CNG Tank Market Outlook:

CNG Tank Market size was valued at USD 2.78 billion in 2025 and is expected to reach USD 6.4 billion by 2035, registering around 8.7% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of CNG tank is assessed at USD 3 billion.

The lower the carbon footprint, the more countries are promoting the use of CNG vehicles for transportation and logistics. Governments are offering various schemes and policies in the form of incentives, tax benefits, and subsidies to increase the consumption of CNG. The majority of countries have replaced their conventional public transportation with CNG tank-based vehicles. The integration of CNG in automobiles is set to increase the profits of leading companies in the year ahead. The research and development focused on the hydrogen-based CNG is generating positive earning opportunities for industry giants.

For instance, the U.S. government invested more than USD 233.8 million in the CNG transit initiative. The project aims to advance public transport buses by integrating CNG technologies. Such huge funding is expanding the compressed natural gas infrastructure and boosting the revenues of key CNG tanks market players. Such investments are increasing the dominance of the country in the zero-emission landscape and mitigating the reliance on fossil fuel buses. CNG tank-installed transport buses are more cost-effective and represent leadership in renewable gas transportation.

Key Compressed Natural Gas (CNG) Tank Market Insights Summary:

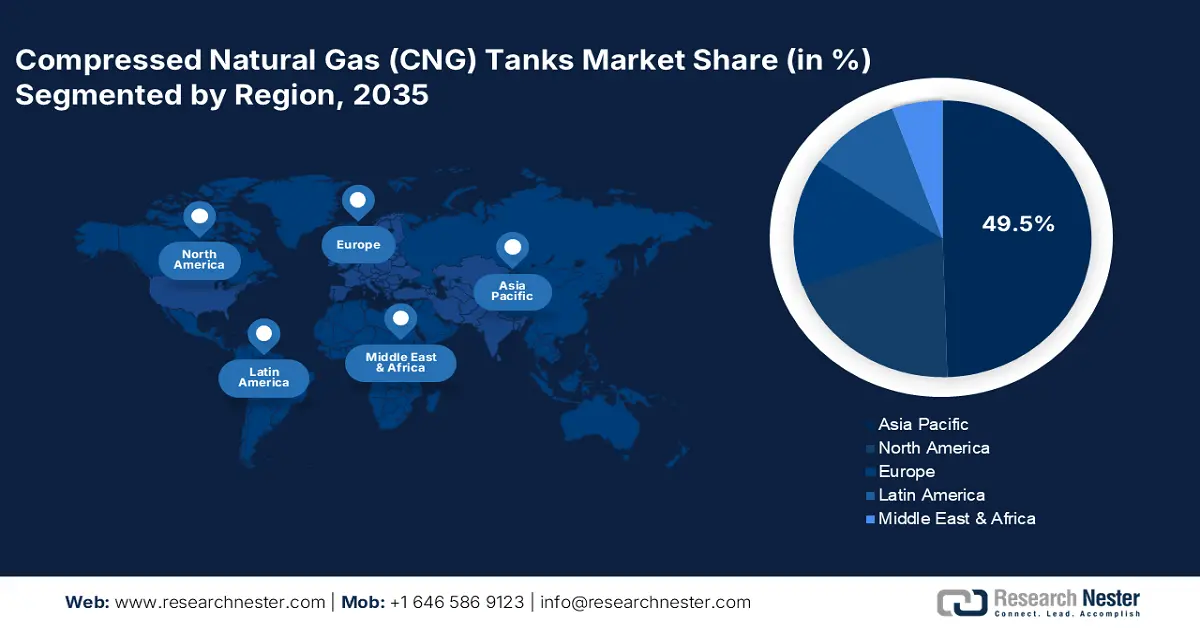

Regional Highlights:

- Asia Pacific CNG tanks market will dominate over 49.50% share by 2035, driven by rising investments in natural gas storage.

- North America market will exhibit a robust rate by 2035, driven by carbon neutrality goals and automotive CNG demand.

Segment Insights:

- The light-duty vehicles segment in the cng tank market is poised for substantial growth during 2026-2035, driven by rising demand for zero-emission and cost-effective transportation.

- The refinery segment in the cng tank market is forecasted to attain a 35.10% share by 2035, influenced by increased cng tank applications in fuel desulfurization processes.

Key Growth Trends:

- CNG infrastructure expansion

- Increasing use in automobiles

Major Challenges:

- High CAPEX

- Lack of awareness & infrastructure

Key Players: PJSC Gazprom, TotalEnergies SE, Faber Industrie S.p.A, Hexagon Composites ASA, and Luxfer Gas Cylinders.

Global Compressed Natural Gas (CNG) Tank Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.78 billion

- 2026 Market Size: USD 3 billion

- Projected Market Size: USD 6.4 billion by 2035

- Growth Forecasts: 8.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (49.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, India, Japan, Germany

- Emerging Countries: China, India, South Korea, Brazil, Mexico

Last updated on : 8 September, 2025

CNG Tank Market Growth Drivers and Challenges:

Growth Drivers

-

CNG infrastructure expansion: The swiftly developing infrastructure of natural gas, such as LNG and CNG, is both developed and high-potential economies are opening lucrative doors for CNG companies. The countries are expanding their pipeline networks owing to the sustainability trend. The carbon neutrality aim is to further promote the sales of compressed natural gas tanks. According to the report by the International Energy Agency (IEA), the government of Lithuania is highly pushing the use of compressed natural gas and liquefied natural gas in transportation. This rising use of alternative fuels is poised to fuel the demand for CNG tanks. The transport sector of Lithuania consumed 1,225 TJ of natural gas in 2022.

-

Increasing use in automobiles: The lower prices of CNG compared to other fuels are augmenting their demand in the automotive sector. The companies are increasingly developing CNG-based vehicles, considering this trend. This zero-emission move is fueling the sales of compressed natural gas tanks for all vehicle sizes. The aftermarket for CNG tanks is anticipated to gain momentum during the foreseeable period, as many companies are focusing on the development of innovative cylinders. Hexagon Agility, in February 2024, confirmed that it received orders for compressed natural gas and renewable natural gas systems. These products are set to be installed in the Cummins X15N CNG engines of major-sized trucks.

Challenges

-

High CAPEX: The high capital investment required for the production of compressed natural gas cylinders or tanks is challenging the revenue growth of the CNG tanks market players. The supply chain disruptions in raw materials used in the production of compressed natural gas tanks increase the cost of the final product. The significant infrastructure investments also deter many low-budget companies from expanding their operations in the compressed natural gas tank business.

-

Lack of awareness & infrastructure: The lack of awareness and resistance to change are hampering the sales of compressed natural gas tanks in price-sensitive CNG tanks markets. Low budgets are hindering the CNG gas infrastructure growth. The dominance of fossil fuels such as petrol and diesel is lowering the importance of CNG gas. The lenient environmental regulations are also boosting the use of fossil fuel-powered vehicles, limiting the sales of CNC vehicles. All of these factors are acting as major drawbacks for the compressed natural gas tank trade.

CNG Tank Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

8.7% |

|

Base Year Market Size (2025) |

USD 2.78 billion |

|

Forecast Year Market Size (2035) |

USD 6.4 billion |

|

Regional Scope |

|

CNG Tank Market Segmentation:

Application Segment Analysis

The refinery segment is expected to capture 35.1% of the global CNG tanks market share by 2035. The importance of refineries in desulfurizing fuels is contributing to their dominance in the CNG tank market. CNG tanks are highly used as efficient storage solutions by the refinery facilities, which directly contributes to their sales growth. The continuous advancements and modernizations of refinery infrastructure are set to boost the installation of advanced CNG tanks. Furthermore, the supportive government policies and shift towards renewable fuels are accelerating the application of CNG tanks in refineries.

End use Segment Analysis

The light-duty vehicles are projected to account for 65.7% of the global CNG tanks market share throughout the assessed period. The growing popularity of zero-emission vehicles is anticipated to drive the sales of CNG tanks in the years ahead. The cost-effectiveness and benefits of mitigating carbon footprint are boosting the sales of CNG tank-based light-duty vehicles. The increasing expansion of CNG infrastructure in developing regions is expected to create a profitable space for CNG vehicle producers. The continuous technological advancements are also boosting the development of advanced CNG tanks. The aftermarket manufacturers are estimated to earn higher gains in the coming years.

Our in-depth analysis of the compressed natural gas (CNG) tanks market includes the following segments:

|

Type |

|

|

Application |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

CNG Tank Market Regional Analysis:

APAC Market Insights

The Asia Pacific CNG tanks market is estimated to hold 49.5% of the global revenue share through 2035. The increasing awareness of natural gas is amplifying the sales of compressed natural gas tanks. The growth in public-private investments in renewable fuels is expected to augment the revenues of compressed natural gas storage solution manufacturers. China and India are set to offer high returns to the CNG tank investors during the projected timeframe. Japan and South Korea are anticipated to lead the innovations in compressed natural gas tanks during the same period.

The robust consumption of natural gas is increasing the demand for type 1 and 2 CNG storage solutions in China. The production and commercialization trade is set to propel the sales of larger CNG tanks. The U.S Energy Information Administration (EIA) estimates that China consumed natural gas of around 2.6 Bcf/d in 2023. The significant potential of maritime transport of natural gas is further creating high-earning opportunities for advanced CNG tank producers. The multiple applications of natural gas are likely to accelerate the production of CNG storage solutions in the coming years.

The innovations in both public and private refiners are foreseen to accelerate the demand for advanced compressed natural gas storage solutions in India. The Ministry of Petroleum and Natural Gas revealed that in 2024, the refining capacity of the country crossed 256.816 million metric tons per annum. The precise expansion of refineries across the country is expected to increase the installation of CNG tanks. Furthermore, the IEA study underscores that by 2030, the demand for natural gas in the country is estimated to increase by 60%. All the above statistics highlight that investing in India is likely to offer hefty gains to CNG tank producers during the foreseeable period.

North America Market Insights

The North America CNG tanks market is projected to increase at a robust rate between 2025 to 2035. The presence of dominant natural gas storage manufacturers is backing the overall sales growth. The increasing innovations and expansion of natural gas infrastructure are set to increase the demand for innovative and efficient tanks. The increasing production and export activities are also anticipated to propel the sales of compressed natural gas tanks. The U.S. and Canada are both expected to register high sales of CNG tanks due to their carbon neutrality goals.

The automotive and transportation sectors of the U.S. are likely to augment the sales of compressed natural gas tanks. According to the U.S. Department of Energy (DOE), there are over one lakh seventy-five thousand natural gas vehicles in the country. Such a boasting number highlights the CNG tank demand. The country’s move towards carbon neutrality is augmenting investments in the transformation of public transportation. In July 2024, the government funded USD 105 million in CNG bus transit. These moves are encouraging CNG tank companies to invest in the U.S.

The dominance of Canada in renewables is expected to propel the sales of natural gas storage solutions in the coming years. The production and commercialization trade represents profitable opportunities for compressed natural gas tank manufacturers. The report by the Canadian Energy Regulator underscores that the generation of natural gas in the country amounted to 17.9 billion Bcf/d. Alberta leads the country’s natural gas production, followed by Quebec and British Columbia. The increasing consumption of non-renewable natural fuels is likely to amplify the sales of natural gas storage tanks.

CNG Tank Market Players:

- PJSC Gazprom

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- TotalEnergies SE

- Faber Industrie S.p.A

- Hexagon Composites ASA

- Luxfer Gas Cylinders

- Ullit SA

- Worthington Industries, Inc.

- Owens Corning

- Andy-Tec

- Quantum Fuel Systems LLC.

- NGV Technology

- Everest Kanto Cylinder Limited

- We R CNG

- Beijing Tianhai Industry Co. Ltd.

- National Iranian Gas Company

- Chevron Corporation

- Indraprastha Gas Limited

- Phillips 66 Company

- Exxon Mobil Corporation

- Royal Dutch Shell Plc

- Occidental Petroleum Corporation

- JW Power Company

The major manufacturers of compressed natural gas tanks are employing various organic and inorganic marketing strategies to uplift their position in the competitive space. The leading companies are investing heavily in research and development activities to uplift their product portfolios. They are also entering into strategic collaborations and partnerships with other players to accelerate their production cycles. The industry giants are mainly targeting untapped compressed natural gas tanks markets to earn higher gains. The organic sales are expected to register a double-digit percent revenue growth in the coming years.

Some of the key players include:

Recent Developments

- Luxfer Holdings announced that it has acquired the “Structural Composites Industries” business of Worthington Industries in a deal worth USD 20 million. The aim of this acquisition enhances Luxfer's composite cylinder options and is in line with recent investments made to develop alternative fuel capabilities to take advantage of the expanding potential for compressed natural gas (CNG) and hydrogen.

- Quantum Fuel Systems LLC, a fully integrated alternative energy company, in partnership with Permian Global, Inc. d/b/a CORE Automatic Fueling Solutions (CORE) delivered six of the industry-leading virtual pipeline trailers for natural gas.

- Report ID: 3171

- Published Date: Sep 08, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.