- Introduction

- Market Definition

- Market Segmentation

- Product Overview

- Assumptions and Acronyms

- Research Methodology

- Research Process

- Primary Research

- Industrial Service Providers

- End Users

- Secondary Research

- Market Size Estimation

- Executive Summary – Global Industrial Services Market

- Analysis on the Market Dynamics

- Growth Drivers

- Market Trends

- Major Roadblocks for the Market

- Key Market Opportunities

- Service Type Based

- Application Type Based

- End-User Based

- Geography Based

- End-User Usability Analysis – Industrial Services

- Average Pricing Analysis

- Impact of Covid-19 on the Industrial Services Market

- Impact on the overall market

- Impact on the supply chain

- Impact on end-users

- Impact on overall price trend

- Impact on demand

- Impact on revenue generation of key players

- Regional Analysis of Industrial Services Ecosystem

- Technological Outlook on Explosion Protection

- Product Portfolio Comparative Analysis

- Global Industrial Services Market Outlook

- By Value, 2019-2028 (USD Million)

- By Service Type

- Engineering and Consulting, 2019-2028F (USD Million)

- Installation and Commissioning, 2019-2028F (USD Million)

- Operational Improvement and Maintenance, 2019-2028F (USD Million)

- By Application

- Distributed Control System (DCS), 2019-2028F (USD Million)

- Programmable Logic Controller (PLC), 2019-2028F (USD Million)

- Supervisory Control and Data Acquisition, 2019-2028F (USD Million)

- Electric Motors and Drives, 2019-2028F (USD Million)

- Valves and Actuators, 2019-2028F (USD Million)

- Human Machine Interface (HMI), 2019-2028F (USD Million)

- Monitoring Systems, 2019-2028F (USD Million)

- Signaling Systems, 2019-2028F (USD Million)

- Imaging Systems, 2019-2028F (USD Million)

- Manufacturing Execution System (MES), 2019-2028F (USD Million)

- Safety Systems, 2019-2028F (USD Million)

- Explosion Protection System, 2019-2028F (USD Million)

-  Motors & Control Systems, 2019-2028F (USD Million)

-  Power Supply System, 2019-2028F (USD Million)

-  Automation System, 2019-2028F (USD Million)

-  Surveillance System, 2019-2028F (USD Million)

-  Other Systems, 2019-2028F (USD Million)

- Burner Management System (BMS), 2019-2028F (USD Million)

- Emergency Shutdown System (ESD), 2019-2028F (USD Million)

- Fire and Gas Monitoring and Control, 2019-2028F (USD Million)

- Others, 2019-2028F (USD Million)

- Explosion Protection System, 2019-2028F (USD Million)

- By End-User

- Oil & Gas Industry, 2019-2028F (USD Million)

- Chemical Industry, 2019-2028F (USD Million)

- Energy & Power, 2019-2028F (USD Million)

- Mining, 2019-2028F (USD Million)

- Marine and Shipbuilding, 2019-2028F (USD Million)

- Pharmaceutical Industry, 2019-2028F (USD Million)

- Aviation, 2019-2028F (USD Million)

- Food & Beverage Industry, 2019-2028F (USD Million)

- Others, 2019-2028F (USD Million)

- By Region

- North America, 2019-2028F (USD Million)

- Europe, 2019-2028F (USD Million)

- Asia Pacific, 2019-2028F (USD Million)

- Latin America, 2019-2028F (USD Million)

- Middle East & Africa, 2019-2028F (USD Million)

- By Service Type

- By Value, 2019-2028 (USD Million)

- North America Industrial Services Market Outlook

- By Service Type

- Engineering and Consulting, 2019-2028F (USD Million)

- Installation and Commissioning, 2019-2028F (USD Million)

- Operational Improvement and Maintenance, 2019-2028F (USD Million)

- By Application

- Distributed Control System (DCS), 2019-2028F (USD Million)

- Programmable Logic Controller (PLC), 2019-2028F (USD Million)

- Supervisory Control and Data Acquisition, 2019-2028F (USD Million)

- Electric Motors and Drives, 2019-2028F (USD Million)

- Valves and Actuators, 2019-2028F (USD Million)

- Human Machine Interface (HMI), 2019-2028F (USD Million)

- Monitoring Systems, 2019-2028F (USD Million)

- Signaling Systems, 2019-2028F (USD Million)

- Imaging Systems, 2019-2028F (USD Million)

- Manufacturing Execution System (MES), 2019-2028F (USD Million)

- Safety Systems, 2019-2028F (USD Million)

- Explosion Protection System, 2019-2028F (USD Million)

-  Motors & Control Systems, 2019-2028F (USD Million)

-  Power Supply System, 2019-2028F (USD Million)

-  Automation System, 2019-2028F (USD Million)

-  Surveillance System, 2019-2028F (USD Million)

-  Other Systems, 2019-2028F (USD Million)

- Burner Management System (BMS), 2019-2028F (USD Million)

- Emergency Shutdown System (ESD), 2019-2028F (USD Million)

- Fire and Gas Monitoring and Control, 2019-2028F (USD Million)

- Others, 2019-2028F (USD Million)

- Explosion Protection System, 2019-2028F (USD Million)

- By End-User

- Oil & Gas Industry, 2019-2028F (USD Million)

- Chemical Industry, 2019-2028F (USD Million)

- Energy & Power, 2019-2028F (USD Million)

- Mining, 2019-2028F (USD Million)

- Marine and Shipbuilding, 2019-2028F (USD Million)

- Pharmaceutical Industry, 2019-2028F (USD Million)

- Aviation, 2019-2028F (USD Million)

- Food & Beverage Industry, 2019-2028F (USD Million)

- Others, 2019-2028F (USD Million)

- By Service Type

- Europe Industrial Services Market Outlook

- Asia-Pacific Industrial Services Market Outlook

- Latin America Industrial Services Market Outlook

- Middle East & Africa Industrial Services Market Outlook

- Competitive Landscape, 2019-2028

- General Electric

- Honeywell International Inc.

- Samson AG

- R. Stahl AG

- Siemens AG

- Schneider Electric

- Rockwell Automation, Inc.

- Eaton Corporation plc

- ABB Ltd.

- Leadec Holding BV & Co. KG

- Bilfinger SE

- WERMA Signaltechnik GmbH

- Other leading players

Industrial Services Market Outlook:

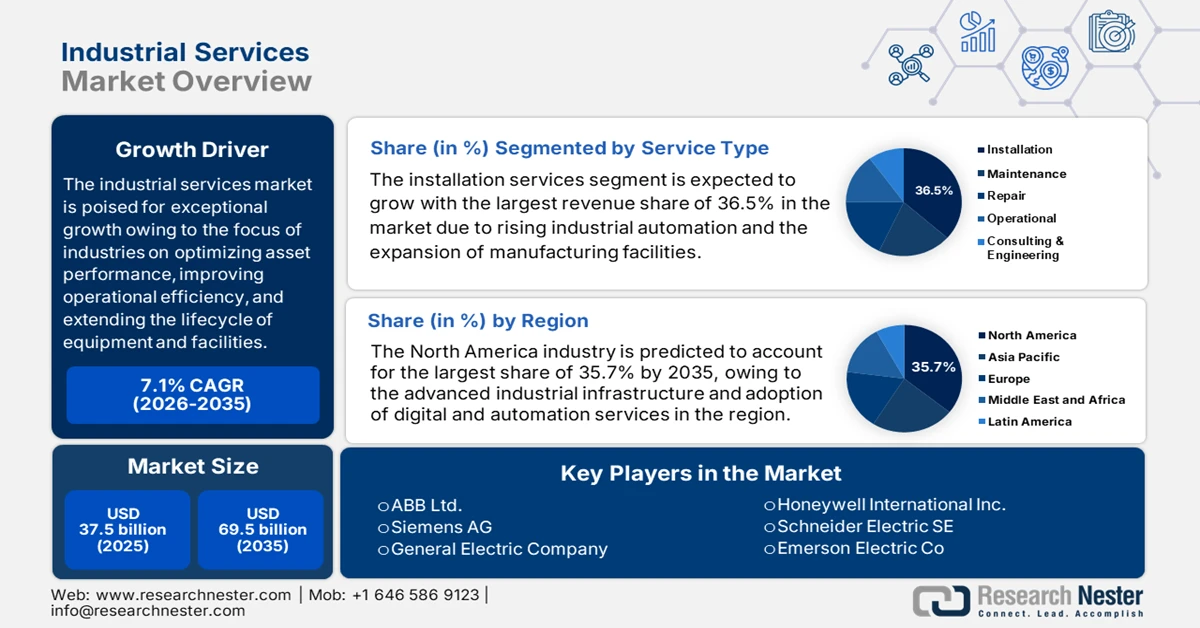

Industrial Services Market size was valued at USD 37.5 billion in 2025 and is projected to reach USD 69.5 billion by the end of 2035, rising at a CAGR of 7.1% during the forecast period, i.e., 2026-2035. In 2026, the industry size of industrial services is evaluated at USD 40.1 billion.

The industrial services market is poised for exceptional growth, owing to the focus of industries on optimizing asset performance, improving operational efficiency, and extending the lifecycle of equipment and facilities. In this context, Bilfinger SE, which is an international industrial services provider, reported that has been announced for inclusion in the STOXX Europe 600 index in June 2025. The company delivers services across the entire industrial value chain in Europe, North America, and the Middle East, and its revenues exceeded USD 5.4 billion (€5 billion) in 2024. Hence, such instances enhance the firm’s visibility and credibility with investors, which in turn can attract additional capital for expansion projects, enable larger industrial service contracts, and support growth in the industrial services sector.

Furthermore, the aspects of energy transition initiatives, expansion of manufacturing capacity, and heightened emphasis on safety, compliance, and reliability are stimulating unprecedented growth in the market. In October 2024, H.I.G. Capital, a global alternative investment firm with USD 65 billion under management, announced the acquisition of Rainham Industrial Services, a UK provider of installation, maintenance, and refurbishment services for the power generation, energy-from-waste, nuclear, and manufacturing sectors. Rainham operates from four UK locations, delivering mechanical, access, insulation, painting, and cleaning services, and the company benefits from an ageing industrial base and a growing power generation industry. It plans to expand its offerings through selective M&A while retaining its existing management team. Hence, this transaction demonstrates a strong private equity appetite driven by ageing infrastructure and consolidation opportunities.

Key Industrial Services Market Insights Summary:

Regional Highlights:

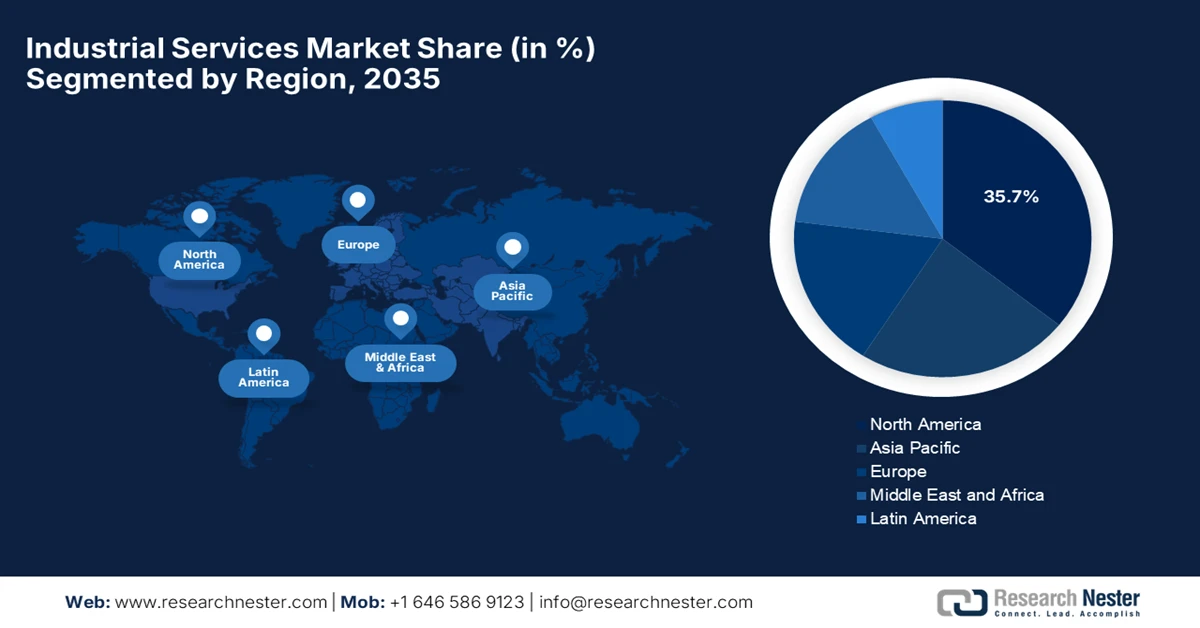

- North America is expected to dominate the industrial services market by capturing a 35.7% revenue share by 2035, supported by advanced industrial infrastructure and accelerating adoption of digitalization and automation services.

- Asia Pacific is projected to register the fastest expansion over the 2026-2035 forecast period, stimulated by rapid industrialization, urban development, and manufacturing capacity buildup across emerging economies.

Segment Insights:

- Installation services is projected to command the largest revenue contribution of 36.5% by 2035 within the industrial services market, underpinned by rising deployment of automated and digital industrial systems necessitating specialized equipment setup, calibration, and integration.

- Manufacturing execution system is expected to secure a considerable share during the 2026-2035 forecast period, supported by manufacturers’ accelerating adoption of digital production management platforms to streamline workflows, enable real-time data visibility, and integrate advanced analytics.

Key Growth Trends:

- Adoption of advanced technologies & industry 4.0

- Outsourcing & operational optimization

Major Challenges:

- Skilled labor shortage and workforce aging

- Demand volatility and project uncertainty

Key Players: ABB Ltd. (Switzerland), Siemens AG (Germany), General Electric Company (U.S.), Honeywell International Inc. (U.S.), Schneider Electric SE (France), Emerson Electric Co. (U.S.), Rockwell Automation, Inc. (U.S.), Mitsubishi Electric Corporation (Japan), Yokogawa Electric Corporation (Japan), Hitachi, Ltd. (Japan), Bosch Rexroth AG (Germany), Atlas Copco AB (Sweden), SKF AB (Sweden), Eaton Corporation plc (Ireland), Fluor Corporation (U.S.), Jacobs Engineering Group Inc. (U.S.), Veolia Environnement S.A. (France), SGS S.A. (Switzerland), L&T Technology Services Ltd. (India), Petrofac Limited (UK)

Global Industrial Services Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 37.5 billion

- 2026 Market Size: USD 40.1 billion

- Projected Market Size: USD 69.5 billion by 2035

- Growth Forecasts: 7.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35.7% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, China, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Saudi Arabia, Australia

Last updated on : 30 January, 2026

Industrial Services Market - Growth Drivers and Challenges

Growth Drivers

- Adoption of advanced technologies & industry 4.0: The rising integration of IoT, AI, data analytics, smart sensors, and automation is the primary factor boosting demand in the industrial services market to install, manage, and support these technologies. In this context, in March 2025, Systems with Intelligence (SWI) announced that it acquired Enertics Inc., which is a company specializing in AI-powered industrial IoT solutions for real-time asset health monitoring. Besides, this acquisition enhances SWI’s touchless monitoring systems by integrating advanced sensing, connectivity, and predictive analytics, enabling faster deployment and improved operational efficiency for industrial and utility applications. Furthermore, both of the companies aim to strengthen remote monitoring capabilities, optimize asset performance, and reduce operational risks through AI-based diagnostics and automation.

- Outsourcing & operational optimization: Companies are allocating maintenance, repair, and operational tasks to service providers for management of core business functions and accessing technical expertise. This trend is most evident in the manufacturing, energy, and utility sectors, where in-house capabilities may be limited. In June 2025, SBM Offshore announced an operations and maintenance contract with TotalEnergies EP Suriname B.V. for the FPSO GranMorgu in Suriname’s Block 58. It also mentioned that the agreement covers the operational readiness phase before first oil and at least two years of ongoing O&M services, with extension options. Hence, this marks SBM Offshore as the first FPSO operator in Suriname and highlights TotalEnergies’ strategy of outsourcing specialized operational and maintenance tasks to leverage SBM’s expertise and optimize project performance, benefiting the market.

- Rising industrialization & infrastructure development: Expansion in terms of industrial activities in emerging markets is efficiently boosting the market. Also, the infrastructural modernization of factories, power plants, and processing facilities requires technical services throughout their asset lifecycle. In this context, the Uzbekistan Government in October 2025 reported that it had begun the first stage of construction for its small modular nuclear power plant (SMNPP) in the Jizzakh area, which was a major step in national energy infrastructure development. This project involves extensive technical and industrial services, which include excavation, equipment installation, and assembly, supported by 308 specialists and 177 units of machinery. Further, this initiative not only advances Uzbekistan’s energy independence and economic growth but also drives demand for specialized industrial services during the plant’s lifecycle, from construction to workforce training, hence denoting a positive market outlook.

Challenges

- Skilled labor shortage and workforce aging: The industrial services market faces a major challenge of skilled labor, owing to an aging workforce and insufficiencies in terms of young, technically trained professionals. Most of the experienced technicians and maintenance specialists are near retirement, whereas the replacements possess equivalent hands-on expertise. The presence of this skill gap negatively affects service quality, response times, and the ability to scale operations. Moreover, industrial services also necessitate digital, automation, and data analytics skills, increasing talent shortages in this sector. Furthermore, the aspect of training and upskilling programs demands both time and investment, making workforce management a major challenge for service providers operating across complex environments.

- Demand volatility and project uncertainty: The market is sensitive to macroeconomic cycles, capital expenditure trends, and geopolitical factors. Therefore, demand can fluctuate owing to the economic slowdowns, commodity price volatility, or changes in terms of government infrastructure spending. At the same time, project delays, cancellations, or scope reductions are common, especially in large-scale industrial and energy projects. This uncertainty complicates capacity planning, workforce deployment, and revenue forecasting for service providers. In addition, increasing customer preference for short-term or flexible contracts reduces revenue visibility, making long-term strategic planning and investment decisions even more challenging for industry participants.

Industrial Services Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

7.1% |

|

Base Year Market Size (2025) |

USD 37.5 billion |

|

Forecast Year Market Size (2035) |

USD 69.5 billion |

|

Regional Scope |

|

Industrial Services Market Segmentation:

Service Type Segment Analysis

By the end of 2035, the installation services segment is expected to grow with the largest revenue share of 36.5% in the industrial services market. The growth is mainly propelled by industries deploying new automated and digital systems, requiring expert setup, calibration, and integration of advanced equipment. In September 2025, GlobalLogic, in collaboration with Ericsson, reported that it had deployed a private 5G network at Hitachi Rail’s digital factory in Hagerstown, Maryland, serving as the backbone for advanced automation and smart manufacturing. Besides, this installation enabled real-time operations such as predictive maintenance, digital twins, AI-powered inspections, and IoT-driven material transport by requiring expert setup, integration, and calibration of cutting-edge systems. Hence, this project exemplifies that the prominence of industrial services, particularly installation services, is driving efficiency, safety, and digital transformation in modern factories.

Application Segment Analysis

The manufacturing execution system is expected to attain a considerable share in the market during the forecast period. Manufacturers are opting for digital production management systems to optimize workflow, track real-time data, and integrate with advanced analytics, positioning the segment at the forefront to generate revenue in this sector. In December 2024, Sumitomo Rubber Industries announced the deployment of a manufacturing execution system platform from Rockwell Automation at its Shirakawa Factory, Japan. It also notes that this MES will integrate production data, quality metrics, and forecasts with the company’s ERP system, enabling standardized, real-time management across global manufacturing sites. Moreover, this initiative is part of Sumitomo’s broader digital transformation strategy to enhance operational efficiency, accelerate decision-making, and optimize factory operations across the world, hence denoting a wider segment scope.

Technology Used Segment Analysis

The cloud computing segment based on technology used is anticipated to gain a significant revenue stake in the market during the forecast duration. The cloud-based industrial services are relied upon to optimize uptime and system performance. Most of the manufacturers and utilities are dependent upon cloud platforms to centralize operational data, integrate IoT devices, and support remote diagnostics. Cloud-based solutions also facilitate scalable and flexible IT infrastructure, reducing the need for heavy on-premise investments by ensuring high system reliability. In addition, cloud computing enhances collaboration across multiple sites, thereby enabling consistent performance tracking and process optimization. Furthermore, government and enterprise initiatives emphasize digital transformation and Industry 4.0 adoption, accelerating demand for cloud-based industrial services.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegments |

|

Service Type |

|

|

Application |

|

|

Technology Used |

|

|

End use Industry |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Industrial Services Market - Regional Analysis

North America Market Insights

The North America industrial services market is anticipated to lead, capturing the largest revenue share of 35.7% by the end of 2035. The advanced industrial infrastructure and increasing adoption of digital and automation services are the key factors behind the region’s leadership in this field. The region also benefits from the presence of a high-skilled workforce and a strong ecosystem of technology providers that continuously innovate with a collective goal to enhance operational efficiency. In February 2025, Babcock & Wilcox declared that its subsidiary, Babcock & Wilcox Construction Co., LLC, secured USD 35 million in contracts for maintenance, refurbishment, and installation services at power plants and industrial facilities across North America, adding to a USD 160 million construction backlog. Besides the project's aim to ensure peak performance, energy security, and grid reliability for utilities and manufacturers, thereby fostering steady market growth.

The U.S. industrial services market represents extensive growth in the regional landscape and is closely linked to smart manufacturing and Industry 4.0 initiatives, wherein the factories are adopting MES, cloud computing, and IoT-enabled monitoring systems. The market growth in the country is also fueled by heightened demand from automotive, aerospace, and energy sectors, which are looking to improve uptime and reduce operational risks. In October 2024, Cemtrex reported that its subsidiary, Advanced Industrial Services (AIS), secured a USD 4.5 million contract for the Elizabethtown Training Academy project, covering HVAC renovations in Phase 1 and boiler, piping, and fire protection upgrades in Phase 2, which were set for completion in FY 2025. Hence, such projects highlight AIS’s growing capacity, followed by its 2023 acquisition of Heisey Mechanical, thereby strengthening its ability to deliver large-scale industrial services.

The Canada market has gained increased visibility, with a strong focus on energy infrastructure, mining, and utility services. At the same time, the adoption of digital twins, remote monitoring, and smart sensors across the country—primarily aimed at optimizing production and resource management—supported by government incentives for modernization and sustainable operations, is creating a lucrative business environment. For example, in June 2025, Blackstone Industrial Services announced that it had acquired Trican Pipeline & Industrial Services, primarily to expand its presence in pipeline and critical equipment services. Additionally, this deal boosts the company’s technical capabilities and strengthens its position in the midstream and industrial sectors. Moreover, the acquisition improves technical expertise, broadens service offerings, and extends sector reach, effectively driving increased demand and overall market growth in Canada.

APAC Market Insights

The Asia Pacific industrial services market is expected to register the fastest growth during the forecast period, owing to the rapid pace of industrialization across countries. The aspects of urbanization, infrastructure development, and manufacturing growth are also accelerating the regional market expansion. For instance, in July 2025, Mahindra Industrial Park Chennai Limited and Sumitomo Corporation together announced that they had signed a strategic cooperation agreement with Osaka Prefecture to support Japan-specific companies entering India. Therefore, this partnership aims to facilitate market entry by providing consultation, regulatory support, and infrastructure access, thereby positioning Chennai as a hub for international manufacturing. In addition, this collaboration strengthens India’s industrial ecosystem by attracting foreign investment and driving consistent growth in industrial services across the region.

The industrial services market in China has acquired a strong position in the regional landscape, facilitated by the government-backed initiatives for smart factories and continuous industrial upgrades. In November 2024, the General Office of China’s Ministry of Industry and Information Technology (MIIT) announced the 2024 pilot cities for the integration and application of 5G + industrial internet, including Nanjing, Wuhan, Qingdao, Shenzhen, Suzhou, Shanghai, Ningbo, Guangzhou, Shenyang, and Chengdu. These cities are tasked with driving digital transformation in industries such as electronics, automotive, petrochemicals, and equipment manufacturing, through 5G-enabled smart factories, industrial internet infrastructure, and innovative application instances. Additionally, the initiative also aims to strengthen industrial clusters, promote large-scale deployment of 5G solutions, and foster collaboration between industry, academia, and research institutions, hence enhancing the overall competitiveness of China’s market.

India industrial services sector is maintaining a strong position due to rapid manufacturing and infrastructure growth, particularly in the automotive, power, and chemical industries. In August 2025, VinFast reported that it inaugurated its 400-acre electric vehicle assembly plant at SIPCOT Industrial Park, Tamil Nadu, which marks its first facility outside Vietnam. Besides, the plant leverages advanced automation and multiple workshops and will initially assemble 50,000 EVs on a yearly basis, supporting VinFast’s goal of 1 million vehicle sales in India by the conclusion of 2030. In addition, the company is collaborating with local suppliers, dealer networks, and battery partners, and it aims to foster supply chain localization, workforce upskilling, and sustainable EV development. Hence, such instances boost the market growth, driving demand for local supply chains, logistics, maintenance, quality control, and workforce training.

Europe Market Insights

Europe is solidifying its position in the global landscape, facilitated by the strong emphasis on sustainability, compliance, and modernization of legacy industrial systems. The region is witnessing increasing adoption of digital solutions, cloud-based monitoring, and predictive maintenance, wherein the service providers are supporting energy, automotive, and chemical sectors. In April 2025, Deutsche Telekom and NVIDIA announced the world’s first-ever industrial AI cloud, which is a USD 1.08 billion (approximately €1 billion) initiative aimed at providing sovereign, secure AI infrastructure for Germany and Europe. It also mentioned that the platform is supported by SAP’s business technology platform, and it enables large organizations, SMEs, and start-ups to develop and deploy AI across all manufacturing applications, from design to robotics. Furthermore, with more than 10,000 NVIDIA GPUs installed in a renovated Munich data center, the project forms a flagship of the made 4 Germany initiative, involving more than 100 companies, including Siemens and Agile Robots.

Germany industrial services market has registered itself as a manufacturing powerhouse, relying on industrial services for advanced automation, robotics integration, and Industry 4.0 solutions. The country’s market also benefits from the presence of a skilled workforce and innovation, and is all set for continued expansion, especially with AI and ML integration. In this context, Leadec in October 2025 reported that it has restructured its services to strengthen factory logistics by focusing on production-associated tasks such as warehousing, production supply, pre-assembly, and waste management, and by also integrating automation & digital solutions. The company supports more than 800 factories across the world by providing suitable logistics, maintenance of systems and automated guided vehicles, and real-time digital tracking to ensure smooth operations. The company generated more than USD 1.41 billion (about €1.3 billion) in 2024, offering services across installation, automation, maintenance, logistics, and facility management through its digital platform called Leadec. os.

The UK industrial services market is mainly driven by energy, manufacturing, and utilities modernization, and there has been increasing adoption of digital monitoring, MES platforms, and cloud-based management solutions. In this context, the UK Power Networks in March 2024 announced that it has extended and expanded its IT modernization partnership with Kyndryl for four more years, now including its new role as a distribution system operator. The collaboration enables a Microsoft Azure cloud-based environment, leveraging automation, Infrastructure as Code, and cloud-native builds to enhance operational efficiency, innovation, and resilience across the network serving around 8.5 million customers. Furthermore, this initiative demonstrates the country’s prominence in digital and cloud-based modernization in the industrial services sector, thereby improving asset lifecycle management, service delivery, and green electricity integration.

Key Industrial Services Market Players:

- ABB Ltd. (Switzerland)

- Siemens AG (Germany)

- General Electric Company (U.S.)

- Honeywell International Inc. (U.S.)

- Schneider Electric SE (France)

- Emerson Electric Co. (U.S.)

- Rockwell Automation, Inc. (U.S.)

- Mitsubishi Electric Corporation (Japan)

- Yokogawa Electric Corporation (Japan)

- Hitachi, Ltd. (Japan)

- Bosch Rexroth AG (Germany)

- Atlas Copco AB (Sweden)

- SKF AB (Sweden)

- Eaton Corporation plc (Ireland)

- Fluor Corporation (U.S.)

- Jacobs Engineering Group Inc. (U.S.)

- Veolia Environnement S.A. (France)

- SGS S.A. (Switzerland)

- L&T Technology Services Ltd. (India)

- Petrofac Limited (UK)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Siemens AG registered itself as one of the most influential players in the global market, which has a strong presence in automation, digital industries, and smart infrastructure. The company’s industrial services strategy centers on digital twins, industrial IoT, and advanced analytics to improve asset performance and operational efficiency. Besides, Siemens is also focused on sustainability-driven services, thereby helping industrial clients reduce energy consumption, emissions, and downtime across various industries.

- ABB Ltd. is based in Switzerland, and it holds a leading position in industrial services through its expertise in electrification, robotics, motion, and process automation. The company is mainly focused on lifecycle services, including remote monitoring, predictive maintenance, and performance optimization. In addition, ABB’s strategy is built around digital solutions such as ABB Ability, which connects equipment, systems, and services to enhance reliability and efficiency.

- Honeywell International Inc. is also a major force in terms of industrial services, especially in process industries, building automation, and energy management. The company differentiates itself through software-driven services, i.e., asset performance management, cybersecurity, and advanced process control. Long-term service agreements, digital upgrades for legacy systems, are strengthening Honeywell’s competitive position across oil and gas, chemicals, and manufacturing industries.

- Schneider Electric SE is a key player in industrial services that has a strong focus on energy management, automation, and sustainability solutions. The company’s EcoStruxure platform enables connected services such as condition-based maintenance, energy optimization, and real-time asset monitoring. Besides, Schneider combines digital technologies with consulting and lifecycle services, which in turn strengthens long-term customer relationships, thereby expanding its presence in various sectors.

- General Electric Company is a central player in this field, particularly through its power, renewable energy, and aerospace-related service operations. The company is focused on advanced analytics, digital diagnostics, and outcome-based service contracts that maximize equipment uptime and performance. Furthermore, GE’s emphasis on predictive maintenance, remote monitoring, and modernization services enables customers to extend asset life by also improving efficiency and reliability.

Below is the list of some prominent players operating in the global market:

The industrial services market is dominated by multinational engineering and automation leaders, which have extensive international footprints. Key players in this field compete through advanced digital capabilities, which include predictive maintenance, industrial IoT platforms, and data-driven asset management solutions. On the other hand, strategic initiatives are focused on expanding service portfolios and pursuing mergers and acquisitions to enhance their technological depth as well as their geographic reach. In December 2024, Amper reported that it had sold its industrial services business to Germany-based Mutares for USD 25 million (€23 million), generating a capital gain of USD 16.5 million (€15 million) and completing all planned non-core divestments under its 2023-2026 Strategic Plan, which is subject to regulatory approval. This transaction enables Amper to sharpen its strategic focus, following recent investments in energy storage systems and offshore wind manufacturing facilities expected to be operational by 2026.

Corporate Landscape of the Industrial Services Market:

Recent Developments

- In December 2025, ABB announced that it had entered an agreement to acquire UK-based IPEC, enhancing predictive maintenance for critical industries such as data centers, utilities, and healthcare. IPEC’s monitoring technology, using AI and advanced analytics, enables proactive detection of partial discharge to prevent costly downtime, reduce maintenance by up to 85%, and extend asset life.

- In November 2025, KBR’s joint venture, Brown & Root Industrial Services, signed an agreement to acquire Specialty Welding and Turnarounds, which is a leading provider of turnaround, cooling tower, and industrial catalyst services. The acquisition expands capabilities, customer base, and end-market exposure across refineries, petrochemicals, and renewables, while enabling operational efficiencies and cross-selling opportunities.

- Report ID: 3078

- Published Date: Jan 30, 2026

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Industrial Services Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.