Liquid Sodium Silicate Market Outlook:

Liquid Sodium Silicate Market size was valued at USD 4.04 billion in 2025 and is set to exceed USD 6.21 billion by 2035, expanding at over 4.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of liquid sodium silicate is estimated at USD 4.2 billion.

The growth in the construction sector, particularly in emerging economies, drives the demand for liquid sodium silicate for cement and concrete applications. The automotive industry also contributes to the market, as liquid sodium silicate is used in the production of heat-resistant coatings for engine components.

Liquid sodium silicate finds application across various industries due to its unique properties. It is used as a binding agent in manufacturing applications such as adhesives, cement, and coatings. It is also utilized in the production of detergents, soaps, and cleaning products.

Key Liquid Sodium Silicate Market Insights Summary:

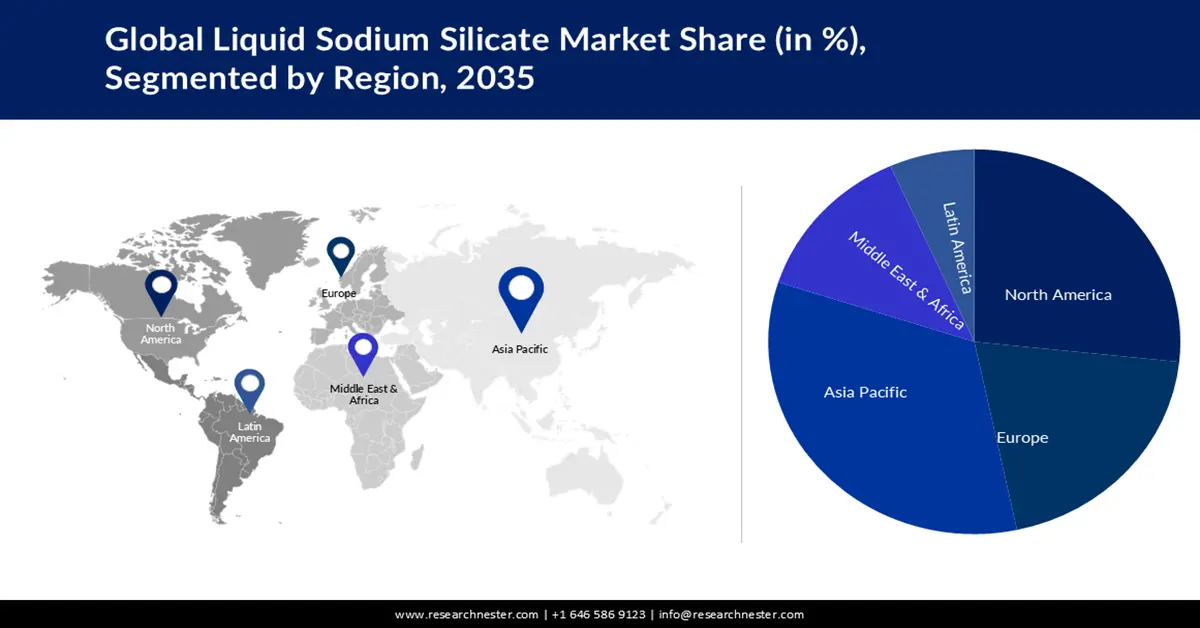

Regional Highlights:

- Asia Pacific liquid sodium silicate market will dominate more than 45% share by 2035, driven by rising construction activities and urban infrastructure growth.

- North America market will hold the second largest share by 2035, driven by infrastructure development projects boosting demand.

Segment Insights:

- The detergents segment in the liquid sodium silicate market is expected to capture the largest share by 2035, driven by rapid urbanization and the increasing demand for cleaning products.

- The automotive segment in the liquid sodium silicate market is projected to hold a significant share by 2035, driven by rising vehicle production requiring heat-resistant coatings.

Key Growth Trends:

- Construction and Infrastructure Development

- Growing Automotive Industry

Major Challenges:

- Fluctuating Raw Material Prices

- Environmental Regulations

Key Players: PQ Corporation, PPG Industries, Tokuyama Corporation, BASF SE, W.R. Grace & Co., Sinchem Silica Gel Co., Ltd., Nippon Chemical Industrial Co., Ltd., Occidental Petroleum Corporation, CIECH Group, Silmaco NV.

Global Liquid Sodium Silicate Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 4.04 billion

- 2026 Market Size: USD 4.2 billion

- Projected Market Size: USD 6.21 billion by 2035

- Growth Forecasts: 4.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (45% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, India

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 9 May, 2025

Liquid Sodium Silicate Market Growth Drivers and Challenges:

Growth Drivers

- Construction and Infrastructure Development: The construction industry is a major consumer of liquid sodium silicate, particularly for applications such as concrete and cement. As urbanization and infrastructure development continue to expand globally, the demand for liquid sodium silicate is expected to increase.

- Growing Automotive Industry: Liquid sodium silicate is used in the automotive industry for heat-resistant coatings on engine components. With the increasing production and demand for automobiles, especially in emerging economies, the market for liquid sodium silicate is expected to witness substantial growth.

- Increasing Need for Detergents and Cleaning Products: Liquid sodium silicate is a key ingredient in the production of detergents, soaps, and cleaning products. The demand for these products remains consistent, driven by factors such as increasing urbanization, rising awareness of hygiene and cleanliness, and a growing middle-class population.

Challenges

- Fluctuating Raw Material Prices: The cost of raw materials used in the production of liquid sodium silicates, such as sodium hydroxide and silica, can be volatile. Fluctuations in raw material prices can affect the overall production cost and profitability for manufacturers. Price volatility may result from factors like supply-demand imbalances, geopolitical issues, or changes in production capacities.

- Environmental Regulations

- Intense Competition

Liquid Sodium Silicate Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.4% |

|

Base Year Market Size (2025) |

USD 4.04 billion |

|

Forecast Year Market Size (2035) |

USD 6.21 billion |

|

Regional Scope |

|

Liquid Sodium Silicate Market Segmentation:

Application Segment Analysis

The detergents segment is slated to gain the largest share of the liquid sodium silicate market in the year 2035. Rapid urbanization, coupled with population growth, has led to an increase in the demand for detergents worldwide. As more people move to urban areas and adopt modern lifestyles, the demand for cleaning products, including detergents, rises.

End Use Industry Segment Analysis

Liquid sodium silicate market from the automotive segment is expected to garner a significant share in the year 2035. The growth of the segment can be accredited to increasing vehicle production. The automotive industry is experiencing steady growth, with increasing vehicle production globally. As more vehicles are manufactured, the demand for various automotive components, including those requiring heat-resistant coatings, grows. Liquid sodium silicate is used in the automotive industry for heat-resistant coatings on engine components, such as exhaust systems and cylinder heads.

Our in-depth analysis of the global market includes the following segments:

|

Application |

|

|

End Use Industry |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Liquid Sodium Silicate Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is predicted to dominate majority revenue share of 45% by 2035. The regional growth is owing to the construction boom. The Asia Pacific region is experiencing substantial construction activities, driven by urbanization, infrastructure development, and population growth. Liquid sodium silicate finds extensive usage in the construction industry for applications such as cement and concrete. According to a report, Asia Pacific is expected to account for nearly 55% of global construction output by 2032.

North American Market Insights

The liquid sodium silicate market in the North American region is projected to hold the second-largest share during the forecast period. The North American region witnesses ongoing construction and infrastructure development projects, driving the demand for liquid sodium silicate. Major construction projects, such as residential, commercial, and infrastructure developments, contribute to the market growth.

Liquid Sodium Silicate Market Players:

- PQ Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- PPG Industries

- Tokuyama Corporation

- BASF SE

- W.R. Grace & Co.

- Sinchem Silica Gel Co., Ltd.

- Nippon Chemical Industrial Co., Ltd.

- Occidental Petroleum Corporation

- CIECH Group

- Silmaco NV

Recent Developments

- PQ Corporation: PQ Corporation announced the acquisition of a specialty silicate and engineered materials business from Solvay. This acquisition expands PQ Corporation's portfolio of specialty silicates and strengthens its position in the global market.

- PPG Industries: PPG Industries announced a partnership with a global automotive manufacturer to develop an innovative liquid sodium silicate-based coating for automotive battery components. The collaboration aims to improve battery performance and safety in electric vehicles.

- Report ID: 5012

- Published Date: May 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Liquid Sodium Silicate Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.