Sodium Diacetate Market Outlook:

Sodium Diacetate Market size was valued at USD 659.74 million in 2025 and is likely to cross USD 1.17 billion by 2035, registering more than 5.9% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of sodium diacetate is assessed at USD 694.77 million.

The primary growth driver of sodium diacetate is its increasing demand in the food industry, particularly for enhancing food safety and extending shelf life. Sodium diacetate is an effective preservative and pH regulator, inhibiting mold and bacteria growth in various food products such as bakery items, meat, poultry, and dairy. This functionality aligns with the growing consumer emphasis on food safety and the desire for products with longer shelf lives.

Additionally, the sodium diacetate market benefits from its applications in animal feed, improving gut health and nutrient absorption, and in personal care products as a pH-balancing agent. The Asia Pacific region, including India, is expected to witness significant growth due to rising disposable incomes and changing dietary habits.

Key Sodium Diacetate Market Insights Summary:

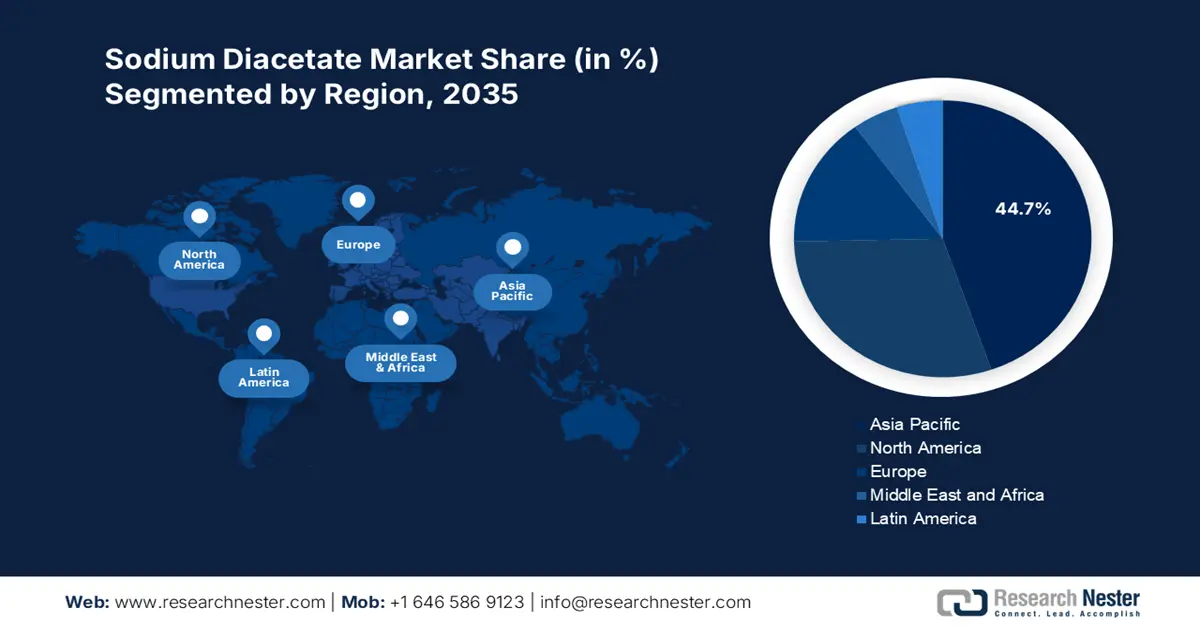

Regional Highlights:

- Asia Pacific sodium diacetate market will account for 44.70% share by 2035, driven by increasing demand in food processing, animal feed, and pharmaceutical sectors.

- North America market will exhibit the fastest growth during the forecast period 2026-2035, attributed to multifaceted applications across food, animal feed, pharmaceutical, and personal care industries.

Segment Insights:

- The food grade segment in the sodium diacetate market is projected to hold a significant share by 2035, driven by extensive applications as preservative, flavor enhancer, and pH regulator in the food industry.

Key Growth Trends:

- Expansion of pharmaceutical and personal care applications

- Consumer preference for clean-label and natural ingredients

Major Challenges:

- Health concerns at high dosages

Key Players: Corbion N.V., Jungbunzlauer Suisse AG, Galactic S.A., Shandong Fuxin Biotechnology Co., Ltd., Anhui Haoyuan Chemical Group Co., Ltd., Foodchem International Corporation, Mitsubishi Chemical Corporation, American Elements, Hawkins, Inc., Vinipul Inorganics Pvt. Ltd.

Global Sodium Diacetate Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 659.74 million

- 2026 Market Size: USD 694.77 million

- Projected Market Size: USD 1.17 billion by 2035

- Growth Forecasts: 5.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (44.7% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, India

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 18 September, 2025

Sodium Diacetate Market Growth Drivers and Challenges:

Growth Drivers

- Expansion of pharmaceutical and personal care applications: In the pharmaceutical industry, sodium diacetate is utilized for its buffering and pH-regulating properties, which are crucial for drug formulations, intravenous solutions, and excipients. The growing demand for pharmaceuticals, especially in emerging markets, and the emphasis on product stability and safety are contributing to the increased use of sodium diacetate in this sector.

Sodium diacetate’s role in the personal care industry is expanding due to its pH-balancing properties and antimicrobial activity. As consumers increasingly seek products with natural and safe ingredients, sodium diacetate’s compatibility with clean-label formulations makes it an attractive choice for manufacturers.

- Consumer preference for clean-label and natural ingredients: A clean label refers to food products that avoid listing ingredients perceived as undesirable, such as artificial additives, preservatives, and colorings. Instead, these products emphasize natural, simple, and easily recognizable ingredients. Consumers prefer labels that are easy to read and understand, often seeking products free from artificial ingredients, GMOs, and allergens.

Sodium diacetate, a compound derived from acetic acid and sodium acetate, aligns well with clean-label trends due to its natural origin and multifunctional properties. It serves as both a preservative and a flavoring agent, making it a valuable ingredient in various food products.

Challenges

- Regulatory compliance challenges: Sodium diacetate manufacturers must adhere to stringent food safety regulations and labelling requirements across different regions. Companies with agencies such as the European Food Safety Authority (EFSA) and the U.S. Food and Drug Administration (FDA) can be complex and costly, especially when regulations vary between countries. This complexity adds to the production and marketing challenges for manufacturers.

- Health concerns at high dosages: While sodium diacetate is generally recognized as safe, high concentrations of acetic acid, a component of sodium diacetate, can lead to health issues such as acidosis and hemodynamic instability. These potential health implications necessitate careful formulation and usage guidelines, particularly in pharmaceutical applications.

Sodium Diacetate Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.9% |

|

Base Year Market Size (2025) |

USD 659.74 million |

|

Forecast Year Market Size (2035) |

USD 1.17 billion |

|

Regional Scope |

|

Sodium Diacetate Market Segmentation:

Grade Segment Analysis

The food grade segment is anticipated to hold a share of 54.7% in the global sodium diacetate market by 2035, driven by its extensive applications in the food industry as a preservative, flavor enhancer, and pH regulator. Sodium diacetate is widely used to inhibit microbial growth, thereby extending the shelf life of various food products such as baked goods, meats, and snacks. It imparts a mild vinegar-like flavor, enhancing the taste profile of products like chips, sauces, and savory snacks. It also acts as a buffering agent, maintaining the desired acidity levels in food items, which is crucial for both taste and preservation.

Application Segment Analysis

The food and beverages segment is expected to capture a significant portion of the global sodium diacetate market, owing to the compound’s effectiveness as a preservative, flavor enhancer, and pH regulator. Sodium diacetate inhibits the growth of mold, bacteria, and fungi, thereby extending shelf life, and it is commonly used in baked goods, processed meats, and ready-to-eat snacks. It provides a mild acetic acid flavor, enhancing taste profiles and helping stabilize acidity in beverages and certain foods, improving product stability and safety.

Our in-depth analysis of the global sodium diacetate market includes the following segments:

|

Grade |

|

|

Application |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Sodium Diacetate Market Regional Analysis:

Asia Pacific Market Insights

Asia Pacific sodium diacetate market is projected to gain the largest share of 44.7% by 2035. The region is experiencing significant growth, driven by increasing demand in the food processing, animal feed, and pharmaceutical sectors. Rapid urbanization and changing dietary habits in countries like China and India have led to increased consumption of processed and convenience foods, boosting the demand for preservatives like sodium diacetate.

China hosts numerous manufacturers specializing in sodium diacetate production. Moreover, the country’s regulatory framework supports the use of food-grade preservatives, facilitating the adoption of sodium diacetate in various applications. Innovations in controlled-release technologies enhance the efficacy of sodium diacetate, particularly in animal feed applications. On the other hand, India, with its vast population and expanding middle class, presents lucrative opportunities for sodium diacetate manufacturers. The country’s rapid industrialization and growth in the food sector contribute significantly to the regional market’s expansion.

North America Market Insights

North America has rapidly emerged as the fastest-growing sodium diacetate market. The market is experiencing steady growth, driven by its multifaceted applications across the food, animal feed, pharmaceutical, and personal care industries. In the U.S. and Canada, increasing consumption of processed and convenience foods has driven the demand for preservatives to improve shelf life and enhance flavor. Additionally, the rise of online food retail platforms necessitates robust preservative solutions to ensure food safety across extended supply chains, increasing the demand for sodium diacetate.

Sodium Diacetate Market Players:

- Henan Honghui Biotechnology Co., Ltd.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- ULRICH GmbH

- Macco Organiques Inc.

- Niacet

- Kerry Company

- Corbion

- Vinipul Inorganics Pvt Ltd.

- Fooding Group Limited

Key players are the primary force behind the sodium diacetate market’s expansion by combining technical leadership, regulatory strength, and strategic business development. Multiple players ensure stable supply chains across regions by setting up production plants and warehouses in key markets. Investment in e-commerce and logistics networks increases their accessibility to small and mid-sized buyers. Moreover, collaborations with food and pharma companies provide integrated solutions, ensuring consistent adoption of sodium diacetate in production chains.

Here are some of the key players in sodium diacetate market:

Recent Developments

- In April 2024, Celanese completed strategic actions to enhance its global acetyl chain operations. This included the startup of a new 1.3-million-ton acetic acid expansion at its Clear Lake, Texas facility, touted as having the lowest carbon footprint globally. Additionally, a new vinyl acetate ethylene (VAE) unit commenced operations in Nanjing, China, increasing capacity by 70 kilotons to meet growing regional demand.

- In June 2021, Kerry Group, a global leader in taste and nutrition, announced the acquisition of Niacet Corporation for approximately USD 1.0 billion. Niacet is renowned for its preservation technologies, particularly in bakery, meat, and pharmaceutical applications.

- Report ID: 7656

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Sodium Diacetate Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.