Polymer Colloids Market Outlook:

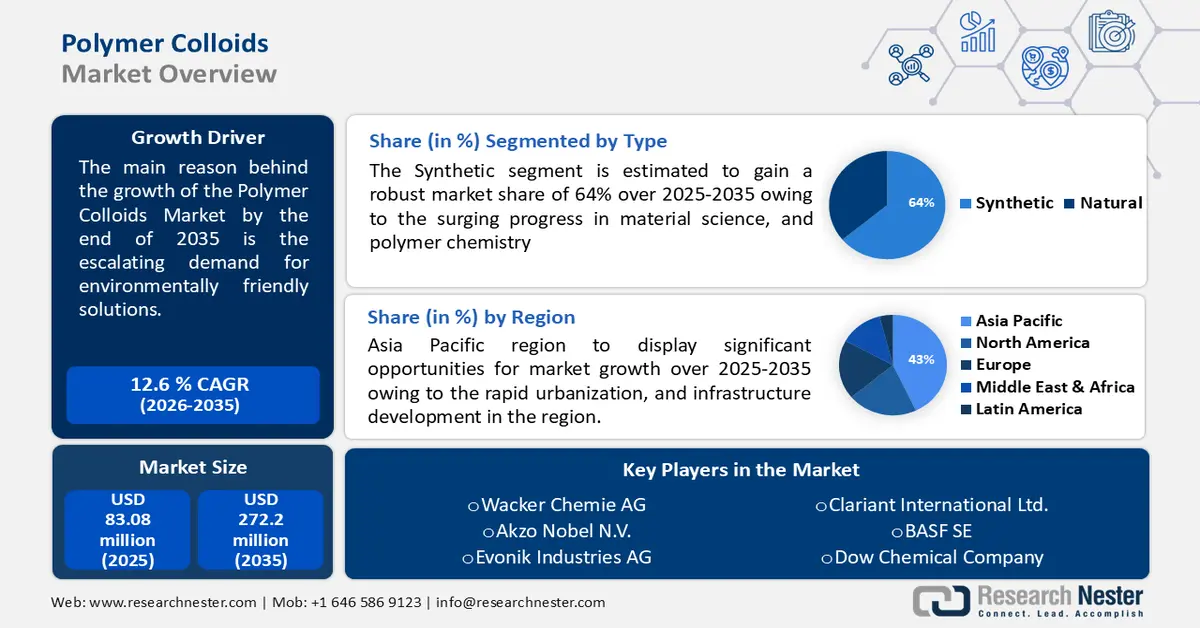

Polymer Colloids Market size was over USD 83.08 million in 2025 and is anticipated to cross USD 272.2 million by 2035, witnessing more than 12.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of polymer colloids is assessed at USD 92.5 million.

There has been an escalating demand for environmentally friendly solutions across various industries. As global awareness of environmental sustainability intensifies, industries are increasingly seeking alternatives that minimize their ecological footprint. The surge in demand for water-based polymer colloids is closely tied to their eco-friendly attributes. These colloids significantly diminish volatile organic compound (VOC) emissions, which are known contributors to air pollution and adverse health effects.

Unlike solvent-based formulations, water-based polymer colloids mitigate the release of harmful pollutants into the atmosphere during application and curing processes. This aligns with the global push towards sustainable practices and regulatory frameworks promoting environmentally responsible manufacturing. These colloids find applications in various industries, including electronics, adhesives, coatings, textiles, paper, and construction.

Key Polymer Colloids Market Insights Summary:

Regional Insights:

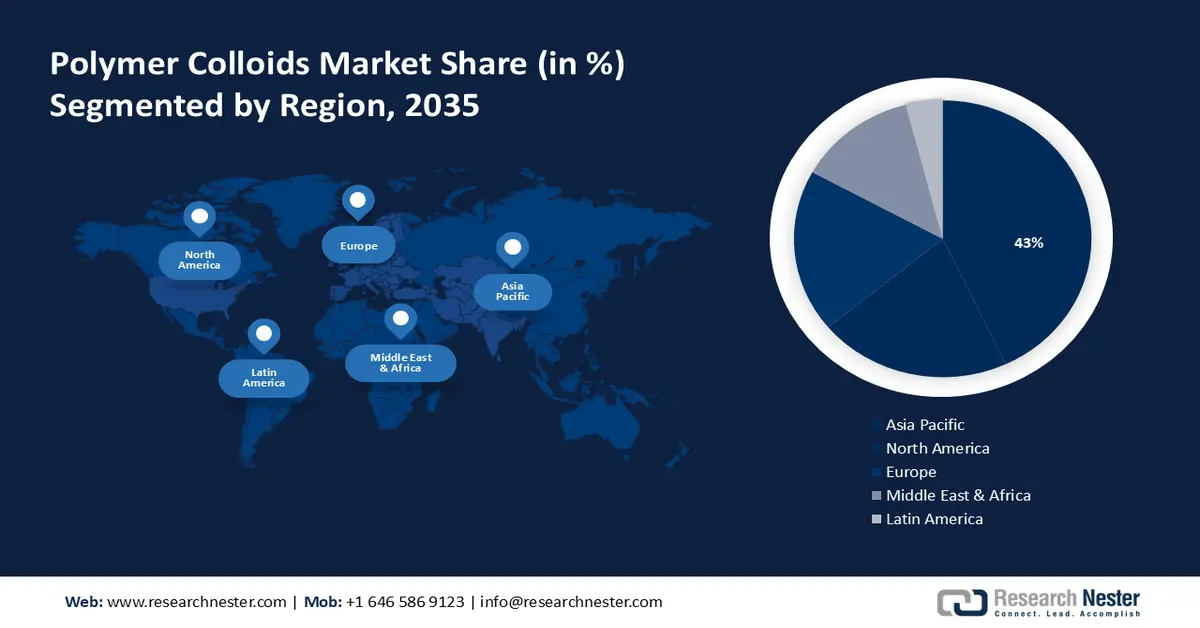

- By 2035, the Asia Pacific region is forecasted to command a 43% share of the polymer colloids market, impelled by the surge in research and development efforts in the region.

- The North America region is projected to secure the second-largest share by 2035, underpinned by the thriving construction and infrastructure sector.

Segment Insights:

- The synthetic segment in the polymer colloids market is anticipated to capture over 64% share by 2035, propelled by ongoing progress in material science and polymer chemistry.

- The electronics segment is expected to secure a notable share by 2035, supported by the exponential rise in demand for consumer electronics and smart devices.

Key Growth Trends:

- Increasing demand for sustainable packaging solutions

- Rising adoption of water based coatings in the automotive industry

Major Challenges:

- Competitive market dynamics

- Regulatory compliance

Key Players: Dow Chemical Company, BASF SE, Arkema Group, Wacker Chemie AG, Akzo Nobel N.V., Synthomer plc, Celanese Corporation, Ashland Global Holdings Inc., Clariant International Ltd., Evonik Industries AG.

Global Polymer Colloids Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 83.08 million

- 2026 Market Size: USD 92.5 million

- Projected Market Size: USD 272.2 million by 2035

- Growth Forecasts: 12.6%

Key Regional Dynamics:

- Largest Region: Asia Pacific (43% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: – United States, China, Germany, Japan, South Korea

- Emerging Countries: – India, Vietnam, Indonesia, Mexico, Brazil

Last updated on : 28 November, 2025

Polymer Colloids Market - Growth Drivers and Challenges

Growth Drivers

- Increasing demand for sustainable packaging solutions - The global emphasis on sustainable practices has driven a significant uptick in the demand for environmentally friendly flexible packaging solutions. Polymer colloids, particularly those used in water-based adhesives for packaging applications, have witnessed a surge in adoption. Sustainable packaging not only aligns with corporate responsibility goals but also responds to evolving consumer preferences for eco-conscious products.

- Rising adoption of water-based coatings in the automotive industry - Due to consumer preferences and environmental regulations, the automotive industry has shifted to water-based coatings, which has significantly accelerated the growth of polymer colloids. Polymer colloids in water-based coatings provide low volatile organic compound (VOC) emissions and meet strict environmental standards.

According to a report, by 2025, water-based coatings will hold 80% of the market for automotive coatings, which supports the growing use of polymer colloids in this industry. In the textile industry, polymer colloids are widely used for finishing applications, offering advantages like increased fabric durability and softness. - Growing popularity of water-based inks in the printing industry - A noticeable trend in the printing industry is the use of water-based inks that incorporate polymer colloids for better printability and a smaller environmental impact. The growing popularity of environmentally friendly printing methods attests to the growing importance of polymer colloids in this field.

Challenges

- Competitive market dynamics - The increasing usage of polymer colloids in paper coatings can be attributed to the paper industry's efforts to improve quality and printability. There are many companies fighting for market share in the fiercely competitive polymer colloids market. Manufacturers' profit margins are impacted by price wars that frequently result from fierce competition.

For businesses to remain competitive in this ever-evolving market, they must constantly innovate and distinguish their products. The raw material price fluctuations that affect the polymer colloids industry can have a substantial effect on production costs. For example, changes in the price of crude oil can have an impact on the price of essential raw materials for polymer colloids, making it difficult for producers to keep their prices steady and their profits high. - Regulatory compliance

- Global supply chain disruptions

Polymer Colloids Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

12.6% |

|

Base Year Market Size (2025) |

USD 83.08 million |

|

Forecast Year Market Size (2035) |

USD 272.2 million |

|

Regional Scope |

|

Polymer Colloids Market Segmentation:

Type Segment Analysis

In polymer colloids market, synthetic segment is likely to hold more than 64% share by 2035. One of the primary growth drivers for the synthetic polymer is the ongoing progress in material science and polymer chemistry. Innovations in molecular engineering, monomer design, and polymerization processes help create new synthetic polymers with specific characteristics.

For example, research and development (R&D) spending in the fields of chemistry and material science has consistently increased; the National Science Foundation (NSF) estimates that the United States alone invested over USD 5.7 billion in these areas in 2019. High-performance synthetic polymers, which prioritize durability, fuel economy, and lightweighting, are widely used in engine and interior component parts as well as structural auto parts.

Application Segment Analysis

The electronics segment in the polymer colloids market is expected to garner a significant share in the year 2035. The demand for electronic components is driven by the exponential growth in consumer electronics and smart devices, which is a major factor in the electronics segment. The demand for electronic materials and components, such as semiconductors and advanced polymers, is rising due to the rise in demand for smartphones, wearable technology, smart home appliances, and other consumer electronics.

Our in-depth analysis of the global polymer colloids market includes the following segments:

|

Type |

|

|

Application |

|

|

Product |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Polymer Colloids Market - Regional Analysis

APAC Market Insights

Asia Pacific industry is expected to dominate majority revenue share of 43% by 2035, impelled by surge in research and development efforts in the region. The rapid pace of urbanization and infrastructure development in the Asia Pacific region is a major factor in the polymer colloids market expansion. According to the Asian Development Outlook 2021, Asia's urban population is expected to reach 3.2 billion by 2050.

As cities grow, there is an increased need for environmentally friendly solutions in the construction sector that is driving the adoption of polymer colloids. The Asia Pacific region is a global hub for automotive production, and the growing demand for vehicles is a significant growth driver for polymer colloids.

North American Market Insights

The polymer colloids market in the North America region is projected to hold the second-largest share by 2035. This regional growth can be influenced by the thriving construction and infrastructure sector because polymer colloids play a crucial role in enhancing construction materials' performance.

The demand for sustainable and high-performance solutions in construction projects contributes significantly to the growth of the market in North America. The increasing emphasis on sustainable and green building practices in North America acts as a key growth driver for the polymer colloids market. The automotive industry's demand for advanced coatings is a significant driver for the market in North America.

Polymer Colloids Market Players:

- Dow Chemical Company

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- BASF SE

- Arkema Group

- Wacker Chemie AG

- Akzo Nobel N.V.

- Synthomer plc

- Celanese Corporation

- Ashland Global Holdings Inc.

- Clariant International Ltd.

- Evonik Industries AG

Recent Developments

- BASF SE announced the investment in the expansion of the polymer dispersions business in Merak, Indonesia. This expansion will bring more supply reliability to fulfill the demand for acrylics and styrene-butadiene dispersions in Southeast Asia.

- Clariant International Ltd., and its partner Lummus Technology have been selected by Huizhou Boeko Materials Co. Ltd., to provide their CATOFIN catalyst and process technology for the dehydrogenation of isobutane at the new plant in Huizhou City, China.

- Report ID: 5775

- Published Date: Nov 28, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Polymer Colloids Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.