Glass Manufacturing Market Outlook:

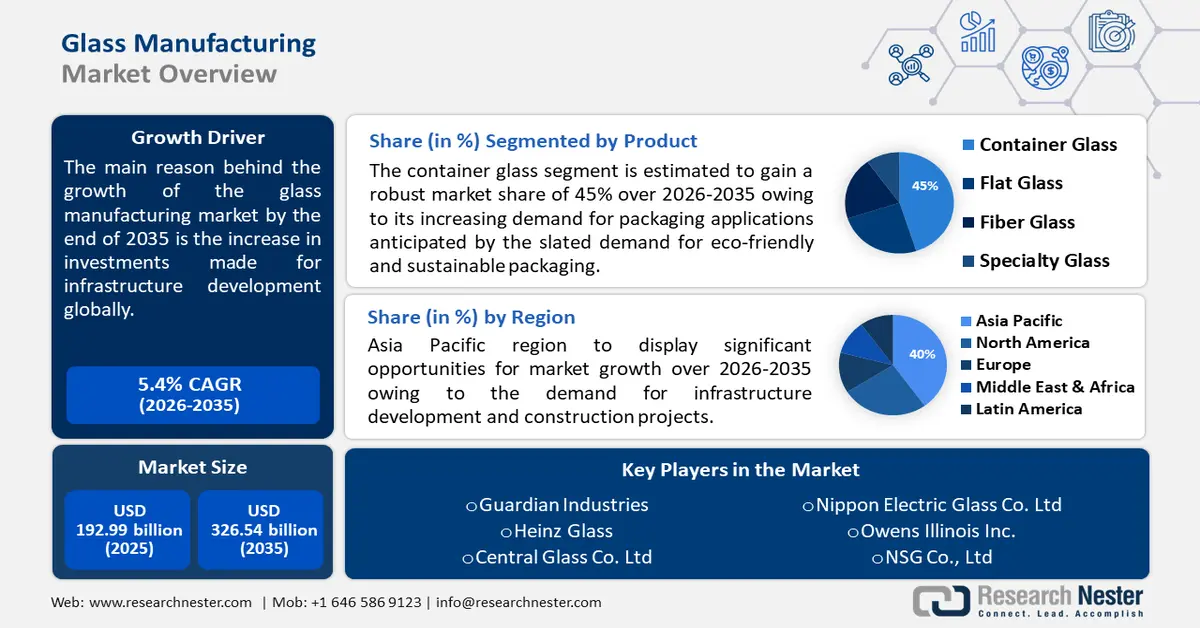

Glass Manufacturing Market size was valued at USD 192.99 billion in 2025 and is set to exceed USD 326.54 billion by 2035, registering over 5.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of glass manufacturing is estimated at USD 202.37 billion.

The reason for this increase is attributed to an increase in global infrastructure development investments. According to a report by the World Bank in 2023, in developing countries, investors invested about USD 85.6 billion in infrastructure projects, and it is expected that by 2030, every year, about 4.5% of GDP will be about USD 1.5 trillion for middle- and low-income countries.

Key Glass Manufacturing Market Insights Summary:

Regional Highlights:

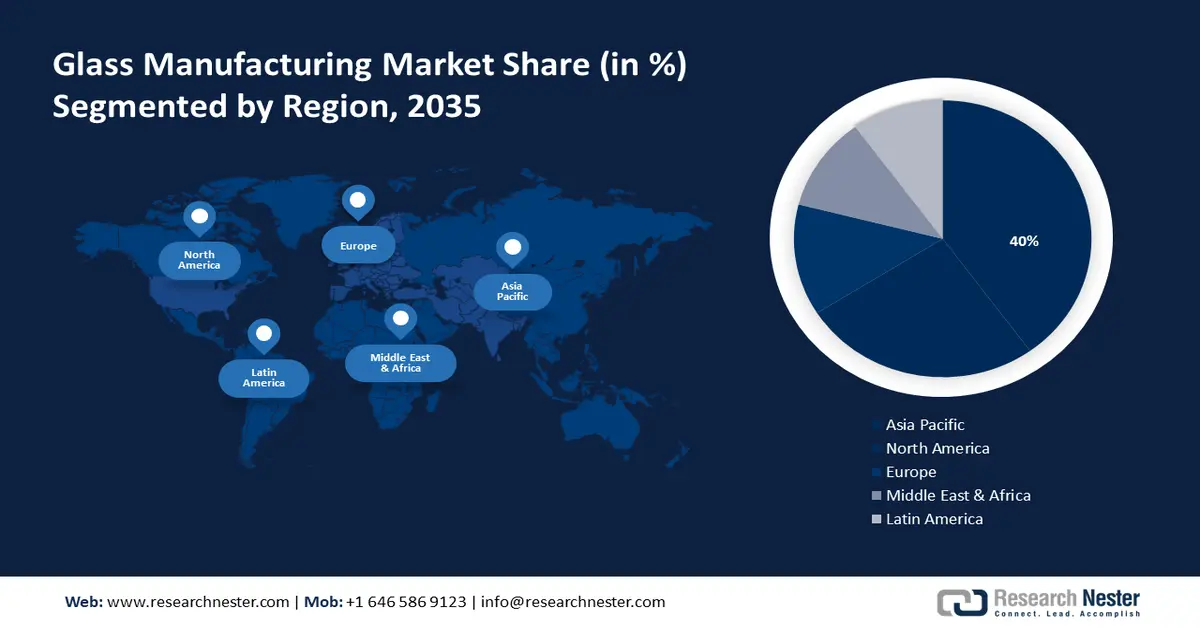

- Asia Pacific glass manufacturing market is anticipated to capture 40% share by 2035, driven by slated demand for infrastructure development and construction projects.

- North America market will hold the second largest share by 2035, driven by increasing demand from the construction sector.

Segment Insights:

- Container glass segment in the glass manufacturing market is anticipated to achieve 45% growth by the forecast year 2035, driven by increasing demand for eco-friendly and sustainable packaging applications.

- The packaging segment in the glass manufacturing market is projected to experience a notable CAGR through 2035, attributed to increasing food & beverage industry demand requiring glass for storage.

Key Growth Trends:

- Rising government and private investments

- Increasing application in several industries

Major Challenges:

- The requirement of skilled professionals to act as a major challenge

Key Players: Vitro, AGC Inc., Fuyao Glass Industry Group Co. Ltd., Guardian Industries, Heinz Glass, Central Glass Co. Ltd, Nippon Electric Glass Co. Ltd, Owens Illinois Inc., NSG Co., Ltd.

Global Glass Manufacturing Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 192.99 billion

- 2026 Market Size: USD 202.37 billion

- Projected Market Size: USD 326.54 billion by 2035

- Growth Forecasts: 5.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (40% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, France

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 17 September, 2025

Glass Manufacturing Market Growth Drivers and Challenges:

Growth Drivers

- Rising government and private investments - With the lucrative global population coupled with the augmenting economies, there is also a significant increase in infrastructural and constructional investments by both government and private organizations. According to the World Bank estimates, private participation in infrastructure (PPI) investments in 2023 accounted for USD 86 billion.

- Increasing application in several industries - There is a high usage of glass material in various sectors such as automotive, construction, IT & telecom, electronics, and many more, as glass can be used for several purposes such as windows, glass fiber optics, and many more.

- Increase in disposable income - There has been a growth in disposable income which is attributed to the growing need for comfort in residential buildings, automobiles, and many more. According to a report by the Office for National Statistics in 2023, the gross disposable household income (GDHI) in 2021 increased by 3.6% when compared to 2020 in the UK. Moreover, there has been growth in residential housing which fuels the demand for this sector.

- Growing urbanization - Urbanization has been considered one of the major driving forces for the glass manufacturing industry owing to the building of residential and commercial infrastructure, among many others. As per the European Commission’s Joint Research Center (JRC) 2023 estimates, around 44.7% of the world’s population is projected to be living in cities by 2025.

Additionally, urbanization has also led to an increasing focus on aesthetics and design, which has created a surge in the market demand for glass products that are not only functional but also visually appealing.

Challenges

- The requirement of skilled professionals to act as a major challenge - Glass manufacturing requires a person with specialized training because errors can result in dangerous circumstances, as while operating the machine, employees must be appropriately outfitted. Replaceable particulate filter respirators and head and body protective gear are a few examples of preventive equipment. If the worker exhibits any neglect in adhering to the procedure, there is a tremendous risk to their health.

- Major obstacles include cost and availability, particularly in areas with restricted access to high-quality silica sand and other inputs. The production of glass might be less sustainable and more costly, driven by its high energy usage. The business is also impacted by substitute materials like plastics and composites, which have advantages like reduced weight and expense.

Glass Manufacturing Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.4% |

|

Base Year Market Size (2025) |

USD 192.99 billion |

|

Forecast Year Market Size (2035) |

USD 326.54 billion |

|

Regional Scope |

|

Glass Manufacturing Market Segmentation:

Product Segment Analysis

Container glass segment is projected to hold more than 45% glass manufacturing market share by 2035. The segment's lucrative growth rate can be propelled by the increasing demand for packaging applications anticipated by the slated demand for eco-friendly and sustainable packaging, as renewable, recyclable, biodegradable packaging attracts more businesses and consumers to reduce their environmental footprints. Research Nester analysis observed that in 2023, more than 64% of consumers in the UK would purchase a product if it had sustainable packaging.

Consumers are also willing to pay more in this sector owing to the environmentally friendly process and packaging of these products. Moreover, glass containers are infinitely reusable and about 100% sustainable, recyclable, and refillable, which acts as a growing factor for this sector as plastics release toxins into the food while heating that can cause fertility issues and metabolic disorders.

Sector Segment Analysis

The packaging segment is estimated to grow at a notable CAGR in the coming years due to the increasing food & beverage industry, as glass material plays a vital role in storing processed foods, fruits & vegetables, syrups, dairy products, instant coffee, condiments, and many more. Moreover, glass material is also used in food and beverages to prevent bacterial growth. According to a report by the National Institutes of Health in 2023, the food manufacturing landscape contributes about 2.1% of the GDP in developing countries.

Additionally, glass materials are also used in several other industries including, cosmetics, pharmaceuticals, dairy, and many others.

Our in-depth analysis of the glass manufacturing market includes the following segments:

|

Product |

|

|

Sector |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Glass Manufacturing Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is anticipated to account for largest revenue share of 40% by 2035. The market expansion in the region is expected on account of the slated demand for infrastructure development and construction projects, which will attract more businesses and consumers and increase its revenue share. According to the World Bank, they provided more than 12 billion to developing countries to support infrastructure development, while highlighting that several developing countries have to spend about 4.5% of GDP for basic improvements in energy, digital, transport, and several other sectors.

China's ever-growing economy and rapid industrialization are set to fuel the glass manufacturing market’s growth. According to a report in 2022, it is projected that by 2035 the urbanization rate of China will cross 78%, which was valued at 66% in 2023.

In Japan there is a surge in urbanization and increasing demand for manufacturing & construction activities along with infrastructure development. According to the UN-Habitat, it is projected that the urban population in Asia Pacific will grow by 50% by 2050.

North America Market Insights

The North American region will also encounter a huge influence on the glass manufacturing market during the forecast period and will account for the second position attributed to the increasing demand for the construction sector. According to a report published by the U.S. Bureau of Census in 2024, there was an increase of about 4.1% in the country’s spending on construction in 2020 as compared to the same study done in 2017. Additionally, consumers are more aware of their packaging choices and are becoming highly aware of the environmental impacts because of them. According to a recently published report, about 13 environmental indicators reported that about 10% of the total life cycle emissions are caused by plastic packaging.

Moreover, Canada is predicted to have a high demand for glass manufacturers propelled by the slated growth rate of the construction sector. According to a report in 2024, the construction industry is one of the main contributors to Canada’s GDP, as employment in construction has increased by 80% since 2002 that is about 1.5 million people now.

Glass Manufacturing Market Players:

- Saint-Gobain

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Vitro, S.A.B de C.V

- AGC Inc.

- Fuyao Glass Industry Group Co. Ltd.

- Guardian Industries

- Heinz Glass

- Central Glass Co. Ltd

- Nippon Electric Glass Co. Ltd

- Owens Illinois Inc.

- NSG Co., Ltd

Most of the companies are continuously collaborating, expanding, making agreements, and joining ventures for the growth of this sector and are estimated to be the major key players in this landscape.

Recent Developments

- Saint Gobain - Saint-Gobain acquired the Bailey Group in April 2024, a privately owned maker of metal frames for light construction in Canada. This USD 639.39 million acquisition will boost Saint-Gobain's position in light and sustainable building while also expanding its product line in Canada.

- Vitro, S.A.B de C.V - Vitro and First Solar expand their contract to provide high-tech glass front sheets for solar panels manufactured in North America on October 2023. Over the next ten years, the contract expansion is estimated to generate nearly USD 1.3 billion in new sales on top of the original USD 1.2 billion contract.

- Report ID: 6198

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Glass Manufacturing Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.