Lithium Iron Phosphate Battery Market Outlook:

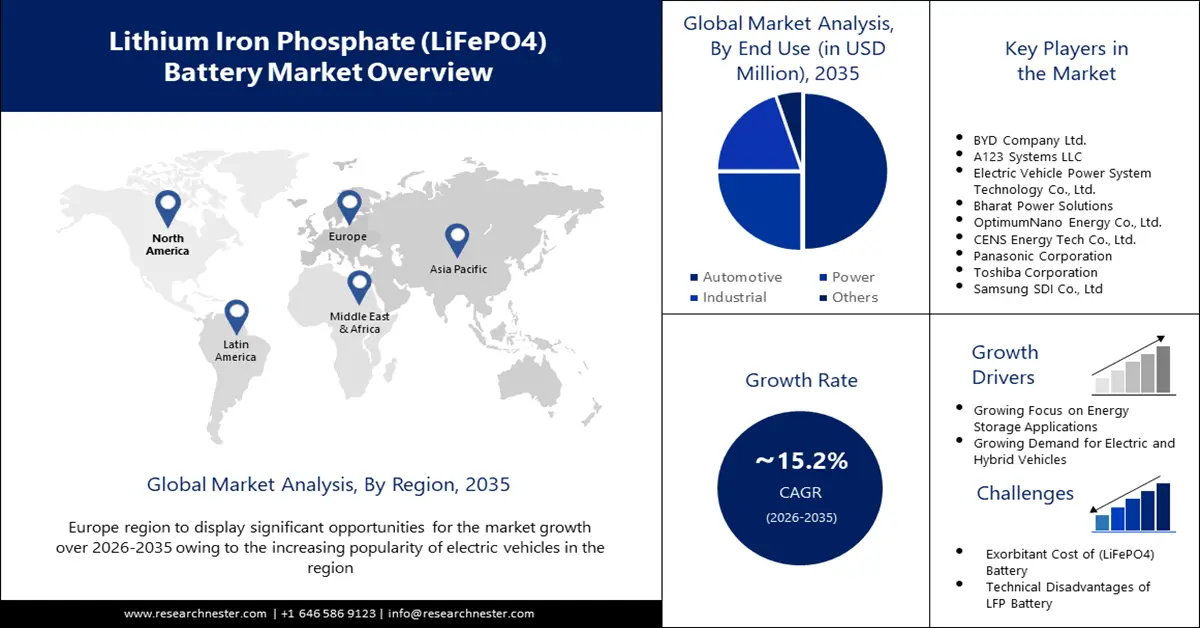

Lithium Iron Phosphate Battery Market size was over USD 17.08 billion in 2025 and is anticipated to cross USD 84.23 billion by 2035, witnessing more than 17.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of lithium iron phosphate battery is assessed at USD 19.74 billion.

The pressing need for social and environmental sustainability is propelling innovation and accelerating the development of cutting-edge energy technologies and clean energy for transportation. Lithium batteries have emerged as the key to limiting GHGs by 30% for road transportation electric vehicles. According to the U.S. Department of Energy Office of Scientific and Technical Information’s (OSTI) Battery Performance and Cost Estimation (BatPaC) model, cathode amounts to over 50% of cell materials cost for lithium batteries. This has spurred interest in developing cathode materials that can balance affordability, energy efficiency, and environmental impact.

Lithium iron phosphate (LFP), lithium nickel cobalt aluminum oxide (NCA), and lithium nickel manganese cobalt oxide (NMC) comprise the key cathode materials used in lithium-ion batteries (LIB). All three compete for a significant lithium iron phosphate battery market share within utility-scale energy storage and EV battery subsectors. In conjunction with governmental support to strengthen the global supply chain and foster the development of lithium iron phosphate, it has gained attention in the EV battery industry during the past years. Recent innovations, including BYD’s Blade Battery, have further improved lithium iron phosphate batteries by optimizing structural design and space utilization at the module level and narrowing the energy density gap using higher-density alternatives.

Furthermore, in terms of cost advantage, LFP battery cells are roughly 30% more affordable than NCA and NMC batteries, which reached USD 95 per kWh in 2023. Despite NMC-based batteries currently dominating the global EV industry, LFP batteries have experienced a steady rise of 39% market share in 2024 from 34% in 2022. Environmentally, LFP batteries render more scalable manufacturing, lower carbon footprints, easier recyclability, and fewer regulatory concerns regarding sourcing critical materials such as nickel and cobalt. In terms of job opportunities, energy employment was approximately 67 million in 2022 and over half a million in clean energy, expanding by 3.4 million jobs over the pre-pandemic level. The fossil fuel workforce was surpassed by the clean energy segment. that of fossil fuels around 2021 to employ over 50% of total energy workers worldwide, a trend that remains true in most regions.

Total employment by sector by 2023 (in million workers)

|

Year |

Clean Energy |

Fossil Fuel |

|

2019 |

30.1 |

33.0 |

|

2020 |

30.0 |

30.6 |

|

2021 |

31.9 |

31.1 |

|

2022 |

34.8 |

31.7 |

|

2023 |

36.2 |

32.1 |

Source: IEA

Key Lithium Iron Phosphate Battery Market Insights Summary:

Regional Highlights:

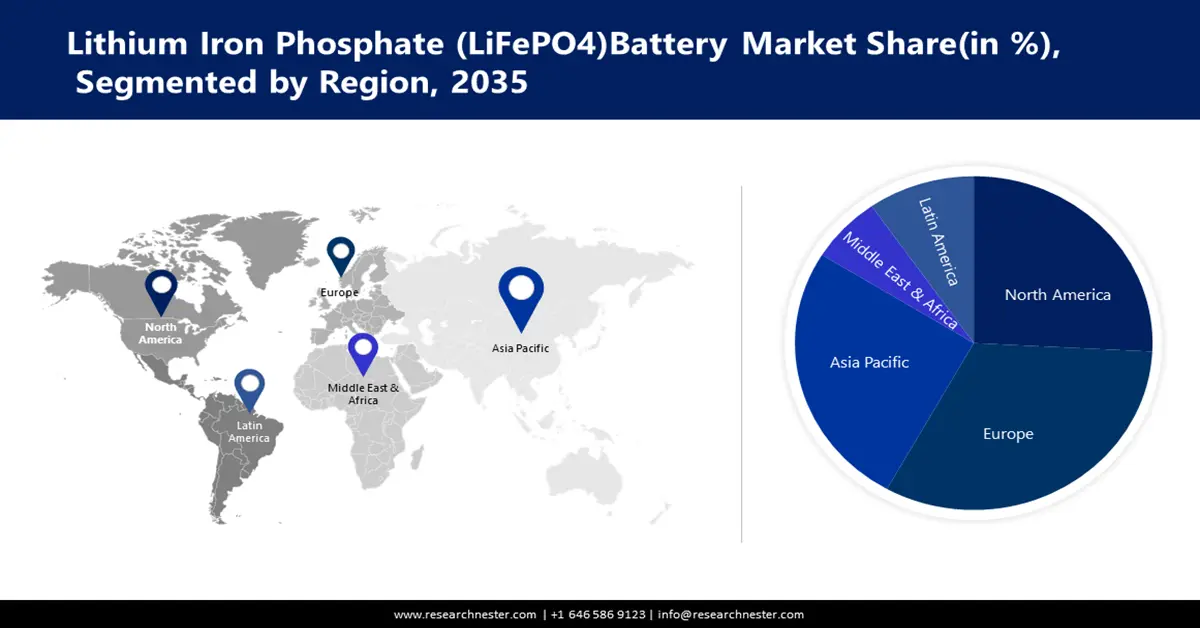

- Asia Pacific lithium iron phosphate (LiFePO4) battery market holds the largest share by 2035, driven by Asia’s large energy workforce, supported by a wide population base, lower labor costs, sizable clean energy production sectors, and brisk investments.

- North America market will secure significant revenue share by 2035, fueled by demand for EV batteries and clean tech investments.

Segment Insights:

- The automotive segment in the lithium iron phosphate battery market is expected to secure the largest share by 2035, attributed to the surging demand for low-emission electric vehicles globally.

- The portable segment in the lithium iron phosphate battery market is anticipated to hold a significant share by 2035, driven by the rising popularity of portable batteries in the automotive industry.

Key Growth Trends:

- Increase in raw material production and global trade

- Rising EV market & investments in critical materials

Major Challenges:

- Hight cost of LiFePO4 battery

Key Players: LiFeBATT, Inc., BYD Company Ltd., A123 Systems LLC, Electric Vehicle Power System Technology Co., Ltd., Bharat Power Solutions, OptimumNano Energy Co., Ltd., CENS Energy Tech Co., Ltd., Panasonic Corporation, Toshiba Corporation, Samsung SDI Co., Ltd.

Global Lithium Iron Phosphate Battery Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 17.08 billion

- 2026 Market Size: USD 19.74 billion

- Projected Market Size: USD 84.23 billion by 2035

- Growth Forecasts: 17.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, South Korea, Germany

- Emerging Countries: China, India, Brazil, Mexico, South Korea

Last updated on : 9 September, 2025

Lithium Iron Phosphate Battery Market Growth Drivers and Challenges:

Growth Drivers

- Increase in raw material production and global trade: The worldwide demand for critical minerals including phosphate, cobalt, and nickel is set to skyrocket by 400-600% in the upcoming decades the next several decades, while for minerals such as graphite and lithium will surge by over 4,000%, as per a February 2022 fact sheet by The White House. Moreover, it discusses BIL funding of USD 3 billion in refining battery materials and battery recycling facilities, thereby creating more jobs in clean energy production and deployment. Global demand for critical minerals for EVs and solar PVs has been experiencing steep growth. In total, demand for cobalt rose 70%, lithium tripled, and nickel jumped 40% until 2022.

According to August 2024 data by the World Nuclear Association, 2022 production of lithium globally reached 89 million tons. Bolivia has the largest lithium resources of 21 Mt, followed by Argentina (19 million tons), Chile (9.8 million tons), the U.S. (9.1 million tons), Australia (7.3 million tons) and China (5.1 million tons). Lithium demand in 2020 was 74,000 tons, with 30% from the EV sector and energy storage (22,000 tons). In line with the IEA’s sustainability goals, lithium demand is projected to reach 1,160,000 t by 2040, energy storage and EV accounting for 90% of the total production.

In 2022, lithium batteries were registered as the world's 1069th most traded item, with an overall trade value of USD 3.43 billion. The exports grew by 4.76% that year, from USD 3.27 billion the previous year, and ascribed to 0.014% of total world trade. China was ranked the top exported with trade of USD 784 million and the U.S. has an import value of USD 430 million. The countries with a greater net export value than imports in 2022 were China (USD 617 million), Indonesia (USD 266 million), Singapore (USD 174 million), Japan (USD 138 million), and Israel (USD 89.2 million). The world trade value of phosphorus was USD 1.23 billion, with top exporters- Vietnam (USD 731 million, 59.2% share of the total trade), Kazakhstan (USD 270 million), the U.S. (USD 65 million), Poland (USD 57.4 million), and Latvia (USD 33.1 million). - Rising EV market & investments in critical materials: Governments and private entities have stated policies to accelerate EV adoption in the transportation sector. Such private-public commitments indicate 200 million total EVs will be sold by 2030. The world trade value of EVs in 2022 was USD 93 billion and was the 27th most traded out of 5380, registering an export CAGR of 46.7%. In July 2024, EU and EBRD collaborated to invest USD 102 million to develop green transition manufacturing processes for critical materials.

Challenges

- Hight cost of LiFePO4 battery: The comparatively high cost of the LFP battery than NCA and NMC is one factor predicted to hamper the lithium iron phosphate battery market growth. The presence of affordable alternatives and persistent R&D in new material chemistry poses a threat of substitution.

Lithium Iron Phosphate Battery Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

17.3% |

|

Base Year Market Size (2025) |

USD 17.08 billion |

|

Forecast Year Market Size (2035) |

USD 84.23 billion |

|

Regional Scope |

|

Lithium Iron Phosphate Battery Market Segmentation:

End user

The automotive segment is estimated to gain the largest lithium iron phosphate battery market share over the projected time frame. The growth is attributed to the increasing demand for low-emission electric vehicles across the globe. Electric car sales were 14 million in 2023, of which 95% were in China (60%), the U.S. (10%), and Europe (25%). EV sales in 2023 were 3.5 million higher as compared to 2022, a 35% CAGR. The same year there were more than 250, 000 new weekly registrations, which is more than the annual total a decade ago. Electric cars ascribed to 18% of total cars sold in 2023, marking a 14% rise from 2022. Additionally, in 2023 battery electric cars held 70% of the overall electric car stocks.

Type

The portable segment in lithium iron phosphate battery market is expected to garner a significant share in the forecast timeline. The growth is due to the increasing popularity of portable batteries in the automotive industry. Portable lithium iron phosphate batteries are lightweight, easy to carry, swappable, and have a lower physical footprint. The segment is fragmented owing to the presence of large number of small players entering the space.

Our in-depth analysis of the global lithium iron phosphate battery market includes the following segments:

|

By Power Capacity |

|

|

By Type |

|

|

By End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Lithium Iron Phosphate Battery Market Regional Analysis:

APAC Market Insights

Asia hosts the largest energy workforce due to a wide population-base, lower labor costs, and sizable clean energy production sectors, and brisk investments. China’s capacity to manufacture LFP cells and individual battery units has grown manifold. By 2021, China-based companies were generating about 90% of the global LFP powder. In 10 years, Shenzhen Dynanonic, a local company increased its annual LFP capacity to 265,000 tons from 500 tons. Unlike other firms, Dynanonic has integrated a solution-based method similar to Süd-Chemie hydrothermal process used in Montreal. Other China-based battery businesses have started expanding overseas to strengthen their lithium iron phosphate (LiFePO4) battery market position. For instance, Gotion High-Tech, a veteran LFP batteries and cathode materials producer in China, plans to build 100 GW h of battery cell capacity across other countries in the next 3 years. In June 2022, the company, whose biggest shareholder is Volkswagen, disclosed its plans to inaugurate its first LFP battery facility in Europe.

Energy employment by economic activity and by key region & country, in 2022 (thousand workers)

|

Region/Country |

Employment |

|

China |

19,300 |

|

India |

8,400 |

|

Rest of APAC |

8,700 |

|

Europe |

7,700 |

|

North America |

7,100 |

|

Africa |

4,300 |

|

CSA |

4,200 |

|

Middle East |

3,900 |

|

Eurasia |

2900 |

Source: IEA

China has a high manufacturing capacity of LiFePO4 batteries, with most factories that produce LFP using a standardized solid-state process. Shenzhen Dynanonic has led the China LiFePO4 battery market, in terms of LFP shipment volume, valuing a production capacity of 120,000 tons in 2021 and is anticipated to reach to 145,000 tons with new facilities in the forthcoming years. Also, Guizhou Anda Energy Technology quickly emerged as a prominent player, with a yearly capability utilization of 60,000 tons, supplying high-quality materials to some of the top battery manufacturers including BYD. Fulin Precision Metal in collaboration with CATL and BYD aims at expanding its capacity to 65,000 tons during the forecast period. Other than above, Pulead Technology Industry, BTR New Energy Materials, Tianjin STL Energy Technology, Chongqing Terui Battery Materials and Yantai Zhuoneng Battery Materials are producing and supplying LFP in China and around the globe.

North America Market Forecast

North America LiFePO4 battery market is expected to garner a significant revenue share by the end of 2035, attributed to the presence of some market giants and rising investments. Nano One in Canada is advancing clean technology for affordable LiFePO4 production, while ICL is leading the North America region with an investment of USD 400 million for a new manufacturing facility. The diverse needs for energy storage systems and EV batteries, ranging from high capacity and fast charging to long cycling life, is driving expansion of LEP in the region.

Commercial-scale lithium production in the U.S. has gained momentum over the last few years due to rising government focus in the form of fundings and grants to decouple from China’s influence on its manufacturing processes. In 2022, the U.S. DOE selected 12 projects funded with USD 1.6 billion to support the domestic production of lithium, innovate battery components, promote recycling, and bring in new technologies to boost the country’s lithium reserves. Furthermore, the U.S. Inflation Reduction Act has rolled out tax incentives to consolidate battery materials supply, sourcing, and EV manufacturing in U.S.-partner countries. U.S. demand for LFP batteries, particularly in the passenger EV segment is anticipated to continue outstripping domestic production capacity. According to c&en, the estimated U.S. LEP capacity will be over 150 GW/year by 2030.

Lithium import-export comparative analysis through 2023 (in Watts)

|

Salient Statistics |

2019 |

2020 |

2021 |

2022 |

2023 |

|

Imports for consumption |

2,620 |

2,460 |

2,640 |

3,270 |

3,400 |

|

Exports |

1,660 |

1,200 |

1,870 |

2,440 |

2,300 |

|

Price, annual average-nominal, battery-grade lithium carbonate, dollars per metric ton |

12,100 |

8,600 |

12,600 |

68,100 |

46,000 |

Source: USGS

Lithium Iron Phosphate Battery Market Players:

- LiFeBATT, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- BYD Company Ltd.

- A123 Systems LLC

- Electric Vehicle Power System Technology Co., Ltd.

- Bharat Power Solutions

- OptimumNano Energy Co., Ltd.

- CENS Energy Tech Co., Ltd.

- Panasonic Corporation

- Toshiba Corporation

- Samsung SDI Co., Ltd

The lithium iron phosphate market is driven by the strategic initiatives by the key players such as product innovation, R&D in critical material, strengthening mining and production to proliferate their global positioning. Companies are capitalizing on the rising demand for electric motor vehicles and are ramping up the supply of LEP raw materials. Some of the main LiFePO4 battery market players include:

Recent Developments

- In August 2024, Vatrer Power launched a new all-in-one Lithium battery energy storage system, paving the way for a greener future. The product not only represents the latest breakthrough in energy storage technology but also offers efficient energy solutions.

- In June 2024, Electrovaya launched a lithium iron phosphate (LFP) based infinity cell at its annual battery technology day event. The newly developed EV-44 cells, feature LFP chemistry and retain the key competitive advantages.

- Report ID: 3676

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.