High Purity Aluminum Consumption Market Outlook:

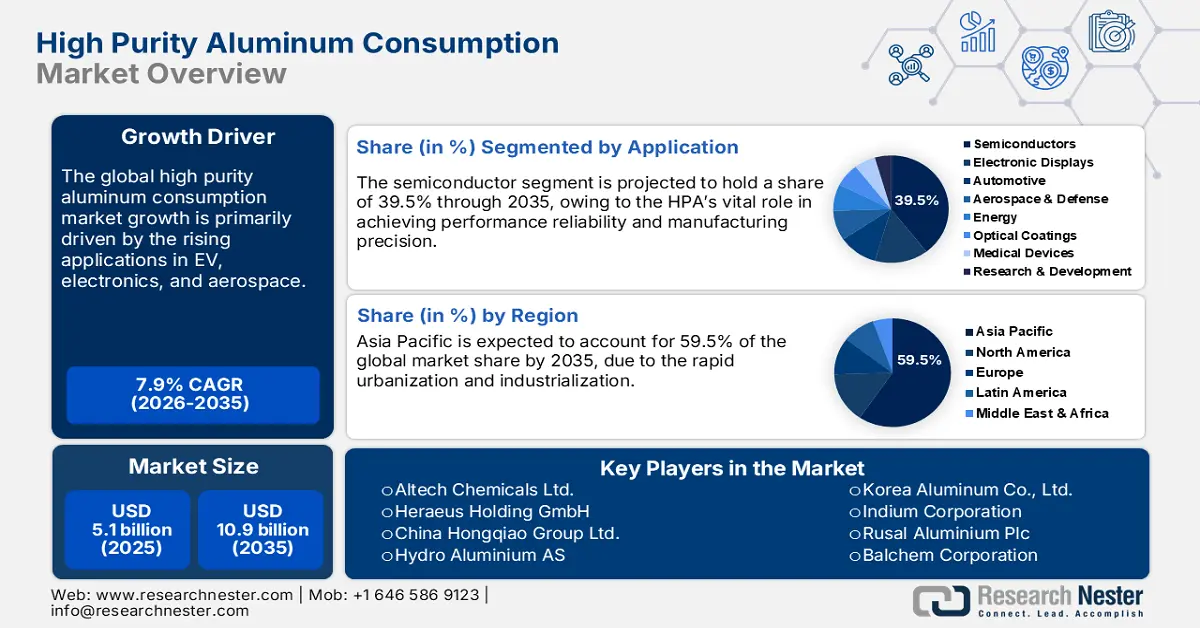

High Purity Aluminum Consumption Market size was USD 5.1 billion in 2025 and is estimated to reach USD 10.9 billion by the end of 2035, expanding at a CAGR of 7.9% during the forecast period, i.e., 2026-2035. In 2026, the industry size of high purity aluminum consumption is estimated at USD 5.5 billion.

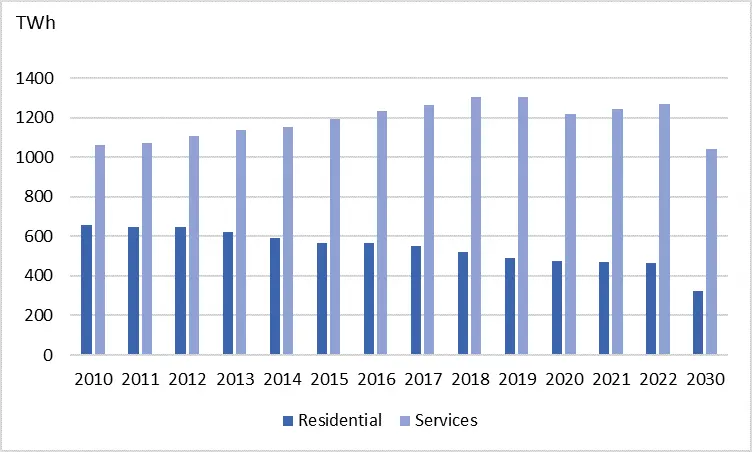

The global transition toward energy-efficient lighting is estimated to propel the consumption of high purity aluminum (HPA). Several governments across the world are implementing strict regulations on the non-use of incandescent bulbs. The phasing out of halogen lamps is also contributing to the increasing use of LED solutions. Most halogen lamps are phased out due to the European Union's Ecodesign regulation. The U.S. Department of Energy also tightened its standards on eliminating most incandescent lighting solutions. This regulatory shift is expected to boost the use of HPA sapphire substrates in LED. The report by the International Energy Agency (IEA) discloses that the global residential LED sales increased from 5% in 2013 to 50% in 2022. Continuous technological advancements are poised to boost the effectiveness and adoption of LED lighting, subsequently contributing to the high consumption of HPA.

Global Residential Lighting Sales Share by Technology in Net Zero Scenario, 2010-2030

Source: IEA

The robust infrastructure development programs, such as smart cities and advanced transportation hubs, are also contributing to the increasing consumption of high purity aluminum. The International Institute for Management Development (IMD) reveals that Zurich holds 1st smart city rating, followed by Oslo, Geneva, Dubai, and Abu Dhabi. The growth of smart transportation and advanced healthcare systems is creating great opportunities for companies making high-purity aluminum. Also, improvements in car headlights, smartphones, and display backlighting are increasing the demand for high-purity aluminum used in sapphire substrates.

Key High Purity Aluminum Consumption Market Insights Summary:

Regional Highlights:

- By 2035, the Asia Pacific high purity aluminum consumption market is expected to command a 59.5% share, bolstered by rapid industrialization and urbanization.

- North America is projected to maintain the second-largest share by 2035, supported by the growing demand for advanced electronics and increasing registrations of electric vehicles.

Segment Insights:

- The semiconductors segment is expected to account for 39.5% of the high purity aluminum consumption market share by 2035, underpinned by HPA’s vital role in achieving performance reliability and manufacturing precision.

- By 2035, the ingot segment is set to capture a 55.5% share, spurred by the versatility of ingots.

Key Growth Trends:

- Electric vehicle trend

- Growing aerospace and defense usage

Major Challenges:

- High production costs & technical barriers

Key Players: Altech Chemicals Ltd. (Australia), Alcoa Corporation (USA), Heraeus Holding GmbH (Germany), China Hongqiao Group Ltd. (China), Hydro Aluminium AS (Norway), Korea Aluminum Co., Ltd. (South Korea), Indium Corporation (The U.S.), Rusal Aluminium Plc (Russia), Balchem Corporation (The U.S.), Vedanta Limited (India), Novelis Inc. (The U.S.), ALD Vacuum Technologies GmbH (Germany), Malaysia Smelting Corporation Berhad (Malaysia), China Zhongwang Holdings Ltd. (China), Toyotsu Aluminium Co., Ltd. (Japan), Sumitomo Metal Mining Co., Ltd. (Japan), Panasonic Corporation (Japan), UACJ Corporation (Japan), Shin-Etsu Chemical Co., Ltd. (Japan), Mitsubishi Materials Corporation (Japan).

Global High Purity Aluminum Consumption Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 5.1 billion

- 2026 Market Size: USD 5.5 billion

- Projected Market Size: USD 10.9 billion by 2035

- Growth Forecasts: 7.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (59.5% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: China, United States, Japan, Germany, South Korea

- Emerging Countries: India, Vietnam, Mexico, Indonesia, Brazil

Last updated on : 17 November, 2025

High Purity Aluminum Consumption Market - Growth Drivers and Challenges

Growth Drivers

- Electric vehicle trend: The electric vehicle (EV) trend is doubling the revenues of high purity aluminum consumption market. The booming demand for lithium-ion batteries is promoting the consumption of high purity aluminum. Asia Pacific and Europe are expected to lead the production and commercialization of zero-emission vehicles during the foreseeable period. The Global EV Outlook 2023, published by the Organisation for Economic Co-operation and Development (OECD), reveals that electric car sales surpassed 10 million in 2022. The new CO2 standards for cars and vans adopted by the European Union are poised to fuel the registrations of EVs. The same source also reveals that the venture capital funding for EV and battery technology start-ups increased to around USD 2.1 billion in 2022, a hike of 30% from 2021. These moves are directly increasing investments in critical minerals, including high purity aluminum.

- Growing aerospace and defense usage: High-purity aluminum is being widely used in the defense sector owing to its exceptional material properties. The defense solutions require material that withstands extreme conditions, which is emerging as a lucrative factor for HPA sales. The Global Electronics Association estimates that by 2035-2040, electronics are expected to make up 25% of the value of defense equipment in Europe. The increasing defense budgets and advancements in technologies, including drones and surveillance systems.

- Emerging use in medical devices: The medical device manufacturers are increasingly investing in high-purity aluminum components owing to its exceptional biocompatibility. High-purity aluminum is also used for special coatings on medical implants such as orthopedic screws, dental implants, and prosthetics. The World Health Organization (WHO) projects that there are over 1.9 million various kinds of medical devices available across the world. Further, the Advanced Medical Technology Association (AdvaMed) states that the U.S. is the largest medical device market with more than 40% of the global revenue share. Overall, the MedTech sector is likely to double the profits of key players in the years ahead.

Challenges

- High production costs & technical barriers: The production of high-purity aluminum is an energy-intensive process, unlike other metals. Small companies and start-ups often find it challenging to compete with giant players owing to limited budgets. Thus, costly energy prices and strict environmental regulations further limit the expansion of small and medium-scale manufacturers in some regions. The advanced technologies are effective in achieving the purity of aluminum, such as 99.99% or 99.999%. However, it requires controlled environments, high-quality reactors, and advanced purification methods, which are costly and require expertise to handle. All these factors challenge small companies from taking advantage of trending opportunities.

High Purity Aluminum Consumption Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

7.9% |

|

Base Year Market Size (2025) |

USD 5.1 billion |

|

Forecast Year Market Size (2035) |

USD 10.9 billion |

|

Regional Scope |

|

High Purity Aluminum Consumption Market Segmentation:

Application Segment Analysis

The semiconductors segment is expected to account for 39.5% of the high purity aluminum consumption market share, due to HPA’s vital role in achieving performance reliability and manufacturing precision. High purity aluminum is being increasingly used in power electronics, logic devices, and memory chips as a semiconductor wafer base. The Semiconductor Industry Association (SIA) revealed that the global semiconductor sales totaled USD 179.9 billion in the second quarter of 2025. In June, sales expanded by 19.6% on a year-to-year basis, led by Asia Pacific and America. The increasing demand for semiconductors is set to directly fuel the consumption of high purity aluminum.

Form Segment Analysis

The ingot segment is projected to capture 55.5% of the high purity aluminum consumption market share by 2035. Ingots are prime feedstocks used in the production of high-purity aluminum oxide (HPA powder), wafers, and alloys. The versatility of ingots is contributing to their high sales. The LED and optical glass industries prefer using ingots owing to their flexibility without losing their quality. Further, Asia Pacific and North America, with advanced semiconductor fabs and advanced electronics sectors, are likely to propel the sales of ingots during the study period.

Purity Level Segment Analysis

The 4N (99.99%) HPA segment of high purity aluminum consumption market is poised to hold 46.1% of the share by 2035, owing to its high performance and effectiveness. The efficient purity to meet the stringent requirements of mainstream industries is also driving the sales of 4N HPA. LEDs, lithium-ion battery separators, semiconductors, and electronic components are the main end users of 99.99% HPA. The packaging industry is further expected to accelerate the trade of 4N HPA in the years ahead. Many players are also focusing on the expansion of 4N HPA owing to their less energy-intensive and more scalable production process.

Our in-depth analysis of the high purity aluminum consumption market includes the following segments:

|

Segment |

Subsegments |

|

Purity Level |

|

|

Application |

|

|

Form |

|

|

Production Method |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

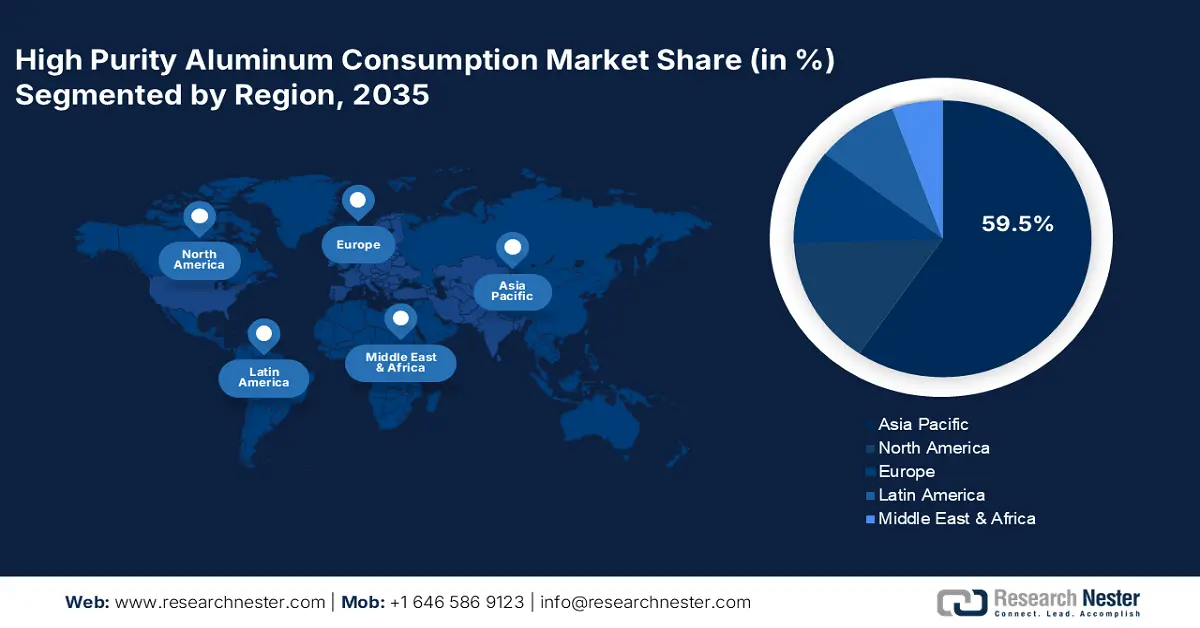

High Purity Aluminum Consumption Market - Regional Analysis

APAC Market Insights

The Asia Pacific high purity aluminum consumption market is expected to account for 59.5% of the global revenue share through 2035. The rapid industrialization and urbanization are substantially propelling the sales of high purity aluminum. The industrial automation and smart infrastructure trends are also contributing to the increasing consumption of high purity aluminum. The electronics, renewable energy, and electric vehicle (EV) sectors are anticipated to double the revenues of key players in the years ahead. Further, China, Japan, and South Korea, owing to established manufacturing environments, are likely to attract several international investors.

China leads the high purity aluminum consumption market, owing to the strong presence of key players. The expanding electronics sector and robust EV production are pushing the demand for high purity aluminum. IEA states that nearly half of all cars sold in China were electric in 2024. The same source also reports that over 11 million electric cars, which exceeds the total global electric car sales just two years prior, were sold in the country. This suggests that investing in the country is likely to yield substantial returns in the years to come.

The India high purity aluminum consumption market is foreseen to increase at the fastest CAGR from 2026 to 2035. The government-led renewable energy projects and the emerging EV trend are driving the sales of high purity aluminum. Initiatives such as Make in India and the National Electric Mobility Mission are also contributing to the overall HPA sales growth. Strategic public-private partnerships drive the total infrastructure investment. The Ministry of Information & Broadcasting reveals that the budget allocation for infrastructure development grew to around USD 120.5 billion between 2023 and 2025. The swift rise in smart structures is anticipated to drive the consumption of high purity aluminum.

North America Market Insights

The North America high purity aluminum consumption market is projected to hold second second-largest revenue share throughout the study period. The growing demand for advanced electronics and increasing registrations of electric vehicles are pushing the adoption of high purity aluminum. Hefty investments in aerospace and defense sectors aimed at enhancing their surveillance drones, armored vehicles, and other solutions are likely to fuel the application of high purity aluminum. Further, infrastructure modernization and clean energy shift are accelerating the consumption of high purity aluminum in both the U.S. and Canada.

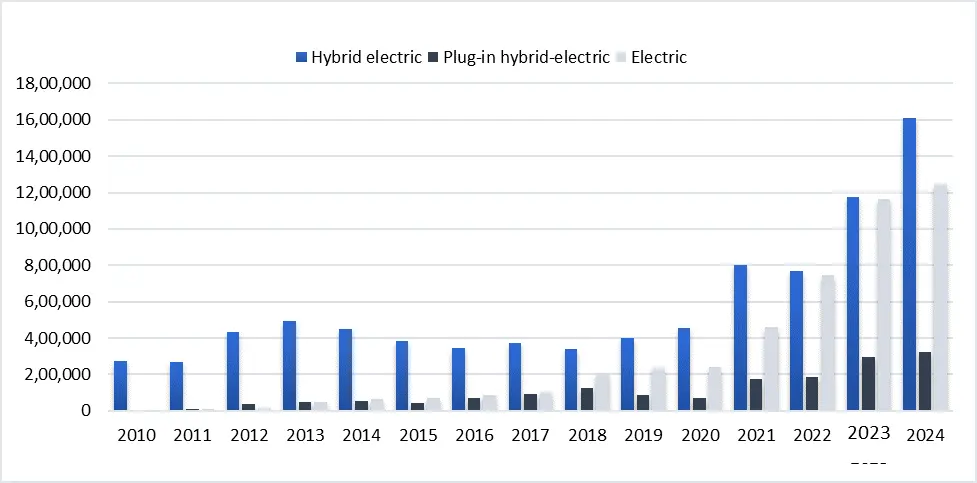

The sales of high purity aluminum in the U.S. are driven by its strong electronics, EV, semiconductor, and aerospace industries. The government’s focus on semiconductor self-reliance and EV adoption under programs such as the CHIPS and Science Act is fueling the demand for HPA. The study by the Rocky Mountain Institute (RMI) reveals that the country’s EV share of new passenger vehicle sales is expected to reach 27% by 2030. The Bureau of Transportation Statistics (BTS) also states that in 2024, around 1,609,035 hybrid electric vehicles and 1,247,656 electric vehicles were sold in the country. This indicates that the EV sector is expected to have a positive influence on the sales of HPA throughout the study period.

Hybrid-Electric, Plug-in Hybrid-Electric, and Electric Vehicle Sales

Source: BTS

The Canada high purity aluminum consumption market is expected to be driven by the clean energy trend. The hefty investments in renewable energy solutions are poised to directly propel the consumption of critical minerals and metals, including high purity aluminum. The Canadian Renewable Energy Association (CanREA) states that between 2019 and 2024, the country’s total wind, solar, and storage installed capacity increased by 46%. Such a positive clean energy curve is creating a profitable environment for key players. Further, the increasing adoption of smart homes is also promoting the demand for HPA.

Europe Market Insights

The Europe high purity aluminum consumption market is anticipated to expand at a robust pace between 2026 and 2035. The strong presence of early adopters and next-gen manufacturing units is pushing the sales of high purity aluminum. The countries in the region are most focused on energy efficiency and clean technology adoption, which is accelerating the application of high purity aluminum. LED lighting and semiconductor industries are also major consumers of HPA in Europe.

Sales of high purity aluminum in Germany are estimated to be fueled by the industrial automation trend. The robust use of advanced technologies in the manufacturing and logistics sectors is directly accelerating the consumption of high purity aluminum. In June 2025, the International Federation of Robotics (IFR) revealed that the country captured nearly 30% of the total robot installations in Europe. HPA is a vital component for the production of robotics, which contributes substantially to its consumption rate.

France high purity aluminum consumption market is expected to register a significant demand for high purity aluminum in the years ahead due to the expanding electronics, EV, and aerospace sectors. Government programs promoting clean power and energy-efficient infrastructure are poised to propel the sales of HPA. Electronics applications, including display technologies and smart devices, are further pushing the demand for high purity aluminum. Similar to Germany, the industrial automation trend is also opening lucrative doors for high purity aluminum producers.

Key High Purity Aluminum Consumption Market Players:

- Altech Chemicals Ltd. (Australia)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Alcoa Corporation (USA)

- Heraeus Holding GmbH (Germany)

- China Hongqiao Group Ltd. (China)

- Hydro Aluminium AS (Norway)

- Korea Aluminum Co., Ltd. (South Korea)

- Indium Corporation (The U.S.)

- Rusal Aluminium Plc (Russia)

- Balchem Corporation (The U.S.)

- Vedanta Limited (India)

- Novelis Inc. (The U.S.)

- ALD Vacuum Technologies GmbH (Germany)

- Malaysia Smelting Corporation Berhad (Malaysia)

- China Zhongwang Holdings Ltd. (China)

- Toyotsu Aluminium Co., Ltd. (Japan)

- Sumitomo Metal Mining Co., Ltd. (Japan)

- Panasonic Corporation (Japan)

- UACJ Corporation (Japan)

- Shin-Etsu Chemical Co., Ltd. (Japan)

- Mitsubishi Materials Corporation (Japan)

- Alcoa Corporation is a high purity aluminum consumption market pioneer and most influential aluminum producers, operating across the complete value chain from bauxite mining to high-value aluminum materials. The company leverages advanced smelting technologies and low-carbon processes to meet rising demand for high-purity aluminum used in aerospace, electronics, and specialty industrial applications. While not exclusively focused on ultra-high-purity grades, Alcoa’s extensive R&D capabilities and global refining infrastructure enable it to supply consistent, high-quality aluminum products. Its strong sustainability initiatives and robust global presence make Alcoa a key consumer and contributor in the high purity aluminum consumption market.

- Rusal Aluminium Plc is one of the largest aluminum producers globally, providing a broad portfolio of primary and specialty aluminum products. While widely recognized for commodity-grade output, RUSAL also supplies higher-purity aluminum grades tailored for electronics and industrial applications. Its vertically integrated operations, from bauxite mines to state-of-the-art smelters, enable consistent supply reliability. RUSAL’s R&D initiatives focus on advanced alloys, purification technologies, and low-carbon smelting, supporting its role in the high-purity aluminum supply chain. With expanding global demand for premium aluminum materials, the company remains a significant high purity aluminum consumption market participant, especially in volume-sensitive sectors.

- Norsk Hydro is a global leader in aluminum production and one of the few companies with a dedicated business line for high-purity aluminum required in semiconductors, capacitors, and advanced electronics. With vertically integrated operations spanning energy, refining, casthouse production, and recycling, Hydro offers precise control over purity and product consistency. The company’s technological leadership—particularly in producing ultra-pure grades above 99.99%—positions it as a strategic supplier to high-tech industries. Its focus on clean energy–powered smelting also enhances the sustainability profile of high-purity aluminum products for demanding global customers.

The high purity aluminum consumption market is characterized by the strong presence of big players. The start-ups are increasingly entering the high purity aluminum consumption market and are employing technological innovation tactics to stand out from the crowd. The industry giants are employing several organic and inorganic marketing strategies to boost their revenue shares and reach. They are entering into strategic partnerships to develop next-gen products and attract a wider consumer base. Leading companies are also expanding their operation into emerging markets to earn hefty gains from untapped opportunities.

Here is a list of key players operating in the global high purity aluminum consumption market:

Executive Summary of Major Industry Players:

Recent Developments

- In September 2023, Alpha HPA started building the second stage of its HPA First Project, with strong funding to support full-scale production. Once complete, the facility is estimated to produce over 10,000 tons of high-purity aluminum products each year, creating 120 permanent local jobs and 300 jobs during construction.

- In August 2023, the REMADE Institute, funded partially by the U.S. Department of Energy, shared that Phinix LLC, one of its research partners, started licensing a new scrap aluminum purifying technology to a recycling company. This technology upgrades aluminum recycling furnaces to remove impurities from scrap aluminum, making it suitable for various uses

- In October 2024, Proterial, Ltd. started licensing ALectro, a technology that creates high-purity aluminum films and foils through a process known as aluminum electroplating. This method eases the production of high purity aluminum coatings.

- In March 2024, Fastmarkets introduced a new price measure for low-carbon aluminum in Asia. They started publishing a price difference for low-carbon aluminum delivered to Japan and South Korea, becoming the first major agency to set prices for this type of aluminum in East Asia.

- Report ID: 8241

- Published Date: Nov 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.