Liquid Gas Cylinder (LGC) Market Outlook:

Liquid Gas Cylinder (LGC) Market size was valued at USD 5.1 billion in 2025 and is projected to reach USD 9.5 billion by the end of 2035, rising at a CAGR of 7.2% during the forecast period, i.e., 2025-2035. In 2026, the industry size of liquid gas cylinder (LGC) is estimated at USD 5.4 billion.

The liquid gas cylinder (LGC) market outlook remains highly promising, which is supported by increasing industrialization, expanding energy infrastructure, and growing demand across healthcare, manufacturing, and residential applications. The supply chain aspect for liquid gas cylinders comprises raw material inputs such as steel plate, aluminium, and composite fibre materials, along with cylinder forming, welding, finishing, testing, and certification services, followed by logistic distribution to gas-filling plants or end-use sites. In this regard, the World Integrated Trade Solution reported that in 2023, the U.S. imported containers for compressed or liquefied gas valued at approximately USD 549.6 million, which totaled around 138.3 million kilograms. It also stated that major import partners included Mexico, China, and India, reflecting strong global trade integration in the gas cylinder supply chain.

U.S. Imports of Containers for Compressed or Liquefied Gas by Country, 2023

|

Country |

Import Value (USD ‘000) |

Quantity (Kg) |

|

World (Total) |

549,606.86 |

138,313,000 |

|

Mexico |

126,045.60 |

35,184,100 |

|

China |

99,471.29 |

26,790,900 |

|

India |

62,178.75 |

14,010,500 |

|

Thailand |

35,289.70 |

15,799,500 |

|

Canada |

30,245.29 |

10,579,400 |

|

Malaysia |

26,086.05 |

3,673,320 |

|

South Korea |

25,566.38 |

6,384,900 |

Source: WITS

Furthermore, technology investment aspect of the liquid gas cylinder (LGC) market displayed in the shifting mix of cylinder materials towards composites, increased automation and inspection, and enhanced regulatory compliance. Manufacturers are opting for different strategies to manage both cost and quality, which include integrating supply-chain improvements, lean manufacturing, and sourcing of materials. In this regard, the Ministry of Petroleum & Natural Gas, in February 2024, announced that Bharat Petroleum Corporation Limited launched the pure for sure initiative to enhance transparency and safety in LPG delivery across India. It also stated that the system will allow customers to verify cylinder authenticity through tamper-proof QR-coded seals. It is integrated with features such as real-time tracking, AI route optimization, and OTP-based delivery. The initiative reinforces its commitment to the LPG ecosystem, hence denoting a positive market outlook.

Key Liquid Gas Cylinder (LGC) Market Insights Summary:

Regional Highlights:

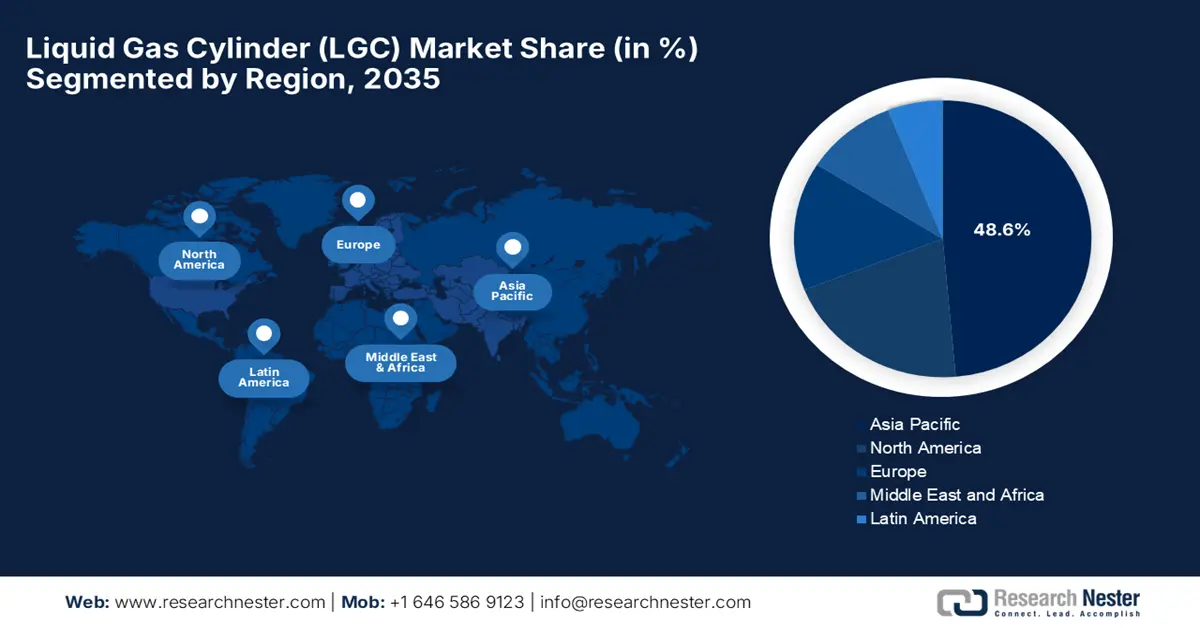

- Asia Pacific in the liquid gas cylinder (LGC) market is projected to hold 48.6% share by 2035, impelled by urbanization, industrialization, and growing household demand for LPG as a clean cooking fuel.

- North America is expected to capture a 32.1% share by 2035, owing to well-established infrastructure, high safety standards, and adoption of LPG across residential, commercial, and industrial sectors.

Segment Insights:

- The steel cylinders segment in the liquid gas cylinder (LGC) Market is projected to account for 70.4% share by 2035, driven by cost-effectiveness, durability, and a wider manufacturing base.

- The industrial use segment is anticipated to gain 50.7% share by 2035, owing to continuous demand across manufacturing, welding, chemical processing, and other industrial sectors.

Key Growth Trends:

- Industrial demand

- Technological advancement

Major Challenges:

- Safety and regulatory compliance

- High manufacturing and material costs

Key Players: Luxfer Gas Cylinders - U.S./U.K., Worthington Industries - U.S., Hexagon Composites ASA (via Ragasco) - Norway, Faber Industrie S.p.A. - Italy, Everest Kanto Cylinder Ltd. - India, Safe Gas Global Inc. - India, Linde plc - Europe, Air Liquide S.A. - France, Taiyo Nippon Sanso Corporation - Japan, Iwatani Corporation - Japan, Chart Industries, Inc. - U.S., Cavagna Group - Italy, Messer Group GmbH - Germany, INOX Air Products Ltd. - India

Global Liquid Gas Cylinder (LGC) Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 5.1 billion

- 2026 Market Size: USD 5.4 billion

- Projected Market Size: USD 9.5 billion by 2035

- Growth Forecasts: 7.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (48.6% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, India, Germany, Japan

- Emerging Countries: Brazil, Indonesia, Mexico, South Africa, Vietnam

Last updated on : 19 November, 2025

Liquid Gas Cylinder (LGC) Market - Growth Drivers and Challenges

Growth Drivers

- Industrial demand: The liquid gas cylinder (LGC) market has strongly benefited from consistent industrial demand across sectors such as manufacturing, welding, and chemical processing. These industries rely on LGCs for safe storage of gases such as oxygen, nitrogen, and argon, which are highly essential for both production and operational continuity. WLGA in February 2022 reported that Copa Energia, which was formed after Copagaz’s acquisition of Liquigás, has become Latin America’s largest LPG distributor, which is readily operating across 24 states with 9.5 million cylinders monthly and offering high-purity gases for both industrial and consumer applications. On the other hand, the company has strengthened supply security through imports from Bolivia and Argentina and continues to expand into renewable energy with small hydroelectric and solar plants, as well as bio-LPG projects in collaboration with universities in Brazil.

- Technological advancements: This is one of the important growth drivers for the liquid gas cylinder (LGC) market since it enhances the safety and efficiency of the cylinder. Also, the cylinders designed in recent times are increasingly equipped with tamper-proof seals, IoT-enabled monitoring, and QR codes, allowing widespread adoption. In November 2024, Time Technoplast Ltd. announced that it had received approval from the Petroleum and Explosives Safety Organization to manufacture type-3 fully wrapped fibre-reinforced composite cylinders for hydrogen-powered fuel cells in UAVs and drones, marking the first company in India to achieve this. It further underscored that these high-pressure cylinders provide a lightweight, energy-dense, and eco-friendly alternative to traditional batteries, thereby enabling longer flight times, higher payloads, and lower operating costs across different applications.

Corporate Developments in the Gas Cylinder and Hydrogen Sector (2022-2025)

|

Year |

Company |

Details |

Opportunity |

|

2025 |

CIMC-Hexagon |

First Type IV high-pressure hydrogen cylinders delivered to Europe |

TPED-certified, 380 bar cylinders, ramping up production |

|

2023 |

Air Water America |

Acquisition of American Gas Products LLC |

Expands helium and industrial gas supply in North America |

|

2022 |

Air Products |

USD 475 million funding for Alberta net-zero hydrogen complex |

Federal and provincial support, large-scale clean hydrogen production |

Source: Company Official Press Releases

- Investments and policy support: The supportive government policies, coupled with strategic investments, are prompting a profitable business environment for the liquid gas cylinder market. The sector also benefits from incentives for industrial gas infrastructure, safety regulations, as well as standards for cylinder manufacturing, which is encouraging modernization of production facilities. In this regard, the U.S. Department of the Treasury in January 2025 reported that it released final rules for the section 45v clean hydrogen production tax credit under the Inflation Reduction Act, along with the IRS, thereby providing clarity, flexibility, and investment certainty for clean hydrogen projects. It also stated that by incentivizing clean hydrogen production, which includes the DOE’s regional clean hydrogen hubs, the policy supports the deployment of sustainable energy solutions, drives industry growth.

Challenges

- Safety and regulatory compliance: One of the primary challenges associated with the liquid gas cylinder (LGC) market is stringent safety and regulatory standards, since these cylinders store pressurized gases, which are inherently hazardous. Also, any type of leak, rupture, or mishandling can cause fire, explosion, or even toxic exposure. In this regard most of the nation’s impose extremely rigorous safety certifications, inspection routines, and compliance standards such as ISO, PESO in India, DOT in the U.S. Therefore, most of the manufacturers must continuously invest in safety testing, quality assurance, and staff training to meet these evolving regulations wherein failure can in turn result in legal penalties thereby reducing the firm’s credibility in this field.

- High manufacturing and material costs: This aspect is diminishing the growth dynamics of the liquid gas cylinder market since the production of composite and lightweight cylinders involves expensive raw materials such as carbon fiber, polymers, or high-grade aluminum. On the other hand, manufacturing processes require specialized equipment, precision engineering, and skilled labor, which makes it extremely challenging for firms from price-sensitive regions. Hence, these factors increase the cost per cylinder, creating imbalances in affordability with performance. This is particularly pressing in emerging markets where there are cost-sensitive consumers who may prefer affordable cylinders, ultimately slowing down liquid gas cylinder market expansion.

Liquid Gas Cylinder (LGC) Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

7.2% |

|

Base Year Market Size (2025) |

USD 5.1 billion |

|

Forecast Year Market Size (2035) |

USD 9.5 billion |

|

Regional Scope |

|

Liquid Gas Cylinder (LGC) Market Segmentation:

Material Segment Analysis

The steel cylinders segment in the liquid gas cylinder (LGC) market is expected to dominate, capturing the largest revenue share of 70.4% by the end of 2035. The cost-effectiveness, durability, and wider manufacturing base are the key factors behind this leadership. Also, the existing infrastructure, refill exchange networks, and regulatory familiarity are supporting the dominance of the new composite materials. In August 2025, Air Water India announced that it had begun operations at its new liquefied gas manufacturing plant in Chennai to meet rising industrial and medical gas demand. It also stated that this facility will significantly strengthen the company’s regional supply chain and support key sectors such as automotive, EV, and electronics manufacturing. Hence, this marks a major step toward expanding domestic production capabilities and achieving its target of 30 billion yen in revenue by the end of 2027.

Application Segment Analysis

In the case of application, the industrial use segment is expected to gain a share of 50.7% in the liquid gas cylinder market throughout the analyzed timeframe. The growth in the segment is driven by the continuous demand in terms of manufacturing, welding, chemical processing, and other industrial sectors as well. In July 2025, Linde announced major U.S. investments to support the growing commercial space sector, expanding its Mims, Florida, facility to supply liquid oxygen and nitrogen for rocket launches and constructing a new air separation unit in Brownsville, Texas. Thus, these projects are expected to enhance the company’s industrial gas infrastructure and strengthen its role in the U.S. space sector as well. Overall, the rising industrial applications, coupled with strategic investments by key players such as Linde, will reinforce the dominance of the industrial use segment in the liquid gas cylinder market through 2035.

Gas Type Segment Analysis

By the end of the forecast duration LPG segment based on gas type is likely to grow with a considerable share of 40.8% in the liquid gas cylinder market. Their widespread utilization across various sectors, such as residential, commercial, and small‑industrial settings, is positioning the subtype as the gold standard for generating revenue in this field. The households, commercial kitchens, and small industries are converting to LPG as a cleaner fuel, due to which the demand for LPG cylinders is significantly rising. Air Water India, in June 2023, announced the construction of a new cylinder gas filling station in Faridabad, along with the establishment of its Gurgaon Office to strengthen sales and service in northern India. Hence, this move will enhance logistics efficiency and meet rising industrial gas demand from the region’s manufacturing sector, helping it to grow its industrial gas infrastructure and support the country’s rapidly developing economy in terms of LGC.

Our in-depth analysis of the liquid gas cylinder (LGC) market includes the following segments:

|

Segment |

Subsegments |

|

Material |

|

|

Application |

|

|

Gas Type |

|

|

Cylinder Size |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Liquid Gas Cylinder (LGC) Market - Regional Analysis

APAC Market Insights

In the liquid gas cylinder (LGC) market, the Asia Pacific is expected to capture the largest revenue share of 48.6% during the forecast duration. This expansion is effectively attributable to urbanization, industrialization, and growing household demand for LPG as a clean cooking fuel. Prominent countries such as India, China, Japan, and Australia are witnessing increased government initiatives promoting LPG adoption, infrastructure development, and safety standards for cylinder use. In this regard Ministry of Petroleum & Natural Gas in March 2024 announced that the government of India has approved the continuation of a targeted subsidy of Rs. 300 (USD 3.59) per 14.2 kg LPG cylinder for pradhan mantri ujjwala yojana beneficiaries, which enables coverage up to 12 refills per year for the year 2024 to 2025, where the subsidies will be credited directly to their bank accounts. This initiative, benefiting over 10.27 crore consumers, as a result, average LPG consumption among PMUY beneficiaries has risen by 29% from 2019 to 2020, reflecting sustained usage.

China’s liquid gas cylinder market is gaining momentum due to both industrial and residential demand, wherein the government is proactively promoting cleaner energy alternatives. The country also benefits from widespread adoption of LPG cylinders in urban and semi-urban areas, which is positively influenced by strong domestic manufacturing capabilities and an expanding distribution network. In March 2022, CIMC-Hexagon Hydrogen Energy Development Limited announced that it signed an investment agreement with the Luancheng District Government of Shijiazhuang, Hebei Province, to build production lines for Type III and IV high-pressure hydrogen cylinders and integrated supply systems for vehicles, railroads, and marine applications. It also stated that the facility aims to become a benchmark for automated manufacturing in China and Southeast Asia, hence expanding the national hydrogen industry chain.

India is emerging as one of the largest and prominent global landscapes for the liquid gas cylinder (LGC) market, backed by the presence of government schemes such as the Pradhan Mantri Ujjwala Yojana. The country has witnessed lucrative infrastructure investments, in which distributors are expanding cylinder availability to remote locations. Testifying to this, IOCL reported that its popular brand called Indane has grown from serving 2,000 households to becoming India’s largest LPG brand, reaching nearly 18 crore kitchens and offering cylinders from 2 kg to 425 kg for domestic, commercial, and industrial use. It also highlighted that the Indane LPG is available across the nation, including remote areas, with metro prices for a 14.2 kg cylinder ranging from Rs. 852.50 to Rs. 879 (USD 10.21 to USD 10.53) and for a 19 kg cylinder from Rs. 1,542 to Rs. 1,750 (USD 18.47 to USD 20.96) as of 2025.

North America Market Insights

The liquid gas cylinder market in North America is supported by a well-established infrastructure, high safety standards, and diverse applications across sectors such as residential, commercial, and industrial. The region also benefits from rising awareness of LPG as a cleaner energy source when compared to traditional fuels and the widespread adoption of portable cylinders for both outdoor and recreational purposes. On the other hand, manufacturers are capturing consumer interest through technological advancements in cylinder design, leak detection systems, and automated refill processes, thereby enhancing operational efficiency and safety. In addition, there exist regional energy policies that are incentivizing low-emission fuel adoption and the growing use of LPG in remote or off-grid locations. Hence, the existence of all of these factors creates a lucrative growth opportunity for domestic as well as international players.

The U.S. has successfully acquired a dominant position in the regional liquid gas cylinder market, which is positively impacted by residential, commercial, and recreational demand, particularly in suburban and rural areas. The country also benefits from portable cylinders, which are extensively utilized for grilling, heating, and camping are popular, while Industrial applications include manufacturing, agriculture, and construction. In October 2024, Honeywell announced that it acquired Air Products’ liquefied natural gas process technology and equipment business for USD 1.81 billion in cash, as a result, enhancing its energy transition capabilities with end-to-end LNG solutions and digital automation. The acquisition includes Air Products’ coil-wound heat exchangers and related equipment, expanding the company’s installed base and aftermarket service opportunities across the globe.

Canada in the liquid gas cylinder market is reshaped by industrial and off-grid energy applications, particularly in remote regions and northern communities where LPG is a critical fuel source. The government policies promoting renewable energy adoption, safe cylinder handling, and modernized distribution infrastructure are also prompting a profitable business environment for the country’s market. As of January 2025 Canadian government reports that the country is developing a highly competitive liquefied natural gas industry, where natural gas is cooled to −160°C to become a liquid, reducing its volume by 1/600th for economical transport through specialized tankers. It also stated that these LNG projects undergo strict federal and provincial regulatory approvals and compliance with safety standards like CSA Z276-01. Currently, Canada has LNG facilities serving domestic markets in Saint John and Hamilton, with multiple export projects proposed to expand the country’s role in global LNG trade.

Europe Market Insights

The widespread household LPG use, industrial applications, and a strong focus on energy transition and sustainability are consistently driving business in Europe’s liquid gas cylinder (LGC) market. Countries across the region are readily making investments in safer cylinder technologies, automated refill services, and supply chains, stimulating business in this field. In October 2025, Liquid Gas Europe prompted the European Commission to adopt a technology of neutral heating and cooling strategy that addresses structural and economic barriers in terms of rural and off-grid areas, where nearly 50 million households reported inefficient buildings and high-carbon fuels. It also emphasized renewable liquid gases such as bioLPG and rDME as cost-effective, scalable solutions that can cut lifecycle emissions by up to 90% while using existing infrastructure, hence denoting a positive market outlook.

Germany has a huge potential to capitalize on the liquid gas cylinder market due to the high safety standards, rigorous quality control, and extensive utilization in both residential and industrial sectors. Also, the government’s push for energy efficiency and reduced carbon emissions has encouraged LPG adoption as an alternative to traditional fuels. In February 2025, Clean Energy Wire reported that Germany’s state-owned LNG terminals at Wilhelmshaven and Brunsbüttel handled most of the country’s imported liquefied natural gas, operating at 65% capacity, while privately-owned Deutsche Regas terminals on the Baltic Sea accounted for only 8.5 TWh of the 67.6 TWh imported. It also underscored that Germany currently sources about 95% of its gas from abroad, primarily from Norway, following a major energy supply shift after Russia’s 2022 invasion of Ukraine.

The U.K. is the central player in the liquid gas cylinder market, which serves both household and commercial sectors. The industry also benefits from the adoption of LPG, supported by government policies and safety regulations. Companies in the country are concentrating on smart cylinder solutions such as QR-coded seals, IoT-enabled monitoring, and home delivery services to enhance both convenience and safety. On the other hand, industrial adoption for hospitality, manufacturing, and agricultural operations also contributes to liquid gas cylinder market development in the U.K. Environmental awareness, coupled with technological advancements and modernized distribution systems, resulted in a competitive landscape in the country, making it responsive to evolving energy needs. Furthermore, the heightened demand for cleaner and more efficient energy solutions is driving innovation and investment in both residential and industrial liquid gas applications across the country’s vast geography.

Key Liquid Gas Cylinder (LGC) Market Players:

- Luxfer Gas Cylinders - U.S./U.K.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Worthington Industries - U.S.

- Hexagon Composites ASA (via Ragasco) - Norway

- Faber Industrie S.p.A. - Italy

- Everest Kanto Cylinder Ltd. - India

- Safe Gas Global Inc. - India

- Linde plc - Europe

- Air Liquide S.A. - France

- Taiyo Nippon Sanso Corporation - Japan

- Iwatani Corporation - Japan

- Chart Industries, Inc. - U.S.

- Cavagna Group - Italy

- Messer Group GmbH - Germany

- INOX Air Products Ltd. - India

- Luxfer Holdings PLC is a UK-listed company with a business unit, Luxfer Gas Cylinders, headquartered in Riverside, California, and manufacturing facilities in the U.S., UK, Canada, and China. Luxfer specializes in high-pressure composite and aluminium cylinders used in applications ranging from firefighting, medical oxygen, alternative fuels, and aerospace. The company’s strategic initiatives include expanding production capacity and developing its G Stor Hydrosphere MEGC system for hydrogen transport.

- Worthington Industries, Inc., headquartered in Columbus, Ohio, is a diversified steel processing and cylinder manufacturing business, globally supplying pressure cylinders for LPG, industrial gases, cryogenics, and alternative fuel storage. Worthington is also focusing on sustainability by using low-carbon steel (XCarb recycled/renewably produced) capturing the interest of both consumers and investors in this field.

- Hexagon Composites ASA, a Norway-based global leader in composite cylinder technology, Hexagon, through its subdivision Hexagon Ragasco, produces lightweight LPG composite cylinders and high-pressure Type 4 cylinders for hydrogen applications. The company recently initiated a strategic review of its LPG cylinder business, signalling a possible refocus on hydrogen/clean fuel cylinders and digital sensor-enabled products.

- Linde plc. Although primarily known as an industrial gases’ giant, its product portfolio includes gas cylinders and containment solutions relevant to the liquid gas cylinder market. Its strategy emphasizes global reach, a comprehensive product range, and leveraging its supply chain and distribution networks to serve industrial, healthcare, and specialty gas segments worldwide.

- Air Liquide S.A. Based in France, Air Liquide is another major player in industrial gases and related storage/containment equipment. In the cylinder market, the company’s competitive strength comes from its broad global footprint (in over 70 countries), emphasis on regulatory compliance, safety, and sustainability in materials and supply chain operations.

Below is the list of some prominent players operating in the global liquid gas cylinder (LGC) market:

In the global liquid gas cylinder (LGC) market, competition lies around material innovation, cost efficiency, and global supply chain scale. Leading pioneers in this field are making investments heavily in composite and lightweight cylinder technologies to reduce weight and logistical costs, and are expanding geographically through manufacturing footprints in high-growth markets. In July 2025, Hexagon Composites announced that it had completely acquired Worthington’s alternative fuels business, SES, which strengthened its footprint and created SES Composites for high-pressure Type 3 and 4 cylinders in Europe. Hence, the acquisition enhances Hexagon’s capabilities in CNG fuel systems for transit OEMs based in Europe, leveraging synergies across production and supply chains. The transaction was valued at €11.7 million (USD 12.75 million), wherein the company aims to focus on emerging energy segments while maintaining joint ownership of SES’s steel cylinder operations in Austria.

Corporate Landscape of the Liquid Gas Cylinder (LGC) Market:

Recent Developments

- In April 2024, Hexagon Ragasco announced that, in partnership with Linde, it had launched the Linktra Smart cylinder nationwide in Norway, which allows consumers to monitor gas levels via mobile phones and provides LPG distributors with real-time usage data to optimize logistics.

- In February 2024, Emirates Gas, a subsidiary of ENOC Group, introduced the UAE’s first-ever marine LPG Composite Cylinders in 2 kg and 11 kg sizes during the Dubai International Boat Show.

- Report ID: 8246

- Published Date: Nov 19, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Liquid Gas Cylinder (LGC) Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.