Natural Gas Liquids Market Outlook:

Natural Gas Liquids Market size was USD 16.3 billion in 2025 and is estimated to reach USD 29.4 billion by the end of 2035, expanding at a CAGR of 6.1% during the forecast period, i.e., 2026-2035. In 2026, the industry size of natural gas liquids is assessed at USD 17.2 billion.

The booming energy demand is creating a profitable environment for natural gas liquid manufacturers. The clean energy trend is fueling the demand for liquefied petroleum gas (LPG), which is derived from propane and butane. Both developed and developing markets are witnessing a sustainability trend and government initiatives aimed at energy transition. According to the International Energy Agency (IEA), global demand for natural gas hit a new record in 2024, with most of the growth coming from developing countries. Early data indicate that gas use grew by 2.7%, or 115 billion cubic meters (about 4 exajoules), with Asia capturing around 40% of this increase due to its expanding economy. Thus, the rising population, increasing urbanization, and supportive government policies are collectively contributing to the high trade of natural gas liquids.

Key Natural Gas Liquids Market Insights Summary:

Regional Highlights:

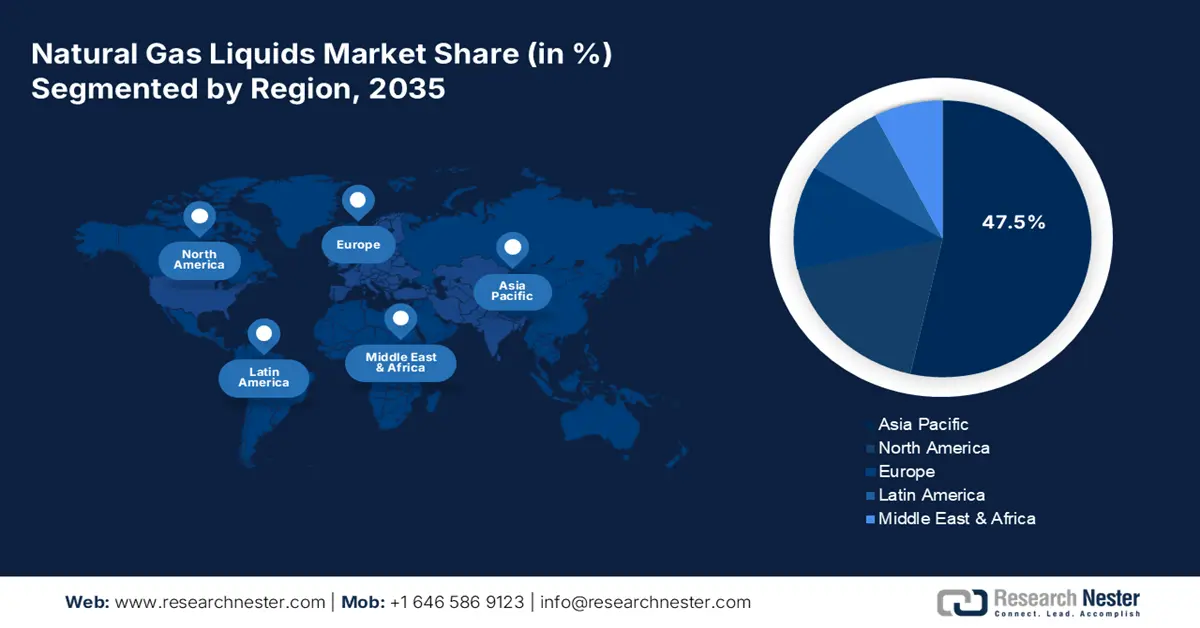

- The Asia Pacific natural gas liquids market is projected to account for 47.5% of the global share by 2035, owing to surging petrochemical demand, rising energy consumption, and expanding industrial capacity.

- North America is expected to secure the second-largest share during the forecast period, impelled by the shale gas revolution and robust midstream infrastructure supporting NGL trade.

Segment Insights:

- The ethane segment is projected to account for 38.1% of the global natural gas liquids market share through 2035, propelled by its critical role in petrochemical feedstock and ethylene production.

- The industrial segment is expected to hold a 47.5% share by 2035, supported by the rising use of NGLs as raw materials in large-scale petrochemical and manufacturing processes.

Key Growth Trends:

- Rise in petrochemical projects

- Shift toward petrochemical feedstocks

Major Challenges:

- Infrastructure bottlenecks

- Stringent environmental regulations

Key Players: Saudi Arabian Oil Company (Saudi Aramco), Exxon Mobil Corporation, Royal Dutch Shell plc (Shell), QatarEnergy, Chevron Corporation, Abu Dhabi National Oil Company (ADNOC), TotalEnergies SE, BP p.l.c., ConocoPhillips, Petroliam Nasional Berhad (Petronas), Petróleo Brasileiro S.A. (Petrobras), Equinor ASA, Eni S.p.A., Woodside Energy Group Ltd, Reliance Industries Limited, Oil and Natural Gas Corporation (ONGC).

Global Natural Gas Liquids Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 16.3 billion

- 2026 Market Size: USD 17.2 billion

- Projected Market Size: USD 29.4 billion by 2035

- Growth Forecasts: 6.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (47.5% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, China, India, Japan, South Korea

- Emerging Countries: Indonesia, Vietnam, Philippines, Brazil, United Arab Emirates

Last updated on : 8 October, 2025

Natural Gas Liquids Market - Growth Drivers and Challenges

Growth Drivers

- Rise in petrochemical projects: The swift expansion of new petrochemical projects across the world is accelerating the production and commercialization of natural gas liquids. Countries in North America, Europe, Asia, and the Middle East are pouring billions into integrated refinery-petrochemical complexes. In September 2025, ExxonMobil Corporation entered into a strategic collaboration with GHGSat to track and reduce methane emissions across its land-based operations in North America and Asia, including the United States, Canada, Papua New Guinea, and Indonesia. This partnership aims to monitor and control methane on a large scale. Thus, hefty investments are expected to secure long-term industrial demand for NGLs and boost global trade.

- Shift toward petrochemical feedstocks: The expanding demand for natural gas liquids as raw materials for the production of various by-products, rather than just sticking to fuel, is anticipated to boost the natural gas liquids market revenues of key players in the years ahead. Ethane and propane are leading the path, as they are the top choices for ethylene production, which is cost-effective and gives better results than traditional naphtha. This transformation is highly noticeable in Asia Pacific, where rapid industrialization and urbanization are driving demand for plastics and synthetic materials. For instance, in September 2025, Asahi Kasei, Mitsui Chemicals, and Mitsubishi Chemical teamed up to form a partnership to run ethylene production facilities in western Japan. Thus, the structural shift toward NGL-derived feedstocks is expected to propel the demand for ethane and propane and influence global trade patterns in the years ahead.

- Value-added products from NGLs: The transformation of natural gas liquids into valuable products is one of the promising possibilities set to double the revenues of key players. The growing demand for plastics, advanced materials, and specialized chemicals in both developed and developing countries is propelling the consumption of NGLs. Not only this, as the sustainability trend gains momentum, companies are directing their attention towards the production of recyclable and eco-friendly plastics using NGLs, ensuring their importance in a low-carbon future. Thus, downstream integration into chemical manufacturing is expected to offer high margins to leading companies.

Challenges

- Infrastructure bottlenecks: The insufficient midstream infrastructure is hampering the market growth in some regions. The underdeveloped or fragmented markets with low infrastructure budgets are expected to witness low production and commercialization of natural gas liquids. However, some big companies are targeting these markets to boost their revenue shares through strategic partnerships with public entities and collaboration with domestic players.

- Stringent environmental regulations: The strict environmental regulations are likely to hinder the demand for natural gas liquids to some extent. The push for net-zero targets by the public and environmental organizations is creating a challenging environment for natural gas liquid manufacturers. NGLs, though being cleaner, are still hydrocarbons and are being manufactured through an energy-intensive process. These factors are thus lowering long-term investments in the big NGL projects.

Natural Gas Liquids Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.1% |

|

Base Year Market Size (2025) |

USD 16.3 billion |

|

Forecast Year Market Size (2035) |

USD 29.4 billion |

|

Regional Scope |

|

Natural Gas Liquids Market Segmentation:

Product Segment Analysis

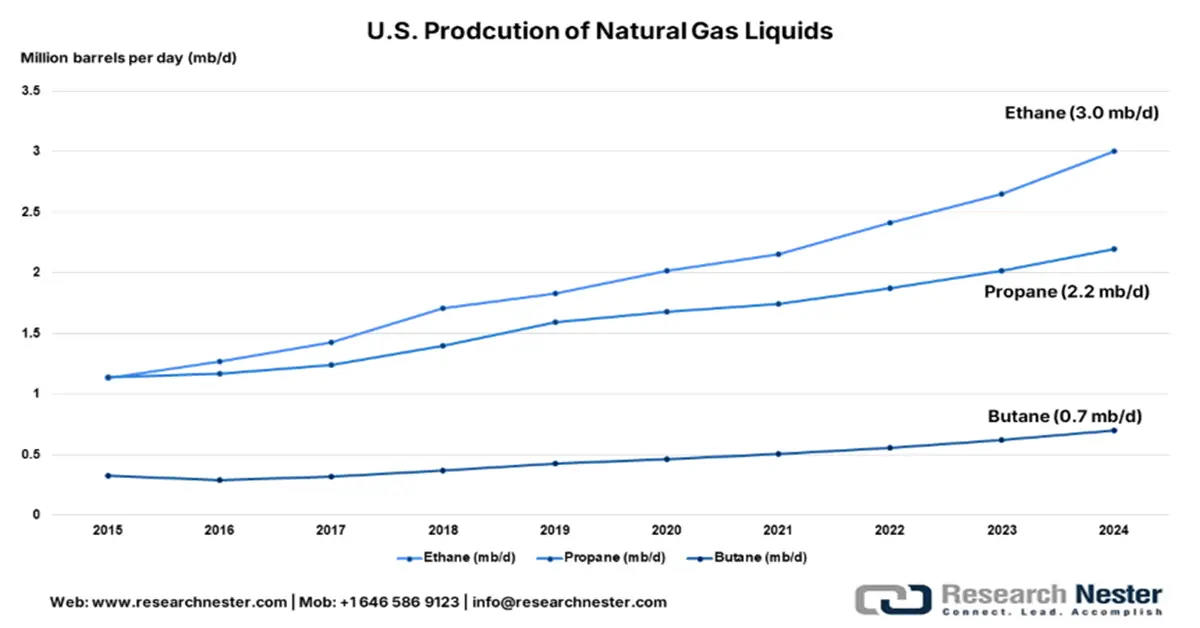

The ethane segment is projected to account for 38.1% of the global natural gas liquids market share through 2035. The prime factor boosting ethane consumption is its key role in petrochemical feedstock and ethylene. Some of the developed countries are leading the trade of ethane, while Asia and the Middle East, focused on expanding petrochemical capacity, are set to drive the segmental growth in the years ahead. The Federal Reserve Bank of Dallas reveals that the U.S. ethane production grew by 28% in 2024, reaching 3.0 million barrels per day by November. The same source also states that most of the U.S. ethane export share is captured by China, as its need for ethylene in the petrochemical industry has increased substantially. Overall, ethane’s cost-effectiveness and high yield are anticipated to drive its global sales in the coming years.

Source: Federal Reserve Bank of Dallas

Application Segment Analysis

The industrial segment is expected to hold 47.5% share throughout the study period. NGL’s importance as a raw material for large-scale petrochemical and manufacturing processes is contributing to its high industrial demand. The United Nations Industrial Development Organization (UNIDO) states in its International Yearbook of Industrial Statistics that the industrial sector makes up 21.3% of the world’s economy. The robust demand for ethane, propane, and butane is reported in industrial processes. They are widely used for the production of ethylene, propylene, and other base chemicals.

Our in-depth analysis of the natural gas liquids (NGL) market includes the following segments:

|

Segment |

Subsegments |

|

Product |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Natural Gas Liquids Market - Regional Analysis

APAC Market Insights

The Asia Pacific natural gas liquids market is estimated to hold 47.5% of the global revenue share through 2035. The surging petrochemical demand and rising energy consumption are the top driving factors. The expanding industrial capacity is also boosting a high demand for natural gas liquids. China, India, South Korea, and Japan are some of the top marketplaces in the region. Indonesia, Vietnam, and the Philippines, where propane and butane are increasingly replacing biomass and kerosene for household cooking and heating, are further opening lucrative doors for natural gas liquid producers.

China leads sales of natural gas liquids owing to the increased demand for petrochemicals and clean energy trends. The robust manufacturing activities and swift urbanization are pushing a high demand for natural gas liquids. The U.S. Energy Information Administration (EIA) reports that in 2023, China used 7% more natural gas, or an extra 2.6 billion cubic feet per day, compared to 2022. Residential and commercial consumption increased by 8%, owing to a shift towards natural gas from coal. Overall, the country is expected to be investment investment-worthy marketplace for both domestic and international companies.

The India market is expected to increase at the fastest CAGR between 2026 and 2035, owing to the strong growth in LPG consumption and rising petrochemical feedstock demand. The hefty government budgets are attracting several international investors. The India Brand Equity Foundation (IBEF) disclosed that the Union Budget for 2025-26 has set aside about USD 640.46 million for the Ministry of Petroleum and Natural Gas to support the second phase of the Indian Strategic Petroleum Reserves Ltd (ISPRL) project. This project aims to convert two large underground caverns into storage facilities for petroleum. The 100% foreign direct investment (FDI) in upstream and private sector refining projects is also set to offer hefty long-term returns to key players.

North America Market Insights

The North America natural gas liquids market is poised to hold the second-largest global revenue share throughout the forecast period. The shale gas revolution is primarily driving the sales of natural gas liquids. The strong presence of leading companies is propelling the trade of natural gas liquids in the region. The domestic consumption and global supply are expected to be led by the fractionation capacity and midstream infrastructure. The U.S. and Canada are both the most profitable marketplaces in North America.

The sales of natural gas liquids in the U.S. are expected to be driven by massive production and export capability. According to EIA, the field production of NGLs totaled 7,041 thousand barrels per day in 2024. The easy availability of raw materials and continuous technological advancements are contributing to the market growth. The Federal Reserve Bank of St. Louis disclosed that the producer price index for NGL extraction stood at 198.256 in January 2025. The expanding industrial activities are further driving the consumption of NGLs.

The Canada natural gas liquids market is estimated to grow at a high pace, due to major production and commercialization activities. The rich natural gas reserves of ethane, propane, and butane in Alberta and British Columbia are aiding the country in uplifting its position in the global landscape. The report by the Canada Energy Regulator reveals that in 2024, the country exported an average of 218,300 barrels of propane and 56,100 barrels of butane per day. This is a 9.2% increase for propane and a 15% increase for butane compared to the previous year. Strategic public-private partnerships and expanding overseas NGL demand are attracting key investors.

Europe Market Insights

The Europe natural gas liquids market is set to increase at the fastest pace from 2026 to 2035. The high consumption of petrochemicals and energy transition policies are accelerating the demand for natural gas liquids. The residential and commercial sectors are prime end users of natural gas liquids, including propane, butane, and ethane. The expanding LPG demand in Eastern and Southern Europe is further contributing to the overall market growth.

The U.K. leads the sales of natural gas liquids owing to its strong petrochemical sector and energy diversification strategy. The residential and commercial heating markets, especially in rural areas, are mainly boosting the consumption of liquefied natural gas. The established infrastructure and evolving low-carbon initiatives are likely to attract several international players in the years ahead.

The NGL demand in Germany is poised to be driven by the increasing industrial automation and infrastructure modernization initiatives. The expanding demand for ethylene and propylene in the manufacturing sector is anticipated to double the profits of key players in the coming years. Further, public-private investments in LPG infrastructure expansion are estimated to push the position of the domestic market across the EU landscape.

Key Natural Gas Liquids Market Players:

- Saudi Arabian Oil Company (Saudi Aramco)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Exxon Mobil Corporation

- Royal Dutch Shell plc (Shell)

- QatarEnergy

- Chevron Corporation

- Abu Dhabi National Oil Company (ADNOC)

- TotalEnergies SE

- BP p.l.c.

- ConocoPhillips

- Petroliam Nasional Berhad (Petronas)

- Petróleo Brasileiro S.A. (Petrobras)

- Equinor ASA

- Eni S.p.A.

- Woodside Energy Group Ltd

- Reliance Industries Limited

- Oil and Natural Gas Corporation (ONGC)

The natural gas liquids market is mainly dominated by large-scale companies, creating a challenging competitive landscape. These industry giants are controlling the space through owning big gas fields and petrochemical off-take. The leading companies are also investing in R&D activities to boost their market positions and align with sustainability trends. Further, some of the key players are targeting high-potential markets to earn lucrative gains from untapped opportunities. The organic sales are poised to double the revenues of NGL companies in the years ahead.

Some of the key players in the natural gas liquids market include:

Recent Developments

- In August 2025, AMIGO LNG, signed a 20-year agreement with Gunvor to supply 0.85 million tons of LNG per year starting in late 2028. This LNG is estimated to come from the first part of their planned 7.8 million tons per year LNG export facility in Guaymas, Mexico.

- In June 2025, Plains All American Pipeline, L.P., and Plains GP Holdings announced they signed agreements to sell most of their natural gas liquids (NGL) business to Keyera Corp. for about USD 3.75 billion. The deal is expected to be completed in early 2026, pending standard conditions and regulatory approvals.

- In April 2025, JERA Co., Inc. and Saibu Gas Co., Ltd. agreed to work together to ensure a steady supply of LNG. They are set to use the Hibiki LNG Terminal strategically to support their global business growth.

- In July 2023, the European Commission announced that the EU and Japan are strengthening their energy partnership by starting a special discussion on global liquefied natural gas (LNG). This dialogue focused on three main areas: ensuring a steady global LNG supply, making markets clearer and fairer, and reducing methane emissions in the LNG supply chain.

- Report ID: 8178

- Published Date: Oct 08, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Natural Gas Liquids Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.