Graphic Processor Market Outlook:

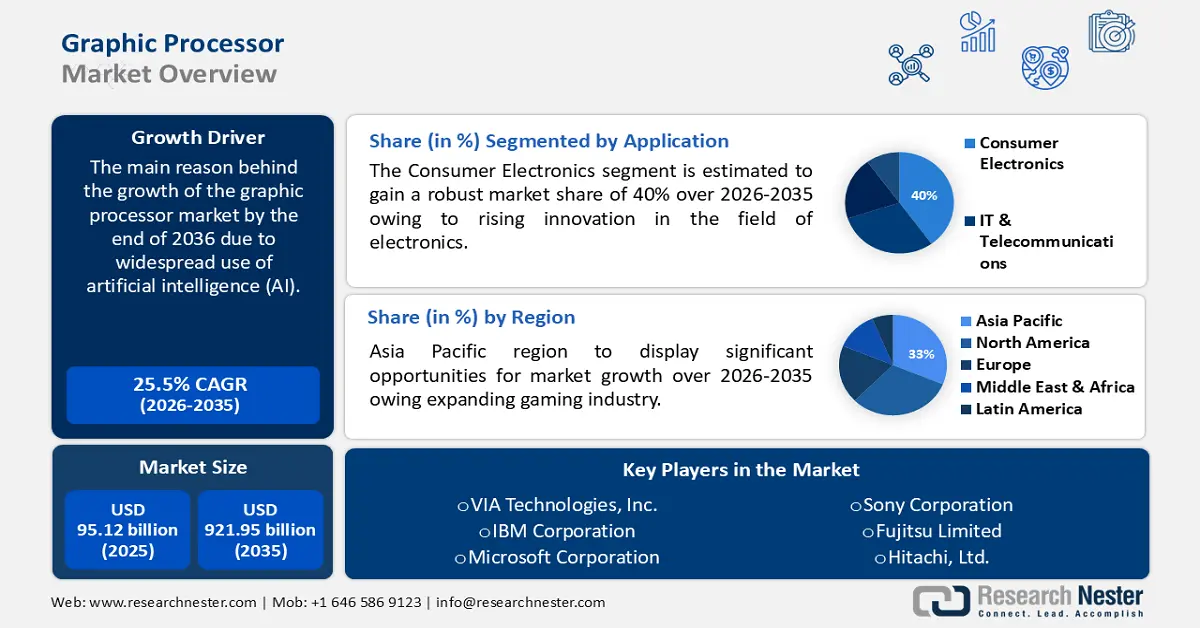

Graphic Processor Market size was valued at USD 95.12 billion in 2025 and is likely to cross USD 921.95 billion by 2035, registering more than 25.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of graphic processor is assessed at USD 116.95 billion.

The market is expanding at a substantial rate due to the widespread use of artificial intelligence (AI) and machine learning applications as well as the strong demand for experiences in virtual reality (VR), augmented reality (AR), and data visualization. There will be 1.4 billion active AR user devices by 2023. Also, in 2024, that amount is projected to rise to 17.3 billion.

In addition to these, the final photos or videos are created by skillfully combining these elements. As a result, this process creates realistic animations and complex images more quickly, guaranteeing flawless real-time experiences. With no noticeable delays, users can enjoy the luxury of fully immersing themselves in intricate images and lifelike animations owing to this simplified technique. Overall, these benefits support the market expansion.

Key Graphic Processor Market Insights Summary:

Regional Highlights:

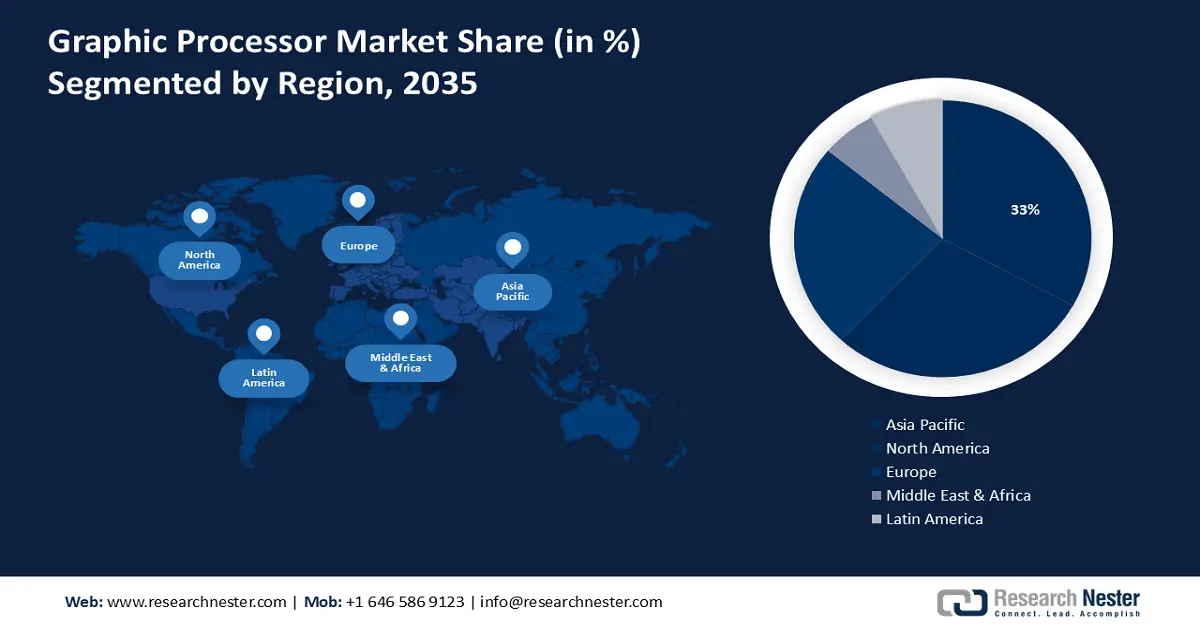

- Asia Pacific graphic processor market is expected to capture 33% share, propelled by rapid growth of the gaming and tech sectors, forecast period 2026–2035.

- North America market will account for 29% share, driven by demand from entertainment and tech sectors, forecast period 2026–2035.

Segment Insights:

- The cloud deployment segment in the graphic processor market is forecasted to achieve a 60% share by 2035, attributed to the advent of cloud computing enabling on-demand high-performance GPUs.

- The consumer electronics segment in the graphic processor market is anticipated to secure a 40% share by 2035, driven by rising innovation in electronics and demand for improved GPUs.

Key Growth Trends:

- Growth in the gaming sector

- Increasing usage in healthcare and medical imaging

Major Challenges:

- Negative consequences of regulatory obstacles

- Falling workstation sales could impede the growth of the market

Key Players: NVIDIA Corporation, Advanced Micro Devices, Inc. (AMD), Intel Corporation, Samsung Electronics Co., Ltd., Qualcomm Incorporated, Imagination Technologies Limited, VIA Technologies, Inc., IBM Corporation, Microsoft Corporation, Matrox Electronic Systems Ltd.

Global Graphic Processor Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 95.12 billion

- 2026 Market Size: USD 116.95 billion

- Projected Market Size: USD 921.95 billion by 2035

- Growth Forecasts: 25.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (33% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 16 September, 2025

Graphic Processor Market Growth Drivers and Challenges:

Growth Drivers

- Growth in the gaming sector - The graphic processor market is largely driven by the gaming sector. To enjoy better graphics, faster frame rates, and more immersive gaming, gamers are always looking for GPUs with greater power. GPU sales have also increased as a result of the expansion of esports and the need for game content producers.

- Such experiences are mostly dependent on high-quality graphics, and GPUs are essential to rendering these images. The popularity of a game is significantly impacted by its graphics quality, which inspires game developers to produce visually appealing games that make the most of current GPU technology.

- The need for GPUs with more processing capacity to produce clear and detailed images has increased due to the availability of high-resolution monitors and displays, such as 4K and ultra-wide screens. By 2024, there will be 1.31 billion active gamers worldwide or roughly 16.35% of the total population. By 2027, this is predicted to increase to 17.7%, or up to 1.47 billion gamers globally.

- Increasing usage in healthcare and medical imaging - GPUs speed up research and enhance patient care in the fields of medical imaging, genome sequencing, and medication discovery. Graphic processor market’s expansion is driven by the healthcare industry's growing reliance on technology. High-resolution medical pictures from CT, MRI, and ultrasound scans are processed and rendered by GPUs.

- These GPUs assist in enhancing image quality and allow medical professionals to visualize data in real-time. 3D and 4D imaging have been made possible by advancements in GPU technology, which offer insightful information for diagnosis and treatment planning. The market has been greatly impacted by the expansion of healthcare applications and medical imaging.

- Development of immersive multimedia and geographic information systems (GIS) - The market for graphic processors is also being driven by the growth of immersive multimedia and geographic information systems (GIS). The widespread use of smartphones, tablets, and other mobile computing devices has led to an increase in the use of apps like geographic information systems (GIS), which give real-time spatial and geographical data.

- With a GIS, users may create queries, examine spatial data, map data, and produce results. On the other hand, mobile computing devices heavily integrate graphic processors to deliver information in real-time.

Challenges

- Negative consequences of regulatory obstacles - Government-imposed trade restrictions and export controls affect the market by restricting access to specific technologies or reducing their availability. Several nations' governments apply trade restrictions and export limits on specific technologies, including GPUs. These rules restrict market access in particular areas and have an impact on GPU import and export. Manufacturers of GPUs have to manage complicated, constantly changing export compliance rules.

- In the technology sector, particularly the market for graphic processors, intellectual property (IP) conflicts and patent litigation are frequent occurrences. These legal disputes result in expensive court cases, limitations on product sales, or licensing costs that must be paid. Consequently, the graphic processor market faces several regulatory obstacles that affect its operations and expansion, much like the larger technology sector.

- Market expansion is hampered by the incapacity to appropriately balance system performance, efficiency, and power consumption.

- Falling workstation sales could impede the growth of the market.

Graphic Processor Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

25.5% |

|

Base Year Market Size (2025) |

USD 95.12 billion |

|

Forecast Year Market Size (2035) |

USD 921.95 billion |

|

Regional Scope |

|

Graphic Processor Market Segmentation:

Application Segment Analysis

The consumer electronics segment in the graphic processor market is estimated to gain the largest revenue share of about 40% in the year 2035. The segment growth can be attributed to the rising innovation in the field of electronics, GPUs are essential since they are the basis for improved visual experiences and processing power. Integrated graphic cards represent a crucial aspect of consumer electronics, which includes GPUs that are deeply incorporated into gadgets like laptops, tablets, smartphones, and smart TVs to deliver smooth and optimum graphics performance.

By 2026, more than 1.1 billion households globally—or 51% of all households—are expected to own a smart TV. The market is expanding due to the growing demand for visually immersive apps and content, which includes mobile gaming and high-definition video streaming.

Furthermore, the increasing popularity of multipurpose gadgets like hybrid tablets and 2-in-1 laptops is driving the incorporation of flexible graphics solutions. Customers are looking for devices that can switch between productivity duties and leisure activities with ease, thus GPUs that can accurately perform both functions are required.

Deployment Segment Analysis

The cloud segment is poised to hold majority market share, accounting for 60% during the projected timeframe. The advent of cloud computing has had a notable impact on the industry's use of GPUs, leading to the development of a noteworthy trend called on-demand cloud-based GPUs. Unlike traditional local hardware configurations, cutting-edge cloud GPU technology presents a paradigm shift by providing the experience of a high-performance graphics card within the cloud environment.

One of cloud GPUs' greatest advantages is that they can avoid direct rivalry with local graphics cards, giving users an effective and affordable option. Continuous improvements in GPU performance open up a wide range of opportunities for demanding applications, including computer vision, computational graphics, and a variety of high-performance computing jobs.

Our in-depth analysis of the market includes the following segments:

|

Component |

|

|

Type |

|

|

Deployment |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Graphic Processor Market Regional Analysis:

APAC Market Insights

Graphic processor market in the Asia Pacific is anticipated to hold the largest with a share of about 33 % by the end of 2035. The market growth in the region is also expected on account of rapidly expanding gaming industry in the region. The area is a hub for the creation and consumption of video games, and a sizable player base demands immersive and graphically stunning experiences. To produce cutting-edge games and satisfy the expectations of the aficionados of gaming, GPUs are essential.

Additionally, the Asia Pacific region's emphasis on cutting-edge technology like robotics, AI, and driverless cars increases demand for GPUs. GPU demand is also being driven by the region's growing need for data centers and cloud services. Currently, 10-12% of data in Australia is created and processed outside of a cloud or centralized data center; however, by 2025, that percentage is predicted to reach 65–70%, a global trend that is also evident in Australia.

North America Market Insights

The North American region will also encounter huge growth for the graphic processor market over the forecasted period and will hold the second position, amounting to 29% of the market share. The North American market is primarily being driven by the booming technology and entertainment sectors. The demand for state-of-the-art GPUs, which enable sophisticated visual effects, 3D modeling, and gaming experiences, is constantly high due to the presence of significant tech hubs and entertainment districts in places like Silicon Valley and Hollywood.

Graphic Processor Market Players:

- NVIDIA Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Advanced Micro Devices, Inc. (AMD)

- Intel Corporation

- Samsung Electronics Co., Ltd.

- Qualcomm Incorporated

- Imagination Technologies Limited

- VIA Technologies, Inc.

- IBM Corporation

- Microsoft Corporation

- Matrox Electronic Systems Ltd.

Recent Developments

- Advanced Micro Devices, Inc made a big announcement about launching a new range of RX 7000 series GPUs. The cutting-edge architecture at the heart of these recently released RX 7000 series GPUs promises significant gains in both performance and power efficiency. To meet the needs of contemporary gaming and content creation, the recently released GPUs promise to provide cutting-edge performance and functionality. Every graphic card in the RX 7000 series is designed to cater to a certain market niche, providing a range of features and performance levels so that customers may select the GPU that best fits their demands and budget.

- NVIDIA Corporation introduced new GeForce RTX GPUs and technologies. With NVIDIA's GeForce RTX 40 Series graphics cards, gamers and content creators can experience a quantum leap in performance, AI-powered graphics, more immersive gameplay, and the fastest processes for creating content. The performance of the newest games has increased by a factor of two. Developers can achieve up to a 4X boost in speed in fully ray-traced games by leveraging Ada advances such as DLSS 3. Up to twice as much performance is available in 3D rendering, video export speed, and AI features for creative apps with the GeForce RTX 40 Series graphics cards.

- Report ID: 5647

- Published Date: Sep 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Graphic Processor Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.