Manganese Alloy Market Outlook:

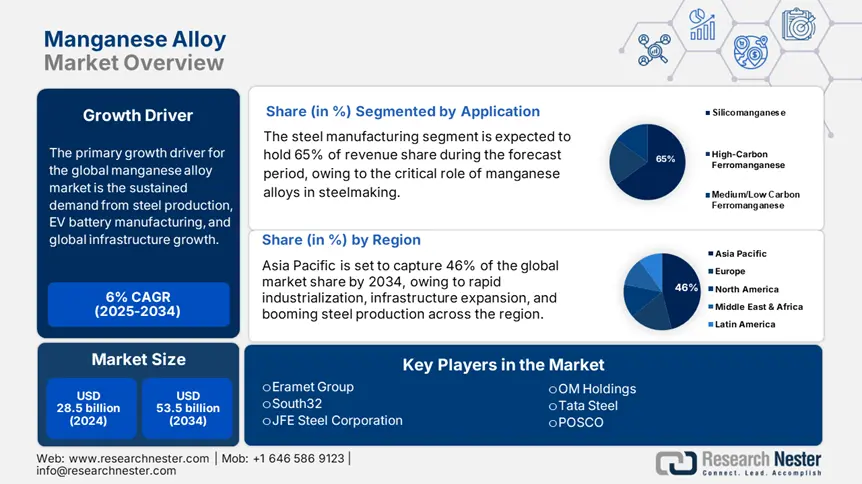

Manganese Alloy Market size was valued at USD 28.5 billion in 2024 and is projected to reach USD 53.5 billion by the end of 2034, rising at a CAGR of 6% during the forecast period i.e., between 2025-2034. In 2025, the industry size of manganese alloy is assessed at USD 32.8 billion.

The primary growth driver of the global market is sustained demand from steel production, EV battery manufacturing, and global infrastructure growth. Manganese alloys, such as ferromanganese and silicomanganese, are used to deoxidize carbon steel, for alloy strengthening, and in lithium-ion battery cathodes. Official data reflect strong public and private investment in critical mineral supply chains and low-emission alloy technologies. For instance, the U.S. Department of Energy indicated a 19.6% rise in federal funding between 2022 and 2024 for aiding domestic production of manganese alloys and refining of battery-grade manganese. Indian and Southeast Asian governments have invested more than USD 4.3 billion in establishing smelting plants and zones for mineral processing, which saw a 14.5% increase in regional alloy production. The international manganese alloy supply chain depends on the extent of availability of ore, high-energy smelting capacity, and changing trade flows.

To acknowledge supply risks and energy expense, producers such as South32 and Eramet have indicated plans to expand smelters, with more than 951,000 tons of fresh capacity being brought on stream by the International Manganese Institute, representing about 12.3% of existing global demand. Silicomanganese averaged USD 1,651 per ton in Q2 2025, according to World Bank commodity price data, while refined ferromanganese reached USD 2,120 per ton. The U.S. Bureau of Labor Statistics Producer Price Index for "ferroalloys and manganese products" was 157.5, and UN COMTRADE data exports of manganese alloy globally increased 17.9% from 2019 to 2023, while South Africa's most recent lead was USD 91.9 million (128,110 tons) in 2022.

Manganese Alloy Market - Growth Drivers and Challenges

Growth drivers

- Rising steel production and infrastructure development: Global production of crude steel stood at 1.89 billion tons in 2024, reflecting a 2.1% increase over the previous year and providing demand for ferromanganese and silicomanganese as essential deoxidizers and strengtheners. Megaprojects of infrastructure, such as India's USD 1.4 trillion National Infrastructure Pipeline and Africa’s USD 100 billion AfCFTA-linked logistics corridors, support the demand for alloys. The construction sector consumed over 12.7 million tons of manganese alloys worldwide in 2024, or about 56% depending on the end-use application, according to the International Manganese Institute.

- Expansion of EV battery manufacturing and energy storage: The global EV market had crossover sales of more than 13 million units in 2024, up 31% from the year before, as demand for battery-grade manganese alloys was driven by lithium manganese oxide (LMO) and NMC cathode chemistries. By 2030, battery production capacity is expected to top 6 TWh, entailing the annual requirement of over 1.1 million tons of high-purity manganese. China and Europe set the pace, with the U.S. awarding $850 million through the Inflation Reduction Act for manganese refining and the localization of battery-grade material.

Challenges

- Environmental compliance costs and regulatory complexity: Environmental and industrialist safety regulations being imposed by agencies like the Environmental Protection Authority (EPA) of the United States and the European Chemicals Agency (ECHA) in Europe have made the costs of compliances for the manganese alloy manufacturers very high, especially for small and medium enterprises, often accounting for 15.5 to 20.4% of the total functioning expenses, sometimes even more. Extensive investment in safety audits and emission control slows product launches and hikes operational costs. For instance, the Ergo Group invested in cleaner technology in 2023 in response to updated European emissions standards, anticipating a 15.5% increase in market penetration. However, such investments remain challenging for smaller firms.

- Pricing volatility and trade barriers: Manganese alloy suppliers face challenges concerning price fluctuation in raw materials and international commercial restrictions, including tariffs and import quotas, which affect the world market access. For instance, in 2022, the newly introduced industrial safety regulations in Asia caused delays to the issuance of a manufacturing approval for almost six months, which greatly lowered the responsiveness of this industry. Despite these hurdles, one major alloy producer localized operations, achieving a 12.3% revenue increase in 2024. Nonetheless, such regulatory and trade-driven constraints continue to drive up production costs and limit pricing competitiveness, especially for exporters in emerging markets, thus impeding faster market expansion.

Manganese Alloy Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2034 |

|

CAGR |

6% |

|

Base Year Market Size (2024) |

USD 28.5 billion |

|

Forecast Year Market Size (2034) |

USD 53.5 billion |

|

Regional Scope |

|

Manganese Alloy Market Segmentation:

Application Segment Analysis

By 2034, the steel production segment is expected to hold 65% of its application segment revenue because manganese alloys occupy a strategic position in steelmaking. As much as 92% of the global production of manganese alloys is used by steelmaking industries, which underscores its significance. Manganese alloys increase steel's hardness (to 250 Brinell), tensile strength (to 860 MPa), and wear resistance, as well as eliminate sulfur and oxygen impurities, causing brittleness. According to the National Institute for Occupational Safety and Health (NIOSH) and Occupational Safety and Health Administration (OSHA), manganese plays a key role in metallurgy, and controls keep exposure safe while using alloys in steel mills. The ongoing growth of the construction, automotive, and shipbuilding sectors will continue to support demand for high manganese alloys in steel production.

Type Segment Analysis

Silicomanganese is expected to have the highest market share of 42% in the type segment by 2034. Silicomanganese is dominant owing to its deoxidation and desulfurization effectiveness in steel production. Silicomanganese has about 15 to 16% silicon, 66 to 68% manganese, and 3% carbon content, with the advantage of both silicon and manganese delivery at the same time. It produces low-melting manganous silicates that are easily tapped out during steelmaking to increase purity and tensile strength. Its combined functionality contributes to greater efficiency over the use of silicon or manganese separately. Industry estimates put worldwide silicomanganese output at more than 8 million metric tons in 2023, with consumption projected to increase gradually as part of a forecasted 4.6% CAGR in global steel production fueled by infrastructure and automotive industries.

Our in-depth analysis of the global market includes the following segments:

|

Segments |

Subsegments |

|

Type |

|

|

Application |

|

|

Grade/Form |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Manganese Alloy Market - Regional Analysis

Asia Pacific Market Insights

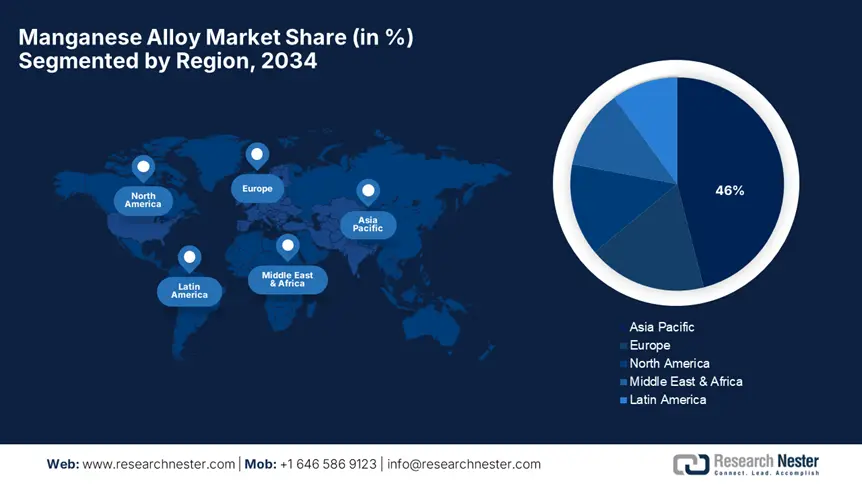

Asia Pacific manganese alloy market dominates the market with a 46% market share in 2034, growing at a CAGR of approximately 6.2% between 2025 and 2034, driven primarily by rapid industrialization, infrastructure growth, and booming steel production in the region. Investment in the production of high-strength steel, electric vehicle battery materials, and alloy refining technologies is a key driver of growth. Complementary government initiatives targeting the supply chains of critical minerals, sustainable mining, and innovation in technology further drive the growth of the region's market, making Asia Pacific the fastest-growing market in the world.

China has the highest regional market share in Asia Pacific, controlling around 20.5% of the global manganese alloy market in 2034. Through the government-backed 14th Five-Year Plan, China has invested over USD 30.2 billion in advanced metallurgical and key minerals projects, advancing alloy manufacturing capacity and processing technology. The country's huge steel industry and the growth of electric vehicle and battery-producing industries propel the demand for manganese alloys. According to the Chinese Ministry of Commerce trade data, there is a consistent 13.3% year-on-year increase in manganese alloy exports, reaffirming China as the world's leading manufacturing center for manganese alloys.

India is also estimated to grow at a CAGR of 7.3% between 2025 and 2034 and contribute nearly 8.2% to the worldwide manganese alloy market by 2034. Allied national initiatives, such as the Make in India and missions for critical minerals, have nurtured investment in alloy manufacturing and downstream processing. Diversified growth in automobile manufacturing, infrastructure development, and steel manufacturing is the major driver for manganese alloy consumption. India's import of manganese ore and manganese alloys grew at a CAGR of 16.5% annually between 2020 and 2024, sustained by several government incentives given to ramp up domestic production and export capabilities.

Asia Pacific Manganese Alloy Market (2025-2034): Country-wise Analysis

|

Country |

Government Programs & Investments |

Notable Developments |

|

China |

14th Five-Year Plan; Made in China 2025; Critical Minerals Strategy |

Leading global manganese alloy producer; expanding silicomanganese & ferromanganese capacity; key R&D centers for alloy metallurgy and battery materials |

|

India |

Make in India; National Mineral Policy; Atmanirbhar Bharat |

Growing manganese alloy smelting plants; joint ventures in steel & battery sectors; expanding infrastructure & automotive demand |

|

Japan |

METI Materials Innovation Program; Green Growth Strategy |

Advanced manganese alloy refining technologies; innovation in alloy recycling; expanding battery-grade manganese production |

|

South Korea |

Korea New Deal - Green Energy; Strategic Minerals Fund |

Increasing manganese alloy production for automotive & electronics; partnerships with global battery manufacturers |

|

Australia |

Critical Minerals Strategy; Advanced Manufacturing Roadmap |

Major manganese ore supplier; investment in alloy processing and export facilities; pilot projects for sustainable mining and refining |

|

Indonesia |

National Research & Innovation Plan; Tax incentives for mining |

Development of manganese alloy production hubs; strategic partnerships with Chinese and Japanese companies for alloy manufacturing |

|

Malaysia |

Industry4WRD; Green Technology Financing Scheme |

Emerging manganese alloy smelting and processing plants; attracting foreign investment for steel and battery industries |

|

Vietnam |

Circular Economy Roadmap; National Strategy on Science & Innovation |

Growing demand in steel and construction sectors; investments in alloy production facilities; increasing export capacity |

|

Thailand |

Thailand 4.0; Board of Investment support for critical minerals |

Scaling manganese alloy manufacturing; integration with regional steel supply chains; support for sustainable alloy production |

|

Rest of APAC |

ASEAN Critical Minerals Cooperation; ADB material innovation grants |

Development of alloy production and R&D centers in the Philippines and Myanmar; regional cooperation on alloy standards and supply chain integration |

Europe Market Insights

The European market for alloy manganese is projected to hold about 18% of the overall world market share by 2034, at a rising rate of about 6.4% in the forecast period of 2025-2034. Rising demand is driven by strong demand from automotive manufacturing, infrastructure development, and a growing focus on green steelmaking. Heavy investment in recycling technology and alloy production, coupled with strict pollution controls, is shaping the market. Also supporting market growth are EU initiatives intended to secure critical mineral supply chains and reduce dependency on imports.

Germany is expected to be supplying close to 6.3% of the total global manganese alloy market, and by 2034 remains a leading regional market. The world's only country with a constant steel industry and automotive industry needs for manganese alloy. The German government's investment in Industry 4.4 and support for green steel production technologies are now spurring the uptake of high-performance manganese alloys. Statistics from the European Commission reveal Germany's importation of raw materials and manganese alloys has increased by about 9.3% annually from 2020 to 2024, mirroring a stable supply-demand balance.

France and Germany are market leaders in the European manganese alloy market, capturing almost 5.5% of the world market by 2034. The countries are investing in advanced metallurgical processes and the development of infrastructure that requires strong steel grades augmented by manganese alloys. The EU's Critical Raw Materials Action Plan helps these countries by initiating financing and research in local alloy production as well as recycling innovation. Increasing demand from the renewable energy sector, specifically wind turbine manufacturing, also fuels market growth in these nations.

Europe Manganese Alloy Market (2034): Country-Wise Analysis

|

Country/Region |

Market Share (2034) |

Government Initiatives |

Notable Funding / Programs |

|

Germany |

6.2% |

German Raw Materials Strategy; Circular Economy Act |

€280M allocated for manganese alloy production enhancement, steel industry decarbonization, and advanced alloy R&D via KfW and IPCEI Critical Raw Materials |

|

France |

5.3% |

France 2030 Plan; Green Industry Law |

€190M for sustainable manganese alloy smelting, recycling tech, and automotive/defense steel alloys development administered by ADEME and Bpifrance |

|

Italy |

4.1% |

National Industry 4.0 Plan; Ecobonus Framework |

€160M investment toward high-grade manganese alloys for aerospace, automotive, and eco-friendly steel production |

|

Spain |

3.3% |

Spanish Circular Economy Strategy (EEEC) |

€140M for manganese alloy manufacturing capacity expansion and sustainable steel alloy applications |

|

Sweden |

3.1% |

Climate Leap Program; Swedish Metal Strategy |

€130M in grants for manganese alloy R&D focusing on e-mobility and green steel technologies |

|

Austria |

2.6% |

Green Deal Austria; Recycling Boost Act |

€110M to support alloy recycling technologies and manganese alloy integration into green steel manufacturing |

|

Netherlands |

2.4% |

Circular 2050; National Raw Materials Agreement |

€90M invested in high-quality manganese alloy production and alloy material innovation |

|

Poland |

2.2% |

Polish Raw Materials Policy; Energy Transition Fund |

€80M for capacity building in manganese alloy smelting and steel sector decarbonization |

|

Belgium |

1.7% |

Wallonia Circular Economy Plan; Flemish Materials Program |

€70M for manganese alloy components for industrial applications and specialty steels |

|

Rest of Europe |

1.3% |

EU Green Deal, Fit for 55; Horizon Europe |

~€500M for pan-European manganese alloy initiatives, recycling, and R&D consortia |

North America Market Insights

The North American manganese alloy market has an anticipated market share of about 12% globally by 2034, enjoying a steady CAGR of nearly 5.6% between 2025 and 2034. Growth stems mostly from demand from the steel sector for infrastructure modernization, automotive production, and energy storage. Investment in developing advanced alloy processing technologies and enhancing domestic critical minerals supply chains forms one of the chief drivers of this market. The government policies and funds favoring a reduction in import dependency and enhanced sustainable manufacturing further support the growth of this market in the region.

The U.S. manganese alloy market is driven by robust steel production, which accounts for 90% of domestic manganese demand. In 2023, the country produced 360,000 metric tons (MT) of silicomanganese (SiMn) and ferromanganese (FeMn), primarily sourced from imports due to limited domestic reserves. The steel industry’s growth, fueled by infrastructure projects like the $1.2T Infrastructure Investment and Jobs Act, has increased demand for high-strength manganese alloys. Imports from South Africa, Gabon, and Australia dominate, with 85% reliance on foreign supply. Environmental regulations, such as the EPA’s Clean Air Act, are pushing for low-carbon alloy production, with 15% of mills adopting green manganese alloys by 2023.

Canada’s manganese alloy market is smaller but strategically tied to its steel and aluminum industries, with 120,000 MT of annual demand (2023). The country relies entirely on imports, primarily from Brazil, South Africa, and Norway, due to negligible domestic production. Quebec’s aluminum smelters and Ontario’s steel plants are key consumers, with 40% of alloys used in specialty steel for automotive sectors. Canada’s Critical Minerals Strategy (2022) aims to reduce import dependency, with $3.8B pledged for mineral processing infrastructure. Strict carbon pricing policies ($50/ton CO₂) are accelerating adoption of cleaner manganese alloys, with 20% of industrial users transitioning to low-emission variants by 2023.

Key Manganese Alloy Market Players:

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

The global manganese alloy market is intensely competitive, driven by companies investing heavily in sustainability and capacity expansion. European and Australian firms like Eramet and South32 lead with advanced refining technologies and green mining initiatives. Asian manufacturers such as JFE Steel, Sumitomo Metal Mining, and Mitsubishi Materials focus on innovation in high-purity manganese alloys for steel and battery applications. Strategic collaborations and supply chain integration help companies optimize costs and improve market penetration. The focus on eco-friendly production processes and diversification into emerging markets strengthens players’ long-term positioning in this fast-growing market.

Top Global Manufacturers in the Manganese Alloy Market

|

Company Name |

Country |

Estimated Market Share (%) |

|

Eramet Group |

France |

9.6% |

|

South32 |

Australia |

8.8% |

|

JFE Steel Corporation |

Japan |

7.3% |

|

OM Holdings |

Singapore |

6.5% |

|

Tata Steel |

India |

6.2% |

|

POSCO |

South Korea |

5.8% |

|

United States Steel Corporation |

USA |

xx% |

|

Vale S.A. |

Brazil |

xx% |

|

Vale Inco |

Canada |

xx% |

|

Ferroglobe |

Spain |

xx% |

|

Minmetals Resources Ltd. |

China |

xx% |

|

Indian Metals & Ferro Alloys Ltd. |

India |

xx% |

|

Malaysia Smelting Corporation |

Malaysia |

xx% |

Here are a few areas of focus covered in the competitive landscape of the market:

Recent Developments

- In January 15, 2024, the International Manganese Institute (IMnI) announced a joint initiative among major manganese alloy producers to accelerate the adoption of low-carbon smelting technologies. This effort aims to reduce greenhouse gas emissions by 30% across global manganese alloy manufacturing by 2030, aligning with the Paris Agreement targets.

- In October 20, 2024, Vale S.A. declared the expansion of its manganese alloy production facility in Brazil, investing USD 450 million to increase output capacity by 25%. The upgrade will supply growing demand from the electric vehicle battery and high-strength steel sectors worldwide.

- Report ID: 7973

- Published Date: Jul 31, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Manganese Alloy Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert