Engineering Consulting Services Market Outlook:

Engineering Consulting Services Market size was valued at USD 202.8 billion in 2025 and is projected to reach USD 296.2 billion by the end of 2035, rising at a CAGR of 4.3% during the forecast period, i.e., 2026-2035. In 2026, the industry size of engineering consulting services is evaluated at USD 211.5 billion.

The engineering consulting services market is poised for steady growth driven by the heightened demand for infrastructure development, urbanization, and industrial expansion across the globe. AECOM in July 2025 announced that it was awarded two five-year IDIQ contracts by the U.S. Army Corps of Engineers Europe District to provide architecture and engineering services across Germany, Poland, the Benelux region, the Czech Republic, Norway, and Denmark, which have a combined ceiling of more than USD 490 million. The firm also mentioned that these contracts cover multi-disciplinary design, planning, permitting, and engineering studies for both military and non-military construction projects, which are aligned with U.S., host nation, and NATO standards. In addition, AECOM is leveraging both regional presence and global expertise, aiming to deliver resilient infrastructure that positively impacts engineering consulting services market growth.

Similarly, in November 2024, the Department for Infrastructure Northern Ireland (DfI TRAM) announced that it had awarded the T-1137 engineering services consultancy Partner contract, which was valued at £83 million (≈ USD 102 million), to engage external civil engineering consultants. Besides, the contract is structured in two lots covering the Eastern or Western and Northern or Southern divisions, providing support for transport and road‑asset management programmes. The report mentions the services to be minor highway improvements, major works, highway structures, active travel projects, and technical staff support for in-house delivery teams. Furthermore, the procurement emphasizes quality (70%) along with cost (30%) in awarding the contract and may support future projects financed by European Union funds, hence reflecting the government’s focus on consultancy engagement, putting a positive effect on the engineering consulting services market.

Key Engineering Consulting Services Market Insights Summary:

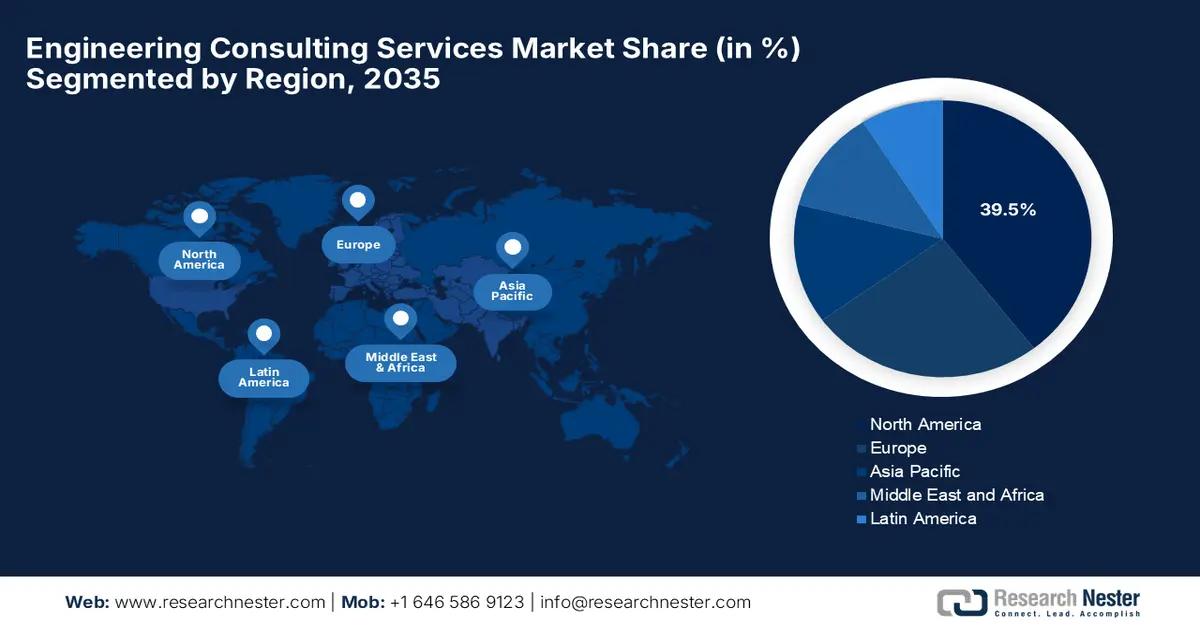

Regional Insights:

- North America is projected to account for a commanding 39.5% share by 2035 in the engineering consulting services market, supported by continuous technological innovation and large-scale infrastructure modernization initiatives.

- Asia Pacific is anticipated to emerge as the fastest-expanding region over the 2026–2035 period, benefiting from rapid industrialization and rising private-sector investments across manufacturing, energy, and technology sectors.

Segment Insights:

- The project-based service type is forecast to capture a substantial 45.8% share by 2035 in the engineering consulting services market, reflecting its strong alignment with complex infrastructure and smart city developments requiring specialized expertise.

- The private sector application segment is expected to retain a leading share during the forecast period 2026–2035, reinforced by expanding manufacturing activity and increased adoption of advanced engineering solutions for product design and construction efficiency.

Key Growth Trends:

- Urbanization & industrial expansion

- Sustainable & smart infrastructure investments

Major Challenges:

- High project complexity & regulatory compliance

- Intense competition & pricing pressures

Key Players: AECOM (U.S.), WSP Global Inc. (Canada), Jacobs Solutions Inc. (U.S.), Fluor Corporation (U.S.), Arup Group (United Kingdom), SNC-Lavalin / AtkinsRéalis (Canada), Ramboll Group (Denmark), Stantec Inc. (Canada), Bechtel Corporation (U.S.), Worley (Australia), Mott MacDonald (U.K.), Arcadis (Netherlands), HDR, Inc. (U.S.), Tata Consulting Engineers (India), Nippon Koei Co., Ltd. (Japan)

Global Engineering Consulting Services Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 202.8 billion

- 2026 Market Size: USD 211.5 billion

- Projected Market Size: USD 296.2 billion by 2035

- Growth Forecasts: 4.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (39.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, United Kingdom, Japan, China

- Emerging Countries: India, China, Brazil, United Arab Emirates, South Korea

Last updated on : 16 December, 2025

Engineering Consulting Services Market - Growth Drivers and Challenges

Growth Drivers

- Urbanization & industrial expansion: The engineering consulting services market is primarily fueled by rapid urbanization and industrial growth, which increases the need for infrastructure planning, construction, and maintenance services. In this regard, the Government of Uttar Pradesh in September 2025 issued an RFP to engage a consultancy firm for a two-year programme management unit to support urban development schemes, which include AMRUT, Smart City Mission, PMAY, and Swachh Bharat Mission-Urban. The article also mentioned that the PMU will provide programmatic support, monitoring, and coordination under the Department of Urban Development, which also reported an estimated consultancy fee of ₹7.92 crore (~USD 960,000), and may be extended depending on performance. Hence, this move highlights the growing role of public-sector projects in efficiently driving demand for engineering consulting services.

- Sustainable & smart infrastructure investments: Both the government and private entities are making investments in sustainable, smart, and resilient infrastructure, which includes transportation networks, energy systems, and digitalized industrial facilities. These initiatives create substantial opportunities for engineering consulting firms to demonstrate extensive project management expertise in the respective sectors. In April 2023, the U.S. Bureau of Land Management reported that it awarded multiple multi-year indefinite delivery or indefinite quantity contracts, which were supported by the Bipartisan Infrastructure Law, to six small businesses for environmental support services, including project planning and regulatory compliance to plug and remediate orphaned oil and gas wells on public lands. It also notes that each contract has a maximum value of USD 50 million, with a one-year base period and four optional one-year extensions, hence positively impacting the engineering consulting services market.

- Public-private partnerships: Rising public-private partnerships, coupled with the worldwide development programs, are expanding cross-border opportunities for firms involved in the engineering consulting services market. In September 2022, Qatar’s Public Works Authority (Ashghal) announced that it had signed a public-private partnership contract, which was worth more than 5.4 billion Qatari riyals (~USD 1.48 billion) for the Al Wakrah and Al Wukair sewage treatment works project. Besides, the project involves proper infrastructure planning, design, and consultancy services aiming to support sustainable drainage systems and urban development, serving around 306,000 residents. Hence, the emergence of such a type of PPP model highlights the crucial role of engineering consulting and project management expertise in large-scale government infrastructure projects by leveraging private sector innovations.

Challenges

- High project complexity & regulatory compliance: The firms involved in the engineering consulting services market undertake projects that have intricate technical and structural requirements. The large-scale projects in terms of infrastructure, energy, and urban development sometimes span multiple jurisdictions, out of which has distinct regulations, codes, and environmental standards. Therefore, navigating these requirements necessitates demands, clear knowledge, and documents. Also, non-compliance can result in legal penalties, project delays, or expenses, whereas overly cautious approaches can reduce efficiency in this field. Additionally, projects involving sustainability, safety, and smart infrastructure introduce the firms to the additional layers of complexity, requiring advanced modeling, risk assessment, and stakeholder engagement.

- Intense competition & pricing pressures: The engineering consulting services market is extremely competitive, in which both global and regional players are vying for a limited number of projects. The existence of intensive competition among firms pressurizes for more bids than can compress the profit margins, especially for smaller or mid-sized firms that have very few resources. Also, clients are showcasing priority towards cost efficiency by expecting high-quality, which adds pressure on consultants to optimize resources and maintain service excellence. In addition, international firms may leverage economies of scale, advanced and global experience, placing a disadvantage on regional players. Furthermore, sustaining profitability under such competitive pressures demands a very careful project selection.

Engineering Consulting Services Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

4.3% |

|

Base Year Market Size (2025) |

USD 202.8 billion |

|

Forecast Year Market Size (2035) |

USD 296.2 billion |

|

Regional Scope |

|

Engineering Consulting Services Market Segmentation:

Service Type Segment Analysis

The project-based service type is predicted to command the largest revenue share of 45.8% in the engineering consulting services market over the discussed timeframe. The segment’s leadership in this field is fueled by its alignment with large-scale infrastructure projects worldwide. Simultaneously, the growth of global infrastructure initiatives and smart city projects continues to fuel demand for project-based engineering consultancy. In addition, the increasing complexity and scale of infrastructure developments require specialized expertise that project-based services provide, thereby ensuring clear deliverables and cost transparency. Also, both the governments and private sectors prefer this model for managing risks and timelines even more effectively. Furthermore, advancements in digital tools and project management technologies enhance the efficiency and appeal of project-based consulting services.

Application Segment Analysis

In the application segment, the private sector companies are expected to lead with a significant stake in the engineering consulting services market during the discussed timeframe. The growth in the segment is efficiently driven by their innovative solutions in terms of product design and construction processes. The rise in manufacturing industries is readily increasing the demand for specialized consultancy services. In February 2023, the County of Placer announced that it had entered into a professional services agreement with Stantec Consulting Services Inc. to provide engineering, project management, civil design, stormwater and landscape design, environmental permitting, geotechnical engineering, and right-of-way support for the Tahoe City Downtown Access Improvements Project. Hence, in this agreement, Stantec will operate as an independent contractor, being responsible for all personnel and subcontractors.

Vertical Segment Analysis

By the end of 2035, the construction & infrastructure consulting will grow at a lucrative rate in the engineering consulting services market. This subtype’s growth is due to continuous urbanization and industrial expansion. Simultaneously, governments across most nations are prioritizing infrastructure modernization, including transportation, water systems, and energy facilities. In October 2024, the U.S. General Services Administration announced that it had awarded a USD 745,714 architectural and engineering services contract to Marble Fairbanks for the Land Port of Entry project at Beebe Plain, Vermont, which is funded through the Bipartisan Infrastructure Law. It also mentioned that this project aims to modernize the port with sustainable improvements, improve traffic management, and support U.S. Customs and Border Protection operations, hence denoting a wider segment scope.

Our in-depth analysis of the engineering consulting services market includes the following segments:

|

Segment |

Subsegments |

|

Service Type |

|

|

Application |

|

|

Vertical |

|

|

Consulting Model |

|

|

Project Size |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Engineering Consulting Services Market - Regional Analysis

North America Market Insights

In the global engineering consulting services market, North America is expected to lead, capturing the largest revenue stake of 39.5% during the forecast duration. The region’s leadership in this region is propelled by both technological and infrastructural advances. In November 2025, Egis announced that it had acquired Colorado-based RockSol Consulting Group, which is a transportation infrastructure firm specializing in engineering, planning, environmental compliance, and construction management, strengthening its presence in the U.S. Mountain States and Western regions. This acquisition was followed by Egis’ merger with Lochner, and it advances the company’s strategy to become a global top ten professional services firm. Further, Egis aims to enhance infrastructure solutions and deliver high-quality projects across highways, bridges, transit, and public works throughout by combining technical expertise and resources, hence making it suitable for overall market growth.

The U.S. is continuing its growth trajectory in the regional engineering consulting services market on account of ever-increasing energy efficiency projects, along with the presence of key market players. Both the public and private entities in the country are putting efforts into commercializing in this field. In this regard, CHA in December 2024 announced that it acquired Civil Engineering Consulting Services, Inc., which is a South Carolina-based transportation engineering firm, expanding its southeast U.S. transportation services. Besides, this acquisition enhances the firm’s capabilities in project management, highway and structural design, traffic engineering, and utility coordination, thereby supporting both federal and state infrastructure investments. Furthermore, through this strategic move, CHA strengthens its regional presence and ability to deliver sustainable engineering solutions to municipalities, counties, and state transportation agencies.

Canada in the engineering consulting services market is experiencing steady growth, owing to aspects as large-scale infrastructure modernization, urban development, and renewable energy projects. The country’s market is also augmented by public sector investments in transportation, water, and energy infrastructure, coupled with private sector demand for advanced engineering solutions, which are fueling the need for consultancy services. In September 2025, Englobe Corporation, Colliers’ Canada-based engineering platform, announced that it had acquired LRL Associates Ltd., which is a leading multidisciplinary engineering consulting firm in Ontario and New Brunswick. This acquisition strengthens Englobe’s scale and capabilities in the country, thereby enhancing expertise across mechanical, electrical, civil, structural, environmental, and geotechnical engineering services for public and private clients, hence attracting more players to make investments in this field.

APAC Market Insights

Asia Pacific is recognized as the fastest-growing region in the engineering consulting services market primarily due to industrial expansion in China, India, and Japan. The region’s leadership is also propelled by increasing private sector investments in manufacturing, energy, and technology sectors. In September 2025, Engineers India Limited announced that it had signed an MoU with Nuclear Power Corporation of India Limited to provide engineering services for the Bharat Small Reactor by supporting India’s nuclear energy expansion. It also mentioned that the collaboration focuses on designing civil structures for the 220 MWe BSR, incorporating the latest safety upgrades and regulatory standards. Furthermore, it aligns with the country’s clean energy goals and aims to accelerate nuclear power capacity to 100 GW by the end of 2047, fostering green energy for energy-intensive industries.

China’s engineering consulting services market is expanding, fueled by massive industrial upgrades and national initiatives such as the Belt and Road Initiative and green energy development. Both national and international engineering firms are participating in large-scale construction, smart city developments, and industrial modernization projects. In September 2023, China International Engineering Consulting Corporation announced that it won the 2023 FIDIC Outstanding Project Award for the large-scale Jinsha River Baihetan Hydropower Station, which marks its seventh FIDIC Project Award. Hence such these recognitions underscore the country’s expanding role in delivering technically advanced, socially impactful megaprojects on the global level. Hence, these achievements highlight the country’s leadership in terms of complex engineering projects.Top of Form

Bottom of Form

The engineering consulting services market in India is witnessing exceptional growth owing to the presence of government initiatives such as smart cities, renewable energy expansion, and industrial modernization. Both public and private sectors in the country are outsourcing specialized engineering services for various projects. In August 2023, Tata Consulting Engineers reported that it played a critical engineering role in India’s space missions by designing and developing key indigenous systems and facilities used for ISRO’s satellite launch operations. The company also underscores that it has engineered major infrastructure, which includes the solid propellant plant, vehicle assembly building, and mobile launch pedestal that supported the successful Chandrayaan-3 mission. Furthermore, Tata is leveraging a long-standing partnership with ISRO, hence contributing to India’s expanding space capabilities and national technological advancement.

Europe Market Insights

Europe has a stronger potential to scale in the engineering consulting services market owing to the heightened demand in energy, construction, and transportation. The European Union has imposed significant green initiatives and carbon-neutral goals, which in turn are encouraging sustainable designs and digital infrastructure. In July 2025, Sweco announced the acquisition of Volantis, which is an architecture and engineering consultancy specializing in healthcare and industrial projects. Hence, the acquisition strengthens the firm’s capabilities in sustainable design, circularity, and energy-transition consultancy by deepening its reach across hospitals, care organizations, and major industrial sectors such as chemicals and pharmaceuticals. Furthermore, the move also aligns with Sweco’s broader growth strategy in Europe, enhancing its position as a leading architecture and engineering consultancy across the region.

Germany is growing in the regional engineering consulting services market, efficiently backed by its industrial base, manufacturing ecosystem, and continuous investments in terms of infrastructure modernization. The country’s market also benefits from public–private collaborations that are ensuring the steady expansion of consulting services. In March 2023 reported that the City of Bamberg had initiated the renovation of the Graf-Stauffenberg Schools, which includes the Realschule, Wirtschaftsschule, and associated facilities, thereby addressing aging structures, energy inefficiencies, and legacy hazardous materials such as asbestos and PCB. It also notes that the procurement is strongly focused on structural engineering services (Fachplanung Tragwerksplanung) under HOAI, which will initially cover preliminary planning and special services such as fire-resistance verification, on-site supervision, and demolition instructions for the roof, hence providing an encouraging opportunity for market growth.

The U.K. is identified as one of the most influential landscapes of the engineering consulting services market since it leverages strong activity in infrastructure redevelopment, clean energy initiatives, and the modernization of public assets. Large national programs in the country, such as rail modernization, offshore wind expansion, and urban regeneration, are creating substantial opportunities for engineering management services. In December 2023, the country’s government announced that Oxford Direct Services is establishing a framework of contractors to provide a wide range of professional services, which include programme and project management, architectural, structural, and civil engineering, and principal design, in support of construction and maintenance projects across Oxfordshire. Besides, the services will support local authority, business, and community projects such as housing, highways, parks, and public buildings, hence making it suitable for standard market development.

Key Engineering Consulting Services Market Players:

- AECOM (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- WSP Global Inc. (Canada)

- Jacobs Solutions Inc. (U.S.)

- Fluor Corporation (U.S.)

- Arup Group (United Kingdom)

- SNC-Lavalin / AtkinsRéalis (Canada)

- Ramboll Group (Denmark)

- Stantec Inc. (Canada)

- Bechtel Corporation (U.S.)

- Worley (Australia)

- Mott MacDonald (U.K.)

- Arcadis (Netherlands)

- HDR, Inc. (U.S.)

- Tata Consulting Engineers (India)

- Nippon Koei Co., Ltd. (Japan)

- AECOM is recognized as one of the world’s largest infrastructure and engineering consulting firms, which is offering services across planning, design, engineering, program management, and construction management. The company has a strong global reach and multidisciplinary expertise that are positioning a leader in transportation, water, energy, and urban development projects. AECOM also leverages digital engineering, sustainable design capabilities, and major project wins across Asia, the Middle East, and North America.

- WSP Global Inc. is yet another top international engineering consulting firm that is best known for environmental services, transportation engineering, buildings, and energy transition projects. The firm is deliberately expanding through strategic acquisitions and emphasizes ESG, climate-resilient infrastructure, and digital engineering tools. Furthermore, WSP aims to lead innovation across engineering, environment, and advisory domains in the years ahead.

- Jacobs Solutions Inc. is leading in terms of engineering, technical consulting, and digital solutions, with strengths in infrastructure, advanced facilities, and space technologies. The company is strongly focused on climate response, intelligent systems, and digital platforms to differentiate itself with sustainable infrastructure and clean energy projects. In addition, Jacob’s diversified client base includes government, aerospace, and energy sectors.

- Fluor Corporation is well well-known firm for engineering, procurement, construction, and project management in industrial, energy, chemicals, and infrastructure sectors. The firm’s scale in EPC allows it to deliver complex megaprojects from concept to completion. Furthermore, fluor is emerging toward energy transition projects, which include hydrogen and carbon capture, by leveraging its global footprint for technically demanding projects.

- Arup Group is the central player in terms of engineering and design consultancy, and is renowned for sustainable infrastructure, high-performance buildings, and urban development. This is an employee-owned firm that emphasizes innovation and net-zero design strategies, thereby contributing to iconic projects. In addition, Arup has deep technical expertise and a collaborative global model, which makes it a benchmark in engineering consulting.

Below is the list of some prominent players operating in the global engineering consulting services market:

The engineering consulting services market is dominated by the global pioneers, having strong multidisciplinary capabilities and extensive international portfolios. Companies are constantly putting efforts into differentiating through digital transformation, sustainability-focused solutions, and sector specialization across various sectors. Mergers and acquisitions to expand geographic presence, partnerships to advance digital engineering and automation, and investments in ESG-design frameworks are a few strategies implemented by the top players. In December 2025, Wipro reported that it had completed its acquisition of HARMAN’s Digital Transformation Solutions business to strengthen its engineering global business line and advance its AI-based engineering capabilities. Hence, the move enhances Wipro’s global engineering services portfolio, enabling innovation at scale and supporting complex transformations across industries.

Corporate Landscape of the Engineering Consulting Services Market:

Recent Developments

- In November 2025, AECOM notified that it has been appointed to deliver the HKIA Dongguan Logistics Park, the world’s first sea-air intermodal transshipment hub linking Hong Kong International Airport with Dongguan’s major manufacturing base.

- In October 2025, WSP announced that it had completed the acquisition of Ricardo plc, which is a global strategic and engineering consulting firm operating across more than 20 countries, thereby strengthening its capabilities in energy transition, water solutions, rail, policy strategy, and environmental services.

- In January 2025, Tata Consulting Engineers announced that it had acquired CDI Engineering Solutions, which is a 75-year-old design and engineering firm recognized among ENR’s Top 20 in industrial, oil & gas, and the move aims to offer integrated, sustainable, and innovation-driven engineering solutions.

- Report ID: 8320

- Published Date: Dec 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.