Bitcoin Payments Ecosystem Market Outlook:

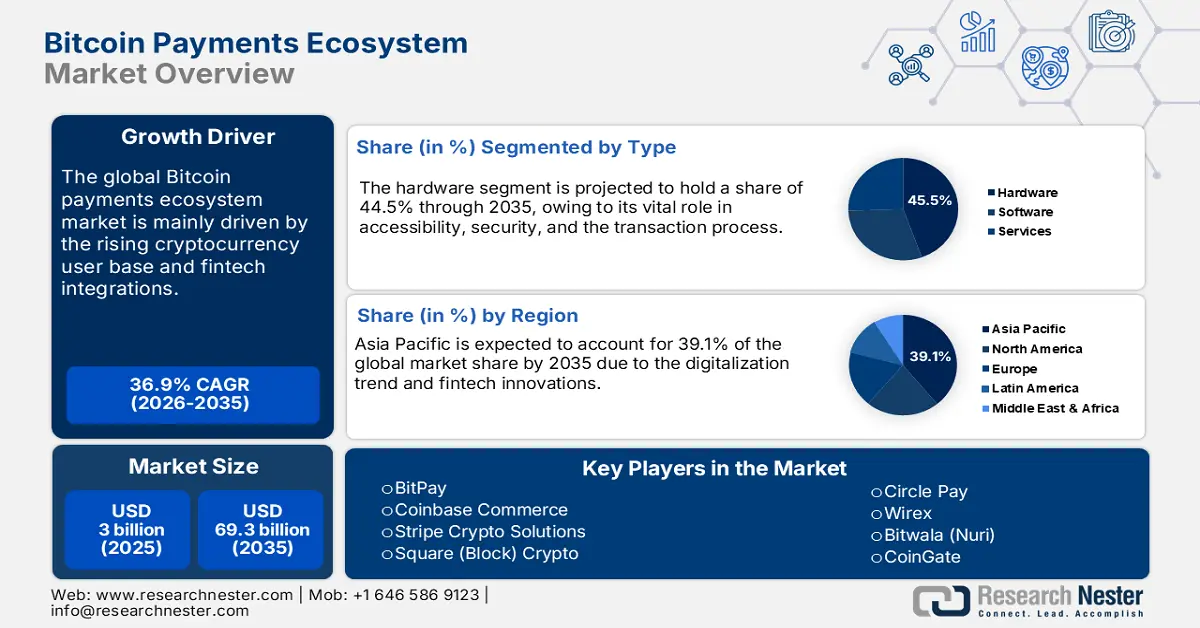

Bitcoin Payments Ecosystem Market size was USD 3 billion in 2025 and is estimated to reach USD 69.3 billion by the end of 2035, expanding at a CAGR of 36.9% during the forecast period, i.e., 2026-2035. In 2026, the industry size of bitcoin payments ecosystem is assessed at USD 4.1 billion.

The micropayments concept, largely enabled by the Lightning Network, is emerging as the key booster for bitcoin sales, owing to its layer-2 upgrades enabling super-fast, low-cost transactions, even for tiny amounts as small as a few satoshis. This opens up new ways for digital creators, apps, and smart device service providers to earn money. According to the LouBitDevs Org report over the years, the average amount of bitcoin handled by the Lightning Network has increased by 118%, while the average number of connections (channels) per user has dropped by 30%. This change shows the network is becoming more efficient, letting people move larger amounts of money with fewer connections. It also points to users' growing confidence in the network's reliability and better grasp of its advantages. Overall, the Lighting Network is a boon to key players in the bitcoin payments ecosystem market.

Key Bitcoin Payment Ecosystem Market Insights Summary:

Regional Insights:

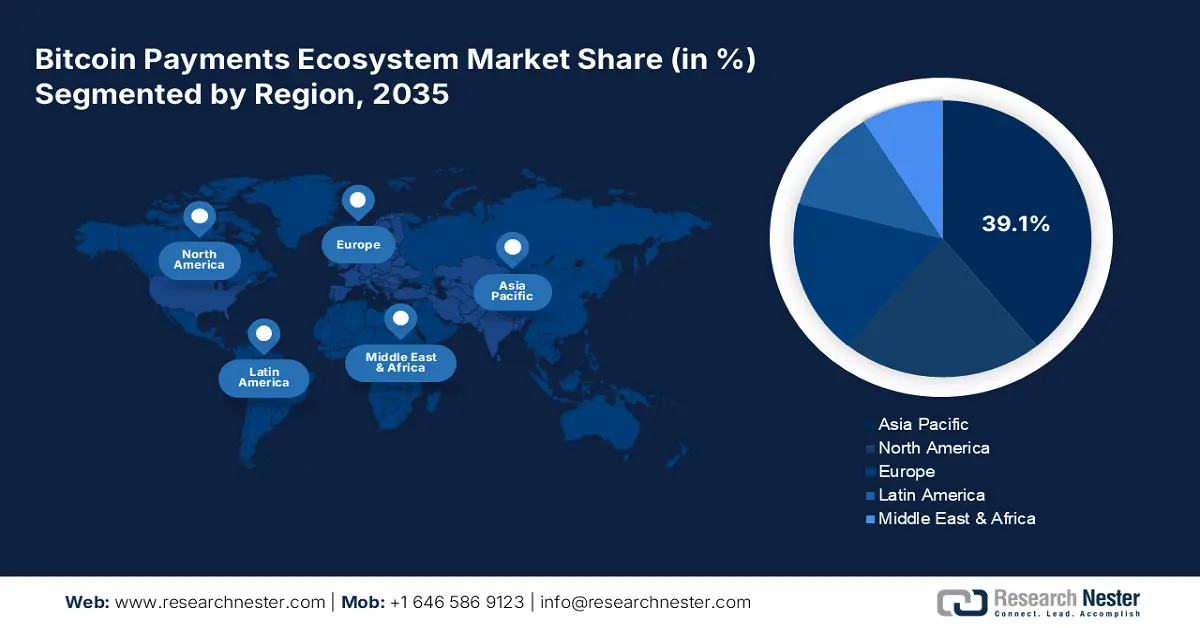

- The APAC Bitcoin Payments Ecosystem Market is projected to command a 39.1% global revenue share through 2035, driven by rapid digitalization, fintech innovations, and growing e-commerce adoption.

- The North America region is anticipated to secure the second-largest revenue share by 2035, supported by advanced fintech infrastructure, rising digital adoption, and expanding cross-border trade.

Segment Insights:

- The hardware segment is projected to hold a 44.5% share of the Bitcoin Payments Ecosystem Market by 2035, propelled by its crucial function in ensuring accessibility, security, and smooth transaction processing.

- The trading marketplaces segment is anticipated to capture 25.9% of the global market share by 2035, owing to its key role in facilitating liquidity, efficient price discovery, and global cross-border transactions.

Key Growth Trends:

- Growing crypto consumer base

- Enterprise partnerships

Key Growth Trends:

- Regulatory fragmentation

- Stablecoin competition

Key Players: BitPay, Coinbase Commerce, Stripe Crypto Solutions, Square (Block) Crypto, Circle Pay, Wirex, Bitwala (Nuri), CoinGate, AnyPay, Coingate, GMO Coin, bitFlyer, SBI VC Trade, Rakuten Wallet, FISCO Cryptocurrency Exchange, CoinSpot, Upbit, Koinex, ZebPay, Luno.

Global Bitcoin Payment Ecosystem Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3 billion

- 2026 Market Size: USD 4.1 billion

- Projected Market Size: USD 69.3 billion by 2035

- Growth Forecasts: 36.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: APAC (39.1% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: India, Singapore, South Korea, Australia, Canada

Last updated on : 7 October, 2025

Bitcoin Payments Ecosystem Market - Growth Drivers and Challenges

Growth Drivers

- Growing crypto consumer base: The expanding global crypto user base is one of the key drivers for the sales of bitcoin payment solutions. A report from Security Org reveals that the number of Americans owning cryptocurrencies has nearly doubled in the three years since late 2021. In 2025, about 28% of American adults, or roughly 65 million people, own some kind of cryptocurrency. A growing number of tech-savvy shoppers, plus changes in online buying and gaming, are increasing the need for bitcoin payment options. Furthermore, younger groups, particularly Millennials and Gen-Z, are expected to become the main bitcoin buyers in the coming years, contributing to the market growth.

- Enterprise partnerships: The strategic partnerships between banks, card networks, and crypto infrastructure providers are transforming the bitcoin payments market growth. The large financial enterprises exploring BTC rails as a settlement layer for faster, borderless transactions are also contributing to the bitcoin payment solution sales growth. The enterprise partnerships, being scalable, regulated, and commercially viable solutions, further attract potential investments in the market.

- Fintech integrations: The fintech integrations are a big reason why more merchants are adopting Bitcoin, as they make it easier to use and help reach a wider audience. The e-commerce companies such as Shopify, WooCommerce, Magento, and BigCommerce support BTC payments through third-party payment processors. These fintech connections open up chances for joint promotions and loyalty rewards, letting stores give customers cryptocurrencies as prizes. Linking cryptocurrency systems to millions of online shops worldwide is set to drive overall market growth.

Challenges

- Regulatory fragmentation: The complex regulatory environment is expected to hamper the Bitcoin payments ecosystem in some regions. The divergent rules on anti-money laundering (AML), know-your-customer (KYC), and others create a compliance overhear for merchants and financial institutions. Thus, both the complexity and compliance costs are major factors hindering the Bitcoin payments ecosystem market growth.

- Stablecoin competition: Bitcoin as a payment medium often faces competition from stablecoins such as USDT (Tether) and USDC (Circle). The prime factors that make these coins dominant in the market are their price stability. This stability makes them a great choice for everyday shopping, small online payments, and sending money abroad. Thus, the strong presence of competitors is likely to lower the adoption of Bitcoin to some extent.

Bitcoin Payments Ecosystem Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

36.9% |

|

Base Year Market Size (2025) |

USD 3 billion |

|

Forecast Year Market Size (2035) |

USD 69.3 billion |

|

Regional Scope |

|

Bitcoin Payments Ecosystem Market Segmentation:

Type Segment Analysis

The hardware segment is projected to capture 44.5% of the global market share throughout the forecast period. The prime factors making hardware the dominant type are its vital role in accessibility, security, and the transaction process. The devices in this market enable seamless acceptance of BTC and other cryptocurrencies in retail and e-commerce, which drives a high demand for specialized hardware components. The continuous technological advancements are also poised to propel the demand for enhanced hardware parts.

Application Segment Analysis

The trading marketplaces segment is anticipated to account for 25.9% of the global Bitcoin payments ecosystem market share by 2035. The prime factors aiding trading marketplaces to dominate the application area are their central role in liquidity provision, price finding, and transaction. Trading marketplaces are also important for the commercialization of Bitcoins for both customers and merchants, which contributes to the segmental growth. Additionally, trading marketplaces foster global participation, enabling cross-border transactions.

End user Segment Analysis

The enterprises segment is expected to hold the largest market share throughout the study period, due to its scale and vast transaction volume. The ability to leverage Bitcoin for both operational and strategic advantages also increases its application in the enterprise sector. The large companies are widely integrating Bitcoin acceptance into their payment infrastructure, contributing to high trade opportunities. The International Monetary Fund's (IMF) 2023 report disclosed that private companies such as Stone Ridge Holdings Group own 10,000 Bitcoins, while Massachusetts Mutual owns 3,500 Bitcoins. The growth of online shopping is expected to build a stronger setup for using Bitcoin as a way to pay.

|

U.S. Firms Crypto Asset Holdings |

||

|

Top 10 Public Companies |

Bitcoin |

Value (end 2023 Q3 prices) |

|

MicroStrategy |

158,245 |

$4,259,466,423 |

|

Robinhood Markets, Inc. |

118,300 |

$3,184,270,453 |

|

Gemini |

118,000 |

$3,176,195,380 |

|

Marathon Digital Holdings Inc |

13,726 |

$369,461,507 |

|

Tesla, Inc. |

10,725 |

$288,683,860 |

|

Coinbase Global, Inc. |

9,000 |

$242,252,190 |

|

Galaxy Digital Holdings |

8,100 |

$218,026,971 |

|

Block, Inc. |

8,027 |

$216,062,037 |

|

Riot Platforms, Inc. |

7,327 |

$197,220,200 |

|

CleanSpark Inc |

2,240 |

$60,293,878 |

Source: IMF

Our in-depth analysis of the Bitcoin payments ecosystem market includes the following segments:

|

Segment |

Subsegments |

|

Type |

|

|

Application |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Bitcoin Payments Ecosystem Market - Regional Analysis

APAC Market Insights

The APAC Bitcoin payments ecosystem market is estimated to account for 39.1% of the global revenue share through 2035, owing to the digitalization trend and fintech innovations. Japan, South Korea, Singapore, and Australia are key marketplaces for Bitcoin payment solution providers. In these countries, enterprises are leading adopters of Bitcoin payments. Also, the proliferation of e-commerce platforms and wallet providers is accelerating the demand for Bitcoin payment platforms. Further, the cross-border remittances and micropayments are anticipated to drive the overall market growth.

Japan is anticipated to hold a dominant market share during the study period, owing to clear regulatory frameworks and early adoption of cryptocurrency by both enterprises and consumers. The Financial Services Agency (FSA) regulates exchanges and custodial wallets and encourages enterprise integration. The e-commerce, retail, and digital services are the leading adopters of Bitcoin payment solutions. According to the International Monetary Fund (IMF) report, Japan’s share of cashless payments grew from 21.3% in 2017 to 36% by the end of 2022. The same source also notes that it ranks in the top 20 countries worldwide for cryptocurrency adoption, coming in 18th, behind other G7 economies such as the U.S. (4th) and the U.K. (14th), but ahead of Canada (19th). Thus, investing in the country is likely to offer lucrative gains.

The South Korea bitcoin payments ecosystem market is estimated to be driven by its tech-savvy population. The advanced digital payment systems and supportive government policies are opening up big profit opportunities for leading companies. Businesses in the country are investing in these tools for international transfers and payments between companies. The young population is eagerly using cryptocurrency payments and mobile wallets, which is set to fuel the market's growth in the coming years.

North America Market Insights

The North America bitcoin payments ecosystem market is expected to capture the second-largest revenue share throughout the study period. The advanced fintech infrastructure and high digital adoption are propelling the sales of Bitcoin payment solutions. The booming e-commerce trade is expected to fuel the revenue streams of key players in the years ahead. The robust cross-border trade activities are also prime reasons for the commercialization of Bitcoin payment technologies.

The U.S. leads the North America market owing to the strong presence of tech-savvy consumers and industry giants. The robust fintech infrastructure and a favorable regulatory environment are also amplifying the sales of Bitcoin payment solutions. According to the Federal Reserve Bank of St. Louis, the daily, 7-day frequency of the Coinbase Bitcoin stood at USD 120,514.09 on the second of October 2025. The dominant enterprise base is contributing to the overall market growth.

The Canada bitcoin payments ecosystem market is expected to increase at a healthy pace from 2026 to 2035. The progressive fintech sector and regulatory support are likely to fuel the adoption of Bitcoin payment solutions. The integration of Bitcoin into e-commerce and retail platforms is projected to fuel the ecosystem in the country. According to the Exchange Rates report, the Average exchange rate in 2025 of Bitcoin was USD 104,358.16. The positive exchange rates indicate that the customers and merchants of the country are playing a vital role in expanding the market growth.

Europe Market Insights

The Europe bitcoin payments ecosystem market is foreseen to increase at the fastest pace from 2026 to 2035. The swift digital shift in both public and private sectors is increasing Bitcoin's popularity. The fintech infrastructure and regulatory changes are poised to fuel the trade of Bitcoin payment platforms. The expanding e-commerce trade and evolving stock market are also estimated to drive investments in the Bitcoin exchange solutions. Germany and the U.K. are likely to lead the Europe market growth.

The Germany bitcoin payments ecosystem market is fueled by the rising consumer interest and fintech innovation. In March 2023, the World Economic Forum (WEF) revealed that nearly 18% of the country’s population has invested in cryptocurrency. The supportive government policies and easy exchange medium are accelerating Bitcoin's popularity. The strong presence of tech giants is expected to drive innovation in the Bitcoin payment platforms.

The digitalization trend in the fintech industry and regulatory guidance are expected to increase Bitcoin trading in the U.K. The high interest by merchants and enterprises is fueling the adoption of Bitcoin payment solutions. Furthermore, the country’s well-established payments infrastructure and the digital-first populations, who are comfortable using digital wallets, are contributing to the U.K. Bitcoin payments ecosystem market growth.

Key Bitcoin Payments Ecosystem Market Players:

- BitPay

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Coinbase Commerce

- Stripe Crypto Solutions

- Square (Block) Crypto

- Circle Pay

- Wirex

- Bitwala (Nuri)

- CoinGate

- AnyPay

- Coingate

- GMO Coin

- bitFlyer

- SBI VC Trade

- Rakuten Wallet

- FISCO Cryptocurrency Exchange

- CoinSpot

- Upbit

- Koinex

- ZebPay

- Luno

The Bitcoin payments ecosystem market is highly competitive and dominated by industry players headquartered in developing countries. The key players are focused on strategic partnerships with other players and fintech companies to expand their revenue share and reach. The leading companies are also employing both organic and inorganic marketing strategies to earn lucrative shares. Technological innovations, regional expansion, mergers & acquisitions are some of the leading tactics aiding companies to boost their market position in the global landscape.

Here is a list of key players operating in the global market:

Recent Developments

- In July 2025, PayPal announced it is making international sales easier for merchants by linking cryptocurrencies, digital wallets, and sellers around the world, while cutting transaction fees by up to 90%. Their Pay with Crypto feature connects businesses to a market worth over USD 3 trillion by letting customers pay instantly in crypto, which PayPal converts right away to stablecoins or regular money.

- In May 2025, Block, Inc. announced plans to add Bitcoin payments to its Square system, a big step toward making Bitcoin easier for everyone to use and accept. The feature was set to be on display at the Bitcoin 2025 event in Las Vegas from May 27 to 29, where visitors can try it out in person at the BTC Inc. booth.

- Report ID: 8171

- Published Date: Oct 07, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Bitcoin Payment Ecosystem Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.