Silico Manganese Market Outlook:

Silico Manganese Market size was over USD 29.97 billion in 2025 and is projected to reach USD 53.67 billion by 2035, growing at around 6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of silico manganese is evaluated at USD 31.59 billion.

The rising steel demand across the automotive, construction, and manufacturing industries is the key driver for the growth of the silico manganese market. Increasing urbanization, growth in stainless steel utilization, and growing transportation needs propel its demand. Furthermore, government investments in steel manufacturing and modernization further support the growth of the market. Silicon manganese plays a key role in steel manufacturing, improving the durability and strength of carbon and stainless steel. This steel is broadly utilized across various industries such as transportation, construction, and infrastructure.

The automotive industry specifically relies heavily on silicon manganese for constructing high-strength steel. Furthermore, its applications in non-biodegradable slag formation during steel separation contributed to industries such as railway infrastructure and road construction. Urbanization and the changing lifestyles of consumers have also driven the need for stainless steel products, including kitchen utensils and household goods. The easy maintenance and durability of stainless steel make it a preferred choice for both domestic and industrial applications, further accelerating the silico manganese market expansion.

Additionally, the increasing vehicle production has further propelled the usage of steel in casting processes, strengthening the role of silicon manganese in the sector. Furthermore, the private and government sector players are actively investing in modernizing the steel production facilities. Continuous research and development are done to enhance production efficiency and minimize environmental effects, further driving the silico manganese market. For instance, the U.S. steel corporation announced a USD 3 billion investment in a state-of-the-art steel plant in Arkansas, featuring 2 electric arc furnaces with a projected annual capacity of 3 million tons. However, an estimated USD 16 billion is anticipated to be invested in the U.S. steel sector by 2023 to modernize and decarbonize production facilities. These investments would raise the need for silicon manganese, further driving the market growth.

Key Silico Manganese Market Insights Summary:

Regional Highlights:

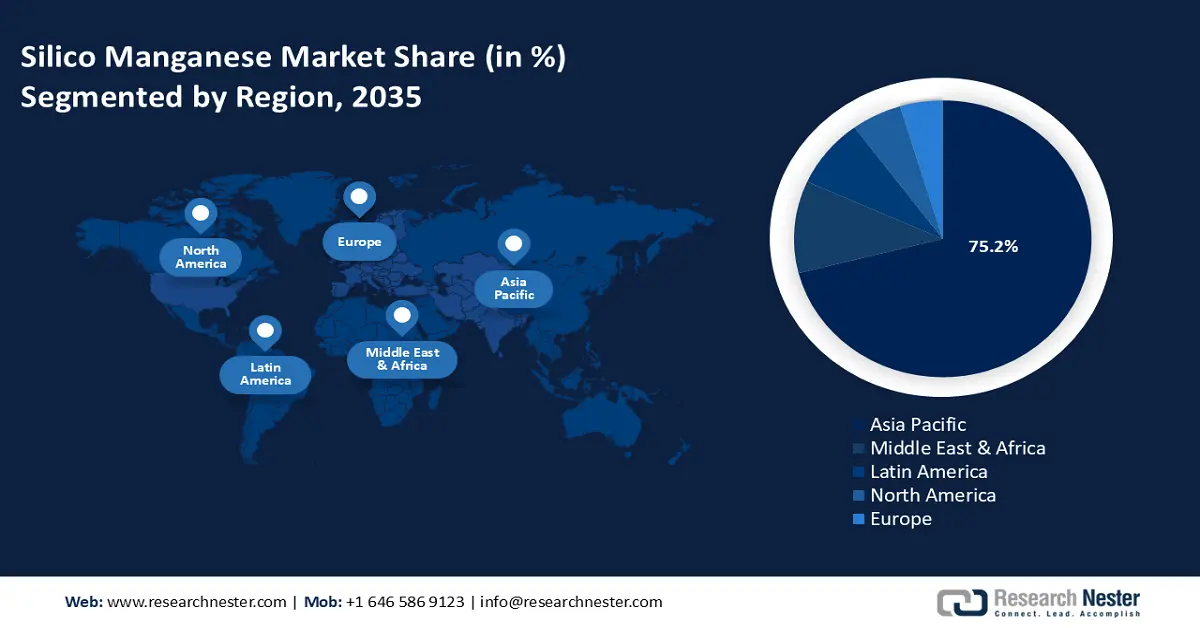

- Asia Pacific commands the Silico Manganese Market with a 75.2% share, driven by large-scale infrastructure development and high steel demand, ensuring robust growth through 2026–2035.

- Middle East and Africa’s silico manganese market is expected to experience rapid growth through 2026–2035, driven by rising steel production investments and infrastructure projects.

Segment Insights:

- The Carbon Steel segment is expected to experience substantial growth from 2026 to 2035, driven by widespread use in infrastructure and transportation projects globally.

- The Low-Carbon segment is projected to achieve substantial market share by 2035, driven by its critical role in high-quality stainless steel production for automotive and industrial applications.

Key Growth Trends:

- Growing steel industry demand

- Automotive industry expansion

Major Challenges:

- Raw material price volatility

- Economic fluctuations

- Key Players: OM Holdings Ltd., Sabayek, Sakura Ferroalloys, Steel Force, Tata Steel Ltd., Sheng Yan Group, PJSC Nikopol, Glencore.

Global Silico Manganese Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 29.97 billion

- 2026 Market Size: USD 31.59 billion

- Projected Market Size: USD 53.67 billion by 2035

- Growth Forecasts: 6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (75.2% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, India, Japan, United States, Germany

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 12 August, 2025

Silico Manganese Market Growth Drivers and Challenges:

Growth Drivers

- Growing steel industry demand: The increasing need for silicon manganese in the steel industry is propelled by the rising demand for corrosion-resistant and high-strength steel across various industries. Urbanization and industrialization lead to fast growth in railways, bridges, skyscrapers, and highways, all demanding durable steel reinforced with silicon manganese. Moreover, the renewable energy sector, especially power transmission structures and wind turbines, relies on high-performance steel, further accelerating silicon manganese consumption.

Globally, governments started to invest in large-scale and smart city infrastructure projects, further propelling market growth. Technological innovations in steelmaking processes, such as the adoption of electric arc furnaces (EAFs) and improved alloy formulations, are enhancing efficiency and extending the applications of silicon management. In addition, the key players are expanding production capacities and securing long-term supply agreements to satisfy increasing global demand. For instance, Tata Steel's Ferro Alloys & Minerals Division launched TATA SILCOMAG, India's first branded silicon manganese, in Durgapur major consumption center for the alloy. This strategic shift aimed to fulfill the domestic steel industry's need for consistent and high-quality silicon manganese, necessary for the construction of strong and durable steel products. The introduction of TATA SILCOMAG underscores the growing need within India's steel industry for dependable alloying agents to support the nation's developing infrastructure and construction projects.

- Automotive industry expansion: The growth of the automotive industry accelerates the growth of the silico manganese market. As vehicle production escalates globally, there is an increased need for durable, high-strength steel in building critical components such as engine parts, body panels, and chassis. Silicon manganese, a necessary alloying element, improves the hardness, strength, and resistance of the steel, thus making it indispensable in automotive manufacturing.

For instance, global automobile production was 80 million units in 2021, increased to over 85 million units by the end of 2021, and further increased to 95 million units in 2023, an increase of about 10% from 2021. This reflects a surge in automobile manufacturing activities. This uptick directly correlates with the heightened consumption of silicon manganese to satisfy the industry's strict material requirements. Furthermore, the move towards electric vehicles has strengthened the demand for lightweight yet strong materials, further amplifying the need for silicon manganese-based steel. As automakers strive for enhanced fuel efficiency and safety standards, the reliance on high-quality steel alloys is set to improve, thereby driving the silico manganese market forward.

Challenges

- Raw material price volatility: The silico manganese market is highly sensitive due to the fluctuations in raw material prices, especially in manganese ore and coke, which are necessary for manufacturing alloys. Price volatility occurs due to various factors such as mining regulations, transportation costs, changes in global supply chain dynamics, and geopolitical tensions. Since manganese ore is sourced from a limited number of countries, any disruption in mining activities or export limitations would lead to prominent price hikes, affecting production costs.

Similarly, coke, a critical reductant in the smelting process, is subjected to divergences in coal prices and environmental policies. This unpredictability makes cost management challenging for manufacturers and affects the profit margins and investment decisions. To stop risks, companies started to concentrate on securing stable supply contracts and exploring alternative sources.

- Economic fluctuations: The need for silicon manganese is closely related to steel production, which fluctuates depending on the economic conditions and infrastructure investments. During periods of economic growth, improved construction, automotive manufacturing, and industrial activities drive steel demand, propelling silicon manganese consumption. However, economic downturns, trade restrictions, or minimized government spending on infrastructure projects can lead to lower steel production, negatively impacting the silico manganese market.

Additionally, fluctuations in currency exchange rates and raw material costs further impact profitability. To navigate economic uncertainties, market players have to concentrate on technological enhancements, strategic partnerships, and diversification to maintain steady demand.

Silico Manganese Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6% |

|

Base Year Market Size (2025) |

USD 29.97 billion |

|

Forecast Year Market Size (2035) |

USD 53.67 billion |

|

Regional Scope |

|

Silico Manganese Market Segmentation:

Application (Carbon Steel, Stainless Steel, Alloy Steel, Cast Iron)

Carbon steel segment is likely to capture silico manganese market share of around 34.6% by the end of 2035, an important material in construction, transportation, and manufacturing. Well-known for its high strength and durability, carbon steel is broadly utilized in constructing infrastructures, heavy machinery, and railroad tracks. Its affordability and mechanical properties make it a preferred choice in structural applications, reinforcing its demand across multiple industries.

The increasing investments in construction projects and transportation infrastructure are anticipated to drive the growth of this segment. For instance, Federal Steel Supply heavily relies on carbon steel for railway track construction, ensuring long-term stability and safety. Carbon steel, especially hot-rolled steel with a grade of 1084 or above, serves as a fundamental material for the construction of railway tracks worldwide. This material is classified as medium carbon steel, produced by processing rail steel derived from natural iron ore. Typically, this results in a composition containing 0.7% to 0.8% carbon and 0.7% to 1% manganese, enabling it to withstand greater stress compared to standard rolled steel. With the expansion of high-speed rail networks and the modernization of existing infrastructure, the need for carbon steel is anticipated to grow further.

The increasing global emphasis on sustainable infrastructure and industrial growth would likely sustain carbon steel’s dominance in the silico manganese market. Similarly, stainless steel is poised for rapid growth, driven by the increasing need in the automobile and construction industries due to its corrosion resistance and durability. Alloy steel benefits from its enhanced mechanical properties, making it necessary for aerospace and heavy machinery. Cast iron remains vital in equipment manufacturing and infrastructure projects.

Product (Low Carbon, Medium Carbon, High Carbon)

The low-carbon segment is anticipated to hold a substantial share in the global silico manganese market revenue, primarily driven by the extensive usage in stainless steel production. Processes such as Vacuum Oxygen Decarburization (VOD), Argon Oxygen Decarburization (AOD), and Creusot-Loire Uddeholm (CLU) rely on low-carbon silicon manganese to produce high-quality stainless steel. The International Stainless-Steel Forum (ISSF) reported that global stainless steel melt shop production increased by 10.6% year-on-year in 2021, reaching 56.3 million metric tons, which represents a rising need for stainless steel.

This trend is anticipated to continue, bolstering the low-carbon silico manganese market. For instance, Tesla’s use of cold-rolled stainless steel in its Cybertruck highlights the increasing application of stainless steel in the automotive sector. Meanwhile, the medium and high carbon segment is anticipated to witness steady demand due to its balanced strength, ductility, making it suitable for structural steel and automotive applications.

Our in-depth analysis of the global silico manganese market includes the following segments:

Application |

|

Product |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Silico Manganese Market Regional Analysis:

Asia Pacific Market Statistics

Asia Pacific silico manganese market is anticipated to hold revenue share of over 75.2% by the end of 2035. This leading position is primarily driven by the substantial investments in infrastructure development aimed at revitalizing economies following the pandemic. Countries such as China and India have initiated large-scale projects to enhance transportation networks, energy facilities, and urban development. For instance, China’s plan to construct the world’s largest artificial island airport, Dalian Jinzhouwan International Airport, reflects its commitment to bolstering infrastructure and economic growth.

Similarly, India’s PM Gati Shakti initiatives, a USD 1.2 trillion national master plan, aim to develop multi-modal connectivity and infrastructure across the country. These extensive infrastructure endeavors have significantly increased the need for steel, thereby driving the consumption of silicon manganese, a critical alloying element in steel production. As these projects progress, the Asia Pacific region is expected to maintain its dominance in the silico manganese market, supported by continuous economic development efforts.

Middle East and Africa Analysis

The Middle East and Africa are anticipated to rapidly emerge as the fastest-growing silico manganese market, driven by increasing public and private investments aimed at improving steel production capacities and satisfying the increasing needs from various sectors. In the Middle East countries, such as North Africa, South Africa’s steel industry has seen significant developments. ArcelorMittal South Africa, for instance, deferred the closure of its long steel plants following a capital injection of UDD 9.150 million from the state-owned Industrial Development Corporation. This investment underscores efforts to sustain steel production in the region.

Similarly, Saudi Arabia and the United Arab Emirates are investing heavily in infrastructure projects as part of their economic diversification strategies. Saudi Arabia’s Vision 2030 initiative, for instance, includes the development of mega-projects like NEOM and the Red Sea Project, which significantly propels the steel demand. These strategic investments and initiatives across the MEA region underscore a concerted effort to bolster steel production capabilities, thereby contributing to the anticipated silico manganese market growth during the forecast period.

Key Silico Manganese Market Players:

- Brahm Group

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- EMCO (Bahrain Ferro Alloys BSC)

- Eramet

- Ferroglobe

- Nippon Denko Co.Ltd.

- OM Holdings Ltd.

- Sabayek

- Sakura Ferroalloys

- Steel Force

- Tata Steel Ltd.

- Sheng Yan Group

- PJSC Nikopol

- Glencore

- Jinneng Group

Key players in the silico manganese market leverage enhanced technologies to improve production efficiency and maintain a competitive edge. These companies employ submerged arc furnaces (SAFs) for energy-efficient smelting, automation in ore blending for quality control, and AI-driven predictive maintenance to optimize operations. Such technological innovations enable these players to meet increasing demand while maintaining cost-effectiveness and environmental compliance.

Recent Developments

- In March 2021, Georgian Manganese LLC, a leading manufacturer of Silico Manganese in Georgia, revealed its intention to invest USD 30 million for the modernization and expansion of its production facilities.

- In December 2020, Tata Steel announced its intention to divest its interest in a Silico Manganese production facility situated in Odisha, India, to its joint venture partner.

- Report ID: 7516

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Silico Manganese Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.