POS Payment Market Outlook:

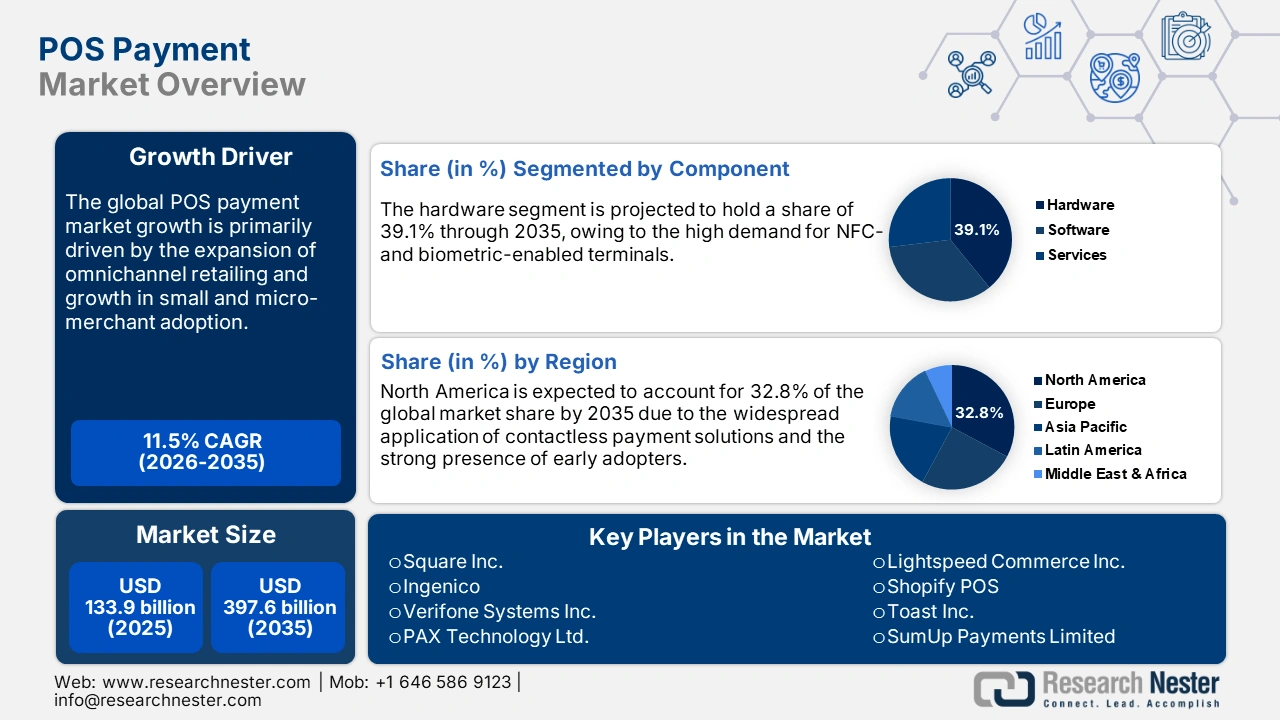

POS Payment Market size is USD 133.9 billion in 2025 and is estimated to reach USD 397.6 billion by the end of 2035, expanding at a CAGR of 11.5% during the forecast period, i.e., 2026-2035. In 2026, the industry size of POS payments is evaluated at USD 149.3 billion.

The global trade of point-of-sale (POS) payment systems revolves around the stable supply chain of specialized hardware, software, and distributed products. The hardware components, such as card readers, terminals, and biometric scanners, are dependent heavily on imported semiconductors and display parts. Microprocessors and secure chips are also sourced from the Asia Pacific, showing reliance on overseas sources. The hardware assembly is carried out closer to major markets, including North America and Europe, to speed up delivery and meet local regulations.

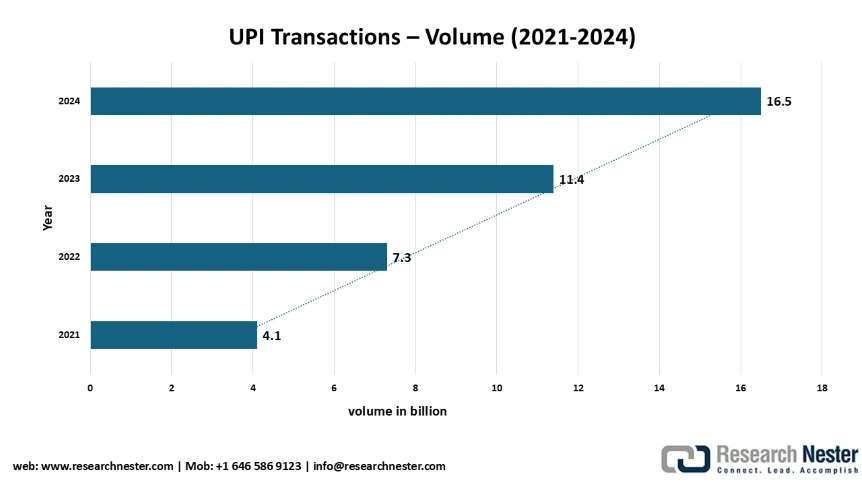

Digital payment services are experiencing rapid growth in transaction volume and value due to user-friendly platforms like UPI, increased adoption, and regulatory support, particularly in India. For instance, in 2023, UPI alone processed 117.64 billion transactions, marking a 46% increase from the previous year, indicating a substantial rise in usage rather than cost, according to Press Information Bureau (PIB).

Source: NPCI

In October 2024, the UPI boosted transactions worth USD 283.01 billion across 16.5 billion financial transfers, reflecting a 45% year-on-year jump from 11.4 billion transactions in October 2023. With 632 banks unified into the system, this rise denotes UPI’s expanding influence in India’s digital payments environment. As both consumers and businesses increasingly choose smooth and secure digital payments, the rising transaction volumes and values reflect UPI’s key role in speeding up India’s transition toward a cashless economy.

Key POS Payment Market Insights Summary:

Regional Insights:

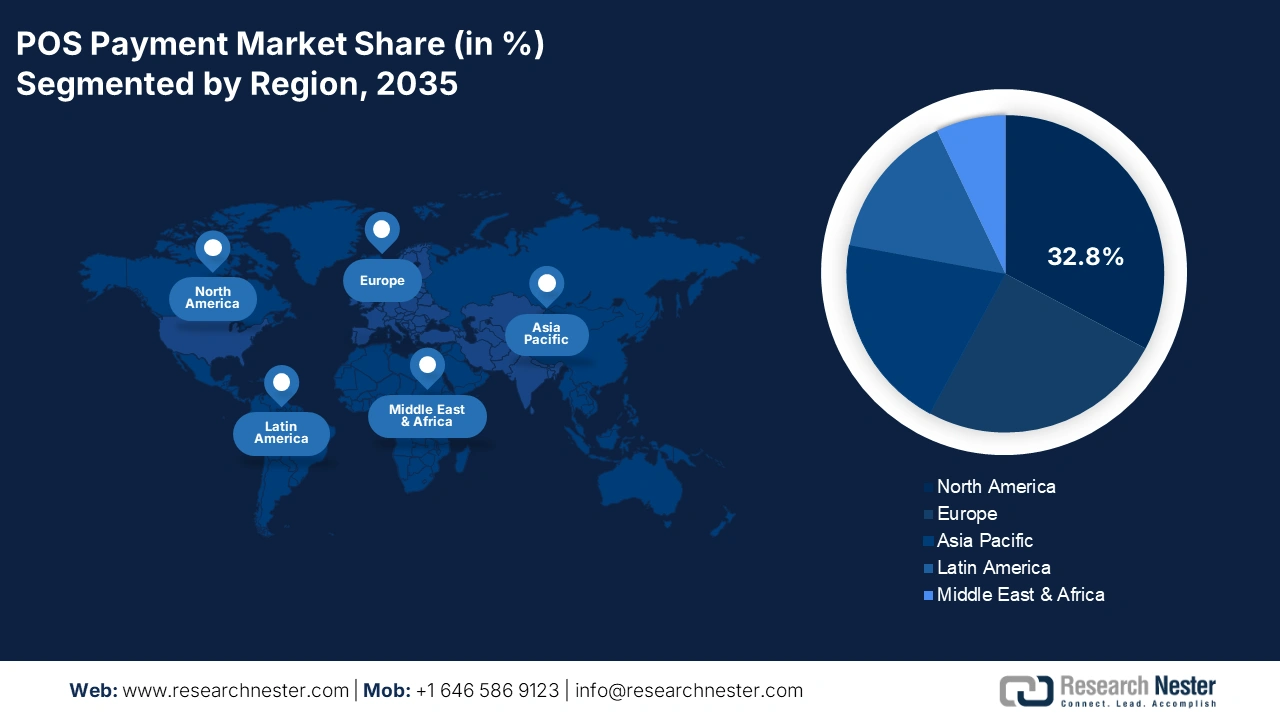

- The North America POS Payment Market is projected to secure a 32.8% share by 2035, owing to the strong penetration of contactless payment solutions and EMV-compliant terminals.

- The Europe region is expected to account for 25.1% of the global share through 2035, impelled by large-scale adoption of real-time and cross-border digital payment infrastructures.

Segment Insights:

- The retail segment is projected to hold a 42.5% share of the global POS Payment Market by 2035, propelled by rapid digital transformation in omnichannel commerce and contactless checkout.

- The hardware segment is anticipated to account for 39.1% of the market share through 2035, driven by rising demand for NFC- and biometric-enabled terminals and modernization of payment infrastructure.

Key Growth Trends:

- Rapid growth of contactless transactions

- Expansion of omnichannel retailing

Major Challenges:

- Infrastructure readiness in emerging markets

- Complex data protection regulations

Key Players: Square Inc. (Block, Inc.), Ingenico (Worldline SA), Verifone Systems Inc., PAX Technology Ltd., Lightspeed Commerce Inc., Shopify POS, Toast Inc., SumUp Payments Limited, PayPal Zettle, Clover Network, Inc. (FIS), MYPOS Europe Ltd., Tyro Payments Limited, ePaisa Services Pvt. Ltd., Pine Labs Pvt. Ltd., Soft Space Sdn. Bhd.

Global POS Payment Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 133.9 billion

- 2026 Market Size: USD 7 billion

- Projected Market Size: USD 149.3 billion by 2035

- Growth Forecasts: 11.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (32.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, Brazil, Indonesia, Mexico, South Korea

Last updated on : 25 September, 2025

POS Payment Market - Growth Drivers and Challenges

Growth Drivers

-

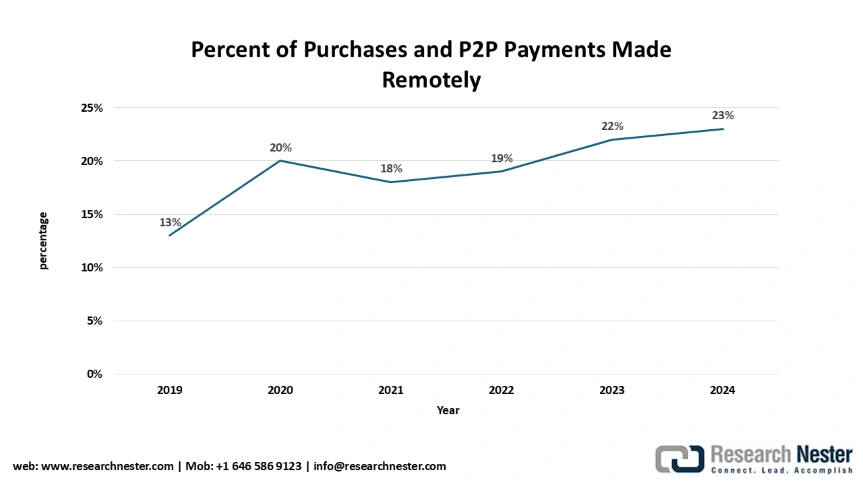

Rapid growth of contactless transactions: The rising consumer demand for faster, hygienic, and frictionless transactions is propelling contactless POS adoption globally. The Diary of Consumer Payment Choice (DCPC) and the Federal Reserve Payments Study track changing payment behaviors in the U.S. According to the 2023 DCPC, the share of contactless-enabled cards rose by 20% between 2022 and 2023, reflecting a notable shift in how consumers pay. This growth highlights the fast adoption of contactless technology, particularly as payment habits continue to evolve in the post-pandemic environment. Many small and mid-sized retailers are leveraging these solutions to enhance checkout efficiency and mitigate queue times.

- Expansion of omnichannel retailing: The increasing demand for smooth transaction options is expected to create high-earning chances for POS payment technology producers. In China and India, where e-commerce is very popular, retailers are using POS systems that work both in-store and online. For example, in January 2025, Salesforce, a leading AI-driven CRM platform, launched two new AI-powered solutions for the retail sector, i.e., Agentforce for Retail and Retail Cloud with Modern POS. These tools are made to improve the efficiency of store associates, customer service teams, and digital merchants, enabling them to drive higher productivity and deliver more tailored shopping experiences. Agentforce for Retail comes with a library of pre-built agent skills, allowing retailers to quickly form AI agents that manage routine tasks like order management and appointment scheduling, while also granting large-scale, personalized shopper interactions.

- Growth in small and micro-merchant adoption: The democratization of POS technology is creating new opportunities for small and micro businesses. The World Bank and regional banks are both aiding in the expansion of digital payment systems in low-income areas, such as Africa, Southeast Asia, and Latin America. In 2023, the number of mobile POS (mPOS) users in Latin America increased significantly. This reflects that the developing economies are expected to propel the revenues of key players in the coming years. The leading companies are estimated to focus on affordable pricing tailored to each region, support for offline transactions, and easy-to-use mobile interfaces for small merchants to earn hefty returns in high-potential markets.

Challenges

- Infrastructure readiness in emerging markets: The unavailability of advanced digital infrastructure in some areas of developing regions is expected to lower the sales of POS payment systems in the years ahead. Low internet penetration, unstable power supply, and underdeveloped banking ecosystems are major factors hindering the application of POS payment technologies in the emerging markets. The World Bank states that only 64% of the Sub-Saharan African population had access to high-speed speed reliable broadband in 2023, and only 24% of the population used the internet as of 2023. To overcome this situation, the governments are expected to increase their IT infrastructure budgets and the public-private sector's participation in the digital inclusion initiatives.

- Complex data protection regulations: The inconsistent and varied data protection regulations are acting as an impediment to the adoption of POS payment solutions. The limitations on data sharing and processing are substantially lowering new market entries. The EU’s GDPR and India’s DPDP Act are restraining the growth of the key players. In India and Europe, many companies faced a six to nine-month delay in launching their point-of-sale software solutions due to the mandatory local data storage provisions in 2023. To overcome these barriers, many companies are expected to invest in modular compliance frameworks and local legal partnerships.

POS Payment Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

11.5% |

|

Base Year Market Size (2025) |

USD 133.9 billion |

|

Forecast Year Market Size (2035) |

USD 397.6 billion |

|

Regional Scope |

|

POS Payment Market Segmentation:

Application Segment Analysis

The retail segment is projected to capture 42.5% of the global POS payment market share through 2035. The rapid digital transformation, particularly in omnichannel commerce and contactless checkout, is boosting the sales of POS systems. According to the U.S. Census Bureau, the e-commerce retail sales captured 16.1% of total retail in the first quarter of 2024, up from 15.4% in 2023. The booming e-commerce trade is also expected to propel the sales of POS payment technologies. Companies are integrating POS terminals with inventory, CRM, and loyalty platforms, streamlining front-end operations. Such moves are likely to accelerate the trade of POS payment solutions in the retail sector.

Component Segment Analysis

The hardware segment is anticipated to account for 39.1% of the global market share throughout the forecast period, owing to the high demand for NFC- and biometric-enabled terminals, especially in sectors with high foot traffic. The segment's growth can be attributed to surging demand for contactless and mobile-enabled terminals as businesses modernize payment infrastructure. Hardware upgrades are also driven by security benchmarks such as EMV compliance and adoption in new emerging markets. A recent example is of June 2024, when Ingenico introduced the Axium DX8000 Android smart POS terminal, made to support omnichannel payments with enhanced connectivity and user-friendly features. This development shows how hardware continues to become a significant supporter for smooth retail transactions.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegments |

|

Deployment Mode |

|

|

Component |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

POS Payment Market - Regional Analysis

North America Market Insights

The North America POS payment market is estimated to hold 32.8% of the global revenue share by 2035, owing to the widespread adoption of contactless payment solutions. The EMV-compliant terminals and next-gen mobile POS systems are also gaining traction due to the strong presence of the early adopters. The massive federal investments in digital infrastructure, including broadband expansion, are promoting POS deployments across retail, logistics, and public sectors. Both the U.S. and Canada are the most profitable marketplaces for POS payment technology producers.

The U.S. POS payment market is expected to increase at a high pace, owing to the rising consumer preference for contactless transactions and the accelerated digitization of small and medium retail operations. The supportive government policies and funding are also accelerating the trade of POS payment systems. The initiatives, such as the BEAD program and ACP under the FCC and NTIA, are significantly expanding broadband access, enabling more retail locations to implement cloud-based POS systems. The expanding fintech and digital commerce projects are also supporting the market growth.

The sales of POS payment solutions in Canada are projected to be driven by the government support for digital equity and the presence of an enhanced connectivity network. The fintech adoption in rural and urban retail environments is positively influencing the trade of POS payment technologies. The Innovation, Science and Economic Development (ISED) has allocated more than CAD 3.3 billion through programs such as the Universal Broadband Fund (UBF) and the Strategic Innovation Fund to improve nationwide access to digital commerce platforms. The positive government support is reflecting high demand for POS payment technologies in the years ahead.

Europe Market Insights

The Europe POS payment market is anticipated to capture 25.1% of the global revenue share throughout the study period, owing to widespread implementation of contactless technologies, real-time payment systems, and cross-border digital payment infrastructures. The retail, logistics, and mobility sectors are expected to boost the adoption of POS payment solutions during the foreseeable period. Furthermore, the European Commission’s Digital Europe Programme and Recovery and Resilience Facility, channeling billions into digital infrastructure upgrades, are facilitating the rapid deployment of POS technologies.

The robust digital infrastructure and advanced industrial retail chains are propelling the adoption of POS payment technologies in Germany. The government-backed cybersecurity mandates are also contributing to the expansive deployment of POS payment solutions. For example, the Federal Ministry for Digital and Transport’s Smart Infrastructure initiative is accelerating POS adoption by subsidizing intelligent retail systems. The initiatives, such as the Digital Strategy 2025 plan, are also pushing the sales of POS payment solutions.

The U.K. POS payment market is projected to be driven by the convergence of fintech innovation and regulatory modernization. The early adopters are driving the sales of contactless and mobile payment technologies in the country. For instance, in May 2025, UK-based Dojo raised $190 million from Vitruvian Partners in its first equity funding round. The cloud-native payments platform, formed in 2021, now serves more than 140,000+ businesses, handling 6-9 million transactions every day. It combines with 450+ POS systems, enabling in-person and digital payments along with services such as financing and booking management. The favorable government moves are set to attract several international players in the years ahead.

APAC Market Insights

The Asia Pacific POS payment market is expected to increase at a CAGR of 12.9% from 2026 to 2035. The rising retail digitization and aggressive ICT investments are opening high-earning opportunities for POS payment technology manufacturers. The government-supported digital infrastructure programs are also accelerating the sales of contactless payment systems. Japan, China, India, Malaysia, and South Korea collectively contributed more than USD 16.4 billion in annual government funding in 2024. These trends are reinforced by national digital roadmaps and SME digitization incentives.

China leads the sales of POS payment solutions owing to the strong presence of high-tech companies and early adopters. The Tier 2 and 3 cities are boosting the adoption of POS payment technologies in the country. The government incentives under the Digital Yuan Pilot and manufacturing subsidies for domestic POS terminal production are set to boost the deployment of advanced payment systems in the years ahead. E-commerce penetration, combined with state-driven digital payment mandates, is projected to increase the shipment volume of POS payment technologies in the country.

The India market for POS payment is projected to expand at a high pace owing to the rapid digitalization and increasing public-private investments in the ICT sector. The initiatives, such as the Digital India program and NASSCOM’s POS infrastructure roadmap, are accelerating the deployment of POS payment technologies. The Government also developed the DIGIDHAN mission to increase digital payments and improve the country’s payment ecosystem. Since FY 2021-22, an incentive scheme has been in place to reward banks and ecosystem partners for encouraging digital transactions, especially through UPI adoption. Digital payment transactions rose to 46%, rising from 8,839 crore in FY 2021-22 to 18,737 crore in FY 2023-24, with UPI accounting for ~70% of the total. Further, the low-cost mobile POS units, Aadhaar-linked merchant onboarding, and UPI integration are creating a scalable ecosystem for POS payment systems.

Key POS Payment Market Players:

- Square Inc. (Block, Inc.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Ingenico (Worldline SA)

- Verifone Systems Inc.

- PAX Technology Ltd.

- Lightspeed Commerce Inc.

- Shopify POS

- Toast Inc.

- SumUp Payments Limited

- PayPal Zettle

- Clover Network, Inc. (FIS)

- MYPOS Europe Ltd.

- Tyro Payments Limited

- ePaisa Services Pvt. Ltd.

- Pine Labs Pvt. Ltd.

- Soft Space Sdn. Bhd.

The market is characterized by the mix of dominant multinationals and region-specific innovators. Supportive government policies and funding are encouraging many new companies and SME to expand their operations. Industry giants are investing heavily in R&D activities to introduce innovative POS payment solutions. The leading companies are also collaborating with raw material suppliers and partnering with other players to boost their revenue shares. Big players are entering emerging markets to earn lucrative gains from untapped opportunities.

Here is a list of key players operating in the global market:

Recent Developments

- In April 2024, Ingenico unveiled AXIUM DX8000, an Android-based smart POS supporting biometric authentication and 5G. The company has partnered with 12 new banks in APAC, which is expected to boost its market share in the region.

- In March 2024, Square, Inc. announced the launch of Square Terminal 2 with embedded tap-to-pay on iPhone functionality. This move led increase the transaction volumes by 17.5% YoY in FY 24.

- In April 2024, Toshiba Corporation introduced a hardware upgrade for its flagship TCx 900 POS system tailored for high-volume retail environments. The company reported a 13.4% rise in POS system orders across Japan and Southeast Asia in Q2 2024.

- In February 2024, Panasonic Corporation announced the launch of a CloudPOS solution. This platform features embedded AI to analyze transaction patterns, flag fraudulent returns, and generate SKU-level sales trends in real time.

- Report ID: 8129

- Published Date: Sep 25, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

POS Payment Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.