Digital Payment Market Outlook:

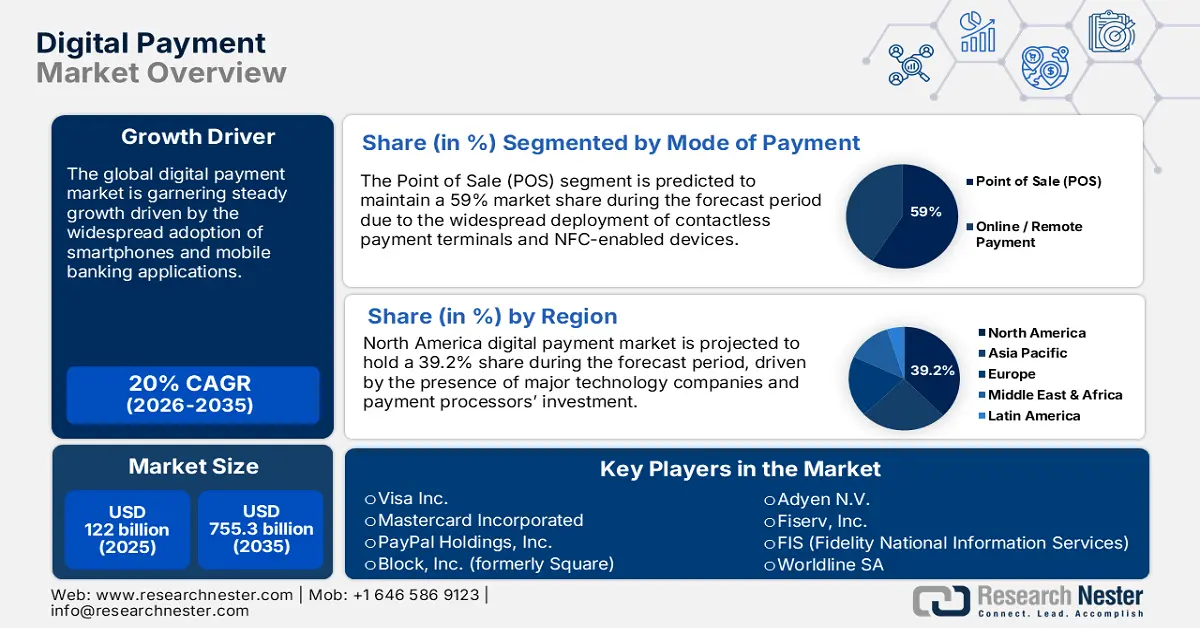

Digital Payment Market size is valued at USD 122 billion in 2025 and is projected to reach a valuation of USD 755.3 billion by the end of 2035, rising at a CAGR of 20% during the forecast period, i.e., 2026-2035. In 2026, the industry size of digital payment is estimated at USD 146.4 billion.

The global market is garnering steady growth with the assistance of technology innovation, evolving consumer behavior, and global deployment of mobile payment technologies. The players are creating strong platforms that enable artificial intelligence, blockchain technologies, and biometric authentication to enhance security and user experience. One such recent news was in May 2024, when Mastercard launched and implemented the Crypto Credential service across 13 countries in Europe and Latin America. This initiative partners with exchanges like Bit2Me and Mercado Bitcoin to simplify crypto transactions, focusing on making blockchain payments easier by facilitating identity verification and standardizing wallet addresses.

Technology companies engage with financial institutions, merchants, and government agencies to expand the acceptance of payments and transaction processing capacity. In January 2025, Visa Inc. unveiled six key trends shaping payments in 2025, highlighting AI-powered fraud prevention through the Visa Protect suite while investing $3 billion in AI and data infrastructure over the past decade. The company introduced three new AI-powered risk and fraud prevention solutions designed to reduce fraud across immediate A2A and card-not-present payments. Government incentives are driving the adoption through broad-based funding programs, such as digital literacy initiatives, regulatory changes, and infrastructure development projects that support electronic payment innovation across the global economy, spanning various industries.

Key Digital Payment Market Insights Summary:

Regional Highlights:

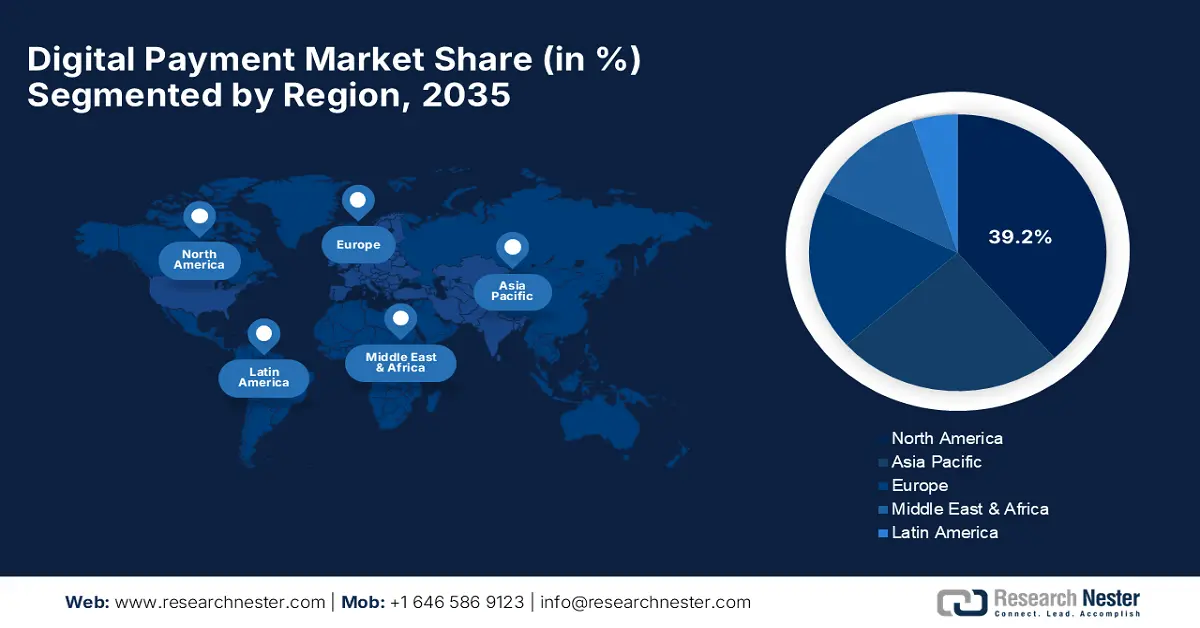

- North America is expected to secure approximately 39.2% share of the digital payment market during 2026-2035, attributed to robust technology infrastructure, heavy venture capital investment, and favorable regulatory frameworks supporting digital payment innovation.

- Asia Pacific is projected to expand at an 18.0% CAGR from 2026-2035 owing to accelerating digital transformation, rising smartphone adoption, and strong government initiatives toward advancing payment infrastructure.

Segment Insights:

- The point of sale (POS) segment in the digital payment market is projected to command a 59% share during 2026-2035, driven by the rapid adoption of combined payment terminals and contactless payment technologies by global merchants.

- The solutions segment is anticipated to capture a 64.5% share by 2035, propelled by the rising need for integrated payment platforms offering fraud prevention, analytics, and customer management capabilities.

Key Growth Trends:

- Advanced security technologies foster consumer confidence and adoption

- Cryptocurrency integration and digital asset payment solutions

Major Challenges:

- Regulatory compliance complexity across multiple jurisdictions

- Cyber attacks and data security weaknesses

Key Players: Visa Inc. (USA), Mastercard Incorporated (USA), PayPal Holdings, Inc. (USA), Block, Inc. (formerly Square) (USA), Adyen N.V. (Netherlands), Fiserv, Inc. (USA), FIS (Fidelity National Information Services) (USA), Worldline SA (France), Apple Inc. (USA), Amazon.com, Inc. (USA).

Global Digital Payment Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 122 billion

- 2026 Market Size: USD 146.4 billion

- Projected Market Size: USD 755.3 billion by 2035

- Growth Forecasts: 20% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (39.2% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, India, United Kingdom, Japan

- Emerging Countries: Indonesia, Brazil, Mexico, South Korea, United Arab Emirates

Last updated on : 12 September, 2025

Digital Payment Market - Growth Drivers and Challenges

Growth Drivers

- Advanced security technologies foster consumer confidence and adoption: Sophisticated fraud prevention technologies through the implementation of artificial intelligence, machine learning, and biometric authentication significantly improve the security of transactions and strengthen consumer confidence in electronic payment systems. Sophisticated security features like real-time threat management, behavior analytics, and multi-factor authentication reduce fraud levels while enabling a frictionless user experience. Large payment processors invest in security infrastructure and threat detection technology to enable competitive advantage and regulatory compliance. In November 2023, Mastercard Incorporated intensified cooperation with NEC Corporation through a new Memorandum of Understanding to accelerate collaboration on biometric payment technology for in-store checkout in Asia Pacific. The collaboration enables new, innovative biometric payments to occur so that customers can have safe and effortless checkout without PINs and phone unlocking.

- Cryptocurrency integration and digital asset payment solutions: Advanced cryptocurrency payment facilities enable merchants and consumers to pay using digital assets while supporting the growing demand for alternative payment solutions. Large payment systems incorporate cryptocurrency capabilities to leverage emerging market opportunities while supporting shifting customer needs for digital asset payments. PayPal Holdings, Inc., in July 2025, announced PayPal World, an interconnection platform that brings together five of the world's largest digital wallets onto a single platform, fundamentally reshaping the way money moves globally. Pay with Crypto supports near-instant settlement and provides transaction fee savings of up to 90% for seamless cross-border payments.

- Real-time payment infrastructure development simplifies transaction processing: The deployment of real-time payment networks and instant settlement features addresses the increasing demand for the instant processing of transactions and enhanced management of cash flows. Payment processors and financial institutions work together to create interoperable real-time payment systems that increase customer satisfaction and operational effectiveness. Fiserv, Inc. drove real-time payments adoption by business customers in March 2025 with the RTP network operated by The Clearing House (launched 2017), FedNow Federal Reserve system (launched 2023), and the Zelle peer-to-peer payment network operated by bank-owned Early Warning Services for small businesses. The firm recognized that it requires a concerted industry strategy more than individual company capability to gain 100% ubiquity.

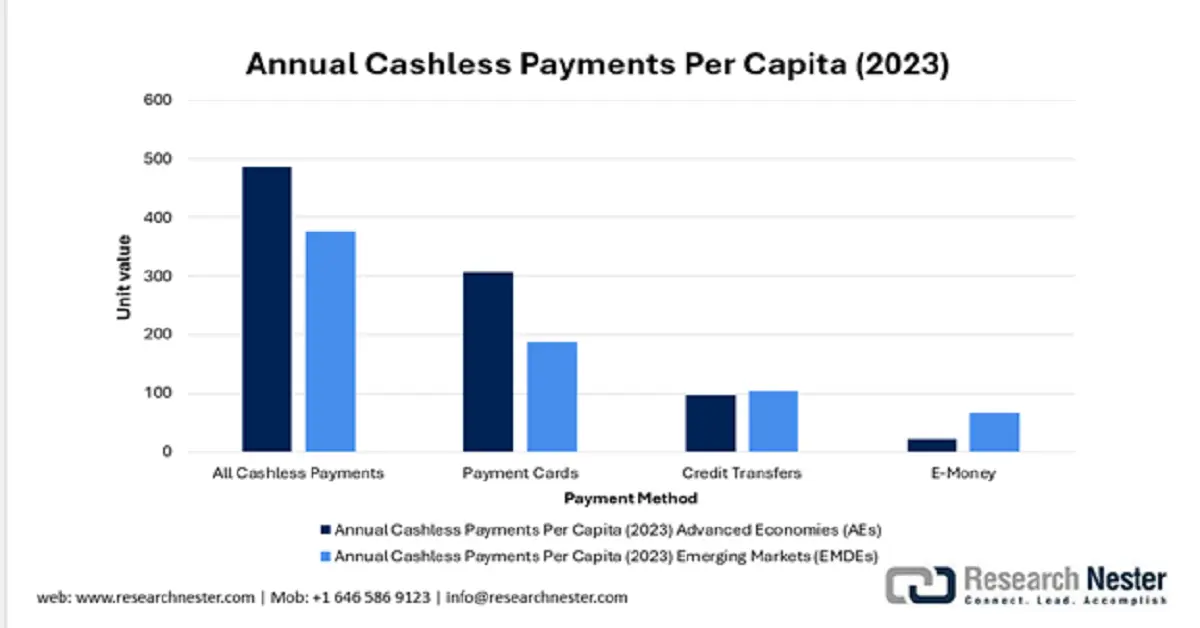

Annual Cashless Payments Per Capita (2023)

The robust 29% growth in per capita cashless payments within EMDEs, significantly outpacing the 4% growth in advanced economies, highlights the market's explosive expansion in emerging regions. This surge is primarily driven by the widespread adoption of fast credit transfers and e-money platforms, which are increasingly used for smaller, everyday transactions, as evidenced by the declining average transaction value.

Source: BIS

Challenges

- Regulatory compliance complexity across multiple jurisdictions: E-payment providers are faced with progressively more advanced regulatory requirements from different states and nations, with a high cost of compliance and specialized expertise. Varying regulatory standards in data protection, anti-money laundering, and consumer protection present operational challenges to global payment platforms. Banks must navigate evolving regulations while delivering quality service and competitive pricing levels across diverse markets. Maintaining pace with perpetual changes in global financial regulations and adjusting in-house systems in response is an ongoing issue. Moreover, the risk of non-compliance can lead to colossal penalties, damage to reputation, and even business suspension in certain markets.

- Cyber attacks and data security weaknesses: Increased sophistication of cyber attacks on payment systems poses critical security threats to payment processors, financial institutions, and consumers. Data breaches, identity theft, and fraudulent transactions are persistent threats that necessitate ongoing investment in threat detection technology and security infrastructure. Payment businesses must balance the convenience of users with security requirements while maintaining system performance and meeting global regulatory requirements across all operations. The only possible response to these threats is through concerted collaboration among industry stakeholders, governments, and cybersecurity experts. Active measures, such as robust encryption, multi-factor authentication, and real-time online fraud detection, are instrumental in safeguarding the integrity of payment systems.

Digital Payment Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

20% |

|

Base Year Market Size (2025) |

USD 122 billion |

|

Forecast Year Market Size (2035) |

USD 755.3 billion |

|

Regional Scope |

|

Digital Payment Market Segmentation:

Mode of Payment Segment Analysis

The Point of Sale (POS) segment is predicted to maintain a 59% market share during the forecast period due to the widespread adoption of combined payment terminals and contactless payment technology by universal merchants. POS solutions provide complete transaction processing functionality, including inventory management, customer relationship management, and premium analytics that enhance merchant operations. In May 2025, Block, Inc. (formerly Square) announced news of bitcoin payment on Square, a milestone towards making bitcoin more mainstream and accessible by utilizing the Square Point of Sale app to allow merchants to accept bitcoin payments directly via square hardware. Growing demand for omnichannel payment experiences and seamless integration of online-offline transactions support long-term POS segment dominance.

Component Segment Analysis

The solutions segment is projected to hold a 64.5% market share through 2035, reflecting the growing demand for integrated payment platforms that offer multiple services, including fraud prevention, analytics, and customer management capabilities. Payment solutions consist of application programming interfaces, software platforms, and bundled services that assist in facilitating transactions between merchants and banks. Advanced solution offerings include fraud detection through artificial intelligence, real-time analytics, and tailored payment flows that support a range of business requirements. Adyen N.V. demonstrated adaptability in its Digital segment in February 2025. In 2024, the processed volume reached €1,285.9 billion, marking a 33% year-on-year increase (27% excluding a single large volume customer). The company employs a single-platform strategy to deliver high authorization rates, sophisticated fraud prevention, and the collection of global and local payment schemes.

Enterprise Size Segment Analysis

The large business segment is expected to command a 69.1% market share by 2035, driven by complex payment processing requirements and the high volumes of transactions that necessitate advanced payment infrastructure. Large businesses have sophisticated payment solution requirements, including multi-currency, superior reporting capabilities, and integration with enterprise resource planning systems. For example, Apple Inc. handled $8.7 trillion in Apple Pay transactions globally in 2025, supporting 1.2 million US-based apps and retailers. Apple Pay demonstrated exceptional security with fraud rates as low as 0.01%, lower than that of traditional credit card transactions, and 99% of transactions use Face ID and Touch ID biometric authentication. This highlights the critical role of robust and secure payment solutions in supporting the vast transactional demands of large enterprises.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegments |

|

Mode of Payment |

|

|

Component |

|

|

Enterprise Size |

|

|

End user Industry |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Digital Payment Market - Regional Analysis

North America Market Insights

North America digital payment sector is anticipated to hold around 39.2% share during the forecast period. The region boasts state-of-the-art technology infrastructure, significant venture capital investment, and sophisticated regulatory systems favorable to digital payment innovation. Large technology companies collaborate with banks and financial institutions to develop innovative payment products, including artificial intelligence, blockchain technology, and biometric identification systems. Strong consumer adoption of mobile payment platforms, combined with widespread merchant acceptance, creates favorable market conditions for future growth.

The U.S. digital payment market leads with broad-based technological innovation, extensive market investment, and progressive regulatory regimes that support payment system development. Companies such as Apple Inc., PayPal Holdings Inc., and Block Inc. have significantly invested in payment platform development and expanded international market coverage. In August 2025, the U.S. Treasury Department made a commitment to complete the transition to electronic disbursements and payments, cutting off issuance of paper checks for all federal disbursements by September, 2025, to the greatest extent feasible under law. This initiative is a significant modernization of federal payment systems that improves efficiency, saves money, and facilitates security while giving citizens quicker access to government payments.

Canada digital payment market reflects steady growth with government support for digital transformation initiatives and inclusive financial technology development programs. Governments and national governments promote digital payment acceptance through infrastructure investment, regulatory reforms, and financial technology innovation across various economic segments. In March 2025, Canada Government cancelled the Digital Literacy Exchange Program (DLEP) that spent a cumulative $47.1 million in eight years (2017-2025) in helping to train digital literacy skills to more than 650,000 persons from underrepresented groups.The program aimed to empower individuals facing barriers to digital economy participation, specifically seniors, Indigenous communities, persons with disabilities, rural populations, and newcomers, by providing instruction on the safe, secure, and effective use of computers, mobile phones, and the Internet.

APAC Market Insights

Asia Pacific digital payment market is estimated to record a CAGR of 18.0% from 2026-2035 due to rising digital transformation initiatives, escalated smartphone penetration, and high government initiatives towards the development of payment infrastructure. Holistic digital payment strategies are followed by regional governments with the promotion of financial inclusion and the adoption of cashless transactions across different economic segments. The region experiences huge-scale adoption of mobile payments, advanced fintech innovation, and cooperative strategies between financial institutions and technology companies. Growing e-commerce transactions, cross-border payments, and remittance requirements drive enormous demand for high-end payments, enabling regional economic integration and digital commerce expansion.

China digital payment market is rising with robust government support, extensive mobile payment penetration, and innovative platform innovation by leading technology companies. The digital payment acceptances are boosted by the initiatives of the government while promoting cross-border payment ease and international payment system integration. In April 2024, the China Government announced an expansion of digital payments in Hong Kong, with Weixin Pay and WeChat Pay HK integrated into other transport systems, including New Lantao Bus, Tramways, Citybus, and Star Ferry. The initiative promotes the Guangdong-Hong Kong-Macao Greater Bay Area development plan emphasizing quality living circles with high-quality public services and promoting smart mobility and convenient living experiences through enhanced digital payment integration.

India digital payment market displays exceptional growth through government-led digital transformation efforts as well as deep financial inclusion programs that support widespread payment adoption. India government promotes the usage of digital payments through the creation of infrastructure, regulatory frameworks, and incentive programs to drive merchant and consumer participation. In March 2025, the Government of India, through the Union Cabinet, approved a USD 1.5 billion incentive scheme for FY 2024-25 to induce low-value BHIM-UPI transactions (Person to Merchant - P2M), driving digital payments adoption and encouraging small merchants to use UPI and induce financial inclusion. The government has zero MDR for RuPay Debit Card and BHIM-UPI transactions with amendments in the Payments and Settlement Systems Act.

Europe Market Insights

Payment Institutions Registered in Europe (2022-2023)

|

Total Registered Entities (EEA, June 2023) |

Detail / Value |

Market Size & Competition |

|

Banks |

3,926 |

Indicates a large, established financial sector |

|

Bank Branches |

844 |

Shows cross-border service provision within the EU |

|

Payment Institutions (PIs) |

2,929 |

Highlights the growing role of non-bank PSPs |

|

PI Branches |

179 |

Demonstrates the expansion of specialized payment services |

Source: ECA

Europe is anticipated to experience significant growth from 2026 to 2035, driven by complete regulatory harmonization, substantial technological investment, and strategic initiatives promoting digital payment adoption among European Union member states. The region is governed by future-oriented regulatory frameworks, such as PSD2 and GDPR, that enhance consumer protection while promoting innovation and competition among payment service providers. Open banking, real-time payments, and facilitation of cross-border transactions with a strong emphasis help create good opportunities for the development of digital payments.

Digital payments in the UK experience robust growth as a result of widespread government initiatives supporting payment system upgrades and financial technology innovation initiatives. Policy strategic frameworks promote competition, innovation, and consumer protection while supporting the development of advanced payment infrastructure and services. In July 2025, the UK Government published the National Payments Vision, which provided a vision for a world-class, successful payments system provided on next-generation technology where businesses and consumers get various payment options equal to their needs. The government established the Payments Vision Delivery Committee as a senior cross-authority department within HM Treasury to provide a transparent forward plan, focusing on frictionless account-to-account payments through the development of Open Banking.

Germany digital payment market is supported by strong manufacturing capabilities, advanced technology infrastructure, and extensive government backing for economic sector digitalization. German banks and technology firms collaborate to develop new payment options with high security and compliance standards. In March 2025, the German Government-supported introduction of the 'Deutschland zahlt digital' (Germany pays digitally) initiative, spearheaded by leading financial industry partners like Commerzbank, Deutsche Bank, Mastercard, Visa, and others, promoting digital payments in the nation while closing acceptance gaps. This integrated approach promotes digital payments against existing barriers while strengthening Germany's business location competitiveness through enhanced payment infrastructure.

Key Digital Payment Market Players:

- Visa Inc. (USA)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Mastercard Incorporated (USA)

- PayPal Holdings, Inc. (USA)

- Block, Inc. (formerly Square) (USA)

- Adyen N.V. (Netherlands)

- Fiserv, Inc. (USA)

- FIS (Fidelity National Information Services) (USA)

- Worldline SA (France)

- Apple Inc. (USA)

- Amazon.com, Inc. (USA)

The digital payment market exhibits intense competition among well-established technology leaders, such as Visa Inc., Mastercard Incorporated, PayPal Holdings Inc., and Apple Inc., as well as emerging fintech companies like Block Inc. and Adyen N.V. These companies compete through constant innovation in payment processing technologies, security measures, and comprehensive service packages that address differing customer demands. Strategic partnerships, growth plans, and acquisition strategies beyond the home market underpin competitive positions as firms meet evolving regulatory requirements and demand. Rakuten Group Inc., Sony Financial Holdings Inc., and Fujitsu Limited are some companies that contribute advanced technology and local market expertise to the global development of the payment ecosystem.

Competitive dynamics drive technology innovation while firms focus on enhancing user experience, security, and operational efficiency in different payment applications and geographies. Industry leaders are still rolling out advanced products and forging alliances to develop technological expertise and support competitive positions in fast-evolving markets. In December, 2023, Itau Unibanco, a prominent bank in Latin America, has launched custody services for Bitcoin and Ether, alongside cryptocurrency trading, for select customers via its ÍON app. This initiative stemmed from consumer desire for cryptocurrency services from a trusted brand, one with whom they already entrusted their traditional assets.

Here are some leading companies in the digital payment market:

Recent Developments

- In June 2025, Visa Inc. launched Visa Intelligent Commerce platform opening its network to developers building AI-powered commerce platforms via integrated APIs and commercial partnership programs. The company announced collaborations with Ant International, Grab, and Tencent to enable secure, AI-driven checkout experiences across Asia-Pacific.

- In February 2025, Mastercard Incorporated launched One Credential, a revolutionary single digitally connected payment solution allowing consumers to consolidate multiple payment options including debit, credit, prepaid, and installments into one digital payment method. The innovation responds to growing Gen Z demand for seamless, flexible, and personalized financial experiences while partnering with fintech leaders Marqeta, Galileo, and i2c to extend solutions to small businesses.

- Report ID: 8097

- Published Date: Sep 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Digital Payment Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.