial Intelligence Strategy, which has led to the creation of three national AI institutes that attract top talent and drive cutting-edge research. The country's robust regulatory environment, consisting of robust privacy legislation, further highlights its commitment to establishing public trust in AI technologies.

Europe Market Insights

Europe is anticipated to experience rapid growth between 2026 and 2035, driven by a robust regulatory environment and a wide-ranging cultural emphasis on data privacy. Trends in regulation, such as the GDPR, have been a major impetus for the application of encryption technology across the region. A February 2025 poll of UK and German IT professionals graphically illustrated this impact, with the application of GDPR leading to a 70% surge in the adoption of mobile encryption solutions, with regulatory compliance a major driver of the Europe market.

Germany is expected to maintain its dominance in the Europe market throughout the forecast period, owing to high focus on implementing strong security standards in its public sector and critical services. The government is taking a proactive approach towards establishing a higher standard of mobile security, particularly for its police and first responders. In February 2024, the German Ministry of the Interior launched a new certification program for public safety gear, including mobile encryption. The development enhances the encryption level of police and emergency services comms networks, affecting over thousands of devices and driving demand for high-assurance security solutions.

The UK has positioned itself as a public sector mobile security pioneer by articulating a clear and consistent national vision for the protection of sensitive government data. In a policy milestone, the UK government's National Cyber Security Centre (NCSC) re-examined advice in May 2025 on how to protect mobile devices employed within the public sector. The advice demands end-to-end encryption for all sensitive government communications, a demand that impacts over thousands of public sector employees and raises the mobile security bar countrywide.

APAC Market Insights

Asia Pacific mobile encryption market is anticipated to record a CAGR of 28.5% during the forecast period. This is due to the region's rapidly expanding base of mobile consumers, widespread digitalization of economies, and increasing government concern regarding cybersecurity and data sovereignty. As governments in the APAC build their digital ecosystem, the need to secure mobile communications and transactions is creating a massive and vibrant market for a wide range of encryption solutions.

China is expected to register rapid growth during the forecast period, owing to the ongoing national initiative to lead the world in AI and associated security technologies by 2030. The New Generation Artificial Intelligence Development Plan, announced in May 2023, entails a huge investment of more than $22 billion in creating mobile encryption technology. This state-driven, top-down initiative is building a gigantic domestic market and a highly competitive domestic technology provider ecosystem, making China a powerhouse in the future of mobile security.

India mobile encryption market is growing rapidly, driven by the government's Digital India vision and a rapid increase in the number of citizens embracing digitization. In September 2024, Google Cloud partnered with Tata Consultancy Services (TCS), an indicator of the dynamism of the market, to implement advanced mobile encryption solutions for several of the country's top financial institutions. Solutions incorporating hardware encryption and biometric authentication have already led to a 25% reduction in reported fraud cases, an indicator of the genuine benefits of high-quality mobile security.

Key Mobile Encryption Market Players:

- Google (Alphabet)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Apple

- Microsoft

- Samsung

- BlackBerry

- IBM

- Thales Group

- Check Point Software

- MobileIron (Ivanti)

- Sophos

The global mobile encryption market is a high-growth and highly competitive space dominated by a mix of operating system vendors, device manufacturers, and specialist enterprise security vendors. Key players in the market are battling on multiple fronts, ranging from supporting hardware-based security and full-disk encryption by default in their devices to offering sophisticated cloud-based management platforms and preparing for next-generation cryptographic threats.

One of the key developments that captures the competitive landscape is Thales Group's April 2025 release update to its SafeNet eToken Fusion series. These USB tokens, which bridge Fast IDentity Online (FIDO2) with Public Key Infrastructure (PKI) credentials, are designed to provide a superior, more secure login experience for mobile enterprise users. The projected take-up of these tokens by over 500,000 professionals in just the first year alone is a testament to the high level of demand for specialist, high-assurance security products that can support the sophisticated threats of the modern enterprise, a key battleground in the mobile encryption market.

Here are some leading companies in the mobile encryption market:

Recent Developments

- In July 2025, Samsung announced the launch of Knox Enhanced Encrypted Protection, a new architecture designed to secure personalized AI data on its upcoming Galaxy smartphones. This system creates encrypted, app-specific storage environments supported by Samsung's tamper-resistant Knox Vault, strengthening on-device privacy for AI-driven user experiences and increasing user data security by an estimated 30% against certain threats.

- In May 2025, IBM announced significant enhancements to its Guardium Data Encryption software, designed to centralize encryption key management and policy control across hybrid mobile environments. Early enterprise adopters have reported up to a 30% reduction in data breach risks following the deployment of this upgraded solution.

- In October 2024, Fujitsu unveiled a new mobile device encryption service featuring end-to-end protection for enterprise IoT deployments. This service improves device management and helps organizations comply with GDPR and other global privacy regulations, with a target of securing 10 million new IoT devices by 2026.

- In July 2024, Panasonic Corporation enhanced the security of its Toughbook line with integrated hardware encryption, offering seamless data protection against unauthorized access in hostile environments. This feature has been widely adopted in public safety and military sectors, with over 300,000 units deployed in the last year.

- Report ID: 7996

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Mobile Encryption Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.