Home Water Filtration Unit Market Outlook:

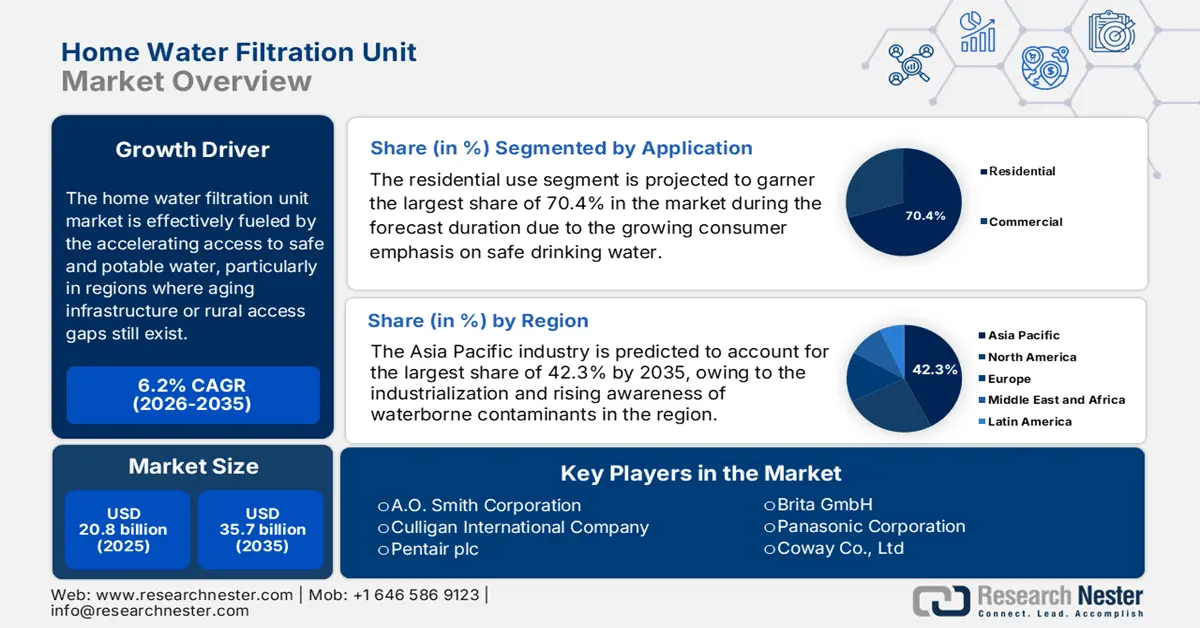

Home Water Filtration Unit Market size was valued at USD 20.8 billion in 2025 and is projected to reach USD 35.7 billion by the end of 2035, rising at a CAGR of 6.2% during the forecast period, i.e., 2026-2035. In 2026, the industry size of home water filtration unit is estimated at USD 22 billion.

The home water filtration unit market is effectively fueled by the accelerating access to safe and potable water, particularly in regions where aging infrastructure or rural access gaps still exist. As of August 2025, under the Jal Jeevan Mission, more than 15.71 crore rural households in India now have tap water connections, which cover more than 80% of homes across the nation. The program also emphasizes long-term sustainability and reliable service delivery, wherein the district administrations play a crucial role in ensuring continuous access. In addition, the initiatives such as the district collectors' Peyjal Samvad strengthen local governance. The reports also indicate that 57% of households purify water before drinking, using methods such as boiling, settling, alum, chemical treatment, and water filters, before consumption, hence providing an encouraging opportunity for pioneers in this field.

Furthermore, the trade aspect in the home water filtration unit market ensures access to critical components across all nations. In this regard, the World Integrated Trade Solution reported that in 2022, the top importers of filtering or purifying machinery and apparatus included the U.S. at USD 2.01 billion (142.18 million units), the European Union at USD 1.23 billion, Germany at USD 519.75 million, France at USD 494.10 million, and China at USD 449.69 million (3.5 million units). Therefore, these imports supply raw materials, membranes, and assembled units crucial for domestic water filtration systems. Simultaneously, strong exports of this machinery and apparatus encourage manufacturers in producing countries to scale production, maintain global assembly lines, and respond to increasing water purification demand.

Top Importers of Filtering or Purifying Machinery and Apparatus (HS 842121) in 2022

|

Country |

Trade Value (USD '000) |

Quantity (Items) |

|

Canada |

390,947.53 |

66,873,800 |

|

U.K. |

326,846.37 |

- |

|

Malaysia |

308,665.99 |

14,241,200 |

|

Italy |

260,757.47 |

- |

|

Mexico |

224,298.47 |

31,053,300 |

|

Spain |

219,868.17 |

- |

|

Israel |

219,390.00 |

- |

|

Netherlands |

218,873.66 |

- |

Source: WITS

Key Home Water Filtration Unit Market Insights Summary:

Regional Insights:

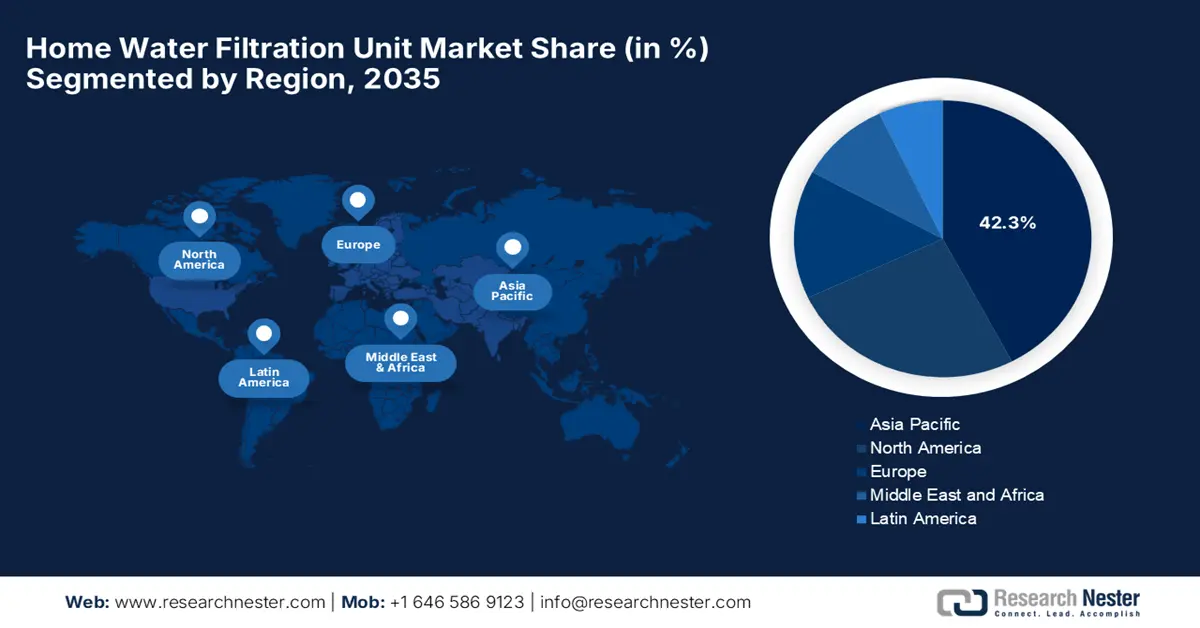

- Asia Pacific is projected to command a 42.3% share of the Home Water Filtration Unit Market by 2035, supported by escalating urbanization, rapid industrial expansion, and heightened awareness of waterborne contaminants.

- North America is expected to record substantial progress across 2026–2035, propelled by stringent regulatory oversight and rising consumer focus on mitigating contamination risks such as PFAS and lead.

Segment Insights:

- The residential use segment in the Home Water Filtration Unit Market is anticipated to secure a dominant 70.4% share by 2035, underpinned by increasing consumer emphasis on safe drinking water.

- The offline retail segment is projected to capture a 60.6% share by 2035, spurred by the need for in-person consultation, installation support, and product demonstration capabilities.

Key Growth Trends:

- Gap in safe drinking water access

- Water quality concerns

Major Challenges:

- High initial cost and affordability

- Maintenance and replacement costs

Key Players: A.O. Smith Corporation (U.S.), Culligan International Company (U.S.), Pentair plc (U.S.), Brita GmbH (Germany), BWT (Best Water Technology) (Austria), Panasonic Corporation (Japan), Coway Co., Ltd. (South Korea), Cuckoo Electronics Co., Ltd. (South Korea), LG Electronics (South Korea), Unilever PLC (U.K.), Eureka Forbes (India), iSpring Water Systems LLC (U.S.), 3M Company (U.S.), Kent RO Systems Ltd. (India), Xiaomi Corporation (China).

Global Home Water Filtration Unit Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 20.8 billion

- 2026 Market Size: USD 22 billion

- Projected Market Size: USD 35.7 billion by 2035

- Growth Forecasts: 6.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (42.3% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, China, India, Germany, Japan

- Emerging Countries: Brazil, Indonesia, Vietnam, Mexico, United Arab Emirates

Last updated on : 25 November, 2025

Home Water Filtration Unit Market - Growth Drivers and Challenges

Growth Drivers

- Gap in safe drinking water access: This is the primary growth driver in the home water filtration unit market since there has been a persistent gap in safe drinking water access. In this regard, the World Health Organization reported that in 2022, 2.2 billion people across all nations lacked safely managed drinking water, which marks 27% of the global population. It also mentioned that 43% of the population lacked safely managed sanitation, whereas 25% of the global population does not have access at home to a handwashing facility with soap and water. Therefore, these factors efficiently drive the demand for point-of-use filtration, such as RO and purifiers. Furthermore, these disparities underscore the strategic importance of clean water, where improving water quality at the household level continues to grow.

- Water quality concerns: This, coupled with health risk mitigation due to chemical, microbial, or inadequate infrastructure, exists in most of the regions since it may not be safe without further purification. Therefore, consumers believe that investing in home filter units helps mitigate public health risks, reducing disease burden from unsafe water. As per an article published by the Ministry of Jal Shakti in January 2025, between 2022 and 2025, India significantly advanced rural sanitation and water quality initiatives under Swachh Bharat Mission Grameen (SBM-G) Phase II, achieving over 5.61 lakh villages declared ODF Plus by December 2024, a 460% increase from 2022. Also, the programs such as the Lighthouse Initiative engaged communities, corporates, and women’s self-help groups to improve decentralized water infrastructure, increasing adoption in the home water filtration unit market.

- Regulatory & sustainability pressures: Most governments are under pressure to reduce untreated water use and improve water quality. The factors such as pollution, groundwater contamination, and aging water infrastructure in both developed and developing markets are pushing policymakers to support decentralized water treatment solutions, supporting growth for the home filtration unit market. EPA in March 2024 revealed that under the Drinking Water and Wastewater Infrastructure Act, it is funding grants specifically for decentralized wastewater systems, such as small community or household-level treatment, through Section 50208. In December 2023, the EPA renewed a memorandum of understanding with multiple partners to improve decentralized system performance through technology transfer. Hence, these grants and partnerships effectively channel support toward water‑treatment technologies and support growth in home filtration solutions in regions where centralized infrastructure is weak.

Challenges

- High initial cost and affordability: This is one of the most considerable challenges in the home water filtration unit market, hindering widespread adoption. The advanced filtration systems, such as reverse osmosis, ultraviolet, or multi-stage filters, come with significant upfront costs. Therefore, for most consumers, especially in emerging markets or rural areas face this purchase price is a major barrier. In this regard, households in developed countries may delay purchase if the value proposition is not clear, ultimately slowing down home water filtration unit market growth. Furthermore, these premium systems are often considered to be luxurious rather than a necessity, limiting adoption.

- Maintenance and replacement costs: Along with a high initial cost, these filtration units come with exacerbated maintenance and replacement costs, limiting growth in the home water filtration unit market. The membrane changes, UV lamp replacements, and periodic servicing are highly essential to maintain system efficiency and water quality. If consumers skip maintenance, the unit’s performance drops, which in turn creates health risks. Therefore, these high recurring costs can also discourage long-term use, which affects manufacturers’ customer retention, negatively impacting the upliftment of the market.

Home Water Filtration Unit Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.2% |

|

Base Year Market Size (2025) |

USD 20.8 billion |

|

Forecast Year Market Size (2035) |

USD 35.7 billion |

|

Regional Scope |

|

Home Water Filtration Unit Market Segmentation:

Application Segment Analysis

Based on the application residential use segment is projected to garner the largest share of 70.4% in the home water filtration unit market during the forecast duration. The dominance of the segment is attributable to the growing consumer emphasis on safe drinking water and household appliance spending. Also, urbanization, increased disposable income, and rising water-contamination incidents are encouraging households to install these filtration units. In addition, service models and annual maintenance contracts make the residential adoption financially sustainable for most families. Furthermore, continuous product innovations such as smart filtration systems and compact designs are further boosting the demand within the residential segment. Hence, all of these factors position the subtype at the forefront of this sector to generate revenue in the field of home water filtration units.

Distribution Channel Segment Analysis

In terms of distribution channel offline retail segment is expected to capture a significant revenue share of 60.6% in the home water filtration unit market by the end of 2035. The need for in-person consulting, installation support, and demonstration production capabilities is the key factor driving this leadership. In addition, consumers are increasingly preferring such appliances from physical stores since they can assess the product quality, compare different models, and receive personalized guidance from store personnel. Also, the presence of authorized dealerships and retail outlets is enhancing trust and sales reliability, thereby strengthening the segment’s position in this field. Furthermore, the availability of promotional discounts, bundled offers also encourages huge adoption among a broader audience group.

Product Type Segment Analysis

Based on product type RO-based filtration systems segment is anticipated to gain a lucrative share of 55.2% in the home water filtration unit market during the analyzed timeframe. Their ability to address a wide spectrum of contaminants, such as heavy metals, dissolved solids, and microbes, has gained extensive trust both in developed and emerging markets. For instance, in April 2021, Aquaporin announced the launch of ONE, which is an under-the-sink water purifier designed to meet the growing demand for sustainable and safe drinking water solutions. The product is powered by Aquaporin Inside technology, the purifier efficiently removes pesticides, bacteria, viruses, and lime while maintaining a high-water recovery rate of 65%. Furthermore, its user-friendly design and superior performance even under low pressure prompt a profitable business environment for the firm.

Our in-depth analysis of the home water filtration unit market includes the following segments:

|

Segment |

Subsegments |

|

Application |

|

|

Distribution Channel |

|

|

Product Type |

|

|

Capacity |

|

|

Contaminant Removal |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Home Water Filtration Unit Market - Regional Analysis

APAC Market Insights

In the home water filtration unit market, Asia Pacific is predicted to dominate, capturing the largest share of 42.3% by the end of 2035. The dominance of the region in this field is effectively attributable to rising urbanization, industrialization, and rising awareness of waterborne contaminants. Also, governments across the region are promoting decentralized water treatment solutions to address the concerns of pollution and deteriorating water infrastructure. In November 2023, Amway announced the launch of its eSpring water purifier, which has an advanced UV-C LED technology and an e3 carbon filter, capable of eliminating bacteria, viruses, cysts, and over 170 contaminants. The company also underscored that the purifier combines high performance with sustainability, thereby offering long-lasting LEDs and a filter that treats up to 5,000 liters annually, hence making it suitable for standard home water filtration unit market growth.

China is a crucial growth contributor for the progressive regional home water filtration unit market. This is effectively propelled by the concerns over industrial pollution as well as aging municipal water systems that have accelerated the adoption of home filtration units. The country’s market also benefits from the government’s focus on improving rural and urban water quality through national clean water programs, which have further encouraged households to invest in personal water treatment solutions. For instance, in May 2024, NSF introduced the NSF P535 protocol in the country to establish local material-safety and performance requirements for point-of-use drinking water filtration systems, covering technologies such as RO, nanofiltration, ultrafiltration, activated carbon, and ceramic filtration. The protocol provides a unified benchmark for contaminants, including lead, mercury, hexavalent chromium, PFOA, PFOS, and BPA, enabling manufacturers to validate product claims through third-party certification.

India has huge potential to grab opportunities in the regional home water filtration unit market, positively impacted by factors such as growing awareness of contaminants such as microbial pathogens and heavy metals. Also, the existence of Government initiatives such as the Jal Jeevan Mission and Swachh Bharat Mission Phase II emphasizes safe drinking water access, indirectly stimulating demand for household filtration systems. In August 2023, Unilever’s Pureit Revito Series introduced a next-generation multi-stage purification system designed to address heavy metal contaminants such as cadmium and chromium, an area where many conventional home filtration units fall short. It also stated the series integrates DURAViva filtration technology with WQA-certified components, seven-stage RO+UV-LED+MF purification, and UV-LED treatment inside the storage tank to prevent any type of secondary microbial contamination, hence suitable for households requiring advanced safety and efficiency.

North America Market Insights

The home water filtration unit market in North America is set to witness extensive growth in the years backed by a strong regulatory framework and higher consumer awareness regarding water quality. The region also benefits from increasing adoption influenced by factors such as contamination concerns, including PFAS and lead. In addition, the aspects of consumer financing options and health-driven campaigns contribute to sustained market expansion, particularly in urban and suburban households that are seeking point-of-use water purification. In April 2025, Blu Technology introduced its UVC AR3 filtration system, which has a four-stage treatment design that pairs NSF-certified sediment and pathogen-reduction filters with a UVC LED chamber that disrupts microbial DNA to achieve 99.99% neutralization of bacteria, protozoa, cysts, and most viruses.

The home water filtration unit market in the U.S. is readily blistering growth due to stringent federal regulations and high-profile water quality incidents. Households in the country are increasingly preferring certified filtration solutions to reduce exposure to contaminants in both municipal and private water sources. Also, the presence of well-established filtration brands, as well as environmental campaigns for safe drinking water, is supporting consistent growth across residential sectors. In February 2025, GE Appliances announced that it had launched a next-generation whole-home water line-up showcasing treatment and filtration solutions at KBIS/IBS in Louisville, Kentucky. Its product portfolio includes smart water softeners, point-of-entry filtration, and a tankless reverse osmosis system, all integrated through the SmartHQ ecosystem for real-time monitoring and control. Hence, this expansion solidifies the firm’s strong push toward smarter, connected home water systems, thereby elevating residential water quality and efficiency across the U.S.

The rising consumer priorities over aging infrastructure in some provinces and the presence of naturally occurring contaminants in well water are propelling the exponential growth of the home water filtration unit market in Canada. Also, urban populations in the country are adopting advanced filtration systems for both health and taste preferences, whereas the rural households often rely on POU units to supplement local water sources. In September 2025, H2O Innovation declared the acquisition of Lama Sistemas de Filtrados with the primary goal of expanding its global filtration products portfolio. In this context, this deal strengthens H2O Innovation’s leadership in membrane pretreatment by integrating Lama’s advanced backwashable filtration technologies used across municipal, industrial, and agricultural sectors. Hence, the strategic move enhances the company’s global reach and positions it as a more credible provider of filtration components for ultrafiltration and reverse osmosis systems.

Europe Market Insights

Europe’s home water filtration unit market is representing standard growth shaped by a combination of factors such as regulatory standards and environmental awareness. The Prominent countries across the continent have also witnessed growth in smart filtration devices that monitor water quality and optimize maintenance, making it attractive to both health-conscious and tech-savvy households, thereby enhancing uptake in this field. In March 2025, Resideo announced the launch of lead-free water filters in Europe to help installers comply with tightening drinking water regulations, such as Germany’s upcoming reduced lead limits in 2028. These filters were developed and produced in Mosbach, Germany, and they adopt fully lead-free materials aligned with the EU drinking water directive while offering modern designs and easier installation, hence denoting a positive market outlook.

Germany’s home water filtration unit market has acquired a dominating position in the regional landscape, facilitated by high consumer expectations for quality, innovation in eco-friendly and energy-efficient filtration. In’s Environment Agency (i.e., UBA ) in March 2025 disclosed that In Germany, drinking water must meet the standards of the drinking water ordinance (TrinkwV) from the source all the way to the tap, with strict limits on contaminants such as lead, copper, and nickel. It also highlighted that the ban on lead pipes requires their removal by January 2026, thereby lowering the allowable lead content in water to 5 µg/L by the end of 2028, which is efficiently driving demand for safer installation materials. In addition, the compliance depends upon careful design, high-quality materials, and certified components to ensure water quality, highlighting the importance of innovation in terms of eco-friendly and reliable home water filtration solutions.

The U.K. holds a strong position in the regional home water filtration unit market due to taste preferences and lifestyle trends that emphasize health, and a shift toward reduced bottled water consumption. In November 2022, the country’s government announced that IF Defence has developed a high-speed, low-energy, portable water purification system, which was funded through DASA, to provide safe, medical-grade drinking water for the Armed Forces in any environment. It is a compact, vehicle-mounted unit that can purify water from rivers, swamps, seawater, and even wastewater, without requiring filter replacements or extensive maintenance. Therefore, this innovation enhances military self-sufficiency, reduces logistical challenges, and it also has potential applications for humanitarian missions and remote water supply solutions, hence providing encouraging opportunities to the players in this field.

Key Home Water Filtration Unit Market Players:

- A.O. Smith Corporation (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Culligan International Company (U.S.)

- Pentair plc (U.S.)

- Brita GmbH (Germany)

- BWT (Best Water Technology) (Austria)

- Panasonic Corporation (Japan)

- Coway Co., Ltd. (South Korea)

- Cuckoo Electronics Co., Ltd. (South Korea)

- LG Electronics (South Korea)

- Unilever PLC (U.K.)

- Eureka Forbes (India)

- iSpring Water Systems LLC (U.S.)

- 3M Company (U.S.)

- Kent RO Systems Ltd. (India)

- Xiaomi Corporation (China)

- AO. Smith Corporation is recognized as the predominant leader in terms of water technology and is best known for its high-performance residential and commercial water purification systems. The company leverages its strong brand reputation and extensive distribution network across North America and China, and its focus lines on technological innovation and making heavy investments in consumer education and domestic R&D.

- Culligan International Company is based in the U.S. and is one of the most recognized names in the water treatment industry, famous for its "Hey Culligan Man!" marketing. The company has built a formidable presence through a direct-to-consumer service model that includes models such as rental, subscription, and sales options. The firm's prime focus relies on building long-term customer relationships through recurring revenue models, such as scheduled filter delivery and maintenance services.

- Pentair plc is emerging as one of the most prominent players in this field, which has a powerful presence in terms of residential water filtration. The company’s strength lies in providing integrated water solutions, from whole-house softeners and filters to advanced RO systems for drinking water. It also focuses on sustainability, promoting water-efficient products and educating consumers on reducing plastic bottle waste, hence prompting greater sustainability in this field.

- Brita GmbH is a subsidiary of Brita LP, is a major dominant force in the point-of-use segment, primarily known for its water filter pitchers and faucet-mounted systems. Also, the company is quite popular, has extensive retail partnerships, and a strong consumer goods marketing approach. On the other hand, the company is addressing a critical environmental challenge by launching major filter recycling programs and promoting its products as a sustainable alternative to single-use plastic bottles.

- Coway Co., Ltd. is based in South Korea and often called the Nespresso of water purifiers, has appreciably revolutionized the home water filtration unit market with its dominant rental and home service models. The firm consists of high-quality, well-designed appliances with regular customer service, including regular, scheduled filter replacements and maintenance. With a huge focus on a subscription-based model that ensures recurring revenue and high customer retention, the company has secured a leading position in Asia.

Below is the list of some prominent players operating in the global home water filtration unit market:

The home water filtration unit market is extremely competitive and fragmented, wherein the top pioneers are driving growth through continuous innovation and strategic expansion. The firms are also making increased investments in technologies that monitor water quality and filter life, attracting the tech-savvy consumers. In addition, huge online marketing and extensive partnerships are a few strategies implemented by the organizations to strengthen their home water filtration unit market positions. In this regard, Fortune Brands Innovations, Inc., in February 2024, announced that it had acquired Springwell Water Filtration Systems to strengthen its presence in the high-growth U.S. residential water filtration industry. Hence, the acquisition positions Fortune Brands to expand its smart, connected home water solutions and capitalize on this field.

Corporate Landscape of the Home Water Filtration Unit Market:

Recent Developments

- In July 2024, Unilever announced the sale of its water purification business, Pureit, to A. O. Smith, expanding the latter’s presence in South Asia and enhancing its premium water treatment portfolio. The transaction, subject to customary closing conditions, allows Unilever to focus on higher-growth areas while A. O. Smith integrates Pureit’s brand, technology, and customer base into its global operations.

- In April 2024, Panasonic Corporation announced the launch of a new water purification system in Indonesia, which is designed to remove iron from well water, integrated with existing well pumps and electric showers, and a new pipe cleaning service, aiming to improve domestic water standards and public health.

- Report ID: 8268

- Published Date: Nov 25, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Home Water Filtration Unit Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.