Medical Tourism Market Outlook:

Medical Tourism Market size was valued at USD 43.8 billion in 2025 and is projected to reach USD 316.7 billion by the end of 2035, rising at a CAGR of 21.9% during the forecast period, i.e., 2026-2035. In 2025, the industry size of medical tourism is assessed at USD 53.3 billion.

The global medical tourism market is driven by a rising international patient pool in cross broader treatment-seeking patients. The market is also fueled due to high domestic medical expenditures and lengthy wait periods, the U.S., Canada, and Western Europe are the main sources of inbound patients, while outbound medical flows are focused on nations like India, Thailand, and Malaysia. As per the Healthy System Tracker data published in August 2025, the U.S. healthcare expenditure is expected to reach USD 5.6 trillion in 2025. This drives more patients to affordable and cost-effective treatment offshore. The market demand relies on cardiac care, fertility treatment, cosmetic procedures, and oncology.

On the supply chain side, advanced drug and device production, cross-border shipping, hospital facilities, and personnel are involved. Medical implants and APIs for surgical, diagnostic, and rehabilitation applications are exported from the U.S., Germany, and Japan to the lead market. The DDNews report in August 2025 states that India is witnessing a surge in medical tourism with 1.31 lakh patients arriving from other countries as India, Singapore, and South Korea developed clinical R&D in the market to reduce development-to-deployment times for cutting-edge therapies.

Key Medical Tourism Market Insights Summary:

Regional Highlights:

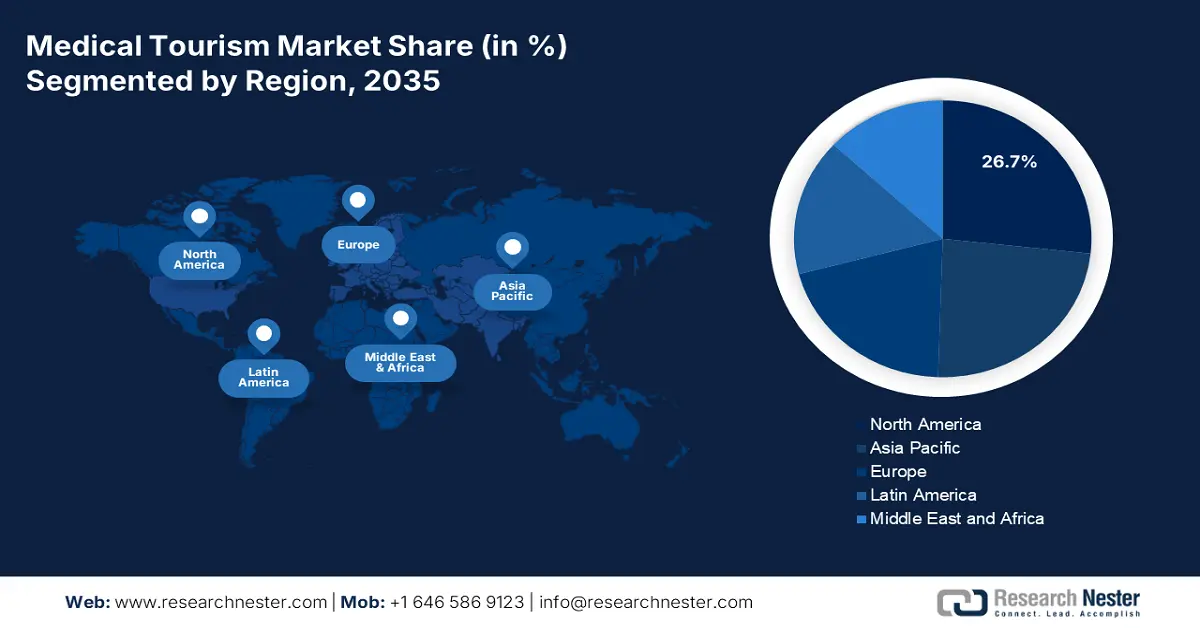

- North America is anticipated to capture a 26.7% share by 2035, impelled by rising out-of-pocket healthcare costs and favorable bilateral treatment agreements.

- Europe is expected to hold a significant share by 2035, owing to cost-effective treatment options and robust cross-border healthcare cooperation.

Segment Insights:

- The merchant segment is projected to account for 63.9% share by 2035, driven by privately-owned hospitals, clinics, and third-party medical tourism facilitators.

- The curative medical treatment segment is set to register substantial growth by 2035, owing to demand for oncology, cardiac, orthopedic, and fertility procedures.

Key Growth Trends:

- Cross-border access due to affordability

- Tech-driven innovations

Major Challenges:

- Trade barriers and exchange rate fluctuations

Key Players: Bumrungrad International Hospital, Cleveland Clinic, Fortis Healthcare, IHH Healthcare Berhad, Johns Hopkins Medicine International, Mayo Clinic, Acibadem Healthcare Group, Anadolu Medical Center, Bangkok Hospital, Mediclinic International, Schön Klinik, Hirslanden Private Hospital Group, Clínica Universidad de Navarra, Ramsay Health Care, Nipro Corporation, Tokushukai Medical Group, Japan Medical Tourism Organization (JMTO), Teikyo University Hospital, Seirei Hamamatsu General Hospital.

Global Medical Tourism Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 43.8 billion

- 2026 Market Size: 53.3 billion

- Projected Market Size: USD 316.7 billion by 2035

- Growth Forecasts: 21.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Europe (significant share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, Germany, United Kingdom, India, Thailand

- Emerging Countries: Turkey, Mexico, Singapore, Malaysia, UAE

Last updated on : 15 September, 2025

Medical Tourism Market - Growth Drivers and Challenges

Growth Drivers

- Cross-border access due to affordability: Medical tourism includes bundled drug treatments and device-enabled procedures not accessible or affordable in the domestic region. For instance, patients in the U.S. get full IVF cycles in India for less than INR 4 lakh, which is four times the cost in their country, stated in Dr. Rita Bakshi report in 2025. Based on FDA report, the biologics and devices applied abroad typically come under a lower regulatory category, making them less expensive without limiting safety. Governments in Costa Rica and Turkey have embraced liberal import/export policies for medical supplies, facilitating quicker access for patients and saving them money. Increasing flexibility in international supply chains is consistent with the widening of medical tourism corridors.

- Tech-driven innovations: Firms are actively expanding their global networks via innovation. Apollo Hospitals in India collaborated with The Clinic by Cleveland Clinic in January 2022 to provide remote second opinions for cardiac and cancer treatment, resulting in a surge in international patients' bookings. Thailand's Bumrungrad International also introduced AI-powered diagnostics for foreign patients, enhancing pre-travel planning and post-discharge care. Such integrations reduce uncertainty and facilitate trust development with foreign clients.

- Increasing patient cases and disease occurrence: According to the OECD and Eurostat report, the endemic disease prevalence is driving the outbound patient expansion. In Germany, patients in need of orthopedic, cardiovascular, or fertility tourism treatment is expanding over the past decade. Aging populations and overburdened public systems increase delays in care delivery. As per the NLM report in July 2025, India is the primary place with 82% of Omani patients receiving treatment abroad. These population shifts generate stable demand streams for global providers of high-throughput, efficient specialty care.

Total Foreign Patients Visited from 2014 to 2024 in Korea

|

Year |

No. of Patients |

|

2014 |

266,501 |

|

2015 |

269,889 |

|

2016 |

364,189 |

|

2017 |

321,574 |

|

2018 |

378,967 |

|

2019 |

497,464 |

|

2020 |

117,069 |

|

2021 |

145,842 |

|

2022 |

248,110 |

|

2023 |

205,768 |

|

2024 |

1,170,467 |

Source: Medical Korea, 2024

Cost Comparison on IVF Treatment in the U.S. and India

|

Country |

IVF Cycle Cost |

|

U.S. |

USD 12,000 to USD 25,000 |

|

India |

INR 1,50,000 - INR 2,50,000 |

Source: White House, February 2025, World Fertility Services, February 2024

Challenges

- Trade barriers and exchange rate fluctuations: Turkey faced a severe depreciation of currency in 2023 due to inflation, which resulted in the price of imported U.S.-based diagnostic devices. This instability affected medical tourism supply chains, especially long-term B2B contracts. Key manufacturers, such as Abbott Laboratories, were forced to renegotiate agreements to incorporate quarterly floating exchange rate terms, making logistics more complex and rising operational uncertainty. Such macroeconomic volatility and trade complexities complicate it for the suppliers to ensure pricing stability and profitability in new markets, making high-risk markets less attractive.

Medical Tourism Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

21.9% |

|

Base Year Market Size (2025) |

USD 43.8 billion |

|

Forecast Year Market Size (2035) |

USD 316.7 billion |

|

Regional Scope |

|

Medical Tourism Market Segmentation:

Trade Segment Analysis

The merchant dominates the segment and is expected to hold the share value of 63.9% by 2035. The merchant model is driven by the privately-owned hospitals, clinics, and third-party medical tourism facilitators. The AHA in January 2025 reports 6,093 hospitals in the U.S. for 2025, of which 1,214 are investor-owned (for-profit) community hospitals, which can be considered merchant-based facilities. Most private providers, predominantly in India, Thailand, and Turkey, join international insurance networks and online booking platforms to reach outbound patients.

Purpose of Visit Segment Analysis

Curative medical treatment leads the purpose of visit segment and is expected to hold a considerable share value by 2035. Patients who go abroad for procedures like oncology therapy, cardiac surgeries, orthopedic procedures, and fertility treatments are the main drivers for this segment. As per the Centers for Disease Control and Prevention report, the excessive treatment expenses and delayed treatment in domestic nations are significant factors causing patients to find alternative sources for treatment. International travelers primarily target treatments for non-communicable diseases, especially cancer, cardiovascular disease, and complications of diabetes. Government assistance in these nations toward the establishment of medical excellence centers also facilitates this expansion.

Traveler Type Segment Analysis

In the traveler type segment, international outbound leads the segment and is anticipated to hold a significant share value by 2035. Traveling patients from industrialized countries, mainly the U.S., UK, Canada, Australia, and GCC, drive their travels with fewer expenses for treatments, less waiting time, and improved medical care abroad. The U.S. Department of Commerce report released in September 2023 depicts that nearly 24.6% people in the U.S. visited healthcare providers for medication. Outbound flows also boost international travel infrastructure and focused visa policies in leading medical tourism destinations.

Our in-depth analysis of the global medical tourism market includes the following segments:

|

Segment |

Subsegments |

|

Treatment Type |

|

|

Service Provider |

|

|

Designation Country |

|

|

Traveler Type |

|

|

Purpose of Visit |

|

|

Trade |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Medical Tourism Market - Regional Analysis

North America Market Insights

North America is dominating the region and is projected to hold a market share of 26.7% by 2035. The region is driven by the expansion in out-of-pocket healthcare costs, favorable bilateral treatment agreements, and long domestic wait times. The health-related tourism in the U.S. accounted for USD 6.3 billion in 2024, based on the International Trade Administration report in December 2024. Further, the U.S. Medical reimbursement expansion by provincial programs and Medicare promotes the regulated outbound treatment. Further, investments in AI-enabled care navigation platforms and concierge services are surging the trend, mainly in Ontario, California, and New York.

The U.S. market is influenced by increasing outbound travel for affordable procedures and inbound luxury wellness services. As per the ASMBS report in 2025, U.S. people travel abroad for affordable healthcare. Rising costs, long wait times, and global access have boosted demand, with procedures often 40% to 80% cheaper than in the U.S. Increased investments, follow-up travel packages, and collaborations with private payers' reimbursement portions and cross-border insurance innovations drive the market leadership.

APAC Market Insights

The Asia Pacific is the fastest-growing region in the medical tourism market and is poised to hold a significant market share by 2035. The region is driven by rising international patient flow and advanced medical infrastructure. India, South Korea, Japan, and China are the major countries leading the region. Further, government support is the primary factor in the Asia Pacific region. Based on Medical Korea report in 2024 states that nearly 1.17 million patients from 202 countries visited Korea for medical related services. Technology advancements such as robotic surgery AI AI-assisted diagnostics, enhance the medical competitiveness in the region. The patient flow is expanding beyond traditional borders due to the multilateral healthcare agreements.

Most Visited Medical Departments in Korea (2014-2024)

|

Country |

Percentage |

|

Dermatology |

23% |

|

Integrative Internal Medicine |

18% |

|

Plastic Surgery |

12% |

|

Health Screening Center |

8% |

|

Obstetrics and Gynecology |

4% |

|

Orthopedics |

4% |

|

Integrated Oriental Medicine |

3% |

|

General Surgery |

3% |

|

Dental Clinic |

3% |

Source: Medical Korea

China market is expanding and holds a significant share. As per the NLM report in August 2024, China's medical visitors grew by 30% in the past five years, aided by deregulation and investment in infrastructure in provinces such as Hainan and Guangdong. China recorded more inbound patients in 2023, with patients seeking traditional Chinese medicine (TCM), orthopedics, and wellness therapies. Traditional Chinese Medicine hospitals with integrated herbal and contemporary care are reshaping into global treatment centers.

Europe Market Insights

Europe is expanding and will dominate the market by 2035. The region is driven by cost-effective treatment options, robust cross-border healthcare cooperation, and high standards of care. European Health Data Space (EHDS). The European Union allocated €1,251 billion in 2023 on general healthcare expenditure in the EU, based on the Eurostat data in March 2025. The rising demand for orthopedic, dental, and fertility-based services has made the region an attractive point for intra-regional and international patient visits.

Germany dominates the medical tourism market in Europe. Germany's healthcare sector gross value added of about €435 billion in 2024, which is 11.5% of the overall economy of the country, based on the International Trade Administration report in August 2025. The government actively funds public hospitals by providing international patient packages, with improved language facilities and electronic documentation protocols. New programs under the Healthcare Export Strategy have enhanced infrastructure to manage inbound medical tourists in Munich, Berlin, and Hamburg.

Key Medical Tourism Market Players:

- Apollo Hospitals

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Bumrungrad International Hospital

- Cleveland Clinic

- Fortis Healthcare

- IHH Healthcare Berhad

- Johns Hopkins Medicine International

- Mayo Clinic

- Acibadem Healthcare Group

- Anadolu Medical Center

- Bangkok Hospital

- Mediclinic International

- Schön Klinik

- Hirslanden Private Hospital Group

- Clínica Universidad de Navarra

- Ramsay Health Care

- Nipro Corporation

- Tokushukai Medical Group

- Japan Medical Tourism Organization (JMTO)

- Teikyo University Hospital

- Seirei Hamamatsu General Hospital

The global medical tourism market is competitive with the domestic hospital chains, insurer-led networks, and digital facilitators for market share. The key players, including Apollo Hospitals, IHH Healthcare, and Bumrungrad, use brand reputation, international accreditation, and specialty care to attract foreign patients. Further, U.S.-based platforms such as PlacidWay and Healthbase aid outbound patients with various pricing models and concierge services. Strategic initiatives such as multilingual patient navigation, expansion into high-growth regions like the Middle East and Southeast Asia, and cross-border insurance partnerships enhance the competitiveness. Post-treatment telehealth, digital health integration, and AI-driven treatment matching are surging competitive differentiators.

Here is a list of key players operating in the market:

Recent Developments

- In June 2025, Vaidam Health acquired MediJourney, which is a digital-first platform for international patient facilitation developed by Ferns N Petals to expand cross-border healthcare services.

- In June 2025, Aditya Oza, co-founder of EMotorad, and Mikhail Bohra, co-founder of Harbor 365, launched Luxora Experiences, which is the bold new venture set to reshape the medical tourism industry.

- Report ID: 4508

- Published Date: Sep 15, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Medical Tourism Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.