Bottled Water Market Outlook:

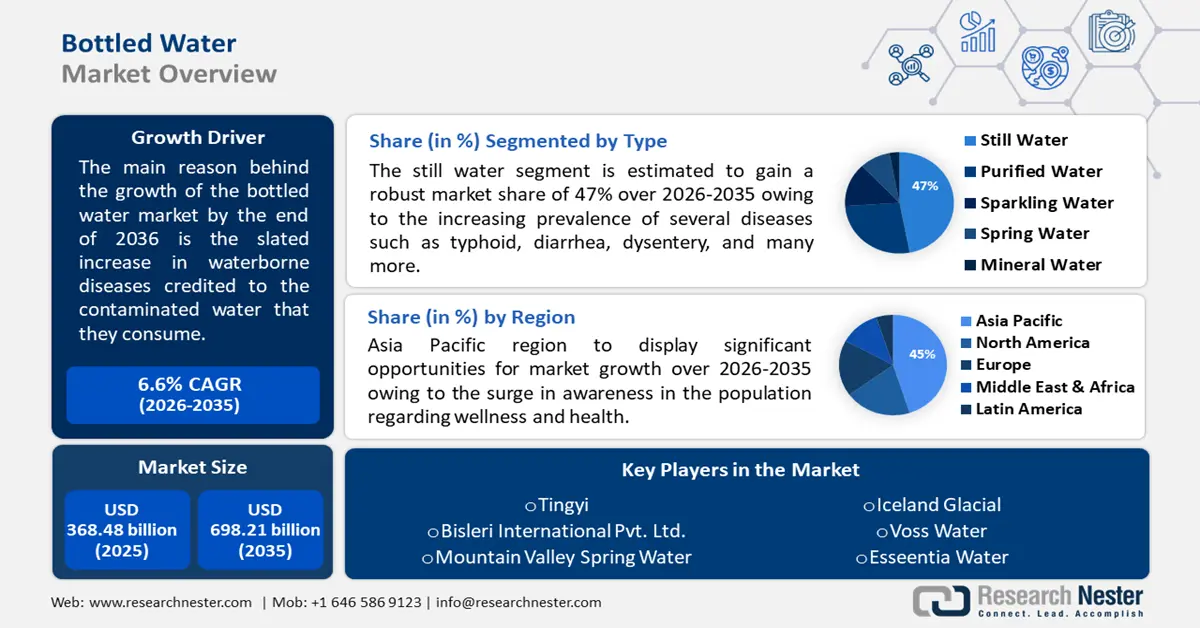

Bottled Water Market size was valued at USD 368.48 billion in 2025 and is set to exceed USD 698.21 billion by 2035, registering over 6.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of bottled water is estimated at USD 390.37 billion.

This boost is anticipated by the slated increase in waterborne diseases credited to the contaminated water that they consume. According to a report by UNICEF in 2023, it is poised that about 829,000 of the global population die every year owing to the consumption of unsafe water, poor hygiene practices, and inadequate sanitary surroundings.

Key Bottled Water Market Insights Summary:

Regional Highlights:

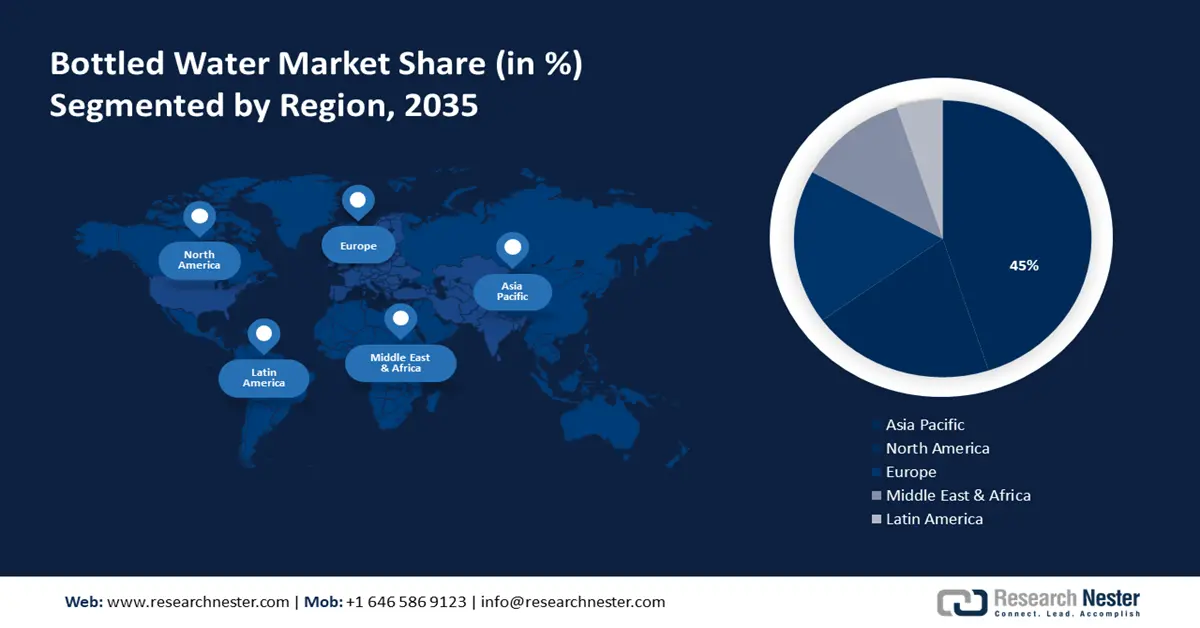

- Asia Pacific bottled water market is expected to capture 45% share by 2035, driven by a surge in awareness regarding wellness and health.

- North America market will experience significant CAGR during 2026-2035, driven by the increasing population and demand for convenient and portable bottled water.

Segment Insights:

- The still water segment in the bottled water market is expected to maintain a 47% share by 2035, propelled by the increasing prevalence of waterborne diseases.

- The off-trade segment in the bottled water market is anticipated to experience robust growth till 2035, driven by the convenience and variety of offline retail outlets.

Key Growth Trends:

- Rising scarcity of drinking water

- Increasing gastrointestinal diseases

Major Challenges:

- Negative environmental impact

- Criticism of the manufacturing companies

Key Players: Nestle, PepsiCo, Nongfu Spring, Tingyi, Bisleri International Pvt. Ltd., Mountain Valley Spring Water, Iceland Glacial, Voss Water, Esseentia Water.

Global Bottled Water Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 368.48 billion

- 2026 Market Size: USD 390.37 billion

- Projected Market Size: USD 698.21 billion by 2035

- Growth Forecasts: 6.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (45% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, India, Japan, Germany

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 17 September, 2025

Bottled Water Market Growth Drivers and Challenges:

Growth Drivers

- Rising scarcity of drinking water - With the lucrative global population along with the boosting economies, there is also a significant increase in demand for drinking water. According to a report by UNICEF in 2020, more than 4 billion people experienced severe water scarcity, which is about 2/3 of the global population for more than 1 month each year.

- Increasing gastrointestinal diseases - There is an increasing concern for health and wellness among the population, as there is an increase in gastrointestinal diseases due to the consumption of contaminated water. According to a report by UZ LEUVEN in 2020, about 40% of the global population suffers from chronic gastrointestinal problems.

- Growth in water pollution - There is a global demand for bottled water owing to the increasing population and polluted water. According to the World Development Report by the UN Environment Program in 2021, researchers surveyed about 75,000 water bodies in about 89 countries and observed that about 40% of the sample was polluted.

Challenges

- Negative environmental impact - The harm that plastic trash does to the environment is one of the main obstacles to the bottled water market revenue share. Plastic bottle manufacturing and disposal generate large amounts of waste, which pollutes the environment and raises concerns. Additionally, consumers are moving toward eco-friendly alternatives as a result of growing knowledge of the negative environmental effects of plastic. Because of this, a lot of businesses are implementing environmentally friendly packaging techniques to reduce a major obstacle facing the bottled water sector.

- Criticism of the manufacturing companies - Environmentalists are becoming more and more critical of the firms that produce bottled water because of the energy-intensive processes involved in extracting, processing, and bottling water. Another aspect impeding the industry is the lack of understanding regarding the health risks associated with inexpensive tap water.

Bottled Water Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.6% |

|

Base Year Market Size (2025) |

USD 368.48 billion |

|

Forecast Year Market Size (2035) |

USD 698.21 billion |

|

Regional Scope |

|

Bottled Water Market Segmentation:

Type

In bottled water market, still water segment is set to account for revenue share of more than 47% by the end of 2035, driven by the increasing prevalence of several diseases such as typhoid, diarrhea, dysentery, and many more which are caused by the contaminated running water. Hence, consumers demand better and safer water options.

Additionally, according to a report by the UN Environment Program in 2021, more than 3 billion people are set to be at risk of getting diseases due to the low water quality available in their surroundings.

Distribution

The off-trade segment in the bottled water market is estimated to gain a robust growth rate owing to the increase in different types of retail outlets such as traditional stores, mini markets, convenience stores, supermarkets, hypermarkets, and many more as compared to online retail. According to a report in 2023, sales at offline retailers showed a growth of about 6% in 2022.

Moreover, there is convenience in picking bottles of water from any brand, such as Nestle, Danone, Dasani, and Aquafina, with a set amount of minerals, which would also act as a growing factor in the growth of the market in the forecasted period.

Packaging

By the end of 2035, PET bottles segment in the bottled water market is poised to hold majority share. The reason behind this fuel is slated by the increasing demand for environment-friendly options in packaging and its cost-effectiveness as compared to other materials such as aluminum or glass.

According to a report by Zero Waste Europe in 2020, PET water bottles have more than 40% of content that can be recycled, and their emissions can also be reduced by 48% as compared to other bottles made from virgin materials.

Our in-depth analysis of the bottled water market includes the following segments:

|

Type |

|

|

Packaging |

|

|

Distribution |

|

|

Technology |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Bottled Water Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is set to account for largest revenue share of 45% by 2035. The landscape's substantial growth in the region is expected to be credited to the surge in awareness in the population regarding wellness and health in the region.

According to a report in 2024, it is predicted that more than 62% of the consumers in the APAC region are giving priority to healthy purchases in food shopping, and food packaging, and are becoming more conscious about their health.

There is an increase in the urban population in Japan that demands portable and convenient hydration solutions. According to a report in 2024, the urban population in 2022 was estimated to be 91% in Japan.

Waterborne diseases and infections are highly common in China owing to its environment. According to a report by the National Institutes of Health in 2020, more than 77,200 villages had fluorosis nationwide due to the available drinking water.

North America Market Insights

North American region in bottled water market size is anticipated to observe significant growth through 2035 attributed to the increasing population and the demand for convenient and portable bottled water.

In the United States, in 2021, Coca-Cola announced its smartwater+, a new range of wellness water premium range that allows users to use unique flavors and ingredient extracts.

Canadians are becoming more aware of living a healthy lifestyle leading to an increase in the demand for bottled water market, according to a report in 2023, about 56% of Canadians were predicted to be more conscious related to their health.

Bottled Water Market Players:

- Danone

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Nestle

- PepsiCo

- Nongfu Spring

- Tingyi

- Bisleri International Pvt. Ltd.

- Mountain Valley Spring Water

- Iceland Glacial

- Voss Water

- Esseentia Water

Most of these companies are continuously collaborating, expanding, making agreements, and joining ventures for the growth of this revenue share and are estimated to be the major key players in this landscape.

Recent Developments

- Danone- recently completed its EDP business in Russia, obtaining all the required approvals and transactions.

- Nestle- launched its pioneer in premium coffee NESPRESSO, currently being sold through e-commerce platforms, and soon will be opening its first NESPRESSO boutique in Delhi.

- Report ID: 6123

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Bottled Water Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.