Marine Internet of Things (IoT) Market Outlook:

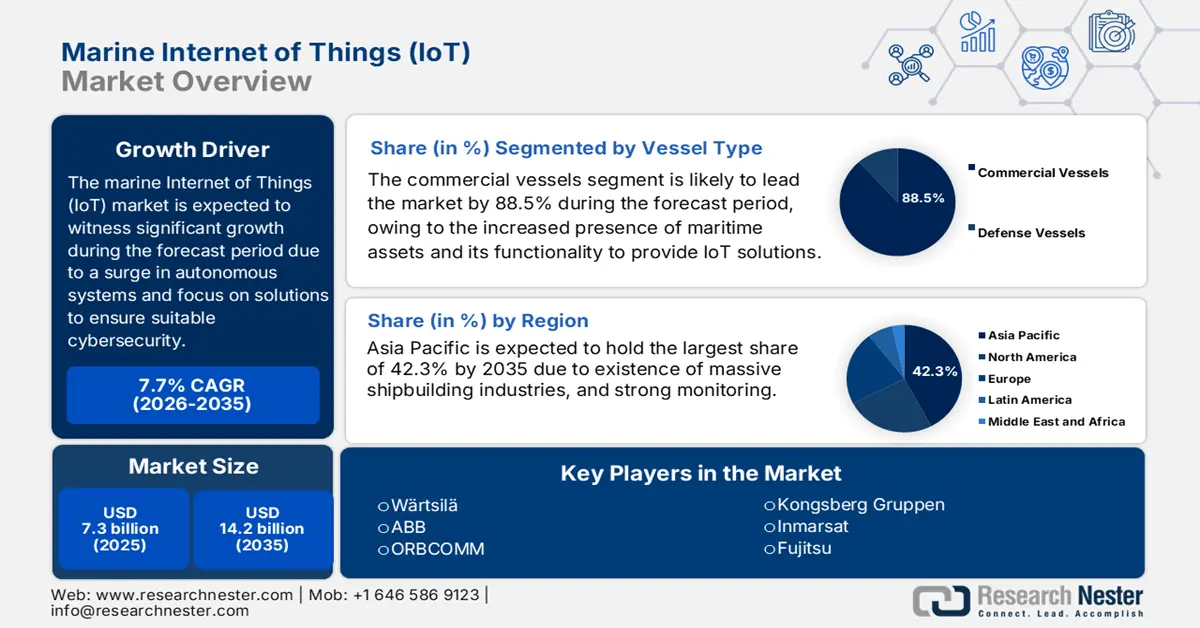

Marine Internet of Things (IoT) Market size was USD 7.3 billion in 2025 and is anticipated to reach USD 14.2 billion by the end of 2035, increasing at a CAGR of 7.7% during the forecast period, i.e., 2026-2035. In 2026, the industry size of the marine internet of things (IoT) is assessed at USD 7.8 billion.

The marine internet of things market is attributed to intense growth, owing to factors such as the sudden shift towards platforms for products, an increase in remote-controlled and autonomous vessels, and the existence of cybersecurity as a foundational element. According to an article published by NLM in February 2022, shipping is considered a global business that has significantly employed 1.6 million seafarers, and also carries almost 90% of international freight. Besides, the aspect of labor expenses can account for nearly 30% of overall costs, hence the ideology of autonomous ships is gaining increased traction.

Furthermore, as stated in the December 2022 ESCAP data report, India comprises a huge maritime industry, with 12 ports and 205 non-major ports, along with a 7,500 km long coastline. In addition, 95% of the country’s overall trade volume, as well as 70% of its trade value, is transport; there is a huge demand for the marine internet of things market in the country. Besides, there are ongoing developments for fully automated ships, with the inclusion of different technologies, such as remote monitoring, strong communications, and sensor fusion, as core components of the market. On the contrary, the aspect of partnerships and collaborations among organizations is also bolstering the market’s exposure.

Key Marine Internet of Things (IoT) Market Insights Summary:

Regional Insights:

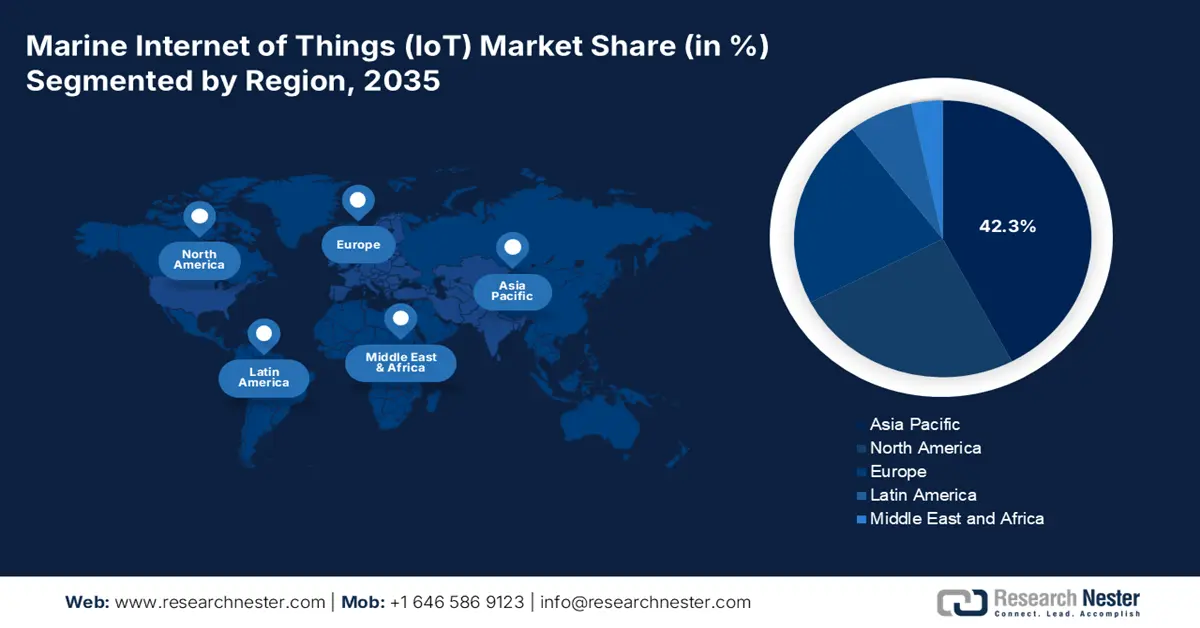

- By 2035, Asia Pacific is anticipated to command a 42.3% share of the Marine Internet of Things (IoT) Market, supported by the concentration of major global ports, expansive shipbuilding activity, and extensive coastlines requiring advanced monitoring.

- Europe is set to emerge as the fastest-growing region through 2035, stimulated by Fit for 55 and Green Deal initiatives that encourage IoT adoption for verification and emissions monitoring.

Segment Insights:

- The commercial vessels segment is poised to capture an 88.5% share by 2035 in the Marine Internet of Things (IoT) Market, reinforced by strong economic imperatives and high-scale operational efficiencies.

- The aftermarket segment is projected to secure the second-largest share by 2035, accelerated by rising demand to retrofit the existing global fleet with digitalized capabilities.

Key Growth Trends:

- Advancements in maritime connectivity

- Port automation and modernization

Major Challenges:

- Uncertain ROI and increase in initial capital outlay

- Lack of data silos and standardization

Key Players: Wärtsilä (Finland),ABB (Switzerland),ORBCOMM (USA),Kongsberg Gruppen (Norway),Inmarsat (UK),Fujitsu (Japan),Windward (Israel),Iridium Communications (USA),Ericsson (Sweden),NTT Group (Japan),Cisco Systems (USA),Microsoft (USA),Hyundai Heavy Industries (South Korea),DNV (Norway),ATEK Access Technologies (USA),Marlink (Norway),Speedcast (Australia),Bharat Electronics Ltd. (India),SAP (Germany),GTT (France)

Global Marine Internet of Things (IoT) Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 7.3 billion

- 2026 Market Size: USD 7.8 billion

- Projected Market Size: USD 14.2 billion by 2035

- Growth Forecasts: 7.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (42.3% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, China, Japan, Germany, South Korea

- Emerging Countries: Singapore, India, Norway, Netherlands, United Kingdom

Last updated on : 13 October, 2025

Marine Internet of Things (IoT) Market - Growth Drivers and Challenges

Growth Drivers

- Advancements in maritime connectivity: The increasing deployment of Low-Earth Orbit (LEO) satellite networks is effectively revolutionizing the marine internet of things market by offering lower-latency and high-speed at sea, and also enabling complex applications and real-time data transfer. According to an article published by NLM in September 2025, the utilization of the WAM-V 16 ASV in Gazebo displayed a 100% success rate under the aspect of medium wave disturbances, and a 90% success rate under high wave conditions, thereby making it suitable for the market’s growth.

- Port automation and modernization: The aspect of international investments in smart ports has created an intensified push for the marine internet of things market globally. In this regard, port community systems, smart berthing systems, and automated cranes deliberately demand seamless data adoption with docked and approaching vessels to improve throughput and diminish port stay period. As per an article published by NLM in January 2023, over 80% of the international merchandise trade is successfully carried by sea. Therefore, the implementation of digitalized processes and technologies through Maritime 4.0 is significantly boosting the market’s exposure across different nations.

- Regulatory push for decarbonization: The single most strong growth driver for the marine internet of things market is the international regulatory upliftment for decarbonization. For instance, the International Maritime Organization's (IMO) Carbon Intensity Indicator (CII) has mandated that ships measure and also progressively optimize their carbon efficiency. This has directly compelled shipowners to invest in data analytics and IoT sensors platforms to fuel monitoring, emission reporting, and route optimization for effectively maintaining asset value and operational compliance.

Integrated Circuits 2023 Export and Import Uplifting the Marine Internet of Things Market

|

Countries/Components |

Export |

Import |

|

Chinese Taipei |

USD 214 billion |

- |

|

China |

USD 154 billion |

USD 200 billion |

|

South Korea |

USD 134 billion |

- |

|

Hong Kong |

- |

USD 200 billion |

|

Singapore |

- |

USD 85.6 billion |

|

Global world trade |

USD 910 billion |

|

|

World trade share |

4.0% |

|

|

Product complexity |

1.2 |

|

Source: OEC

Challenges

- Uncertain ROI and increase in initial capital outlay: The aspect of upfront expense of incorporating a wide-ranging marine IoT solution is considered substantial, which has effectively encompassed hardware, systems integration, satellite airtime, and software licenses. Besides, for shipowners operating on thin margins, the capital expenditure is a serious barrier, which has caused a hindrance in the marine internet of things market internationally. While the potential of operational spending savings is clear, the quantifiable return on investment (ROI) is predicted to be challenging across diversified vessel types and trade routes.

- Lack of data silos and standardization: The marine internet of things market is effectively characterized by proprietary systems from various manufacturers that frequently are unable to communicate. This limitation has resulted in data silos, wherein valuable information from navigation, cargo systems, and engines remains trapped in unconnected and separate platforms. Besides, without the presence of Application Programming Interfaces (APIs) and common data guidelines, it is significantly difficult to develop a united view of vessel performance. This fragmentation has critically restricted the effectiveness of artificial intelligence and analytics, since these technologies demand aggregated and clean data to generate suitable insights.

Marine Internet of Things (IoT) Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

7.7% |

|

Base Year Market Size (2025) |

USD 7.3 billion |

|

Forecast Year Market Size (2035) |

USD 14.2 billion |

|

Regional Scope |

|

Marine Internet of Things Market Segmentation:

Vessel Type Segment Analysis

Based on the vessel type, the commercial vessels segment in the marine internet of things market is anticipated to garner the largest share of 88.5% by the end of 2035. The segment’s upliftment is highly driven by the aspect of direct economic imperative and the function of scale. In addition, the international container ships fleet, commercial vessels, and bulk carriers tend to display the majority of maritime assets, wherein IoT solutions readily deliver a clear and instant return on investment. For these particular operators, the usual drivers are strictly economic and witness administrative pressures, suitable enough for bolstering the overall segment.

End user Segment Analysis

Based on the end user, the aftermarket segment in the marine internet of things market is expected to cater to the second-largest share during the projected timeline. The segment’s growth is highly propelled by the increasing demand to retrofit the present international fleet, which readily comprises huge commercial vessels, along with digitalized capabilities. Besides, unlike OEM-based solutions, aftermarket installations experience significant challenges pertaining to system integration. Meanwhile, this segment ensures the largest market that is addressable since shipowners are effectively compelled to upgrade old assets to meet strict new efficiencies.

Component Segment Analysis

Based on the component, the software segment in the marine internet of things market is predicted to account for the third-largest share by the end of the forecast duration. The segment’s development is driven by the aspect of hardware merely collecting data and transforming this into actionable intelligence and measurable ROI. The segment also comprises fleet management platforms, AI-specific performance optimization tools, and predictive analytics suites. According to an article published by Heliyon in March 2024, a clinical study was conducted to evaluate software implementation on marine ships, wherein 51% of sector professionals stated that Industrial Control Systems (ICS) are devoid of suitable protection. Additionally, 55% were readily concerned about cyberattacks associated with, which can cause a hindrance in the segment.

Our in-depth analysis of the marine IoT market includes the following segments:

|

Segment |

Subsegments |

|

Vessel Type |

|

|

End user |

|

|

Component |

|

|

Application |

|

|

Technology |

|

|

Deployment Model |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Marine Internet of Things (IoT) Market - Regional Analysis

APAC Market Insights

Asia Pacific in the marine IoT market is anticipated to garner the largest share of 42.3% by the end of 2035. The market’s upliftment in the overall region is highly propelled by an increase in the concentration of the world’s busiest ports, huge shipbuilding sectors, focus on fixed and mobile performance, and extended coastlines demanding robust monitoring. Besides, according to an article published by the World Bank Organization in January 2025, the 20th OneSouthAsia Conversation, based on the collaboration with the Commercial Law Development Program of the U.S. Department of Commerce, focused on maritime ports and ongoing development by providing an estimated USD 73 billion, denoting a huge growth opportunity for the market.

The marine IoT market in China is growing significantly, owing to the presence of huge shipbuilding output and tactical Digital Silk Road investments, along with the government’s initiative to successfully integrate IoT into its domestic manufacturing strategy through the Ministry of Industry and Information Technology (MIIT). As stated in the March 2024 Geostrategy Organization article, organizations in the country have gained a monopoly in supply through IoT modules and account for more than 60% of the international market. These companies include MeiG, accounting for a 4.3% share, followed by China Mobile with 5.2%, Sunsea AioT WITH 5.3%, Fibocom with 7.5%, and Quectel with 38.5%.

The marine IoT market in South Korea is also growing due to the existence of notable shipbuilding conglomerates and generous contributions initiated by domestic organizations to incorporate automated navigation systems. In addition, the country is also well equipped with wide-ranging IoT platforms to ensure real-time performance monitoring that has set a high industrial standard. Besides, the December 2023 ITA data report indicated that the cybersecurity market in the country has been valued at USD 3,975 million, along with USD 2,728.5 million for system and product, USD 1,246.4 million for consulting and services, and USD 1,145 million for exchange rate, all of which are positively impacting the market.

Mobile and Fixed-Line Internet Performance in Asia-Based Countries

|

Countries |

Mobile |

Fixed-Line |

||||

|

|

Download (Mbps) |

Upload (Mbps) |

Latency (ms) |

Download (Mbps) |

Upload (Mbps) |

Latency (ms) |

|

Fiji |

25 |

11 |

21 |

17 |

10 |

18 |

|

Maldives |

88 |

22 |

18 |

13 |

12 |

6 |

|

Singapore |

99 |

17 |

17 |

287 |

232 |

4 |

Source: UNCTAD Organization

Europe Market Insights

Europe marine IoT market is expected to emerge as the fastest-growing region during the projected period. The market’s development in the overall region is propelled by the aspect of region’s Fit for 55 and Green Deal package, directly incentivizing the integration of IoT for verification, reporting, and emissions monitoring. In addition, generous investments in hinterland connectivity and port digitalization have been exemplified by projects through the Connecting Europe Facility (CEF). Meanwhile, the region’s robust maritime technology ecosystem, such as Kongsberg and Wärtsilä, has accelerated advancement in data-based solutions for fleet improvement, as well as predictive maintenance.

The marine internet of things (IoT) market in Germany is gaining increased exposure, owing to the aspect of equipment manufacturing and powerhouse shipbuilding sector, which is increasingly adopting IoT into complex vessel systems. As per an article published by the ITA in August 2025, the digital economy field in the country has witnessed effective and stabilized development, with a valuation of USD 250 billion as of 2024, denoting an increase from USD 239 billion as of 2023. Therefore, this indicates a massive growth opportunity for digitized and automated shipping processes, which in turn is uplifting the overall market in the country.

The marine internet of things (IoT) market in the UK is also developing due to the requirement of transparency in data to cater to strict protection and indemnity club needs, along with the aspect of complying with emerging carbon intensity regulations. Besides, the UK Department for Transport's Clean Maritime Plan has successfully mandated zero-emission shipping and pushed investment in IoT majorly for ensuring performance monitoring. Meanwhile, the Maritime and Coastguard Agency (MCA) has readily made alignment with IMO policies to secure IoT-based data transmission, denoting an optimistic outlook of the overall market in the country.

North America Market Insights

North America market is projected to grow steadily by the end of the forecast duration. The market’s growth in the region is extremely driven by innovative technological integration, the presence of strict administrative standards, and modernization in the U.S. Coast Guard fleet, which is readily supported by federal strategies. According to an article published by the U.S. Department of State in April 2022, green shipping will emerge as the ultimate emitter, and by the end of 2050, emissions from the industry are predicted to surge to 50% from previous years, which is rapidly uplifting the demand for IoT-specific emission monitoring.

The marine internet of things (IoT) market in the U.S. is gaining increased traction, owing to the existence of substantial federal investment in modernized port infrastructure and maritime security. In addition, the adoption of IoT with the Department of Defense platforms has been successful in boosting Maritime Domain Awareness. Besides, as per an article published by the U.S. Department of State in September 2025, there has been a generous investment of USD 1.5 billion for over 8 years to bolster maritime security in the overall country through different programs and approaches to ensure protection, thereby making it suitable for boosting the market’s exposure.

The marine internet of things (IoT) market in Canada is also developing due to its focus on enabling safe Arctic navigation, remote coastlines, and safeguarding capabilities, along with an increase in government expenditure on protection plans, which has created a significant need for vessel traffic management and coastal monitoring. As mentioned in the February 2025 Government of Canada article, the Minister of Transport and Internal Trade declared a generous investment of more than USD 125 million under the Ocean’s Protection Plan, with the intention of strengthening marine safety across 47 communities in the country, thus making it suitable for the market’s growth.

Key Marine Internet of Things (IoT) Market Players:

- Wärtsilä (Finland)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- ABB (Switzerland)

- ORBCOMM (USA)

- Kongsberg Gruppen (Norway)

- Inmarsat (UK)

- Fujitsu (Japan)

- Windward (Israel)

- Iridium Communications (USA)

- Ericsson (Sweden)

- NTT Group (Japan)

- Cisco Systems (USA)

- Microsoft (USA)

- Hyundai Heavy Industries (South Korea)

- DNV (Norway)

- ATEK Access Technologies (USA)

- Marlink (Norway)

- Speedcast (Australia)

- Bharat Electronics Ltd. (India)

- SAP (Germany)

- GTT (France)

The international marine IoT market is extremely fragmented, but at the same time consolidated, and is readily characterized by intense competition between established maritime organizations and agile technological entrants. Besides, notable players are strongly pursuing growth through two strategies, including tactical mergers and acquisitions and technological partnerships. For instance, maritime leaders, such as Kongsberg and Wärtsilä, effectively acquired niche AI-based startups to boost their respective analytical capabilities, while operators associated with satellite partnered with cloud providers to develop seamless data-to-insight pipelines, thereby making it suitable for the marine internet of things (IoT) market.

Here is a list of key players operating in the global market:

Recent Developments

- In May 2024, Siren Marine [IM1] and Yamaha Motor Canada declared the introduction of the Siren Connected Boat Experience, thereby permitting boat builders, dealers, and consumers to use the sector’s notable marine IoT experience in Canada for offering, controlling, tracking, and monitoring maintenance information.

- In March 2024, ABB [IM2], along with Siemens, Schneider Electric, Rockwell Automation, Microsoft, and Capgemini notified the collaboration of the latest initiative to provide interoperability for Industrial IoT ecosystems.

- In January 2024, Yamaha Motor Co., Ltd. [IM3] successfully announced that it has effectively concluded a stock purchase deal with Germany's DEUTZ AG, to successfully acquire Torqeedo's shares and accelerate carbon neutrality and boost competitiveness in the marine CASE strategy.

- Report ID: 3692

- Published Date: Oct 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.