Vasopressin Market Outlook:

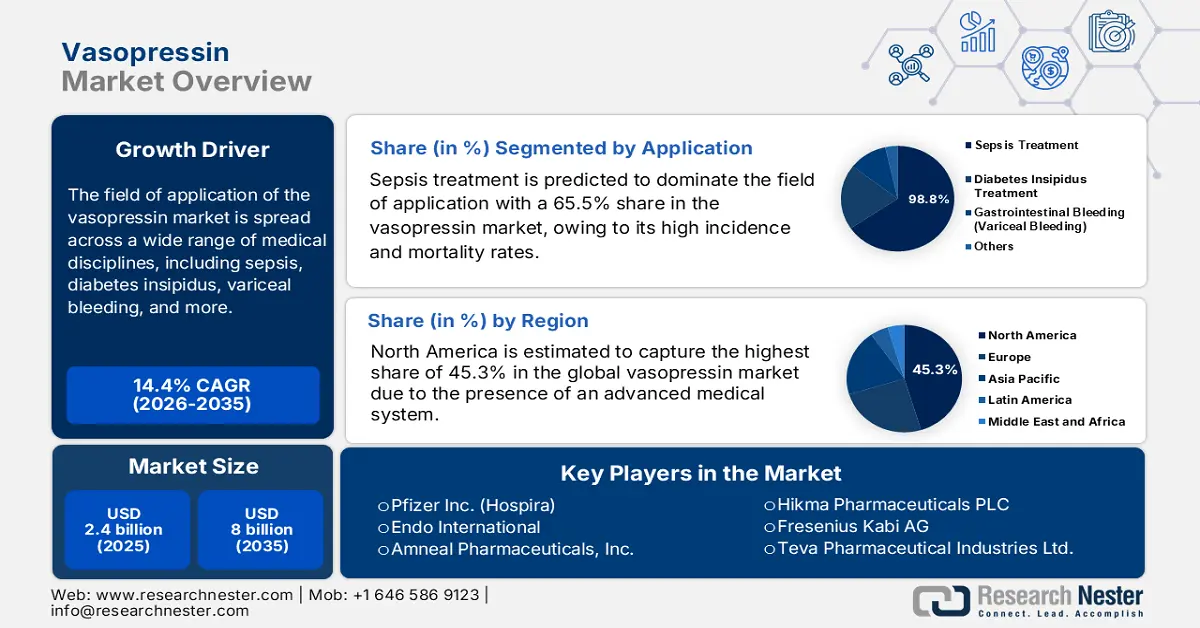

Vasopressin Market size was over USD 2.4 billion in 2025 and is estimated to reach USD 8 billion by the end of 2035, expanding at a CAGR of 14.4% during the forecast period, i.e., 2026-2035. In 2026, the industry size of vasopressin is estimated at USD 2.7 billion.

The field of application of the vasopressin market is spread across a wide range of medical disciplines, including sepsis, diabetes insipidus, variceal bleeding, and more. Despite being a rare condition, the susceptible demography of diabetes insipidus, containing individuals with brain surgery, major head injury, a high intake of bipolar disorder medicines or diuretics, and metabolic disorders, remains high in volume. This can be testified by the 2021 NIH report and 2022 survey conducted by the University of Basel, calculating the worldwide occurrence rate of this ailment to be 1 in 25,000 people. On the other hand, a 2025 Journal of Critical Care Science revealed that traumatic brain injury (TBI) alone affects around 55-69 million residents in the world.

The payers’ pricing dynamics of products available in the vasopressin market have become a focal point for healthcare insurers, particularly in hospital settings, due to escalating costs. In response, pioneers and service providers in this sector are adopting strategic development and distribution models to retain economically liberal for a majority of consumers. This can be evidenced by the promising results from a 2022 NLM analysis on a cost-saving program initiated at a 545-bed academic medical center. It underscored that reformulating vasopressin from a 50-unit/250 mL concentration to a 20-unit/100 mL concentration and removing it from automated dispensing cabinets (ADCs) can save approximately USD 235,241.6 for an institution every year, where per-patient saving was USD 366.4.

Key Vasopressin Market Insights Summary:

Regional Insights:

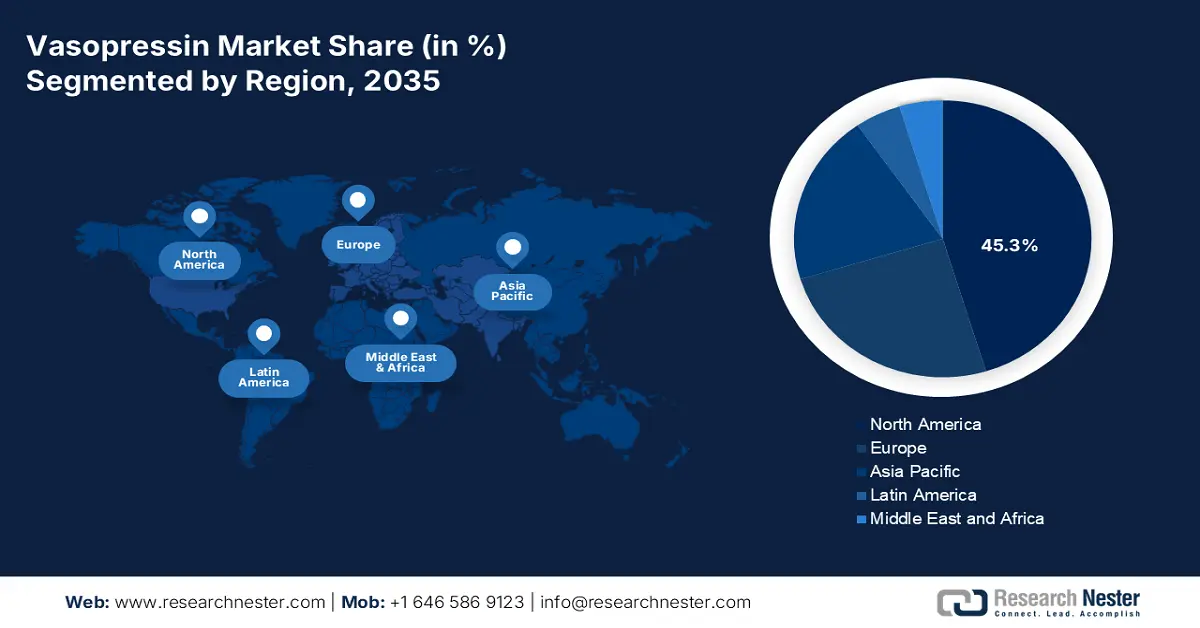

- North America is projected to secure a 45.3% share in the vasopressin market by 2035, supported by advanced healthcare infrastructure and extensive adoption of evidence-based treatment protocols.

- Europe is anticipated to sustain a notable position through 2026–2035, propelled by elevated critical care standards and continuous progress in biomedical research.

Segment Insights:

- The sepsis treatment segment is predicted to capture a 65.5% share in the vasopressin market by 2035, propelled by the increasing global incidence and mortality linked to septic shock.

- The synthetic vasopressin segment is anticipated to account for a 98% share by 2035, owing to its superior stability, safety, and cost-efficient production technologies.

Key Growth Trends:

- Increasing consumption among older people

- Growing awareness of early intervention

Major Challenges:

- Restrictive pricing controls and dynamics

- Strict health technology assessment (HTA) scrutiny

Key Players: Pfizer Inc. (Hospira), Par Pharmaceutical (Endo International), Amneal Pharmaceuticals, Inc., Hikma Pharmaceuticals PLC, Fresenius Kabi AG, Teva Pharmaceutical Industries Ltd., Viatris Inc., Sun Pharmaceutical Industries Ltd., Piramal Enterprises Ltd. (Piramal Critical Care), Amphastar Pharmaceuticals, Inc., Shanghai Soho-Yiming Pharmaceuticals, Hybio Pharmaceutical Co., Ltd., Ferring Pharmaceuticals, Novartis AG (Sandoz), JW Pharmaceutical, Aspen Pharmacare Holdings Ltd., Bachem Holding AG, Archer Daniels Midland Company, PharmaSGP, Long Grove Pharmaceuticals, Baxter International Inc.

Global Vasopressin Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.4 billion

- 2026 Market Size: USD 2.7 billion

- Projected Market Size: USD 8 billion by 2035

- Growth Forecasts: 14.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (45.3% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, United Kingdom

- Emerging Countries: India, Brazil, South Korea, Indonesia, Mexico

Last updated on : 1 October, 2025

Vasopressin Market - Growth Drivers and Challenges

Growth Drivers

- Increasing consumption among older people: The worldwide expansion in the geriatric demography leads to a higher occurrence of associated chronic diseases, such as heart failure and renal dysfunction, where products from the vasopressin market are heavily prescribed. As older adults are more susceptible to complications, including vasodilatory shock, the rapidly aging population is increasing the demand for these therapies. In this regard, the World Health Organization (WHO) unveiled that the count of elderly people in the world is predicted to double by 2050 from 2020, totaling 2.1 billion.

- Growing awareness of early intervention: As infrastructural development in healthcare gains traction, people around the globe are becoming more aware of the clinical benefits of therapeutics from the vasopressin market. Testifying to the same, a 2025 NLM study revealed that early adjunctive vasopressin initiation for septic shock patients reduced the 30-day ICU mortality rate by 0.8%, along with an increase of 9.9% in administration rate from 2015 to 2021 compared to the no vasopressin group. Particularly, in emerging economies, such as India, China, and Brazil, consumer bases are amplifying remarkably under the influence of such evidence.

- Innovations in drug formulations and delivery: The introduction of generic models and improved delivery methods, including IV infusion pumps and subcutaneous pens, enhances treatment affordability and efficacy. As a result, these innovations escalate uptakes and profit margins for global suppliers in the vasopressin market. For instance, till June 2022, Amneal Pharmaceuticals generated a sales value of USD 624 million in the U.S. from its launch of the generic, 1mL, single-dose Vasopressin injection after obtaining Abbreviated New Drug Application (ANDA) approval from the FDA, according to the time-to-market (TTM) estimations from IQVIA.

Historic Demographic Trends in Key Landscapes of the Vasopressin Market

Demographic Trends of Sepsis in the U.S. in Different Timelines

|

Time Period |

Incidence/Rate |

|

1979-1987 |

Increase from 76 to 176 septicemia codes per 100,000 people |

|

1995 (7 states) |

The incidence rate of severe sepsis accounted for 300 per 100,000 |

|

1979-2000 |

Severe sepsis increased from 83 to 240 per 100,000 |

|

2003–2009 |

11% increase in infection codes, 49% in sepsis codes |

|

2004-2009 |

An annual increase of approximately 13% was observed |

|

2003-2012 |

54–706% increase in sepsis codes (administrative data) |

Source: NLM

Analysis of Ongoing/Recent Clinical Research and Findings in the Vasopressin Market

Recent/Current Clinical Trials on Vasopressin

|

Study Title |

Sponsor |

Timeline |

Key Focus |

|

Vasopressin for Septic Shock Pragmatic Trial |

Intermountain Health Care, Inc. |

2024-2027 |

Evaluate two different strategies for septic shock treatment commonly used in current practice |

|

Registry of Patients in Shock Treated with Vasopressin |

Hospital Universitario 12 de Octubre |

2024-2026 |

Characterise the routine clinical practice of vasopressin use in the context of shock |

|

VAsopressin vs. NOradrenaline in the Management of Patients at Risk of Kidney Failure Undergoing Cardiac Surgery |

Centre Hospitalier Universitaire Dijon |

2023-2026 |

Compare the effect of both drugs on the volume of patients with acute renal failure and/or death |

|

HYdrocortisone and VAsopressin in Post-RESuscitation Syndrome (HYVAPRESS) |

Assistance Publique - Hôpitaux de Paris |

2021-2025 |

demonstrate the superiority of arginine-vasopressin (AVP) and hydrocortisone vs. norepinephrine for day-30 survival and neurological recovery |

|

VAsopressin and STeroids in Addition to Adrenaline in Cardiac Arrest - a Randomized Clinical Trial (VAST-A) |

Tiohundra AB |

2021-2027 |

Finding the most suitable treatment for in-hospital cardiac arrest |

Source: Clinicaltrials.gov

Challenges

- Restrictive pricing controls and dynamics: The tightening of affordability thresholds for medicines harmfully shrinks the scope of profitability in the vasopressin market. Particularly, the increased use of government-imposed reference pricing in target countries pushes suppliers to set relatively lower pricing to maintain their competency. This creates a negative pressure on pricing strategies, squeezing profit margins and discouraging new market entry.

- Strict health technology assessment (HTA) scrutiny: The regulatory pathways in key landscapes are increasingly becoming more time-consuming and expensive for pioneers in the vasopressin market, as they demand extensive real-world evidence. On the other hand, a negative HTA opinion severely damages brand reputation, forcing companies to enroll for additional comparative effectiveness reviews. This directly impacts the commercial viability of this sector.

Vasopressin Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

14.4% |

|

Base Year Market Size (2025) |

USD 2.4 billion |

|

Forecast Year Market Size (2035) |

USD 8 billion |

|

Regional Scope |

|

Vasopressin Market Segmentation:

Application Segment Analysis

Sepsis treatment is predicted to dominate the field of application with a 65.5% share in the vasopressin market over the assessed period. The heightening global incidence and mortality rates of septic shock are the primary sources of growth in this segment. In this regard, a 2024 NLM study calculated the global age-standardized occurrence rate of this ailment to be 677.5 cases per 100,000 people. Another WHO report unveiled that the mortality rate for intensive care patients treated for sepsis accounted for 42% in 2024. Along with such a substantial population, public health authorities dedicated to this category strongly recommend the use of vasopressin as a critical second-line vasopressor therapy.

Type Segment Analysis

Synthetic vasopressin is anticipated to maintain its position as the largest shareholder in the market with a 98% by the end of 2035. This overwhelming preference is pledged to the persistence of these formulations in delivering unmatched quality, stability, and scalability compared to natural vasopressin. In addition, products from this segment enable reduced risk of contamination, making it the gold standard for long-term clinical use in treating conditions such as diabetes insipidus, septic shock, and gastrointestinal bleeding. Currently, advancements in production technologies are efficiently lowering manufacturing costs, which contributes to improved accessibility in both hospital and outpatient settings.

Route of Administration Segment Analysis

Intravenous (IV) infusion is estimated to remain the most preferred route of administration in the vasopressin market throughout the discussed timeline, while capturing 98.7% share. The predominant utilization of this method is highly attributable to its ability to deliver precise and controlled dosing. These factors collectively make this an essential tool for seamless management of patients with associated acute and life-threatening conditions. Besides, the rapid onset of action provided by this administration ensures on-time therapeutic initiation, making it the first choice for emergency and intensive care units.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegments |

|

Type |

|

|

Application |

|

|

Route of Administration |

|

|

Distribution Channel |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Vasopressin Market - Regional Analysis

North America Market Insights

North America is estimated to capture the highest share of 45.3% in the vasopressin market during the analyzed tenure. The region’s augmentation in this sector is primarily fueled by the presence of an advanced medical system, a large demography of critical illnesses, and widespread implementation of evidence-based treatment protocols. The landscape is also pledged to a high volume of intensive care patient population, particularly for conditions such as septic shock and cardiac arrest, where vasopressin is a key therapeutic agent. Moreover, robust regulatory pathways, prominent position in formulation advances, and heavy public allocations to biomedical research cumulatively attract greater commercial engagement.

The U.S., in particular, leads the North America vasopressin market due to high healthcare expenditure and awareness of early adoption. The country, with its well-established network of distribution channels, has become an epitome of revenue generation and massive investments in this sector. Exemplifying such a lucrative nature, in June 2023, Fresenius Kabi expanded its U.S.-based critical care portfolio by launching a generic equivalent to Vasostrict, USP, for treating adults with vasodilatory shock. The company also dedicated USD 1 billion to establish a state-of-the-art production and distribution network for vasopressin injection.

Canada plays a prominent role in the regional progress in the vasopressin market in support of its comprehensive public healthcare system and growing emphasis on critical care interventions. Hospitals across the country are increasingly using this formulation to enhance patient management in cases of septic shock and advanced cardiovascular life support (ACLS). Furthermore, continuous federal allocations to ICU capacity and emergency medicine also contribute to steady demand. Additionally, the country’s participation in multinational clinical trials and streamlined regulatory pathways enhances the availability in this sector.

Overview of the National Sepsis Demographics

|

Country |

Metrics |

|

U.S. |

In-hospital sepsis incidence rate stood at 517 per 100,000 inhabitants (2022) |

|

Canada |

Sepsis causes 1 in 18 deaths and USD 2.6 billion in healthcare expenditure annually |

Source: NLM and PLOS

APAC Market Insights

Asia Pacific is expected to emerge as the fastest-growing region in the vasopressin market by the end of 2035. Rapid improvements in healthcare access, infrastructural reinforcement in ICUs, and enactment of favorable treatment protocols are propelling the region’s pace of progress. The massive geriatric populations, higher rates of accidental head injuries, and expansion in the biopharmaceutical industry are also contributing to the accelerated growth in this landscape. This is further complemented by rigorous government initiatives aimed at strengthening critical care capacity.

The rising adoption rate in the China vasopressin market is largely attributable to ongoing advances in formulations and production. The country holds an internationally leading position in participation in extensive clinical research and GMP-compliant manufacturing, fueling expansion in this sector. Additionally, National efforts to improve sepsis management protocols and adopt evidence-based therapies are boosting demand for higher utilization of vasopressin in hospital settings, fostering a sustainable consumer base.

India showcases high potential of generating lucrative revenue from the vasopressin market on account of its substantial high-risk patient population. Specifically, the increasing cases of metabolic disorders and head injuries are garnering attractive opportunities for both domestic and foreign pioneers in this sector. Evidencing the same, a 2024 European Journal of Cardiovascular Medicine recognized India as the source of the largest demography of traumatic brain injuries (TBIs) in the world, where more than 100 thousand lives are lost every year. This figure is further accompanied by the volume of people suffering from TBI, surpassing 1 million.

Europe Market Insights

Europe is predicted to maintain a strong position in the vasopressin market over the timeline between 2026 and 2035. High standards of critical care and consistent progress in biomedical research are the major growth factors behind the region’s augmentation in this sector. Besides, the upgraded treatment protocols for septic shock outbreaks and cardiovascular emergencies are fostering a large consumer base for the merchandise in line with international guidelines. The ongoing advances in large-scale ICU cohort studies also continue to reinforce the therapeutic value of vasopressin, securing a prosperous future for this sector in Europe.

Favorable operations of the regulatory framework across the UK, coupled with a universal healthcare reimbursement framework, contribute to stable demand and accessibility in the vasopressin market. The National Health Service (NHS) plays a pivotal role in enabling equitable access to these life-saving therapies. Moreover, high consumer awareness supports the informed use and ongoing evaluation in this category, which improves commercial adherence to evidence-based treatment guidelines.

Germany is a leading landscape of the Europe vasopressin market, which is backed by its highly developed medical system and strong emphasis on clinical trials. Evidencing the same, in 2022, the nation had the highest number of hospital beds in Europe, totaling 6,42,107, as reported by the European Commission. The country’s advanced emergency treatment protocols also foster an attractive business environment for this category, influencing more local pharma manufacturers to participate. Additionally, the nationwide robust pharmaceutical industry and regulatory efficiency contribute to the steady availability of high-quality synthetic vasopressin products.

Country-wise Sepsis Demographic Trends (2022-2023)

|

Country |

Incidence Rates (per 100,000 people) |

|

Germany |

158 (in-hospital sepsis) |

|

Sweden |

780 (in-hospital sepsis) |

|

Switzerland |

Annual 20,000 sepsis-coded hospitalisations |

Source: NLM and Swiss Sepsis Program

Key Vasopressin Market Players:

- Pfizer Inc. (Hospira)

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Par Pharmaceutical (Endo International)

- Amneal Pharmaceuticals, Inc.

- Hikma Pharmaceuticals PLC

- Fresenius Kabi AG

- Teva Pharmaceutical Industries Ltd.

- Viatris Inc.

- Sun Pharmaceutical Industries Ltd.

- Piramal Enterprises Ltd. (Piramal Critical Care)

- Amphastar Pharmaceuticals, Inc.

- Shanghai Soho-Yiming Pharmaceuticals

- Hybio Pharmaceutical Co., Ltd.

- Ferring Pharmaceuticals

- Novartis AG (Sandoz)

- JW Pharmaceutical

- Aspen Pharmacare Holdings Ltd.

- Bachem Holding AG

- Archer Daniels Midland Company

- PharmaSGP

- Long Grove Pharmaceuticals

- Baxter International Inc.

The commercial dynamics of the vasopressin market feature a highly competitive landscape, consolidated by the strategic product development cohorts and regional expansion milestones. The focus of such key players is currently concentrated on procuring more affordable and efficient therapeutic lines from this category to serve a wide range of clinical applications. For instance, in May 2024, Long Grove Pharmaceuticals shared its plans to debut in the critical care market with the launch of two different concentrations of Premix Vasopressin: 20 units/100 mL (0.2 units/mL) and 40 units/100 mL (0.4 units/mL) in 0.9% sodium chloride. This strategy was drafted to earn bulk procurement contracts from hospital pharmacies throughout the U.S., enabling immediate value from its offerings.

Here is a list of key players operating in the market:

Recent Developments

- In July 2024, Long Grove Pharmaceuticals attained FDA approval for its premix Vasopressin in two different concentrations: 20 units/100 mL and 40 units/100 mL in 0.9% sodium chloride. The injection is indicated to increase blood pressure when other measures have failed for patients in critical hypotensive shock.

- In April 2024, Baxter announced the commercial launch of five injectable products in the U.S., including Vasopressin in 0.9% Sodium Chloride. The FDA-approved, ready-to-use product comes in a flexible container, used to treat adults with vasodilatory shock who remain hypotensive despite fluids and catecholamines.

- Report ID: 8158

- Published Date: Oct 01, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Vasopressin Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.