Simulation Software Market Outlook:

Simulation Software Market size was valued at USD 20.31 billion in 2025 and is likely to cross USD 64.22 billion by 2035, registering more than 12.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of simulation software is assessed at USD 22.54 billion.

The market is expanding as a result of the introduction of electric vehicles and autonomous vehicles. As per estimates, across the globe, approximately 9 million electric automobiles were sold in 2022, and these sales were anticipated to rise by over 34% in the year 2023 to reach close to 13 million. The economy and efficacy of these cars are being tested by automakers using simulation tools in real-world scenarios. Additionally, they use simulation software to adhere to various industry norms and laws.

In addition, using a tool called simulation software; one may virtually simulate a real-time environment to assess the suitability and effectiveness of various products and procedures. Moreover, military weapon effects are mostly determined by the use of simulation techniques. They also assist automakers in identifying the best vehicle prototypes to lower carbon dioxide emissions.

Key Simulation Software Market Insights Summary:

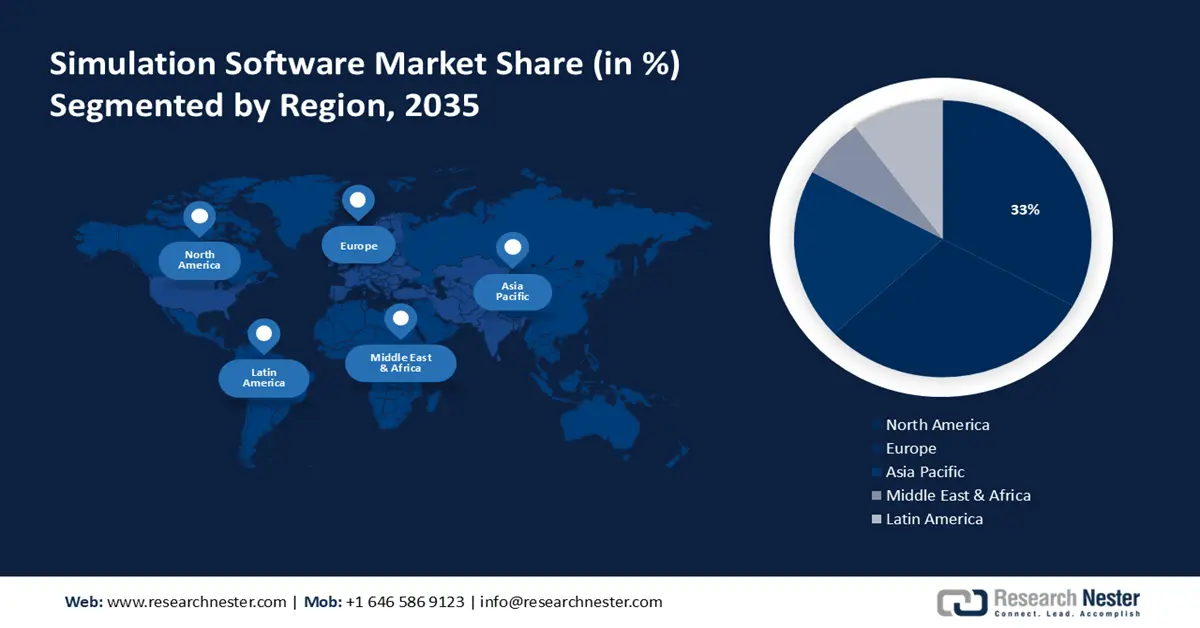

Regional Highlights:

- North America simulation software market will hold around 33% share by 2035, driven by the rising number of SME units and increased R&D activities.

- Europe simulation software market will capture a 28% share by 2035, driven by expansion of automobile manufacturers and demand for fuel-efficient vehicles.

Segment Insights:

- The software segment in the simulation software market is projected to capture 65% share by 2035, driven by benefits like data security, continuous testing, and FEA adoption.

- The on-premises segment in the simulation software market is anticipated to capture a 58% share by 2035, supported by preferences for data protection and secrecy in software deployment.

Key Growth Trends:

- Rising demand for effective software solutions to reduce production and training costs

- Utilizing cutting-edge technologies in simulation tools to drive market expansion

Major Challenges:

- Rising demand for effective software solutions to reduce production and training costs

- Utilizing cutting-edge technologies in simulation tools to drive market expansion

Key Players: Siemens AG, SWOT AnalysisRockwell Automation Inc., Schneider Electric SE, Autodesk Inc., Ansys Inc., Bentley Systems, Incorporated, Dassault Systemes, The MathWorks, Inc., ESI Group, GSE Systems.

Global Simulation Software Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 20.31 billion

- 2026 Market Size: USD 22.54 billion

- Projected Market Size: USD 64.22 billion by 2035

- Growth Forecasts: 12.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (33% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, United Kingdom

- Emerging Countries: China, India, Singapore, South Korea, Brazil

Last updated on : 8 September, 2025

Simulation Software Market Growth Drivers and Challenges:

Growth Drivers

- Rising demand for effective software solutions to reduce production and training costs - The market for simulation software is expanding quickly due to the rising need for effective solutions to reduce training and production costs. These advanced tools enable companies to simulate real-world situations, pinpoint operational inefficiencies, and test novel concepts in a risk-free setting.

By using this strategy, businesses can improve overall performance and productivity while cutting production and training costs dramatically. This prevalent pattern emphasizes how simulation software is becoming more widely acknowledged as a priceless tool for contemporary companies looking for data-driven, cost-effective solutions. As a result, the simulation software market is anticipated to rise. - Utilizing cutting-edge technologies in simulation tools to drive market expansion - The use of simulation software is growing in popularity across several business sectors. Organizations can use the tool to simulate different scenarios, analyze and optimize performance, and determine the need for predictive maintenance. Artificial intelligence and machine learning techniques are becoming more common, and they are being included in simulation programs to improve predicting talents, streamline procedures, and enhance models.

Large volumes of simulation-generated data may now be analyzed by AI-powered algorithms, helping enterprises make data-driven decisions, obtain new insights, and enhance overall simulation performance. Furthermore, to create immersive and engaging experiences, simulation tools are being merged with virtual reality (VR) and augmented reality (AR) technology. There are estimated to be over 2 billion active AR-user devices by 2023. And in 2024, that amount is projected to rise to over 16 billion. With the help of these technologies, users can engage in and visualize simulation more naturally and entertainingly. Therefore, the simulation software market is predicted to experience a surge. - Increasing need for production plants to reduce risk and make smart decisions- Businesses may enhance the overall safety and dependability of their goods, optimize designs, and make well-informed decisions by modeling real-world scenarios and analyzing data.

Additionally, without having to pay extra money, the tool lets companies test out various design configurations, materials, and operational conditions. This adaptability promotes innovation, speeds up product revisions, and fosters creativity. By minimizing material waste and streamlining production processes, the tool also benefits a variety of different industries. Hence, the revenue for the market is poised to grow.

Challenges

- Lack of standards and guidelines - The market for simulation software lacks standard operating procedures, which makes it difficult for companies in different industries like engineering, healthcare, and gaming to collaborate. Different software designs and data formats cause problems with data accuracy, increased expenses, and inefficient use of resources by interfering with smooth integration and resource allocation.

In addition, the lack of benchmarks makes tracking progress and evaluating performance more difficult. To resolve these problems, cooperative efforts are required to create industry standards that improve coherence, encourage innovation, and increase compatibility within the market. - High initial deployment cost is attributed to impeding market growth.

- Data security is becoming a bigger issue, and software integration is getting harder.

Simulation Software Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

12.2% |

|

Base Year Market Size (2025) |

USD 20.31 billion |

|

Forecast Year Market Size (2035) |

USD 64.22 billion |

|

Regional Scope |

|

Simulation Software Market Segmentation:

Offering Segment Analysis

The software segment is predicted to account for around 65% simulation software market share by 2035. The growth of this industry can be influenced by the advantages of software, including data security, dependability, and continuous testing. Furthermore, it is anticipated that finite element analysis will play a major role in the software industry's growth. In industries like automotive, aerospace, military, and electronics, finite element analysis (FEA) is widely used to evaluate the quality, performance, and design of products.

The most important industry development for the simulation is the emergence of sophisticated and multi-simulation platforms that include an extensive range of simulation tools for use across the full product lifecycle. Software can used to model what would happen if an online retailer experienced an unexpected spike in orders, a shortage of workers in the warehouse, or both. Software can also be used to assess how best to arrange the physical architecture of a warehouse based on how people and goods flow through it. Businesses can increase productivity by 25%, space consumption by 20%, and stock utilization efficiency by 30% by implementing integrated order processing into their inventory system.

Deployment Mode Segment Analysis

On-premises segment is poised to hold more than 58% simulation software market share by 2035. The early software adoption was the reason for this segment's significant share. The conventional technique of software deployment, known as "on-premise deployment," entails installing the program locally.

Businesses who want to protect their data from hackers and preserve data secrecy might find this strategy advantageous. The main reasons for the segment's rise are these advantages over data security and secrecy predicted to give rise to the market.

Our in-depth analysis of the global market includes the following segments:

|

Offering |

|

|

Deployment Mode |

|

|

Software Type |

|

|

Application |

|

|

End-Use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Simulation Software Market Regional Analysis:

North American Market Insights

North American region is likely to account for simulation software market share of more than 33% by the end of 2035, due to the rising number of SME units in the area and the increased emphasis on research & development activities over 31 million small enterprises.

Furthermore, governments around North America are consistently emphasizing investment and innovation to create a more environmentally friendly workplace. Companies are using simulators to assess a product's viability before manufacturing it since the region's eco-friendly work environment laws are getting stricter. Additionally, the government's creative city activities in this area have had a favorable influence on the trend of simulation and analytic technology adoption for better surveillance and monitoring.

European Market Insights

Europe region is estimated to account for simulation software market share of more than 28% by the end of 2035, due to the demand for simulation software, which is utilized in the creation of Internet-of-Things (loT) support devices, is being driven by the expansion of automobile manufacturers and the growing desire for more fuel-efficient automobiles.

In addition, Germany held the largest market share in Europe, while the fastest-growing market was the UK.

Simulation Software Market Players:

- Siemens AG

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Rockwell Automation Inc.

- Schneider Electric SE

- Autodesk Inc.

- Ansys Inc.

- Bentley Systems, Incorporated

- Dassault Systemes

- The MathWorks, Inc.

- ESI Group

- GSE Systems

Recent Developments

- November 2023: Ansys, a leading provider of engineering simulation software, and materialise, a leading provider of 3D printing software and services, will offer integrated digital solutions that will assist in resolving workflow issues in the additive manufacturing sector. Magics, Materialise's build preparation tool, will easily incorporate Ansys Additive Suite thanks to this agreement. A first solution will offer a best-in-class workflow for managing AM industrial projects across industries, including the aerospace and medical sectors. It will be previewed at Formnext 2023 and launched in Q2 2024.

- May 2022: Dassault Systemes declared that it had partnered with the BMW Group to set up more effective automotive development initiatives. With the invaluable support of BMW Group's extensive process and specialized knowledge, the two companies collaborated to develop an industry-ready, process-oriented solution for stamping die design and stamped sheet metal component definition that will improve the efficiency of the parts production and design process.

- Report ID: 1316

- Published Date: Sep 08, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Simulation Software Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.