White-Water Kayaks Market Outlook:

White-Water Kayaks Market size was valued at USD 820.8 million in 2025 and is projected to reach USD 13.62 billion by the end of 2035, rising at a CAGR of 5.2% during the forecast period, i.e., 2026-2035. In 2026, the industry size of white-water kayaks is assessed at USD 863.4 million.

The white-water kayaks market is propelled by a stable, growing population based on the increased participation in outdoor recreation and government-supported access to river corridors. According to the SEC data in 2021, nearly 27% of the people in the U.S. are interested in paddle sports. This sustained participation highlights the consistent demand for the equipment in kayaking. Market stability is driven by public sector investment in waterway infrastructure and access. This continued focus on outdoor engagement encourages new entrants as well as repeat users in the kayaking ecosystem, strengthening overall market depth. Furthermore, rising awareness around wellness, adventure sports culture, and environmental conservation is expected to foster long-term growth in the white-water kayak segment.

The white-water kayaks market growth is associated with the development of artificial white-water venues. These are developed by the public-private partnerships with municipal parks and recreation departments, reduce the variability of natural river conditions, and provide controlled, accessible entry points for new participants. This expansion of accessible venues is critical for broadening the market's consumer base beyond traditional core enthusiasts. Furthermore, the industry's supply chain is influenced by material science developments that is supported by federal research institutions. The long-term viability of the market is tied to conservation efforts led by organizations like American Rivers, which advocate for policies protecting federal wild and scenic rivers, thereby preserving the essential natural resources upon which the industry depends.

Key White-Water Kayaks Market Insights Summary:

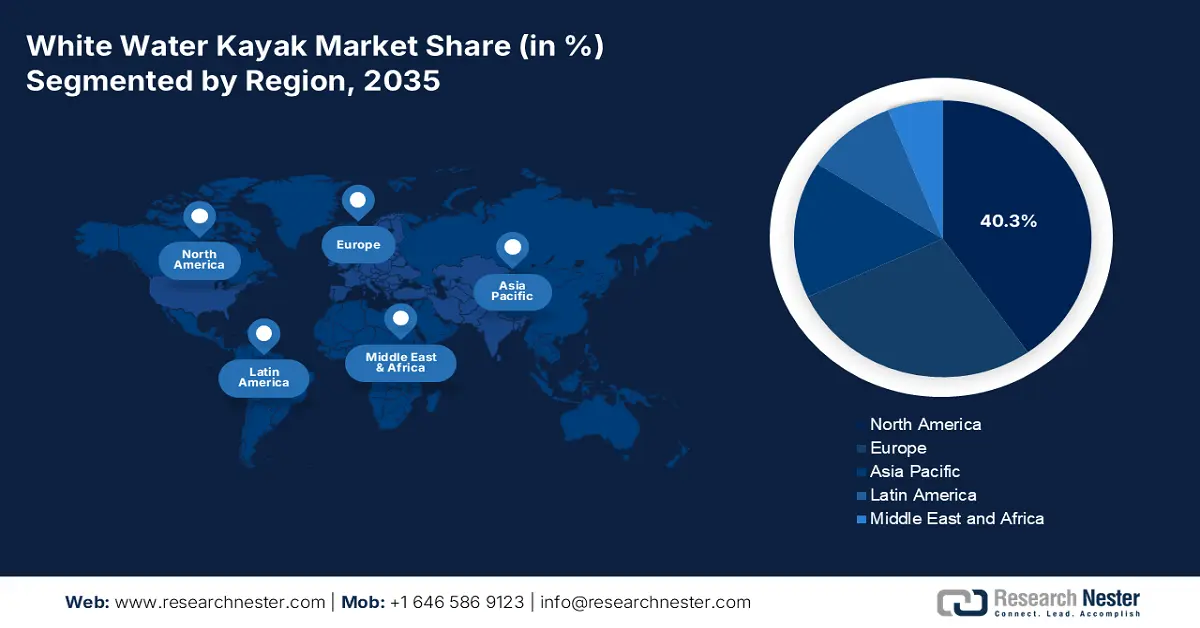

Regional Highlights:

- By 2035, North America is set to secure a 40.3% share of the white-water kayaks market, propelled by rising disposable income and a strong outdoor recreation culture.

- Asia Pacific is projected to grow at a 6.3% CAGR from 2026–2035, supported by increasing interest in adventure tourism and expanding water-sports infrastructure.

Segment Insights:

- By 2035, the Individual consumers segment in the white-water kayaks market is expected to command a 65.7% share, motivated by the growing cultural shift toward owning personalized outdoor recreation gear.

- The Recreational segment is forecast to maintain the largest share by 2035, encouraged by the expansion of artificial white-water parks enhancing beginner accessibility.

Key Growth Trends:

- Rising government investment in adventure tourism

- Public health initiatives promoting physical activity

Major Challenges:

- Increasing accident rates in kayaking

- High competition for low-cost non-specialized alternatives

Key Players: Jackson Kayak (U.S.), Dagger (U.S.), Liquidlogic (U.S.), Wavesport (U.S.), Perception (U.S.), Pyranha Kayaks (U.S.), Waka Kayaks (U.S.), Pyranha Kayaks (UK), Prijon (Germany), Gumotex (Czech Republic), Zet Kayaks (Czech Republic), Riot Kayaks (France), Galasport (Portugal), Aquadesign (Slovakia), DAG (Slovakia), Point65 (Japan), Viking Kayaks (Australia), SIS Kayaks (South Korea), Nova Craft (India).

Global White-Water Kayaks Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 820.8 million

- 2026 Market Size: USD 863.4 million

- Projected Market Size: USD 13.62 billion by 2035

- Growth Forecasts: 5.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40.3% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Canada, Germany, United Kingdom, China

- Emerging Countries: India, Brazil, Australia, South Korea, Mexico

Last updated on : 10 November, 2025

White-Water Kayaks Market - Growth Drivers and Challenges

Growth Drivers

- Rising government investment in adventure tourism: Governments are actively investing in adventure tourism to boost the rural economies. This includes the grants for developing the white-water parks and supporting the surge of river-based destinations. According to the Invest India data in October 2025, India has witnessed a 43.5% growth in foreign tourist arrivals in 2023. This data helps to recreate the adventure sports hubs, hence increasing participation in kayaking and related activities. Further, the improved tourism infrastructure and promotional campaigns boost the equipment sales and rentals in the white-water kayaks market.

- Public health initiatives promoting physical activity: Public health agencies are encouraging on the physical activity to combat a sedentary lifestyle and related health costs. The U.S. CDC data indicate the benefits of physical and mental health in outdoor recreation. State-level health departments partner with Local Health Departments to fund community wellness programs, which include paddle sports. Further, manufacturers use this trend to position kayaking as a holistic activity for a healthy life and partner with public health campaigns, thereby tapping into a broader health-conscious consumer base beyond traditional adventure seekers.

- Surging outdoor recreation: The key driver of the white-water kayaks market growth is the surge in outdoor recreation participation, mainly in adventure sports. This trend is fueled by the rising health consciousness and desire for incredible experiences among the urban population seeking stress relief and physical fitness. According to the Outdoor Participation Trends report in 2022, nearly 164.2 million people in the U.S. participate in outdoor recreation, including paddling activities. The key insight for manufacturers is the urgent need to the new outdoors participants with user-friendly boats, beginner-focused marketing, and clear pathways for skill development.

Challenges

- Increasing accident rates in kayaking: High accident rates in white water kayaking are a significant barrier to white-water kayaks market growth. This directly impacts the insurance costs, manufacturer liability, and public perceptions. According to the Recreational Boating Statistics data in 2022, nearly 14% of deaths occurred due to kayaking. Further, the data indicates that drowning is the leading cause of death. Further, these high-risk profiles are the main disadvantage for the entry of new participants and compel manufacturers to invest in safety warnings and redesign to overcome the liability, and increase the final costs of the kayak, which creates a barrier to market adoption.

- High competition for low-cost non-specialized alternatives: The market faces high pressure for low-cost and general-purpose recreational kayaks that are not designed for whitewater. Most people opt for cheaper and unsafe alternatives due to budget constraints and are not aware of the performance and safety gap. The importance of using appropriate safety gear, including the craft design for specified water conditions, is highlighted by many manufacturers. Further, manufacturers invest heavily in consumer education in order to justify the high pricing cost, relying on the specialized water bodies, which constrain the entry-level paddle sport.

White-Water Kayaks Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.2% |

|

Base Year Market Size (2025) |

USD 820.8 million |

|

Forecast Year Market Size (2035) |

USD 13.62 billion |

|

Regional Scope |

|

White-Water Kayaks Market Segmentation:

End user Segment Analysis

Individual consumers dominate the segment and are poised to hold the share value of 65.7% during the forecast period, 2026 to 2035. The segment is driven by the active cultural shift towards personal ownership of outdoor gear for recreation and lifestyle. Individual buyers are surging the direct sales of kayaks, accessories, and apparel. This demand is propelled by the desire for personalized equipment matching the skill level and paddling style of the individuals. Further, the post-pandemic has surged the self-guided outdoor adventures. The Outdoor Industry Association data has highlighted that paddle sports equipment is the leading segment in the direct consumer spending, with millions of people reporting kayak ownership.

Application Segment Analysis

Recreational holds the largest share and is supported by the vast majority of non-competitive paddles. The growth is fueled by the expansion of artificial white-water parks, which lowers the barrier to entry and expands the trend of seeking outdoor wellness activities. These parks are aided by the municipal tourism boards, which provide a safe and controlled environment for beginners in kayaking. The American Rivers data in 2024 has depicted that nature tourism contributes USD 3.37 billion outdoor recreation economy in the state, reinforcing the growth of river-based activities such as white-water kayaking and boosting participation in the recreational segment.

Material Segment Analysis

Polyethylene is the fueling the material segment due to its high impact resistance and lower cost, making it ideal for the demand of white-water kayaking, and is easily accessible to most consumers. While composite materials are stiffer and lighter, their high cost limits them to elite competitors alone. The durability of polyethylene is vital for withstanding rock strikes in low water conditions. The Canoe Shops data in 2025 stated that high-density polyethylene with a density greater than 0.941 g/cm3 is the preferred material in the manufacturing of kayaks. Further, its high tensile strength and stiff material have a good impact on the strength and the scratch resistance of kayaks.

Our in-depth analysis of the white-water kayaks market includes the following segments:

|

Segment |

Subsegments |

|

Product Type |

|

|

Material |

|

|

Distribution Channel |

|

|

Application |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

White-Water Kayaks Market - Regional Analysis

North America Market Insights

The white-water kayaks market in North America is dominating and is poised to hold share of 40.3% by 2035. The market is primarily driven by rising disposable income, a strong outdoor recreation culture, and improved retail infrastructure. The key drivers of the market are active adventure tourism and the proliferation of artificial whitewater parks that make the sport more accessible. Consumer trends are now shifting towards lightweight composite materials for improved performance, and online platforms are driving the rising used kayak market. Further, sustainability is the rising focus for manufacturers exploring recycled plastics.

The U.S. market is defined by innovation and accessibility. The key trend of the white-water kayaks market is the development of artificial whitewater parks, with the U.S. National Park Service actively playing its role in urban recreation and river conservation. The National Park Service data in June 2025 has depicted that paddle sports, which include white-water kayaking, are gaining popularity as a boating license is not required for small craft under 10 feet and can access the federally designated wilderness areas that make up 97% of Mount Rainier National Park, expanding opportunities for adventure tourism and demand for white-water kayaks. Further, increased permission for commercial activities on federal waterways highlights the consistent growth in guided kayaking.

The white-water kayaks market in Canada is characterized by the strong cultural link to outdoor pursuits. The main trend is the growth of tourism, supporting the partnership of Parks Canada and Destination Canada, offering authentic white-water experiences, thereby expanding market reach. The Manitobo data, which was revealed in 2025, has stated that over 100,000 lakes and countless rivers and streams create a strong recreational base for paddle sports, fueling demand growth in the white-water kayaks market. Further, environmental stewardship is paramount to ensure long-term sustainability of the sports.

APAC Market Insights

Asia Pacific is witnessing the fastest growth and is expected to grow at a CAGR of 6.3% during the forecast period 2026 to 2035. The white-water kayaks market in APAC is driven by the rising experience towards adventure tourism. China and Japan markets are expanding; on the other hand, India shows the highest growth potential due to its vast youth population and emerging adventure sports culture. A key driver is state-level investment in water sports infrastructure; for example, the Uttarakhand Tourism Development Board in India has actively developed the Ganges for rafting and kayaking. Further, consumer trends include a shift from rental services to personal kayak ownership among urban enthusiasts and a growing demand for affordable, durable boats.

China’s white-water kayaks market is influenced by state-led initiatives to develop the sports infrastructure and tourism. The government’s push for sports is outlined by the national fitness plan that directly benefits the niche adventure sports. The People Republic of China data released in November 2025 depicts that the total foreign nationals visiting China was 7.246 million under its visa-free policies, marking a 48.3% YoY rise. The rising interest in adventure travel among international tourists fuels the participation in water-based recreational activities, including white water kayaking. Further, expansion of the outdoor sports zones and river park projects promotes adventure in white water kayaking in China.

India represents the highest growth in the APAC market and is fueled by its young demographic and the development of the Himalayan river system for adventure tourism. The state government is actively supporting economic development. For instance, the India Today report released in October 2025 depicts that 23.46 crore tourists visited Uttarakhand in the past three years, which is a rise in the registered adventure tourism operators. The popular activity preferred by tourists in Uttarakhand is kayaking on the river Ganges. This growth in kayaking and rafting operations accelerates the local equipment white-water kayaks market and exposes a growing number of domestic and international tourists to the sport.

Europe Market Insights

The white water kayaks market in Europe is defined by the mature consumer base, strong environmental awareness, and robust pubic access to waterways. The growth is mainly driven by the growing popularity of outdoor and adventure tourism, which is supported by the European Union’s initiatives to promote active lifestyles and blue economy sustainability. Further, a key trend is the modernization and creation of artificial white water courses that serve as training hubs and tourist attractions. Consumer demand is shifting towards high-performance composite kayaks and a growing used-gear market.

Germany is projected to hold the largest share during the forecast period in Europe. The strong manufacturing heritage and extensive club infrastructure drive the market. The CBI report in February 2024 has provided evidence highlighting that 630,000 people took part in water sports, including kayaking, in 2021, highlighting the strong participation base that supports the demand for equipment and club-driven training culture. Moreover, the people taking part in water activities once a month increased by 31% in 2021. This trend aligns perfectly with the cultural emphasis on environmentalism, which further fuels the white-water kayaks market.

People Participating in Water Sports in Germany from 2018 to 2021

|

Frequency (millions) |

2018 |

2019 |

2020 |

2021 |

% growth 2019 vs 2021 |

|

Several times a week |

0.09 |

0.06 |

0.09 |

0.2 |

233.3% |

|

Several times a month |

0.49 |

0.5 |

0.46 |

0.63 |

26.0% |

|

Once a month |

0.65 |

0.84 |

1.02 |

1.1 |

31.0% |

|

Less than once a month |

4.94 |

5.05 |

5.21 |

5.31 |

5.1% |

Source: CBI February 2024

The UK is the second largest market in Europe and is propelled by the adventure tourism sector and rising investment in the white water facilities. Water sports are the most popular sport in the UK and are primarily driven by the long tradition of water sports. The CBI report in February 2024 highlights that 5.7 million have participated in canoeing/kayaking among which 10.4% are adults aged above 18. This data creates a vast funnel for the white water segment. Further the combination of world-class infrastructure and a large, active outdoor participation secures the UKs leadiing white-water kayaks market position.

Participation in Water Sports in 2021

|

Water sports activities |

Volume ('000) |

Participation rate % |

Participation: % abroad only |

% UK only |

% UK and abroad |

|

Outdoor swimming |

9,711 |

17.9% |

4% |

77% |

19% |

|

Canoeing/kayaking |

5,663 |

10.4% |

2% |

81% |

17% |

|

Small sailboat activities (dinghies) |

3,627 |

6.7% |

1% |

74% |

24% |

|

Kitesurfing/kite foiling |

3,101 |

5.7% |

3% |

62% |

36% |

|

Body boarding |

2,204 |

4.1% |

2% |

75% |

23% |

|

Windsurfing/wind foiling |

2,155 |

4.0% |

1% |

68% |

31% |

|

Stand-up surfing |

1,838 |

3.4% |

1% |

67% |

32% |

|

Waterskiing/wakeboarding |

1,567 |

2.9% |

2% |

64% |

34% |

Source: CBI February 2024

Key White-Water Kayaks Market Players:

- Jackson Kayak (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Dagger (U.S.)

- Liquidlogic (U.S.)

- Wavesport (U.S.)

- Perception (U.S.)

- Pyranha Kayaks (U.S.)

- Waka Kayaks (U.S.)

- Pyranha Kayaks (UK)

- Prijon (Germany)

- Gumotex (Czech Republic)

- Zet Kayaks (Czech Republic)

- Riot Kayaks (France)

- Galasport (Portugal)

- Aquadesign (Slovakia)

- DAG (Slovakia)

- Point65 (Japan)

- Viking Kayaks (Australia)

- SIS Kayaks (South Korea)

- Nova Craft (India)

- The leading player in the white-water kayaks market, Jackson Kayak, leads due to its innovative design that has been customized for playboating and creeking. Much of the company's strategic initiatives depend on direct engagement with the paddling community through professional athletes for product testing, and high-impact marketing via competition sponsorships and viral video content.

- Dagger maintains the top position in the whitewater kayaks market and aims for a versatile, high-performance, and innovative design that appeals to a broad range of paddlers, from beginners to experts. Their strategy involves in continuous material innovation and development of durable lightweight plastics to enhance comfort and have control on the river.

- Liquidlogic has carved a strong niche in the white-water kayaks market and is underscoring safety and stability in its design, mainly for creek boating and river running. Their strategic initiatives are centered on proprietary technologies, including their patented Remix hull shapes that promote confidence in challenging the whitewater. This focus involves creating user-friendly, predictable performance, attracting paddlers to advance their skills, hence allowing Liquidlogic to command a loyal following and a stable segment in the market.

- Wavesport is an iconic brand in the white-water kayaks market and is mainly influenced by the modern playboat design. The company strategy involves in preserving its legacy while integrating contemporary manufacturing techniques. By providing models that are responsive and agile, the company caters to technical paddlers who mainly prioritize the river features to ensure continued relevance and dedication.

- Perception, as part of a larger conglomerate, strategically targets the entry-level and intermediate segments of the White-Water Kayaks Market. Their key initiative is to make the sport more accessible by producing high-quality, affordable kayaks that are easy and fun to paddle. By using the broad distribution channels and offering a range of boats that support skill progression, Perception acts as a critical gateway brand in the market.

Here is a list of key players operating in the global market:

The industry is dominated by the global manufacturers in the white-water kayaks market, with specialized brands from Europe and North America. The competitive landscape is mainly focusing on technological developments in materials such as composite plastics and carbon fiber to improve performance and durability. Strategic initiatives such as strong marketing via professional paddlers and sponsorship of large events to build brand prestige. For instance, Jackson Kayak acquired Eddyline in February 2025. This partnership expands the offerings of Jackson Kayak across whitewater, touring, fishing, and recreation, ensuring more paddlers find the perfect boat.

Corporate Landscape of the White-Water Kayaks Market:

Recent Developments

- In September 2025, Jackson Kayak unveiled its latest whitewater kayak, the Antix 3.0, providing the top-selling half-slice in the market with a major upgrade.

- In May 2024, Jackson Kayak has announced its partnership with Werner Paddles. This partnership continues supporting specialty shops with exclusive products and top-end service.

- Report ID: 8231

- Published Date: Nov 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

White-Water Kayaks Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.