Lithium Mining Market Outlook:

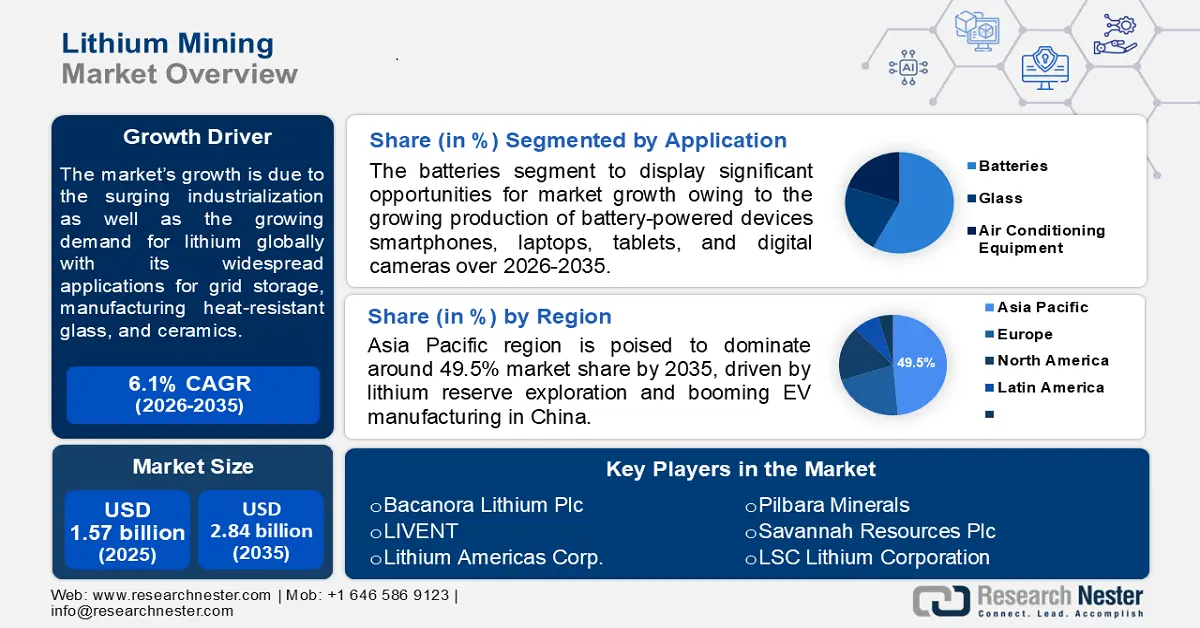

Lithium Mining Market size was valued at USD 1.57 billion in 2025 and is set to exceed USD 2.84 billion by 2035, expanding at over 6.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of lithium mining is estimated at USD 1.66 billion.

The growth of the market over the forecast period can be majorly attributed to the surging industrialization as well as the growing demand for lithium globally with its widespread applications for grid storage, manufacturing heat-resistant glass and ceramics, industrial greases, besides its rising utilization in treatments for bipolar disorder and depression. It was found that the annual production of metal lithium in the major producing countries grew from 25,400 to 85,000 tons between 2008 and 2018.

The expanding utilization of lithium and its compounds in several industrial applications, such as heat-resistant glass and ceramics, lithium grease lubricants, flux additives for iron, steel, and aluminum production, lithium metal batteries, and lithium-ion batteries, consumes over 75% of lithium production, therefore augmenting its demand.

Earlier, lithium and its compounds were extracted from hard rock in Chile, Argentina, and Bolivia but since the 1990s mineral springs, brine pools, and brine deposits had become the dominant source of isolation and extraction of lithium. Lithium extraction, especially for commercial purposes takes place from salt-flat brines through a process of evaporation and chemical recovery. It is also recovered through a process that involves crushing, roasting, and acid leaching from lithium-bearing ores, such as spodumene. Other methods of lithium extraction are currently being investigated to help raise global production. This method includes direct lithium extraction from geothermal and oil well brines.

The growing demand for lithium from the glass & ceramic industries, as well as its rising consumption in the production of Li-on batteries that have widespread use in the automotive sector for battery-powered e-bikes, and EVs, besides energy-storage systems, electrification of tools, and other battery-intensive applications, is anticipated to propel the global lithium mining market over the forecast period. As the research, global lithium consumption in 2021 reached nearly 93kt in 2021.

Key Lithium Mining Market Insights Summary:

Regional Highlights:

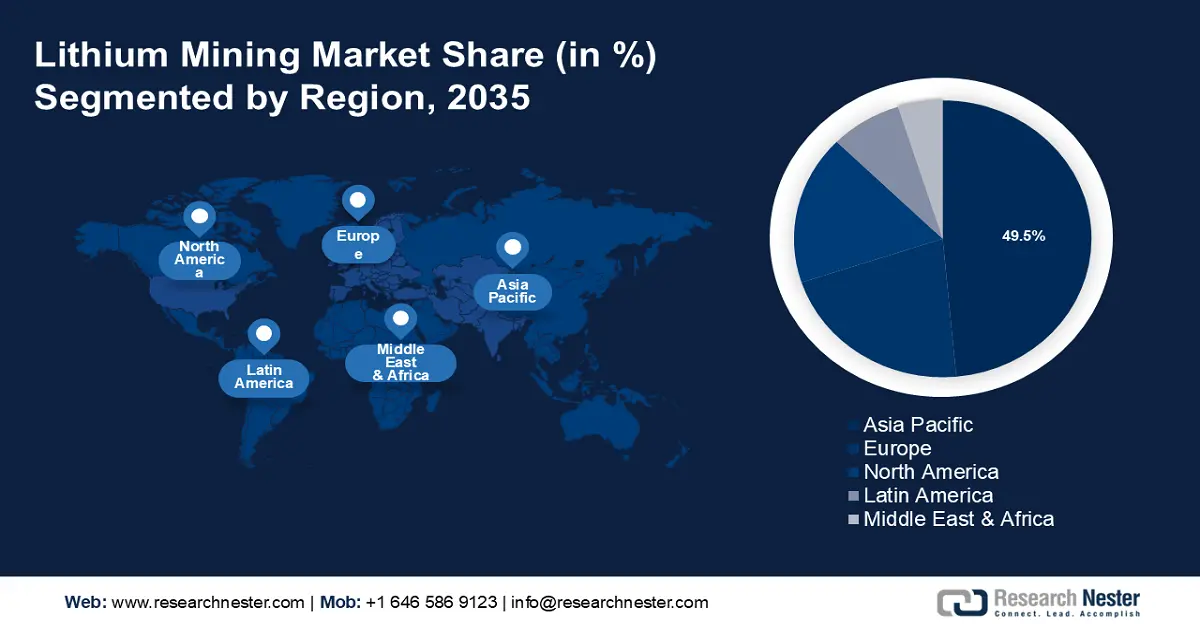

- Asia Pacific lithium mining market leads with a 49.5% share, projected to grow by 2035, driven by lithium reserve exploration and booming EV manufacturing in China.

- North America market, with the second largest share, anticipates growth during the forecast timeline, attributed to renewable energy adoption and demand for battery storage in the U.S.

Segment Insights:

- The electronics segment in the lithium mining market is projected to hold a significant share by 2035, driven by increasing demand for wearable and portable lithium-powered devices.

- The batteries segment in the lithium mining market is forecasted to secure the largest share by 2035, driven by surging demand for lithium batteries in electronics and electric vehicles.

Key Growth Trends:

- Augmenting Demand for Electric Vehicles

- Increasing Exploration of Potential Reserves

Major Challenges:

- Augmenting Demand for Electric Vehicles

- Increasing Exploration of Potential Reserves

Key Players: Bacanora Lithium Plc, Tianqi Lithium Corp, Sichuan Yahua Industrial Group Co., Ltd., LIVENT, Lithium Americas Corp., Pilbara Minerals, Savannah Resources Plc, LSC Lithium Corporation, Neo Lithium Corporation, General Lithium Corp.

Global Lithium Mining Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.57 billion

- 2026 Market Size: USD 1.66 billion

- Projected Market Size: USD 2.84 billion by 2035

- Growth Forecasts: 6.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (49.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: Australia, Chile, China, Argentina, Brazil

- Emerging Countries: China, India, Australia, Brazil, Chile

Last updated on : 9 September, 2025

Lithium Mining Market - Growth Drivers and Challenges

Growth Drivers

-

Augmenting Demand for Electric Vehicles – lithium-ion (Li-on) batteries are gaining incredible popularity for powering electric vehicles, which are considered to account for almost 60% of new car sales by 2030. As these batteries are the key to lightweight, rechargeable power, hence with the augmenting global electric vehicle revolution and expanding demand for fuel-efficient lightweight cars, the production of lithium is expected to expand, fueling the market growth over the forecast period.

-

Increasing Exploration of Potential Reserves - The increasing interest in lithium is responsible for disclosing some of the world’s largest-known reserves significantly. As per the US Geological Survey (USGS), there were nearly 80 million tons of identified reserves globally in 2019.

- Increasing Disposable Income – the growing global urbanization as well as the increasing demand for various consumer electronics, smart & portable devices is a result of the raised standard of living backed by increasing disposable income of the middle class. It is also indirectly responsible for fueling the demand for lithium which is unprecedented and crucial in order to transition to renewables. It was observed that disposable personal income in the United States averaged USD 6048 Billion from 1959 until 2023, touching an all-time high of USD 21826 Billion in March 2021.

- Rising Investment in Green Technology - batteries obtained from lithium are often closely associated with “green” technology. Though the lithium mining processes have some environmental concerns around them yet investment in green technologies is surging as they are considered worthy worldwide. For instance, it was found that new investments in renewable energy globally touched nearly USD 119 billion up from USD 106 billion in the previous quarter.

- Growing Cases of Bipolar Disorder – The increasing demand for lithium as an essential medication to treat and prevent episodes of mania in people with bipolar disorder as lithium is in a class of medications called antimanic agents is anticipated to boost its demand by the pharma companies, which is expanding exponentially.

Challenges

-

Concern About Lithium Mining Environmental Impact – With the rising awareness that lithium mining is harmful to the planet, similar to the extraction of any other resources that result in soil degradation, water shortages, biodiversity loss, damage to ecosystem functions, and an increase in global warming is expected to raise alarm. According to a report by Friends of the Earth (FoE), lithium mining inevitably harms the soil and causes air contamination. The growing environmental concern as well as the rising mining impacts besides the increasing awareness amongst the masses is anticipated to hamper the global lithium mining market growth.

-

Challenges of Consumption, Contamination, and Diversion of Scarce Water Resources

- High Cost of Extraction & Processing

Lithium Mining Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.1% |

|

Base Year Market Size (2025) |

USD 1.57 billion |

|

Forecast Year Market Size (2035) |

USD 2.84 billion |

|

Regional Scope |

|

Lithium Mining Market Segmentation:

Application Segment Analysis

The batteries segment is estimated to gain the largest market share in the year 2035, attributed to the growing production of battery-powered devices smartphones, laptops, tablets, and digital cameras, as well as increasing demand for battery-powered vehicles that need to be powered lithium-ion batteries. According to research, over 71% of the total global lithium demand & utilization contributes manufacturing of rechargeable batteries for electronics, electric vehicles, and grid storage. The growing production of rechargeable, as well as, non-rechargeable batteries that are used in energy storage, smart wearables, consumer electronics, EVs, and others are anticipated to boost the segment growth.

End-user Segment Analysis

The electronics segment is expected to garner a significant share in the year 2035, driven by the rising demand for portable electronics as well as the growing demand for wearable which generally use lithium-based batteries as they have high round-trip efficiency, high energy, and power density, and a low self-discharge rate. The growing global population as well as the rising construction of smart homes is responsible for the demand for consumer electronics, which is indirectly expected to boost the segment growth. As per projections, the global consumer electronics sector is expected earn a revenue of USD 723 billion in 2023, marking a 31.9% annual increase.

Our in-depth analysis of the global market includes the following segments:

|

By Product |

|

|

By Application |

|

|

By End-User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Lithium Mining Market Regional Analysis:

APAC Market Insights

Asia Pacific region is poised to dominate around 49.5% market share by 2035, attributed majorly to the increasing technological advancements as well as the rising exploration of potential lithium reserves in the region along with the augmenting metal mining projects in the region as the maximum lithium in the region comes from ore mining. For instance, Australia with 2.7 million tons of known lithium reserves, was the world’s second-largest lithium miner in 2018. Moreover, the flourishing automotive industry as well as the growing production of EVs in the region is further expected to boost the market growth in the region. For instance, China is known to control most of the world's lithium-processing plants and as per research, 75% of the global lithium-ion batteries are made in China owing to its prospering electronics and electric vehicle industries.

North American Market Insights

The North American lithium mining market is projected to hold the second-largest share during the forecast period, attributed majorly to the increasing government initiatives in the United States to promote the use of renewable energy along with the augmenting demand for battery storage together with the rising sale of solar panels in the region. As per data, in the United States, investment in renewable energy technologies rose from about USD 59 billion in 2019, compared to USD 11.3 billion in 2005. Moreover, as Li-ion batteries are the most scalable type of grid-scale storage, its market has seen strong growth in recent years as it is widely used in many applications, from energy storage to air mobility which is further responsible for the escalation of the lithium mining market in the region.

Europe Market Insights

Europe region is poised to witness substantial growth through 2035, attributed majorly to the growing mining activities in the region to excavate lithium in various regions, including Portugal, Czechia, Finland, Germany, Spain, and Austria. Significant brine resources also exist in Germany. As per the USGS data, Portugal is known to have the largest reserve of lithium in Europe with around 60,000 metric tons of known reserves.

Lithium Mining Market Players:

- Bacanora Lithium Plc

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Tianqi Lithium Corp

- Sichuan Yahua Industrial Group Co., Ltd.

- LIVENT

- Lithium Americas Corp.

- Pilbara Minerals

- Savannah Resources Plc

- LSC Lithium Corporation

- Neo Lithium Corporation

- General Lithium Corp

Recent Developments

-

Pilbara Minerals an Australian lithium and tantalite mining company signed an agreement with Sydney-based technology company Calix to develop a new mid-stream refining process to produce lithium salt.

-

SQM invited R&D centers, universities, and SMEs to propose ideas for electromobility and energy storage progress and reduce the carbon footprint.

- Report ID: 3700

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Lithium Mining Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.