System Integrator Market Outlook:

System Integrator Market size was valued at USD 32.5 billion in 2025 and is projected to reach USD 136.1 billion by the end of 2035, rising at a CAGR of 15.4% during the forecast period, i.e., 2026-2035. In 2026, the industry size of system integrator is estimated at USD 37.5 billion.

The global system integrator market is propelled by substantial public sector investment in digital infrastructure and modernization. The system integrators are vital for every firm to implement and manage AI systems across federal agencies by fusing AI tools with existing IT infrastructure. This fusion ensures data interoperability and maintains cybersecurity compliance. The Authenticated U.S. Government Information data of 2025 reveal that approximately USD 300 million was invested in mandated federal AI spending, opening up new contract opportunities for system integrators to create, deploy, and administer AI-fortified analytics, automation, and risk-assessment solutions in defense and civilian programs.

Similarly, strategic international initiatives are reshaping the demand. The EU4Health programme 2021-2027 depicts that a budget of €5.3 billion for 2021-2027 is allocated for the digitalization of health systems, necessitating the integration of electronic health records and telehealth platforms. This aligns with broader industrial policy that promotes the integration of cyber-physical systems in manufacturing. Further, the foundational need for strong cybersecurity in these connected environments is mandated by various directives, pushing organizations to secure their integrated IT and operational technology landscapes.

Key System Integrator Market Insights Summary:

Regional Highlights:

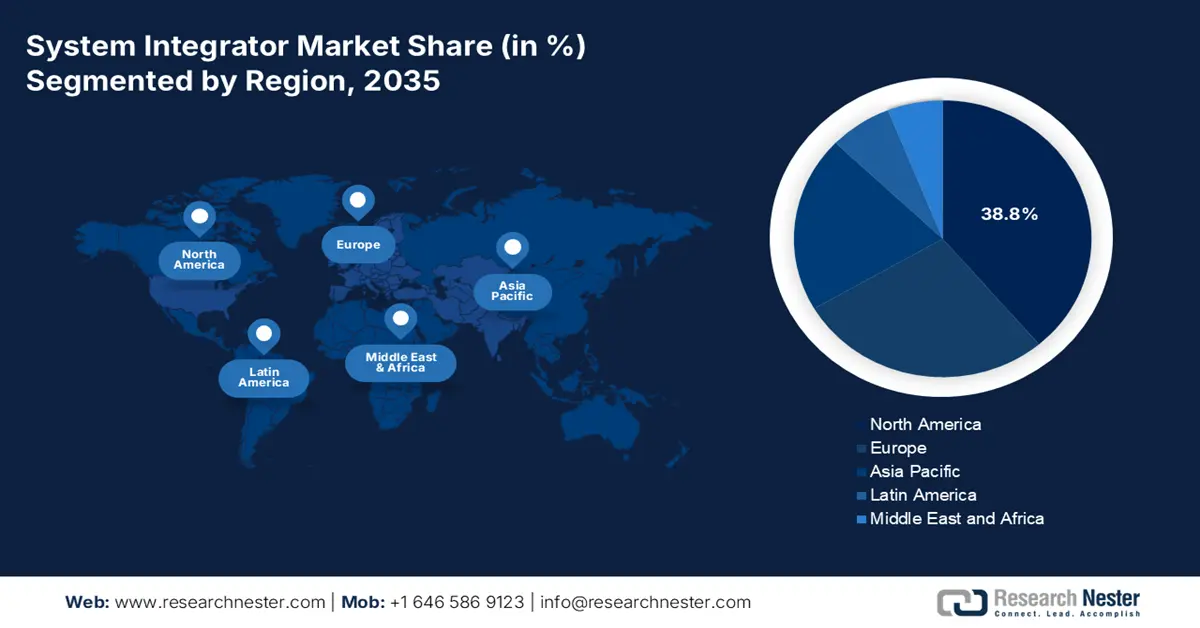

- North America is projected to command a 38.8% share of the system integrator market by 2035, supported by robust digital transformation initiatives across manufacturing, healthcare, and BFSI sectors.

- Asia Pacific is anticipated to record a CAGR of 10.2% from 2026 to 2035, spurred by rapid industrialization and government-backed digitalization programs.

Segment Insights:

- The infrastructure integration segment of the system integrator market is projected to hold a 35.6% share by 2035, fueled by the urgent modernization of legacy systems and the growing need to connect hybrid IT environments.

- The cloud/data center integration segment is anticipated to capture the largest share during 2026–2035, propelled by the widespread adoption of hybrid and multi-cloud strategies.

Key Growth Trends:

- The acceleration of Industry 4.0 and intelligent manufacturing

- Digitalization of healthcare systems

Major Challenges:

- Regulatory compliance and certification barriers

- Cybersecurity and data sovereignty requirements

Key Players: IBM (U.S.), Deloitte (U.S.), PwC (PricewaterhouseCoopers) (U.S.), EY (Ernst & Young) (U.S.), KPMG (U.S.), Cognizant (U.S.), DXC Technology (U.S.), Capgemini (France), Siemens (Germany), ABB (Switzerland/Sweden), Atos (France), Schneider Electric (France), Fujitsu (Japan), South Korea (Japan), Samsung SDS (Japan), Tata Consultancy Services (India), Infosys (India), Wipro (India), Accenture (Australia), SCIVAX (Malaysia).

Global System Integrator Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 32.5 billion

- 2026 Market Size: USD 37.5 billion

- Projected Market Size: USD 136.1 billion by 2035

- Growth Forecasts: 15.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Australia, Mexico

Last updated on : 27 October, 2025

System Integrator Market - Growth Drivers and Challenges

Growth Drivers

- The acceleration of Industry 4.0 and intelligent manufacturing: National strategies such as Made in China 2025 and Germany's Plattform Industrie 4.0 push manufacturing digitization. This creates demand for integrators to implement cyber-physical systems, industrial IoT, and AI-based analytics on the top floor. The actionable insight is the transition from isolated automation to integrated, data-driven production lines. Integrators mainly offer deep domain expertise in some specific manufacturing verticals to connect applications such as robotics, ERP, and supply chain platforms seamlessly.

- Digitalization of healthcare systems: Government initiatives are transforming healthcare infrastructure. The International Trade Administration in September 2023 data provides evidence that the Indian Health Industry reached USD 372 billion, and this number is expected to rise due to the growing demand for digitalized and higher quality healthcare facilities. The focus for digital healthcare is mainly on achieving interoperability to improve patient outcomes and operational efficiency. For example, a complex task requires specialized health tech integration skills.

- Federal IT investment drive: Sustained and growing Civilian Federal IT spending is a powerful, predictable driver for the system integrator market. The Authenticated U.S. Government Information in 2025 depicts that the Budget proposes spending USD 75 billion on IT at civilian agencies in 2025, which are expected to deliver simple, seamless, and secure Government services. For system integrators, this provides a steady stream of big projects to consolidate data centers, move agency workloads to the cloud, and install integrated, secure enterprise platforms in the federal government.

Breakdown of 2025 Civilian Federal IT Spending (by Agency)

|

Agency |

Spending (USD millions) |

% of Total |

|

Department of Homeland Security |

11,116 |

14.8% |

|

Health and Human Services |

9,884 |

13.2% |

|

Treasury |

9,067 |

12.1% |

|

Veterans Affairs |

8,833 |

11.8% |

|

Energy |

5,511 |

7.3% |

|

Justice |

4,446 |

5.9% |

|

Transportation |

4,361 |

5.8% |

|

Others (State, Commerce, SSA, etc.) |

21,910 |

29.1% |

|

Total Civilian IT Spending FY 2025 |

75,128 |

100% |

Source: Authenticated U.S. Government Information data 2025

Challenges

- Regulatory compliance and certification barriers: Governments impose strict certifications for integrated solutions across industries such as healthcare and infrastructure. Navigating divergent international standards, such as FDA rules in the U.S. and the EU's MDR, creates significant delays. Firms spend heavily on specialized legal and compliance units to make their solutions comply with the disparate requirements. This complex, time-consuming process increases development costs and extends the timeline for market entry, acting as a major deterrent for new entrants lacking the resources to manage multi-jurisdictional regulatory landscapes.

- Cybersecurity and data sovereignty requirements: Integrators are seeing increasing requirements for strong cybersecurity and data sovereignty compliance. Directives such as the EU's NIS2 Directive mandate strict security measures, while data residency regulations demand local data processing. Providers need to craft systems with deep threat protection and sophisticated data governance structures to meet these requirements. This requirement adds layers of cost and technical complexity, which complicates in providing cost-efficient solutions while addressing the high-security requirements of public sector customers and purchasers.

System Integrator Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

15.4% |

|

Base Year Market Size (2025) |

USD 32.5 billion |

|

Forecast Year Market Size (2035) |

USD 136.1 billion |

|

Regional Scope |

|

System Integrator Market Segmentation:

Service Segment Analysis

Under the service segment, infrastructure integration is dominating the system integrator market and is expected to hold the share of 35.6% by 2035. The segment is driven by the critical need to modernize legacy systems and connect hybrid IT environments. The demand for smart infrastructure is aided by initiatives such as the U.S. Bipartisan Infrastructure Law, funds requires the integration of physical operational technology (OT) with the IT network. As per the CAIA data in January 2024, Cambridge estimates the smart infrastructure investment opportunity is expected to rise from USD 2.6tn to USD 6.2tn by 2025, globally. These investments are essential for efficiency and resilience in various sectors.

Operation Segment Analysis

The cloud/data center integration is poised to account for the largest system integrator market share during the forecast period 2026-2035. The segment is propelled by the mass migration of hybrid and multi-cloud strategies. The SQ Magazine report in July 2025 depicts that 94% of enterprises are using cloud services in 2025 to ensure data portability, workload optimization, and cost management. The Cybersecurity and Infrastructure Security Agency highlights the security challenges in hybrid environments, hence driving the demand for integrators to implement secure, compliant architectures in complex and distributed systems.

Industry Segment Analysis

IT & Telecom is the leading consumer of integration services with the deployment of 5G and network virtualization. The shift toward software-defined networks (SDN) and network function virtualization (NFV) involves integrating new virtualized elements into existing telecom infrastructure. The 5G connections are expected to contribute 36.4 trillion to India's economy, according to the PIB data of November 2024, which will require huge integration projects to develop the network core and enable new Internet of Things (IoT) and edge computing services.

Our in-depth analysis of the system integrator market includes the following segments:

|

Segment |

Subsegments |

|

Service |

|

|

Technology |

|

|

Operation |

|

|

Industry |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

System Integrator Market - Regional Analysis

North America Market Insights

North America is dominating the system integrator market and is expected to hold a share of 38.8% by 2035. The market is led U.S. and Canada. The region is driven based on the robust digital transformation initiatives across manufacturing, healthcare, and BFSI. As per the Bosch news report in 2025, Climatec, LLC, a subsidiary of Robert Bosch in North America, has acquired Engineered Control Solutions (ECS), which is a leading building automation solutions provider and system integrator with offices in North and South Carolina. Some key trends are the integration of IoT and AI into industrial automation, that is surged by cloud adoption and strong cybersecurity needs.

The advanced manufacturing and clean energy technology drive the U.S. system integrator market. The primary trend is outlined by the modernization of infrastructure by the Cybersecurity and Infrastructure Security Agency, by using operational technology via integrated cybersecurity solutions. As per the Authenticated U.S. Government Information data in 2025, the trends in federal civilian IT spending in 2022 accounted for USD 65,075, highlighting the growing reliance on system integrators to improve the interoperability, automation, and security in federal and industrial digital ecosystems.

Federal Civilian IT Spending

|

Year |

Spending (USD) |

|

2023 |

65,833 |

|

2024 |

74,455 |

|

2025 |

75,128 |

Source: Authenticated U.S. Government Information data 2025

National digital economy and resource sector innovation strategies structure Canada market. The government's 2030 Emissions Reduction Plan is driving demand in the oil and gas sector through the integration of sophisticated clean technology and surveillance systems. The Canadian Manufacturing Technology Show in September 2025 statistics illustrate that USD 700 billion is being invested towards Advanced Manufacturing, Digital Technology, and Scale AI clusters facilitate the adoption of smart technology, underline the need for system integrator services, and fuel industrial automation for advanced manufacturing.

APAC Market Insights

Asia Pacific is the fastest-growing region in the system integrator market and is poised to hold a CAGR of 10.2% during the forecast period 2026 to 2035. The region is fueled by rapid industrialization, government-led digitalization initiatives, and massive manufacturing sectors. According to the IFR data in 2023, Asia is the largest industrial robot market and has installed more than 404,578 units of robots in the industrial sector, which is a rise of 5% from 2021. This highlights the demand for integrating advanced technologies into the existing system to increase the productivity.

China is leading the market in APAC and is driven by the Made in China 2025 initiatives that aggressively promote smart manufacturing. As per the New Era of Chinese Manufacturing report in June 2024, China’s manufacturing sector, contributed 31.7% of GDP in 2023. The sector is diversified in automation, electronics, and smart factory technologies. System integrators are significant in designing, implementing, and managing these integrated manufacturing systems, including robotics, IoT, AI, and cybersecurity solutions.

Japan's system integrator market is characterized by its industrial robotics leadership and strategic use of AI to address the aging population. The IFR data in March 2022 depicts that Japan is the largest robot market in the world by delivering 45% of the global supply chain, primarily to the electronics and automotive sectors. System integrators play a key role in implementing high-end automation cells and cognitive technologies in factories to keep Japan competitive in high-precision manufacturing. These data highlight the increased dependence on system integrators to provide interoperability across the systems, streamline production processes, and provide predictive maintenance solutions within Japan's manufacturing ecosystem.

Europe Market Insights

The system integrator market in Europe is defined by a strong transition towards Industry 4.0. The growth is driven by the requirement to upgrade manufacturing infrastructure, improve supply chain resilience, and meet the strict European Green Deal. Key trends include the integration of AI and IoT in smart factories and the strategic shift to cloud-edge hybrid environments for data processing. The market is extremely collaborative, with system integrators playing a key role in guiding the business in managing complex digital and regulatory transformations, mainly in sectors such as automation, pharmaceutical, and energy.

Germany is Europe’s largest manufacturing economy, and the system integrator market is massive, centered on Industrie 4.0. The market mainly demands for integration of robotics, AI, and IoT on factory floors. As per the Digital Strategy 2025 data, Germany’s GDP rose €82 billion in digital technologies as German companies aggressively integrate advanced technologies in the area of industrial production. The German government’s High-Tech Strategy 2025 allocates billions towards digitalization, with a substantial portion flowing through system integration projects to maintain global industrial competitiveness.

France market is defined by the government-led initiative that aims to reindustrialize the nation. The key demand is the health sector, which is supported by the EU funding. The key drivers are government led programs that are promoting the digital transformation of traditional industries and the development of sustainable and smart infrastructure. The demand is mainly focused on sectors such as aerospace, energy, and healthcare. These sectors are essential for integrators deploying complex IoT, AI and cloud solutions to improve the competitiveness and address the ambitious national goals for digitized economy.

Key System Integrator Market Players:

- Accenture (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- IBM (U.S.)

- Deloitte (U.S.)

- PwC (PricewaterhouseCoopers) (U.S.)

- EY (Ernst & Young) (U.S.)

- KPMG (U.S.)

- Cognizant (U.S.)

- DXC Technology (U.S.)

- Capgemini (France)

- Siemens (Germany)

- ABB (Switzerland/Sweden)

- Atos (France)

- Schneider Electric (France)

- Fujitsu (Japan)

- South Korea (Japan)

- Samsung SDS (Japan)

- Tata Consultancy Services (India)

- Infosys (India)

- Wipro (India)

- Accenture (Australia)

- SCIVAX (Malaysia)

- Accenture is a dominant player in the market and specializes in large-scale, cloud-first transformation programs. Their focus is mainly focused in creating industry-specific platforms and acquiring specialist firms to integrate advanced technology solutions such as AI and data analytics into cohesive digital cores for clients. The company has made 46 acquisitions in 2024 by investing USD 6.6 billion for business growth.

- IBM uses its deep expertise in hybrid cloud and enterprise software to carve a unique place in the system integrator market. The company is highly focused on Red Hat OpenShift and AI-powered automation. Further, the company integrates complex, mission-critical workloads across on-premises and multi-cloud environments, aiding clients in modernizing legacy systems and scaling a strong digital foundation.

- Deloitte competes in the market by fusing its formidable consulting prowess with technical implementation services. Their strategy focuses on cloud ecosystem alliances and industry-specific solutions, mainly in ERP and CRM platforms. The company integrates business processes with technology stacks to drive operational transformation and data driven decision making for global enterprises.

- PWC addresses the market through the lens of risk assurance and business value. Their strategic initiatives focus on helping clients navigate digital transformation by integrating complex systems while managing cybersecurity, data governance, and regulatory compliance. This approach makes sure that the technological ecosystem is efficient, secure, and resilient. The company has invested USD 1.5 billion in AI to explore new opportunities.

- EY (Ernst & Young) positions itself in the system integrator market and focuses on transformative business and technology integration, mainly in the wake of merges and acquisitions. Their strategic initiatives include building integrated cloud finance and supply chain platforms, aiding clients achieve enterprise connectivity and automation while ensuring tax and regulatory compliance is embedded within the new system architecture.

Here is a list of key players operating in the global market:

The system integrator market is dominated by well-established IT consulting and engineering players, impacting a competitive landscape that focuses on digital transformation, Industry 4.0, and cloud adoption. The top players are pursuing strategic initiatives, including mergers and acquisitions to fill the gaps, forming strategic partnerships with cloud hyperscalers, and developing industry-focused solutions to expand the services further. One such example is in July 2025, STMicroelectronics, to strengthen its position in sensors has acquired NXP’s MEMS sensors business. The purchase price of this acquisition is USD 950 million in cash.

Corporate Landscape of the System Integrator Market:

Recent Developments

- In August 2025, RMH Systems has acquired Complete Solution Robotics to expand in-house engineering expertise, strengthens its regional footprint in the Mountain West, and advances its position as a full-service systems integrator.

- In July 2025, Accenture acquires Systema in Germany to strengthen semiconductor and high-tech manufacturing integration capabilities. Further, the employees of Systema will join Accenture’s Industry X practice.

- In July 2025, Comau has completed its acquisition of Automha, which is an Italian company specializing in warehousing and automated intralogistics systems. With this acquisition the company will develop intelligent, high-performance automated storage and retrieval handling systems that can optimize efficiency and reliability across diverse industries.

- Report ID: 8193

- Published Date: Oct 27, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

System Integrator Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.