Managed Detection and Response Service Market Outlook:

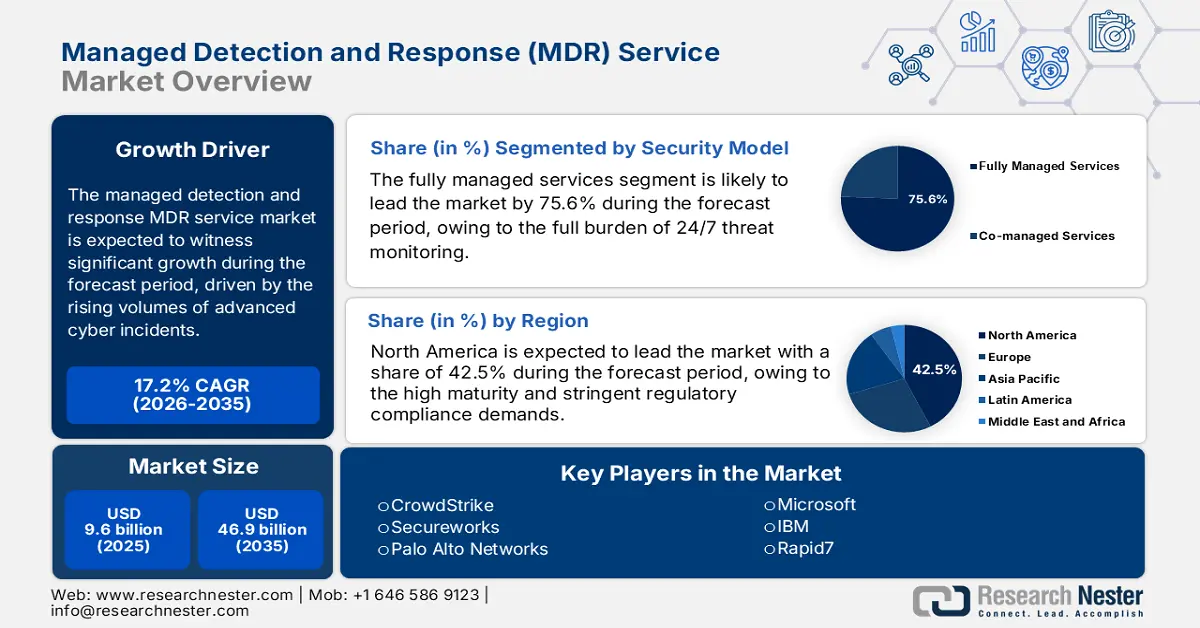

Managed Detection and Response Service Market size was valued at USD 9.6 billion in 2025 and is projected to reach USD 46.9 billion by the end of 2035, rising at a CAGR of 17.2% during the forecast period, i.e., 2026-2035. In 2026, the industry size of MDR service is estimated at USD 11.2 billion.

The demand for the managed detection and response service market is stimulated by the fact that public sector agencies, healthcare systems, and critical infrastructure organizations face higher volumes of advanced cyber incidents. The U.S. Government Accountability Office in January 2025 reported that nearly 32,211 information security incidents were registered in 2023, with 38% mainly due to improper usage. The public sector system also experienced a rise in known exploited vulnerabilities across the year, underscoring the pressure for continuous monitoring and response capabilities. On the other hand, the healthcare are the largest adopter of the managed detection and response service as the sector has witnessed a sustained surge in attacks. These pressures illustrate the expanding reliance on MDR providers across regulated industries and public-sector environments that require continuous visibility, rapid containment, and compliance-aligned reporting.

Information Security Incidents (2023)

|

Factors |

Percentage |

|

Improper Usage |

38 |

|

Email/ Phishing |

19 |

|

Web |

11 |

|

Loss or Theft of the Equipment |

10 |

|

Attrition |

4 |

|

Spoofing, Multiple Attack Vendors, External/ Removable Media |

Less than 1 |

|

Other/ Unknown |

18 |

Source: GAO January 2025

Besides, the Cybersecurity and Infrastructure Security Agency notes that resource constraints, including staffing and tools, are the top challenge for the organization in maintaining defensive operations. This aligns with findings on the cyber workforce gap that continues to hinder the organizational capacity. The volume and impact of the cyber incidents remain high. The FBI’s Internet Crime Complaint Center reported adjusted losses from cybercrime exceeding USD 12.5 billion in 2023, with business email compromise and ransomware representing significant and ongoing threats. These figures indicate that the high financial stakes and operational risks that MDR services are designed to mitigate. The market’s path is thus shaped by the convergence of persistent adversarial threats, a strained talent pool, complex digital transformation efforts, and the need for cost-effective security operations that can adapt to evolving tactics.

Key Managed Detection and Response Service Market Insights Summary:

Regional Highlights:

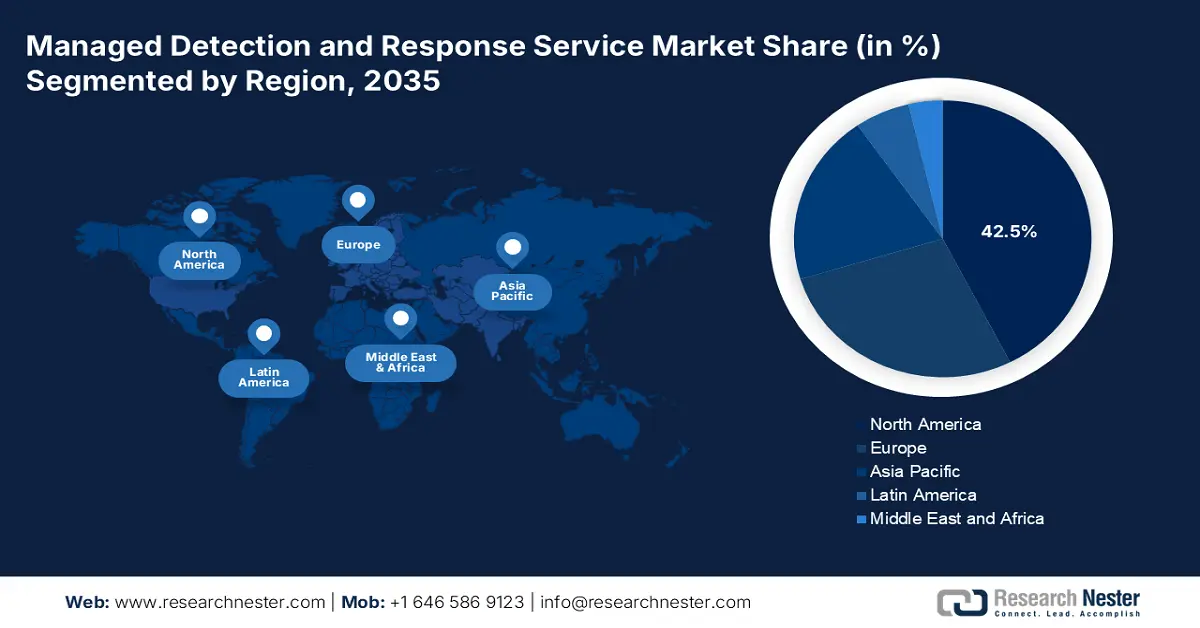

- North America is projected to hold a 42.5% share by 2035 in the managed detection and response service market, (impelled by regulatory compliance demands and acute cybersecurity talent shortages).

- Asia Pacific is anticipated to be the fastest-growing region in the market by 2035, (driven by digital transformation, rising cyber threats, and evolving regulations).

Segment Insights:

- Fully managed services segment is projected to account for 75.6% share by 2035 in the managed detection and response service market, (propelled by increasing outsourcing due to cybersecurity skill shortages).

- Cloud-based deployment segment is anticipated to hold the largest share within deployment by 2035, (driven by hybrid work adoption and reliance on cloud infrastructure).

Key Growth Trends:

- Rising government cybersecurity spending across regions

- Growing board-level awareness of cyber risk

Major Challenges:

- High initial capital and operating costs

- Acute shortage of skilled cybersecurity talent

Key Players: CrowdStrike (U.S.), Secureworks (U.S.), Palo Alto Networks (U.S.), Microsoft (U.S.), IBM (U.S.), Rapid7 (U.S.), Sophos (UK), AT&T Cybersecurity (U.S.), BAE Systems (UK), Arctic Wolf (U.S.), Trellix (U.S.), SentinelOne (U.S.), ESET (Slovakia), Kaspersky (Russia), Accenture (Ireland), Wipro (India), NTT Ltd. (Japan), Telstra (Australia), LG CNS (South Korea), LGMS (LE Global Services) (Malaysia).

Global Managed Detection and Response Service Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 9.6 billion

- 2026 Market Size: USD 11.2 billion

- Projected Market Size: USD 46.9 billion by 2035

- Growth Forecasts: 17.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (42.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Canada, United Kingdom, Germany, France

- Emerging Countries: India, China, Singapore, Japan, South Korea

Last updated on : 19 December, 2025

Managed Detection and Response Service Market - Growth Drivers and Challenges

Growth Drivers

- Rising government cybersecurity spending across regions: Government cybersecurity budgets continue to expand and are directly driving the adoption of outsourced MDR services across the critical sector, thereby surging the managed detection and response service market. The White House data in 2025 has reported that the Federal Budget allocates USD 13 billion for the civilian cybersecurity programs, emphasizing modernization, threat monitoring, and continuous incident response capacity functions typically fulfilled via managed detection and response partnerships. Similarly, the European Union announced increased funding via the Digital Europe Programme, allocating 1.6 billion euros toward cybersecurity capacity building and operational monitoring across the member states, stimulating the demand for MDR-aligned capabilities.

- Growing board-level awareness of cyber risk: Cybersecurity has evolved from a technical IT concern to a top-tier governance and fiduciary responsibility for corporate boards. The regulatory pressures, such as the U.S. Securities and Exchange Commission’s rule on cybersecurity incident disclosure, have formalized board accountability for oversight. This shift elevates security discussions from operational budgets to the core of strategic enterprise risk management, demanding clear metrics, proven efficacy, and expert assurance. The boards are driving the procurement of managed detection and response services that offer defined service level agreements, demonstrable outcomes, and executive-level reporting. This trend fundamentally shifts the buyer dynamic, favoring mature MDR providers who can articulate risk reduction in financial and operational terms, provide regular executive briefings, and integrate their services seamlessly into the organization’s broader risk governance framework.

- Escalating frequency and impact of cyber threats: The relentless rise in advanced cyberattacks, mainly ransomware, against the critical infrastructure is a primary demand driver in the managed detection and response services market. Organizations face tangible operational and financial damage moving cybersecurity from a technical issue to a core business risk. This is quantified by the official report from the Federal Bureau of Investigation Internet Crime Report in 2023, which recorded that over 880,000 complaints were registered. Such data highlights the direct threat to business continuity, compelling the firms to seek 24/7 expert monitoring and response capabilities they cannot maintain in-house. The trend is shifting client conversation from pure cost to risk mitigation and resilience, making MDR a critical insurance policy.

Challenges

- High initial capital and operating costs: Entering the managed detection and response (MDR) service market requires a massive upfront investment in proprietary security operations center infrastructure advanced analytics platform, and skilled personnel. Ongoing costs for the 24/7 staffing threat intelligence feeds and tool licensing create significant financial barriers. The top players are investing heavily in developing their concierge security platform before achieving profitability. Smaller vendors often struggle to match this scale. The cost to build and operate a mature in-house SOC is high, making it prohibitive for the new entrants without substantial venture backing or an existing security product line to leverage.

- Acute shortage of skilled cybersecurity talent: The global workforce gap in the cybersecurity sector exceeds, with the specialized roles in threat hunting and incident response being particularly scarce. This talent shortage severely limits the new provider's ability to staff a competent SOC, directly impacting the service quality and scalability. Leading companies address this issue via their extensive training programs and hiring security professionals to support their managed services division, highlighting the scale of the investment needed to overcome this human resource challenge.

Managed Detection and Response Service Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

17.2% |

|

Base Year Market Size (2025) |

USD 9.6 billion |

|

Forecast Year Market Size (2035) |

USD 46.9 billion |

|

Regional Scope |

|

Managed Detection and Response Service Market Segmentation:

Security Model Segment Analysis

Within the security model segment, the fully managed services will continue to dominate as the leading sub-segment and are poised to hold the managed detection and response (MDR) service market share value of 75.6% by 2035. Organizations increasingly seek to transfer the full burden of 24/7 threat monitoring, detection, and response to expert providers due to a pervasive cybersecurity talent shortage. This model offers predictable operational expenditure access to specialized skills and rapid scalability, making it the preferred choice for companies lacking mature in-house Security Operations Centers. The World Economic Forum report in 2025 highlights that resource constraints significantly hamper effective cyber defense, noting that 67% of the organizations reported a moderate to critical skill gap in cybersecurity, which is a key driver of outsourcing to fully managed MDR providers.

Deployment Segment Analysis

The cloud-based sub-segment commands the highest MDR service market share within the deployment segment, a trend stimulated by the shift to hybrid work and cloud infrastructure. The cloud deployment offers superior scalability, rapid deployment, and easier integration with modern cloud native applications and services. It eliminates the need for on-premises hardware management and allows MDR providers to deliver global services from centralized, scalable platforms. Supporting this growth, a recent report by the Eurostat in December 2023 depicts that the business IT adoption found a significant uptick in cloud service reliance, with 95.8% of responding businesses reporting the EU enterprise use of at least one cloud computing service to support operations as of 2023, underscoring the foundational shift driving cloud-based MDR demand.

Cloud Computing in Enterprises (2023)

|

Country |

Percentage of Enterprise Buying Cloud Computing |

|

Belgium |

51.7 |

|

Bulgaria |

17.5 |

|

Czechia |

47.2 |

|

Denmark |

69.5 |

|

Germany |

47 |

Source: Eurostat December 2023

Organization Size Segment Analysis

In managed detection and response (MDR) service Market, large enterprises are the leading sub-segment in the organization size and are driven by their complex, multi-faceted IT environments and higher cybersecurity budgets. These organizations are the prime targets for the advanced attacks and face robust regulatory compliance mandates, making a comprehensive MDR coverage a critical investment. They require services that can scale across global networks, diverse endpoints, and hybrid cloud estates. A U.S. government analysis of cyber incidents reinforces this focus, including the fact that large firms, while fewer in number, reported the highest total financial losses from cybercrime, illustrating the high-stakes environment that necessitates robust outsourced MDR protection. Consequently, their strategic partnerships with the top-tier MDR providers are pivotal for maintaining enterprise resilience and safeguarding against catastrophic financial and reputational damage.

Our in-depth analysis of the managed detection and response (MDR) service market includes the following segments:

|

Segment |

Subsegments |

|

Service Type |

|

|

Deployment |

|

|

Organization Size |

|

|

Industry Vertical |

|

|

Service Model |

|

|

Threat Coverage |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Managed Detection and Response Service Market - Regional Analysis

North America Market Insights

North America is dominating the managed detection and response services market and is projected to hold the share of 42.5% by 2035. The MDR service market is defined by high maturity, stringent regulatory compliance demands, and significant cybersecurity budgets. Its leadership is fueled by a concentrated presence of large enterprises across finance, healthcare, and technology sectors that are prime targets for advanced threat actors. The regulatory environment, including the SEC disclosure rules and sector-specific mandates, compels investment in 24/7 monitored security services. Further, high cyber insurance penetration and requirements directly drive the managed detection and response adoption as a prerequisite for coverage. A consistent driver is the region’s acute cybersecurity talent shortage, making the outsourcing of advanced threat hunting and incident response a strategic necessity rather than a discretionary cost, ensuring sustained market growth and innovation.

The U.S. managed detection and response (MDR) service market is driven by a unique convergence of the robust federal and state regulations, a high concentration of the Fortune 500 companies, and a relentless targeting by advanced persistent threats. A primary trend is the government’s active role in shaping demand via mandates. For example, the Biden-Harris Administration’s 2023 National Cybersecurity Strategy emphasizes shifting liability to promote secure services, directly incentivizing the adoption of managed detection and response services. Data shows a significant federal investment with the White House 2025 report stating its budget request 2024 included USD 3 billion to boost the nation’s cyber defense funds that flow into initiatives requiring advanced monitoring capabilities. This regulatory and financial push, combined with a severe talent shortage, solidifies MDR as a foundational enterprise security component.

In Canada, the managed detection and response services market is propelled by the escalating ransomware threats to critical infrastructure and small to medium enterprises, alongside rigorous enforcement of federal privacy laws such as PIPEDA. A defining trend is increased public sector investment and guidance. Public Safety Canada’s National Cyber Security Action Plan directs funding to protect vital systems and support private sector resilience. This is reflected by Statistics Canada in October 2024, noting that 1 in 8 businesses in Canada reported experiencing ransomware attacks, which is a surge of 11% from 2021. Further, this environment is driving the demand for managed services that provide both detection and assured response to mitigate financial and operational damage. MDR is transitioning from a premium service for large corporations to an essential operational expense for a broader range of Canadian organizations seeking to ensure regulatory compliance and business continuity.

APAC Market Insights

The Asia Pacific is the fastest-growing managed detection and response market and is driven by the rapid digital transformation, escalating cyber threats, and evolving regulatory landscapes. Unlike more mature markets, APAC growth is fueled by a massive and expanding base of small to medium enterprises and large corporations rapidly migrating operations to the cloud, creating vast unprotected attack surfaces. A key driver is the proliferation of strong data protection laws such as India’s Digital Personal Data Protection Act and China’s expanded Cybersecurity Law that mandate robust security measures and incident reporting, compelling organizational investment. The key trends include a strong preference for integrated security as a service platform, the rise of local and regional MDR providers competing with global giants, and increasing demand for cloud native MDR solutions customized to hybrid infrastructures.

The China’s managed detection and response service market is the largest in APAC and is mainly driven by the top-down regulatory mandates rather that orgaic enterprise demand. The foundational driver is the national Multi Level Protection Scheme 2.0 and Cybersecurity Law that legally require critical information infrastructure operators to implement graded security protections including monitoring infrastructure operators to implement graded security protections including monitoring and incident response capabilities. This creates a vast compliance-driven market favoring domestic sovereign providers. The scale of the underlying threat is immense. As per the 2023 annual report from China’s National Computer Network Emergency Response Technical Team, the organization handled high cybersecurity incidents, underscoring the critical need for the managed services that the regulations enforce. The MDR service market is moving toward an integrated platform from the local giants such as Qihoo 360, which combine MLPS compliance tools with active threat hunting.

Japan’s managed detection and response service market is propelled by high maturity technological advancements and a strong public-private partnership model. The demand is driven by the need to protect vital infrastructure, advanced manufacturing, and a dense concentration of global corporations from advanced cyber intelligence and ransomware. The government’s active role is formalized via the National Center of Incident Readiness and Strategy for Cybersecurity, which sets the frameworks for active cyber defense. The report from the SAIS Review of International Affairs indicates that the financial harm caused by cyberattacks is anticipated to quadruple by 2027, totaling USD 8 trillion in 2023. This data reflects a continuous rise in incidents that require professional investigation and response. This environment favors MDR providers that offer deep integration with local IT ecosystems, provide services in Japan, and can meet the stringent operational standards expected by Japan enterprises.

Europe Market Insights

Europe’s managed detection and response services market is a rapidly growing segment driven by an escalating threat landscape, robust data protection regulations, and a significant cybersecurity skills shortage. The implementation of the EU’s Network and Information Security Directive is a primary catalyst compelling a wider range of entities across critical sectors such as energy, transport, and healthcare to adopt advanced proactive security measures such as MDR. Key trends include the rise of integrated extended detection and response platforms and a strong push for sovereignty, with the demand growing for services operated within EU borders to ensure compliance with the GDPR and other data localization norms. The MDR service market is also defined by consolidation, as large system integrators and telecom providers acquire specialized MDR firms to offer comprehensive security portfolios.

Germany’s managed detection and response service market is the largest in Europe and is driven by its extensive industrial base and robust regulatory landscape. The vital need is to protect manufacturing and critical infrastructure from ransomware and espionage, forces significant investment. This demand is codified in laws such as the IT Security Act 2.0, which expands the cybersecurity obligations. A concrete indicator of the threat driving this MDR service market is the report from the State of IT Security in Germany in 2023, stating that Germany recorded over 250,000 new malware variants every day during the reporting period. This data highlights the massive automated threat landscape that MDR services are designed to counteract. This environment makes the MDR mainly solutions integrating IT and operational technology security a strategic necessity for business continuity.

Average Daily Growth in New Malware Variants

|

Month |

New Malware Variants (Amounts in Thousands) |

|

June 2022 |

280 |

|

July 2022 |

294 |

|

August 2022 |

304 |

|

September 2022 |

205 |

|

October 2022 |

203 |

|

November 2022 |

208 |

|

December 2022 |

246 |

|

January 2023 |

230 |

|

February 2023 |

163 |

|

March 2023 |

211 |

|

April 2023 |

286 |

|

May 2023 |

290 |

|

June 2023 |

332 |

Source: The State of IT Security in Germany 2023

The UK’s managed detection and response service market is defined by the high maturity, concentrated demand from the financial and professional services sectors, and a proactive national cyber strategy. As a global financial hub, the UK is a premier target for advanced cyberattacks, pushing firms to adopt advanced threat hunting services. Government strategy plays a direct role in the UK’s National Cyber Strategy 2022 committed to strengthening resilience across the economy. Supporting this, the UK 2022 reported that the UK cybersecurity sector’s annual revenue grew to approximately 10.1 billion euros in 2022, a figure that encompasses the core services and products, including the MDR, that underpin the national defense posture. This growth reflects sustained investment from both the private and public sectors into capabilities like 24/7 monitored detection and response.

Key Managed Detection and Response Service Market Players:

- CrowdStrike (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Secureworks (U.S.)

- Palo Alto Networks (U.S.)

- Microsoft (U.S.)

- IBM (U.S.)

- Rapid7 (U.S.)

- Sophos (UK)

- AT&T Cybersecurity (U.S.)

- BAE Systems (UK)

- Arctic Wolf (U.S.)

- Trellix (U.S.)

- SentinelOne (U.S.)

- ESET (Slovakia)

- Kaspersky (Russia)

- Accenture (Ireland)

- Wipro (India)

- NTT Ltd. (Japan)

- Telstra (Australia)

- LG CNS (South Korea)

- LGMS (LE Global Services) (Malaysia)

- CrowdStrike is a leader in the managed detection and response service market, having revolutionized the sector by integrating its cloud native Falcon platform with 24/7 human-led threat hunting. This advancement ensures real-time AI-powered visibility and proactive threat remediation across endpoints, cloud workloads, and identity data, optimizing enterprise security postures against advanced attacks. The company in the fourth quarter of 2024 accelerates with a growth rate of 27%.

- Secureworks is a pioneer in the managed detection and response (MDR) service market and has significantly advanced the field via its Taegis platform and globally distributed security operations centers. This advancement ensures the real-time analytics-driven threat detection and coordinated response, leveraging extensive threat intelligence to optimize security outcomes for a diverse global clientele.

- Palo Alto Networks has made significant advancements in the managed detection and response service market by fully integrating its Cortex XDR and XSIAM platforms with its comprehensive security stack. These advancements ensure real-time automated correlation of network, cloud, and endpoint data, optimizing threat detection, investigation, and response via a unified AI-powered SOC platform. In 2025, it made a revenue of USD 9.22 billion, making a 15% rise compared to the previous year.

- Microsoft is a dominant player in the managed detection and response (MDR) service market, using its unique integration of Defender XDR, Sentinel SIEM, and vast global telemetry from its enterprise ecosystem. This advancement ensures real-time cross-domain security monitoring and AI-driven response, optimizing protection by contextualizing threats within the architecture of modern business operations.

- IBM is a key player in the managed detection and response service market, distinguished by its IBM Security QRadar Suite and expert services powered by its X Force threat intelligence. This advancement ensures real-time hybrid cloud security management and incident response, optimizing detection accuracy and remediation speed for complex regulated enterprise environments.

Here is a list of key players operating in the global managed detection and response (MDR) service market:

The global managed detection and response (MDR) service market is intensely competitive and is dominated by the U.S. based cybersecurity pure plays and platform vendors expanding their services. The key players, such as CrowdStrike and Microsoft, leverage their integrated security platforms to offer MDR as a seamless extension, while the specialists, such as Arctic Wolf, focus solely on managed security outcomes. The strategic initiatives are centered on technology integration, strategic partnerships to extend global reach, and a strong push towards cloud native offering. Further acquisitions are common to rapidly gain advanced capabilities and talent. For example, in November 2025, Coalition announced the acquisition of automated MDR provider Wirespeed. The market is also seeing the growth in the regional players, such as India’s Wipro and Malaysia’s LGMS, who compete by offering localized expertise and cost-effective services to their markets.

Corporate Landscape of the MDR Service Market:

Recent Developments

- In November 2025, ESET, a global leader in cybersecurity solutions, announced the launch of two managed detection and response (MDR) subscription tiers, ESET PROTECT MDR for small and medium businesses (SMBs) and ESET PROTECT MDR Ultimate for enterprises in India.

- In March 2025, Infopercept has introduced its new MDR solution called Real MDR Solution. Delivered via Infopercept’s consolidated cybersecurity platform Invinsense, the solution offers comprehensive cybersecurity coverage that goes beyond conventional MDR offerings.

- In June 2024, Darktrace has announced the launch of its new service offering, Darktrace Managed Detection & Response (MDR). The service combines its best-in-class detection and response capabilities spanning across the enterprise, with the expertise of its global analyst team.

- Report ID: 8327

- Published Date: Dec 19, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Managed Detection and Response Service Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.