Sodium Cyanide Market Outlook:

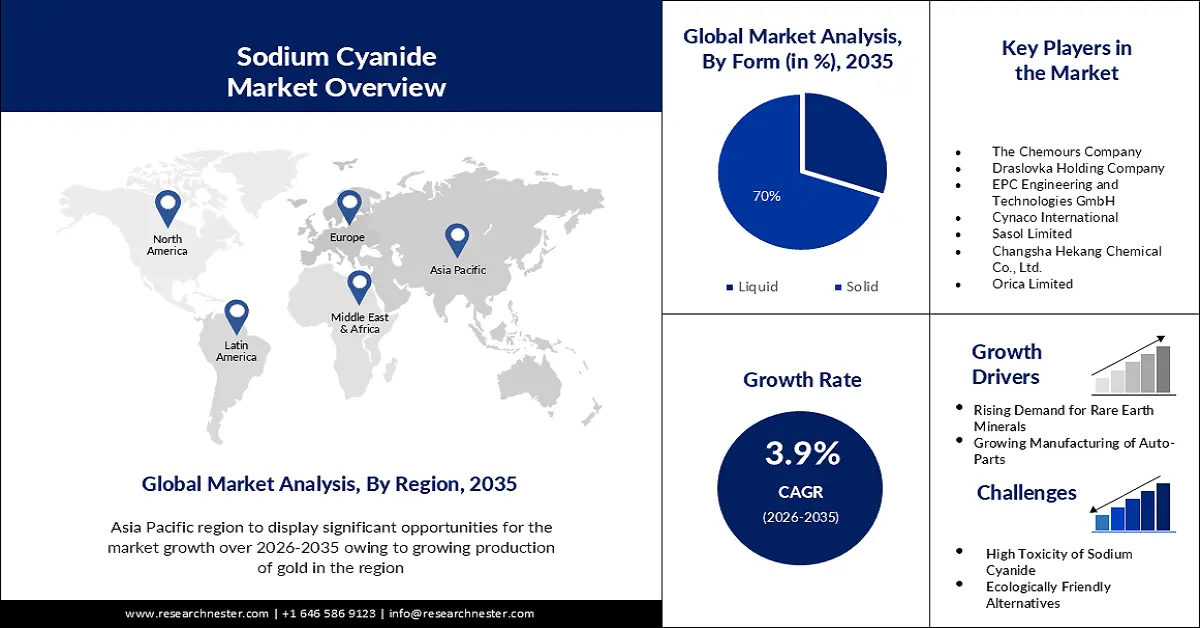

Sodium Cyanide Market size was valued at USD 2.3 billion in 2025 and is set to exceed USD 3.37 billion by 2035, registering over 3.9% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of sodium cyanide is estimated at USD 2.38 billion.

In the world, there are currently over 400 mining initiatives, that involve the exploration of rare earth metals, this excludes the count of China. Rising mining projects are boosting the need for sodium cyanide, which is used to extract gold and other precious metals.

In addition to this, a rising infestation of pests is thought to be fueling the expansion of the sodium cyanide market. Pest infestation causes around 40% of the world's crop production loss. Moreover, the world suffers a loss of USD 70 billion due to pest invasion. Sodium cyanide has been used for fumigation purposes to control pests and other insects on stored grains and crops.

Key Sodium Cyanide Market Insights Summary:

Regional Highlights:

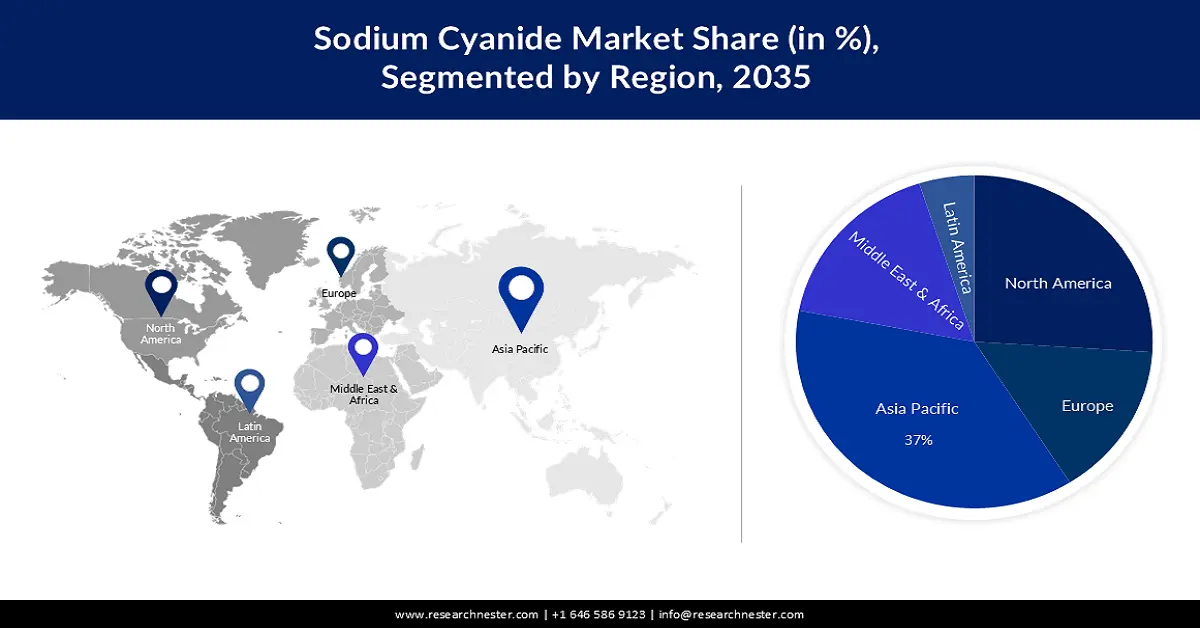

- The Asia Pacific region is projected to secure a 37% share by 2035 in the sodium cyanide market, attributable to the rising number of gold reserves and rapid production of gold.

- North America is anticipated to hold a 26% share by 2035, supported by increased investment in the production of minerals.

Segment Insights:

- The solid segment in the sodium cyanide market is expected to capture about 70% share by 2035, propelled by increasing demand for gold.

- The mining segment is projected to attain nearly 46% share by 2035, underpinned by rising demand for lithium.

Key Growth Trends:

- Growing Trend of Fast Fashion

- Rising Production of Automotives

Major Challenges:

- Presence of New Alternatives

- Negative Perception of Sodium Cyanide

Key Players: Evonik Industries AG, The Chemours Company, Draslovka Holding Company, EPC Engineering and Technologies GmbH, Cynaco International, Sasol Limited, Changsha Hekang Chemical Co., Ltd., Orica Limited, Australian Gold Reagents Pty Ltd., Gujrat Alkalies and Chemicals Limited.

Global Sodium Cyanide Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.3 billion

- 2026 Market Size: USD 2.38 billion

- Projected Market Size: USD 3.37 billion by 2035

- Growth Forecasts: 3.9%

Key Regional Dynamics:

- Largest Region: Asia Pacific (37% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Australia, Canada, Germany

- Emerging Countries: India, Brazil, Indonesia, Mexico, Vietnam

Last updated on : 25 November, 2025

Sodium Cyanide Market - Growth Drivers and Challenges

Growth Drivers

- Growing Trend of Fast Fashion– Fast fashion has increased the production of clothes and other apparel, moreover, the variety has also increased. This in turn has increased the need for sodium cyanide to produce more dues and pigments for the growing apparel production. Clothing and footwear consumption is predicted to rise by 63% by 2030 across the globe.

- Rising Production of Automotives– In 2022, the world produced around 85 million vehicles, and the overall production increased by around 6% from 2021. Sodium cyanide is used in the electroplating process of applying a layer of copper or other metals onto the surfaces of auto parts.

Challenges

- Presence of New Alternatives- As industries progress, there may be initiatives to develop more ecologically friendly and less contingent techniques of metal extraction and processing that are not as dependent on sodium cyanide. This could impact the demand for sodium cyanide.

- Negative Perception of Sodium Cyanide

- Disposal Impact on the Environment

Sodium Cyanide Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

3.9% |

|

Base Year Market Size (2025) |

USD 2.3 billion |

|

Forecast Year Market Size (2035) |

USD 3.37 billion |

|

Regional Scope |

|

Sodium Cyanide Market Segmentation:

Form Segment Analysis

The solid segment is estimated to gain the largest market share of about 70% in the year 2035. The growth of the segment can be attributed to the increasing demand for gold. Solid sodium cyanide is particularly used in dissolving and separating the gold from its ores through a process of leaching and cyanidation. According to the World Gold Council, in 2022 the total supply of gold increased to 3611.9 tonnes from 3568.9 tons in 2021. In addition to this, solid sodium cyanide is much easier to handle in comparison to liquid sodium cyanide, therefore, it is usually used more by the end-user industries.

End User Segment Analysis

The mining segment in the sodium cyanide market is expected to garner a significant share of around 46% in the year 2035. The rising demand for lithium in the world is expected to boost the growth of the segment. Global lithium carbonate equivalent (LCE) production reached 540,000 tonnes in 2021. Demand for lithium is estimated to rise to 1.5 million tonnes by 2025. The lithium is extracted by the procedure of underground mining, therefore, increasing the demand for sodium cyanide.

Our in-depth analysis of the global market includes the following segments:

|

Form |

|

|

End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Sodium Cyanide Market - Regional Analysis

APAC Market Insights

Asia Pacific industry is predicted to dominate majority revenue share of 37% by 2035. The growth of the market can be attributed majorly to the rising number of gold reserves and rapid production of gold. China accounts for around 9% of total gold production and it is the greatest producer of gold in the world. Australia is expected to overtake China in output soon. Australia's gold sector generated 320 tonnes of mined gold in 2022, a 1.5% increase over the previous year. Moreover, the rising production of other minerals will drive market growth in the region. China is also the leading producer of minerals, such as bauxite, copper, cobalt, silver, and magnesium.

North American Market Insights

The North America sodium cyanide market is estimated to be the second largest, registering a share of about 26% by the end of 2035. The growth of the market can be attributed majorly to the increased investment in the production of minerals in the region. The rising investment will increase the need for mining and subsequently the use of sodium cyanide for the extraction of these minerals.

Sodium Cyanide Market Players:

- Evonik Industries AG

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- The Chemours Company

- Draslovka Holding Company

- EPC Engineering and Technologies GmbH

- Cynaco International

- Sasol Limited

- Changsha Hekang Chemical Co., Ltd.

- Orica Limited

- Australian Gold Reagents Pty Ltd.

- Gujrat Alkalies and Chemicals Limited

Recent Developments

- The Chemours Company announced to sell its mining solution business to Draslovka Holding Company, the leading producer of cyanide, the transaction was made for the total cash of USD 250 million.

- Draslovka Holding Company, a Czech-based producer of agriculture chemicals, and cyanide chemicals has announced to acquire the sodium cyanide business of Sasol South Africa Limited.

- Report ID: 5174

- Published Date: Nov 25, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Sodium Cyanide Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.