Electric Water Heater Market Outlook:

Electric Water Heater Market size was valued at USD 28.9 billion in 2025 and is projected to reach USD 47.6 billion by the end of 2035, rising at a CAGR of 5.7% during the forecast period, i.e., 2026-2035. In 2026, the industry size of electric water heater is evaluated at USD 30.5 billion.

The global electric water heater market is set to witness notable expansion in the upcoming years, owing to the rising consumer demand for energy-efficient and convenient hot water solutions across residential, commercial, and industrial sectors. In this regard, the World Integrated Trade Solution (WITS) reported that in 2023, the U.S. imported electric instantaneous and storage water heaters, which were valued at approximately USD 795.5 million, totaling 12.62 million units. The report also underscored that the majority of imports originated from Mexico with USD 498.8 million, 4.55 million units, China USD 148.8 million, 6.93 million units, followed by Canada, Germany, and South Korea. Therefore, these imports reflect the U.S. reliance on both North America and Asia manufacturing for meeting domestic demand, positively impacting electric water heater market growth.

U.S. Electric Instantaneous & Storage Water Heaters Imports by Country in 2023

|

Partner Country |

Trade Value (USD ‘000) |

Quantity (Items) |

|

Canada |

42,983.22 |

345,405 |

|

Germany |

42,858.96 |

274,725 |

|

Korea, Rep. |

9,707.97 |

61,567 |

|

Japan |

7,276.50 |

14,435 |

|

Sweden |

4,836.59 |

70,285 |

|

France |

4,802.78 |

15,716 |

|

U.K. |

4,347.90 |

6,688 |

|

Spain |

4,257.26 |

50,775 |

|

Australia |

4,199.52 |

5,727 |

|

Italy |

3,464.42 |

129,640 |

Source: WITS

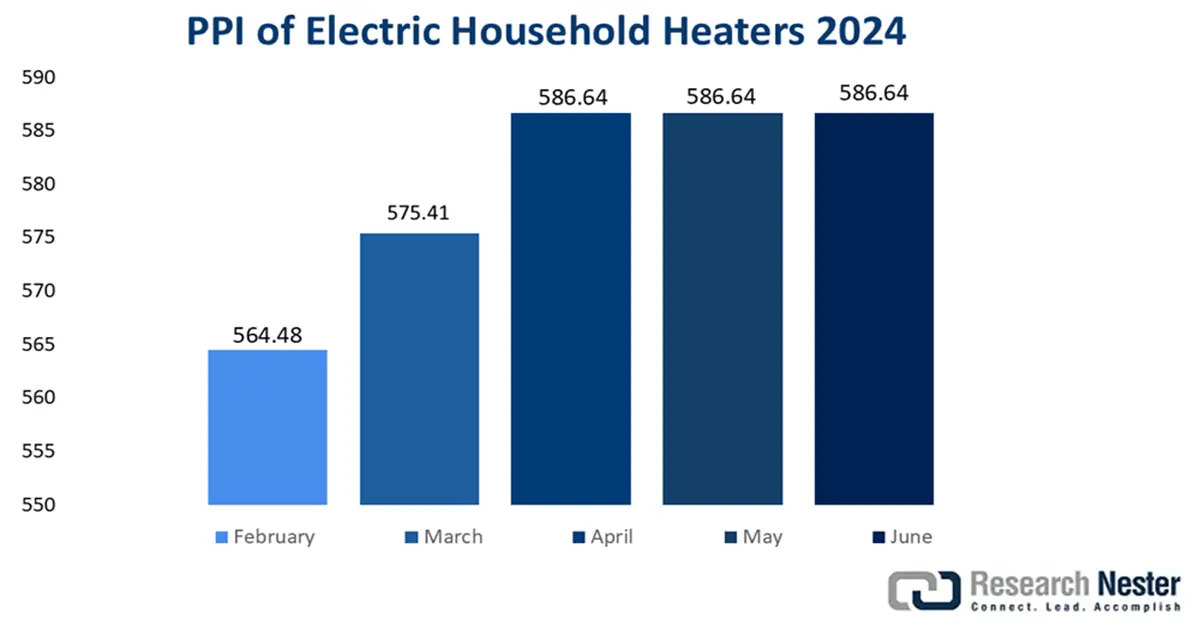

Furthermore, the electric water heater market is impacted by the pricing pressures, wherein the U.S. Bureau of Labor Statistics reported that the Producer Price Index (PPI) for electric household water heaters in the U.S. represented a constant increase in 2024, which reflects the rising manufacturing costs. The article also mentioned that electric water heater for permanent installation reached PPI of 586.64 by June, whereas the non-electric household water heaters surpassed 359.027 during the same timeline.

These figures indicate the presence of constant cost pressures in the production of water heating equipment, which can influence both domestic pricing as well as import export competitiveness in this field. Hence, the existence of higher producer prices can incentivize manufacturers to invest in energy-efficient electric water heater, thereby enhancing product value and profitability.

Key Electric Water Heaters Market Insights Summary:

Regional Highlights:

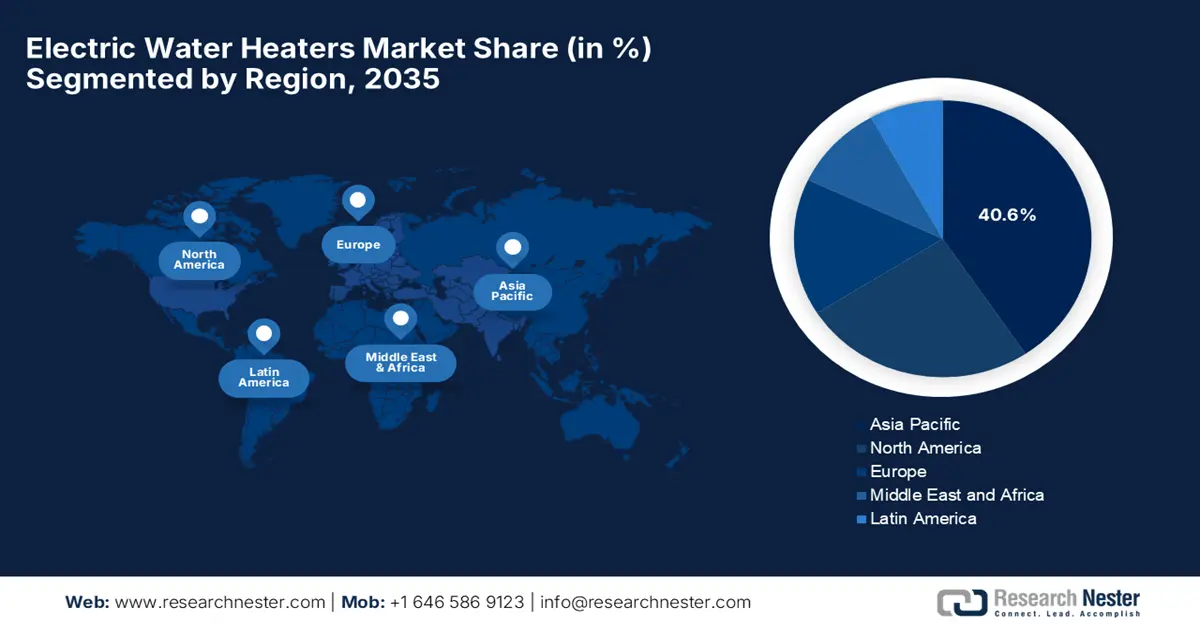

- Asia Pacific is projected to secure a 40.6% share by 2035 in the electric water heater market, supported by expanding electrification and rising disposable incomes across a broad consumer base.

- North America is anticipated to advance steadily through 2035, bolstered by accelerating adoption of energy-efficient and smart water heating solutions.

Segment Insights:

- The with tank subtype is forecast to account for a dominant 55.6% revenue share by 2035 in the electric water heater market, attributed to its affordability and widespread consumer familiarity.

- By 2035, the residential application segment is expected to hold a leading share, fueled by growing urbanization and increasing preference for modern electric water heating systems.

Key Growth Trends:

- Urbanization & construction growth

- Technological improvements

Major Challenges:

- High operating costs & electricity dependence

- Competition from alternative technologies

Key Players: A. O. Smith Corporation (U.S.), Rheem Manufacturing Company (U.S.), Ariston Thermo Group (Italy), Bosch Thermotechnology / Bosch Home Comfort Group (Germany), Haier Group Corporation (China), Midea Group (China), Bradford White Corporation (U.S.), Rinnai Corporation (Japan), Noritz Corporation (Japan), Whirlpool Corporation (U.S.), Bajaj Electricals Ltd. (India), Stiebel Eltron (Germany), Vaillant Group (Germany), Ferroli S.p.A. (Italy), Navien, Inc. (South Korea).

Global Electric Water Heaters Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 28.9 billion

- 2026 Market Size: USD 30.5 billion

- Projected Market Size: USD 47.6 billion by 2035

- Growth Forecasts: 5.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (40.6% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, China, Japan, Germany, South Korea

- Emerging Countries: India, Vietnam, Indonesia, Brazil, Mexico

Last updated on : 16 December, 2025

Electric Water Heater Market - Growth Drivers and Challenges

Growth Drivers

- Urbanization & construction growth: The world is witnessing expansion in terms of urbanization, and there has been consistent progress in residential, commercial construction growth that efficiently fuels growth in the electric water heater market. In this context, Census.gov in September 2024 reported that the U.S. new residential construction data for August 2025 indicates mixed trends that could impact the market. It stated that Building permits were at a seasonally adjusted annual rate (SAAR) of 1,312,000, down 3.7% from July and 11.1% below August 2024, while single-family authorizations were 856,000, slightly decreasing from July. Also, housing starts totaled 1,307,000, showing an 8.5% decline from July and a 6% decrease versus last year, with single-family starts at 890,000, which suggests that although new construction activity is moderating, the higher completion rate can sustain demand for electric water heater in finished homes.

- Technological improvements: The electric water heater benefit from improvements in insulation, heating elements, IoT-enabled controls, and tankless designs. Rheem, in September 2022, announced that it had launched the prestige smart electric water heater, which has a LeakGuard, allowing homeowners to connect to the electric grid and comply with new energy regulations. Besides, the product is available in 40-, 50-, and 55-gallon models, and units wherein it also features high efficiency up to 0.93 UEF, EcoPort (CTA-2045) connectivity, use scheduling, and EcoNet Wi-Fi integration to optimize energy consumption and thereby reduce peak demand costs. Furthermore, the LeakGuard system consists of an auto shut-off valve to limit leaks to 20 ounces, enhancing safety, and the company also expanded its smart water heater portfolio with professional classic plus and professional classic models.

- Increasing disposable income: This, coupled with upgrading living standards, is prompting a favorable business environment for the electric water heater market since the rise in income means more households can afford higher-quality appliances. As per the article published by Resolution Foundation in December 2024, the UK Government’s decision to prioritize rising living standards by targeting growth in real household disposable income and GDP per person is a sensible shift, reflecting what matters most to families. It also mentioned that these milestones have been met in most of the parliaments, wherein the RHDI rose by just 0.3% on a yearly basis in the last Parliament, especially across regions. Furthermore, the Resolution Foundation notes true success means ensuring gains reach low- and middle-income households, thereby improving purchasing power among individuals.

Challenges

- High operating costs & electricity dependence: This is the major hampering factor for the upliftment of the electric water heater market. These heaters rely entirely on electricity, which makes them highly expensive to operate, especially in regions that have higher energy tariffs and unstable power supply. Also, the households and commercial households are facing severe energy expenses that can limit adoption in cost-sensitive markets. When compared to gas or solar alternatives, electric water heater are identified as less economical in the long term, even if there is lower initial installation complexity. Furthermore, manufacturers need to balance energy efficiency improvements with affordability to maintain competitiveness in this field.

- Competition from alternative technologies: The electric water heater market is facing a huge competition from alternative technologies such as gas-fired water heaters, solar thermal systems, and heat pump water heaters. In this context, heat pumps and solar water heaters are coming up with lower operating costs, which makes them attractive to consumers from price-sensitive regions. Also, gas water heaters are dominating in regions that leverage cheaper natural gas availability. In addition, the adoption of renewable energy is increasing, so the preference for heat pumps and solar solutions may grow, making it challenging for the electric water heater market share. Hence, manufacturers need to be innovative by integrating smart features and differentiating products to sustain growth.

Electric Water Heater Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.7% |

|

Base Year Market Size (2025) |

USD 28.9 billion |

|

Forecast Year Market Size (2035) |

USD 47.6 billion |

|

Regional Scope |

|

Electric Water Heater Market Segmentation:

Product Type Segment Analysis

The with tank subtype is expected to lead with the largest revenue share of 55.6% in the electric water heater market throughout the analyzed timeframe. Their cost-effectiveness and familiarity with consumers across the globe are the key factors behind this leadership. For many households, mostly in developing nations, a constant hot water supply and simple installation make storage tanks highly preferred among a wider group of audiences. In October 2023, Voltas announced that it had launched its new range that features Quartzline Technology, offering both instant and storage water heaters. It also stated that the products are available in multiple capacities, which include 10, 15, and 25 litres, suitable for the needs of different household sizes. Furthermore, with an annual market demand of around 5 million units and consistent growth of 10% to 12%, the firm aims to leverage its extensive distribution and retail network to capture a significant share.

Application Segment Analysis

By the conclusion of 2035, the residential sector is expected to lead the application segment with a considerable share in the electric water heater market. The increasing urbanization, rising homeownership, and growing middle-class populations are driving consistent growth in this segment. Simultaneously, the government incentives and energy-efficiency awareness support the adoption of modern electric water heater in homes. In addition, improvements such as smart controls and faster heating systems are encouraging more households to opt for these electric water heater. The ever-increasing real estate sector is boosting the installation rates in the new housing units. Therefore, the presence of all of these factors together will position the residential segment as the most prominent force shaping electric water heater market demand over the forecasted years.

Capacity Segment Analysis

The small capacity category is anticipated to capture a lucrative stake in the electric water heater market over the forecasted years. The growth of the segment is highly subject to its suitability for a wide range of families, lower energy consumption, and storage volume. Also, these water heaters are increasingly being adopted in urban houses owing to their capability to meet the daily water demands. In September 2023, Midea India announced that it had launched its smart Wi-Fi storage water heaters, offering 15 and 25-litre capacity models, which are designed for convenience, energy efficiency, and safety. It also stated that the heaters feature remote control through the SmartHome app, intelligent scheduling to reduce energy bills, and voice control with Alexa and Google Home. Furthermore, both the cube-shaped VN series and cylinder-shaped FY series include titanium enamel glassline tanks, Xpress Heating, and 5-star BEE energy ratings.

Our in-depth analysis of the electric water heater market includes the following segments:

|

Segment |

Subsegments |

|

Product Type |

|

|

Application |

|

|

Capacity |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Electric Water Heater Market - Regional Analysis

APAC Market Insights

Asia Pacific is likely to hold a commendable share of 40.6% in the electric water heater market over the forecast duration. The region benefits from the presence of a large consumer base and the key market pioneers. The increasing electrification, coupled with the increasing disposable incomes, is prompting a profitable business environment in the region. In June 2025, Noritz Corporation announced that it is set to launch its natural refrigerant hybrid water heater, the HPHB R290, sequentially, which uses the eco-friendly refrigerant R290, achieving industry-leading energy efficiency, reducing CO₂ emissions, and utility costs through its smart control system. The system comes in a compact design that enhances installation flexibility, with models available in 145L and 70L capacities, making it suitable for different household needs. Furthermore, additional features include solar-powered hot water storage, disaster-prepared hot water functions, for a very efficient and safe operation, hence contributing to overall electric water heater market expansion.

China is continuing its growth trajectory as the global hub of innovation in the electric water heater market, efficiently backed by smart home integrations. Domestic manufacturers are developing energy-efficient water heaters that are suitable for a wide range of households in the country. In November 2024, the China Household Electrical Appliances Association announced that at the 24th Conference, it unveiled updated technical roadmaps for water heaters along with other appliance categories. The conference was themed Intelligence, Low Carbon, Healthiness, and New Materials, highlighted the recent trends in consumer demand, regulatory changes, and market drivers. In this regard, it also mentioned that the water heater roadmap focuses on energy efficiency, smart-home integration, and technological upgrades to meet evolving household needs, and it aims to guide the industry’s development in alignment with China’s 15th Five-Year Plan, thereby preparing manufacturers for future innovations and sustainable growth.

India also has a strong scope to capitalize on the regional electric water heater market on account of rising urban housing and rising homeownership. Consumers in the country are preferring highly modernized products. Simultaneously, the government incentives and the expansion of distribution channels, which include online platforms, are supporting wider availability and penetration of electric water heater in both urban and semi-urban regions. In April 2024, GM Modular announced that it had entered the country’s market by launching its first storage water heater, the R1X, which is designed with a 15-litre capacity and combines elegant design, advanced technology, and safety features, including 99.5% heating efficiency, a rust-proof body, and a thermal cutout. Furthermore, firms such as GM are committed to developing innovative, convenient, and reliable home electrical solutions, thereby expanding their appliance portfolio in the country.

North America Market Insights

North America is readily progressing in the international electric water heater market, efficiently propelled by the steady adoption of energy-efficient and smart water heating solutions. The region’s leadership is also attributable to innovations such as heat pump water heaters and connected devices have increased consumer interest in eco-friendly and cost-saving products. In May 2025, Ariston Group and Lennox announced that they formed a joint venture to introduce a range of residential water heaters in the U.S. and Canada by combining Ariston’s knowledge in water heating technology with Lennox’s strong brand presence and distribution network. In this context, the partnership aims to enhance innovation and electric water heater market reach, with Lennox-branded high-efficiency water heaters through Lennox stores, dealer networks, and distributors. In addition, Ariston will continue serving its existing customers under its own brands through its Ariston U.S. subsidiary, hence strengthening both companies’ foothold in North America.

In the U.S., the electric water heater market is positively influenced by growing awareness of energy conservation and rising demand for modern water heating technologies. On the other hand, federal and state-level incentives for energy-efficient appliances encourage increased adoption, whereas the domestic manufacturers are focused on smart connectivity and improved safety features. According to the article published by the U.S. Department of Energy in April 2024, it finalized new energy-efficiency standards for residential water heaters, which are projected to save around USD 7.6 billion annually on utility bills from the country’s households. It also notes that the updated rules prioritize heat pump technology, significantly improving efficiency for common-sized electric storage water heaters, with compliance required starting in 2029. Furthermore, within 30 years, these standards are expected to save around USD 124 billion in energy costs and reduce 332 million metric tons of CO₂ emissions.

Canada is witnessing a heightened demand in the electric water heater market owing to the colder climates and emphasis on factors as reliability and durability. In addition, regional regulations are promoting energy efficiency, whereas the gradual replacement of older water heaters is driving growth in both urban and rural areas. As per the article published by the country’s government, Natural Resources Canada announced in July 2022 that it is considering updating Canada’s energy efficiency regulations for household electric water heater to align with U.S. standards. It also stated that the initiative aims to improve energy performance, reduce greenhouse gas emissions, and encourage manufacturers to adopt more efficient product designs. Furthermore, the proposed amendments would apply to electric storage tank water heaters with a nominal capacity of at least 50 liters and an input rate below 12 kW, with new efficiency and testing standards expected to take effect for units manufactured on or after January 2025.

Europe Market Insights

Europe has captured the most prominent position in the global electric water heater market, facilitated by the larger consumer pool, emphasis on sustainability, and strict environmental regulations. Market growth in the region is also supported by initiatives that are promoting smart home technologies and integration with renewable energy sources. As per an article published by EHPA in May 2023, the hot water heat pumps also saw a 48.7% rise, whereas the water-to-water heat pumps experienced a slight decline, though geothermal systems remained steady and are increasingly used in commercial buildings. The report also underscored that the region currently has around 20 million connected heat pumps, heating about 16% of residential and commercial buildings. Furthermore, adoption in multi-family buildings is lower due to a variety of heating demands, highlighting the need for suitable heat pump solutions to boost their use.

Germany is efficiently growing in the regional electric water heater market, positively influenced by technologically advanced solutions that possess high energy efficiency with reliability. Domestic manufacturers are making heavy investments in innovative designs and connectivity features for environmentally conscious as well as tech-savvy consumers. Roth Werke, in November 2025, announced that it launched a patented hybrid domestic hot water station at ISH 2025, which is a combination of an 11 kW electric instantaneous water heater with a heat interface unit for decentralized, hygienic hot water supply. It also notes that the system delivers consistent temperatures, high tapping capacities by preventing limescale and corrosion. Furthermore, its smart controller allows precise, on-demand heating and, use of multiple outlets, hence denoting a positive market outlook.

The U.K. consumers and investors are showcasing growing interest in the electric water heater market to be utilized in both new constructions and retrofits. Also, the existence of supportive government policies, growing awareness of sustainable living, and a rise in smart home adoption are efficiently propelling market upliftment in the country. In addition, both residential and commercial sectors are making investments in innovative technologies such as compact and tankless units to optimize space and energy usage, thereby encouraging more players to establish their footprint in the country. Also, manufacturers are responding with smart, connected products that integrate with home automation systems, which enhances user convenience. Furthermore, collaborative initiatives between companies and government bodies are supporting research, development, and deployment of high-efficiency water heating solutions across the country.

Key Electric Water Heater Market Players:

- A. O. Smith Corporation (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Rheem Manufacturing Company (U.S.)

- Ariston Thermo Group (Italy)

- Bosch Thermotechnology / Bosch Home Comfort Group (Germany)

- Haier Group Corporation (China)

- Midea Group (China)

- Bradford White Corporation (U.S.)

- Rinnai Corporation (Japan)

- Noritz Corporation (Japan)

- Whirlpool Corporation (U.S.)

- Bajaj Electricals Ltd. (India)

- Stiebel Eltron (Germany)

- Vaillant Group (Germany)

- Ferroli S.p.A. (Italy)

- Navien, Inc. (South Korea)

- A. O. Smith Corporation is identified as the leading global manufacturer of water heating equipment, which has a strong presence across North America, Asia, and Europe. The company is focused on technological innovation and smart water heaters that are integrated with IoT. Furthermore, A. O. Smith leverages profitable acquisitions and sustainability initiatives to maintain its leadership and address a broad range of customer requirements.

- Rheem Manufacturing Company is a pioneer in residential and commercial water heating systems, which is best known for durable electric and tankless solutions. The company deeply emphasizes energy efficiency as well as environmental compliance, which includes ENERGY STAR-certified products. In addition, Rheem’s strategy for growth involves expanding its product portfolio, increasing investments in smart technology, and strengthening global distribution channels.

- Ariston Thermo Group is operating in over 150 countries, which has a portfolio that spans electric and gas water heaters. The company is leveraging premium and energy-efficient solutions, which are highlighted by its Racold brand. Acquisitions, joint ventures, and local manufacturing are a few strategies implemented by the firm to uplift the market growth both at the national and international scales.

- Bosch Thermotechnology is yet another dominant force in this field, which is offering high-quality electric water heater emphasizing energy efficiency, smart-home integration, and durable design. The company is leveraging advanced R&D to develop hybrid and tankless technologies, whereas its global presence and sustainability initiatives reinforce its position as a premium market player over the forecasted years.

- Haier Group Corporation is a popular brand name in this sector, which offers a wide range of electric storage and tankless water heaters possessing strategic pricing and advanced features. The company deliberately emphasizes innovation, smart-home integration, and expanding its presence in emerging nations with an extended focus on domestic production, along with strong retail networks.

Below is the list of some prominent players operating in the global electric water heater market:

The global electric water heater market is dominated by the established entities such as A. O. Smith Corporation, Rheem Manufacturing Company, and Ariston Thermo Group, which are constantly making investments in innovation, energy efficiency, and global expansion. Simultaneously, the Europe-based firms such as Bosch Thermotechnology and Ferroli are emphasizing sustainability and compliance with environmental regulations, whereas Asia-based players such as Haier and Midea focus on wide distribution networks and cost-effective, locally adapted solutions. In October 2025, Ariston Group announced that it had acquired a new manufacturing facility in Hyderabad to strengthen the growth of its premium Racold brand. Besides, the plant, owned by Hintastica Private Limited, is a joint venture between Groupe Atlantic and Hindware Home Innovation Limited, spanning around 23,100 sqm with a yearly production capacity of approximately 500,000 electric storage water heaters, hence meeting the rising demand for advanced hot water solutions.

Corporate Landscape of the Electric Water Heater Market:

Recent Developments

- In October 2025, Enphase Energy expanded its IQ energy management system in Belgium, the Netherlands, and Switzerland to include smart control of electric water heater. It is integrated with the IQ Energy Router. This capability allows homeowners to preheat water using excess solar energy.

- In October 2025, Rinnai America Corporation announced that it is expanding its distribution network with a new warehouse in Markham, Ontario, that shortens lead times and ensures steady availability of high-performance residential and commercial water heaters.

- In July 2025, LG Electronics announced that it had acquired a 100% stake in OSO, which is a leading provider known for stainless steel hot water systems, to strengthen its HVAC portfolio and expand its B2B growth.

- Report ID: 8316

- Published Date: Dec 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Electric Water Heaters Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.