Finite Element Analysis (FEA) Software Market Outlook:

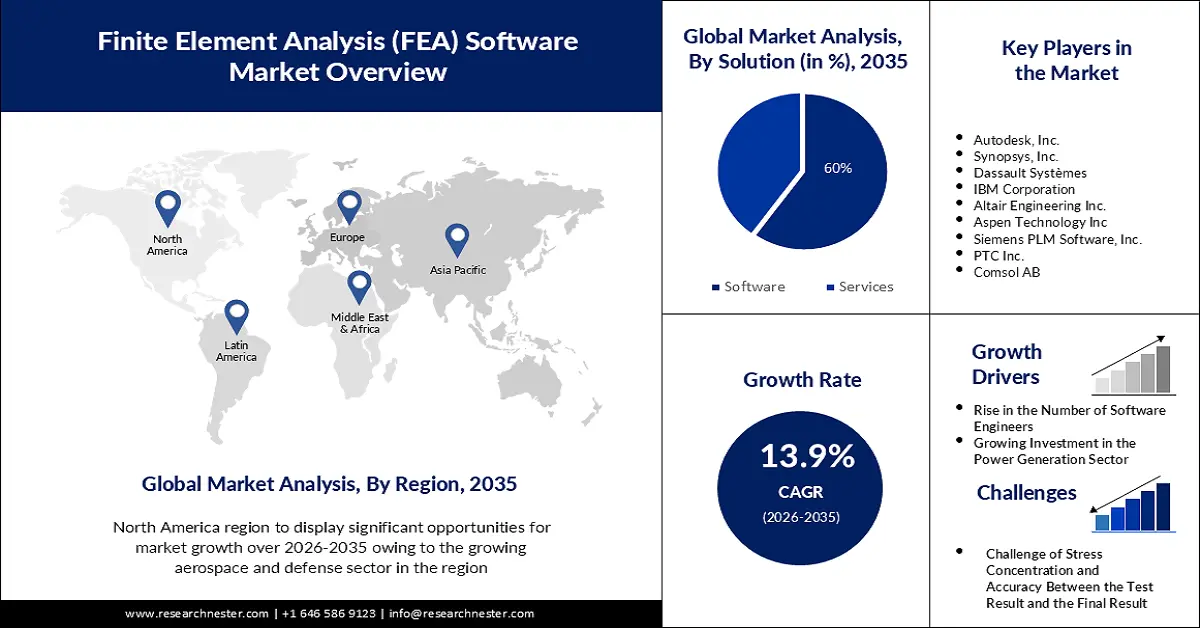

Finite Element Analysis (FEA) Software Market size was over USD 6.91 billion in 2025 and is anticipated to cross USD 25.39 billion by 2035, witnessing more than 13.9% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of finite element analysis software is assessed at USD 7.77 billion.

The reason behind the growth is impelled by the growing innovation in science and technology as well as engineering. Science and technology are essential for social and economic advancement and are vital in the creation of new technologies that improve people's quality of life, and are the main forces behind global human progress. For instance, global IT spending increased from more than 5% in 2022 to around USD 4 trillion in 2023.

The growing transformation in finite element analysis is believed to fuel the FEA software market growth. Future simulation programs will function much differently from software programs owing to the growing application of artificial intelligence (AI) and machine learning (ML), as a result of which finite element analysis (FEA) may be made more accurate and efficient with the, and this will also have a significant impact on how the finite element analysis software market develops in the future.

Key Finite Element Analysis (FEA) Software Market Insights Summary:

Regional Highlights:

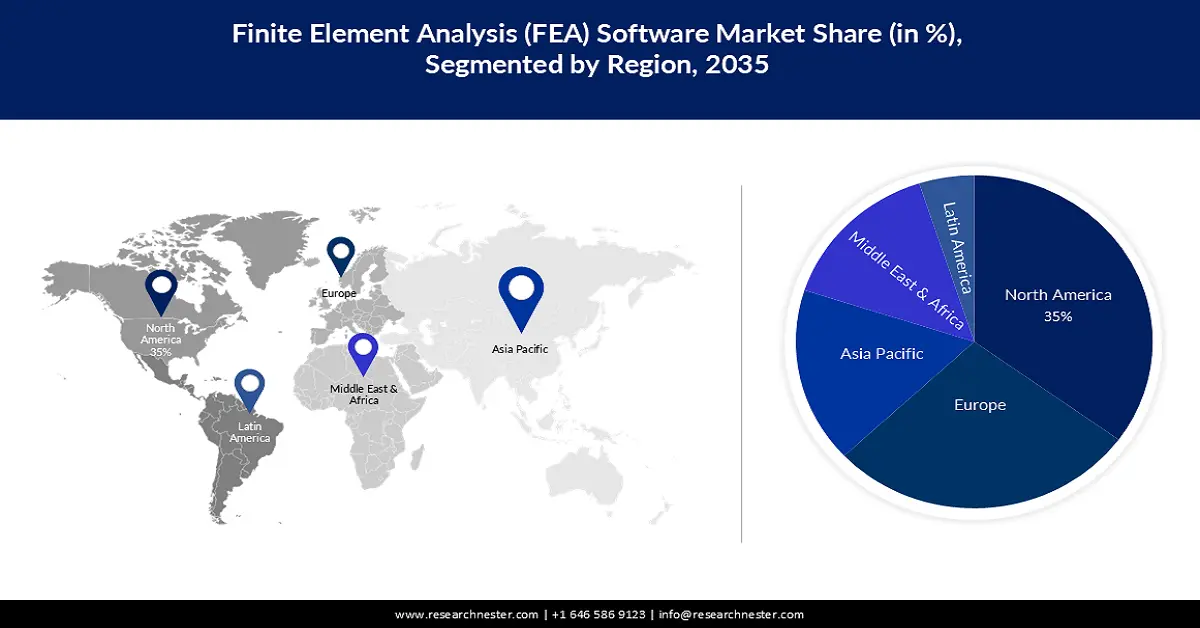

- By 2035, North America is projected to secure a 35% share of the finite element analysis (FEA) software market, buoyed by the expanding aerospace and defense sector.

- Europe is anticipated to hold the second-largest share by 2035, supported by rising industrial production.

Segment Insights:

- The software segment in the finite element analysis (FEA) software market is expected to command a 60% share in the coming years, propelled by the widening adoption of cloud FEA computing.

- The automotive segment is poised to capture a notable share by 2035, underpinned by the increasing use of FEA for virtual safety assessment and structural integrity testing.

Key Growth Trends:

- Rise in the Number of Software Engineers

- Growing Investment in the Power Generation Sector

Major Challenges:

- Challenge of Stress Concentration and Accuracy Between the Test Result and the Final Result

- Complex and Time Consuming Process Owing to the Complexity of Model Generation and Analysis,

Key Players: Autodesk, Inc., Synopsys, Inc., Dassault Systèmes, IBM Corporation, Altair Engineering Inc., Aspen Technology Inc, Siemens PLM Software, Inc., PTC Inc., Comsol AB.

Global Finite Element Analysis (FEA) Software Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 6.91 billion

- 2026 Market Size: USD 7.77 billion

- Projected Market Size: USD 25.39 billion by 2035

- Growth Forecasts: 13.9%

Key Regional Dynamics:

- Largest Region: North America (35% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Mexico, Singapore

Last updated on : 21 November, 2025

Finite Element Analysis (FEA) Software Market - Growth Drivers and Challenges

Growth Drivers

- Rise in the Number of Software Engineers - FEA software, serves as the foundation for contemporary simulation software and aids engineers in identifying weak points, tension points, and optimizing components during the design process, and minimizing the need for actual prototypes and experiments. As of 2022, there were approximately 30 million software engineers around the globe out of which the United States has more than 687,000 software engineers.

- Growing Investment in the Power Generation Sector- The complex nature of power generator is understood with the support of finite element analysis software to solve structural engineering problems.

- Upsurge in Defense R&D Expenditure - The equipment that is used in defense is tested through finite element analysis software before getting approved.

- Increase in Liquid Fuel Production and Consumption –Finite element analysis software is utilized in the oil and gas industry to detect the effect of fluid in a given system. Moreover, the oil and gas production industry deals with extreme temperatures that are controlled by engineers through the system. According to the U.S. Energy Information Administration (EIA), global petroleum and other liquid fuel production and consumption are estimated to be ~100 and ~99.58 million barrels per day respectively, in the first quarter of 2022.

- Finite Element Analysis for Stress Analysis- The computerized process of FEA stress analysis is used to forecast a product's response to forces, and other physical factors to pinpoint a product's weak points and provide insightful information that can be used to enhance the design of the product and maximize performance.

Challenges

- Challenge of Stress Concentration and Accuracy Between the Test Result and the Final Result- As accurate as its user, FEA is. however, also rather complicated, and there are some errors in it such as choosing elements and meshing, defining boundary conditions, accurately determining material properties, and convergence problems. Inadequate mesh quality can result in mistakes, problems with convergence, and long calculation times, which is expected to harm the accuracy of the outcomes of a simulation. The mesh size has a significant impact on the precision of the findings; as a coarse mesh produces results that are less accurate since there will be fewer elements in a coarse mesh. A crucial step in validating finite element models is mesh refining, which can be a difficult and time-consuming process. In FEA, one of the most prevalent issues is mesh size, therefore it is an essential phase to address finite element problems (FEM).

- Complex and Time - Consuming Process Owing to the Complexity of Model Generation and Analysis,

- Demands for Higher Configuration System

Finite Element Analysis (FEA) Software Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

13.9% |

|

Base Year Market Size (2025) |

USD 6.91 billion |

|

Forecast Year Market Size (2035) |

USD 25.39 billion |

|

Regional Scope |

|

Finite Element Analysis (FEA) Software Market Segmentation:

Solution Segment Analysis

The software segment in the finite element analysis (FEA) software market is estimated to gain a robust revenue share of 60% in the coming years. Moreover, software is further bifurcated as, on-premises and cloud-based software. A service known as "cloud FEA computing" gives users on-demand network access to a shared pool of programmable computer resources for finite element analysis (FEA) which may significantly increase structural engineering efficiency. With the help of the cloud FEA compute service, users may quickly and efficiently execute several load scenarios which also makes it possible to return findings for big sets of load situations, and enables to assign time-consuming calculations to specialized data centers.

In addition, local installation of on-premise software occurs on a PC or server whereby, users can install and customize their versions of a FEA system using on-premises finite element analysis (FEA) software.

Industry Segment Analysis

The automotive segment in the finite element analysis software market is set to garner a notable share shortly. Modern automobiles are developed with the use of Finite Element Analysis (FEA), which has become a vital technology in the automotive industry that also allows engineers to evaluate safety, and test structural integrity in a virtual environment. FEA is now a vital tool in the construction of more dependable, safe, and efficient automobiles which aids in optimizing designs, and lower development costs.

The strength, stiffness, and longevity of vehicle assemblies and components can be assessed by using finite element analysis (FEA) to facilitate knowledge of the dynamic behavior of cars. Moreover, this study helps to ensure the dependability and lifetime of components, optimize cooling systems, identify potential resonance concerns, identify the underlying causes of vibrations, and assess thermal management solutions.

Our in-depth analysis of the global finite element analysis (FEA) software market includes the following segments:

|

Solution |

|

|

Industry |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Finite Element Analysis (FEA) Software Market - Regional Analysis

North American Market Insights

North America industry is expected to dominate majority revenue share of 35% by 2035, impelled by the growing aerospace and defense sector. When it comes to production and infrastructure, the aerospace and defense industry in the United States is among the biggest, which supplies goods and services to the markets for general aviation, commercial aviation, missiles, space exploration, and military aircraft. For instance, in terms of aerospace exports, the US contributed over USD 102 in 2022.

European Market Insights

Europe finite element analysis software market is estimated to be the second largest, during the forecast timeframe led by the growing industrial production. Europe has been at the forefront of manufacturing excellence and holds a prominent position in various industrial manufacturing sectors. For instance, the industrial production of the EU increased by around 7% in 2021 compared to 2020 and by more than 4% in 2022, maintaining its increasing trend. Additionally, several of the biggest aerospace businesses in the world, including Thales, Leonardo, Safran, Rolls Royce, and BAE Systems, are based in Europe and produce aero engines, drones, helicopters, and other systems and equipment. This, as a result, is expected to fuel finite element analysis software market growth in the region.

Finite Element Analysis (FEA) Software Market Players:

- ANSYS, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Autodesk, Inc.

- Synopsys, Inc.

- Dassault Systèmes

- IBM Corporation

- Altair Engineering Inc.

- Aspen Technology Inc

- Siemens PLM Software, Inc.

- PTC Inc.

- Comsol AB

Recent Developments

- Ansys announced its simulation technology to help validate a NASA-backed research program on aviation sustainability. The 5 - project is to test and qualify the use of ammonia as an alternate fuel to power zero-carbon jet engines.

- Synopsys announced the development of its 8nm RF design reference flow and companion design solutions kit (DSK). The RF design reference flow attributes tightly integrated solutions from Synopsys and Ansys and will enhance the quality-of-results, time-to-results, and cost-of-results for next-generation RF design.

- Report ID: 4188

- Published Date: Nov 21, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Finite Element Analysis (FEA) Software Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.