Lithium Thionyl Chloride Battery Market Outlook:

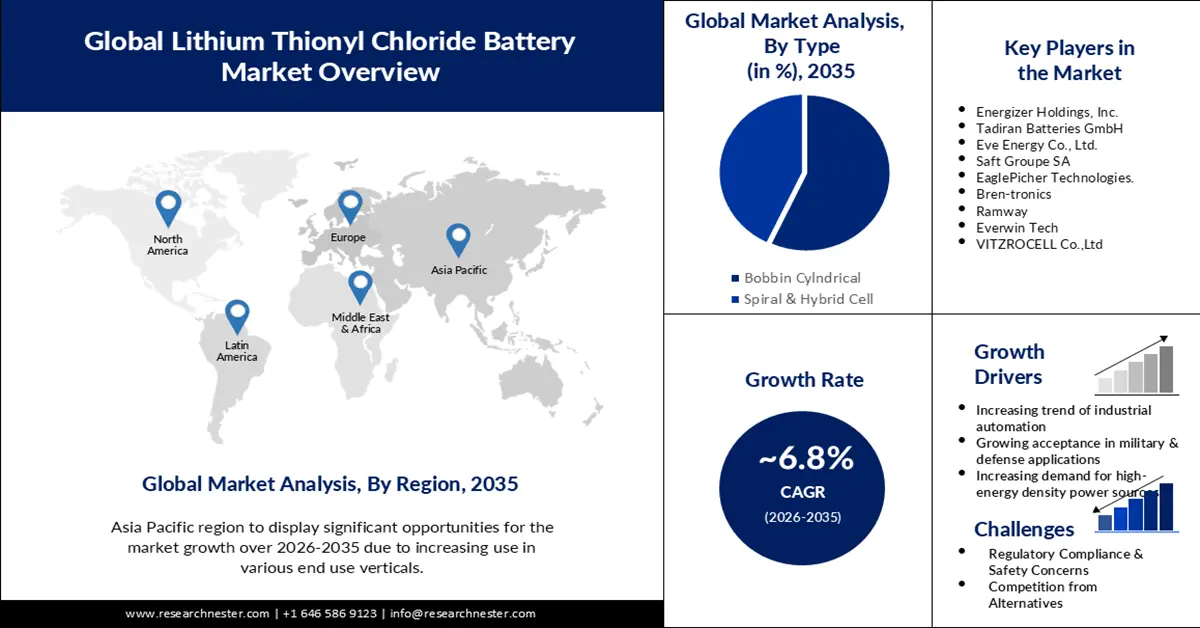

Lithium Thionyl Chloride Battery Market size was over USD 8.94 billion in 2025 and is poised to exceed USD 17.26 billion by 2035, growing at over 6.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of lithium thionyl chloride battery is estimated at USD 9.49 billion.

The global market for lithium thionyl chloride batteries is anticipated to be significantly influenced by the increase in industrialization and modernization on a global scale. Because of this, the market is anticipated to be driven by the safety and dependability that these batteries provide. The market for lithium thionyl chloride batteries is experiencing rapid growth as a result of rising sales of wireless or handheld devices-such as utility metering devices and tracking devices—that run on primary batteries as well as increased research and development into primary batteries. For instance; it is projected that by 2030, there will be over 29 billion Internet of Things (IoT) devices globally, nearly doubling from 15 billion in 2020.

The market is also expanding due to the growing demand for primary lithium battery types in a variety of devices. The market is benefiting from developments in digital technology that allow for more effective production, portfolio expansion, efficient operational maintenance, and sales tracking. Among the major market changes are the growing demand for smart automation, decentralized networks, smart storage, and rising disposable incomes in rapidly emerging countries.

Key Lithium Thionyl Chloride Battery Market Insights Summary:

Regional Highlights:

- Asia Pacific is forecasted to secure a 31% revenue share of the lithium thionyl chloride battery market by 2035, underpinned by expanding utilization across medical devices, industrial applications, and aerospace.

- North America is expected to experience substantial growth through 2026–2035, supported by advancements in the medical device sector and a strong presence of lithium thionyl chloride battery manufacturers.

Segment Insights:

- The bobbin cylindrical segment is projected to command a 57% share of the global lithium thionyl chloride battery market by 2035, propelled by its long-standing design efficiency and cost-optimized production processes.

- The consumer electronics segment is set to emerge as the fastest-growing segment over 2026–2035, supported by escalating adoption of compact electronic devices and rising demand for advanced lithium batteries.

Key Growth Trends:

- Increasing demand for High Energy Density Power Sources

- Rising acceptance in military & defense applications

Major Challenges:

- Regulatory Compliance and safety concerns

Key Players: Ultralife Corporation, Energizer Holdings, Inc., Tadiran Batteries GmbH, Eve Energy Co., Ltd., Saft Groupe SA, EaglePicher Technologies, Bren-tronics, Ramway, Everwin Tech, VITZROCELL Co.,Ltd, Maxell, Ltd.

Global Lithium Thionyl Chloride Battery Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 8.94 billion

- 2026 Market Size: USD 9.49 billion

- Projected Market Size: USD 17.26 billion by 2035

- Growth Forecasts: 6.8%

Key Regional Dynamics:

- Largest Region: Asia Pacific (31% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, China, Japan, Germany, South Korea

- Emerging Countries: India, Brazil, Mexico, Indonesia, Vietnam

Last updated on : 19 November, 2025

Lithium Thionyl Chloride Battery Market - Growth Drivers and Challenges

Growth Driver

- Increasing demand for High-Energy Density Power Sources- The need for high-energy-density power sources in a variety of industries is driving the market for lithium thionyl chloride (Li-SOCl2) batteries. Because of their exceptional energy density, Li-SOCl2 batteries are widely recognized as the best option for applications requiring dependable, long-lasting power. Among other things, industrial machinery, Internet of Things devices, and remote monitoring systems all make extensive use of these batteries. The Internet of Things (IoT) ecosystem's explosive growth is one of the main drivers of this need. Batteries that can supply steady power for extended periods of time are necessary for Internet of Things devices like sensors, meters, and trackers. This is where Li-SOCl2 batteries shine since they have a low self-discharge rate and a large capacity, which guarantees continuous operation for Internet of Things applications. These batteries are also necessary to power sensors and data loggers in challenging settings, such as those found in the oil and gas industry, where remote monitoring is essential.

- Rising acceptance in military & defense applications- Because of Li-SOCl2 batteries' remarkable dependability, extended shelf life, and capacity to function in harsh environments, they have become increasingly popular in military and defense applications. Unmanned aerial vehicles (UAVs), night vision gadgets, and communication systems are just a few of the defense equipment items that require these batteries. The need for cutting-edge battery solutions that can withstand the demanding needs of military operations is growing as long as defense spending throughout the world keeps rising. The great energy density and long-lasting performance of Li-SOCl2 batteries make them an excellent choice for powering contemporary military technologies. It is anticipated that this factor would keep driving the market for lithium thionyl chloride batteries.

- Increasing trend of Industrial automation- The market demand for Li-SOCl2 batteries is also being driven by the growing trend toward Industry 4.0 and industrial automation. Industrial automation systems use sensors, controls, and actuators that run on batteries to automate tasks, keep an eye on machinery, and boost productivity. For these applications, Li-SOCl2 batteries are recommended because of their long lifespan, minimal maintenance needs, and shock and vibration resilience. Automation solutions are being used at a quick pace in industries like manufacturing, logistics, and energy management, and this trend is anticipated to continue. Because of this, there will be a continued need for dependable, long-lasting power sources like Li-SOCl2 batteries, which will propel market growth.

Challenges

- Regulatory Compliance and safety concerns- The persistent safety issues around lithium thionyl chloride batteries and the requirement for stringent regulatory compliance pose a substantial challenge to the lithium thionyl chloride battery market.

- Competition from Alternative is Expected to Pose Limitation on the Market Growth in the Projected Period

Lithium Thionyl Chloride Battery Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.8% |

|

Base Year Market Size (2025) |

USD 8.94 billion |

|

Forecast Year Market Size (2035) |

USD 17.26 billion |

|

Regional Scope |

|

Lithium Thionyl Chloride Battery Market Segmentation:

Type Segment Analysis

Based on type, the bobbin cylindrical segment is estimated to hold 57% share of the global lithium thionyl chloride battery market during the forecast period. The bobbin cylindrical design is a well-known and long-standing design. Li-SOCl2 batteries in a cylindrical form have a very low rate of self-discharge. They are appropriate for devices that may need to sit inactively for long periods of time before activating, as they can stay dormant for years while retaining their energy. Cost-effectiveness has been maximized in the bobbin cylindrical Li-SOCl2 battery production procedures. Their competitiveness in the market has increased as a result, particularly in applications where cost effectiveness is a crucial consideration.

End User Segment Analysis

Lithium thionyl chloride battery market from the fastest growing segment in the material segmentation of smart food scale market is the consumer electronics. The industry is seeing an increase in the use of small electronic devices, which is driving up demand for improved lithium batteries. Stimulators and hearing aids are among the many single-use medical equipment that are made with non-rechargeable batteries. The rising for mobile consumer electronics, including watches, remote control keys, smoke alarms, LED lights, and a plethora of other items, is likely to drive growth of lithium thionyl chloride market in this segment. For instance; the consumer electronics industry generated approximately USD 1.1 trillion in 2023.

Our in-depth analysis of the global lithium thionyl chloride battery market includes the following segments:

|

Type |

|

|

Battery Capacity |

|

|

End-User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Lithium Thionyl Chloride Battery Market - Regional Analysis

APAC Market Insights

Asia Pacific industry is expected to dominate majority revenue share of 31% by 2035. The growing demand for lithium thionyl chloride batteries across a range of industries, including medical devices, industrial applications, and military and aerospace, is propelling the expansion of the market for these batteries in Asia Pacific. Because of their growing application in the aerospace and defense industries, innovative lithium-based batteries are in high demand in this region. According to the International Trade Association, India's domestic aviation sector is predicted to reach $30 billion by 2024, ranking third internationally.

North America Pacific Market Insights

The lithium thionyl chloride battery market in the North America region is anticipated to grow significantly by the end of forecast period. Growing developments in the medical device industry in North America, coupled with the region's abundance of lithium thionyl chloride battery producers, are the main drivers of market expansion in that region. According to a 2017 data analysis from the U.S. Department of Commerce's International Trade Administration (ITA), the United States continues to lead the world in the production of medical devices. Furthermore, the medical device industry in Canada was projected to be worth US$6.8 billion in 2022. It is anticipated that the market will expand by 5.4% a year until 2028.

Lithium Thionyl Chloride Battery Market Players:

- Ultralife Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Energizer Holdings, Inc.

- Tadiran Batteries GmbH

- Eve Energy Co., Ltd.

- Saft Groupe SA

- EaglePicher Technologies.

- Bren-tronics

- Ramway

- Everwin Tech

- VITZROCELL Co.,Ltd

- Maxell, Ltd.

Recent Developments

- EVE Energy announced an investment of USD50 million in Vitzrocell. Vizrocell will be able to produce more Li-SOCl2 batteries and create new products with the support of this investment.

- Tadiran Batteries invested USD100 million with aim of expanding its Li-SOCl2 battery production capacity in Israel. Company is planning to build a new plant which will increase companies production to double by 2025.

- Report ID: 2067

- Published Date: Nov 19, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.