Polymer Coatings Market Outlook:

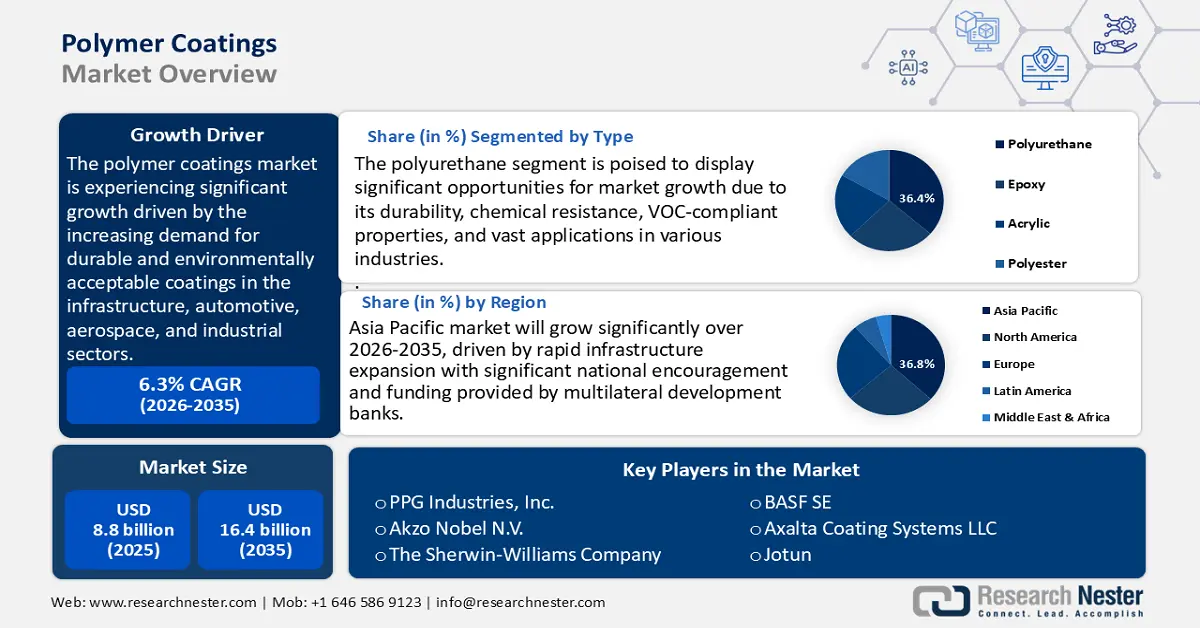

Polymer Coatings Market size was valued at USD 8.8 billion in 2025 and is projected to reach USD 16.4 billion by the end of 2035, rising at a CAGR of 6.3% during the forecast period, from 2026 to 2035. In 2026, the industry size of polymer coatings is estimated at USD 9.3 billion.

The global polymer coatings market is expected to experience significant growth over the projected years, primarily driven by the increasing demand for durable and environmentally friendly coatings in the infrastructure, automotive, aerospace, and industrial sectors. This trend is facilitated by the government's influence on infrastructure modernization and tighter environmental legislation that advocates for low-VOC and environmentally friendly coating products. According to the American Coatings Association, polymer finishing enhances the service life and energy performance of building materials and a plate and its overall sustainability and durability, leading to lower expenses. In addition, the regulations in regard to air quality by the U.S. Environmental Protection Agency, especially the Clean Air Act, have enhanced the water-based polymer coating, minimized damaging emissions, and encouraged environmentally friendly strategies. Strong regulatory push, with the growth of industrial activities and global urbanization, increases the demand for high-performance polymer coating steadily.

Within the supply chain and manufacturing environment, polymer coating relies mainly on petrochemical derivatives that include resins, solvents additives that are both sourced globally. Manufacturing is concentrated towards North America, Europe, and Asia-Pacific, with China and the U.S. dominating the supply of polymer resins and the coatings manufacturing establishments. For instance, BASF’s Coatings division has more than doubled its production capacity for polyester and polyurethane resins used in automotive spray coats at its Caojing plant in Shanghai, China, in March 2025. Originally established with an annual capacity of 8,000 metric tons, the facility now produces 18,800 metric tons annually. This expansion supports the growing automotive coatings market across China and the broader Asia-Pacific region. According to the U.S. Bureau of Labor Statistics, the Producer Price Index (PPI) for final demand goods, including chemical products used in polymer coatings, rose 0.7% in July 2025.

Processed chemical inputs increased 0.8%, reflecting input cost inflation. Over 12 months, prices for processed chemical goods rose 2.1%, indicating steady inflation pressures in the polymer coatings supply chain. Government investment in research, development, and deployment (RDD) is also supported through programs through the National Institute of Standards and Technology aimed at polymer innovation and scalable, sustainable manufacturing processes. For example, NIST’s Molecular Foundations for Sustainability: Sustainable Polymers Enabled by Emerging Data Analytics (MFS-SPEED) program accelerates the discovery and manufacturing of sustainable polymer coatings by applying data-driven techniques like artificial intelligence and machine learning, enabling more sustainable and scalable polymer coating solutions for industrial applications.

Key Polymer Coatings Market Insights Summary:

Regional Insights:

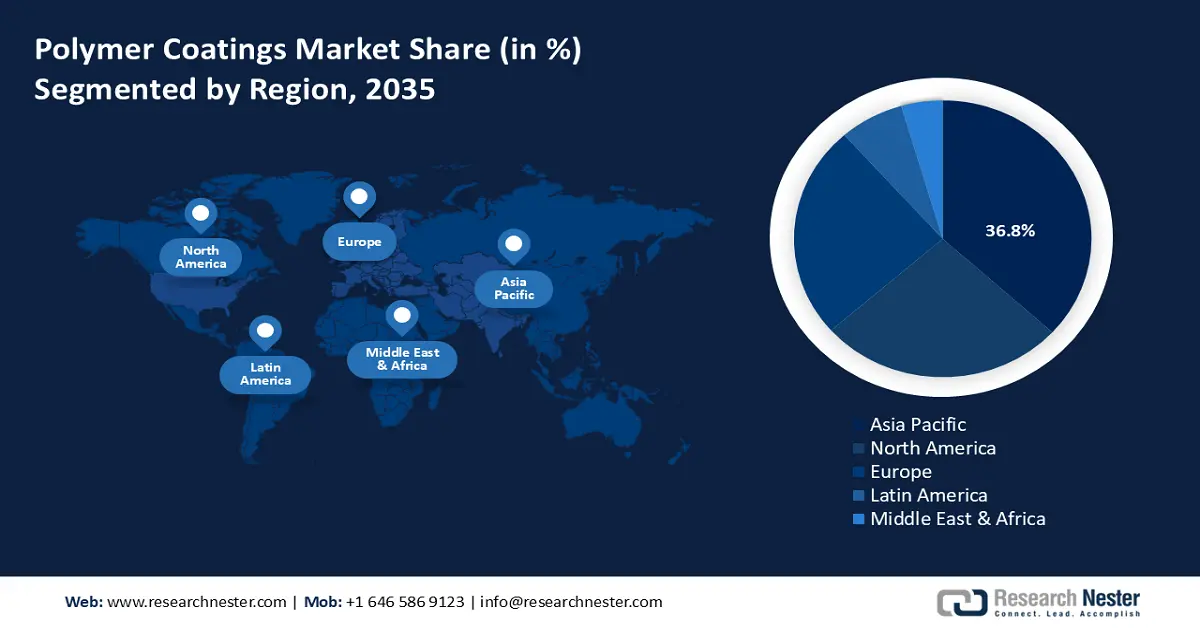

- The Asia Pacific polymer coatings market is projected to hold the largest revenue share of 36.8% over the forecast period, supported by rapid infrastructure expansion and significant multilateral funding.

- The North American polymer coatings market is expected to achieve a 26.7% share from 2026 to 2035, enhanced by strong industrial demand and favorable regulatory dynamics.

Segment Insights:

- The polyurethane type segment in the Polymer Coatings Market is projected to account for a 36.4% share from 2026 to 2035, owing to its durability, chemical resistance, and VOC-compliant properties.

- The spray coatings segment is expected to witness substantial growth over the forecast period, propelled by their efficiency, minimal material waste, and widespread industrial adoption.

Key Growth Trends:

- PFAS disclosure mandate by EPA TSCA reporting rule

- Burden on chemical registration due to excessive TSCA Fees

Major Challenges:

- Limited innovation in sustainable solutions

- Global plastic treaty stalemate delays regulatory clarity

Key Players: PPG Industries, Inc., Akzo Nobel N.V., The Sherwin-Williams Company, BASF SE, Axalta Coating Systems LLC, Jotun, Sumitomo Seika Chemicals Co., Ltd., Asian Paints Limited, Cytec Industries Inc., Pidilite Industries Limited, Hempel A/S.

Global Polymer Coatings Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 8.8 billion

- 2026 Market Size: USD 9.3 billion

- Projected Market Size: USD 16.4 billion by 2035

- Growth Forecasts: 6.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (36.8% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, Germany, China, Japan, South Korea

- Emerging Countries: India, Vietnam, Thailand, Indonesia, Malaysia

Last updated on : 3 September, 2025

Polymer Coatings Market - Growth Drivers and Challenges

Growth Drivers

-

PFAS disclosure mandate by EPA TSCA reporting rule: PFAS disclosure requirements under the TSCA reporting rule are compelling manufacturers and importers to document the use, volume, and applications of PFAS in products, including polymer coatings. This heightened transparency is pushing the coatings industry toward PFAS-free alternatives, stimulating investment in new resin formulations, bio-based polymers, and advanced protective coatings that match or exceed traditional performance. As regulatory compliance becomes a priority across supply chains, the demand for sustainable, high-performance coatings is expanding, positioning innovation and safer chemistries as key growth drivers for the polymer coatings market.

-

Burden on chemical registration due to excessive TSCA Fees: EPA finalized a revised TSCA fee schedule in February 2024, which is effective in fiscal years 2024-2026, filing a Premanufacture Notice (PMN), Significant New Use Notice (SNUN), or a Microbial Commercial Activity Notice (MCAN) now goes at USD 37,000 (compared to USD 19,020 previously) and exemptions such as a Low-Volume Exemption or Test Marketing Exemption, carry a fee of USD 10,870 (up from USD 5,590). These increases reflect EPA attempts to recoup up to 25% of TSCA program costs and place a significant financial hurdle before coating manufacturers seeking to bring to market a new or alternative chemistry. This can make smaller players inactive or forego innovation in developing products using approved substances, which limits the entry of new and sustainable formulations into the polymer coatings market.

-

Improving production efficiency via green catalysis: Advanced green catalytic technology is prevalent in the polymer industry, making it more sustainable by making the reaction more efficient and saving raw materials and energy. Research demonstrates that green catalysis has the potential to reduce energy consumption by 35%, reduce waste by 40%, and curb CO2 emissions by 50% in comparison with traditional processes. Although more expensive in terms of the initial catalyst outlay, the greater recyclability and turnover frequency result in massive cost savings and a 30% rise in industrial output.

Catalytic recycling techniques funded by the U.S. Department of Energy are exemplary of complementary innovations that result in impressive rates of monomer recovery and reduce the use of virgin feedstocks. VolCat project designs BHET, a new organocatalytic recycling process that will reach more than 90% of monomer recovery in the post-consumer recycled (PCR) PET waste, such as carpets and bottles. The recycle gives a repeat use of the catalyst and of ethylene glycol solvent, and minimal generation of waste. Such efficiencies translate into cost and environmental savings, as well as allowing manufacturers to make more environmentally friendly coatings at lower prices.

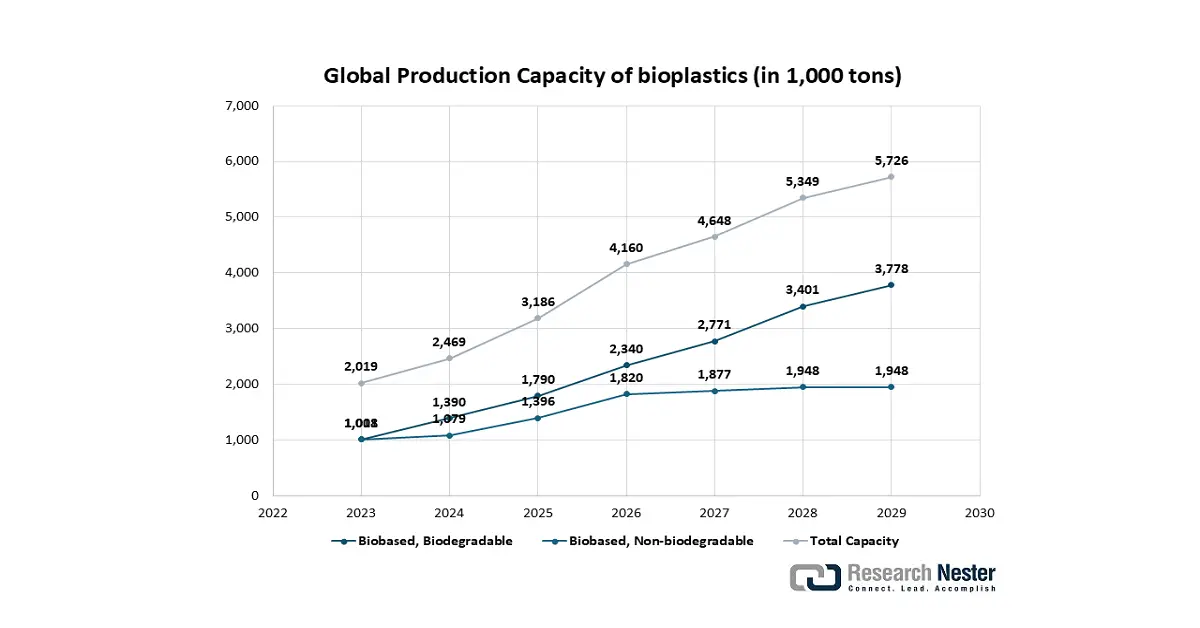

Global Bioplastics Production

The rising production of bioplastics acts as a key catalyst for the polymer coatings market by creating a new and rapidly expanding segment focused on sustainability. As industries like packaging, textiles, and consumer goods face increasing regulatory pressure and consumer demand for eco-friendly products, they seek to replace conventional petroleum-based coatings. This drives innovation and investment in new coating formulations derived from materials like PLA, PHA, and bio-based polyurethanes, which offer functionalities such as compostability, biodegradability, and reduced carbon footprint. Consequently, bioplastics are not just expanding the overall volume of the coatings market but are also pushing it toward higher-value, specialized, and sustainable solutions, opening up fresh applications and driving growth through diversification rather than direct replacement.

Source: European Bioplastics, nova-Institute 2024

Challenges

-

Limited innovation in sustainable solutions: Around 44% of chemical firms achieved a negative change in "green capex" in 2023 and 2024, and another 36% are expected to shrink in 2025, indicating limited investment in sustainable solutions due to budgetary constraints. In the lack of price premiums or shifts in customer demand, companies face difficulties in justifying allocated capital to R&D or renewable or eco-friendly assets. This financial circumstance suppresses their ability to come up with more environmentally friendly polymer coating chemistries, which in turn hampers the transformation of the market despite the regulatory and social demand for sustainability.

-

Global plastic treaty stalemate delays regulatory clarity: A significant group of countries at the latest UN negotiations called for binding restrictions on plastic production and regulation of toxic chemicals, but petrochemical-producing nations like Saudi Arabia, Russia, Iran, and, reportedly, the U.S. opposed such measures, favoring a focus on waste management. The ideological gap resulted in the lack of any universal accord, weakening the position of creating standardized standards on polymer-related products. The uncertainty in a delayed treaty brings a regulatory gap and unequal regulation, making long-term global market strategies a headache for polymer coatings suppliers.

Polymer Coatings Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.3% |

|

Base Year Market Size (2025) |

USD 8.8 billion |

|

Forecast Year Market Size (2035) |

USD 16.4 billion |

|

Regional Scope |

|

Polymer Coatings Market Segmentation:

Type Segment Analysis

The polyurethane type segment is projected to grow at the highest polymer coatings market share of 36.4% from 2026 to 2035, attributed to its durability, chemical resistance, and VOC-compliant properties. EPA observes that surface coatings, of which polyurethanes are widely applied in industries, contributed more than 20% of the total VOC emissions in the U.S. coating industry, causing a greater push towards low-VOC use of polyurethane in the industry. The automotive and construction industries are also contributing to the rise of polyurethane due to the shift towards sustainability in the coating programs established by governments.

The aliphatic polyurethane and waterborne polyurethane are the leading types in the polyurethane coatings. Aliphatic polyurethane produces excellent UV stability and color retention, thus suitable in demanding exterior environments like the automotive and aerospace industries. The U.S. Environmental Protection Agency estimates that the conversion of lacquer to polyurethane clearcoats shaves down the VOC emissions per gallon of solids to about 13 lb compared to 73 lb, a decrease of nearly 82%. Waterborne Polyurethane coatings are increasing due to non-toxicity and sustainability attributes. Recognized in green chemistry initiatives, two-component waterborne polyurethane formulations can cut VOC and hazardous air pollutant emissions by 50 -90% compared to traditional solvent-borne systems. A combination of these two subtypes highlights an important role that polyurethane plays in performing well and being environmentally compliant in the dynamic polymer coatings marketplace.

Process Type Segment Analysis

The spray coatings segment is expected to experience substantial growth in the polymer coatings market over the forecast period, driven by their efficiency, minimal waste of materials, and their prevalence in the industry. Automotive, furniture, and even industrial applications extensively use HVLP spray guns due to their precision and effectiveness in the application of smooth and even coating with minimal overspray. In automotive, they facilitate perfect base coats, primers, specialty finishes, and ensure better appearance, along with protection. Furniture manufacturers have also applied HVLP guns to fine, delicate finishes on delicate furniture pieces without using up excess material. Industrial production lines use these guns because they allow them to control the pattern of the spray, enhance the durability of the coating, and ensure a reduction in the environmental effects by reducing VOC emissions. As projected, global automotive manufacturing is expected to surpass 100 million vehicles per year by 2030, and spray application systems are and will continue to be the most scalable and cost-effective in mass manufacturing.

Airless spray systems have considerably better transfer efficiency (TE)-generally 65-70% as opposed to air atomized spray, 25-50%, so they are more economical where areas are large, such as ship hulls and factory expanses. Further augmented efficiency is available with electrostatic spray methods, commonplace in the automotive assembly industry, at deposition levels of 60 to 95% relative to configuration (manual, automatic, or rotary atomizing systems). Such methods are highly efficient not only in the reduction of material waste but also in the areas of VOC emissions and environmental compliance, which is in line with EPA standards in dealing with surface coatings. These two methods of spraying coating are combined, and they dominate in operations of high-performance coating because they balance industrial production with environmental sustainability in the contemporary industry.

End use Segment Analysis

The automotive industry segment is anticipated to grow progressively with a polymer coatings market revenue share of 31.7% by 2035. This growth is driven by surging EV sales and the demand for lightweight corrosion-protective materials. In 2023, the global electric vehicle (EV) sales increased by 35% over 2022 to 14.2 million units. The world had about 40 million EVs, and Europe/China/USA had nearly 95% of the market share. This trend transferred to 2024 when more than 17 million electric cars were sold and the market share reached more than 20% of new cars. This growth leads to the direct growth in demand of polymer protective coatings, in exteriors, interiors, and protection of EV batteries, where automotive will become the highest revenue-generating end-use market by 2035.

Our in-depth analysis of the polymer coatings market includes the following segments:

|

Segments |

Subsegments |

|

Type |

|

|

Process Type

|

|

|

End-use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Polymer Coatings Market - Regional Analysis

Asia Pacific Market Insights

The Asia Pacific polymer coatings market is expected to dominate the global polymer coatings market with the largest revenue share of 36.8% over the forecast period. This growth is driven by rapid infrastructure expansion with significant national encouragement and funding provided by multilateral development banks. There is a huge demand across the region for protective and architectural coats driven by major projects financed by the Asian Development Bank (ADB), such as a commitment of USD 23.6 billion in climate finance in 2024. Further, the wide-reaching Belt and Road Initiative launched by China has created substantial demand in ports, railways, and energy infrastructure in the undertaking countries, necessitating higher-performance coating.

Additionally, in response to the environmental consequences of rapid industrialization, the Association of Southeast Asian Nations (ASEAN) has implemented a Framework of Circular Economy, which would promote sustainable production, hence indirectly affecting the coatings manufacturers. The United Nations Economic and Social Commission for Asia and the Pacific (UNESCAP) notes that the region is rapidly urbanizing, which is a contributing factor to the growth of construction materials such as coatings. In India, the Ministry of Chemicals and Fertilizers continues to highly encourage domestic production via production-linked incentive (PLI) plans, under which the entire specialty chemicals industry gains a boost, thereby driving the market in the region.

The polymer coatings market in China is expected to dominate the region during the projected years, owing to the national strategic shift towards high-tech manufacturing and domestic innovations, going beyond its function as a low-cost producer. The Made in China 2025 initiative specifically puts advanced materials, including new-energy vehicles and next-generation industrial production, necessitating high-performance coating. This is facilitated by large state-led investment in research and development, where the national spending on R&D rose by 10.4% in 2022 to exceed 3.00 trillion yuan. The various regulations of the Ministry of Ecology and Environment, such as the Blue-Sky Defense War policy, are aggressively enforced and are leading to the rapid transition of the industry to water-based formulations, powder, and radiation curing. Moreover, the trend to create a niche of the automotive market with the electric vehicles (6.9 million new-energy vehicles were sold in 2022) is at the dominance by Chinese manufacturers.

By 2035, India’s polymer coatings market is expected to grow at the fastest CAGR over the forecast years, due to the megaprojects in housing and infrastructure by the state, combined with strategies to ensure that domestic manufacturing is influenced. The most significant flagship scheme, Pradhan Mantri Awas Yojana - Urban (PMAY-U), has so far approved more than 12.3 million homes since its establishment, which triggered long-term and deep-rooted demand for architectural paints and coatings. The ramifications of this large-scale housing project benefit a variety of industries in the economy in areas such as steel, cement, bricks, and paints, which provide opportunities to other industries. Furthermore, 228 infrastructure projects worth over 15.88 lakh crore have been sanctioned in the last 3 years under the PM Gati Shakti National Master Plan.

The majority of the projects concentrate on roads (108) and railways (85), and other projects lie in the field of urban development, and so on. There is an appraisal of the projects worth more than 500 crore by the Network Planning Group in order not to impact the plan objectives. The plan also helps in effective district-level planning in 27 aspiration districts. The Indian government approved the Production Linked Incentive (PLI) Scheme on Advanced Chemistry Cell (ACC) Battery Storage in May 2021 with a budgetary outlay of 18,100 crore in 2021. This scheme is expected to shore up domestic self-reliance in the manufacturing of ACCs by incentive gigafactory plants, preferably the one that maximizes domestic value addition. This emphasis on quality has also been enhanced with the ever-increasing middle-class need to have high-quality, durable, and decorative paints, which is observed through the steady increase in the sale of lead-free and environmentally conscious paints.

North America Market Insights

The North American polymer coatings market is expected to grow significantly at a revenue share of 26.7% during the projected years from 2026 to 2035, driven by robust industrial demand and favorable regulatory dynamics. According to the 2022 Manufacturing Energy Consumption Survey (MECS), it has been noted that the energy consumption of the U.S. manufacturing sector was boosted by 6% between the years of 2018 and 2022. This industry is still a significant energy consumer with almost a share of two-fifths of the total primary energy consumption of the country. In the manufacturing sector, the chemical industry remains an adaptable consumer, with nonfuel (feedstock) energy consumption taking the lead. Further, the EPA Green Chemistry Challenge program has minimized the chemical hazard wastes down to 830 million pounds annually and 7.8 billion pounds, equivalent to carbon dioxide annually. Such figures demonstrate that energy efficiency, environmental regulation, and sustainability initiatives are enhancing the polymer coatings' potential in North America to lead in high-performance, environmentally friendly polymer coatings.

The U.S. polymer coatings market is anticipated to lead the North American market and grow at a notable share by 2035. The chemical manufacturing industry has a large environmental impact, consuming 4,842 TBtu of primary energy and 332 million metric tons of CO2 equivalent (MMT CO2e) through energy use in the U.S. As a result of the Green Chemistry Challenge program launched by the EPA, various sustainable chemical product processes are being used and significantly decreasing the production of hazardous wastes and emissions during polymer-related manufacturing. The U.S. Department of Energy also foresees that it will be able to produce an ethane of 2.68 million barrels per day by the year 2035, with a sustained supply of ethane that is affordable to sustain the polymer and coating industries. Combinations of these dynamics with energy-intensive chemical operations, progressive environmental policy, and a secure raw materials supply strengthen the position of the U.S. as a leading manufacturer of high-performance polymer coatings.

Canada’s polymer coatings market is expected to grow with an upward trend over the forecast period from 2026 to 2035. The chemical manufacturing sector of the country contributes about CAD 13.4 billion, or 0.8% of the country's GDP, clearly demonstrating its financial importance. In Q1 2025, the Canadian import & exports grew by 4.1% facilitated by various sectors, including coatings. In 2024, Canada’s trade ecosystem remained robust and recorded merchandise exports valued at CAD 721.1 billion and imports totaling CAD 765.7 billion. This trade volume reflects a modest growth compared to previous years and highlights Canada’s significant role in the global trade network. The provincial backing through the Canadian Clean Technology Data Strategy communicates investment in low-emission concept/innovation-stimulated industries that indirectly promote the growth of sustainable polymer coverings. All these economic fundamentals and growth policies make Canada a slowly growing destination for modern and environmentally-friendly coatings.

Europe Market Insights

The polymer coatings market in Europe is expected to grow with a substantial revenue share of 25% during the projected years from 2036 to 2035, attributed to new and highly restrictive EU environment regulations. For example, the EU Directive 2004/42/EC aims to limit emissions of volatile organic compounds (VOCs) from certain paints, varnishes, and vehicle refinishing products to reduce air pollution and tropospheric ozone formation. It sets strict VOC content limits for various coating types, including water-borne and solvent-borne coatings, with phased reductions implemented from 2007 and 2010. The directive also mandates labelling requirements and monitoring to ensure compliance, supporting environmental protection and public health across the EU.

The regulatory push is further complemented by the objectives of the European Green Deal, which promotes innovation in the production of bio-based and circular materials. It also aims to cut emissions by at least 50% by 2030, rising towards 55%, while legally binding the 2050 neutrality goal through the European Climate Law. As a result, a great number of investments in programs such as Horizon Europe programs are being attracted to next-generation sustainable coating R&D. Strength in demand of key industries, especially the automotive industry, owing to applications in the electric vehicles segment, forms a key growth driver. The high demand of the construction industry with respect to durable and protective finishes further guarantees a stable market ground. These cooperative factors promote regulatory pressure, prudent funding, and good industrial demand, which strengthen the European market as a pioneer in the advanced polymer coatings sector.

Key Polymer Coatings Market Players:

- PPG Industries, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Akzo Nobel N.V.

- The Sherwin-Williams Company

- BASF SE

- Axalta Coating Systems LLC

- Jotun

- Sumitomo Seika Chemicals Co., Ltd.

- Asian Paints Limited

- Cytec Industries Inc.

- Pidilite Industries Limited

- Hempel A/S

The global industry is moderately consolidated and has a combination of multinational players along with regional players. Huge global presence of major industries such as PPG, Akzo Nobel, and Sherwin-Williams, product-line diversification, and significant investments in research and business are some of the key reasons to dominate the markets. Japan's largest share of 14% is held by companies, such as Kansai Paint, Nippon Paint, Chugoku Marine Paints, and Sumitomo Seika, as they are technologically innovative and feature high demand in the country, especially in automotive and electronics coatings. The strategic moves of such market players include sustainable product development, the growth of waterborne and low-VOC coatings, and digital manufacturing. Collaboration, green acquisitions, and green chemistry are various strategies used in gaining a competitive advantage in a tightening environment of environmental regulations around the world. The rapidly changing environment has encouraged constant innovation along with meeting emerging market and regulatory requirements.

Top Global Polymer Coatings Manufacturers:

Recent Developments

- In May 2025, PPG Industries launched EnviroLuxe Plus, a new range of powder coatings that uses up to 18% post-industrial recycled plastic (rPET) and does not have per- and polyfluoroalkyl substances (PFAS). The situation reverses the restriction on coatings through a regulatory body, in addition to the increasing consumer demands for sustainable coatings solutions. EnviroLuxe Plus offers excellent durability and performance, and high sustainable plastic application to appliances and furniture, but has a low environmental impact. Since its launch, PPG has indicated a 20% market adoption in its sustainable coating portfolio, which instills its leadership in green innovations in the polymer coatings.

- In February 2025, Roquette unveiled the Plant-Based Coatings Platform by introducing Tabshield and ReadiLYCOAT. These film coating solutions are bio-based products specifically tailored to the pharmaceutical and nutraceutical industries. The products help to drastically minimise solvent consumption and carbon emissions, which serve the industry's sustainability objectives. The platform improves the efficiency of manufacturing high-performance products owing to faster coating processes. Such a move by Roquette can be understood as part of an overall trend toward cleaner and renewable products in polymeric coatings due to increased regulatory pressure and consumer interest in using environmentally-friendly coatings. This launch makes Roquette a leader of sustainable polymer design.

- Report ID: 7159

- Published Date: Sep 03, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Polymer Coatings Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.