Intermediates for Paints & Coatings Market Outlook:

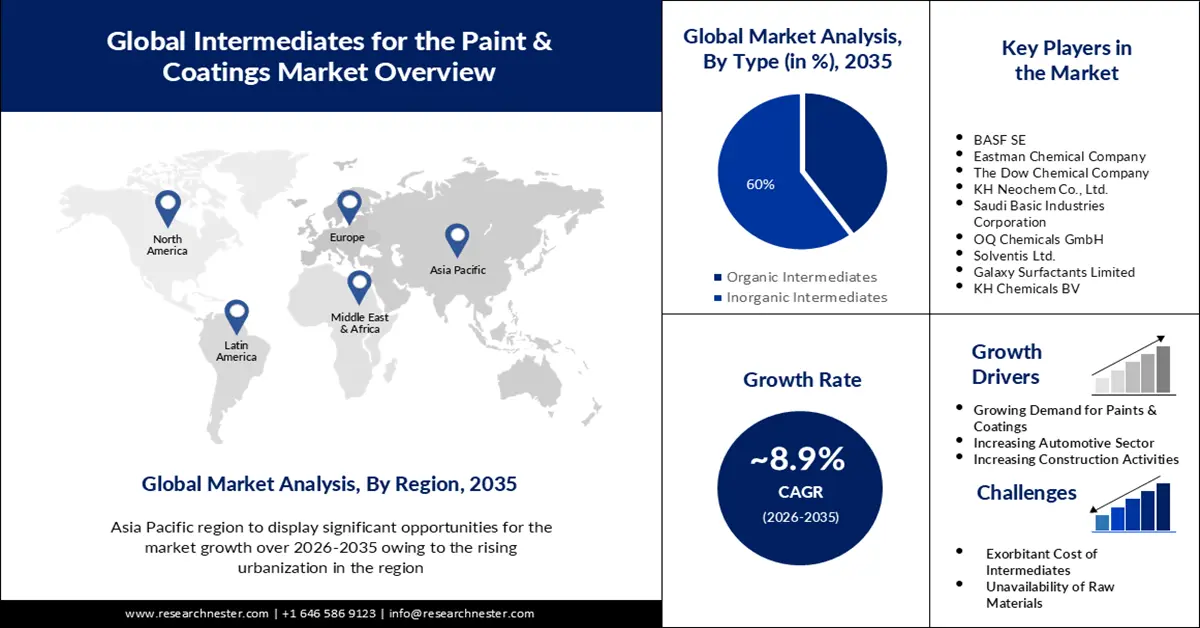

Intermediates for Paints & Coatings Market size was valued at USD 338.53 billion in 2025 and is set to exceed USD 794.1 billion by 2035, expanding at over 8.9% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of intermediates for paints & coatings is evaluated at USD 365.65 billion.

The growth of the market can be impelled by an increasing construction sector across the world. Paints & coating are frequently required in construction activities which is expected to add to the market growth. According to estimates, the worldwide construction business is quickly expanding, with the market value estimated to reach over USD 10 trillion by 2023.

The increasing automotive sector is believed to fuel market growth. For the production and repainting of vehicles, various kinds of paints & coatings are used which in turn is estimated to drive market growth. For instance, ethyl acetate is a substance used in coatings and paints for automobiles, which is utilized as a solvent for coating systems such as acrylic and nitrocellulose lacquers owing to its solubility in the primary natural and synthetic resins.

Key Intermediates for Paints & Coatings Market Insights Summary:

Regional Highlights:

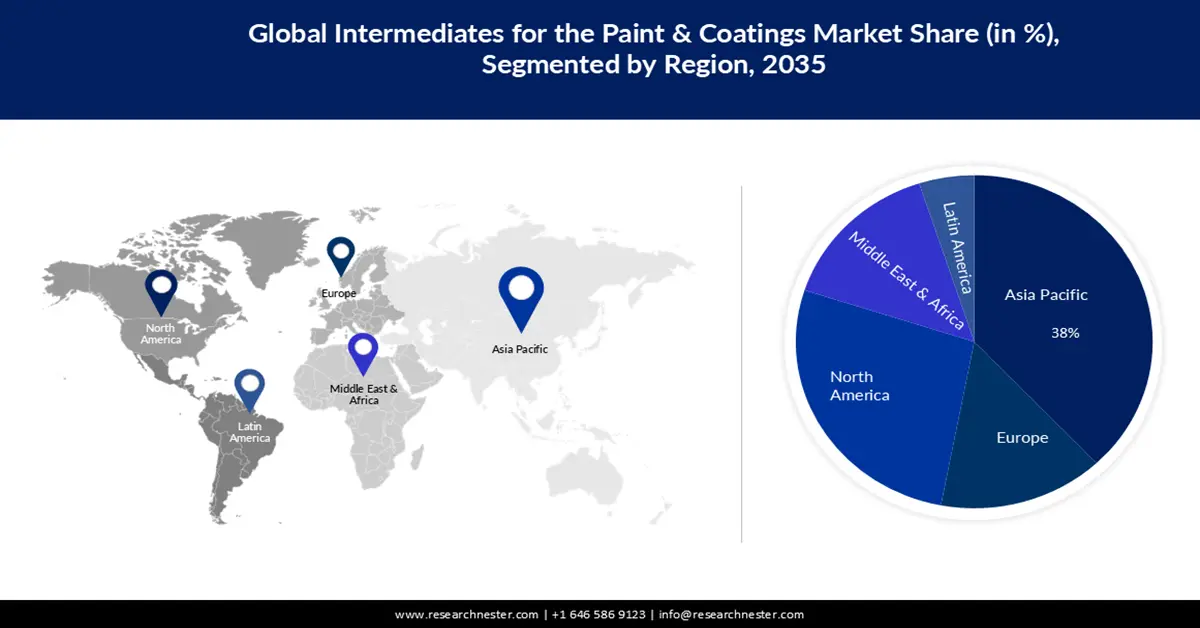

- Asia Pacific is estimated to command a 38% share by 2035 in the Intermediates for Paints & Coatings Market, impelled by rising urbanization in the region.

- North America is poised to hold a substantial share by 2035, underpinned by increasing demand for paint and coating applications across automotive, construction, and aerospace sectors.

Segment Insights:

- The inorganic intermediates segment is projected to command around a 60% share by 2035 in the Intermediates for Paints & Coatings Market, propelled by the growing need for coatings.

- The organic intermediates segment is expected to secure a notable share by 2035, supported by rising demand for environmentally friendly coatings.

Key Growth Trends:

- Growing Demand for Paints & Coatings

Major Challenges:

- Exorbitant Cost of Intermediates

- Unavailability of Raw Materials

Key Players: Venator Materials PLC, BASF SE, Eastman Chemical Company, The Dow Chemical Company, KH Neochem Co., Ltd., Saudi Basic Industries Corporation, OQ Chemicals GmbH, Solventis Ltd., Galaxy Surfactants Limited, KH Chemicals BV.

Global Intermediates for Paints & Coatings Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 338.53 billion

- 2026 Market Size: USD 365.65 billion

- Projected Market Size: USD 794.1 billion by 2035

- Growth Forecasts: 8.9%

Key Regional Dynamics:

- Largest Region: Asia Pacific (38% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, China, Germany, Japan, India

- Emerging Countries: South Korea, Brazil, Mexico, Indonesia, Vietnam

Last updated on : 20 November, 2025

Intermediates for Paints & Coatings Market - Growth Drivers and Challenges

Growth Drivers

-

Growing Demand for Paints & Coatings – As the need for paints & coatings is rising across the globe, more intermediates are required for their production. For instance, ingredients such as binders, pigments, thickeners, curing agents, modifiers, humectants, open-time additives, alkyd latex resins, and polymers are used to create finished aqueous or solvent-borne paint and coating products are known as intermediates and are utilized to generate paints and coatings in the final useable form.

Challenges

- Exorbitant Cost of Intermediates - The high cost is one of the major factors predicted to slow down the market growth. For instance, the price of raw materials keeps on fluctuating as the materials are not easily available. This as a result can increase the overall cost of the intermediates.

- Unavailability of Raw Materials

- Strict Environmental Regulations

Intermediates for Paints & Coatings Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

8.9% |

|

Base Year Market Size (2025) |

USD 338.53 billion |

|

Forecast Year Market Size (2035) |

USD 794.1 billion |

|

Regional Scope |

|

Intermediates for Paints & Coatings Market Segmentation:

Type Segment Analysis

The inorganic intermediates segment is estimated to gain a robust market gain of 60 % in the coming years. The segment growth can be attributed to the growing need for coatings. There is a rising need for coatings across various industries which has led to an increase in demand for inorganic intermediates, since it helps in reducing corrosion, and are suitable binders for any structural element. For instance, due to their exceptional performance, these coatings are commonly used in industries like building, painting, and other facets of daily life. They are generated chemically, changing the metal's surface layer into a metallic oxide film or compound, which minimizes corrosion.

Type Segment Analysis

The organic intermediates segment in the intermediates for the paints & coatings market is set to garner a notable share shortly. The growth of the segment is driven by rising demand for environmentally friendly coatings. Owing to stringent environmental regulations to reduce the effect of coatings on the environment the demand for organic intermediates is set to increase. Also, environmentally friendly options such as water-based technologies are becoming more and more popular with consumers. Traditional paints, varnishes, enamels, lacquers, water-emulsion finishes, and varnishes are all considered organic coatings that are frequently applied multiple times before they are thick enough to prevent corrosion. Furthermore, binders are within the broad category of organic binders which are biodegradable and are therefore seen to be safe for the environment.

Our in-depth analysis of the global market includes the following segments:

|

Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Intermediates for Paints & Coatings Market - Regional Analysis

APAC Market Insights

Asia Pacific industry is estimated to dominate majority revenue share of 38% by 2035, impelled by rising urbanization in the region.For instance, as more and more people are shifting towards urban areas, the need for houses and other commercial buildings has increased in the region. This has led to a rise in demand for intermediates for the paints & coatings since these projects widely utilize paints and coatings for various purposes. In addition, construction activities are increasing in countries such as India, Southeast Asia, and South America to keep up with rising rates of urbanization. Furthermore, it is anticipated that more than 50% of Asia's population will be urban by 2030.

North American Market Insights

North America intermediates for the paints & coatings market are estimated to hold a tremendous share, between 2026 and 2035. The growth of the market can be led by rising demand for paint and coating in industries such as automotive, construction, and aerospace in the area. This has resulted in the increased demand for the intermediates such as resins, epoxy, pigments, and solvents in these sectors.

Intermediates for Paints & Coatings Market Players:

- Venator Materials PLC

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- BASF SE

- Eastman Chemical Company

- The Dow Chemical Company

- KH Neochem Co., Ltd.

- Saudi Basic Industries Corporation

- OQ Chemicals GmbH

- Solventis Ltd.

- Galaxy Surfactants Limited

- KH Chemicals BV

Recent Developments

- BASF SE provided a variety of chemical intermediates with carbon footprints that are much lower than the global market average manufactured from fossil-based raw materials. These intermediates can be used in paints and coatings, and other daily use items.

- The Dow Chemical Company introduced a new digital paint formulation platform DOW Paint Vision which uses cutting-edge technology to simplify the formulation process, allows for the creation of novel solutions, and accelerates innovation in the paints and coatings sector

- Report ID: 3871

- Published Date: Nov 20, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Intermediates for Paints & Coatings Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.