High-Performance Ceramic Coatings Market Outlook:

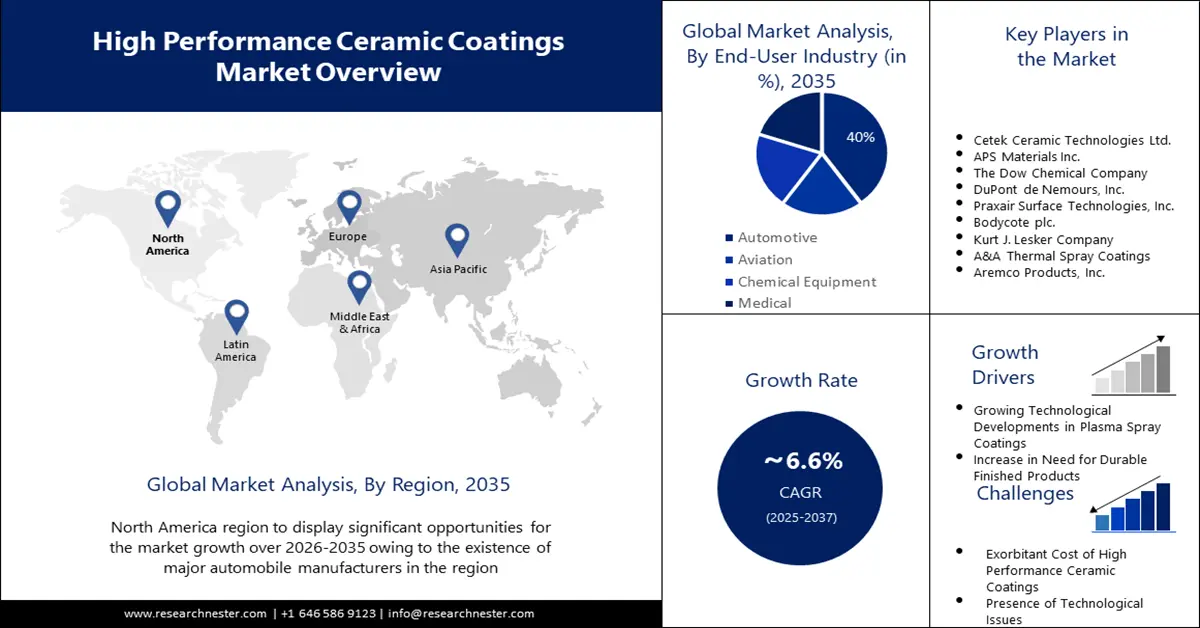

High-Performance Ceramic Coatings Market size was valued at USD 11.58 billion in 2025 and is likely to cross USD 21.94 billion by 2035, registering more than 6.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of high-performance ceramic coatings is assessed at USD 12.27 billion.

The high-performance ceramic coatings market is expanding due to the rising need for cutting-edge materials with better resistance to wear, corrosion, and high temperatures. These coatings' capacity to improve component performance and longevity makes them indispensable in high-stress situations, and they are quickly becoming standard in a variety of sectors. Thermal technologists Zircotec received government funding in September 2024 through the Advanced Propulsion Center UK (APC) to create a single patented ceramic coating that will enable the use of lightweight materials in cooling plates and EV battery enclosures. For battery enclosures and covers, a tried-and-true, lightweight, high-performance thermal barrier coating provides both extended protection at 700°C and short-term flame protection at 1,400°C. Without causing any electrical effects after application, it can be used on steel, aluminum, composite, and plastic substrates. An electrically conductive battery cover and casing that shields vital parts from electromagnetic interference and stops EM leaks. This metallic-based, high-integrity covering is extremely thin (~50 μm), light (~135 g/m2), and capable of functioning at temperatures as high as 600ºC.

The need for efficient and sustainable energy solutions is driving a shift in the energy sector. Since high-performance ceramic coatings are applied to power generation equipment to increase efficiency and lower maintenance costs, they are essential in this industry. The coatings are perfect for use in boilers, turbines, and other crucial parts because of their resistance to high temperatures and corrosive conditions. It is anticipated that the use of ceramic coatings in this industry would rise sharply as global energy demand rises, especially in developing nations.

Key High-Performance Ceramic Coatings Market Insights Summary:

Regional Highlights:

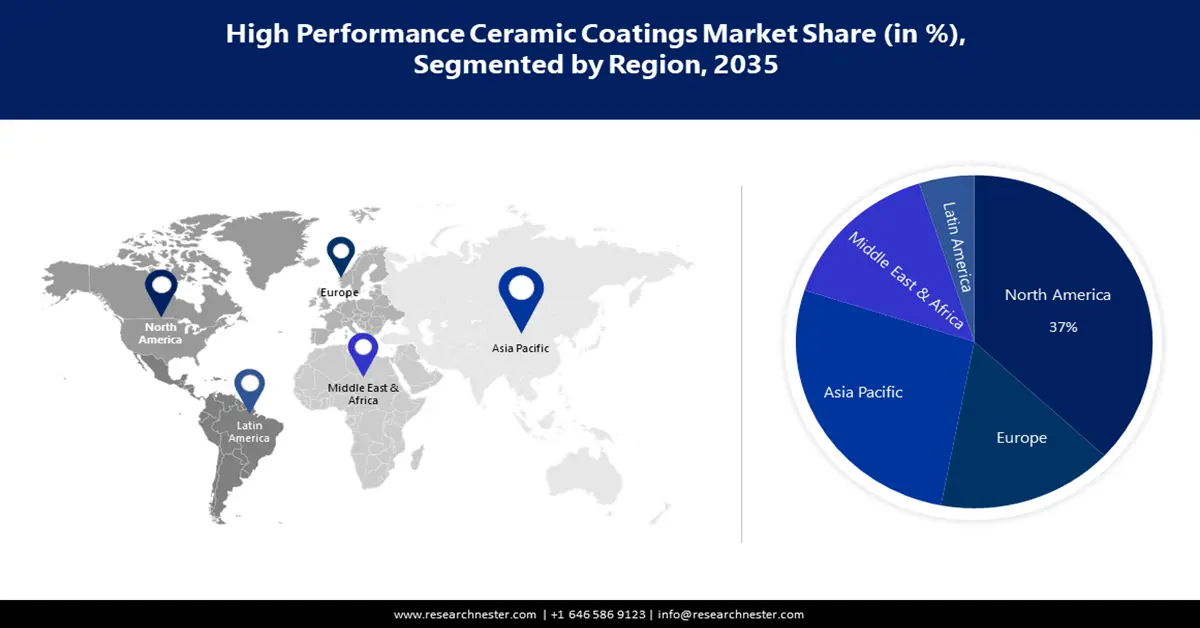

- Asia Pacific high-performance ceramic coatings market will dominate over 43.50% share by 2035, fueled by industrialization and growth in the automotive and aerospace sectors.

- North America market will exhibit a stable CAGR from 2026 to 2035, driven by demand from aerospace, automotive, and sustainable infrastructure upgrades.

Segment Insights:

- The oxide segment in the high-performance ceramic coatings market is projected to secure a 59.20% share by 2035, driven by oxides’ superior resistance to heat, chemicals, and oxidation.

- The aerospace & defense segment in the high-performance ceramic coatings market is poised for noteworthy growth during 2026-2035, fueled by increased need for thermal-resistant coatings in aerospace and defense applications.

Key Growth Trends:

- Increasing demand in the aerospace and defense industry

- Rising automotive sector

Major Challenges:

- High initial cost

- Raw material availability

Key Players: Ceramic Pro, Aremco Products Inc., Bodycote plc, APS Materials Inc., Keronite Group Limited, Zircotec Ltd., Morgan Advanced Materials plc, Kurt J. Lesker Company, A&A Coatings, Thermal Spray Technologies Inc., and Flame Spray Coating Co.

Global High-Performance Ceramic Coatings Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 11.58 billion

- 2026 Market Size: USD 12.27 billion

- Projected Market Size: USD 21.94 billion by 2035

- Growth Forecasts: 6.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (43.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, India

- Emerging Countries: China, India, Japan, South Korea, Vietnam

Last updated on : 9 September, 2025

High-Performance Ceramic Coatings Market Growth Drivers and Challenges:

Growth Drivers

-

Increasing demand in the aerospace and defense industry: The high-performance ceramic coatings market is expanding due to the growing demand from the defense and aerospace industries. Components that can endure harsh environments without degrading are essential as these sectors aim for increased efficiency and dependability. Ceramic coatings offer superior resistance to heat and corrosion, which is essential for parts that are subjected to corrosive conditions and high temperatures. Furthermore, the creation and application of lightweight materials in aerospace applications improve fuel efficiency, which increases the demand for protective coatings that can preserve material integrity in harsh environments. Boeing's latest forecast of the Chinese aviation market, published in November 2024, projects that the nation would need 8,600 new aircraft over the next 20 years, for USD 1.4 trillion. According to the business, China "remains on track to become the world's largest aviation market," accounting for around 25% of global aviation growth over the past ten years. Boeing estimates that during the next 20 years, Chinese operators will need 1,590 new widebody aircraft and 6,450 new single-aisle aircraft.

-

Rising automotive sector: High-performance ceramic coatings, like carbide and nitride coatings, are widely utilized in the automotive industry to protect various auto components from corrosion and wear. With rising production and sales, the vehicle sector is flourishing internationally, which is anticipated to fuel high-performance ceramic coatings market expansion over the forecast period. In February 2025, there will be 249 million passenger automobiles on EU roads, with an average car age of 12.5 years. 10.6 million passenger automobiles were sold in the EU in 2024, a 0.8% increase over the year before. In 2024, Europe shipped 4,553,344 automobiles valued at around USD 169.95 billion. It is projected that a significant increase in the global automotive industry will increase the use of high-performance ceramic coatings, which will propel market expansion throughout the forecast period.

Challenges

-

High initial cost: High-performance ceramic coatings' high cost has been a major obstacle, which could limit the high-performance ceramic coatings market's expansion throughout the projection period. For coating application, a broad range of ceramic coating processes are used, including chemical vapor deposition and thermal spray. However, the high expense of these coating technologies prevents them from being widely used. The most expensive is plasma spray technology, which is a sophisticated ceramic coating method that can spray a variety of materials. This technology has not yet reached the point where it is widely used, despite its great qualities.

-

Raw material availability: In the high-performance ceramic coatings market, material availability is a critical element that affects pricing and production dynamics. Zirconia, alumina, titania, and silicon carbide are examples of advanced materials that are commonly used in the formulation of high-performance ceramic coatings. These materials were chosen due to their remarkable qualities, which include excellent resistance to corrosion, wear, and heat. The pricing and supply stability of ceramic coatings can be impacted by the availability of these raw materials, which can be influenced by variables such as mining and extraction capabilities, geopolitical concerns, and changes in high-performance ceramic coatings market demand.

High-Performance Ceramic Coatings Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.6% |

|

Base Year Market Size (2025) |

USD 11.58 billion |

|

Forecast Year Market Size (2035) |

USD 21.94 billion |

|

Regional Scope |

|

High-Performance Ceramic Coatings Market Segmentation:

Product

The oxide segment in high-performance ceramic coatings market is projected to gain a 59.2% share through 2035. Oxides' superior adhesive qualities and capacity to offer chemical and heat resistance make them one of the most extensively utilized materials. They are especially preferred in applications where it is essential to protect the surface from wear and oxidation. Because of their adaptability, oxide coatings can be used in a variety of sectors, such as aerospace and automotive, where parts are exposed to harsh environments.

In contrast, carbide is renowned for its remarkable hardness and resistance to wear. When extreme endurance is needed, these coatings are frequently found in industrial machinery and cutting instruments. The use of carbide coatings is being propelled by the rising need for sophisticated machining techniques and precision production. The use of carbide coatings is becoming more crucial as businesses work to increase production efficiency and decrease downtime to guarantee component lifespan and dependability.

Nitrides are perfect for applications requiring both resistance to wear and thermal stability because of their special blend of hardness and toughness. These coatings are frequently utilized in the energy and automotive industries, where parts are subjected to high temperatures and mechanical strain. Nitride coatings are becoming more and more popular in a variety of industries due to their capacity to improve engine parts' performance and lower friction in moving parts.

Other materials, such as coatings made of boride and silicide, are used in specialized applications where particular material qualities are needed. These coatings provide customized solutions for sectors that face particular operational difficulties, like harsh chemical conditions or extremely high temperatures. The availability and range of applications for these specialty coatings are anticipated to increase as long as research and development activities continue to enhance ceramic coatings' capabilities.

Application

Based on the application, the aerospace and defense segment in high-performance ceramic coatings market is likely to hold a noteworthy share by the end of 2035. For components to be reliable and long-lasting in the aerospace and military industries, high-performance ceramic coatings are essential. Turbine blades, engine parts, and other vital elements that function under extreme stress are coated with these substances. Ceramic coatings are an essential part of contemporary aerospace engineering as the need for lightweight, fuel-efficient aircraft has made the usage of materials resistant to corrosive conditions and high temperatures necessary. The high-performance ceramic coatings market for these coatings is expected to increase as governments and commercial organizations around the world make investments in their aerospace capabilities.

High-performance ceramic coatings are also widely used in the automotive sector. These coatings are essential for improving engine performance, lowering friction, and prolonging component life. The demand for sophisticated coatings that might enhance battery efficiency and thermal management is being driven, in particular, by the move to electric vehicles. In keeping with international regulatory standards, ceramic coatings are also used in exhaust and braking systems to help lower wear and emissions. It is anticipated that the automotive industry's shift towards efficiency and sustainability will increase demand for ceramic coatings.

High-performance ceramic coatings are very beneficial to the energy sector, especially in power generation and renewable energy applications. Turbines, boilers, and other equipment are coated with these materials to improve thermal efficiency and guard against wear and corrosion. The use of ceramic coatings to extend the lifespan and efficiency of power production equipment is becoming more and more crucial as the world's energy needs continue to rise and as there is a drive for more environmentally friendly energy sources. In the upcoming years, this tendency is probably going to support the high-performance ceramic coatings market's expansion.

Ceramic coatings are used in the industrial products sector to improve the robustness and effectiveness of machinery and equipment. Heavy-duty equipment that works in challenging environments is essential to sectors like manufacturing, mining, and construction. High-performance ceramic coatings offer the defense required to prolong the life of equipment and lower maintenance expenses. The need for these protective coatings is anticipated to rise as industrial sectors aim for greater cost-effectiveness and productivity.

Our in-depth analysis of the high-performance ceramic coatings market includes the following segments:

|

Product |

|

|

Application |

|

|

Technology |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

High-Performance Ceramic Coatings Market Regional Analysis:

Asia Pacific Market Insights

Asia Pacific is expected to lead the high-performance ceramic coatings market with a share of 43.5% during the forecast period, owing to the increasing industrialization as well as the expanding automotive and aerospace industries. The demand for ceramic coatings is expected to be driven by rising investments in infrastructure development and industry.

As the second-largest economy in the world with the highest rate of growth, China is a major player in the manufacturing and industrial sectors, like steel, automobiles, and electric cars. The high-performance ceramic coatings market has a lot of prospects thanks to this strong economic base. Demand is anticipated to be driven by the growing use of these coatings in vital industries, including steel and automobile manufacture. For a third consecutive month, China's automobile sales increased 14.8% over the previous year as government-subsidized auto trade-ins lessened the negative effects of US tariffs on consumer confidence. According to figures from the China Passenger Car Association (CPCA), passenger vehicle sales totaled 1.78 million units last month and were 8.2 percent higher than the same period a year ago, at 6.97 million units. Last month, sales of new energy vehicles, which include plug-in hybrids and electric cars, climbed 33.9% year over year to account for 50.8% of all automobile sales.

India’s emphasis on innovation and technical growth has made it a major consumer of ceramic coatings. With 167,629 units sold at retail last month, the Indian EV sector had its greatest sales in April. Data from the Vahan site indicates that this represents a robust 45% increase over the prior year. In April 2023, retail sales of e-PVs surpassed the 100,000 milestone for the first time. The strong EV industry sales in April 2025, which include two and three-wheelers, passenger cars, and commercial vehicles, follow India EV Inc.'s record-breaking 1.96 million units sold in FY2025. As a result, the high-performance ceramic coatings market is expanding due to the robust presence of the automotive and aerospace sectors.

North America Market Insights

North America is expected to experience a stable CAGR during the forecast period. The continued need for high-performance coatings is being fueled by the existence of significant aircraft manufacturers and the continuous upgrade of military hardware. Furthermore, the high-performance ceramic coatings market in this area is anticipated to be further driven by the automobile industry's push towards sustainable solutions and electric vehicles.

The U.S. rising automotive industry and the growing significance of infrastructure development are predicted to boost demand for high-performance ceramic coatings in automotive and construction applications. By 2040, Airbus anticipates that 39,000 additional passenger and freighter aircraft will be needed. The sector's 2050 net-zero goal will be made possible by ongoing advancements in propulsion technologies, operations, sustainable fuels, and fleet efficiency. Over the next 20 years, there will be a need for more than 710,000 highly qualified technicians and more than 550,000 additional pilots.

In Canada, high-performance ceramic coatings are in constant demand due to the existence of significant aerospace manufacturers and the continuous upgrade of military hardware. Furthermore, the high-performance ceramic coatings market in this area is anticipated to be further driven by the automobile industry's push towards sustainable solutions and electric vehicles. Ceramic Industrial Coatings, a US-based producer of premium coating materials, including high-performance ceramic coatings, was acquired by Canlak Inc., a coating and finishing solutions firm based in Canada, in May 2023. The acquisition, which is valued at an undisclosed sum, supports Canlak's focus on OEM wood coatings and fits with its goal of becoming a specialist wood coating systems business.

High-Performance Ceramic Coatings Market Players:

- Ceramic Pro

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Aremco Products Inc.

- Bodycote plc

- APS Materials Inc.

- Keronite Group Limited

- Zircotec Ltd.

- Morgan Advanced Materials plc

- Kurt J. Lesker Company

- A&A Coatings

- Thermal Spray Technologies Inc.

- Flame Spray Coating Co.

The high-performance ceramic coatings market is expected to grow steadily due to its versatile properties and growing demand across many industries, particularly in the automotive, aerospace, and advanced manufacturing sectors. To take advantage of new high-performance ceramic coatings market opportunities and technological advancements, future industry expansion will require addressing competition, raw resource availability, and environmental concerns.

Here are some leading players in the high-performance ceramic coatings market:

Recent Developments

- In May 2023, XPEL introduced four New Ceramic Coating Options for Superior Paint Protection. Surfaces are sealed and shielded from environmental pollutants, damaging UV rays, and insect acids by FUSION PLUS ceramic coating, which forms molecular connections. Additionally, it resists fading and minor scratches. Surfaces are easy to clean because of their hydrophobic qualities, which repel liquids and grime. FUSION PLUS can be applied over XPEL's paint protection film for even more defense.

- In September 2022, INDUSTRIAL ION NITRIDING introduced the Mentor, model HFL-2018-2IQ, a compact, horizontal, front-loading, vacuum heat-treating and brazing furnace that is primarily made to effectively and economically handle small to mid-size furnace loads. For ease of transportation and mobility, the Mentor is fixed on a single, transportable platform. Designed to facilitate the following processes: normalization, annealing, tempering, sintering, homogenizing, degassing, diffusion bonding, heat treatment, hardening, brazing, stress relief, and creep formation.

- Report ID: 3889

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.