Medical Engineered Materials Market Outlook:

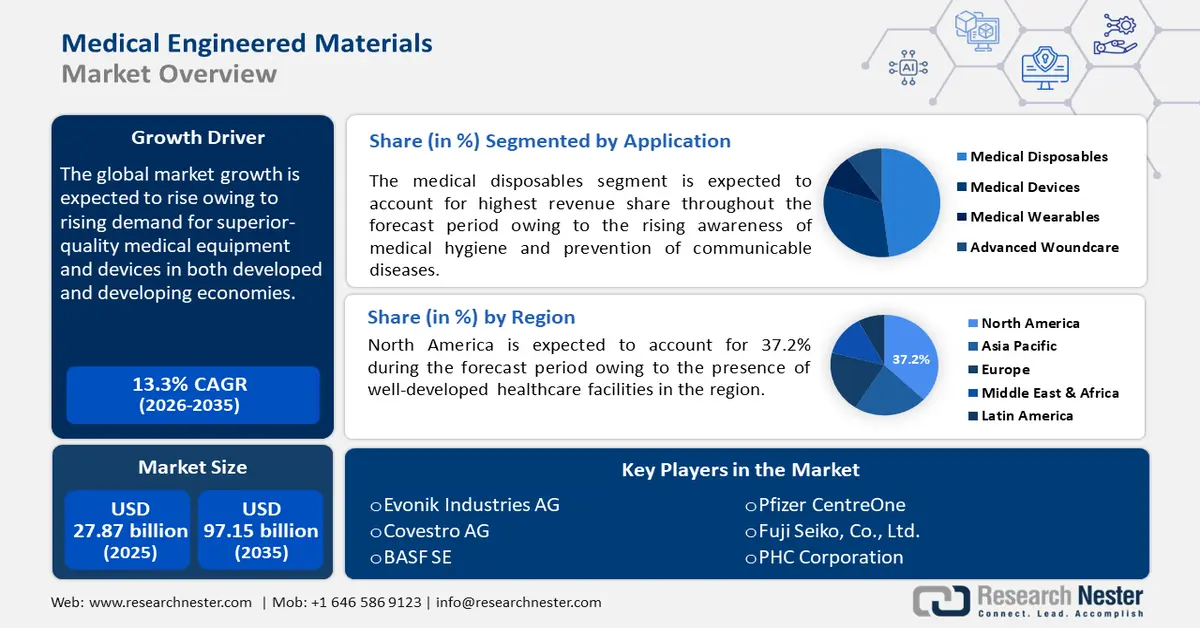

Medical Engineered Materials Market size was over USD 27.87 billion in 2025 and is projected to reach USD 97.15 billion by 2035, witnessing around 13.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of medical engineered materials is evaluated at USD 31.21 billion.

The growing prevalence of chronic ailments including cardiovascular diseases, diabetes, cancer, and neurological diseases is boosting the demand for devices such as pacemakers, artificial limbs, glucose monitors, and more. As per the CDC, in 2021, 29.7 million people of all ages, which is 8.9% of the total U.S. population were diagnosed with diabetes. As stated by IDF Diabetes Atlas, 1 in every 11 adults in Southeast Asia was suffering from diabetes, registering 747,000 deaths due to diabetes in 2021. It further states that the number is expected to reach 113 million by 2030.

According to the American Cancer Society, over 2 million new cancer cases are projected to be diagnosed in 2024 in the U.S., registering approximately 611, 720 deaths by the end of the year. Crisis as such demands constant upgradation of medical equipment and devices. This surge drives innovation in biocompatible materials, precision medicine tools, and drug delivery systems which is directly impacting the demand for medical engineered materials. Sedentary lifestyle adoption, growing alcohol consumption, and smoking, in addition to increasing pollution, are contributing highly to severe health problems. This in return is remarkably promoting the medical engineered materials market growth.

Key Medical Engineered Materials Market Insights Summary:

Regional Highlights:

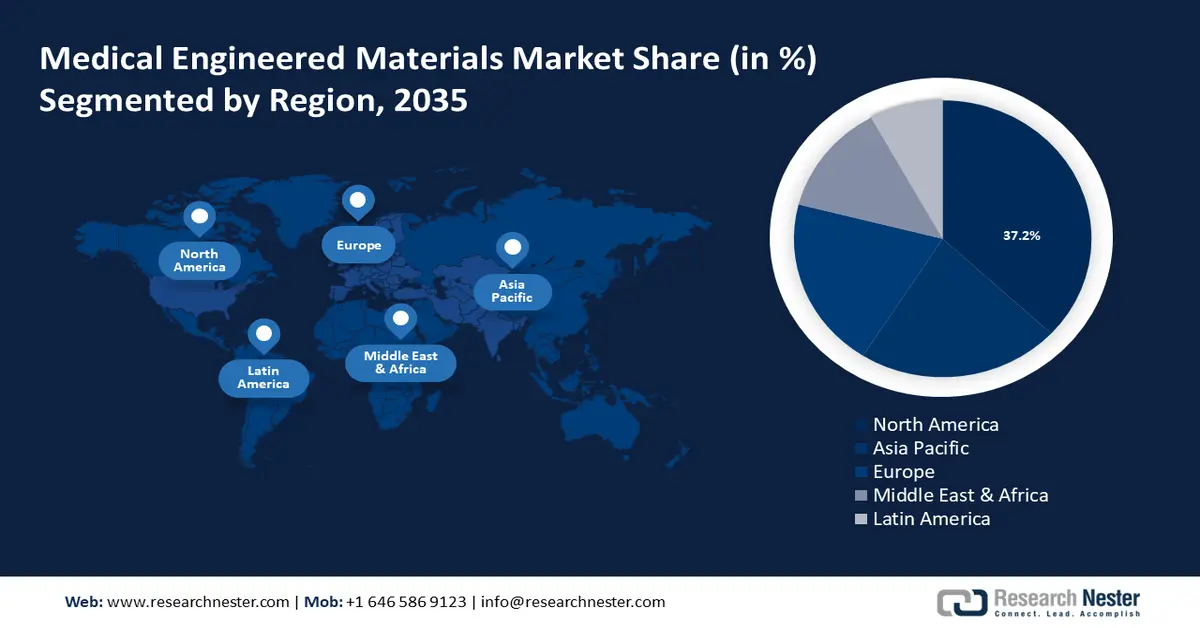

- North America’s medical engineered materials market will account for 37.2% share by 2035, driven by well-developed healthcare infrastructure and growing medical and pharmaceutical industries.

- Asia Pacific market will register lucrative growth during the forecast timeline, driven by rising demand for efficient healthcare systems and investments in innovative materials.

Segment Insights:

- The medical plastics segment in the medical engineered materials market is projected to hold a dominant share by 2035, driven by affordability, sustainability, and regulatory approvals.

- The medical disposables segment in the medical engineered materials market is projected to experience a notable CAGR through 2035, driven by rising awareness of medical hygiene and prevention of diseases.

Key Growth Trends:

- Increasing demand for minimally invasive surgical procedures

- Rising investments in healthcare in developed and emerging economies

Major Challenges:

- Increasing demand for minimally invasive surgical procedures

- Rising investments in healthcare in developed and emerging economies

Key Players: Evonik Industries AG, Covestro AG, BASF SE, DSM Biomedical, Celanese Corporation, DuPont de Nemours, Inc., Solvay S.A., SABIC, Victrex plc, Arkema S.A.

Global Medical Engineered Materials Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 27.87 billion

- 2026 Market Size: USD 31.21 billion

- Projected Market Size: USD 97.15 billion by 2035

- Growth Forecasts: 13.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (37.2% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, France

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 18 September, 2025

Medical Engineered Materials Market Growth Drivers and Challenges:

Growth Drivers

- Increasing demand for minimally invasive surgical procedures: The medical engineered materials market is significantly driven by the rising demand for lightweight, durable, and biocompatible materials used in minimally invasive surgery instruments and devices. According to the American Society of Plastic Surgeons, cosmetic surgery procedures grew by 19% in 2022 in comparison to 2019. There was also a noteworthy 7% growth rate in facelift procedures. Breast augmentation and liposuction topped the list in minimally invasive surgical procedures. This, in turn, impacted the medical engineered materials market positively, thus boosting its growth further.

With a growing emphasis on early diagnosis and precision medicine, there is an increasing need for materials that can enhance medical procedures. As more patients opt for minimally invasive options due t their reduced recovery times, smaller incisions, and lower risks of complications, manufacturers are investing more in the development of innovative materials, thereby driving the medical engineered materials market growth. - Rising investments in healthcare in developed and emerging economies: Increasing investments in healthcare are fueling market growth as healthcare systems increasingly prioritizes advanced technologies and innovative materials to improve patient care. These investments are driving several R&D activities. According to the American Medical Association, U.S. health spending expanded by 4.1% in 2022 to USD4.5 trillion per capita. The overall health spending was registered at 17.3% of 2022’s GDP. As funding grows, companies accelerate the production and enhancement of their equipment and devices, leading to greater adoption of medical-engineered materials across the healthcare sector.

Growing medical tourism in emerging economies is also impacting the medical engineered materials market significantly. Countries like India, Thailand, and Japan are becoming popular destinations for affordable and advanced medical treatments, including procedures requiring high-quality medical devices. This in turn is pushing manufacturers in these regions to innovate and cater to the specific market needs, further fueling the market growth.

Challenge

- Material biocompatibility: It is essential in developing medical engineered materials as it ensures that new substances interact safely with the human body without causing any adverse effects. This involves testing to assess immune response, toxicity, and integration with tissues. Materials are expected to maintain their properties and perform effectively over time without degrading or leaching substances that could cause harm.

The process includes preclinical studies, clinical trials, and quality control. Regulatory agencies review the data collected during these processes to ensure material safety for further use. Adherence to regulatory standards is crucial to ensure the materials meet safety and performance standards, ensuring support for intended medical functions for market launch of the product. - Growing concerns about medical waste management: Medical waste management is a significant challenge in the market due to the complexity of handling, treating, and disposing of hazardous materials safely. Improper waste handling can lead to environmental contamination, public health risks, and legal consequences, making this a critical issue for the industry. Thus, the rising pressure to develop sustainable, eco-friendly materials is an increasing challenge in the market.

A wide range of medical devices and disposables such as syringes, and gloves contribute to medical waste. As regulations tighten and environmental awareness rises, the demand for biodegradable, recyclable, and reusable materials is growing. This in turn is propelling the manufacturers to develop environment-friendly products while balancing performance, and safety.

Medical Engineered Materials Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

13.3% |

|

Base Year Market Size (2025) |

USD 27.87 billion |

|

Forecast Year Market Size (2035) |

USD 97.15 billion |

|

Regional Scope |

|

Medical Engineered Materials Market Segmentation:

Type Segment Analysis

The medical plastics segment dominated the global medical engineered materials market owing to their variety of uses including diagnostic equipment, medical instruments, disposables, and other materials in the healthcare industry. Furthermore, medical plastics contain properties such as durability and are recyclable, making them a good investment. These plastics are also used in single-use medical products such as syringes, and tubes. Owing to affordability, sustainability, and versatility, medical plastics are projected to remain a primary medical material consistently in demand. Additionally, regulatory approvals for plastic-based devices are considerably boosting the market growth. For instance, in April 2024, 3D Systems received FDA 510(k) clearance for VSP PEEK Cranial Implant, which is a 3D-printed, patient-specific cranial implant solution.

Application Segment Analysis

Medical disposables is expected to witness a notable growth rate till 2035. This majorly includes single-use syringes, gloves, catheters, IV tubes, and more. Rising awareness of medical hygiene and prevention of communicable and infectious diseases contributes significantly to market growth. With further advancements in materials including medical-grade plastics and polymers, disposable medical devices are gaining more popularity, catering to specific procedures and patient needs. This continues to drive the expansion of medical disposables in the medical engineered materials market.

Our in-depth analysis of the medical engineered materials market includes the following segments:

|

Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Medical Engineered Materials Market Regional Analysis:

North America Insights

North America industry is anticipated to account for largest revenue share of 37.2% by 2035, North America medical engineered materials market is set to capture around 37.2% revenue share. This growth can be attributed to the availability of well-developed healthcare infrastructure in the region, economically developed countries, and growing medical and pharmaceutical industries. In addition, the rising prevalence of chronic diseases and growing adoption of biomaterials in further propelling the medical engineered materials market growth. The region is witnessing several expansions in terms of facilities and investments. For instance, in October 2023, Texas Health and the HHCS announced an investment of USD 120 million to transform a treatment center in Harlingen, Texas, into a state-of-art inpatient psychiatric facility.

The changing lifestyle has led to a high prevalence of diseases among the population, demanding precise and accurate diagnosis of suitable and suitable medical devices in the region, mainly in the US. The U.S. is home to a wide number of patients suffering from chronic diseases. As per the Centers for Disease Control and Prevention (CDC) 2024, nearly 129 million people in the US have been tested with at least one major chronic disease. Whereas, five out of the top ten causes of death in the country are associated with treatable and preventable chronic diseases. Factors as such are promoting the medical engineered materials market in the U.S.

Strict regulations regarding the use of materials in medical applications have significantly driven the medical engineered materials market in Canada. Additionally, Canada is importing medical devices in bigger quantities to meet the growing needs. In 2022, medical devices valued CAD USD 5.2 billion were imported from the U.S., which represents as much as 38% of Canada’s overall medical devices imports. Furthermore, growing demand of AI and robotics, 3D printing, and other innovative technologies are boosting the Canada market growth.

APAC Market Insights

Asia Pacific medical engineered materials market size will witness lucrative growth till 2035, owing to rising demand for efficient healthcare systems to meet the growing needs of the population. The demand for superior-quality healthcare and rising investments have significantly boosted the need for innovative materials used in medical devices and equipment. This is attracting several companies in the region. For instance, in January 2024, Optimal Industrial Technologies announced its expansion in the Asia Pacific by initiating brand new appointments, strengthening strategic partnerships, and reinforcing local support.

The government in China is launching policies that promote domestic production of medical devices and the localization of supply chains is supporting the sector. Collaborations between multinational companies and local manufacturers are further enhancing China’s position in the medical engineered materials market. For instance, in February 2023, Germany’s Covestro and China’s Zhuhai Feiyang Novel Materials announced a collaboration for setting up a new site with an annual production capacity of 120,000 tons of TPU after the completion of the final phase expansion. The joint effort aims to create high-performance biocompatible solutions for advanced medical devices needed in China.

Japan medical engineered materials market is showcasing steady growth, driven by the country’s advanced healthcare system, and increasing demand for high-quality medical equipment. The country’s focus on precision medicine and innovation is fueling the development of biocompatible materials, critical for implants, tools, and other medical instruments. For instance, in September 2021, Sumitomo Chemical launched Meguri, a new brand of recycled plastics, covering a variety of products such as PMMA, and poly-methyl-methacrylate, which are used in several medical devices.

Medical Engineered Materials Market Players:

- Evonik Industries AG

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Covestro AG

- BASF SE

- Solvay

- SABIC

- Trelleborg AB

- DSM

- Celanese Corporation

- DuPont de Nemours Inc

The global medical engineered materials market is dominated by several prominent players who lead in development and supply of high-performances materials for medical applications. These companies are focused on developing advanced bioresorbable materials used in medical devices. Their dominance is majorly driven by strong R&D activities, innovations, and strategic partnerships to meet the demand for lightweight and durable materials in healthcare. Some of the key companies in the market are:

Recent Developments

- In April 2024, AES Clean Technology announced the launch of the CleanLock Module, an airlock solution that enhances cleanliness, speed, and efficiency. It is developed to reduce the risk of contamination and can be seamlessly integrated into any facility. This product is projected to serve several industries including biotechnology, pharmaceuticals, and medical device manufacturing

- In February 2023, Covestro launched a brand new ultra-durable material solution, Makrolon 3638 polycarbonate, which is a combination of unique properties that are maintained over a wide range of temperatures, in healthcare and life sciences

- Report ID: 6415

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Medical Engineered Materials Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.