Microfiltration Membranes Market Outlook:

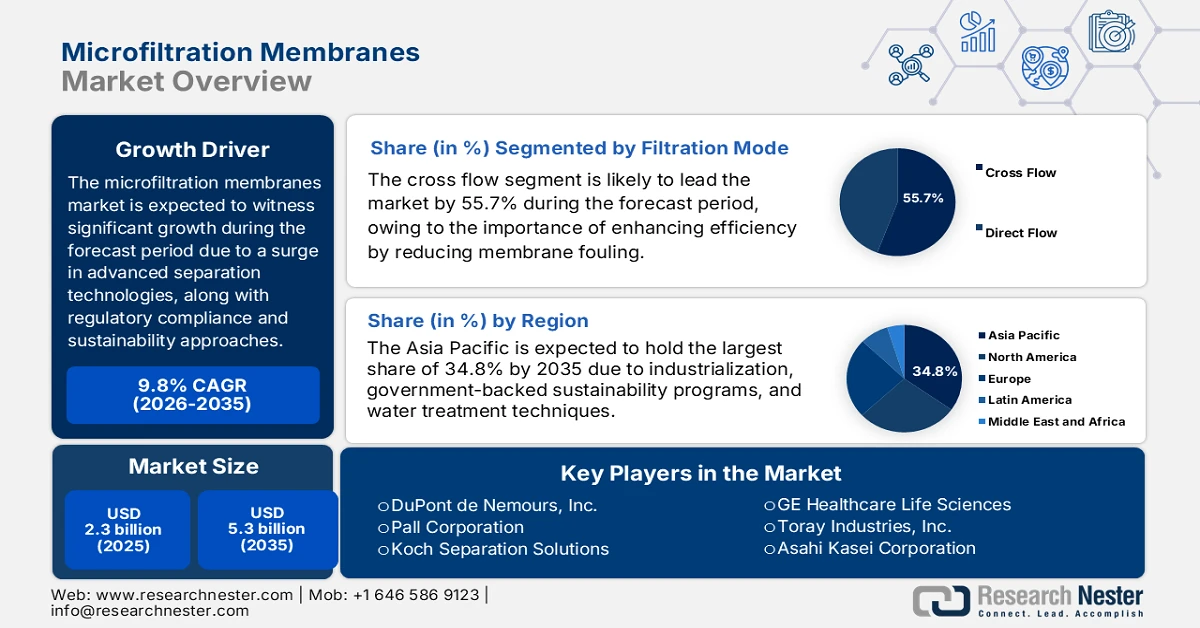

Microfiltration Membranes Market size was over USD 2.3 billion in 2025 and is estimated to reach USD 5.3 billion by the end of 2035, expanding at a CAGR of 9.8% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of microfiltration membranes is estimated at USD 2.5 billion.

The international market is effectively entering into a transformative phase since industries are adopting innovative separation technologies. While the global demand is readily fueled by sustainability imperatives and regulatory compliance, the market’s growth is shaped by technological advancement, a shift in industrial priorities, and the latest applications in emerging economies. According to official statistics published by the Open Access Government article in January 2024, over 2million people, which is a quarter of the global population, lack accessibility to clean drinking water. Besides, present portable water filtration methods, especially microporous membranes and filter paper, filter out nearly 40% and 80% of particles larger than 10 nanometers. In addition, the newly created system significantly boosts a catch rate of almost 100% for such particles, while the ongoing water purification technologies supply is also bolstering the market’s growth.

2023 Water Purification and Filtration Equipment

|

Countries |

Export (USD) |

Import (USD) |

|

China |

1.9 billion |

592 million |

|

Germany |

1.3 billion |

524 million |

|

U.S. |

1.2 billion |

2.0 billion |

|

Global Trade Valuation |

11.9 billion |

|

|

Global Trade Share |

0.052% |

|

|

Product Complexity |

0.79 |

|

|

Export Growth |

2.4% |

|

Source: OEC

Furthermore, the integration of smart monitoring technologies, a shift towards decentralized and modular systems, the adoption of the circular economy, and the presence of cross-industry applications are a few trends that are proliferating the market globally. As per an article published by the AAQR Organization in February 2023, a smart filter performance monitoring system usually costs less than USD 200 and can deliberately report filtration efficiency, differential pressure, temperature, and relative humidity in real time. Meanwhile, the criteria for filter replacements are readily based on mileage or installed time, for instance, 3 months for residential heating, ventilation, and air conditioning (HVAC) filters and approximately 12,000 miles for vehicle cabin air filters. Therefore, with the presence of suitable filters, there is a huge growth opportunity for the market across different regions.

Key Microfiltration Membranes Market Insights Summary:

Regional Highlights:

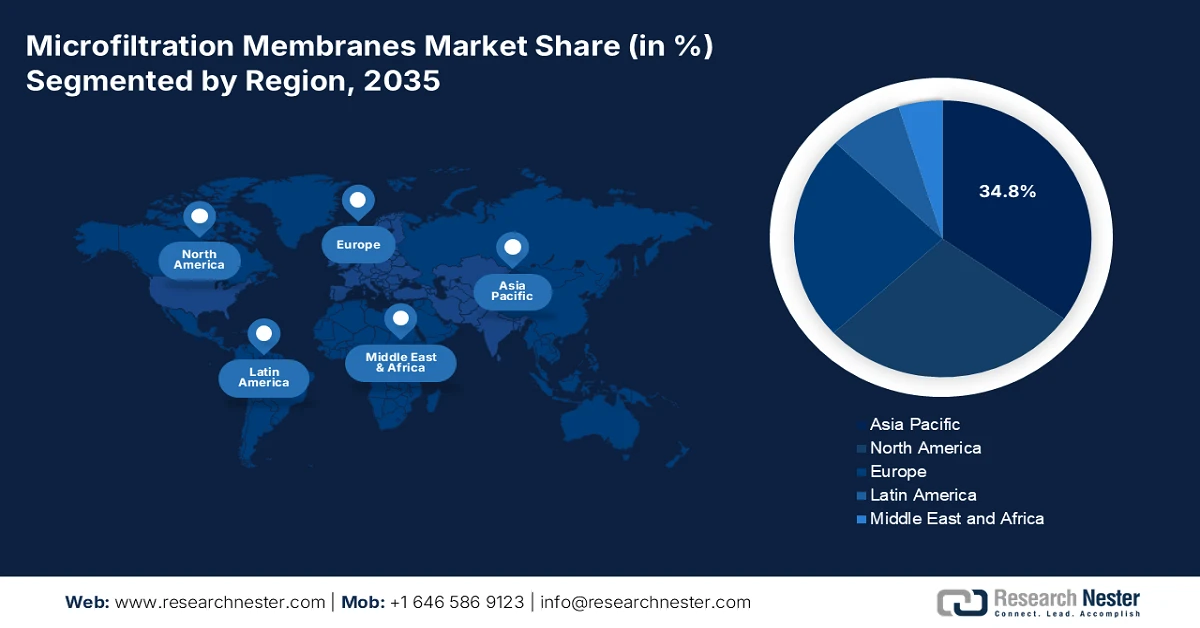

- Asia Pacific is projected to command a 34.8% share by 2035 in the microfiltration membranes market, attributed to accelerating industrialization, rising water treatment requirements, and government-led sustainability initiatives.

- Europe is expected to register the fastest growth during the forecast period, supported by stringent ECHA regulations, strong sustainability reforms, and expanding demand from water treatment, food & beverage, and pharmaceutical industries.

Segment Insights:

- The cross flow segment within the filtration mode is anticipated to secure a dominant 55.7% share by 2035 in the microfiltration membranes market, supported by its effectiveness in minimizing membrane fouling and enabling continuous, high-efficiency operation.

- The organic polymers sub-segment is projected to hold the second-largest share by 2035, backed by its cost efficiency, material versatility, scalable manufacturing, and adaptability across municipal, industrial, and biopharmaceutical applications.

Key Growth Trends:

- Expansion of biopharmaceutical manufacturing

- Rise in precision filtration for food and beverage

Major Challenges:

- Membrane fouling and performance limitations

- Regulatory complexity and compliance burden

Key Players: Merck KGaA (Germany), Sartorius AG (Germany), 3M Company (U.S.), DuPont de Nemours, Inc. (U.S.), Pall Corporation (U.S.), Koch Separation Solutions (U.S.), GE Healthcare Life Sciences (U.S.), Toray Industries, Inc. (Japan), Asahi Kasei Corporation (Japan), Mitsubishi Chemical Corporation (Japan), Sumitomo Electric Industries, Ltd. (Japan), LG Chem Ltd. (South Korea), Kolon Industries, Inc. (South Korea), Memcor (Australia), Veolia Water Technologies (France), SUEZ Water Technologies & Solutions (France), Parker Hannifin Corporation (U.S.), Reliance Industries Limited (India), Petronas Chemicals Group Berhad (Malaysia), Johnson Matthey (UK).

Global Microfiltration Membranes Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.3 billion

- 2026 Market Size: USD 2.5 Billion

- Projected Market Size: USD 5.3 billion by 2035

- Growth Forecasts: 9.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (34.8% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, China, Germany, Japan, France

- Emerging Countries: India, South Korea, Brazil, Vietnam, Indonesia

Last updated on : 28 January, 2026

Microfiltration Membranes Market - Growth Drivers and Challenges

Growth Drivers

- Expansion of biopharmaceutical manufacturing: The international boom in vaccines and biologics demands sterile filtration processes that is also uplifting the microfiltration membranes market globally. As per a data report published by the IFPMA Organization in 2023, the research and development-based biopharmaceutical sector is projected to spend USD 198 billion, with the yearly expenditure being 8.1 times more than the defense and aerospace industries, 7.2 times more than the chemical sector, and 1.2 times more than computer and software services. Besides, the industry effectively employs an estimated 5.5 million people globally, which includes through the manufacturing of generic medicines. Therefore, with continuous growth in the industry, the market is also gaining increased traction.

International Biopharmaceutical Research and Development Spending Analysis (2016-2026)

|

Year |

Spending Amount (USD Billion) |

Growth % |

|

2016 |

145 |

7.1 |

|

2017 |

150 |

5.9 |

|

2018 |

160 |

7.8 |

|

2019 |

168 |

4.2 |

|

2020 |

179 |

4.1 |

|

2021 |

182 |

7.0 |

|

2022 |

189 |

3.5 |

|

2023 |

196 |

3.3 |

|

2024 |

202 |

5.8 |

|

2025 |

207 |

3.5 |

|

2026 |

213 |

2.5 |

Source: IFPMA Organization

- Rise in precision filtration for food and beverage: An increase in consumer preference for contaminant-free and high-quality products is significantly driving the integration of microfiltration membranes in bottled water, brewing, and dairy industries. According to official statistics published by NLM in March 2022, almost 90% of the population in the U.S. receives drinking water from public water systems. In addition, 55% of domestic adults consume tap water, and meanwhile 68% perceived that localized tap water is safe to consume. Therefore, this denotes a growing demand for water filters, which is positively impacting the market growth. Moreover, a study was conducted on 546 adults in northcentral West Virginia, wherein 58% utilized a water filter while drinking tap water, thus making it suitable for the market’s expansion.

- Increase of energy efficiency in chemical processing: Membranes provide lower energy consumption in comparison to thermal separation methods, thus making them attractive for sectors to gain sustainability and cost savings. As per an article published by the IEA Organization in 2026, the global rate of energy intensity increased by just by 1% as of 2023. Likewise, the international energy demand growth was nearly 2% in the same year. Moreover, industry catered to nearly 75% of final energy demand growth, owing to energy utilization recovery from manufactured sectors. Besides, the energy intensity at the industrial level is optimized most for cars and buildings, thus bolstering the market globally.

Challenges

- Membrane fouling and performance limitations: Membrane fouling, known as the accumulation of particles, organic matter, or microbial growth on the membrane surface, is a persistent technical challenge in the microfiltration membranes market. Fouling reduces permeability, increases energy consumption, and shortens membrane lifespan, leading to higher operational costs. In industries such as food processing and pharmaceuticals, fouling can compromise product quality and safety, making it a critical concern. Cleaning protocols, such as chemical washing or backwashing, are necessary but add complexity and cost to operations. Moreover, repeated cleaning can degrade membrane materials, further reducing efficiency. Performance limitations also arise in handling highly contaminated or chemically aggressive feed streams, where microfiltration membranes may not provide adequate durability.

- Regulatory complexity and compliance burden: The global market is heavily influenced by regulatory frameworks, which vary significantly across regions. While regulations drive demand by enforcing stricter water quality and chemical safety standards, they also create compliance challenges for manufacturers and end users. In the U.S., agencies such as the EPA and OSHA impose rigorous standards, while Europe’s ECHA enforces REACH regulations, requiring extensive testing and certification. In Asia, countries including China and India are rapidly tightening environmental laws, but enforcement remains inconsistent, creating uncertainty for businesses. Navigating these diverse regulatory landscapes requires significant investment in compliance, documentation, and certification, which increases costs and slows product launches.

Microfiltration Membranes Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

9.8% |

|

Base Year Market Size (2025) |

USD 2.3 billion |

|

Forecast Year Market Size (2035) |

USD 5.3 billion |

|

Regional Scope |

|

Microfiltration Membranes Market Segmentation:

Filtration Mode Segment Analysis

The cross flow segment in the filtration mode is anticipated to garner the largest market share of 55.7% by the end of 2035. The segment’s upliftment is highly driven by its importance for maximizing efficiency by diminishing membrane fouling and ensuring ongoing operation. According to official statistics published by the Journal of Building Engineering in October 2024, the heat conductivity of stainless steel plates, utilized as water filters with biofilm, diminished from 15 to 0.6 W/m.K, leading to a 96% reduction in heat transfer. Additionally, the aspect of corrosion also lowers the mechanical strength of the metal, thus ensuring suitable cross flow. Besides, as per an article published by the MDPI in June 2025, atmospheric water constitutes just 0.04% of the Earth’s overall water and plays a crucial role in the hydrological cycle by replenishing surface and groundwater through precipitation, thus readily supporting the segment’s growth.

Material Segment Analysis

The organic polymers sub-segment in the microfiltration membranes market is projected to hold the second-largest share during the forecast period. The sub-segment’s growth is highly fueled by its versatility, cost-effectiveness, and adaptability across industries. Polymers such as polyvinylidene fluoride (PVDF), polysulfone (PS), and polyethersulfone (PES) dominate because they combine chemical resistance with mechanical strength, making them suitable for applications ranging from water treatment to biopharmaceutical manufacturing. Their ability to be engineered into different pore structures and surface chemistries allows for tailored performance in diverse environments. Besides, a key advantage is its scalability, based on which manufacturers can produce membranes at relatively lower costs, enabling widespread adoption in municipal and industrial water treatment.

Pore Size Class Segment Analysis

By the end of the stipulated timeline, the 0.1-0.2 µm sub-segment, which is part of the pore size segment, is expected to account for the third-largest share in the market. The sub-segment’s development is highly propelled by providing an optimal balance between particle retention and flow efficiency. Membranes in this range are particularly effective at removing bacteria, fine particulates, and colloids while allowing essential nutrients and smaller molecules to pass through. This makes them indispensable in industries such as pharmaceuticals, biotechnology, food and beverage, and municipal water treatment. In pharmaceutical manufacturing, 0.1-0.2 µm membranes are widely used for sterile filtration, ensuring that injectable drugs and biologics remain free of microbial contamination.

Our in-depth analysis of the microfiltration membranes market includes the following segments:

|

Segment |

Subsegments |

|

Filtration Mode |

|

|

Material |

|

|

Pore Size Class |

|

|

Configuration |

|

|

Application |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Microfiltration Membranes Market - Regional Analysis

APAC Market Insights

Asia Pacific is anticipated to garner the largest market share of 34.8% by the end of 2035. The market’s upliftment in the region is highly fueled by an increase in industrialization, water treatment demands, and government-based sustainability programs across different countries. According to official statistics published by the Infrastructure Asia Organization in 2026, Evoqua Water Technologies, PUB, and Singapore’s National Water Agency readily trialed the utilization of Electro-deionisation (EDI) technology in a 3,800 m3/day demonstration plant. This further utilizes a low-pressure process that makes use of an electric field to diminish salt ions from seawater. Besides, Xylem has emphasized the use of smart water technologies to save time and conserve water on condition assessments, thereby making it suitable for boosting the market’s exposure in the region.

The microfiltration membranes market in China is growing significantly due to industrial chemical safety, prioritizing wastewater treatment, both of which mandate innovative membrane adoption across the pharmaceutical and petrochemical sectors. As per an article published by the State Council in November 2025, the percentage of non-fossil energy consumption surged from 16.0% to 19.8% as of 2024. Besides, in terms of distributed power generation, the installed capacity of photovoltaic power effectively surpassed 1,690 GW by the end of August 2025 in the country. Moreover, as per the July 2025 International Review of Economics & Finance article, the country is home to more than 20% of the global population, significantly possessing nearly 7% of the international renewable freshwater resources. Therefore, the availability of renewable water resources is deliberately uplifting the market in the country.

The aspects of generous funding for advanced filtration technologies and sustainable chemical production are readily responsible for enhancing the microfiltration membranes market in India. According to official statistics published by the Invest India Government in March 2025, the petrochemical and chemical industry readily contributes more than 9% to manufacturing-based gross value added and 7% to overall exports. Besides, the domestic demand and tactical efforts have been suitable for increasing self-sufficiency in an unprecedented way for the industry’s market value. The chemical industry was worth USD 220 billion as of 2024, and is further expected to be USD 300 billion by the end of 2028, thereby positively contributing towards the country’s economic upliftment. Therefore, with an expectation of boosting the overall industry, there is a huge growth opportunity for the market in the country.

Europe Market Insights

Europe market is expected to emerge as the fastest-growing region during the forecast period. The market’s development in the region is highly propelled by regional sustainability reforms, strict ECHA chemical safety regulations, along with a robust need for water treatment, food and beverage, and pharmaceutical sectors. According to official statistics published by the CEFIC Organization in January 2025, the chemical sector in the overall region generated almost €165 billion of added value as of 2023 from a diversified and complicated chemical value chain. This upstream level of the value chain is considered the most capital and energy-intensive, as it produces the building blocks of all chemicals. In addition, the sector demonstrates nearly 655 billion euros in turnover, thereby denoting an optimistic outlook for the market’s growth.

The microfiltration membranes market in Germany is gaining increased traction due to increased focus on prioritizing sustainable chemical production and allocating generous funds for advanced manufacturing and decarbonization. As stated in an article published by the Clean Energy Wire Organization in February 2025, the country has aimed to reach net greenhouse gas neutrality by the end of 2045, and comprises the interim objective of reducing emissions by almost 65% by the end of 2030 and 88% by 2040. In addition, the country’s government has declared a long-lasting strategy regarding negative emissions for reducing the concentration of greenhouse gases in the atmosphere to meet the 1.5°C target of the Paris Agreement. Moreover, an increase in the availability of critical materials for supporting innovative semiconductor manufacturing is also bolstering the demand for filtration technologies in the country.

The existence of strong sustainability policies, a surge in investments for clean water technologies, and the robust government support for green chemistry are factors that are driving the market in Norway. As stated in a data report published by the Nordic Energy Research in 2025, carbon dioxide emissions from industry and fossil fuels gradually increased, with a 30% decrease as of 2022 in the country. Additionally, the country has diminished carbon dioxide emissions by 8%, marking a notable focus on clean energy facilities. Besides, the country has also increased the share of renewable energy in its final energy consumption by 12%. Besides, the Nordic innovation councils and the Royal Association of the Dutch Chemical Industry collaborated on regional projects under Horizon Europe for escalating the adoption of innovative membranes, thus suitable for the market’s growth.

North America Market Insights

North America microfiltration membranes market is projected to witness considerable growth by the end of the stipulated timeline. The market’s growth in the region is highly driven by the EPA’s strict water quality standards and clean energy programs that are suitable for innovative filtration technologies for industrial and municipal wastewater treatment facilities. According to official statistics published by the White House Government in 2025, the President’s 2025 Budget comprises USD 10.6 billion in Department of Energy climate and clean energy research, demonstration, development, and deployment programs. This denoted a 12% surge above the 2023 enacted level. These investments also include more than USD 1 billion to optimize technologies to reduce pollution from industrial infrastructure, and almost USD 900 million to commercialize them, thereby making it suitable for bolstering the market.

The microfiltration membranes market in the U.S. is gaining increased exposure due to the presence of industrial and chemical safety regulations, advanced manufacturing programs, and expansion in the biotech and pharmaceutical fields. Based on government estimates published by the Department of Energy (DOE) in October 2023, the Industrial Efficiency and Decarbonization Office (IEDO) declared renewed funding for the Rapid Advancement in Process Intensification Deployment (RAPID) Institute by offering USD 40 million in investment. This is suitable for propelling research, development, and demonstrations of innovative process technologies to ensure resilient, lower-cost, along with diminishing carbon footprint and energy manufacturing across process industries. Besides, DOE also issued a Notice of Intent (NOI) to provide a funding opportunity of USD 38 million, which is also boosting the market’s exposure in the country.

The microfiltration membranes market in Canada is also growing, owing to environmental sustainability, water treatment facilities, resource industry applications, particularly in oil and mining sands, as well as government green chemistry and innovation programs. As stated in an article published by the British Columbia government in March 2025, the governments of Canada and British Columbia finalized an agreement of USD 250 million in federal funding for more than 5 years under the Canada Housing Infrastructure Fund (CHIF). This is highly suitable for Phase 1 of the Iona Island Wastewater Treatment Plant project to significantly enable homes and optimize densification. Moreover, as per the May 2025 Mining Association of Canada data report, the current mining industry contributed USD 117 billion as of 2023, which is 4% of the nation’s gross domestic product (GDP). Therefore, with such investment availability, there is a huge growth opportunity for the market in the country.

Key Microfiltration Membranes Market Players:

- Merck KGaA (Germany)

- Sartorius AG (Germany)

- 3M Company (U.S.)

- DuPont de Nemours, Inc. (U.S.)

- Pall Corporation (U.S.)

- Koch Separation Solutions (U.S.)

- GE Healthcare Life Sciences (U.S.)

- Toray Industries, Inc. (Japan)

- Asahi Kasei Corporation (Japan)

- Mitsubishi Chemical Corporation (Japan)

- Sumitomo Electric Industries, Ltd. (Japan)

- LG Chem Ltd. (South Korea)

- Kolon Industries, Inc. (South Korea)

- Memcor (Australia)

- Veolia Water Technologies (France)

- SUEZ Water Technologies & Solutions (France)

- Parker Hannifin Corporation (U.S.)

- Reliance Industries Limited (India)

- Petronas Chemicals Group Berhad (Malaysia)

- Johnson Matthey (UK)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- Merck KGaA is a leading player in the global microfiltration membranes market, leveraging its strong presence in life sciences and chemicals. The company invests heavily in research and development for advanced membrane technologies, particularly for pharmaceutical and bioprocessing applications, strengthening its European and global footprint.

- Sartorius AG is recognized for its specialized filtration solutions in biopharmaceutical manufacturing. Its microfiltration membranes are widely adopted in sterile filtration and cell culture processes, with the company expanding production capacity to meet rising global demand.

- 3M Company has a diversified portfolio that includes microfiltration membranes used in industrial, healthcare, and water treatment applications. The firm’s innovation-driven approach and global distribution network make it a key competitor in North America and beyond.

- DuPont de Nemours, Inc. is a major supplier of advanced filtration materials, including membranes for chemical processing and water purification. Its strong focus on sustainability and high-performance materials positions it as a leader in industrial and environmental applications.

- Pall Corporation, a subsidiary of Danaher, is a global leader in filtration and separation technologies. Its microfiltration membranes are extensively used in biopharma, food and beverage, and industrial chemical sectors, supported by continuous innovation and strategic partnerships.

Here is a list of key players operating in the global market:

The international market is highly competitive, with leading players adopting strategies such as mergers, acquisitions, and research and development investments to strengthen their positions. Companies, such as Merck KGaA and Sartorius AG, focus on innovation-driven growth, while U.S. firms such as DuPont and Pall Corporation leverage scale and global distribution networks. Asia-based manufacturers, including Toray and LG Chem, emphasize advanced material technologies and sustainability initiatives. Besides, in November 2025, PPG announced unveiling an ultrafiltration antifouling membrane for industrial water purification and a suitable treatment for its overall portfolio of spiral-wound filter elements. This has been significantly developed to meet the increasing demands for sustainable ultrafiltration solutions, which is positively impacting the microfiltration membranes industry globally.

Corporate Landscape of the Microfiltration Membranes Market:

Recent Developments

- In November 2025, Parker Hannifin Corporation declared that it has successfully entered into a definitive deal to acquire Filtration Group Corporation on a debt-free and cash-free basis for a cash purchase of USD 9.2 billion, representing 19.6x Filtration Group’s calendar year 2025.

- In November 2025, Electrolux Professional successfully partnered with Mimbly to effectively strengthen its commitment to ensure sustainable advancement by supporting the creation of microplastics filtration as well as water saving technology.

- In June 2025, Toray Industries, Inc. notified that Toray Membrane Middles East LLC commenced with operations at its very own Middle East water Treatment Technical Center b providing suitable technological services.

- Report ID: 8367

- Published Date: Jan 28, 2026

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Microfiltration Membranes Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.