Manganese Ore Market Outlook:

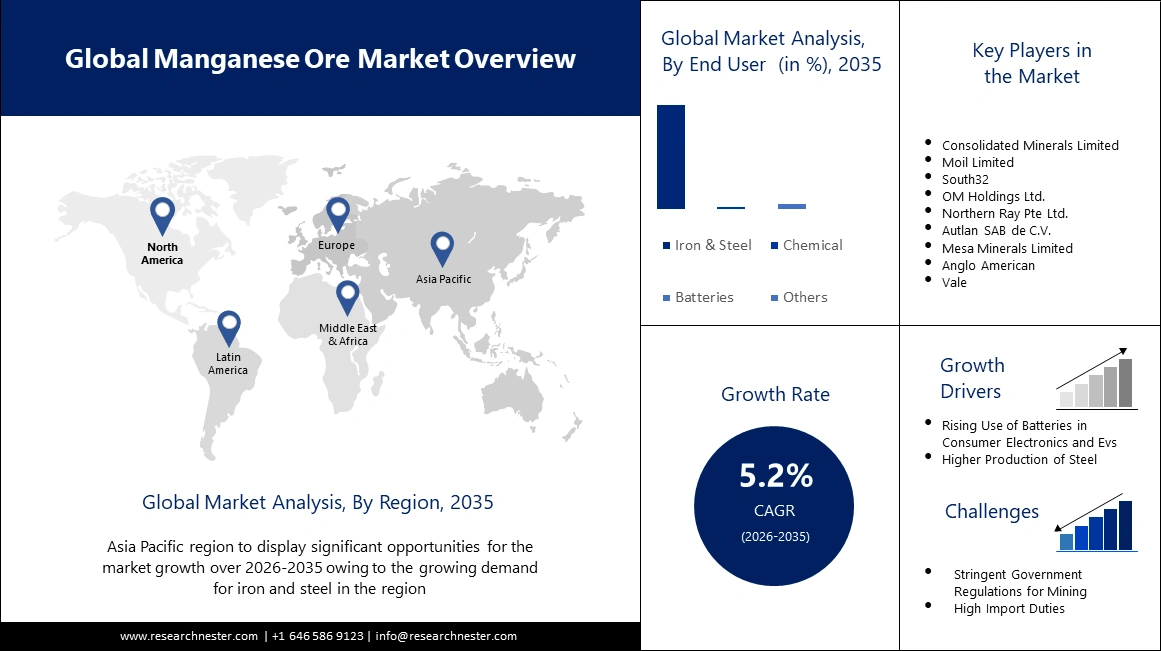

Manganese Ore Market size was over USD 11.46 billion in 2025 and is anticipated to cross USD 19.03 billion by 2035, growing at more than 5.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of manganese ore is assessed at USD 12 billion.

The growth of the market can be attributed to the rising demand for the production of automobiles. Manganese ore is often mixed with copper and aluminum alloys and then used in different products, such as car radiators, temperature control devices in the car, the outer body of the vehicle, and others. In the world, around 85 million motor vehicles were manufactured in 2022, which is about 6% higher than in 2021. Japan, Germany, and China were the largest manufacturers in 2022, especially for commercial vehicles and cars.

In addition to these, factors that are believed to fuel the growth of manganese ore market include the rising focus on sea-bed mining. The majority of deep-sea mining is expected to occur in international seas, or those that are beyond any nation's territorial borders, where international agreements which are currently lacking in deep-sea mining—are required for governance and regulation implementation. The International Seabed Authority (ISA) was established in response to the United Nations Convention on the Law of the Sea (UNCLOS), and it was given the authority to supervise related developments in international waters as well as to develop policies, guidelines, and procedures for seabed minerals. So far, the ISA has awarded about 30 contracts, allowing for the exploration of nearly 1.5 million km2 of seafloor for deep-sea mining.

Key Manganese Ore Market Insights Summary:

Regional Highlights:

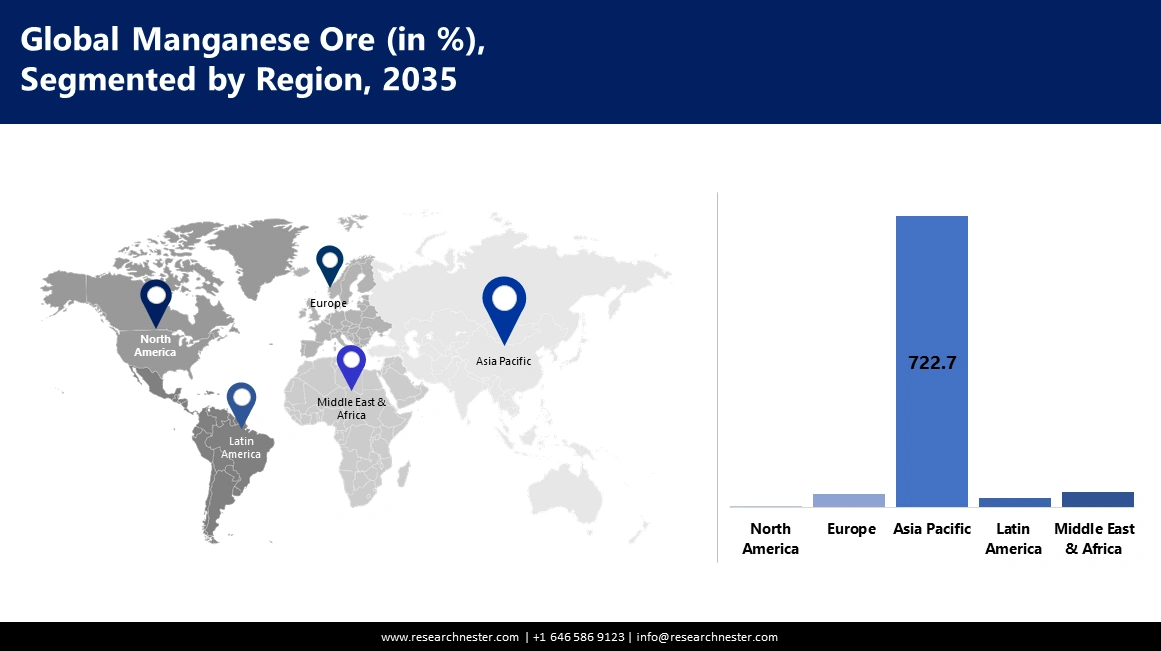

- Asia Pacific manganese ore market is projected to capture an 87% share by 2035, driven by rising demand and production of crude steel along with booming construction and automotive sectors.

Segment Insights:

- The iron & steel segment in the manganese ore market is projected to capture an 89% share by 2035, attributed to the rising demand for manganese ore in steel and iron production.

- The high carbon ferromanganese (hcfemn) segment in the manganese ore market is expected to capture a 29% share by 2035, driven by the growing need for steel in the construction industry.

Key Growth Trends:

- Growing Constructional Activities

- Rapid Transition to New Technology

Major Challenges:

- Growing Constructional Activities

- Rapid Transition to New Technology

Key Players: Eramet Group, Consolidated Minerals Limited, Moil Limited, South32, OM Holdings Ltd., Northern Ray Pte Ltd., Autlan SAB de C.V., Mesa Minerals Limited, Anglo American, and Vale.

Global Manganese Ore Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 11.46 billion

- 2026 Market Size: USD 12 billion

- Projected Market Size: USD 19.03 billion by 2035

- Growth Forecasts: 5.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (87% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, India, Australia, Brazil, Japan

- Emerging Countries: China, India, Indonesia, Thailand, Brazil

Last updated on : 11 September, 2025

Manganese Ore Market Growth Drivers and Challenges:

Growth Drivers

- Growing Constructional Activities- Steel demand rises proportionally as global infrastructure projects and building activities increase due to causes such as growing urbanization, population growth, and continued infrastructure development, particularly in developing countries. This growth in building demands a greater supply of manganese ore to meet the growing demand for robust and strong steel products. Building construction has grown in recent years, and it is expected to grow steadily further. According to the United Nation, the global population will stand at around 10 billion by 2050, and the number of buildings will need to increase to accommodate this population. It is anticipated that 1.6 billion new buildings will be built by 2050, for a total of 2.6 billion buildings worldwide.

- Rapid Transition to New Technology - Automation, data analytics, and remote monitoring have all aided mining operations. These technological advances improve efficiency, safety, and the ability to extract ore from deeper and more challenging sources. High-tech equipment and processes are used to convert manganese ore into usable items. Materials science and mineral processing advancements have optimized manganese beneficiation, reducing waste and increasing purity. Moreover, real-time data reduces the time required for various mining phases and decision-making intelligence. To identify rock faces and classify soil, remote sensing data is used.

- Growing Production of Batteries - Over the next 10 years, rising electric car sales and the development of novel battery chemistries are likely to drive up demand for manganese in batteries. The global EV sales, which include battery-electric cars (BEVs) and plug-in hybrids (PHEVs), are going to top 14 million units by the end of 2023. This amounts to a 34% increase in EV sales over 2022. Adding manganese, an ingredient required by nickel cobalt manganese (NMC) cathodes, is a relatively inexpensive technique for expanding the range of electric vehicles. New battery compositions are expected to require even more manganese. Automotive sectors are progressively utilizing manganese-intensive battery chemistry due to its cheaper cost structures and improved performance.

Challenges

- Indefinite Balance Between Supply and Demand - The balance of supply and demand is one of the most prominent factors influencing manganese ore pricing. When the demand for a commodity exceeds the supply, the price of the product rises. In the case of manganese ore, the iron and steel sector has made major demand for the product. Furthermore, as battery production increases, so does the demand for high-purity manganese ore. However, there is still a limited supply of battery-grade manganese ore available globally, which can have a substantial impact on battery product prices.

- Growing import prices will affect the supply chain

- Adverse situations caused by restricted government policies

Manganese Ore Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.2% |

|

Base Year Market Size (2025) |

USD 11.46 billion |

|

Forecast Year Market Size (2035) |

USD 19.03 billion |

|

Regional Scope |

|

Manganese Ore Market Segmentation:

End User Segment Analysis

The iron & steel segment share in the manganese ore market is estimated to cross 89% in the year 2035. The growth of the segment can be attributed to the rising demand for manganese ore in steel and iron production. The majority of manganese ore is smelted to create alloys used in the manufacture of iron and steel. Manganese is essential in the manufacture of iron and stainless steel, accounting for more than 90% of manganese mined globally. The demand for stainless steel is expected to increase faster than steel in general, increasing demand for manganese. Furthermore, per capita steel consumption in the developing world is continually increasing, driven by population growth as much as increased income, and is thus somewhat impervious to economic downturns.

Finished Products Segment Analysis

The HCFeMn segment in the manganese ore market is expected to be largest with revenue share of 29% in the year 2035. The growing need for steel in the construction industry is expected to drive the segment’s growth. The finished steel demand from the building and construction industry is forecast to reach 90 MT in FY31, with a CAGR of 9.7 percent, and the infrastructure sector is expected to reach 63 MT in FY31, with a CAGR of 6.8 percent.

Our in-depth analysis of the global manganese ore market includes the following segments:

|

Grade |

|

|

Finished Products |

|

|

End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Manganese Ore Market Regional Analysis:

APAC Market Insights

The manganese ore market in Asia Pacific is projected to garner revenue share of 87% by 2035. The growth of the market can be attributed majorly to the rising demand and production of crude steel. China, India, Japan, and South Korea collectively produce over 70% of the world's crude steel capacity. This demonstrates the solid industry structure in the Asia Pacific area as a whole. The region's burgeoning construction and automotive sectors will also increase demand for iron and steel, influencing demand for manganese ore.

MEA Market Insights

The Middle East & Africa manganese ore market is expected to grow substantially over the projected time frame. The electric car market in South Africa is one of the most advanced in the region. While the EV sector in South Africa is still in its nascent stages, it is likely to grow in the next years. Significant investment has been made in the automobile sector to enable it to shift to EV production. Furthermore, EV production in the UAE is likely to increase. This would result in a huge increase in the demand for battery-grade manganese materials.

Manganese Ore Market Players:

- Eramet Group

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Consolidated Minerals Limited

- Moil Limited

- South32

- OM Holdings Ltd.

- Northern Ray Pte Ltd.

- Autlan SAB de C.V.

- Mesa Minerals Limited

- Anglo American

- Vale

Recent Developments

- ERAMET that it has completed the sale of its Norwegian business for USD 245 million. Because INEOS Enterprises obtained regulatory approvals prior to Eramet accepting its offer, the transaction is complete and without caveats. This instant transaction allows Eramet to improve its financial position and adds to the funding of its metals-related efforts for the energy transition.

- OM Holdings Ltd (OMH) now has entire control of its flagship smelter in Bintulu, Sarawak, after paying Cahya Mata Sarawak Bhd's (CMSB) subsidiary USD 120 million for the remaining 25% stake. The ferroalloy smelting company said that in June 2022, OM Materials signed a conditional share purchase agreement with Samalaju Industries Sdn Bhd, a fully owned subsidiary of CMSB, with all conditions precedent satisfied on September 15, 2022. The deal was funded with existing cash reserves, private bond issuances, and operational cash flows.

- Report ID: 5438

- Published Date: Sep 11, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Manganese Ore Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.