Mobile Payment Market Outlook:

Mobile Payment Market size was valued at USD 120.1 billion in 2025 and is projected to reach USD 2 trillion by the end of 2035, rising at a CAGR of 36.7% during the forecast period, i.e., 2026-2035. In 2026, the industry size of mobile payment is evaluated at USD 164.1 billion.

Driven primarily by the proliferation of smartphones, high-speed mobile internet, and the increasing demand for convenient, contactless and secure payment options, mobile payments have become a mainstream alternative to traditional cash and card methods, with diverse technologies such as mobile wallets, QR codes, NFC-enabled contactless payments, and in-app payments forming the core of this ecosystem. Key growth drivers include the rise of e-commerce, contactless transactions, and digital wallets embedded within other apps that combine payments, banking, and lifestyle services. Moreover, innovations like peer-to-peer transfers, cross-border mobile payments, and loyalty program integrations are becoming critical competitive features for providers seeking to attract and retain users.

Secured payment method incorporation is another boosting factor for the market. In December 2024, VISA announced the acquisition of real-time artificial intelligence (AI) payments protection technology developer, Featurespace, to boost the capabilities of its fraud protection and improve security for its worldwide users. Ongoing trends include integration with digital banking, biometric authentication, and enhanced security measures to protect against fraud, which together are encouraging consumers to adopt mobile payment solutions more frequently for both in-store and online transactions. In November 2023, NatWest and IBM announced a collaboration to enhance NatWest’s virtual assistant, Cora, by integrating generative AI capabilities using IBM’s enterprise AI platform, watsonx. Cora+ is designed to provide customers with natural, personalised responses to complex queries and access information from multiple secure sources that were previously unavailable via the chat service and aims to improve the digital banking experience by making interactions more intuitive and human-like. As more innovations are made by major players of the market and regions pursue cashless initiatives and supportive regulatory frameworks, mobile payments are set to become even more integral to global commerce and everyday financial interactions.

Key Mobile Payment Market Insights Summary:

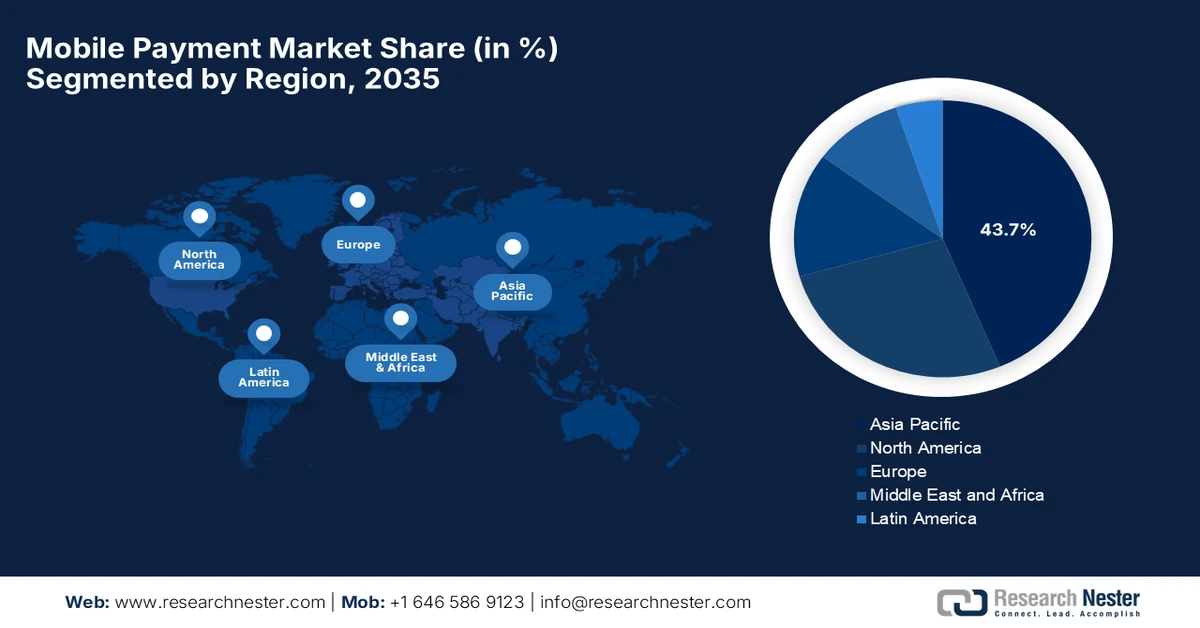

Regional Highlights:

- Asia Pacific is forecast to command around 43.7% share by 2035 in the mobile payment market, reflecting strong regional leadership shaped by rapid digitalization, rising smartphone adoption, supportive government initiatives, and expanding digital payment infrastructure reinforced by accelerating shift toward cashless transactions.

- North America is expected to capture a considerable share during the 2026–2035 period, supported by advanced banking systems, high smartphone and internet penetration, and widespread adoption of digital wallets and loyalty-linked payment solutions strengthened by favorable regulatory frameworks and consumer convenience preferences.

Segment Insights:

- NFC is projected to account for approximately 43.3% share by 2035 in the mobile payment market, highlighting its dominance across smartphones and terminals through secure and rapid transactions stimulated by surging demand for contactless payment experiences.

- Proximity payment is anticipated to secure a considerable share by 2035, as tap-and-pay and QR-based models simplify daily purchases and reduce reliance on cash or cards enabled by expanding smartphone usage and growing acceptance of contactless technologies.

Key Growth Trends:

- Growth of e-commerce

- Consumer demand for convenience

Major Challenges:

- Security & privacy risks

- Technical & user adoption issues

Key Players: Apple Pay, Google Pay, Samsung Pay, PayPal Holdings Inc., Visa Inc., Mastercard Inc., Alipay, WeChat Pay, Amazon Pay, American Express Co., Stripe, Inc., Square, Inc., Zelle, Venmo, Paytm, M-Pesa, Huawei Pay, KakaoPay Corp., MoneyGram International Inc., Fidelity National Information Services (FIS), Inc..

Global Mobile Payment Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 120.1 billion

- 2026 Market Size: USD 164.1 billion

- Projected Market Size: USD 2 trillion by 2035

- Growth Forecasts: 36.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (43.7% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, South Korea, United Kingdom

- Emerging Countries: India, Brazil, Indonesia, Mexico, Vietnam

Last updated on : 28 January, 2026

Mobile Payment Market - Growth Drivers and Challenges

Growth Drivers

- Growth of e-commerce: Consumers prefer payment options that are small-screen friendly, require minimal typing, and offer one-click or biometric authentication. Mobile payments such as digital wallets, UPI, QR payments, and in-app payments reduce the trouble by eliminating the need to enter card details repeatedly. Marketplaces, food delivery apps, ride-hailing platforms, and subscription services incorporate mobile payments directly into their apps, making payments easier for the user. The IBEF in August 2025 stated that India's e-commerce sector achieved a GMV of approximately USD 14 billion, reflecting a 12% YoY growth in FY 2025. Mobile payments simplify purchases of digital content, gaming, streaming, and cross-border e-commerce by handling currency conversion and local payment preferences.

- Consumer demand for convenience: According to the PIB, in July 2025, India was recorded as the global leader in terms of fast payments, with ₹24.03 lakh crore processed via 18.39 billion UPI transactions in June 2025. Mobile payments allow users to pay on the go, whether in a store, online, or peer-to-peer, without having the need to carry cash or physical cards. Biometric authentication, saved credentials, and tap-to-pay have reduced the time and effort required to complete a transaction. Urbanization, busy schedules, and the gig economy favor quick transactions, especially for small-value, high-frequency payments like transport, food, and retail. Convenience-driven behavior accelerates habitual use of mobile payments, turning them from an alternative payment method into a default choice.

- Innovation & emerging technologies: New technologies are making the payment process faster, cheaper, and easier. Blockchain and digital currencies offer quicker global transactions at a comparatively lower cost, especially in places that are limited to using traditional banking methods. Advanced data tools help detect fraud, assess risk, and offer more relevant services, making payments safer and more personalized. Payments are made automatically through connected devices. Wearable devices such as including smartwatches and fitness bands also allow people to pay without using a phone, making everyday transactions quicker and more convenient.

Challenges

- Security & privacy risks: With the rise of mobile payment usage, the number of fraud and identity theft cases has also multiplied. Phishing and malware are two significant issues registered in terms of this. Moreover, mobile wallets store sensitive data, both financial and personal, making them good targets for cyberattacks. This collection and sharing of user data without transparency has also, in many cases, led to a reduction in user trust. Data breaches and hacking, and device loss or theft, are two more factors challenging the market in terms of security. The PIB in October 2025 stated that cybersecurity incidents in India rose from 10.29 lakh in 2022 to 22.68 lakh in 2024. Adhering to data protection laws is complex and expensive, creating a challenge for market players to expand or gain profit.

- Technical & user adoption issues: Lack of interoperability limits the mobile payment market growth as mobile payment platforms do not work across all banks, devices, or merchants. Factors such as poor internet connectivity, fear or fraud and misuse, high setup costs and transaction fees for the merchants, also limit the market expansion. Device compatibility is another drawback, as old keypad phones or older versions of smartphones, used mostly in rural areas or by the geriatric population, do not support such apps. The geriatric population, or the less tech-savvy users, further faces difficulty in setting up the platforms, discouraging usage.

Mobile Payment Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

36.7% |

|

Base Year Market Size (2025) |

USD 120.1 billion |

|

Forecast Year Market Size (2035) |

USD 2 trillion |

|

Regional Scope |

|

Mobile Payment Market Segmentation:

Technology Segment Analysis

NFC holds the largest share within the technology category, accounting for approximately 43.3% of the global mobile payment technology market in 2035. Its wide use in smartphones, payment terminals, and contactless cards allows quick and safe transactions, making it a popular choice for everyday shopping. Growing demand for contactless payments, has accelerated NFC usage further. In May 2025, Samsung Wallet launched Samsung Tap to Transfer and became the first to partner and deploy Visa’s Tap To P2P. NFC remains the preferred technology for seamless mobile payments. NFC remains the preferred technology for seamless mobile payments. Strong security features like encryption also help reduce the risk of fraud in NFC, making it highly demanding among the public.

Payment Type Segment Analysis

Proximity payment is expected to garner a considerable share by 2035 in the mobile payment market, as the process is fast, easy, and convenient for everyday purchases. It allows users to tap and pay or scan a QR code through their mobiles near a payment terminal. The reduced need to carry cash or cards makes it more preferable to the customers, and is considered safer and more hygienic. The growing use of smartphones and smart devices is supporting this trend. Contactless payment methods such as NFC and QR codes are becoming more common in stores. Businesses are benefiting from quicker and two-way payment methods, providing a better customer experience. Banks and payment companies are further driving growth through their integration with their systems and new launches.

Industry Vertical Segment Analysis

The retail and e-commerce segment is anticipated to register a significant market share during the forecast period. This growth is driven by the rising number of online shoppers and the increasing use of smartphones. E-commerce in general is one of the booming industries globally. According to the International Trade Administration’s 2024 eCommerce Size & Sales Forecast, B2B businesses’ worldwide e-commerce market is valued at USD 36 trillion by the end of 2026, and expand at a 14.4% CAGR in 2027. Retailers and e-commerce platforms are adopting digital wallets and contactless payment options to improve customer experience. Secure payment technologies are building trust among consumers. Small and large retailers alike are integrating mobile payment systems. Offers, cashbacks, and loyalty programs linked to mobile payments in the e-commerce sector further encourage usage.

Our in-depth analysis of the mobile payment market includes the following segments:

|

Segment |

Subsegments |

|

Payment Type |

|

|

Technology |

|

|

Payment Mode |

|

|

Operating System |

|

|

Industry Vertical |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Mobile Payment Market - Regional Analysis

APAC Market Insights

Asia Pacific is projected to dominate in 2035 with 43.7% market share, driven by rapid digitalization, increasing smartphone penetration, and strong support from governments and financial institutions. High-speed uninterrupted internet, and developing infrastructure is further boosting the market’s growth in APAC. For instance, according to PIB in July 2025, Unified Payments Interface (UPI) powers 85% of India’s digital payments, with more than 640 million transactions daily, ahead of Visa. The region has a large population that is quickly adopting cashless payment methods. Rising e-commerce activity and widespread use of digital wallets are also supporting market growth across the region.

The mobile payments ecosystem in India has grown extraordinarily fast, driven largely by the UPI platforms and widespread QR-code adoption, becoming the backbone of digital transactions, with real-time payments across peer-to-peer and retail uses, leading to massive transaction volumes. The UPI system of India serves 491 million individuals and 65 million merchants, connecting 675 banks on a single platform. Mobile wallets and apps have expanded beyond urban centres into tier-2 and tier-3 cities, with both online and in-store adoption rising steadily. The local government and regulators have actively promoted digital payments. Furthermore, demonetization, cultural shifts toward cashless behavior, and strong backing for UPI have all contributed to transforming India into one of the most dynamic mobile payment markets globally.

China is home to one of the most advanced mobile payment markets globally, with digital wallets commonly used in day-to-day life. Alipay and WeChat Pay dominate the market and handle most online and in-store payments for a large number of users. Growth has been driven by the easy integration of payments into social media, messaging, ride-hailing, and delivery apps, which has reduced reliance on cash and cards. According to The State Council of The People’s Republic of China, in February 2025, the overall cross-border transactions by China UnionPay and NetsUnion Clearing Corporation increased by 124.54%, and the overall transaction value increased by 90.49%.

North America Market Insights

North America mobile payment market is projected to hold a considerable share during the forecast period. This growth is positively influenced by the increased penetration of smartphones and widespread access to the internet. Furthermore, rapid adoption of digital wallets such as Apple Pay, Google Pay, and PayPal, in addition to supportive regulatory frameworks, advanced banking and card infrastructure, and integration of mobile payments with loyalty programs, is boosting the market growth. In April 2024, Visa launched the Visa Web3 Loyalty Engagement Solution for customer engagement that helps brands meet next-gen customers. The presence of the big global players in the region, and strong consumer convenience preference, also drive the market significantly.

The U.S. mobile payment market is expanding with more people choosing digital and contactless payment methods. According to the Federal Reserve, in 2022, mobile payments usage increased to 74% in the U.S. from 10% in 2013, in addition to the rise in digital wallets usage by 38%. The continued rise of e-commerce and mobile shopping has increased dependence on mobile payments. Several retailers are also upgrading their checkout systems to support contactless transactions, making payments faster and more convenient. Improvements in security, including biometric verification, have helped build trust among users, while retailers and service providers continue to adopt mobile payments to improve checkout efficiency and customer experience.

Average Monthly Use by Payment Types, 2022 (Number of Participants - 2,005)

|

Payment Type |

Average Monthly Use |

|

Bank’s Mobile Apps |

11.4 |

|

Other Mobile Apps |

7.8 |

|

Digital Wallet |

7.6 |

|

Electronic Payment from Checking |

6.8 |

|

Cheque |

3.5 |

Source: The Federal Reserve

Canada mobile payment market is expanding with more people are using cash-free ways to pay. Contactless payments are common in stores, public transport, and at service outlets. Online shopping and digital services have made mobile payments even more important. The citizens trust bank-backed payment apps, encouraging more people to use them. Strong security features, including fraud protection and easy verification, help people feel safe using mobile payments. Other factors, like rewards programs, loyalty points, and faster checkout options, are also encouraging adoption. Overall, mobile payments are becoming a regular part of everyday life in Canada.

Europe Market Insights

Europe mobile payment market is expected to witness a slow but steady growth by the end of 2035. The market is growing as both consumers and businesses increasingly prefer contactless and digital payment methods for everyday use. Digital wallets, QR-code payments, and mobile banking apps are becoming more common because they offer speed and convenience. The expansion of e-commerce and cross-border shopping has also increased the need for payment solutions that work smoothly across different countries and systems. Moreover, improvements in security, such as biometric authentication, have strengthened user confidence. Acceptance of mobile payments by retailers and cooperation between banks, fintech firms, and merchants are further supporting the adoption of digital payments.

Changes in Payment Methods at Physical Points of Sale in Europe (2016–2024)

|

Payment Method |

Share of Transactions (2016) |

Share of Total Value (2016) |

Share of Transactions (2024) |

Share of Total Values (2024) |

|

Cash |

79% |

54% |

52% |

39% |

|

Card Payments |

19% |

39% |

39% |

45% |

|

Mobile Payments |

<1% |

<1% |

6% |

7% |

Source: data.europa.eu

The mobile payment market in UK has transformed rapidly over the past few years. According to UK Finance, 2024, 57%, which is over half of UK adults, used mobile wallets such as Apple Pay and Google Pay for contactless or online purchases in 2024, up sharply from around 42 % in 2023. It further states that cash usage has fallen below 10 % of total payments for the first time, underscoring the shift toward digital finance. High smartphone penetration and consumer comfort with digital banking, in addition, the country’s advanced fintech ecosystem and supportive regulatory environment, have encouraged both established banks and challengers to innovate in mobile payment offerings.

Digital transactions users in the Netherlands mobile payment market benefits from high internet and smartphone penetration, making digital transactions convenient and accessible. The International Trade Administration stated in September 2024 that iDEAL, a Dutch payment solution, dominated the country’s 70% market share for online purchases, while credit cards account only for 8%. The ongoing rise of e-commerce and mobile commerce, with retailers prioritizing seamless checkout experiences, is also accelerating mobile payment use, while strong regulatory frameworks. Additionally, evolving consumer preferences for convenience and speed, combined with supportive fintech innovation from banks and third-party providers, continue to reinforce mobile payment adoption.

Key Mobile Payment Market Players:

- Apple Pay (U.S.)

- Google Pay (U.S.)

- Samsung Pay (South Korea)

- PayPal Holdings Inc. (U.S.)

- Visa Inc. (U.S.)

- Mastercard Inc. (U.S.)

- Alipay (China)

- WeChat Pay (China)

- Amazon Pay (U.S.)

- American Express Co. (U.S.)

- Stripe, Inc. (U.S.)

- Square, Inc. (U.S.)

- Zelle (U.S.)

- Venmo (U.S.)

- Paytm (India)

- M-Pesa (UK)

- Huawei Pay (China)

- KakaoPay Corp. (South Korea)

- MoneyGram International Inc. (U.S.)

- Fidelity National Information Services (FIS), Inc. (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Google Pay: It is Google’s mobile wallet and contactless payment platform, which enables in-app, online, and in-person transactions, mainly through Android devices. The service originated from Android Pay and Google Wallet integrations and is available in over 100 countries, with one of the highest adoption rates in markets such as India’s UPI ecosystem. Google continues innovating with financial tools like co-branded UPI credit cards and broader financial management features as part of its Google Wallet ecosystem. Its revenue contribution comes indirectly through the parent company Alphabet as part of broader advertising and services monetization tied to payments usage, though specific standalone revenue figures for Google Pay aren’t publicly broken out.

- Apple Pay: It is Apple’s mobile wallet service integrated across the Apple ecosystem, including iPhone, Apple Watch, iPad. Through this service, contactless NFC payments, person-to-person transfers, and online purchases can be made easily using Apple devices. A strong emphasis is placed on user privacy and security, with transactions being protected through Face ID and Touch ID authentication. Through the use of Apple Pay, more than USD 1 billion in potential fraud has been prevented globally. In addition, over USD 100 billion in additional global merchant sales have been generated from purchases made using Apple Pay. This exceeded total consumer spending recorded during the November–December 2025 holiday season, highlighting the growing role of Apple Pay in global digital payments.

- Samsung Pay: Developed by Samsung Electronics, it is a mobile payments platform that supports NFC and MST in some markets, especially for broader merchant acceptance. It is available on Samsung devices and tied to Samsung Wallet. While Samsung does not usually disclose standalone payments revenue, its strength lies in device integration and partnerships with major banks worldwide, and recent industry moves include biometric authentication innovations and cross-border payment pilots with banks, reducing transfer costs and increasing speed.

- Amazon Pay: It is a digital payment service by Amazon for online payments within the platform as well as on third-party websites. The service allows customers to easily make one-click purchases and complete transactions securely using their Amazon accounts. The global merchant network continues to be expanded, making digital payments easier for businesses to accept. Amazon Pay in October 2025 stated that more than 110 million customers use Amazon Pay UPI in India, with 75% of the usage coming from Tier II and III towns

- PayPal Holdings, Inc.: PayPal is one of the longest-established digital payment companies in the world. In the fourth quarter of 2024, its net revenue increased by 4% to USD 8.4 billion, mainly due to higher customer activity and greater use of checkout services. In the third quarter of 2025, net revenue further increased by 7% to USD 8.4 billion. During the same period, USD 2.0 billion in operating cash flow and USD 1.7 billion in free cash flow were generated. The company is also engaging in expansion through new partnerships, including checkout integrations with OpenAI.

Here is a list of key players operating in the global market:

Key players in the mobile payment market are expanding through technology upgrades, partnerships, and the expansion into new regions. New features are being added to make transactions faster, more secure, and easier to use, while fraud prevention and data protection are being improved as well. Partnerships and associations with banks, third parties, and fintech companies are boosted to reach more customers and expand payment acceptance. At the same time, investments in mobile wallets, contactless payments, and digital systems have been made to handle more transactions and meet growing demand worldwide.

Corporate Landscape of the Mobile Payment Market:

Recent Developments

- In January 2025, MobiKwik, in partnership with the Reserve Bank of India and Yes Bank, launched e-rupee (e₹), which is a complete version of India’s Central Bank Digital Currency. MobiKwik is the country’s first digital wallet that has a full-scale e₹ wallet production, available to its Android users.

- In August 2024, Windcave partnered with Alipay+ to allow more than 10,000 merchants across Australia and New Zealand to accept a wide range of international mobile wallet payments. With this, customers from 15 Alipay+ partner e-wallets such as Alipay (China), AlipayHK, GCash (Philippines), Kakao Pay and Naver Pay (South Korea), Touch ’n Go eWallet (Malaysia) and others can scan a QR code at Windcave terminals displaying the Alipay+ logo and pay in their local currency, providing a fast, secure and seamless checkout experience.

- In February 2023, Mobily partnered with Ericsson to launch Mobile Pay in the Kingdom of Saudi Arabia, to conduct personalized financial services, including money transfers, contactless payments, digital card payments, cash-back, mobile top-up, bill payments, international remittance, and more, securely at the user’s convenience.

- Report ID: 8366

- Published Date: Jan 28, 2026

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Mobile Payment Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.