- Introduction

- Market Definition and Segmentation

- Study Assumptions and Abbreviations

- Study Assumptions and Abbreviations

- Secondary Research

- Primary Research

- SPSS Approach

- Data Triangulation

- Executive Summary

- Industry Overview

- Country Synopsis

- Industry Supply Chain Analysis

- DROT

- Driver

- Restraint

- Opportunity

- Trend

- Government Regulation

- Competitive Landscape

- AGC Inc.

- ChromoGenics

- Corning Incorporated

- Gauzy Ltd.

- Gentex Corporation

- Guardian Industries Holdings, LLC

- Halio Inc.

- Merck KGaA (Merck Group)

- Nippon Sheet Glass Co. Ltd.

- Polytronix Inc.

- PPG Industries Inc

- Strategies Adopted By Key Players

- Technology Analysis

- Technology Trends in Smart Windows

- Functionality Type Analysis

- Demand Analysis For Smart Windows

- Product Pricing Analysis

- Application Analysis

- SWOT Analysis

- PESTLE Analysis

- Strategic News

- PORTER Five Forces Analysis

- Industry Risk Assessment

- Global Outlook and Projections

- Global Overview

- Market Value (USD Million), Current and Future Projections, 2024-2037

- Increment $ Opportunity Assessment, 2024-2037

- Year-on-Year Growth Forecast (%)

- Global Segmentation (USD Million), 2024-2037, By

- Glass Type, Value (USD Million)

- Passive Electrochromic Glass

- Thermochromic Glass

- Photochromic Glass

- Active Electrochromic Glass

- Polymer Dispersed Liquid Crystal (PDLC) Glass

- Suspended Particle Device (SPD) Glass

- Others

- Passive Electrochromic Glass

- Application, Value (USD Million)

- Architectural

- Residential

- Smart Windows

- Privacy Glass

- Commercial

- Residential

- Automotive

- Aerospace

- Consumer Electronics

- Others

- Architectural

- Functionality, Value (USD Million)

- Energy-efficient Solutions

- Privacy Control

- Temperature Regulation

- UV Protection

- Others

- Glass Type, Value (USD Million)

- Regional Synopsis, Value (USD Million), 2024-2037

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

- Global Overview

- North America Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2024-2037

- Increment $ Opportunity Assessment, 2024-2037

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2024-2037,

- Glass Type, Value (USD Million)

- Passive Electrochromic Glass

- Thermochromic Glass

- Photochromic Glass

- Active Electrochromic Glass

- Polymer Dispersed Liquid Crystal (PDLC) Glass

- Suspended Particle Device (SPD) Glass

- Others

- Passive Electrochromic Glass

- Application, Value (USD Million)

- Architectural

- Residential

- Smart Windows

- Privacy Glass

- Commercial

- Residential

- Automotive

- Aerospace

- Consumer Electronics

- Others

- Architectural

- Functionality, Value (USD Million)

- Energy-efficient Solutions

- Privacy Control

- Temperature Regulation

- UV Protection

- Others

- Country Level Analysis Value (USD Million), 2024-2037

- U.S.

- Canada

- Glass Type, Value (USD Million)

- Overview

- Europe Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2024-2037

- Increment $ Opportunity Assessment, 2024-2037

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2024-2037,

- Glass Type, Value (USD Million)

- Passive Electrochromic Glass

- Thermochromic Glass

- Photochromic Glass

- Active Electrochromic Glass

- Polymer Dispersed Liquid Crystal (PDLC) Glass

- Suspended Particle Device (SPD) Glass

- Others

- Passive Electrochromic Glass

- Application, Value (USD Million)

- Architectural

- Residential

- Smart Windows

- Privacy Glass

- Commercial

- Residential

- Automotive

- Aerospace

- Consumer Electronics

- Others

- Architectural

- Functionality, Value (USD Million)

- Energy-efficient Solutions

- Privacy Control

- Temperature Regulation

- UV Protection

- Others

- Country Level Analysis Value (USD Million), 2024-2037

- UK

- Germany

- France

- Italy

- Spain

- NORDIC

- Russia

- Rest of Europe

- Glass Type, Value (USD Million)

- Overview

- Asia Pacific Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2024-2037

- Increment $ Opportunity Assessment, 2024-2037

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2024-2037,

- Glass Type, Value (USD Million)

- Passive Electrochromic Glass

- Thermochromic Glass

- Photochromic Glass

- Active Electrochromic Glass

- Polymer Dispersed Liquid Crystal (PDLC) Glass

- Suspended Particle Device (SPD) Glass

- Others

- Passive Electrochromic Glass

- Application, Value (USD Million)

- Architectural

- Residential

- Smart Windows

- Privacy Glass

- Commercial

- Residential

- Automotive

- Aerospace

- Consumer Electronics

- Others

- Architectural

- Functionality, Value (USD Million)

- Energy-efficient Solutions

- Privacy Control

- Temperature Regulation

- UV Protection

- Others

- Glass Type, Value (USD Million)

- Country Level Analysis Value (USD Million), 2024-2037

- China

- Japan

- India

- Indonesia

- Australia

- South Korea

- Vietnam

- Malaysia

- Rest of Asia Pacific

- Overview

- Latin America Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2024-2037

- Increment $ Opportunity Assessment, 2024-2037

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2024-2037,

- Glass Type, Value (USD Million)

- Passive Electrochromic Glass

- Thermochromic Glass

- Photochromic Glass

- Active Electrochromic Glass

- Polymer Dispersed Liquid Crystal (PDLC) Glass

- Suspended Particle Device (SPD) Glass

- Others

- Passive Electrochromic Glass

- Application, Value (USD Million)

- Architectural

- Residential

- Smart Windows

- Privacy Glass

- Commercial

- Residential

- Automotive

- Aerospace

- Consumer Electronics

- Others

- Architectural

- Functionality, Value (USD Million)

- Energy-efficient Solutions

- Privacy Control

- Temperature Regulation

- UV Protection

- Others

- Glass Type, Value (USD Million)

- Country Level Analysis Value (USD Million), 2024-2037

- Brazil

- Argentina

- Mexico

- Rest of Latin America

- Overview

- Middle East & Africa Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2024-2037

- Increment $ Opportunity Assessment, 2024-2037

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2024-2037,

- Glass Type, Value (USD Million)

- Passive Electrochromic Glass

- Thermochromic Glass

- Photochromic Glass

- Active Electrochromic Glass

- Polymer Dispersed Liquid Crystal (PDLC) Glass

- Suspended Particle Device (SPD) Glass

- Others

- Passive Electrochromic Glass

- Application, Value (USD Million)

- Architectural

- Residential

- Smart Windows

- Privacy Glass

- Commercial

- Residential

- Automotive

- Aerospace

- Consumer Electronics

- Others

- Architectural

- Functionality, Value (USD Million)

- Energy-efficient Solutions

- Privacy Control

- Temperature Regulation

- UV Protection

- Others

- Glass Type, Value (USD Million)

- Country Level Analysis Value (USD Million), 2024-2037

- GCC

- Israel

- South Africa

- Rest of Middle East & Africa

- Overview

- About Research Nester

- Our Global Clientele

- We Serve Clients Across World

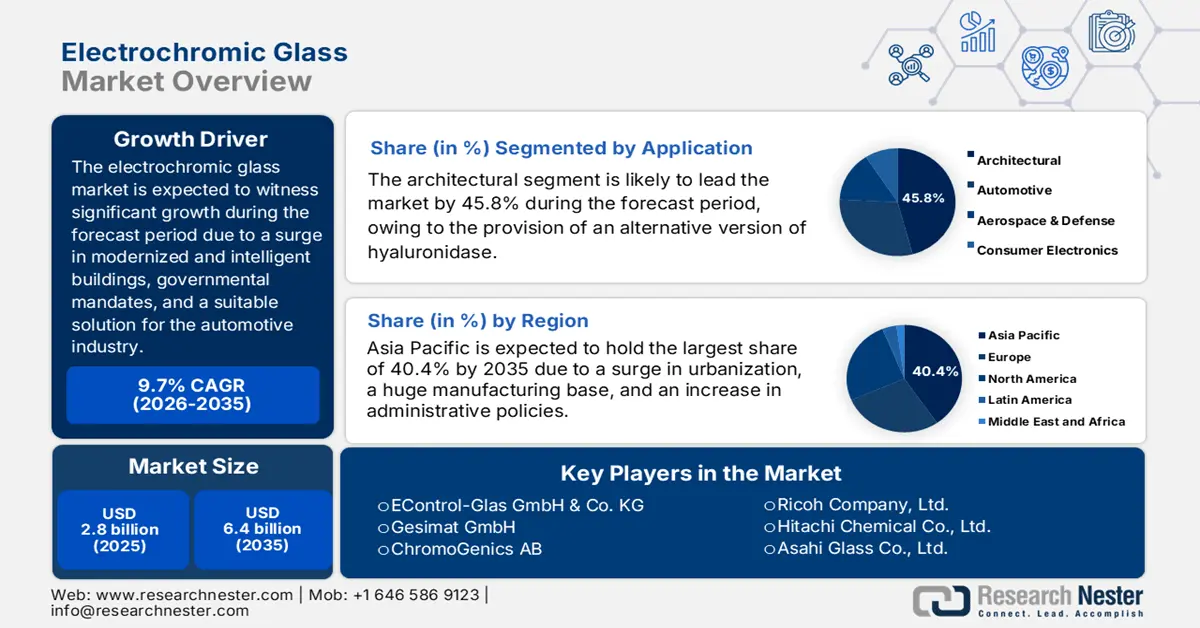

Electrochromic Glass Market Outlook:

Electrochromic Glass Market size was over USD 2.8 billion in 2025 and is estimated to reach USD 6.4 billion by the end of 2035, expanding at a CAGR of 9.7% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of electrochromic glass is estimated at USD 3 billion.

The international electrochromic glass market is undergoing a revolutionary expansion, which is propelled by the robust convergence of administrative mandates for energy efficiency and a rise in occupant-centric and intelligent buildings. In addition, dynamic glass is increasingly emerging as the mainstream solution for the automotive and construction sectors, which is fueled by the ability to control solar heat gain and improve natural light. Based on this, according to an article published by the Department of Energy in August 2023, Polyceed Inc. dba Glass Dyenamics partnered with the National Renewable Energy Laboratory (NREL), with funding of USD 381,381, along with a 20% minimum cost share. The project’s purpose demonstrated solid electrolyte electrochromic devices, along with neutral coloring electrochromic devices, which creates an optimistic approach for the overall electrochromic glass market.

Furthermore, the aspect of material advancements, along with smart building and the Internet of Things (IoT) integration, expansion in transportation and automotive, and the increased demand for human-centric design, have also propelled the electrochromic glass market globally. As per an article published by NLM in July 2023, the self-structuring-based electrochromic devices readily exhibit a distinctive gradient and multicolor pattern by achieving effective transmission contrast for almost 60%. In addition, the optical transmittances of these devices in dyed and bleached states are measured at a 633 nm wavelength, and are significantly determined to be 11% and 53% respectively. Therefore, these devices provide benefits in color versatility, along with a strong potential for reduced manufacturing expenses and flexibility, which is positively impacting the electrochromic glass market across different nations.

Key Electrochromic Glass Market Insights Summary:

Regional Insights:

- By 2035, the Asia Pacific region in the electrochromic glass market is projected to secure a leading 40.4% share, fueled by unprecedented urbanization, a massive construction base, and strict governmental mandates for green buildings.

- North America is anticipated to emerge as the fastest-growing region through 2026–2035, supported by stringent energy-efficient codes, rising disposable income for green building technologies, and substantial federal government support.

Segment Insights:

- By 2035, the architectural sub-segment in the electrochromic glass market is expected to account for a 45.8% share, sustained by its impact on modernized construction value, aesthetic flexibility, occupant comfort, and energy efficiency.

- Over 2026–2035, the polymer or organic sub-segment is anticipated to hold the second-largest material share, advanced by rapid switching times, reduced fabrication expenses, tunable color, and flexibility.

Key Growth Trends:

- Rising focus on operational cost reduction

- Increased focus on corporate sustainability goals

Major Challenges:

- Durability concerns and technical performance limitations

- Manufacturing scalability and complicated supply chain

Key Players: Saint-Gobain, AGC Inc., Corning Incorporated, Gentex Corporation, Vitro Architectural Glass, Research Frontiers Inc., EControl-Glas GmbH & Co. KG, Gesimat GmbH, ChromoGenics AB, Ricoh Company, Ltd., Hitachi Chemical Co., Ltd., Asahi Glass Co., Ltd., PPG Industries, Inc., SAGE Electrochromics, Inc., Kinestral Technologies, Inc., RavenWindow, Pleotint LLC, Smartglass International Limited, Gauzy Ltd.

Global Electrochromic Glass Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.8 billion

- 2026 Market Size: USD 3 billion

- Projected Market Size: USD 6.4 billion by 2035

- Growth Forecasts: 9.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (40.4% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: India, Brazil, United Arab Emirates, Singapore, Mexico

Last updated on : 25 November, 2025

Electrochromic Glass Market - Growth Drivers and Challenges

Growth Drivers

- Rising focus on operational cost reduction: The compelling overall expense of ownership narrative, wherein significant savings on HVAC, along with lighting expenses, readily outweigh the increased initial investment, is driving the electrochromic glass market adoption in the commercial real estate industry. According to a report published by the Department of Energy in September 2022, heat gain or loss through windows in the U.S. readily accounts for an estimated 4 quads of combined cooling and heating energy utilization at a yearly expense of over USD 40 billion. This has resulted in 0.6 quads of energy savings in residential buildings, along with 0.1 quads in commercial buildings, as well as a 2.1% reduction in overall yearly nationwide building energy utilization, all of which are poised to be achieved by the end of 2030, thus uplifting the market’s growth.

- Increased focus on corporate sustainability goals: The push for ESG compliance is no longer restricted to organizations’ energy bills or supply chains, which is increasingly shaping the electrochromic glass market globally. Besides, modernized interior decorative glassware, especially acoustic panels, doors, and partitions, made from smart glass, serves as a tangible manifestation of these sustainability goals through intense export and import globally. As per an article published by the Department of Science and Technology in June 2024, the transparent battery utilization in smart windows readily integrates a cathode material, which is composed of 170 nm thickness-optimized electrochromic tungsten oxide. In addition, the two-order higher ion-conductive aqueous electrolyte has resulted in rapid charging, thus improving speed with a 155 mAh/m2 discharge capacity, which is positively impacting the electrochromic glass market globally.

2025 Interior Decorative Glassware Export and Import

|

Countries/ Components |

Export |

Import |

|

China |

USD 3.9 billion |

- |

|

France |

USD 743 million |

USD 410 million |

|

Germany |

USD 516 million |

USD 570 million |

|

U.S. |

USD 1.3 billion |

- |

|

Global Trade Valuation |

USD 9.2 billion |

|

|

Global Trade Share |

0.04% |

|

|

Product Complexity |

0.5 |

|

Source: OEC

- Boost in construction and urbanization: The surge in urbanization, particularly in the Asia Pacific region, is significantly fueling he construction of the latest green buildings. These are considered prime objectives for integrating innovative smart glass technologies from the outset, which is positively impacting the electrochromic glass market internationally. As stated in the June 2024 World Economic Forum article, 11 strategic transition levers have been identified across the overall value chain of buildings. These particular levers have the ability to unlock more than 80% of the industry’s abatement and successfully open a USD 1.8 trillion market opportunity. Besides, buildings are responsible for 37% of international carbon dioxide emissions, along with 34% of the earth’s species, owing to which there is a huge demand for green building construction.

Challenges

- Durability concerns and technical performance limitations: Despite significant innovations, the electrochromic glass market continues to witness performance obstacles that restrict its application in certain contexts. Notable technical risks, such as the switching speed, is usually time-consuming, which appears to be slow for rapidly modifying light conditions. Besides, the color uniformity in the tinted state can also be a challenge for large-scale panels, potentially affecting the aesthetic aspect of buildings. Moreover, long-lasting durability and lifespan under actual conditions, such as continuous cycling and exposure to severe temperatures, are still a huge concern for specifiers. The presence of chemical layers within the glass can also degrade with time, eventually resulting in performance loss, failure, and color shift. Therefore, these technical uncertainties develop perceived risk for engineers and architects, which further causes a hindrance in the market’s growth.

- Manufacturing scalability and complicated supply chain: The production process in the electrochromic glass market is a multi-stage and complicated process that comprises depositing thin films of customized chemicals over glass substrates, particularly in clean-room and highly controlled environments. This complexity has developed a fragile and expensive supply chain system, dependent on specific raw materials, whose price and variability can be volatile. Besides, scaling manufacturing to cater to projected international demand displays a monumental risk, demanding huge capital investment in sophisticated equipment and the newest production lines. Unlike standard float glass, which is produced in continuous and huge volumes, the electrochromic glass manufacturing is closer to the semiconductor sector, with reduced yields and increased precision, thus negatively impacting the production process.

Electrochromic Glass Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

9.7% |

|

Base Year Market Size (2025) |

USD 2.8 billion |

|

Forecast Year Market Size (2035) |

USD 6.4 billion |

|

Regional Scope |

|

Electrochromic Glass Market Segmentation:

Application Segment Analysis

The architectural sub-segment in the application segment is anticipated to account for the largest share of 45.8% in the electrochromic glass market by the end of 2035. The sub-segment’s upliftment is highly driven by its unparalleled impact on the actual value proposition of modernized construction, aesthetic flexibility, occupant comfort, and energy efficiency. Unlike aerospace or automotive applications, which are effectively constrained by specific design and size parameters, this sub-segment is integrated into the building’s envelope, which includes skylights, curtain walls, and windows. Therefore, this has positioned the market as the most fundamental tool for compliance with strict international building codes, such as the localized green building standards, known as LEED, as well as the Energy Performance of Buildings Directive (EPBD) in Europe, thereby making it suitable for the segment’s growth.

Material Segment Analysis

By the end of the projected timeline, the polymer or organic sub-segment, which is part of the material segment, is expected to cater to the second-largest share in the electrochromic glass market. The sub-segment’s growth is highly propelled by its provision of rapid switching times, reduced fabrication expenses, tunable color, and flexibility in comparison to conventional inorganic materials. According to an article published by the Royal Society of Chemistry in October 2024, bioactive glass is significantly emerging, with its composition including 2.6 mol% P2O5, 26.9 mol% CaO, 24.4 mol% Na2O, and 46.1 mol% SiO2. This particular glass form readily aids in optimizing biological and mechanical characteristics and effectively alters the degradation kinetics associated with polymers. Therefore, this is extremely essential for the electrochromic glass, which is increasingly using organic and polymer-based materials for its production and manufacturing.

End user Segment Analysis

The building and construction segment, which falls under the end user domain, is projected to constitute the third-largest share in the electrochromic glass market by the end of the stipulated duration. The segment’s development is highly attributed to its association with the architectural application, but only from the perspective of the specifier and customer driving the demand. This particular segment has encompassed the overall ecosystem, starting from architects and developers to contractors and engineering firms, collectively responsible for integrating intelligent and sustainable building solutions. Besides, the growth is further attributed to a strong convergence of administrative push, the rise in total expense of ownership calculus, and corporate ESG mandates, all of which significantly contribute to the segment’s expansion as well as drive the market’s growth internationally.

Our in-depth analysis of the electrochromic glass market includes the following segments:

|

Segment |

Subsegments |

|

Application |

|

|

Material |

|

|

End user |

|

|

Technology |

|

|

Functionality |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Electrochromic Glass Market - Regional Analysis

APAC Market Insights

The Asia Pacific in the electrochromic glass market is anticipated to garner the highest share of 40.4% by the end of 2035. The market in the region is propelled by unprecedented urbanization, a massive construction base, and an increase in strict governmental mandates for green buildings. Besides, the Dual Carbon goals in China, along with the Energy Conservation Building Code (ECBC) in India, are also driving the market in the region by creating the demand for energy-efficient materials. According to an article published by the NITI Government in April 2025, the automotive component production in India is projected to reach USD 145.0 billion by the end of 2030, of which auto component exports will triple to USD 60.0 billion, while effectively yielding USD 25.0 billion as trade surplus. This is eventually predicted to offer 2.0 million to 2.5 million employment opportunities, thus making it suitable for the market.

Consumption and Trade Dynamics in Asia

|

Components/Countries |

China |

Japan |

South Korea |

India |

|

Consumption |

USD 810.0 billion |

USD 228.0 billion |

USD 76.0 billion |

USD 70.0 billion |

|

Exports |

USD 69.0 billion (10%) |

USD 52 billion (7%) |

USD 26.0 billion (4%) |

USD 20.0 billion |

|

Imports |

USD 36.0 billion (5%) |

USD 13.0 billion (2%) |

USD 9.0 billion (1%) |

USD 20.0 billion |

|

Trade Ratio |

1.9 |

4.0 |

2.8 |

0.9 |

|

Major Exports |

U.S. (23.0%), Japan (7.0%), Mexico (6.0%), Germany (5.0%) |

- |

- |

U.S. (28.0%), Germany (7.0%), Brazil (4%) |

|

Major Imports |

Germany (33.0%), Japan (22.0%), U.S. (7.0%), South Korea (5.0%) |

- |

- |

China (30.0%), Germany (11%), South Korea (10.0%) |

Source: NITI Government

China in the electrochromic glass market is growing significantly, owing to a link between the enforcement and scale of the national climate policy, along with governmental objectives that are supported by actionable mandates, such as the strict Green Building Evaluation Standard, which is readily integrated across the country. As per a data report published by the UNCTAD Organization in 2023, there has been an upsurge in the country’s gross domestic product (GDP), which is valued at USD 11,414 per capita as of 2022. Besides, the country accounts for more than 31.0% of the global manufacturing value-addition, and further caters to almost 62.5% of the combined manufacturing value-addition out of the overall 40 OECD states. Therefore, with continuous development in terms of manufacturing within the country, the market is gaining increasing exposure in the country.

India in the electrochromic glass market is also growing due to increased urbanization, an administrative push for sustainable infrastructure, as well as an upsurge in cost-benefit realization. Additionally, the revised ECBC policy in the country has readily mandated strict energy performance standards for commercial buildings. As per an article published by the Bureau of Energy Efficiency in 2023, the building industry accounts for more than 30% of the country’s overall electricity consumption. Moreover, it has been estimated that India is developing 3,00,000 square feet of commercial floor space annually, and is poised to witness the largest residential and commercial building construction. Meanwhile, the Pradhan Mantri Awas Yojana - Urban (PMAY-U) mission, which is under the Ministry of Housing and Urban Affairs, has significantly aimed to create cost-effective and sustainable housing units, thus proliferating the market’s growth.

North America Market Insights

North America in the electrochromic glass market is expected to emerge as the fastest-growing region during the projected period. The market’s development in the region is highly attributed to the leadership, which is readily positioned by the presence of strict energy-efficient codes, an increase in disposable income for green building technologies, and substantial federal government support. According to an article published by the Federal Register Government in August 2024, the Department of Energy (DOE) gained a joint agreement suggesting standards for customer traditional cooking products, with 207 kWh/year for electric smooth cooktop, along with 1,770 kBtu/year for gas utilization. Besides, as per the August 2025 DOE article, the DOE declared its objective to successfully issue funding opportunity notices, amounting to USD 1.0 billion, to ensure advancement in manufacturing technologies, processing, and scale mining, thus boosting the market’s development.

The electrochromic glass market in the U.S. is gaining increased traction, owing to the direct support, along with federal budget allocation, the pivotal role of programs deliberately supporting innovative materials and sustainability, and ensuring chemical safety. As per an article published by the NIST Government in October 2024, the U.S. Department of Commerce significantly issued a Notice of Intent (NOI) to unveil sustainable semiconductor, which has been made possible by the USD 100 million funding by CHIPS. Besides, as per the June 2022 Congress Government article, the DOE received an estimated USD 2.7 billion in funding, denoting a 13.0% surge since the previous year. Therefore, with the availability of generous grants and funding opportunities, there is a huge growth opportunity for the overall market in the country.

The electrochromic glass market in Canada is also growing due to the presence of net-zero mandates, federal carbon pricing, the existence of strict national building codes, the Buy Clean strategy, severe climate, focus on resilient infrastructure, and the presence of Green Building and provincial leadership programs. As per the 2025 David Suzuki Foundation Organization article, the country’s carbon levy, since its commencement, was valued at CAD 20 per tonne and gradually increased by CAD 10 every year to CAD 50 as of 2022. At present, it has currently increased by CAD 15 per year, and is further projected to reach CAD 170 per tonne by the end of 2030. In addition, the recent increase has been recorded to be CAD 80 per tonne in April 2024. Besides, farmers received 80% of the levy, which is utilized to heat greenhouses, and households also receive the same share, which, in turn, is positively uplifting the overall market in the country.

Europe Market Insights

Europe in the electrochromic glass market is projected to witness steady growth by the end of the predicted timeline. The market’s growth in the region is highly driven by unparalleled regulatory pressure, most commonly the Energy Performance of Buildings Directive (EPBD), which has mandated that current buildings will be zero-emission by the end of 2030. Moreover, the regional Green Deal’s Renovation Wave approach has aimed to double yearly energy renovation rates, for which the market is presently witnessing sustained growth. According to a report published by the World GBC Organization in August 2024, 75% of the region’s building stock is energy inefficient, along with the yearly renovation rate accounting for nearly 1.0%. Therefore, the presence of high-performance buildings is readily uplifting the market in the overall region.

Germany in the electrochromic glass market is gaining increased exposure, owing to the existence of a strong manufacturing base, an increase in building renovation rate, along with enforced and strict national energy standards. According to the July 2022 Renewable Energy Institute article, the Buildings Energy Act (GEG) has been revised, which has been suitable for Efficiency Standard 55, under which new heating systems need to offer 65% of the heating need from renewable energy sources. Furthermore, the present GEG demands that the current buildings’ yearly primary energy demand need not exceed 75% of the overall reference building level. Meanwhile, renewable electricity utilization in new buildings is recommended to offer almost 15% of cooling and heating energy demand, which is suitable for boosting and expanding the market in the country.

France, in the electrochromic glass market, is also developing due to the forward-looking and strong Règlementation Environnementale 2020 (RE2020), which significantly regulates the overall carbon footprint of buildings. This has further developed an unparalleled incentive for high-performance and low-carbon materials, such as electrochromic glass, which deliberately diminishes both innovation and operational emissions in embodied carbon and material science. As stated in an article published by the U.S. Department of State in 2025, France 2030 has allocated €30 billion (USD 33 billion) for more than 5 years, aiming to complement the France Relance recovery plan, along with €8 billion (USD 8.8 billion) in the energy industry. Meanwhile, the aspect of foreign direct investment (FDI) is also boosting the economy, which is positively impacting the market’s growth in the country and the overall region.

Europe’s FDI Analysis (2025)

|

Inward Direct Investment |

Outward Direct Investment |

||||

|

Countries |

Amount (USD Million) |

% |

Countries |

Amount (USD Million) |

% |

|

Luxemburg |

435,166 |

10 |

UK |

801,255 |

14 |

|

UK |

433,383 |

10 |

Switzerland |

521,553 |

9 |

|

Germany |

332,293 |

7 |

Germany |

418,576 |

7 |

|

Switzerland |

226,734 |

5 |

Luxemburg |

330,020 |

6 |

Source: U.S. Department of State

Key Electrochromic Glass Market Players:

- View Inc. (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Saint-Gobain (France)

- AGC Inc. (Japan)

- Corning Incorporated (U.S.)

- Gentex Corporation (U.S.)

- Vitro Architectural Glass (Mexico)

- Research Frontiers Inc. (U.S.)

- EControl-Glas GmbH & Co. KG (Germany)

- Gesimat GmbH (Germany)

- ChromoGenics AB (Sweden)

- Ricoh Company, Ltd. (Japan)

- Hitachi Chemical Co., Ltd. (Japan)

- Asahi Glass Co., Ltd. (Japan)

- PPG Industries, Inc. (U.S.)

- SAGE Electrochromics, Inc. (U.S.)

- Kinestral Technologies, Inc. (U.S.)

- RavenWindow (U.S.)

- Pleotint LLC (U.S.)

- Smartglass International Limited (Ireland)

- Gauzy Ltd. (Israel)

- View Inc. is regarded as one of the leading tech-based organizations, as well as the primary driver in marketing dynamic glass for smart buildings. The organization’s ultimate contribution is its implemented smart-glass platform, which has leveraged AI and cloud connectivity to automate tinting for energy savings and ensure comfort on a huge scale.

- Saint-Gobain is the international material science giant that has leveraged its massive scale and expertise in building and glass materials to ensure progress in electrochromic technology. Its notable market contribution lies in adopting SageGlass into architectural-grade and high-performance glazing units by offering complete-building and strong façade solutions for the international construction sector. As stated in its 2025 annual report, the company has generated €46.6 billion, denoting a 1.6% from 2023, along with €3.5 billion in net income, and €4.0 billion in free cash flow.

- AGC Inc. significantly applies its world-leading chemical and glass manufacturing prowess to create and produce high-quality electrochromic glass, especially for the architectural and automotive industries. The organization’s effective contribution is focused on the Asia-based electrochromic glass market, along with its capability to supply electrochromic glass as a key component to the majority of construction and automotive OEM projects.

- Corning Incorporated readily contributes to the market’s foundation through its unparalleled expertise in materials science and specialty glass, in comparison to selling finished electrochromic windows. The organization’s key role is in supplying and developing innovative glass proprietary and substrate components that ensure durability and performance of cutting-edge electrochromic devices. Based on these developments, and as stated in its 2025 annual report, the organization achieved USD 3.5 billion in sales, 34.2% in gross margin, USD 0.3 as EPS, and USD 623.0 million as operating cash flow.

- Gentex Corporation is one of the dominating forces in applying electrochromic technology, accounting for a massive share for auto-dimming rearview mirrors in the international automotive sector. Its major contribution has been focused on perfecting affordable and high-volume electrochromic device manufacturing, with expertise extending into large-scale applications, such as architectural elements and aircraft windows.

Here is a list of key players operating in the global electrochromic glass market:

The worldwide electrochromic glass market is regarded as the most dynamic background between agile technology disruptors and established material science giants. Key players, such as AGC Inc. and Saint-Gobain, have leveraged their massive international distribution networks, along with in-depth expertise in glass manufacturing. Meanwhile, pure-play innovators, including Gauzy Ltd. and View Inc., readily compete through innovative software integration as well as proprietary material science. Besides, in September 2024, SageGlass declared the introduction of the latest Environmental Product Declarations (EPDs) for its outstanding leadership in sustainability, as well as detailing suitable reductions in the carbon footprint of its Insulating Glass Units (IGUs). The organization also offers consumers with transparency, readily committing to adopting sustainable building practices, which in turn creates an optimistic outlook for the overall electrochromic glass market.

Corporate Landscape of the Electrochromic Glass Market:

Recent Developments

- In March 2025, Miru Smart Technologies unveiled one of the world’s largest electrochromic sunroof window devices, which are suitable for the automotive sector. This has been possible with Argotec’s innovative thermoplastic polyurethane (TPU) interlayer films, displaying the commercial value and scalability of the next-generation window solution.

- In October 2024, Mativ, along with Miru, entered into a combined development deal to significantly commercialize a notable lamination interlayer for dynamic electrochromic windows, eWindows. This particular agreement has brought together technologies to simplify the manufacturing process and reduce productivity expenses for automakers and glass fabricators globally.

- Report ID: 3538

- Published Date: Nov 25, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Electrochromic Glass Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.