Geographic Information System Market Outlook:

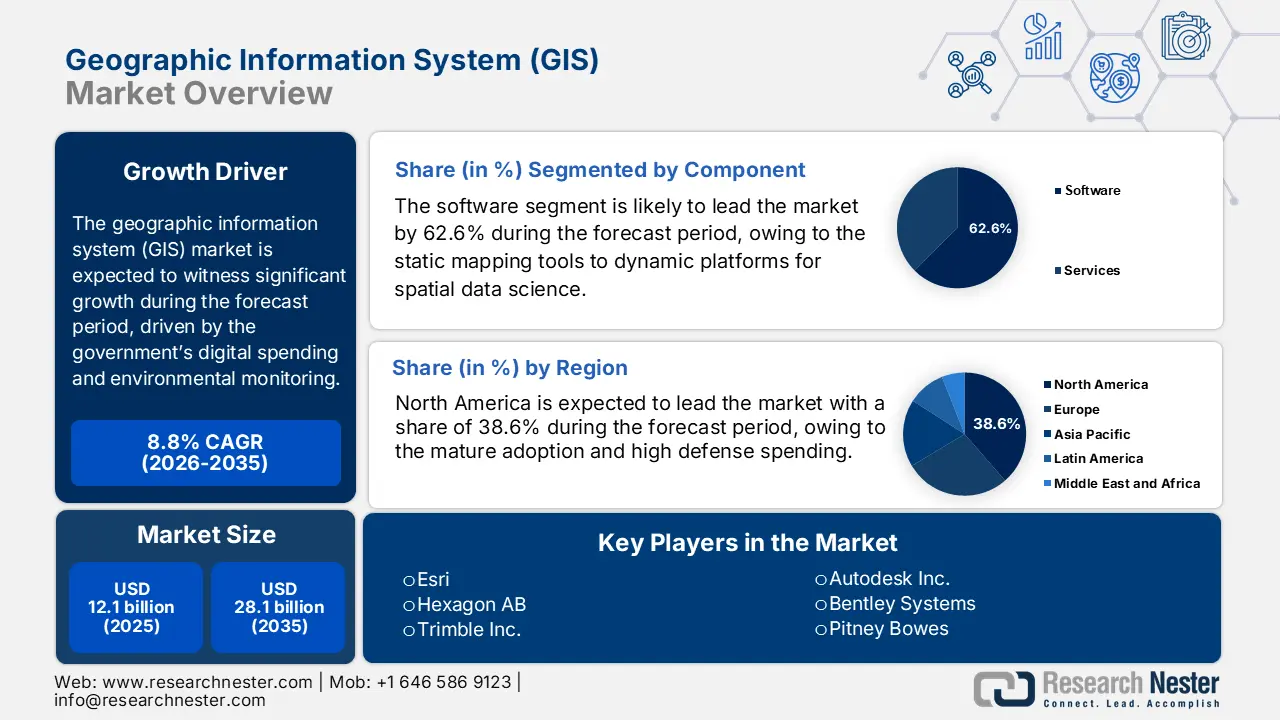

Geographic Information System (GIS) Market size was valued at USD 12.1 billion in 2025 and is projected to reach USD 28.1 billion by the end of 2035, rising at a CAGR of 8.8% during the forecast period, i.e., 2026-2035. In 2026, the industry size of geographic information system is estimated at USD 13.3 billion.

The government digital mapping, environmental monitoring, and national spatial data management programs are the drivers of the geographic information systems market and are increasing the multi-agency utilization of the GIS platforms across defense emergency operations, infrastructure, natural resource oversight, and sustainability initiatives. The Data.gov report published in November 2025 has depicted that the USGS gathers online access to water-resources data gathered at over 1.5 million locations across all 50 states, indicating a steep federal usage for the topography, land cover, and hydrography applications supporting planning and interagency coordination. Similarly, the NOAA indicates the substantial demand for coastal geospatial monitoring, showing a more annual downloads of storms, sea level, and climate datasets that continue to expand as coastal resilience and disaster preparedness programs are funded via federal climate initiatives.

The geographic information system market in Europe oversees the thematic geospatial services via the European Environment Agency, which is tied to the climate monitoring and air quality national environmental compliance under the EU reporting frameworks. At as multilateral level, the report from the FAO February 2025 data states that more than 17,000 satellites have been launched, expanding global earth-observation capacity and enhancing the volume of remote sensing data available for GIS-based environmental and planning applications. Further, the ongoing government spending allocation and the global environmental risk data requirements are creating a long-cycle procurement structure where the modern GIS solutions are increasingly supporting the national resilience frameworks, sovereign spatial datasets, and digital public infrastructure.

Key Geographic Information System Market Insights Summary:

Regional Insights:

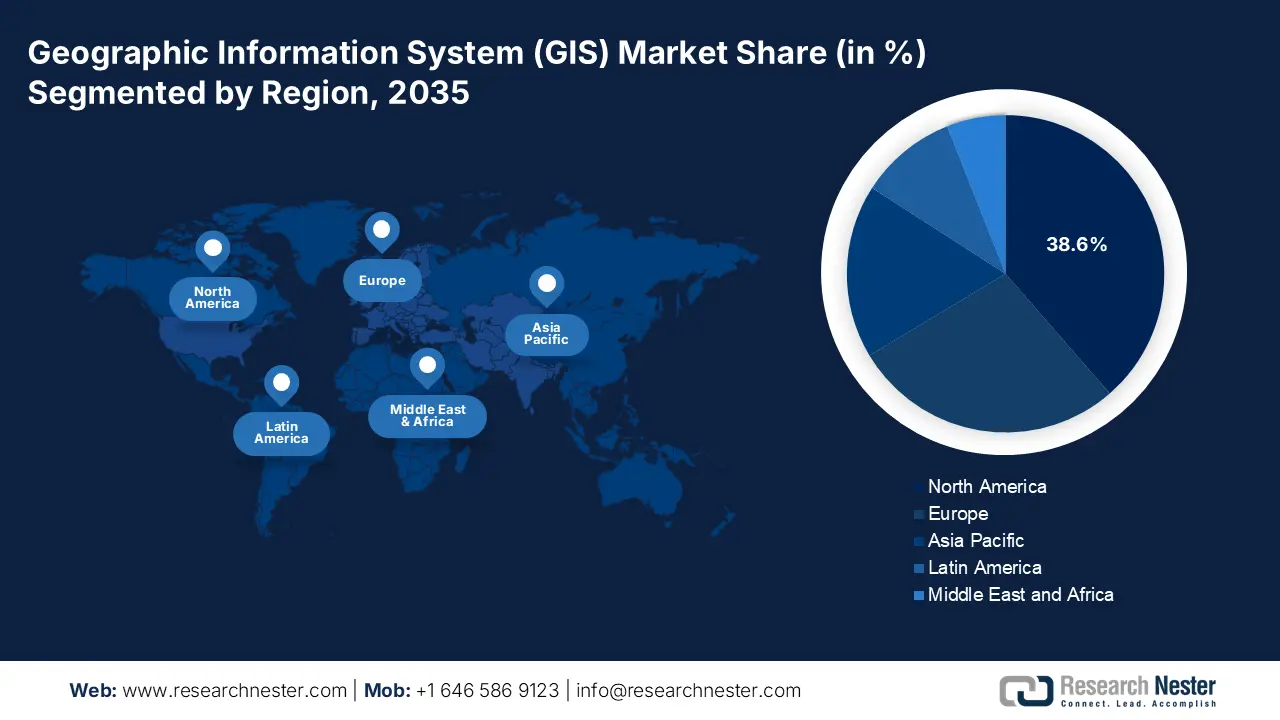

- North America is projected to command a 38.6% share of the geographic information system (gis) market by 2035, supported by entrenched adoption, sustained public investments, and federally mandated geospatial modernization programs owing to expansive digital-infrastructure initiatives.

- Asia Pacific is expected to expand at a 12.5% CAGR during 2026–2035, propelled by significant government-backed digital infrastructure programs and large-scale national spatial data initiatives.

Segment Insights:

- The software segment in the geographic information system market is set to capture a 62.6% share by 2035, propelled by the shift from static mapping tools to AI- and ML-enabled spatial analytics platforms.

- The cloud deployment segment is expected to hold the leading share by 2035, supported by its scalability and its ability to process real-time geospatial big data from IoT devices, satellites, and drones.

Key Growth Trends:

- Expanding government investment in earth observation and climate monitoring

- Increasing use of the GIS in national agricultural monitoring

Major Challenges:

- High technical complexity and integration burden

- Data acquisition cost licensing and quality issues

Key Players: (U.S.), Maxar Technologies (U.S.), TomTom (Netherlands), CARTO (Spain), SuperMap Software Co., Ltd. (China), PASCO Corporation (Japan), RMSI (India), Genesys International Corporation (India), L3Harris Geospatial (U.S.), Caliper Corporation (Maptitude) (U.S.), Nearmap Ltd. (Australia), Samsung SDS (South Korea), Aero-Graphics (M) Sdn Bhd (Malaysia), QGIS Development Team (Open Source) (International), Precisely (U.S.).

Global Geographic Information System Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 12.1 billion

- 2026 Market Size: USD 13.3 billion

- Projected Market Size: USD 28.1 billionby 2035

- Growth Forecasts: 8.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38.6% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, United Kingdom, Japan

- Emerging Countries: India, South Korea, Brazil, Australia, Singapore

Last updated on : 12 December, 2025

Geographic Information System Market - Growth Drivers and Challenges

Growth Drivers

- Expanding government investment in earth observation and climate monitoring: The public financing of the satellite-based environmental monitoring is rapidly expanding the driving the higher downstream demand for the GIS platform to support the climate analytics, agriculture, coastal infrastructure, and national resilience planning. The NASA 2023 Budget Request report states that USD 27,023 million is requested for the fiscal year 2025, increasing the capacity for real-time climate and land use data sets. On the other hand, the NOAA also confirms that the more annual downloads of the coastal datasets are supporting the sea level coastal flooding and disaster monitoring applications. As the effects of climate change intensify, the national agencies allocate more resources to hydrology, wildfire modeling, agricultural forecasting, and environmental risk programs that depend on GIS analytics.

NASA Total Budget Authority

|

Year |

Amount |

|

2021 |

23,271.3 |

|

2022 |

24,801.5 |

|

2023 |

25,973.8 |

|

2024 |

26,493.4 |

|

2025 |

27,023.3 |

Source: NASA 2023

- Increasing use of the GIS in national agricultural monitoring: The GIS is adopted for real-time crop surveillance, yield forecasting, drought detection, and pest prediction. The USDA data in February 2024 indicates that the 2022 Census of Agriculture features more than 6 million farm-level data points down to the county scale. This data illustrates the expanding national reliance on GIS-structured agricultural datasets for crop monitoring, land-use analytics, and farming programs across the U.S. Further, the GIS-based satellite imagery helps to improve crop forecasting in developing economies, enabling soil moisture, rainfall, and vegetation monitoring. With agriculture security and supply chain stability becoming national priorities, GIS continues to support sustainable land use management and precision-driven farming strategies funded under public agricultural modernization programs.

- Modernization of the critical infrastructure and adoption of digital twins: Aging infrastructure in the developed economies and new builds in developing ones are catalyzing GIS use for asset lifecycle management. The concept of the infrastructure digital twins dynamic virtual models relies fundamentally on the GIS for spatial context. The U.S. Department of Transportation’s Every Day Counts initiative promotes the digital construction management that integrates GIS data. The UK’s National Digital Twin programme, led by the Centre for Digital Built Britain (CDBB), explicitly uses GIS as a foundational integration layer, creating demand for platforms that fuse GIS with BIM, IoT, and engineering data for smarter asset management.

Challenges

- High technical complexity and integration burden: Entering the geographic information system market requires deep expertise in cartography, spatial databases, and data science. The new suppliers must ensure their solutions integrate seamlessly with the legacy enterprise systems and modern cloud platforms. This complexity demands a significant R&D investment and poses a major barrier. For example, the leading player, such as Autodesk, invested heavily to integrate the GIS capabilities from Esri directly into the Autodesk Civil 3D and InfraWorks platforms, a multi-year engineering effort to bridge BIM and GIS data models for the infrastructure projects.

- Data acquisition cost licensing and quality issues: High-quality current geospatial data is expensive to acquire or license from providers such as Maxar Technologies or Precisely. The inconsistent accuracy, formatting, and update cycles across the regions can degrade the solution performance. The new entrants often struggle to bundle compelling data packages. The Hexagon AB tackles this by using its vast sensor network to create and control its own high-fidelity data streams, a vertical integration strategy too costly for most newcomers.

Geographic Information System Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

8.8% |

|

Base Year Market Size (2025) |

USD 12.1 billion |

|

Forecast Year Market Size (2035) |

USD 28.1 billion |

|

Regional Scope |

|

Geographic Information System Market Segmentation:

Component Segment Analysis

Under the component segment, the software is dominating and is expected to hold the share value of 62.6% by 2035 in the geographic information system market. The segment is driven by the transition from the static mapping tools to dynamic platforms for spatial data science and predictive analytics. The core driver is the integration of artificial intelligence and machine learning that automates complex analyses, such as feature extraction from the satellite imagery. The HUD's eGIS Open Data Storefront processes over 5 million data requests monthly, while specific applications such as the HUD Resource Locator handle 177,976 requests and Community Planning and Development maps, as per the data from the U.S. Department of Housing and Urban Development in June 2023. These results indicate the increased democratization of geospatial data across the HUD offices following the introduction of cloud-based ArcGIS Online to assist policy via spatial analysis.

Deployment Segment Analysis

Cloud is expected to hold the maximum share value by 2035 in the deployment segment of the geographic information system. The segment is driven due to its ability to handle the massive computational and storage demands of modern geospatial big data. The primary driver is the need to process and analyze the real-time data streams from the IoT sensors, satellites, and drones for applications such as disaster response and precision agriculture. This is coupled with the necessity for a scalable cost cost-effective infrastructure that reduces the large upfront capital expenses and enables seamless collaboration across the distributed teams and agencies. The report from the Esri March 2023 has indicated that Esri India has announced the availability of its Indo ArcGIS on the Indian Public Clouds, along with services at GeoSmart India 2022. This data shows the rising adoption of cloud-based GIS platforms in India, driven by national geospatial digitization initiatives.

Device Segment Analysis

Within the device segment, the mobile device is leading due to the critical requirement for real-time in-field data collection and decision making that bridges the office and the operational site. The key driver is the proliferation of ruggedized tablets and smartphones equipped with high-accuracy GNSS receivers, enabling professionals in utilities, forestry, and public works to capture and validate geospatial data at the source. This is driven by the development of streamlined mobile GIS applications that empower a non-specialist workforce, transforming the field crews into the data-generating nodes for asset management and inspections. The scale of this adoption is evident in the public sector use. The 2023 NOAA Science Report states that 30 teams in the U.S. used a variety of equipment, including the mobile radar, to measure the lightning and the atmosphere within and around storms.

Our in-depth analysis of the geographic information system (GIS) market includes the following segments:

|

Segment |

Subsegments |

|

Component |

|

|

Function |

|

|

Deployment |

|

|

End user Industry |

|

|

Data Type |

|

|

Device |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Geographic Information System Market - Regional Analysis

North America Market Insights

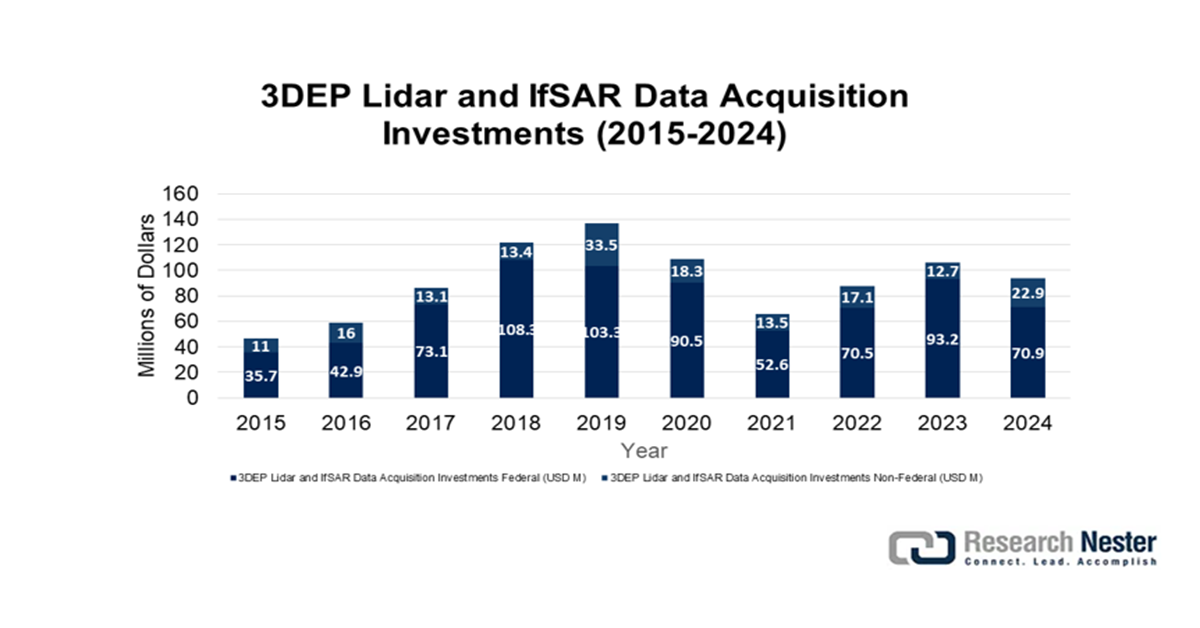

The North America is dominating the geographic information system market and is expected to hold the market share of 38.6% by 2035. The market is driven by the mature adoption, high defense spending, and significant public investment in digital infrastructure. The key drivers include the federal mandates, such as the U.S. Geospatial Data Act, that institutionalize spending and massive multi-year programs, including the USGS 3D Elevation Program. This region leads in adopting cloud platforms, AI/ML analytics, and digital twins for critical infrastructure. In Canada, strong federal and provincial initiatives for resource management and climate adaptation, such as the Flood Hazard Identification and Mapping Program, sustain the demand. The GIS market is defined by the shift from software licensing to scalable analytics-driven SaaS models and integrated solutions for smart cities and national security.

The U.S. is the dominating player in the geographic information systems market in North America and is defined by the institutionalization of geospatial spending and the integration of AI. The Geospatial Data Act mandates cross-agency data coordination, creating a stable and long-term demand. Major investments continue in the foundational data, with the report from the USGS October 2024 stating the 3DEP program received USD 70.9 million for the LiDAR acquisition in 2024 to complete the national elevation coverage, a vital input for flood mapping and infrastructure planning. The dominant trend is the Department of Defense and the Intelligence Community’s Push for AI/ML to automate the analysis of satellite and drone imagery, as highlighted by the National Geospatial-Intelligence Agency's (NGA) Moonshot project for automated feature detection.

Source: USGS October 2024

In Canada, the geographic information system market is driven by the federal-provincial collaborations focused on resource management and climate adaptation. A core trend is the renewal of national topographic data with Natural Resources Canada. The report from the Government of Canada data in May 2024 depicts that Canada’s provincial hydrogen investment initiatives indirectly stimulate the demand for geospatial mapping and infrastructure planning tools. Alberta has committed over USD 50 million to hydrogen technology development by 2023, strengthening government planning requirements for site study, pipeline routing, and environmental monitoring applications that rely significantly on GIS technologies. The GIS market underlines the interoperability and the open data standards to serve these diverse regional and sectoral needs.

APAC Market Insights

Asia Pacific is the fastest-growing geographic information system market and is poised to grow at a CAGR of 12.5% during the forecast period from 2026 to 2035. The market is driven by the massive government investments in the digital infrastructure, smart city development, and national spatial data initiatives. China’s Digital Silk Road and New Infrastructure strategy stimulates the regional demand, heavily funding satellite constellations and geospatial platforms. Further, India’s National Geospatial Policy promotes the ecosystem for startups, while Japan and South Korea are using GIS for precision infrastructure management and disaster resilience. The major trend is the cloud-first adoption and integration of AI with the Earth observation data for agriculture, urbanization monitoring, and environmental compliance. The GIS market is characterized by a blend of large, state-driven projects and a burgeoning private sector serving logistics, retail, and telecommunications.

China’s geographic information system market is a state-driven global leader driven by the massive New Infrastructure investments integrating BeiDou satellite navigation, urban digital twins, and national geospatial data services. The Ministry of Natural Resources mandates the creation of a unified national spatial framework directing procurement for foundational mapping, ecological monitoring, and smart city applications. The demand is heavily concentrated in large-scale public projects. A key statistical indicator is the rapid expansion of China’s civilian remote sensing satellites overseen by the National Administration of Surveying, Mapping, and Geoinformation. According to the People’s Daily Online report in January 2023, China launched over 200 new earth observation satellites, increasing the in-orbit civilian remote sensing fleet, directly fueling the domestic data supply for the government and commercial GIS platforms.

By 2035, India will lead the geographic information system market as it is experiencing explosive growth fueled by the deregulation under the National Geospatial Policy and massive digital public infrastructure projects. The government is the primary catalyst and consumer. The report from the Department of Science and Technology in 2024 has reported that the Annual Land Use Land Cover atlas of India produced by the NRSC-ISRO is using 56-meter resolution satellite data to map and monitor the annual changes in the agriculture, forests, water bodies, and waste lands at the national scale. This includes the cycle from 2022 to 2023 and from 2023 to 2024. Further, this initiative demonstrates an increasing government reliance on GIS-based monitoring and spatial intelligence for policy making and land use planning, thereby contributing to stronger demand for GIS platforms and services at the national and state levels.

Europe Market Insights

Europe is expanding rapidly in the geographic information system market and is driven by the strong regulatory framework cross cross-border environmental initiatives, and significant public investment in digital transformation. The INSPIRE Directive mandates a harmonized spatial data infrastructure across the member states, creating a sustained demand for data standardization and integration services. The key growth drivers include the EU Green Deal, which requires extensive environmental monitoring and reporting, and a major funding program that allocates substantial resources for data spaces and high-performance computing, including geospatial applications. The GIS market is defined by a strong push towards cloud-based platforms, open data policies, and the integration of GIS with IoT and AI for smart city and precision agriculture projects.

Germany is projected to hold the highest revenue share in Europe by 2035 and is driven by industrial digitalization and the federal digital policy. The core driver is the implementation of the Online Access Act that mandates all public services be available online by 2025, requiring massive backend integration of geospatial data for portals related to construction, property, and environmental permits. According to the GTAI 2025 report, the German Federal Statistical Office reported that 85.5% of farms used digital geospatial or precision agriculture technologies in 2022, including GIS-based farm-management, mapping, and digital satellite applications to optimize soil, crop, and livestock operations. Further, the Smart Land strategy in Germany for the rural areas and its leadership in Industry 4.0 creates a demand for GIS in logistics, autonomous systems, and supply chain optimization, supported by strong R&D investments.

The UK will remain a top geographic information system market in Europe due to its mature geospatial economy and strategic government initiatives outside the EU frameworks. The primary growth factor is the UK Geospatial Strategy, overseen by the Geospatial Commission, that aims to drive innovation and improve access to core data. The report from the Government of the UK in March 2022 states that the National Underground Asset Register is building a digital map of underground pipes and cables in the UK to enhance the efficacy and safety, and install, maintain, operate, and repair the buried infrastructure by providing secure access to the data from 600+ public and private sector asset owners. Further, the UK's focus on Digital Twins for national infrastructure, as outlined in the Centre for Digital Built Britain's legacy, continues to stimulate advanced demand for 3D and 4D spatial analytics.

Key Geographic Information System Market Players:

- Esri (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Hexagon AB (Sweden)

- Trimble Inc. (U.S.)

- Autodesk Inc. (U.S.)

- Bentley Systems (U.S.)

- Pitney Bowes (U.S.)

- Maxar Technologies (U.S.)

- TomTom (Netherlands)

- CARTO (Spain)

- SuperMap Software Co., Ltd. (China)

- PASCO Corporation (Japan)

- RMSI (India)

- Genesys International Corporation (India)

- L3Harris Geospatial (U.S.)

- Caliper Corporation (Maptitude) (U.S.)

- Nearmap Ltd. (Australia)

- Samsung SDS (South Korea)

- Aero-Graphics (M) Sdn Bhd (Malaysia)

- QGIS Development Team (Open Source) (International)

- Precisely (U.S.)

- Esri has become a foundational force in the geographic information system market by establishing the ArcGIS platform as an industry standard for spatial analytics. Its technology enables infrastructure firms and environmental agencies to create dynamic data-rich maps for strategic planning, transforming complex geographic data into actionable intelligence for sustainable development and resource management.

- Hexagon AB leverages the geographic information system market to bridge the physical and digital worlds via its sensor and software solutions. By integrating GIS capabilities into its portfolio, the company empowers sectors such as manufacturing, utilities, and public safety with an autonomous connected ecosystem that visualizes and analyzes the real-world conditions for precision and operational efficiency. The company has generated 5.4 billion euros in 2024 as per the annual report.

- Trimble Inc. has uniquely positioned itself within the geographic information system market by focusing on high-precision positioning. Its integration of GIS with GPS, laser, and inertial technologies provides vital field-to-office workflows for agriculture, construction, and surveying, enabling professionals to manage assets and terrain with centimeter-level accuracy in demanding outdoor environments.

- Autodesk Inc. is the leading player and influences the geographic information system market via its design-centric approach, seamlessly embedding GIS context and data into its architecture, engineering, and construction software. This integration allows planners and designers to base their models on real-world geographic and environmental conditions, ensuring that projects from building to cityscapes are conceived with their physical context in mind from the outset. Besides, the company has made USD 6.1 billion in 2025, which is a 12% hike from 2024.

- Bentley Systems advances the geographic information system market specifically for infrastructure engineering, championing the concept of infrastructure digital twins. Its software integrates detailed engineering models with the rich GIS data, enabling owners and operators of roads, railways, and utilities to create dynamic living digital representations of assets for improved resilience performance and lifecycle management.

Here is a list of key players operating in the global GIS market:

The geographic information system (GIS) market is defined by high consolidation with a few dominant players, such as Esri, setting the standard. The competitive landscape is driven by the technological integration of AI, cloud computing, and IoT, shifting the industry toward real-time analytics and platform-as-a-service models. The key strategic initiatives include cloud native deployment, strategic acquisitions to expand the capabilities, and forging partnerships with tech giants for enhanced scalability. For example, in August 2023, Idox acquired Emapsite.com, a UK-based geospatial data specialist. Companies are also focusing on vertical-specific solutions for utilities, smart cities, and defense, while open source platforms and APIs foster developer ecosystems, intensifying innovation and niche competition globally.

Corporate Landscape of the Geographic Information System (GIS) Market:

Recent Developments

- In August 2025, NEC Software Solutions UK has announced that it has expanded the public safety capabilities with the strategic acquisition of Cadcorp. The acquisition enhances the NEC’s capabilities in providing advanced, location-based intelligence to local authorities and public safety organizations across the UK and beyond.

- In April 2024, Avineon has announced the acquisition of the assets held by North Point Geographic Solutions, LLC. The acquisition expands the Avineon’s service offerings and capabilities to help customers derive more value from spatial intelligence.

- Report ID: 8312

- Published Date: Dec 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.