Medical Foods Market Outlook:

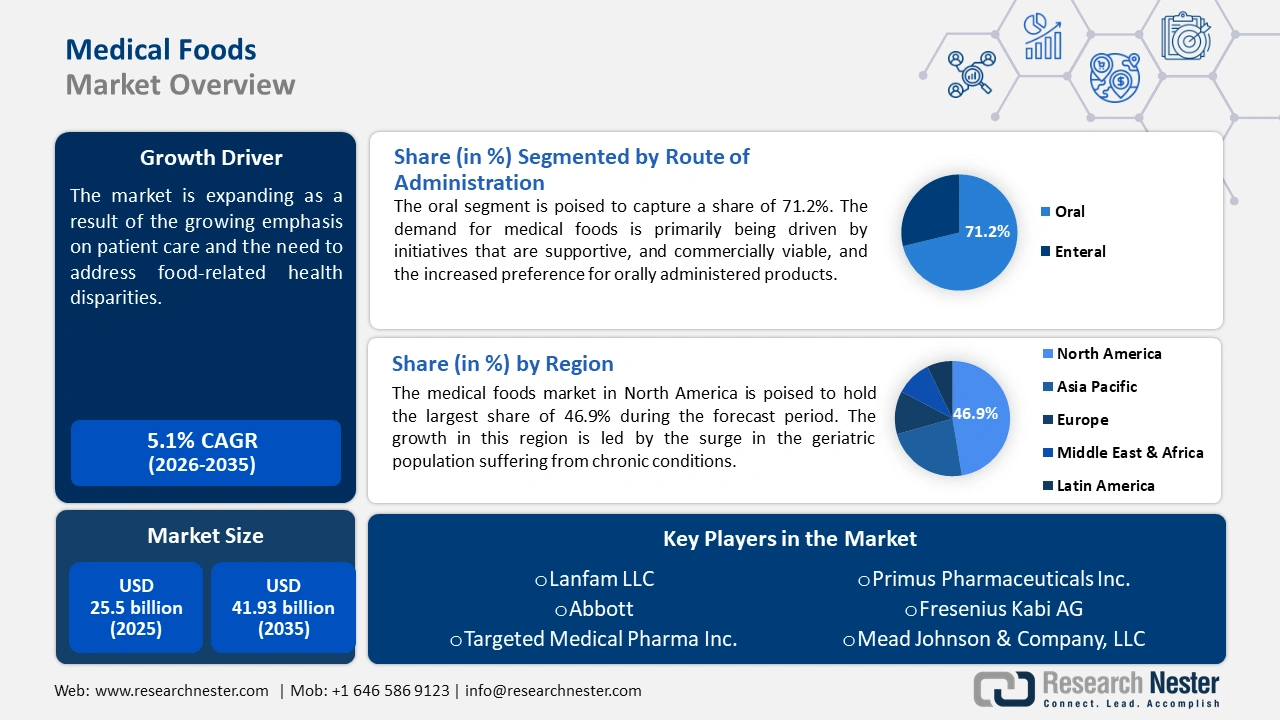

Medical Foods Market size was over USD 25.5 billion in 2025 and is projected to reach USD 41.93 billion by 2035, growing at around 5.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of medical foods is evaluated at USD 26.67 billion.

The growing emphasis on patient care and the need to address food-related health disparities have driven the demand for evidence-based nutritional medicines. Medical foods or foods for special medical purposes (FSMPs) as known in non-EU countries are specially formulated for the dietary management of patients with chronic diseases and are intended for use under medical supervision. Gaining traction owing to their potential disease management, medical foods are subject to general food legislation, such as good manufacturing practice (GMP), Codex Alimentarius, and the Orphan Drug Act under the FDA. The supportive regulatory frameworks have created opportunities for new entrants to capitalize on the rising demand and fostered the development of modern patient care.

A wide array of approved medical foods exists to help manage a range of medical conditions, including Alzheimer’s disease and HIV-associated enteropathy. EnteraGam contains serum-derived bovine immunoglobulin/protein isolate, which is being extensively used in treating inflammatory bowel disease (IBD), diarrhea-predominant irritable bowel syndrome, and HIV-associated enteropathy. Furthermore, Modulen IBD is a whole-protein nutrition formulation derived for treating the active phase of Crohn’s disease and Vivonex is used to manage severe gastrointestinal dysfunction. Stakeholders including the key players and medical practitioners are focused on clinical trials and developing promising therapies.

Key Medical Foods Market Insights Summary:

Regional Highlights:

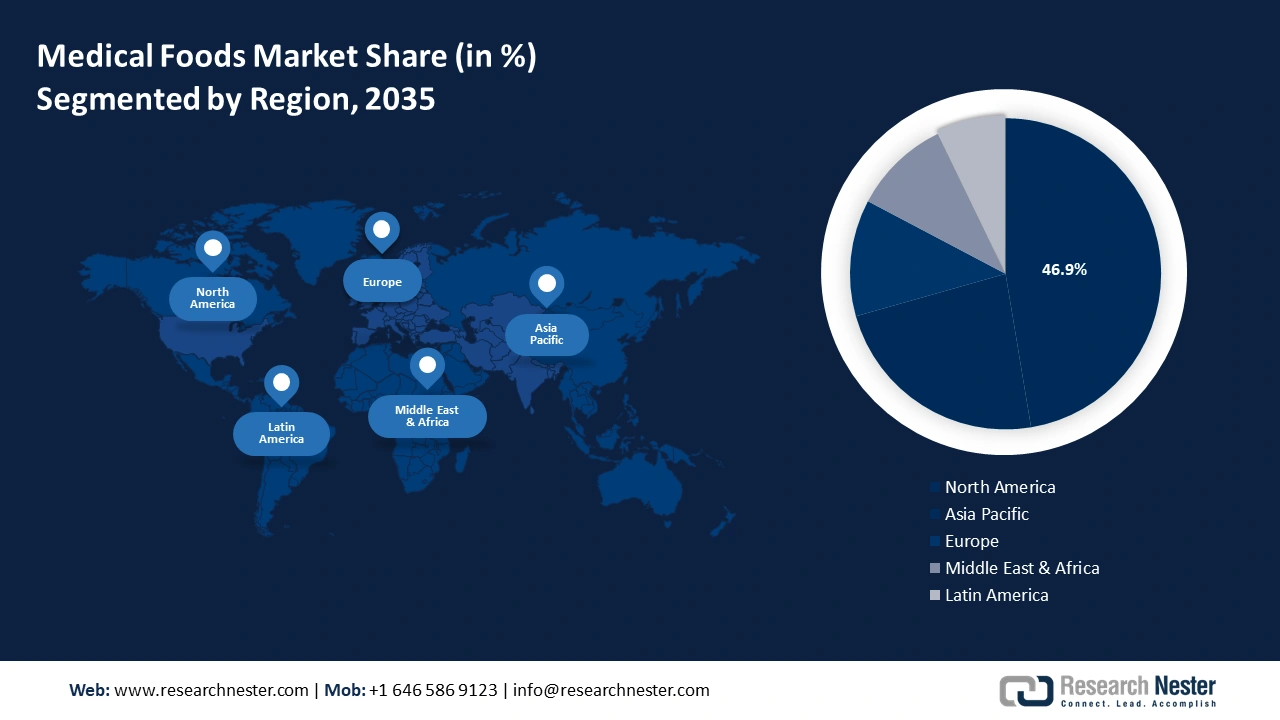

- The North America medical foods market will secure over 47% share by 2035, driven by the surge in the geriatric population suffering from chronic conditions.

Segment Insights:

- The oral segment in the medical foods market is expected to achieve a 71.20% share by 2035, fueled by initiatives supportive of orally administered medical foods and increasing product advancements.

- The powder segment in the medical foods market is anticipated to witness staggering growth till 2035, driven by the availability of powdered medical foods which are easy to store, digest, and can be made vegan or gluten-free.

Key Growth Trends:

- Targeted government projects to promote medical food

- Expansion of product pipeline and innovation

Major Challenges:

- Targeted government projects to promote medical food

- Expansion of product pipeline and innovation

Key Players: Lanfam LLC, Abbott, Targeted Medical Pharma Inc., Primus Pharmaceuticals Inc., Fresenius Kabi AG, Mead Johnson & Company, LLC, SFI Health, Danone.

Global Medical Foods Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 25.5 billion

- 2026 Market Size: USD 26.67 billion

- Projected Market Size: USD 41.93 billion by 2035

- Growth Forecasts: 5.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (47% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 17 September, 2025

Medical Foods Market Growth Drivers and Challenges:

Growth Drivers

-

Targeted government projects to promote medical food- Government research projects focus on areas including food resource coaching for patients, investing in R&D of personalized medical foods, and public policy advocacy to drive the adoption of nutrition-based interventions in underserved communities. For instance, the American Heart Association in January 2024 announced a funding of USD 7.8 million for 19 research projects, focused on heart and brain health as a part of its Health Care by Food initiative.

Furthermore, the U.S. FDA plans to invest USD 7.2 billion as part of the fiscal year (FY) 2025 proposed budget. This funding will allow the FDA to enhance medical food safety and nutrition, advance medical product safety, and support supply chain resiliency. An agency-wide crosscutting initiative will aid the FDA in advancing its capabilities with improved analytics and regulatory approaches. - Expansion of product pipeline and innovation- There is an increasing need for innovative foods to treat hereditary metabolic disorders and chronic illnesses. The demand for medical foods is anticipated to be propelled by increasing numbers of product launches and ongoing innovations by manufacturers. For instance, in May 2024 Wolters Kluwer Health and the International Food Information Service (IFIS) collaborated to unveil Ovid Nutrition and Health (Ovid NutriHealth), an exclusive interdisciplinary health research database. It will help Wolters Kluwer Health to explore new resource for the development of FSMPs.

Additionally, in July 2022, Danone announced their first-ever Dairy and Plants Blend baby formula in response to the high demand for vegetarian and flexitarian options. According to a report by the Multidisciplinary Digital Publishing Institute (MPDI) in February 2024, about 8%, 13%, and 21% of the younger population in Britain are vegan, vegetarian, and will adopt vegetarianism in the future. Moreover, the dietary fibers revenue has increased tremendously augmented by the influenced adoption and growing use of medical foods.

Challenges

-

High Cost- Medical foods are prepared using carefully regulated and customized recipes that are created and evaluated by professionals, attributed to this their cost is comparatively higher. Moreover, there are various pharmaceutical options available that increase the medical foods market competition and act as a restraining factor for the medical foods sector.

- Unavailability of FSMP in hospital pharmacies- As FSMPs are not considered drugs; the products cannot be placed in most hospital pharmacies. However, the State Administration for Market Regulation (SAMR) is keen on improving the registration of FSMPs and formula for infants in hospitals.

Medical Foods Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.1% |

|

Base Year Market Size (2025) |

USD 25.5 billion |

|

Forecast Year Market Size (2035) |

USD 41.93 billion |

|

Regional Scope |

|

Medical Foods Market Segmentation:

Route of Administration Segment Analysis

Oral segment is poised to hold medical foods market share of over 71.2% by the end of 2035. The demand for medical foods is primarily being driven by initiatives that are supportive, and commercially viable, and the increased preference for orally administered products. Furthermore, many companies such as Nutricia are continuously advancing and modifying their products such as pills, powders, and pre-thickened products according to the market demand. For instance, in January 2023, Nutricia announced its ready-to-drink, plant-based oral nutritional supplement, Fortimel. It is specially formulated with high-quality plant protein from soy and peas sources to meet the nutritional requirements of malnourished people.

Product Segment Analysis

The powder segment in medical foods market is expected to be growing with a staggering size by the end of the forecast period. Most of the medical foods are available in powder form which makes them orally administrable. National Institutes of Health 2020 published a report stating that Souvenaid by Nutricia, a patented medical mix of minerals and vitamins was designed to improve brain functioning in the early stages of Alzheimer’s disease and also supports memory functions.

Moreover, this is useful for the elderly and newborns due to its easy digestion and efficient absorption by the body. Credited to this, many innovations in its formulations are possible to enhance its taste. Powdered medical foods are easier to store and eat because they are dry and have a long shelf life. They are easily found in medical supply stores and can be purchased in plastic or metal containers. In addition to meeting the patient's needs, powdered foods can be made vegan or gluten-free to protect the patient from allergies. This acts as a primary growth factor for this medical foods market expansion.

Our in-depth analysis of the global market includes the following segments:

|

Route of Administration |

|

|

Product |

|

|

Application |

|

|

Sales Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Medical Foods Market Regional Analysis:

North America Market Insights

North America industry is set to dominate majority revenue share of 47% by 2035. The growth in this region is led by the surge in the geriatric population suffering from chronic conditions. The Centers for Disease Control and Prevention 2024 estimated that almost 129 million people suffer from major chronic diseases such as diabetes, cancer, hypertension, heart disease, and obesity. Additionally, the increasing number of infants and rising cases of malnutrition are all contributing to the growth of the market.

The increasing number of infants in the U.S. is the primary growth factor for the medical foods market share as they are highly dependent on formulas and medical foods. Centers for Disease Control and Prevention published a report in 2022 stating that in the U.S. the birth rate increased by 1% from 2020 to 2021 crossed about 3 million births in 2022.

Nutritional deficiencies in Canada are the main cause of people suffering from malnutrition. To cater to this condition minerals and vitamin supplements are required which demand for medical foods in this country. According to Global Affairs Canada 2021, about 2.3 billion people suffer from malnutrition, out of which 928 million (due to less food consumption), 2 billion (less vitamins and minerals consumption), and about 40% of all women and men are obese or overweight.

APAC Market Insights

Asia Pacific will also encounter huge growth in the medical foods market share during the forecast period with a notable size and will account for the second position. The rapid population growth in this region coupled with urbanization and awareness of early diagnosis and chronic and critical diseases has fueled the market growth in this region. Asian Development Bank predicted that by the end of 2050, 1 out of 4 people will be over 40 years old.

The increasing prevalence of diabetes and cancer in China makes the population more susceptible to diseases. According to the World Economic Forum 2023, WHO commented that the increase in diabetes in China was “explosive” and predicted that by 2021 the country could have 141 million diabetic patients which accounts for about 1/1oth population.

Japan has shown a lucrative increase in people living a sedentary lifestyle by joining corporate jobs. This makes people take a step towards a healthy life by incorporating nutritious foods into their diet. The National Institutes of Health 2021 estimated that on average about 25% of Japanese fall under the high-sedentary group and have more than 8 hours of sedentary time. Additionally, medical foods are not only meant for patients or to cure diseases but for preventing them as well. This benefited the medical food providers of this country.

Medical Foods Market Players:

- EraCal Therapeutics

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Lanfam LLC

- Abbott

- Targeted Medical Pharma Inc.

- Primus Pharmaceuticals Inc.

- Fresenius Kabi AG

- Mead Johnson & Company, LLC

- SFI Health

- Danone

Medical foods market growth is predicted that these companies will occupy a tremendous share. Most of these companies are continuously collaborating, making agreements, expanding, and joining ventures for the growth of this industry. With the penetration of a sedentary lifestyle and various chronic diseases such as cancer, and cardiovascular diseases, various companies are adapting to improve dietary supplements to the latest trends and are set to be the major key players in this sector.

Some of the key players include:

Recent Developments

- In February 2023, EraCal Therapeutics and Nestlé S.A. collaborated on research to find the latest nutraceuticals relevant to controlling food intake.

- In March 2022, the Lanfam LLC company introduced Proleeva, a new medical food designed to treat inflammatory conditions like neuropathy, osteoporosis, fibromyalgia, diabetic and rheumatoid arthritis, as well as chronic pain.

- Report ID: 6298

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Medical Foods Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.