Integrative Medicines (IM) Market Outlook:

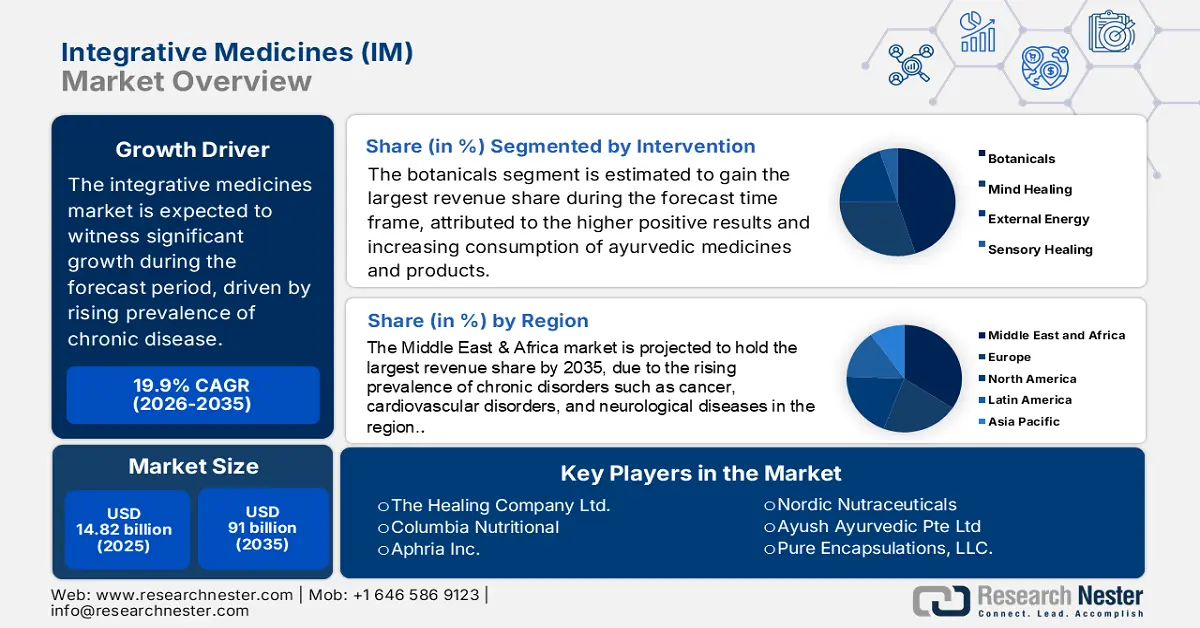

Integrative Medicines (IM) Market size was over USD 14.82 billion in 2025 and is poised to exceed USD 91 billion by 2035, witnessing over 19.9% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of integrative medicines is evaluated at USD 17.47 billion.

The growth of the market can be attributed to the rising demand for herbal medicines all over the world. According to the Ministry of Ayush, India's total export of AYUSH and herbal medicines climbed from USD 1.09 billion in 2014 to USD 1.54 billion in 2020, a strong 5.9% annual growth rate.

In addition to these, factors that are believed to fuel the market growth of integrative medicines (IM) include the rising elderly population globally and the growing investments in the development of alternative treatment methodologies are expected to boost the growth of this market in the upcoming years. The market’s growth can also be attributed to factors such as the increasing awareness and concerns regarding mental health and the rising prevalence of chronic diseases amongst individuals around the world. According to the International Diabetes Federation (IDF), in 2019, 463 million estimated adults aged between 20-79 years were suffering from diabetes, and by 2045 the number is expected to rise to 700 million. Along with these, rising initiatives by government agencies to explore norms related to the betterment of mental & physical health is projected to offer lucrative opportunities to the market in the near future. For instance, the Indian regulatory authorities have made substantial investments in the progress and normalization of integrative medical facilities in some of the states. A government agency, known as the "Ministry of Ayush" has been set up that superintends education, development, product, research, and other Ayurveda facilities, yoga, homeopathy, and naturopathy in India.

Key Integrative Medicines (IM) Market Insights Summary:

Regional Highlights:

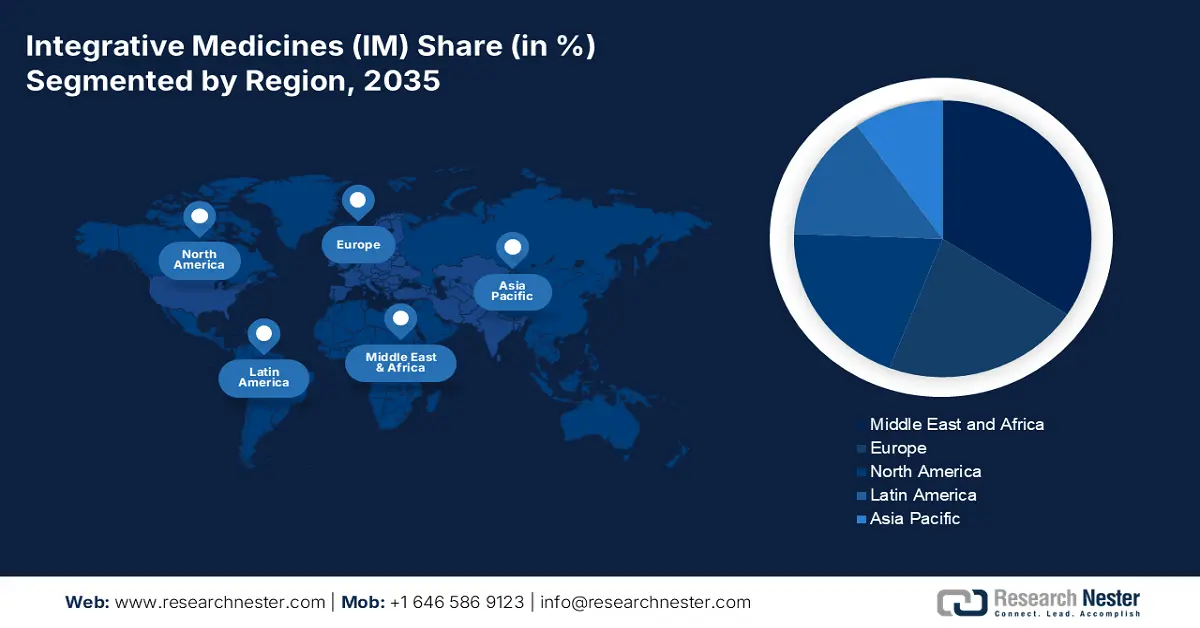

- Middle East & Africa is projected to hold the largest market share by 2035, fueled by rising prevalence of chronic disorders and increasing adoption of integrative medicine.

- Europe is predicted to account for a 30% share by 2035, supported by rising diabetes cases and the strong presence and proven success of integrative medicine service providers.

Segment Insights:

- Botanicals is estimated to secure the largest market share by 2035, owing to higher positive outcomes and increasing consumption of ayurvedic medicines alongside expanding naturopathic practice.

- E-sales is expected to garner a significant share by 2035, driven by surging online demand for herbal dietary supplements and expanding digital distribution channels.

Key Growth Trends:

- Rising Prevalence of Chronic Disease

- Rising Government Expenditure on Ayurveda

Major Challenges:

- Poor Understanding of Integrative Medicines

- Lack of Scientific Evidences Supporting the Integrative Medicines

Key Players: Columbia Nutritional, The Healing Company Ltd., Aphria Inc., Nordic Nutraceuticals, Ayush Ayurvedic Pte Ltd, Pure Encapsulations, LLC., Dabur India Ltd, Rocky Mountain Oils, Sydler India Pvt. Ltd.

Global Integrative Medicines (IM) Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 14.82 billion

- 2026 Market Size: USD 17.47 billion

- Projected Market Size: USD 91 billion by 2035

- Growth Forecasts: 19.9%

Key Regional Dynamics:

- Largest Region: Middle East & Africa

- Fastest Growing Region: Middle East & Africa

- Dominating Countries: United States, China, India, Germany, United Kingdom

- Emerging Countries: China, India, Japan, Australia, South Korea

Last updated on : 19 November, 2025

Integrative Medicines (IM) Market - Growth Drivers and Challenges

Growth Drivers

-

Rising Prevalence of Chronic Disease - Diseases such as piles, rheumatoid arthritis, jaundice, and many more are still incurable by allopathy. Nonetheless, Ayurveda has been successful in treating and controlling these illnesses. Around 0.5% of adults worldwide suffer from rheumatoid arthritis (RA), which affects around 20–50 per 100,000 people each year, mostly women over the age of 40.

-

Rising Government Expenditure on Ayurveda - Over the past seven years, the overall budget allocated to the Ayush Ministry for the National Ayush Misson’s (NAM) cost-effective Ayush services has increased by more than four times, from around USD 83 Million to nearly USD 370 Million.

-

Number of People Inclined to Yoga - Several types of yoga decreased the biochemical indicators of inflammation in numerous chronic diseases. Yoga is frequently practiced by about 300 million individuals worldwide. In addition to this, around 36 million Americans routinely practice yoga.

-

Increasing Count of Clinical Trials for Ayurvedic Medicine– Higher clinical trials are expected to launch new products. From July 1, 2018, to March 31, 2020, around 9700 trials were registered in Clinical Trials Registry-India (CTRI), out of all, around 1400 were cited as the type of study.

-

Higher Number of Wellness Centers - Wellness centers offer various health services for both the body and mind, it provides internal healing of a person. According to NITI Aayog around 150,000 Health and Wellness Centers (HWCs) that are expected to be created as part of the Ayushman Bharat Program.

Challenges

-

Poor Understanding of Integrative Medicines - Many people who promote and purchase fake products do so in the name of Ayurveda, which is frequently unjustified. Tulasi is considered to have teeksha (pungent) and ushna (hot) characteristics in Ayurveda medicine. While typically safe to consume, doing so in excess may increase the chances of underlying bleeding conditions. Therefore, lack of full understanding of integrative medicines is likely to hamper the market growth

-

Lack of Scientific Evidences Supporting the Integrative Medicines

- Rising Use of Allopathic Medicines

Integrative Medicines (IM) Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

19.9% |

|

Base Year Market Size (2025) |

USD 14.82 billion |

|

Forecast Year Market Size (2035) |

USD 91 billion |

|

Regional Scope |

|

Integrative Medicines (IM) Market Segmentation:

Intervention Segment Analysis

The global integrative medicines (IM) market is segmented and analyzed for demand and supply by intervention into botanicals, body healing, mind healing, external energy, and sensory healing. Out of the five interventions, the botanicals segment is estimated to gain the largest market share over the projected time frame. The growth of the segment can be attributed to the higher positive results and increasing consumption of ayurvedic medicines and products. Ayurveda is experiencing a renaissance in India and throughout the world. Moreover, in 2023 government anticipated that demand of ayurvedic products is likely to increase three times and jump from around USD 3 billion to nearly USD 8 billion. In addition to this, in the United States, around 240,000 use ayurvedic medicines. Moreover, increasing focus on naturopathic practice are also projected to contribute to the growth of the market segment during the forecast period. Naturopaths are in practice in more than 98 nations worldwide, accounting for 36% of all nations and every continent.

Sales Channel Segment Analysis

The global integrative medicines (IM) market is also segmented and analyzed for demand and supply by sales channel into direct sales, e-sales, and distance correspondence. Amongst these three segments, the e-sales segment is expected to garner a significant share by the end of 2035. In 2020, the sale of herbal dietary supplements in the United States topped for the first time from nearly USD 10 billion, reaching around USD 12 billion. Moreover, higher offline sales of medicines are also expected to boost segment growth. In the around USD 22–USD 24 billion domestic pharmaceutical sector, the majority of medicine sales take place in offline retail pharmacies.

Our in-depth analysis of the global market includes the following segments:

|

By Intervention |

|

|

By Sales Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Integrative Medicines (IM) Market - Regional Analysis

MEA Market Insights

The Middle East & Africa integrative medicines (IM) market, amongst the market in all the other regions, is projected to hold the largest market share by the end of 2035. The growth of the market can be attributed majorly to the rising prevalence of chronic disorders such as cancer, cardiovascular disorders, and neurological diseases in the region. By 2045, around 136 million people will have diabetes worldwide, with the MENA area having the greatest regional prevalence of nearly 16% and the second-highest predicted growth. Moreover, diabetes-related fatalities among adults of working age are most prevalent nearly 25%) in the MENA region. Furthermore, the rising use of integrative medicine is also expected to boost the market growth in the region. A study on the use of complementary and alternative medicine in Saudi Arabia in October 2020 states that around 74% of individuals used complementary and alternative medicine to address a variety of illnesses.

Europe Market Insights

Europe industry is predicted to hold largest revenue share of 30% by 2035, The market growth in the region is expected on the account of increasing cases of diabetes and the strong presence of leading integrative medicine service providers in the region. As per the Organization for Economic Cooperation and Development (OECD) analysis, approximately 32.3 million adults in the European Union were diagnosed with diabetes in the year 2019. The market in Europe is also anticipated to witness growth on account of the proven success of its healthcare providers in terms of therapy development.

Integrative Medicines (IM) Market Players:

- The Healing Company Ltd.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Columbia Nutritional

- Aphria Inc.

- Nordic Nutraceuticals

- Ayush Ayurvedic Pte Ltd

- Pure Encapsulations, LLC.

- Dabur India Ltd

- Rocky Mountain Oils

- Sydler India Pvt. Ltd.

Recent Developments

-

February 2019: Dabur India Ltd., announced the launch of two integrative medicines, a health restorative called Ratnaprash, and Hridayasava, a medicine to improve heart health. The mission of the product launch was to popularize Ayurveda among the modern-day consumers.

-

November 2022: Aster DM Healthcare launched Wellth, a hub for integrative medicine for healthy people in United Arab Emirates. The goal of the center is to assist individuals live better lifestyles, treat chronic lifestyle disorders, and guard against inherited illnesses.

- Report ID: 3245

- Published Date: Nov 19, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Integrative Medicines (IM) Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.