Bipolar Disorder Therapeutics Market Outlook:

Bipolar Disorder Therapeutics Market size was valued at USD 5.4 billion in 2025 and is projected to reach USD 7.1 billion by the end of 2035, rising at a CAGR of 3% during the forecast period, i.e., 2026-2035. In 2026, the industry size of bipolar disorder therapeutics is evaluated at USD 5.5 billion.

The market is highly driven by a surge in the patient population as there is a fast-rising prevalence of bipolar disorder across all nations. According to the World Health Organization report published in July 2024, the global patient base of bipolar disorder is reported to exceed 40 million cases, with the U.S. dominating with diagnosed cases. Therefore, this has resulted in the demand for advanced therapeutics to aid bipolar disorder, thereby positively influencing the bipolar disorder therapeutics sector. Besides, the supply chain relies on API manufacturers, with China dominating, the export of lithium APIs.

In contrast, the economic and trade sectors are leading the way, pushing business in the industry. For instance, the CAPLYTA, which is the FDA-approved drug for depressive episodes of bipolar I or II disorder, had a stellar sales growth by reaching USD 462 million in 2023, according to the SEC report. Research, development, and deployment investment remains strong. In addition, public and non-profit support is a major driver in allocating significant resources to psychiatric research, such as the development of novel therapeutic mechanisms and improved drug delivery systems for mood stabilizers and antipsychotics.

Key Bipolar Disorder Therapeutics Market Insights Summary:

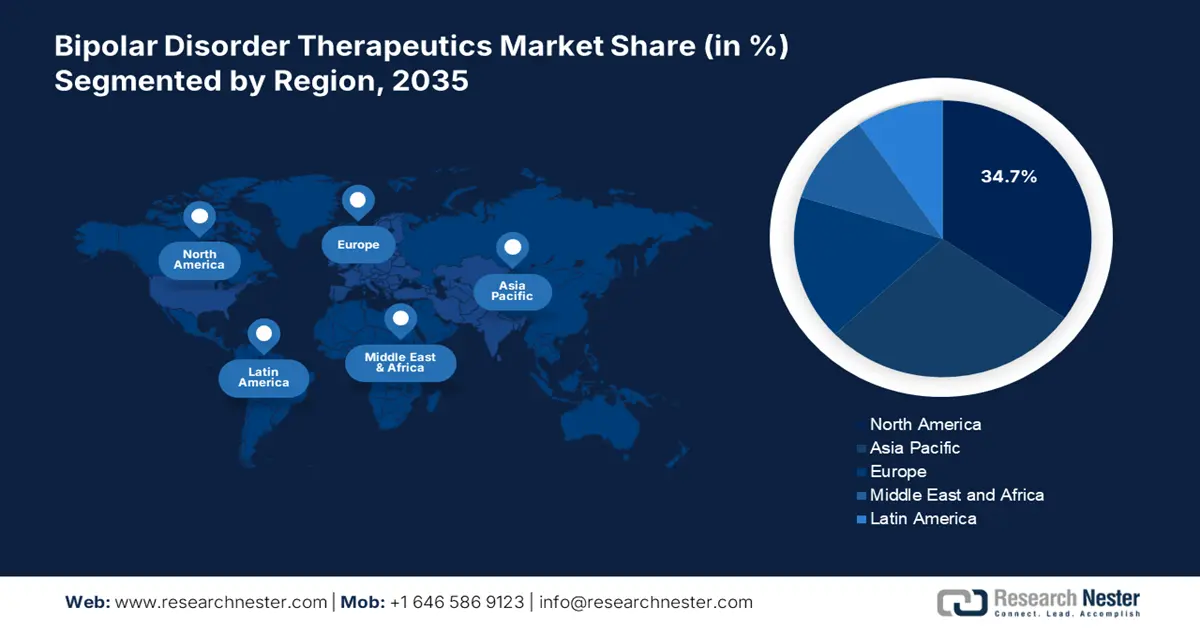

Regional Highlights:

- By 2035, North America is poised to command a 34.7% share of the Bipolar Disorder Therapeutics Market, supported by expanding mental-health awareness and advancing treatment options.

- Asia Pacific is expected to secure a notable share by 2035, strengthened by extensive government support and rising regional awareness of mental-health treatment needs.

Segment Insights:

- The oral subsegment is projected to capture a 65.4% share by 2035 in the Bipolar Disorder Therapeutics Market, propelled by flexible dosing and ease of administration.

- Hospitals are anticipated to hold a considerable share by 2035, sustained by their central role in acute stabilization and long-term management of severe bipolar disorder cases.

Key Growth Trends:

- Advancements in therapeutic innovations

- Trade and supply chain dynamics

Major Challenges:

- Cost and reimbursement limitations

Key Players: Johnson & Johnson, Otsuka Pharmaceutical, AbbVie, Pfizer, Lundbeck, Sun Pharma, Teva, Eisai, H. Lundbeck, Alkermes, Zydus Cadila, Takeda, CSL Limited, Yuhan Corporation, Hikma Pharmaceuticals, Intas Pharma, MSD (Merck & Co.), Cipla, KP Pharmatech, Duopharma Biotech.

Global Bipolar Disorder Therapeutics Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 5.4 billion

- 2026 Market Size: USD 5.5 billion

- Projected Market Size: USD 7.1 billion by 2035

- Growth Forecasts: 3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (34.7% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Australia, Canada

Last updated on : 9 September, 2025

Bipolar Disorder Therapeutics Market - Growth Drivers and Challenges

Growth Drivers

- Advancements in therapeutic innovations: The advancements in terms of therapeutic innovations appreciably drive growth in the market. According to the NLM report in March 2024, 12 novel psychiatric medications were approved by the FDA out of 248 total drug approvals, which represents 4.8% of all FDA drug clearances. Of these, several (e.g., lumateperone for bipolar depression) offered new mechanisms or first-in-class action for psychiatric disorders. Key innovations undertaken by the firm include digital therapeutics integration and long-acting injectable formulations, which improve patient outcomes and support positive market development.

- Trade and supply chain dynamics: Supply chain stability is a major driver for availability. As the FDA Drug Shortages Report indicates, 24% of API facilities are in the U.S., and most of them are in China and India. This geographic concentration represents risk; it also necessitates long-term supply agreements and diversification initiatives on the part of U.S. and EU manufacturers. USITC trade data indicates the EU is still a top exporter of finished medicines to the U.S. and that U.S. exports high-value formulations to Europe.

- Rising investments in R&D: Government backed R&D are rising innovations in mental health. As per the United Global Mental Health Report in 2023, USD 38 million is spent on mental health domestically in low income countries. The report also suggests that the government should increase the mental health financing by 5% on the total mental health spending. Further, various new drugs are introduced and are accelerated by FDA programs supporting generic entry and expedited approvals.

Types of Investigational Drugs (2024)

|

Pharmaceutical Medicine |

Drugs Under Development |

Mechanism of Action |

Target State |

|

Medicine Repositioning |

Brexpiprazole (Schizophrenia) |

D2 receptor partial agonist |

Bipolar Manic and Depression |

|

5-HT1A receptor partial agonist |

|||

|

5-HT2A receptor partial agonist |

|||

|

BXCL501 |

α2 adrenergic receptor agonist |

Bipolar Manic |

|

|

Cannabidiol (epilepsy) |

Regulation of the endocannabinoid system |

Bipolar I and Ⅱ Depression |

|

|

(Epilepsy) |

Regulation of ion channels |

||

|

Innovative Medicine |

NRX101 |

D-Cycloserine partial agonist |

Suicide Treatment Resistant Bipolar Depression |

|

5-HT2a receptor antagonists |

|||

|

JNJ55308942 |

P2X7 antagonist |

Bipolar Depression |

|

|

OSU6162 |

D2 receptor partial agonist |

Bipolar Depression |

|

|

5-HT2A receptor partial agonist |

|||

|

SEP4199 |

Amisulpride enantiomer non-racemic mixture |

Bipolar Depression |

|

|

5-HT7 receptor agonist |

|||

|

Enhancement of the GABAergic system |

Source: Science Direct

Challenge

- Cost and reimbursement limitations: This remains a major bottleneck in the market, as it can limit the adoption among a particular group of patients. Besides, the high costs can lead to challenging reimbursement policies, such as in the U.S. Medicaid covers only for some patients due to budget restrictions. This creates a major hurdle for low-income groups, thereby hindering growth in the market.

Bipolar Disorder Therapeutics Market: Key Insights

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

3% |

|

Base Year Market Size (2025) |

USD 5.4 billion |

|

Forecast Year Market Size (2035) |

USD 7.1 billion |

|

Regional Scope |

|

Bipolar Disorder Therapeutics Market Segmentation:

Route of Administration Segment Analysis

In the route of administration segment, oral subsegments dominate the segment and is expected to occupy the share value of 65.4% by 2035. The segment is propelled because of the flexible dosing and simplicity in administration. Oral therapies are the most widely prescribed and available route worldwide. According to the Jama Network article in October 2024, oral olanzapine, which is an oral formulation, is mostly used for patients with approximately 65.7% of patients in an incident cohort developing relapse at long-term follow-up. Oral antipsychotics remain top due to preference as they are cost-saving, and continued pharmaceutical development in personalized dosing and side effect control.

End user Segment Analysis

Under the end user segment, hospitals dominate the segment and are expected to hold a considerable share by 2035. The segment is driven by acute management and ongoing treatment, mainly for severe cases such as Bipolar I disorder, requiring hospitalization. The U.S. has the leading number of cases of bipolar disorder. Based on the NLM report, published in February 2022, states that Illinois has the highest rate of inpatient stays with 150.6 stays per 100,000 population in bipolar disorder, while comparing with 33.2 per 100,000 in Washington, highlighting the role of hospitals in therapeutic delivery conditions.

Disease Type Segment Analysis

Bipolar I Disorder is dominating the disease type segment and is characterized by severe manic episodes that usually necessitate hospitalization and therapeutic intervention. Based on the December 2021 report of the NLM, about 2.8% of the U.S. adult population had experienced bipolar disorder during the past year, with Bipolar I being the most severe form. The effect of Bipolar I Disorder is large because of its chronic nature and requirement for constant management of manic and depressive mood states for better patient outcomes.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegments |

|

Therapy Type |

|

|

Drug Class |

|

|

Route of Administration |

|

|

Disease Type |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Bipolar Disorder Therapeutics Market - Regional Analysis

North America Market Insights

North America is a key player in the bipolar disorder therapeutics market, projected to register a significant share of 34.7% in 2035. The region benefits from a vast consumer base with rising mental health awareness and expanded treatment advancements. US. dominates the North America market, owing to the exceptional mental health funding and awareness campaigns that are undertaken. Besides, it is reported that the lithium prescribed to about 27% of bipolar disorder patients in 2022 with a slight upward trend through 2025, based on NLM report in July 2025. This contrasts with a slight decrease in antidepressant prescriptions during the same time.

Canada is another major contributor to growth in North America’s bipolar disorder therapeutics market, which is growing at a rapid pace. The existence of components such as provincial and federal healthcare systems is driving business in the country’s bipolar disorder sector. As per the government of Canada report in April 2023, government has allocated USD 200 million for Brain Canada, to improve the mental health status among the individuals an advance the therapies. Therefore, this wider market scope intends to support business in the sector.

Bipolar Disorder Cases in U.S. and Canada

|

Country |

Year |

Cases |

|

U.S. |

2022 |

7 million |

|

Canada |

2025 |

3.4% of the population |

Source: UTSWMED, August 2022, CMHA 2025

Asia Pacific Market Insights

Asia Pacific bipolar disorder therapeutics market is growing exponentially owing to the tremendous support from the region’s governments. Besides the rising mental health awareness among the population intended to fuel growth in this sector. Japan leads the Asia Pacific market spends 16.2 billion JPY in R&D of psychiatric disorders, as reported by JMA journal in January 2025. Besides, South Korea witnessed the adherence to the digital therapeutics push as stated by the MFDS in 2024. Hence, the contribution from these major nations will readily bolster the market expansion by 2035.

India is a leading player in the bipolar disorder therapeutics industry, driven by the tremendous demand for advanced therapeutics. There is a huge patient pool affected by the mental health disorder, with nearly 70% to 92% of patients remaining untreated, showcasing health disparities in the country. Besides, NHM in 2024 reported that this rising prevalence has encouraged the governing bodies to invest in the sector with a substantial investment. Furthermore, there is an increase in lithium uptake, pushing therapeutic production in the country.

Europe Market Insights

Europe's bipolar disorder therapeutics market is driven by a stable population of diagnosed adults, expanded public payer coverage, and manufacturing and distribution centers throughout the EU and UK. Demand focuses on maintenance mood stabilizers and second-generation antipsychotics for bipolar depression and maintenance; aging populations and enhanced screening enhance treated prevalence. Public procurement and centralized HTA drive pricing and access to national formularies, and joint procurement mechanisms compress net prices while guaranteeing volume.

Germany is leading the bipolar disorder therapeutics market and is driven by high healthcare spending and advanced psychiatric care facilities. Germany has spent more than €1 million on mental health accounts for a growing share of the national healthcare budget, according to the NLM report published in June 2024. Improved government programs, universal access to new treatments, and increased awareness fuel sustained growth. Germany's robust pharmaceutical environment also confirms continued market expansion with bipolar disorder drugs.

Key Bipolar Disorder Therapeutics Market Players:

- Johnson & Johnson

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Otsuka Pharmaceutical

- AbbVie

- Pfizer

- Lundbeck

- Sun Pharma

- Teva

- Eisai

- H. Lundbeck

- Alkermes

- Zydus Cadila

- Takeda

- CSL Limited

- Yuhan Corporation

- Hikma Pharmaceuticals

- Intas Pharma

- MSD (Merck & Co.)

- Cipla

- KP Pharmatech

- Duopharma Biotech

The market is highly consolidated, with the presence of key market players aiming to strengthen their market positions. They are undertaking numerous strategies such as product innovation, domestic production, digital integration, and the introduction of affordable generics. In this regard, Johnson & Johnson, Otsuka Pharmaceuticals are leading the market with long-acting injectables and digital therapeutics. Besides, AbbVie and Lundbeck are intensifying the competition on niche indications such as acute mania, hence denoting a positive market demand.

Below is the list of some prominent players in the industry:

Recent Developments

- In August 2025, BioXcel Therapeutics announces positive FDA Pre-sNDA meeting comments for sNDA submission for BXCL501 in agitation associated with bipolar disorders or schizophrenia.

- In October 2024, Autobahn Therapeutics announced the FDA clearance of an investigational new drug (IND) application to support the initiation of a Phase 2 trial of ABX-002 as an adjunctive treatment for patients with bipolar depression.

- Report ID: 2653

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.